Market Overview

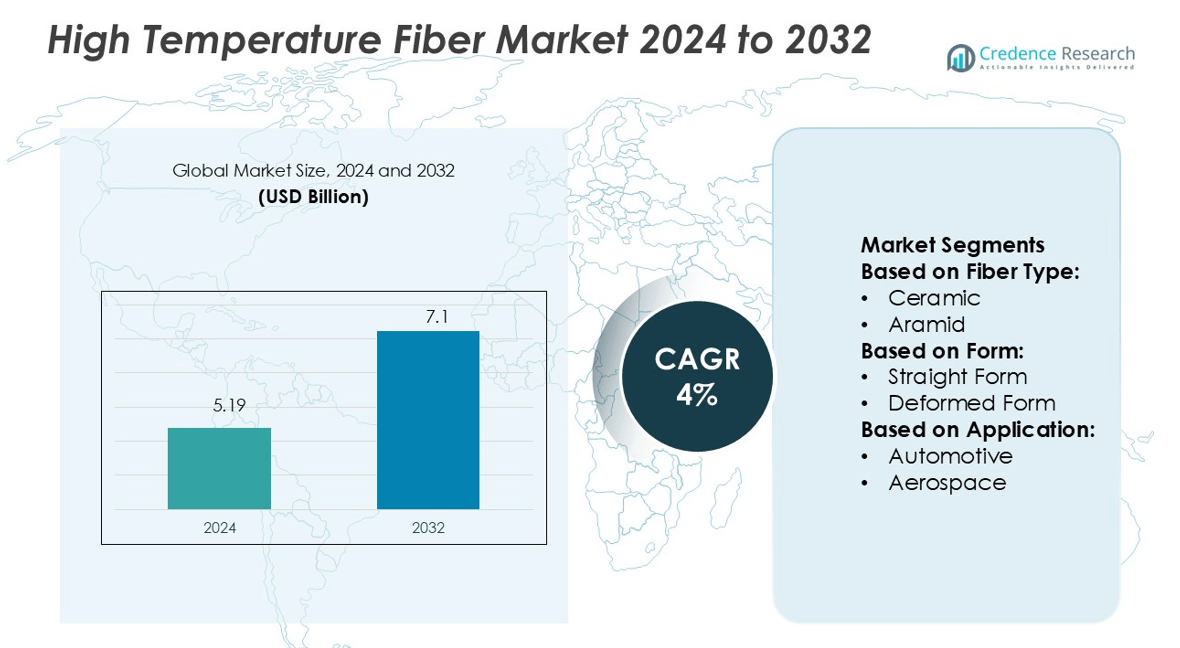

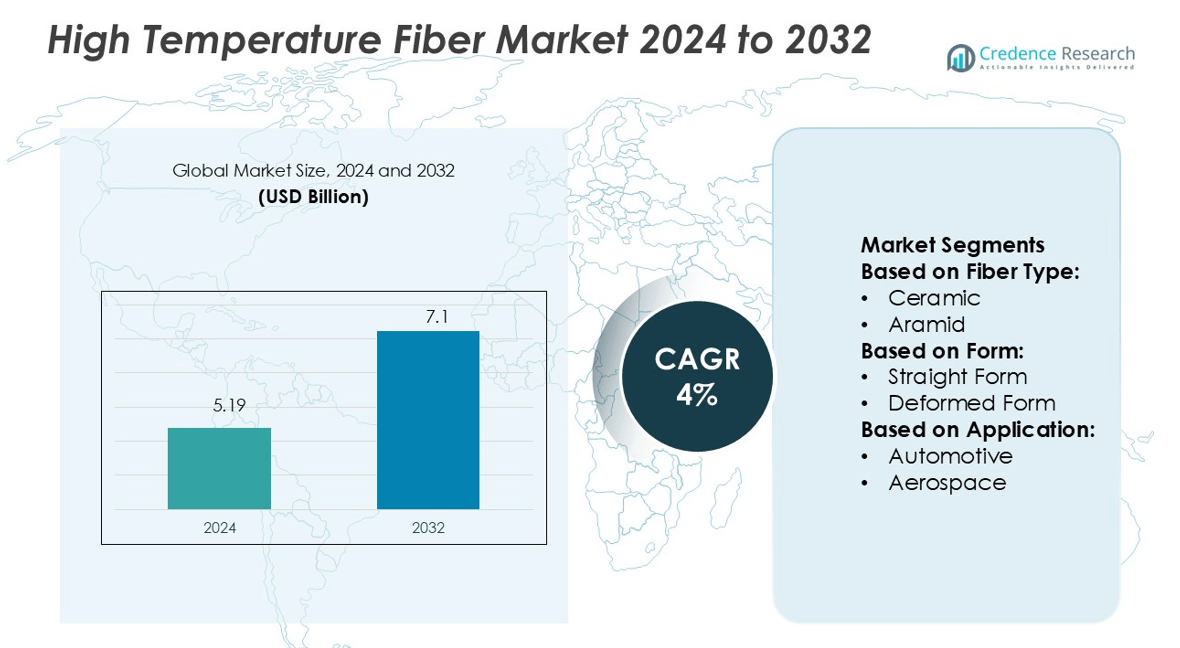

High Temperature Fiber Market size was valued USD 5.19 billion in 2024 and is anticipated to reach USD 7.1 billion by 2032, at a CAGR of 4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| High Temperature Fiber Market Size 2024 |

USD 5.19 billion |

| High Temperature Fiber Market, CAGR |

4% |

| High Temperature Fiber Market Size 2032 |

USD 7.1 billion |

The high temperature fiber market is driven by major players such as TORAY INDUSTRIES, INC., Kamenny Vek, Yantai Tayho Advanced Materials Co., Ltd., Owens Corning, TEIJIN LIMITED, Rex Sealing & Packing Industries Private Limited, DuPont, Kolon Industries, Inc., TOYOBO CO., LTD., and Morgan Advanced Materials. These companies focus on advanced fiber technologies, emphasizing superior heat resistance, lightweight properties, and sustainable materials. Strategic R&D investments and capacity expansions strengthen their global presence across aerospace, automotive, electronics, and industrial applications. Asia Pacific leads the global market with a 33.8% share, supported by rapid industrialization, strong manufacturing capabilities, and rising infrastructure investments. The region’s cost-efficient production and growing export capacity further enhance its dominant position.

Market Insights

- The high temperature fiber market was valued at USD 5.19 billion in 2024 and is projected to reach USD 7.1 billion by 2032, growing at a CAGR of 4%.

- Rising demand from aerospace, automotive, and industrial applications is driving market growth, supported by strong adoption of advanced thermal insulation and lightweight fiber solutions.

- Asia Pacific leads the market with a 33.8% share, followed by North America at 31.2% and Europe at 28.6%, supported by robust manufacturing and export capacity.

- Ceramic fibers hold the largest segment share due to their superior heat resistance, while straight form dominates in reinforcement applications across industries.

- Major players are investing in R&D, capacity expansion, and sustainable solutions, while high production costs and strict regulatory standards act as key restraints.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Fiber Type

Ceramic fibers dominate the high temperature fiber market with the largest market share. Their strong thermal stability and resistance to chemical degradation make them ideal for harsh operating environments. Industries use ceramic fibers in insulation, furnaces, and protective equipment to maintain performance under extreme heat. Aramid fibers follow, driven by their lightweight and high tensile strength. Other fibers find use in specialized applications but hold a smaller market share. Increasing demand from aerospace and automotive sectors further boosts the use of ceramic fibers in advanced thermal protection systems.

- For instance, Basfiber® roving fibers are specified with monofilament diameters from 10 to 22 µm and linear densities from 270 to 4800 tex (dry fiber basis) per its technical sheet.

By Form

Straight form holds the largest share in the high temperature fiber market due to its superior mechanical strength and ease of integration into composite structures. It offers consistent performance in reinforcing high-temperature insulation and structural components. Deformed and hooked forms serve niche applications requiring enhanced bonding and stress distribution. Other forms contribute to specialized use in custom assemblies. Growing demand for lightweight and thermally stable materials in manufacturing and construction fuels the dominance of straight form across industries.

- For instance, Teijin Next™ HTS45 E23 24K, launched in 2025, is a high tenacity carbon fiber, not an intermediate modulus one. It is part of a new, more sustainable product line and is intended for use in the aerospace industry, among other applications.

By Application

The industrial segment leads the high temperature fiber market with the highest market share. It benefits from widespread use in high-temperature insulation, sealing, and protective linings in manufacturing and power generation. The automotive and aerospace sectors follow closely, driven by heat-resistant components for engines and exhaust systems. Electronics and electrical applications also grow with increased demand for thermal management solutions in high-power devices. Expanding industrial infrastructure and energy-efficient operations continue to strengthen the adoption of high temperature fibers in the industrial segment.

Key Growth Drivers

Rising Demand from High-Temperature Industrial Applications

High temperature fibers are widely used in industries like petrochemical, power generation, and metallurgy. These fibers provide superior insulation, heat resistance, and durability under extreme conditions. Rapid industrial expansion in Asia Pacific and North America increases demand for thermal protection materials. Their use in furnace linings, sealing, and insulation helps improve operational efficiency and reduce energy loss. The growing focus on energy-efficient manufacturing processes further drives the adoption of high temperature fibers in heavy-duty industrial applications.

- For instance, Rex also designs gland packing solutions for severe conditions: e.g. RI-18 pure graphite packing tolerates up to 600 °C under pressures of 300 bar, density ranges from 0.9 to 1.3 g/cm².

Growth in Aerospace and Automotive Manufacturing

Aerospace and automotive sectors rely on high temperature fibers for lightweight, heat-resistant components. These fibers support critical functions in thermal shielding, insulation, and noise control. The shift toward electric vehicles and advanced aircraft designs increases the need for materials with superior heat tolerance and low weight. Government emission regulations also push manufacturers to use efficient insulation solutions. Rising production volumes and the integration of advanced fiber technologies accelerate market growth in these transportation industries.

- For instance, DuPont’s Kevlar® EXO™ is engineered for orbital debris shields with a mass reduction of 50% versus ceramic blankets, while maintaining ballistic and thermal performance.

Expansion of Renewable Energy and Power Infrastructure

High temperature fibers play a key role in renewable energy projects, including solar and wind power plants. These fibers ensure thermal stability and insulation in high-heat evironments, improving operational reliability. Growth in concentrated solar power and high-efficiency turbines boosts demand for heat-resistant materials. Power infrastructure upgrades in emerging economies also drive usage in turbines, boilers, and electrical systems. The push for clean energy transitions and grid modernization supports strong growth for high temperature fibers in the energy sector.

Key Trends & Opportunities

Shift Toward Advanced Lightweight Composites

Manufacturers are increasingly combining high temperature fibers with advanced composite materials to improve strength-to-weight ratios. These solutions are essential in aerospace, defense, and automotive industries to meet efficiency and performance targets. Lightweight thermal protection helps reduce fuel use and enhance equipment lifespan. This trend aligns with broader industry moves toward sustainable and energy-efficient designs. Growing demand for fiber-reinforced composites presents new opportunities for material innovation and product differentiation.

- For instance, Kolon Industries’ flagship para-aramid fiber, Heracron® HF200, exhibits a tensile strength of approximately 3,000 MPa, a tensile modulus typically ranging from 83 to 109 GPa.

Integration of Automation and Smart Manufacturing

Automation in manufacturing is enhancing the production of high temperature fibers with better quality control and cost efficiency. Advanced fiber processing methods allow for consistent performance and reduced waste. Smart manufacturing technologies enable tailored fiber forms and insulation solutions for specialized applications. These developments support large-scale deployment in industries requiring high precision. Companies investing in automation can achieve faster production cycles, helping meet the rising global demand for advanced heat-resistant materials.

- For instance, their Superwool® HT Thermo-Bloc™ modules have a classification temperature of 1,300 °C under EN 1094-1 specifications. The maximum continuous use temperature is lower, at 1,150 °C, and they are offered in thicknesses from 100 mm to 300 mm, in 25 mm increments.

Sustainability and Recyclable Fiber Development

The focus on sustainable material solutions is driving R&D in recyclable and eco-friendly high temperature fibers. Traditional fibers often involve energy-intensive production, but new innovations aim to lower carbon footprints. Companies are developing fibers with extended service life and improved recyclability to align with environmental regulations. This shift creates opportunities for manufacturers to position themselves as sustainable material suppliers. Green building initiatives and clean energy projects further expand demand for eco-conscious fiber solutions.

Key Challenges

High Production Costs

Manufacturing high temperature fibers requires expensive raw materials and advanced processing technologies. These factors increase overall production costs and limit adoption in cost-sensitive industries. Price fluctuations of ceramic and aramid materials add further pressure on manufacturers. Smaller companies often struggle to compete with larger players that can scale production. The need for cost optimization remains a key barrier to wider market penetration, especially in emerging economies.

Stringent Safety and Quality Standards

High temperature fibers must comply with strict safety and performance regulations across multiple industries. Meeting international certification requirements involves complex testing and high compliance costs. Aerospace, automotive, and power generation sectors demand exceptional product reliability, leaving little margin for error. Any failure in insulation performance can lead to costly operational risks. These strict standards make it challenging for new entrants to compete effectively, limiting overall market competitiveness.

Regional Analysis

North America

North America holds a 31.2% share of the high temperature fiber market, driven by strong demand from aerospace, automotive, and industrial manufacturing sectors. The U.S. leads with advanced R&D facilities and widespread use of ceramic and aramid fibers. Stringent energy efficiency regulations encourage the adoption of high-performance insulation solutions. Investments in defense and renewable energy projects further support market expansion. Leading manufacturers focus on lightweight composites and thermal protection materials to meet safety and performance standards. The region’s technological leadership and high production capacity strengthen its competitive position in the global market.

Europe

Europe accounts for 28.6% of the high temperature fiber market, supported by strong industrial manufacturing and aerospace activities. Germany, France, and the U.K. drive adoption through advanced automotive production and strict environmental regulations. Demand for sustainable and energy-efficient materials fuels innovation in fiber-reinforced composites. High investment in renewable energy infrastructure, especially in wind and solar power, accelerates fiber use in thermal insulation applications. Key market players in Europe focus on product innovation and compliance with safety standards, strengthening the region’s position as a major producer and consumer of advanced fiber materials.

Asia Pacific

Asia Pacific leads the high temperature fiber market with a 33.8% share, supported by rapid industrialization and strong manufacturing output. China, Japan, India, and South Korea are major contributors due to expanding automotive, electronics, and energy sectors. Large-scale infrastructure projects and renewable energy investments increase demand for heat-resistant materials. Cost-effective manufacturing capabilities give the region a competitive edge. Rising exports of industrial components further boost market growth. The region’s strong production ecosystem and growing domestic consumption make it the fastest-growing market for high temperature fibers globally.

Latin America

Latin America holds a 3.7% share of the high temperature fiber market, driven by increasing adoption in industrial processing, power generation, and oil and gas industries. Brazil and Mexico lead demand due to expanding manufacturing bases and infrastructure modernization. Growing investment in renewable energy projects adds new opportunities for fiber insulation applications. While the market is smaller compared to other regions, rising industrial automation and energy efficiency targets are creating steady growth. Strategic partnerships with global manufacturers are helping strengthen the regional supply chain and improve technology access.

Middle East & Africa

The Middle East & Africa accounts for a 2.7% share of the high temperature fiber market, supported by growing energy and petrochemical industries. GCC countries invest in industrial expansion, driving demand for heat-resistant insulation materials. Renewable energy projects and infrastructure modernization initiatives are increasing fiber applications in thermal protection systems. However, limited local manufacturing capacity and reliance on imports constrain growth. Government initiatives promoting energy-efficient solutions are expected to stimulate further market adoption. As industrial activity expands, the region is likely to experience gradual but steady growth in the coming years.

Market Segmentations:

By Fiber Type:

By Form:

- Straight Form

- Deformed Form

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The high temperature fiber market is highly competitive, with major players including TORAY INDUSTRIES, INC., Kamenny Vek, Yantai Tayho Advanced Materials Co., Ltd., Owens Corning, TEIJIN LIMITED, Rex Sealing & Packing Industries Private Limited, DuPont, Kolon Industries, Inc., TOYOBO CO., LTD., and Morgan Advanced Materials. The high temperature fiber market is characterized by strong competition, driven by rapid technological innovation and expanding industrial applications. Manufacturers are investing in advanced production methods to enhance fiber strength, thermal resistance, and sustainability. Focus areas include lightweight composite development, energy-efficient insulation solutions, and high-performance materials for aerospace, automotive, and power generation sectors. Companies are also adopting strategic partnerships and capacity expansions to strengthen global distribution networks. Environmental regulations are accelerating the shift toward sustainable fiber solutions, while automation in manufacturing improves cost efficiency. This competitive environment encourages continuous innovation and market differentiation.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- TORAY INDUSTRIES, INC.

- Kamenny Vek

- Yantai Tayho Advanced Materials Co., Ltd.

- Owens Corning

- TEIJIN LIMITED

- Rex Sealing & Packing Industries Private Limited

- DuPont

- Kolon Industries, Inc.

- TOYOBO CO., LTD.

- Morgan Advanced Materials

Recent Developments

- In April 2024, YOFC announced the acquisition of RFS Suzhou and RFS Germany to expand its presence in the international cable markets. Both companies are known for their significant international brand presence and robust customer base.

- In January 2024, OFS announced innovations in specialty optical fiber solutions and products at SPIE Photonics West. The company presented its technological expertise and industry management by offering seven highly projected educational conferences at the annual Photonics West Exhibition and SPIE BiOS Expo in San Francisco, California.

- In April 2023, Teijin Limited had qualified its carbon fiber and polyether ether ketone (PEEK) based materials Tenax™ ThermoPlastic Woven Fabric (TPWF) and Tenax™ ThermoPlastic Consolidated Laminate (TPCL) with NCAMP (National Center for Advanced Materials Performance).

- In April 2023, Toray Group has identified achieved circular economy as a key issue under its Medium-Term Management Program, Project AP-G 2022. Towards this end, it was started new initiatives for sustainable products, included supplied recycled fiber &+™

Report Coverage

The research report offers an in-depth analysis based on Fiber Type, Form, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for high temperature fibers will increase with the expansion of aerospace and automotive industries.

- Adoption of lightweight composites will strengthen their role in advanced manufacturing.

- Renewable energy projects will drive wider use of heat-resistant insulation materials.

- Technological innovation will improve fiber performance, durability, and thermal resistance.

- Sustainability initiatives will push the development of recyclable and eco-friendly fiber solutions.

- Automation and smart manufacturing will enhance production efficiency and reduce costs.

- Rising infrastructure investments will boost demand in industrial and power generation sectors.

- Regulatory standards will encourage the use of high-performance insulation materials.

- Strategic collaborations will help expand global supply chains and market reach.

- Asia Pacific will continue to lead market growth through large-scale manufacturing and export capacity.