Market Overview

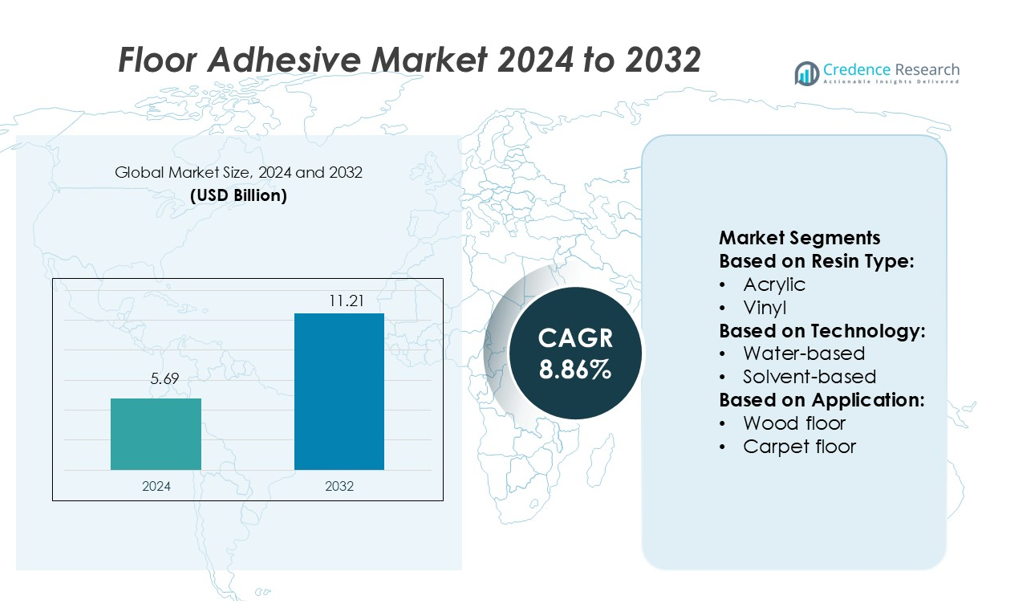

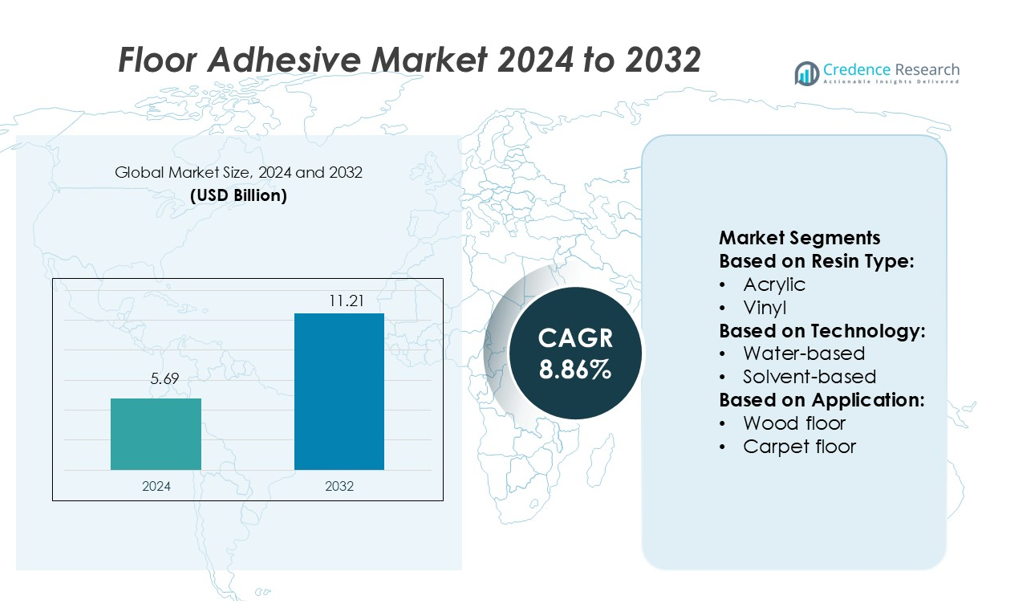

Floor Adhesive Market size was valued USD 5.69 billion in 2024 and is anticipated to reach USD 11.21 billion by 2032, at a CAGR of 8.86% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Adhesive Market Size 2024 |

USD 5.69 billion |

| Floor Adhesive Market, CAGR |

8.80% |

| Floor Adhesive Market Size 2032 |

USD 11.21 billion |

The floor adhesive market is dominated by top players including Henkel Adhesives, Dow, Magicrete, Jowat Adhesives, Forbo, Bison, H.B. Fuller, DAP Global Inc., Bostik Pro Flooring, and Cattie Adhesives. These companies lead through strong product portfolios, advanced adhesive technologies, and broad distribution networks. Their focus on low-VOC, water-based, and high-performance formulations aligns with rising demand for sustainable construction solutions. Strategic mergers and product innovations help strengthen their global footprint and customer base. Asia Pacific leads the market with a 34.8% share, driven by rapid urbanization, infrastructure expansion, and strong residential and commercial construction growth. This regional dominance positions it as the key growth hub for global players.

Market Insights

- The floor adhesive market was valued at USD 5.69 billion in 2024 and is expected to reach USD 11.21 billion by 2032, growing at a CAGR of 8.86%.

- Rising construction activity, urban infrastructure projects, and growing demand for sustainable flooring solutions are driving steady market expansion across key regions.

- The market is shaped by top players focusing on low-VOC, water-based, and advanced adhesive technologies to strengthen product portfolios and global competitiveness.

- Raw material price volatility and strict environmental regulations remain key restraints, increasing production costs and affecting pricing strategies.

- Asia Pacific leads with a 34.8% share, followed by North America and Europe, while vinyl and tile flooring segments hold the largest product share, supported by strong residential and commercial construction growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Resin Type

Epoxy resin dominates the floor adhesive market with a 32.8% share in 2024. Epoxy-based adhesives offer high bond strength, durability, and chemical resistance, making them ideal for heavy-duty flooring applications. They are widely used in industrial and commercial settings, such as factories, warehouses, and hospitals. Demand is rising due to growing infrastructure investments and the need for long-lasting flooring solutions. Polyurethane and acrylic resins are also gaining traction in residential and decorative flooring applications due to their flexibility and ease of application.

- For instance, Dow’s ROBOND™ L-98D is a single-component waterborne acrylic adhesive with a typical coating weight of 1.8–2.5 g/m² and 45 % solids content.

By Technology

Water-based technology leads the floor adhesive market with a 41.5% share in 2024. This dominance is driven by its low VOC emissions, fast drying time, and strong environmental compliance. Water-based adhesives are preferred in residential, healthcare, and commercial construction projects. Their ease of cleanup and strong adhesion properties enhance their adoption in both new construction and renovation projects. Solvent-based adhesives remain relevant in heavy-duty applications but face stricter regulatory measures, pushing the shift toward eco-friendly technologies.

- For instance, Magicrete’s Standard+ Tile Adhesive (a premixed polymer-integrated cementitious adhesive) has a tensile adhesion of 1.0–1.1 N/mm² (after 28 days), according to its technical sheet.retailers report a slightly higher value.

By Application

Tile and stone floor applications hold the largest market share at 37.2% in 2024. These applications demand strong bonding strength and moisture resistance, making them ideal for both indoor and outdoor installations. Growth in urban housing and commercial construction drives strong demand in this segment. Wood and laminate flooring adhesives are also seeing steady growth, supported by rising aesthetic preferences and demand for premium interior finishes. Rapid infrastructure expansion in developing economies further supports the dominance of tile and stone floor applications.

Key Growth Drivers

Rising Residential and Commercial Construction Activities

The growing residential and commercial construction sector is driving floor adhesive demand. Developers increasingly use adhesive solutions for tile, wood, vinyl, and laminate installations due to cost-efficiency and strong bonding. Rapid urbanization, rising disposable incomes, and infrastructure development support this growth. Governments are also investing in smart city and housing projects, which boosts construction activity. This trend is particularly strong in emerging economies such as India, China, and Brazil. Adhesives provide durable flooring solutions, making them essential for modern building applications.

- For instance, Jowat’s Jowatherm PUR GROW 631.20 hot-melt adhesive contains over 20% biobased content while retaining full adhesion performance and can be integrated into manufacturing processes without significant equipment changes.

Shift Toward Eco-Friendly and Low-VOC Products

Growing environmental concerns are encouraging the use of sustainable floor adhesives. Consumers and builders prefer low-VOC and water-based adhesives that meet green building standards. Regulatory frameworks in Europe and North America also favor eco-friendly solutions. Manufacturers are investing in bio-based formulations and non-toxic additives to meet these standards. This shift enhances indoor air quality and supports LEED certifications. As green construction expands, sustainable floor adhesives are gaining rapid market adoption across residential and commercial spaces.

- For instance, Forbo’s Sustain 1195 Sheet & Tile Adhesive offers zero VOC emissions, tolerates moisture emissions up to 10 lbs per 1,000 ft², and works at relative humidity up to 95 %.

Technological Advancements in Adhesive Formulations

Ongoing R&D efforts are improving the performance of floor adhesives. Advanced polyurethane and epoxy-based formulations provide superior bonding strength, flexibility, and moisture resistance. These innovations reduce installation time and maintenance costs, making them ideal for high-traffic areas. Manufacturers are also introducing quick-curing and multi-substrate adhesives that work across varied flooring materials. Such innovations increase application efficiency for contractors and builders. The growing focus on performance-driven adhesives enhances their adoption in both renovation and new construction projects.

Key Trends & Opportunities

Growing Popularity of Modular and Vinyl Flooring

The rise in demand for modular and vinyl flooring is creating strong opportunities for adhesive suppliers. These flooring types are lightweight, easy to install, and cost-effective. They require specialized adhesive solutions that ensure flexibility and durability. The commercial sector, including offices and retail spaces, is rapidly adopting vinyl flooring due to its design variety and easy maintenance. This trend directly drives the consumption of pressure-sensitive and water-based adhesives.

- For instance, Bison’s Flooring Adhesive (ready-to-use, water-based) covers 2–3 m² per kg per its technical sheet. Its solid content is approx. 79 %, density ~1.61 g/cm³, with open time around 15 minutes.

Rising Demand from Emerging Economies

Emerging economies are becoming major growth hubs for floor adhesives. Expanding middle-class populations, rapid urban development, and government infrastructure projects boost construction activity. These countries are witnessing a surge in housing demand and commercial infrastructure investments. The growing number of renovation projects also fuels the adoption of advanced adhesive products. Global manufacturers are expanding their distribution networks and local production to capture these high-growth markets.

- For instance, DAP’s All Purpose Construction Adhesive shows solids content ~68 % and can yield about 32 linear feet with a ¼-inch bead in its 10.3 oz version.

Expansion of DIY Home Improvement Projects

The increasing popularity of DIY flooring projects presents a new opportunity for adhesive manufacturers. Consumers prefer easy-to-apply adhesives for small-scale home renovations. Product innovations such as ready-to-use and quick-setting adhesives cater to this segment. Retailers and e-commerce platforms are also expanding DIY-focused adhesive offerings. This shift encourages manufacturers to launch user-friendly products that simplify installation without professional help.

Key Challenges

Stringent Environmental Regulations

Environmental regulations related to VOC emissions and chemical use pose a major challenge. Manufacturers must comply with evolving standards in regions like Europe and North America. Compliance requires investing in R&D, reformulating products, and adjusting production processes, which increases costs. Non-compliance can lead to penalties and restricted market access. These regulations may also slow the introduction of certain adhesive products in regulated markets.

Volatility in Raw Material Prices

Fluctuating raw material prices significantly impact profit margins for adhesive producers. Key inputs such as resins, solvents, and additives are sensitive to global petrochemical price changes. Sudden cost spikes affect production planning and pricing strategies. Manufacturers face pressure to absorb these costs or pass them to customers, which can affect competitiveness. This volatility makes long-term supply chain planning and contract pricing challenging for industry players.

Regional Analysis

North America

North America holds a 31.2% share of the global floor adhesive market in 2024. The region benefits from high construction spending in residential, commercial, and institutional projects. The United States dominates the market due to strong demand for vinyl, wood, and tile flooring in renovation and new construction. Green building initiatives and strict VOC regulations encourage the use of eco-friendly adhesive solutions. Rapid adoption of advanced polyurethane and epoxy formulations improves installation efficiency. Strong distribution networks and the presence of leading adhesive manufacturers further strengthen North America’s position in the global market.

Europe

Europe accounts for 27.5% of the floor adhesive market in 2024. The region is driven by stringent environmental regulations, which support the adoption of low-VOC and water-based adhesives. Countries like Germany, France, and the UK are investing in sustainable construction and retrofitting old buildings. The growing use of vinyl and laminate flooring enhances adhesive consumption. The renovation of aging infrastructure and public buildings contributes to steady demand. European manufacturers focus on product innovation, sustainable raw materials, and improved bonding technologies, giving the region a strong competitive edge in the global market.

Asia Pacific

Asia Pacific leads the floor adhesive market with a 34.8% share in 2024. Rapid urbanization, strong housing demand, and large-scale infrastructure projects in China, India, and Southeast Asia drive growth. Government initiatives supporting affordable housing and commercial expansion boost adhesive consumption. Vinyl and tile flooring dominate applications due to cost-effectiveness and easy installation. Rising foreign investment in construction and the presence of large manufacturing bases make Asia Pacific a key production hub. The region’s growing middle-class population and renovation activities continue to fuel strong demand for floor adhesives across residential and commercial sectors.

Latin America

Latin America represents 4.2% of the global floor adhesive market in 2024. The region is witnessing steady growth supported by expanding residential construction and commercial renovation projects. Brazil and Mexico lead the market, with growing adoption of vinyl and ceramic flooring solutions. Urban development projects and economic recovery in key countries are boosting flooring adhesive demand. While price sensitivity remains a challenge, rising interest in affordable, easy-to-apply products supports market penetration. Manufacturers are focusing on strengthening local distribution networks and introducing sustainable adhesive solutions tailored to the region’s climatic conditions and construction practices.

Middle East & Africa

The Middle East & Africa accounts for 2.3% of the global floor adhesive market in 2024. Ongoing infrastructure development, particularly in the UAE, Saudi Arabia, and South Africa, drives adhesive demand. Large-scale commercial and hospitality projects, along with rising urban housing, boost market growth. The region is witnessing growing interest in modern flooring materials such as vinyl and laminate, increasing the need for compatible adhesives. Manufacturers are expanding their regional presence to meet project timelines and specifications. Although market share remains modest, rapid construction expansion positions MEA as a growing opportunity for floor adhesive suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Resin Type:

By Technology:

- Water-based

- Solvent-based

By Application:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The floor adhesive market features strong competition among key players such as Henkel Adhesives, Dow, Magicrete, Jowat Adhesives, Forbo, Bison, H.B. Fuller, DAP Global Inc., Bostik Pro Flooring, and Cattie Adhesives. The floor adhesive market is highly competitive, with manufacturers focusing on innovation, sustainability, and performance enhancement. Companies are investing in advanced formulations that offer stronger bonding, faster curing times, and improved durability across various flooring materials. The growing shift toward low-VOC and water-based adhesives aligns with environmental regulations and green building initiatives. Firms are also expanding their production capabilities and distribution networks to strengthen their presence in fast-growing construction markets. Mergers, acquisitions, and partnerships remain key strategies to gain market share. Continuous R&D investment supports the development of specialized adhesives designed for modern flooring applications.

Key Player Analysis

Recent Developments

- In January 2025, Sika AG expanded its production capacity in Southeast Asia to meet growing regional demand for flooring adhesive in high-rise construction. The new facility includes advanced formulation lines for acrylic and polyurethane-based adhesives.

- In September 2024, Dow launched its first bio-circular product for carpet tile backing, enhancing the ENGAGE REN Polyolefin Elastomers portfolio and supporting sustainability goals in the flooring industry.

- In September 2024, Henkel launched the Pattex No More Nails Stick & Peel, an innovative removable construction adhesive, enhancing DIY projects with strong hold, easy removability, and suitability for various surfaces.

- In December 2023, Arkema acquired Arc Building Products in Ireland, a company specializing in construction adhesives and sealants. This acquisition aims to bolster Bostik’s portfolio with Arc’s product range, enhancing its offerings in the expanding Irish construction market.

Report Coverage

The research report offers an in-depth analysis based on Resin Type, Technology, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow steadily with rising residential and commercial construction activities.

- Sustainable and low-VOC adhesives will gain wider adoption due to environmental regulations.

- Asia Pacific will continue to lead demand with rapid urbanization and infrastructure projects.

- Technological innovations will improve adhesive strength, curing speed, and versatility.

- The shift toward modular and vinyl flooring will boost specialized adhesive demand.

- DIY home improvement trends will increase the use of ready-to-use adhesive products.

- Manufacturers will expand their distribution networks in high-growth emerging markets.

- Green building certifications will accelerate the demand for eco-friendly adhesive solutions.

- Strategic partnerships and mergers will enhance market competitiveness and product portfolios.

- Advancements in production processes will reduce costs and improve product quality.