Market Overview

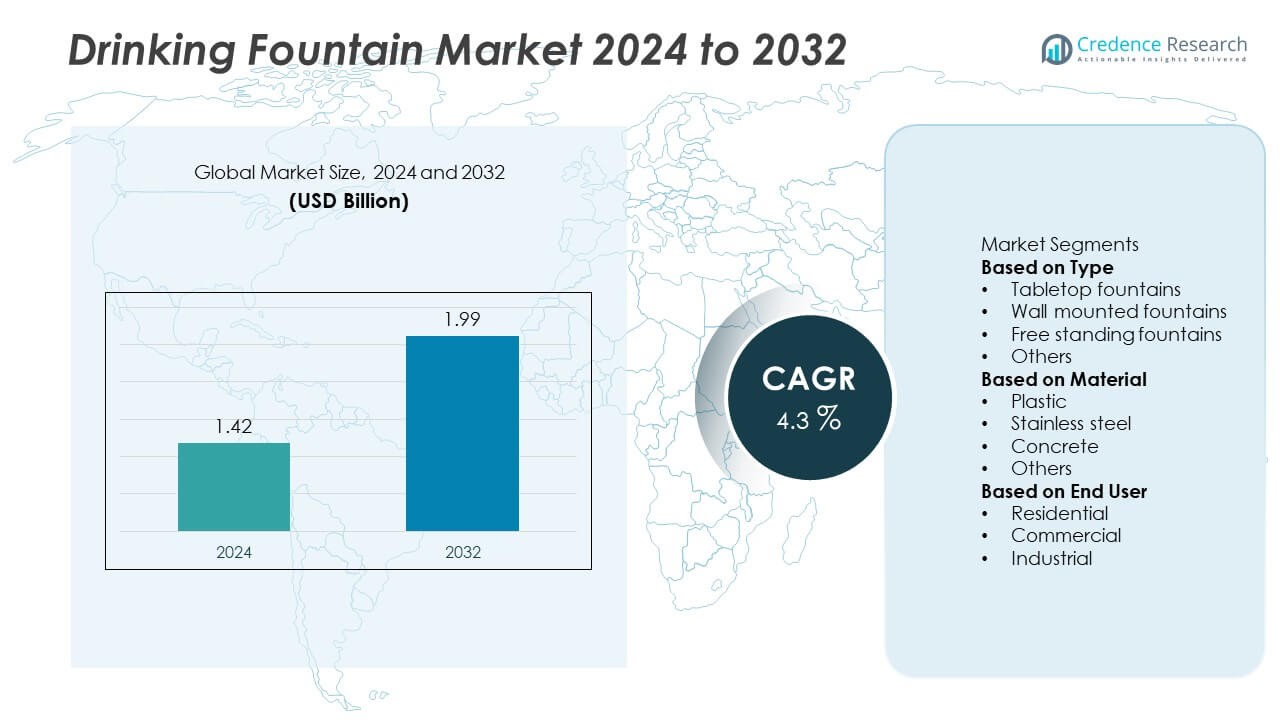

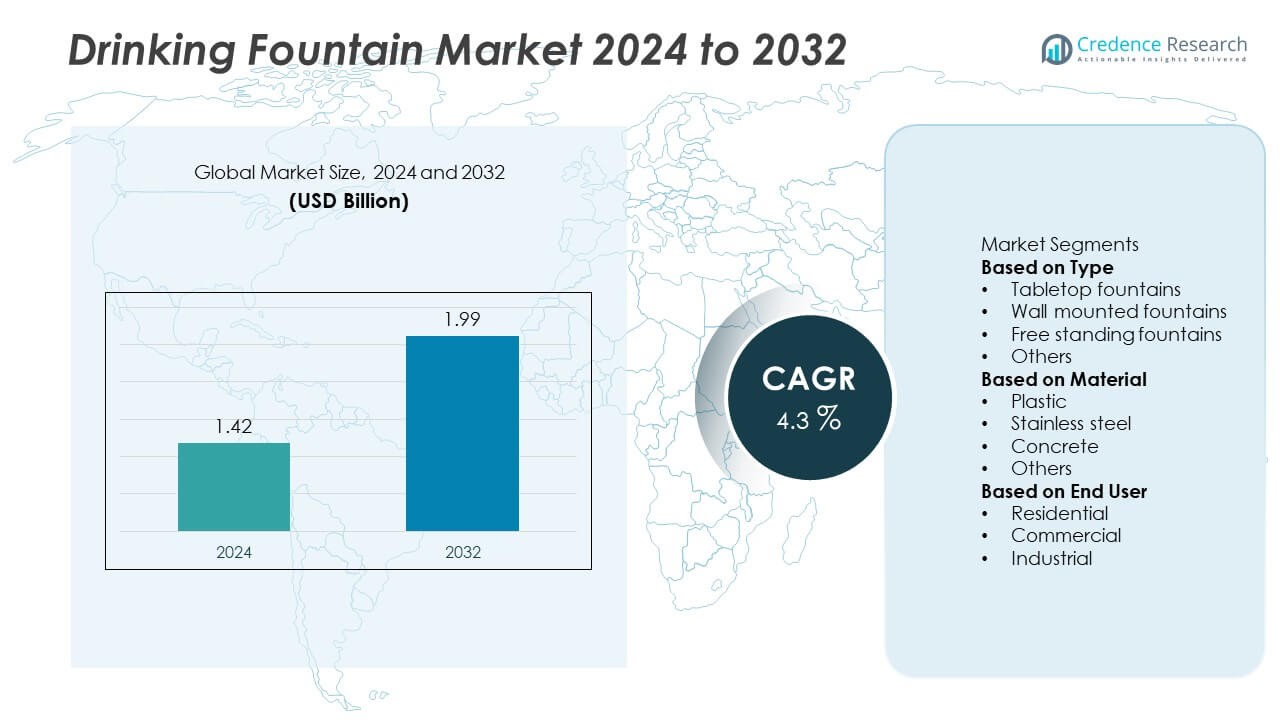

The Drinking Fountain market was valued at USD 1.42 billion in 2024 and is projected to reach USD 1.99 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Drinking Fountain market Size 2024 |

USD 1.42 Billion |

| Drinking Fountain market, CAGR |

4.3% |

| Drinking Fountain market Size 2032 |

USD 1.99 Billion |

The drinking fountain market is dominated by major companies such as Elkay Manufacturing Company, Cuno Incorporated, Bobrick Washroom Equipment, Inc., EVO Water Systems, Beverage Air, Coolers LLC, AmeriWater, Inc., Aqua Bubblers, Inc., Fountains of Youth, Inc., and Bubblers Direct, Inc. These players lead the market through continuous advancements in filtration systems, touchless technology, and eco-friendly designs. They focus on developing durable and hygienic fountains that meet sustainability and health standards across commercial, educational, and public facilities. North America led the market with a 35% share in 2024, supported by extensive installations in schools, offices, and airports. Asia-Pacific followed with a 30% share, driven by rapid urbanization, infrastructure development, and growing public health initiatives promoting clean water access.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The drinking fountain market was valued at USD 1.42 billion in 2024 and is projected to reach USD 1.99 billion by 2032, growing at a CAGR of 4.3%.

- Growth is driven by rising demand for clean and filtered drinking water in schools, offices, and public spaces, supported by hygiene and sustainability initiatives.

- Smart and touchless drinking fountains with integrated filtration and IoT monitoring are key trends improving water quality and user safety.

- The market is moderately competitive, with major players like Elkay, Bobrick, and Cuno focusing on energy-efficient, eco-friendly, and low-maintenance models.

- North America led the market with a 35% share in 2024, followed by Asia-Pacific with 30%, while wall-mounted fountains dominated by type with a 46% share due to wide adoption in public infrastructure.

Market Segmentation Analysis:

By Type

The wall-mounted fountains segment dominated the drinking fountain market with a 46% share in 2024. This segment leads due to its space-efficient design, ease of installation, and widespread use in schools, offices, airports, and public facilities. Wall-mounted models are favored for their low maintenance, accessibility, and integration with water filtration systems. Tabletop fountains follow, driven by adoption in small offices and residential settings for compact hydration solutions. Free-standing units also see rising demand in outdoor public spaces and parks, supported by their durability and larger water capacity.

- For instance, Elkay Manufacturing Company offers the EZH2O Liv Pro line, an in-wall filtered water dispenser for commercial spaces. In general, a non-refrigerated version of an EZH2O bottle filling station can deliver water at a rate of up to 1.5 gallons per minute (GPM), which is significantly faster than a traditional drinking fountain.

By Material

The stainless-steel segment held the largest 49% share of the drinking fountain market in 2024. Stainless steel’s corrosion resistance, hygiene, and long service life make it the preferred material in commercial and institutional applications. Its non-toxic and recyclable nature aligns with global sustainability goals and strict drinking water regulations. Plastic fountains remain popular for residential and temporary installations due to their lightweight and cost-effective design, while concrete units are commonly used in outdoor environments where vandal resistance and durability are key.

- For instance, Bobrick Washroom Equipment, Inc. launched its B-819298 stainless-steel accessible drinking fountain grab bar, constructed from 18-gauge (1.2mm) thick 304-grade steel, which is tested to support loads in excess of 113 kilograms when properly installed.

By End User

The commercial segment accounted for a 57% share of the drinking fountain market in 2024. High installation rates in educational institutions, corporate buildings, transportation hubs, and healthcare facilities drive this segment’s dominance. The rise in public infrastructure development and hygiene awareness further supports demand for contactless and filtered units. Residential adoption is increasing with home-based hydration solutions and kitchen-integrated designs, while the industrial segment shows steady growth driven by the need for safe drinking water in large-scale manufacturing and warehouse environments.

Key Growth Drivers

Increasing Demand for Clean and Filtered Drinking Water

Rising awareness of waterborne diseases and the need for safe drinking water are major growth drivers in the drinking fountain market. Public infrastructure, schools, and corporate facilities increasingly install fountains equipped with advanced filtration systems to ensure water quality. The shift toward cleaner hydration options is driven by consumer health consciousness and regulatory mandates. This demand encourages manufacturers to integrate UV purification, carbon filters, and antimicrobial materials to enhance safety and hygiene in public and commercial environments.

- For instance, the Aqua-Pure™ AP Easy C-Complete filtration system from 3M is a point-of-use unit for residential applications that is NSF certified to remove particles down to 0.5 microns, reduce chlorine taste and odor, lead, cysts, and other volatile organic compounds.

Expansion of Public Infrastructure and Smart Cities

The growth of smart cities and modernization of public infrastructure significantly fuel the demand for drinking fountains. Governments are investing in installing energy-efficient and sensor-based fountains across parks, airports, and transit stations to promote public health and sustainability. These systems help reduce plastic bottle use while offering convenient access to clean water. The integration of touchless and self-cleaning technologies in public installations further enhances user convenience and hygiene compliance.

- For instance, Siemens offers smart water management solutions that use AI-powered apps like SIWA Leak Finder and SIWA Blockage Predictor. These applications analyze real-time data from sensors and smart meters to identify leaks, predict blockages, and optimize water distribution networks.

Sustainability and Eco-Friendly Design Initiatives

Sustainability-focused initiatives across industries are boosting the adoption of eco-friendly drinking fountains. Organizations and municipalities prioritize refillable, low-energy fountains to reduce plastic waste and water consumption. Manufacturers are developing units made from recyclable materials like stainless steel and BPA-free plastics. Energy-efficient refrigeration systems and automatic shut-off features are gaining popularity. This trend aligns with corporate sustainability goals and environmental policies encouraging green infrastructure development in commercial and public spaces.

Key Trends & Opportunities

Adoption of Touchless and Smart Fountain Technology

Touchless operation and smart monitoring features are transforming the drinking fountain market. Infrared sensors and automatic dispensers improve hygiene, especially in public places and corporate environments. Smart fountains equipped with IoT systems allow real-time monitoring of water quality, usage, and maintenance needs. These advancements support sustainability by optimizing water consumption and operational efficiency. Growing demand for contact-free hydration systems, accelerated by post-pandemic health standards, positions smart technology as a key market opportunity.

- For instance, AmeriWater is expanding its Sterile Processing water solutions portfolio with remote monitoring analytics, which includes a cloud-based dashboard for real-time data capture and customizable reports. This supports compliance with the AAMI ST108 standard.

Rising Integration with Bottle Filling Stations

A growing trend is the integration of bottle-filling functions with traditional drinking fountains. This hybrid design reduces plastic waste and encourages refill culture in schools, gyms, airports, and offices. The convenience of dual-purpose fountains drives installation in both new and renovated facilities. Manufacturers are introducing energy-efficient, quick-fill models with real-time usage displays. The trend supports environmental goals and meets increasing consumer preference for sustainable hydration solutions.

- For instance, some modern commercial beverage dispensing systems offer advanced features like interactive touchscreens, smart taps with RFID technology, and remote monitoring for inventory management. These systems are designed for increased efficiency, customization, and to reduce waste and energy consumption compared to conventional dispensers.

Key Challenges

High Maintenance and Installation Costs

The cost of installation, maintenance, and regular filtration system replacement remains a major challenge for the drinking fountain market. Touchless and smart models, though hygienic and efficient, require higher upfront investment and periodic servicing. Commercial facilities face budget constraints in adopting advanced fountains across large premises. To address this, manufacturers focus on developing cost-effective, low-maintenance models with durable filtration systems that extend service life and reduce operational costs.

Limited Awareness and Accessibility in Developing Regions

In developing regions, lack of awareness about clean drinking solutions and limited public infrastructure restrict market expansion. Many areas still rely on bottled or unfiltered tap water due to inadequate maintenance or inconsistent water supply. Governments and NGOs are initiating hydration infrastructure projects, but slow adoption rates and funding challenges persist. Increasing awareness campaigns, affordable product designs, and partnerships with local authorities are essential to overcoming these barriers and expanding market reach.

Regional Analysis

North America

North America held a 35% share of the drinking fountain market in 2024. The region’s leadership is driven by widespread adoption in educational institutions, corporate buildings, and public facilities emphasizing hygiene and accessibility. The U.S. dominates due to strict health regulations and growing use of touchless and filtered systems. Upgrading aging water infrastructure and increasing sustainability initiatives support continued demand. Manufacturers focus on energy-efficient, ADA-compliant, and sensor-operated models. Canada’s commitment to eco-friendly public installations and water safety programs further enhances regional growth across both residential and commercial applications.

Europe

Europe accounted for a 28% share of the drinking fountain market in 2024. The region’s growth is supported by strong environmental policies promoting reduced plastic waste and sustainable hydration solutions. Countries such as Germany, the U.K., and France are increasing installations in airports, schools, and urban areas as part of green city initiatives. Advanced water purification technologies and public hygiene standards drive product innovation. European manufacturers are emphasizing stainless steel and recyclable materials to meet sustainability targets. Rising adoption of refill stations also boosts the region’s transition toward eco-conscious drinking infrastructure.

Asia-Pacific

Asia-Pacific captured a 30% share of the drinking fountain market in 2024. Rapid urbanization, infrastructure development, and expanding commercial construction projects in China, Japan, and India are key growth drivers. Governments across the region are investing in smart public utilities and school-based drinking solutions to improve hygiene and access to clean water. Rising health awareness, coupled with the demand for touchless and filtered units, is strengthening adoption. Local manufacturers offer cost-effective solutions suited for high-traffic environments, while smart city initiatives in countries like Singapore and South Korea further fuel market expansion.

Middle East & Africa

The Middle East & Africa region held a 4% share of the drinking fountain market in 2024. Growth is driven by increasing infrastructure projects in commercial, educational, and hospitality sectors, especially in the UAE, Saudi Arabia, and South Africa. The demand for durable, temperature-controlled fountains suited for arid climates is increasing. Governments are emphasizing sustainable water solutions to reduce plastic consumption and improve public hydration facilities. International brands are expanding partnerships with regional distributors to enhance accessibility, while urban development projects continue to integrate modern, sensor-based hydration systems.

Latin America

Latin America accounted for a 3% share of the drinking fountain market in 2024. The region’s expansion is supported by growing investments in public infrastructure, particularly in Brazil, Mexico, and Chile. Urban centers are adopting filtered and touchless fountains to improve water safety and reduce plastic dependency. Educational and healthcare institutions are key end users, promoting installations that meet hygiene standards. Manufacturers are introducing cost-effective, low-maintenance units tailored to regional needs. Rising government initiatives for clean water access and increased awareness of sustainability further enhance market penetration across Latin American countries.

Market Segmentations:

By Type

- Tabletop fountains

- Wall mounted fountains

- Free standing fountains

- Others

By Material

- Plastic

- Stainless steel

- Concrete

- Others

By End User

- Residential

- Commercial

- Industrial

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the drinking fountain market includes key players such as Elkay Manufacturing Company, Cuno Incorporated, Bobrick Washroom Equipment, Inc., EVO Water Systems, Beverage Air, Coolers LLC, AmeriWater, Inc., Aqua Bubblers, Inc., Fountains of Youth, Inc., and Bubblers Direct, Inc. These companies compete through innovations in filtration technology, touchless operation, and sustainable designs to meet growing demand for hygienic hydration systems. Global leaders focus on developing energy-efficient and sensor-based fountains equipped with advanced purification and monitoring features. Strategic collaborations with schools, airports, and commercial developers enhance market presence, while smaller players emphasize regional manufacturing and cost-effective solutions. Product diversification, customization, and adherence to water safety standards remain key competitive strategies. Continuous investments in research and eco-friendly materials support the industry’s transition toward smart, durable, and environmentally responsible drinking fountain solutions across commercial and public infrastructure segments.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Elkay Manufacturing Company

- Cuno Incorporated

- Bobrick Washroom Equipment, Inc.

- EVO Water Systems

- Beverage Air

- Coolers LLC

- AmeriWater, Inc.

- Aqua Bubblers, Inc.

- Fountains of Youth, Inc.

- Bubblers Direct, Inc.

Recent Developments

- In 2025, Zurn Elkay Water Solutions scheduled its Q3 earnings release and highlighted development of a broadened sustainable drinking-water fixtures portfolio including fountains and bottle fillers.

- In February 2024, Elkay, a leading manufacturer of drinking fountains and water bottle filling stations, announced an expansion of their ezH2O line.

- In January 2024, Haws Corporation, known for its drinking fountains and emergency equipment, launched a new line of smart drinking fountains. These fountains are equipped with IoT sensors that monitor water quality, usage patterns, and maintenance needs in real-time.

Report Coverage

The research report offers an in-depth analysis based on Type, Material, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising adoption of touchless and smart hydration systems.

- Public infrastructure projects will increase installations across transport hubs and educational facilities.

- Demand for filtered and UV-purified fountains will rise due to health awareness.

- Manufacturers will focus on energy-efficient and low-maintenance designs.

- Integration of IoT and real-time monitoring will enhance product functionality.

- Sustainability initiatives will drive the shift toward refillable and eco-friendly fountains.

- Asia-Pacific will remain the fastest-growing region due to rapid urbanization.

- North America will retain leadership supported by regulatory compliance and modernization efforts.

- Partnerships between manufacturers and public authorities will expand installation networks.

- Technological innovation and durable materials will strengthen long-term market competitiveness.