Market Overview

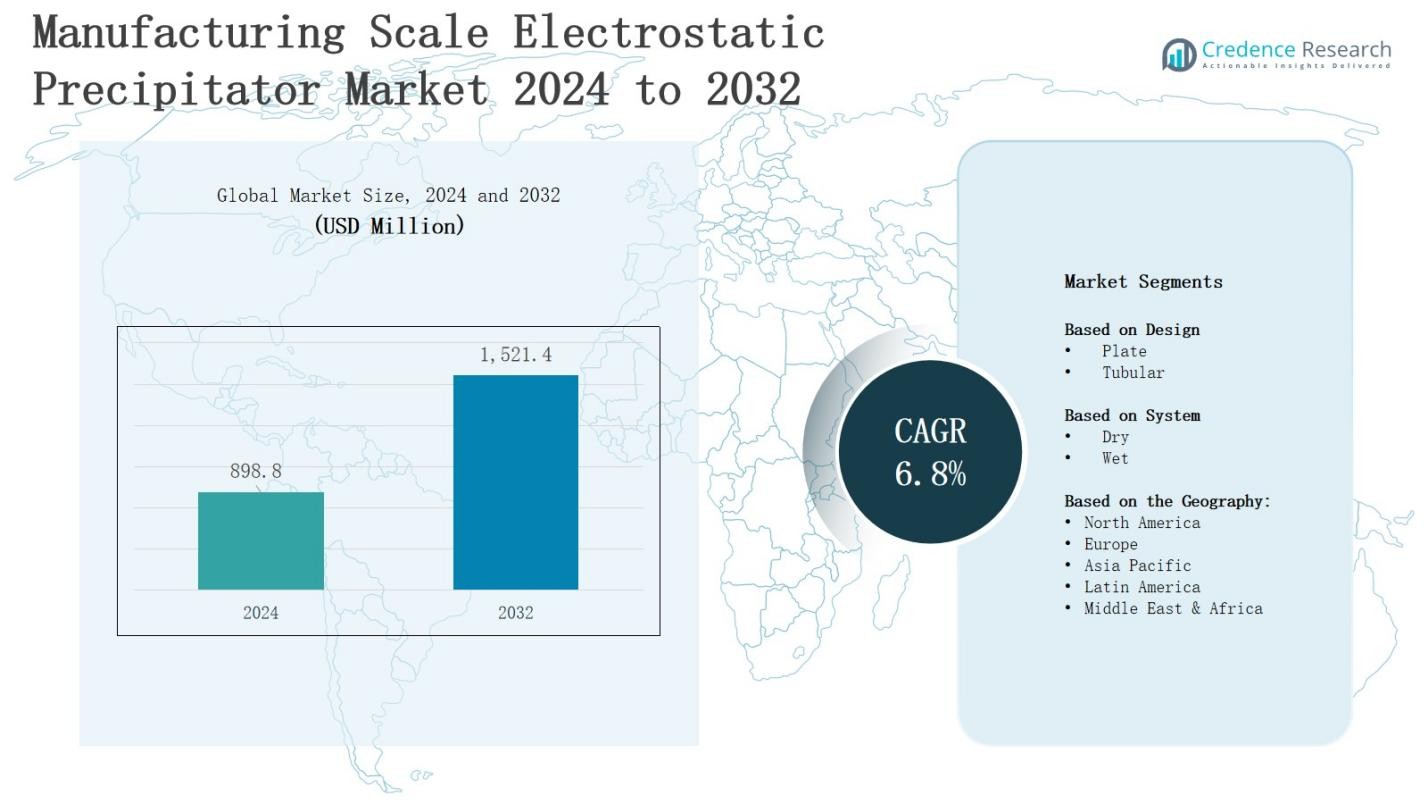

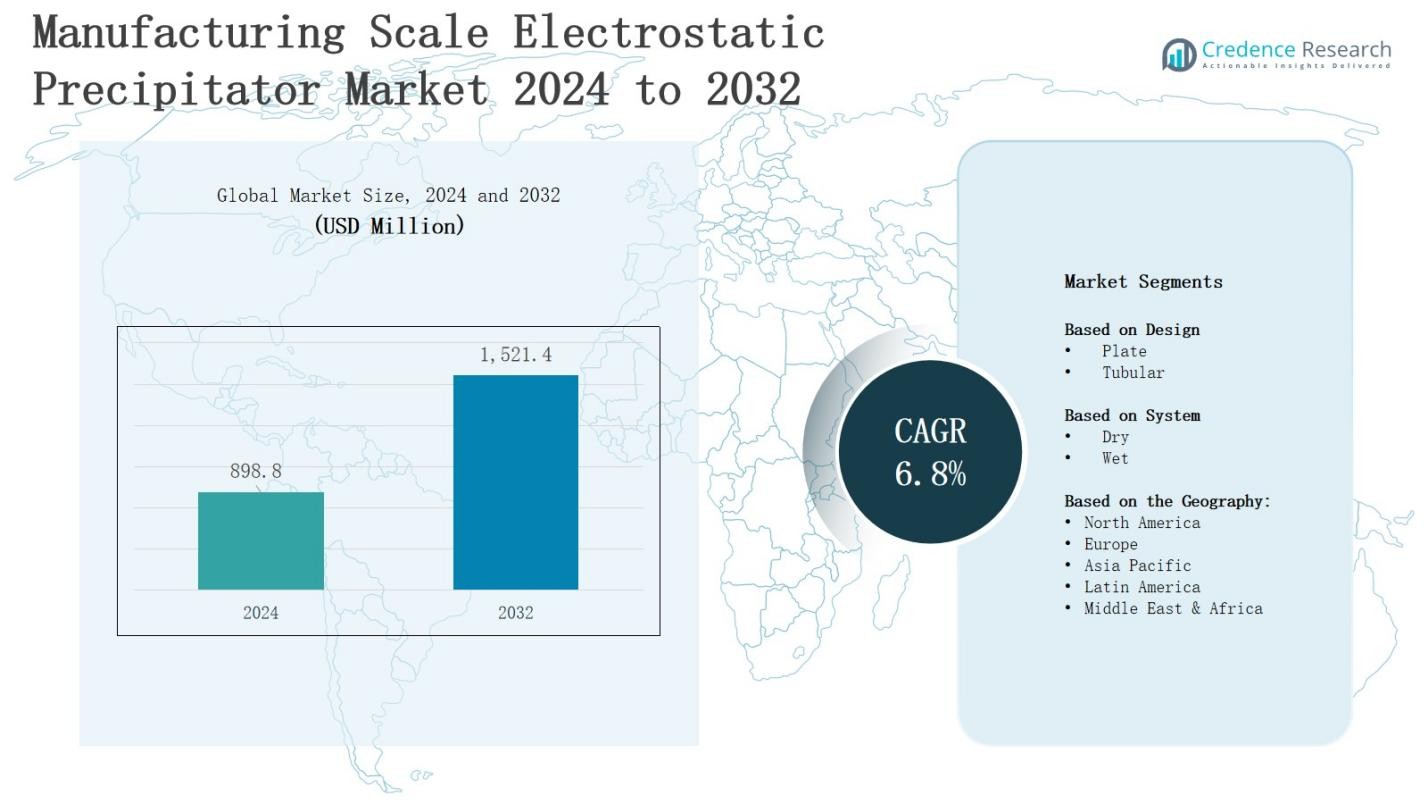

The Manufacturing Scale Electrostatic Precipitator Market is projected to grow from USD 898.8 million in 2024 to USD 1,521.4 million by 2032, reflecting a compound annual growth rate of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Manufacturing Scale Electrostatic Precipitator Market Size 2024 |

USD 898.8 Million |

| Manufacturing Scale Electrostatic Precipitator Market, CAGR |

6.8% |

| Manufacturing Scale Electrostatic Precipitator Market Size 2032 |

USD 1,521.4 Million |

The manufacturing scale electrostatic precipitator market is driven by rising industrial emissions control regulations, increasing demand for efficient particulate matter removal, and the expansion of heavy manufacturing sectors such as power generation, cement, and steel. Growing emphasis on sustainable operations and adoption of advanced filtration technologies further boosts market growth. Trends include integration of IoT-enabled monitoring systems for real-time performance optimization, development of energy-efficient designs to reduce operational costs, and the shift toward modular, compact units for easier installation and maintenance. Advancements in high-voltage power supplies and electrode materials are enhancing collection efficiency and operational lifespan of these systems.

The manufacturing scale electrostatic precipitator market spans North America, Europe, Asia-Pacific, Latin America, the Middle East, and Africa, with Asia-Pacific holding the largest share, followed by North America and Europe. It sees steady growth in Latin America, the Middle East, and Africa driven by industrial expansion and regulatory adoption. Key players include Beltran Technologies, GEA Group, Babcock & Wilcox, Valmet, Kraft Powercon, VT Corp, Thermax, ANDRITZ GROUP, Environ Engineers, and Elex, focusing on innovation, retrofitting solutions, and region-specific designs to meet diverse operational and environmental requirements.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The manufacturing scale electrostatic precipitator market is projected to grow from USD 898.8 million in 2024 to USD 1,521.4 million by 2032, registering a CAGR of 6.8% during the forecast period.

- Rising industrial emissions control regulations, demand for efficient particulate removal, and growth in heavy industries such as power generation, cement, and steel are key growth drivers.

- Technological trends include IoT-enabled monitoring systems, energy-efficient designs, modular configurations, and advanced high-voltage power supplies for improved collection efficiency.

- High capital investment and maintenance costs, along with performance limitations under variable conditions, remain significant challenges for adoption.

- Asia-Pacific holds 39% share, followed by North America at 24% and Europe at 21%, with Latin America, Middle East, and Africa accounting for 9%, 5%, and 2% respectively.

- Regional growth is supported by stricter emission regulations in developed markets and industrial expansion in emerging economies.

- Key players include Beltran Technologies, GEA Group, Babcock & Wilcox, Valmet, Kraft Powercon, VT Corp, Thermax, ANDRITZ GROUP, Environ Engineers, and Elex, focusing on innovation and retrofitting solutions.

Market Drivers

Stringent Environmental Regulations Driving Adoption

The manufacturing scale electrostatic precipitator market is propelled by tightening global and regional environmental regulations aimed at reducing industrial air pollution. Governments enforce strict particulate emission standards for sectors like power generation, cement, steel, and chemicals. It compels manufacturers to invest in advanced dust collection systems to ensure compliance. Regulatory frameworks such as the Clean Air Act and EU Industrial Emissions Directive continue to push industries toward high-efficiency filtration solutions. This regulatory pressure sustains steady market demand.

- For instance, under the U.S. Clean Air Act Section 111, new industrial facilities must apply the best system of emission reduction, which has led to widespread installation of advanced electrostatic precipitators for fine particulate control in power plants and manufacturing units. This ensures compliance with tough emission performance standards.

Rising Industrialization and Energy Demand

Rapid industrialization, coupled with growing energy consumption, significantly fuels the manufacturing scale electrostatic precipitator market. Expansion in thermal power plants, metal processing units, and heavy manufacturing increases particulate emissions, creating urgent need for effective air quality control systems. It enables industries to meet operational efficiency targets while minimizing environmental impact. Emerging economies in Asia-Pacific are major contributors due to their accelerated industrial growth. This trend creates substantial opportunities for system suppliers.

- For instance, Siemens Energy provides electrostatic precipitators widely used in thermal power plants to efficiently remove dust and ash from exhaust gases, helping plants meet emission standards.

Technological Advancements Enhancing Efficiency

Continuous innovation in electrostatic precipitation technology is a key driver for the manufacturing scale electrostatic precipitator market. Modern systems integrate high-frequency power supplies, optimized electrode configurations, and real-time monitoring for improved collection efficiency. It enhances performance while reducing energy consumption and operational costs. Manufacturers are also adopting modular designs for scalability and easier maintenance. Such advancements help industries achieve compliance with evolving environmental norms while optimizing operational reliability.

Growing Emphasis on Sustainable Manufacturing

The shift toward sustainable manufacturing practices strengthens demand in the manufacturing scale electrostatic precipitator market. Industries aim to reduce carbon footprints and adopt cleaner production processes without compromising productivity. It aligns with corporate social responsibility goals and global sustainability targets. Businesses increasingly invest in advanced air pollution control solutions to enhance public image and meet stakeholder expectations. This commitment to environmental stewardship drives consistent adoption across multiple heavy industrial sectors.

Market Trends

Integration of IoT and Smart Monitoring Systems

A key trend in the manufacturing scale electrostatic precipitator market is the integration of IoT-enabled sensors and advanced monitoring software. It allows real-time tracking of particulate levels, system performance, and energy usage, enabling predictive maintenance and minimizing downtime. Remote diagnostics improve operational efficiency and extend equipment lifespan. Data analytics help optimize voltage levels and electrode cleaning cycles for consistent performance. This shift toward connected systems supports compliance and boosts return on investment for end users.

- For instance, Intensiv-Filter Himenviro incorporates IoT and AI technologies in its ESP systems to provide real-time monitoring and predictive maintenance, significantly reducing downtime.

Focus on Energy-Efficient Designs

Energy efficiency is becoming a central design priority in the manufacturing scale electrostatic precipitator market. Manufacturers are introducing high-voltage power supplies with reduced energy loss and optimized airflow designs that lower operational costs. It helps industries meet emission targets while improving overall plant efficiency. Demand for low-maintenance, high-performance units is growing in energy-intensive sectors. Sustainable design innovations also contribute to reducing greenhouse gas emissions, supporting both regulatory compliance and corporate sustainability initiatives.

- For instance, Siemens has developed electrostatic precipitators with advanced high-voltage power supplies and smart control systems that optimize energy consumption while maintaining high particulate removal efficiency.

Adoption of Modular and Compact Configurations

The market is witnessing a rising preference for modular and compact electrostatic precipitator systems. It enables easier installation in space-constrained industrial facilities and simplifies future capacity expansion. Modular units reduce downtime during maintenance and allow phased upgrades without significant capital outlay. Industries value the flexibility these designs provide for adapting to production changes. This trend is particularly strong in retrofitting projects where space and cost constraints drive purchasing decisions.

Use of Advanced Materials and Components

Advancements in materials science are influencing the manufacturing scale electrostatic precipitator market. Manufacturers are adopting corrosion-resistant alloys, high-durability electrodes, and advanced insulators to enhance reliability and lifespan. It improves performance in harsh industrial environments such as cement kilns and metal smelters. Enhanced component quality reduces maintenance frequency and ensures stable collection efficiency over time. This focus on material innovation aligns with the growing demand for long-term operational cost savings and performance stability.

Market Challenges Analysis

High Capital and Maintenance Costs

The manufacturing scale electrostatic precipitator market faces a significant challenge from its high initial investment and ongoing maintenance expenses. Large-scale systems require substantial capital outlay for design, installation, and commissioning, which can deter small and medium-sized enterprises. It also demands skilled personnel for regular inspection, cleaning, and component replacement to maintain efficiency. Frequent maintenance interruptions can disrupt industrial operations and increase operational costs. This cost burden can slow adoption in cost-sensitive markets and limit system upgrades.

Performance Limitations in Variable Conditions

Performance inconsistency under fluctuating operational conditions poses another challenge for the manufacturing scale electrostatic precipitator market. It can experience reduced efficiency when handling variable particulate loads, moisture levels, or high resistivity dust. Environmental factors such as humidity and temperature shifts affect collection performance, requiring advanced controls and calibration. Industries in sectors with highly variable emission profiles may find it challenging to maintain compliance without supplementary filtration solutions. These limitations increase the need for hybrid systems, adding complexity and cost.

Market Opportunities

Expansion in Emerging Industrial Markets

The manufacturing scale electrostatic precipitator market holds strong opportunities in emerging economies undergoing rapid industrialization. Expanding power generation, steel, cement, and chemical sectors in regions like Asia-Pacific, Latin America, and the Middle East are driving demand for advanced air pollution control systems. It creates a favorable environment for manufacturers offering cost-effective, high-performance solutions. Government investments in infrastructure and stricter emission norms are expected to accelerate adoption. Localized production and after-sales service networks can further strengthen market penetration.

Advancement in Technology and Retrofitting Potential

Technological innovation opens new growth avenues for the manufacturing scale electrostatic precipitator market, especially in upgrading legacy systems. It benefits from advancements such as high-frequency power supplies, AI-based control systems, and improved electrode designs that enhance efficiency and reduce energy consumption. Retrofitting older units in established industrial facilities offers a cost-effective path to compliance with updated environmental regulations. Growing focus on sustainability and operational optimization positions advanced systems as attractive investments for long-term performance gains.

Market Segmentation Analysis:

By Design

Based on design, the manufacturing scale electrostatic precipitator market is segmented into plate and tubular configurations. Plate-type units dominate due to their high efficiency in capturing fine particulate matter and suitability for large-scale industrial applications such as power plants, cement kilns, and steel mills. It offers easier maintenance and adaptability to varying gas volumes. Tubular designs, while less prevalent, find demand in specific industries like chemical processing where gas flow patterns and corrosion resistance are critical. Their compact structure benefits facilities with space constraints.

- For instance, plate-wire ESPs are widely employed in coal-fired boilers and cement kilns, effectively handling large gas volumes with parallel flow lanes.

By System

By system, the market is divided into dry and wet electrostatic precipitators. Dry systems hold the largest share due to their ability to handle high-temperature flue gases and lower maintenance requirements. It is widely adopted in heavy industries that generate large volumes of particulate emissions. Wet systems, on the other hand, are gaining attention in applications where sticky or high-resistivity dust makes dry collection less effective. Their capability to simultaneously remove gaseous pollutants enhances their value in specialized industrial processes.

- For instance, Thermax has successfully deployed more than 2,000 dry electrostatic precipitators across heavy industries such as power, cement, steel, and non-ferrous metallurgical sectors, benefiting from features like continuous operation with minimal maintenance and fully automatic controllers.

Segments:

Based on Design

Based on System

Based on the Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis

North America

North America holds 24% share of the manufacturing scale electrostatic precipitator market, driven by strong environmental compliance requirements and the presence of established heavy industries. The U.S. leads adoption, supported by its extensive power generation, cement, and steel production sectors. It benefits from high investments in modernizing existing facilities and integrating energy-efficient particulate control systems. Canada’s emphasis on sustainable manufacturing practices also fuels market growth. Retrofitting projects to meet stricter emission norms remain a major demand driver. Government-backed clean air programs ensure continued need for advanced systems across industrial applications.

Europe

Europe accounts for 21% share of the manufacturing scale electrostatic precipitator market, supported by stringent EU environmental policies and mature industrial infrastructure. Germany, France, and the UK are at the forefront due to their high reliance on emission control in manufacturing, power generation, and waste-to-energy plants. It has a growing preference for modular designs to improve operational flexibility in space-limited facilities. Upgrades to meet evolving regulatory standards contribute to stable demand. The region also emphasizes low-maintenance, high-efficiency systems to reduce operational costs. Technological collaboration between industry and research institutions drives innovation.

Asia-Pacific

Asia-Pacific commands the largest share at 39% of the manufacturing scale electrostatic precipitator market, led by rapid industrial expansion and high particulate emission levels. China and India are the key markets due to large-scale cement, steel, and power generation operations. It benefits from government initiatives targeting air pollution control and industrial modernization. Domestic manufacturing capacity supports cost-effective system supply. Growing mining activities further strengthen demand. Foreign investments and joint ventures with local manufacturers accelerate technology transfer and market penetration.

Latin America

Latin America represents 9% share of the manufacturing scale electrostatic precipitator market, with Brazil, Mexico, and Argentina as primary growth hubs. Expanding cement, mining, and energy industries require effective dust control solutions. It faces moderate adoption rates due to uneven regulatory enforcement, but industrial modernization is creating opportunities. Infrastructure projects and rising foreign investment are expected to increase demand. Adoption of wet electrostatic precipitators is gradually growing in industries handling sticky particulates. Competitive pricing remains critical for market expansion.

Middle East

The Middle East holds 5% share of the manufacturing scale electrostatic precipitator market, driven by its oil and gas, cement, and power generation sectors. GCC countries are investing in industrial emission control to align with environmental goals. It benefits from large-scale infrastructure projects requiring high-performance dust collection systems. Demand is concentrated in petrochemical and energy-intensive industries. Public sector investment in cleaner technologies is rising. Growing collaboration with global suppliers enhances system availability and customization.

Africa

Africa accounts for 2% share of the manufacturing scale electrostatic precipitator market, with South Africa and Nigeria leading demand. Mining, cement production, and energy generation are the key application sectors. It experiences slow adoption due to limited industrial budgets and lower regulatory enforcement. However, foreign-funded industrial projects are introducing advanced systems. Efforts to modernize industrial infrastructure are gradually increasing market potential. Partnerships with international suppliers are helping bridge technology gaps and improve after-sales support.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Competitive Analysis

The manufacturing scale electrostatic precipitator market is characterized by a competitive landscape with the presence of global and regional players focusing on technological innovation, capacity expansion, and strategic partnerships to strengthen market position. It is driven by companies such as Beltran Technologies, GEA Group, Babcock & Wilcox, Valmet, Kraft Powercon, VT Corp, Thermax, ANDRITZ GROUP, Environ Engineers, and Elex, which compete on performance efficiency, cost-effectiveness, and service capabilities. Leading players emphasize R&D to develop energy-efficient designs, IoT-enabled monitoring systems, and advanced electrode configurations to meet evolving environmental standards. Partnerships with industrial operators for retrofitting and modernization projects enhance long-term revenue streams. Market competition is further intensified by local manufacturers offering customized solutions tailored to regional regulatory requirements. Brand reputation, global distribution networks, and after-sales service quality remain critical success factors. Continuous innovation and the ability to offer scalable, low-maintenance solutions enable market leaders to capture demand from both new installations and replacement projects in industries such as power generation, cement, steel, and chemicals.

Recent Developments

- In March 2025, Weixian’s engineering team successfully commissioned a new ESP system at a sulfonation plant in Latin America. The upgrade replaced the existing exhaust system and delivered zero visible emissions, showcasing enhanced environmental performance .

- On June 26, 2024, Babcock & Wilcox (B&W) secured over USD 18 million in contracts to design and supply wet and dry ESP rebuilds across utility and industrial facilities in the United States and Europe.

- In February 2024, Valmet announced supplying ESPs for the recovery boiler at Nordic Paper’s Backhammar mill in Sweden, expected for completion by end of 2025, supporting the mill’s sustainability goals.

- In March 2024, ANDRITZ began a refurbishment project for three ESP units at Södra’s Morrum pulp mill in Sweden, upgrading equipment with next-generation rectifiers to increase boiler capacity and improve energy performance.

Market Concentration & Characteristics

The manufacturing scale electrostatic precipitator market exhibits a moderately consolidated structure, with a mix of global leaders and regional players competing on technology, cost efficiency, and service quality. It is dominated by companies with strong engineering expertise, extensive distribution networks, and the capability to deliver large-scale, customized solutions for industries such as power generation, cement, steel, and chemicals. Market concentration is reinforced by high entry barriers due to significant capital requirements, complex manufacturing processes, and strict environmental compliance standards. Leading players focus on continuous innovation, integrating IoT-based monitoring, energy-efficient power supplies, and advanced electrode designs to enhance system performance. Regional manufacturers compete by offering cost-effective solutions tailored to local regulatory and operational needs. Long-term maintenance contracts, retrofitting services, and modular designs contribute to sustained client relationships. The market’s competitive dynamics favor suppliers that combine advanced technology with flexible, scalable offerings capable of meeting diverse industrial emission control demands.

Report Coverage

The research report offers an in-depth analysis based on Design, System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand will grow with stricter global and regional industrial emission control regulations.

- Adoption of IoT-enabled monitoring systems will enhance operational efficiency and predictive maintenance.

- Energy-efficient designs will become standard to reduce operating costs and meet sustainability goals.

- Modular and compact units will gain popularity for retrofits and space-limited facilities.

- Advanced materials and electrode technologies will improve system durability and performance.

- Retrofitting older units will create steady opportunities in mature industrial markets.

- Asia-Pacific will remain the dominant regional market, driven by industrial expansion.

- Integration with hybrid filtration systems will address performance limitations in variable conditions.

- Localized manufacturing in emerging markets will reduce costs and increase adoption rates.

- Long-term service and maintenance contracts will become a critical revenue stream for suppliers.