Market Overview

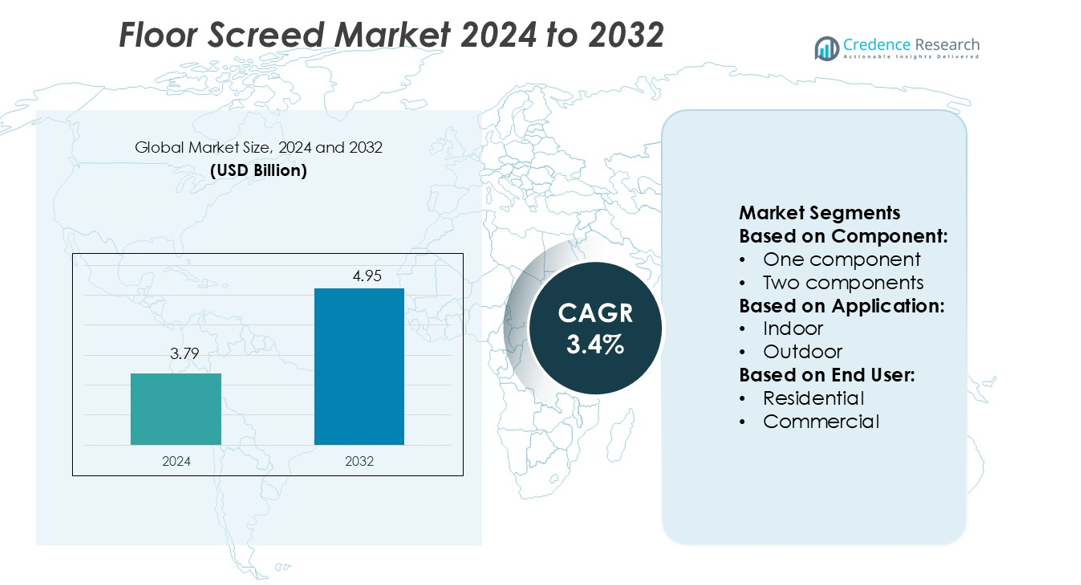

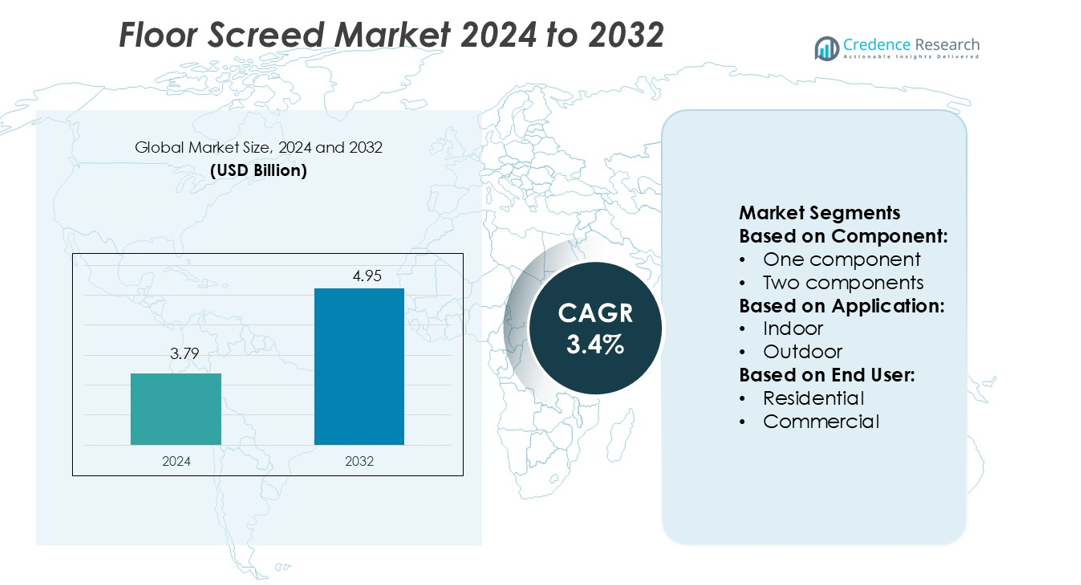

Floor Screed Market size was valued USD 3.79 billion in 2024 and is anticipated to reach USD 4.95 billion by 2032, at a CAGR of 3.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Floor Screed Market Size 2024 |

USD 3.79 billion |

| Floor Screed Market, CAGR |

3.4% |

| Floor Screed Market Size 2032 |

USD 4.95 billion |

The Floor Screed Market is led by prominent companies such as Flowcrete, Colmef Monneli, Saint Gobian, Ardex, Simcrete India, CES Quarry Products, Polycote, Sika Group, Edilteco Group, and Floorex. These players maintain a strong global presence through advanced product portfolios, sustainable material innovation, and efficient distribution networks. Their focus on high-performance formulations, faster curing times, and automated application systems enhances project efficiency and competitiveness. North America holds the leading position in the market with a 39.2% share, driven by rapid urban development, advanced construction technologies, and strong demand for high-quality flooring solutions. The region benefits from well-established infrastructure, high renovation activities, and stringent building standards. Continuous product innovation and strategic investments by key companies further strengthen North America’s dominance, setting a strong benchmark for global market growth and technological advancement in the floor screed industry.

Market Insights

- The Floor Screed Market was valued at USD 3.79 billion in 2024 and is projected to reach USD 4.95 billion by 2032, growing at a CAGR of 3.4%.

- Rapid urbanization, rising renovation activities, and increasing demand for high-quality flooring solutions are driving market growth across residential, commercial, and industrial sectors.

- The market is witnessing a shift toward sustainable, low-VOC materials and automated application technologies, improving installation speed and surface durability.

- Key players such as Flowcrete, Colmef Monneli, Saint Gobian, Ardex, Simcrete India, CES Quarry Products, Polycote, Sika Group, Edilteco Group, and Floorex focus on innovation, strategic expansion, and strong distribution networks to enhance competitiveness.

- North America leads the market with a 39.2% share, supported by advanced infrastructure and high remodeling demand, while self-leveling screeds dominate the product segment due to their superior performance and ease of application.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component

One-component floor screeds hold the dominant market share in the Floor Screed Market. This dominance stems from their ease of application, lower material cost, and faster drying time. These self-leveling formulations are widely used in both residential and commercial spaces. Two-component and three-component systems are gaining attention due to their higher strength and moisture resistance, especially for industrial floors. However, their higher price and longer preparation time limit widespread use. Four-component systems serve niche applications in high-performance environments such as healthcare and manufacturing clean rooms.

- For instance, Flowcrete’s Isocrete 1500 self-leveling floor screed can be walked on in 2–4 hours and accepts moisture-sensitive floor finishes in as little as 24 hours under ideal conditions, such as 20°C and 50% relative humidity.

By Application

Indoor applications account for the largest share in the Floor Screed Market. Strong demand comes from flooring renovations, residential housing, commercial buildings, and industrial facilities. Indoor screeds are preferred for their smooth finish, durability, and compatibility with underfloor heating systems. Outdoor screeds are growing steadily, driven by infrastructure upgrades and commercial landscape projects. These screeds offer high resistance to temperature shifts and water damage but require higher material performance standards.

- For instance, Colmef S.r.l. / Monneli brand offers Autolivellante L 10, a self-levelling compound usable indoors and outdoors. It applies in thicknesses from 1 mm to 10 mm, with a yield of 1.6 kg per m² per mm of thickness.

By End User

The residential segment leads the Floor Screed Market with the highest market share. Rising urbanization and new housing developments fuel this demand. Quick-setting screeds are preferred in residential projects for their ease of installation and compatibility with modern flooring. The commercial sector is also growing rapidly, supported by retail, office, and hospitality expansions. Industrial users focus on heavy-duty screeds with superior load-bearing capacity and chemical resistance to support manufacturing and logistics operations.

Key Growth Drivers

Rising Construction and Infrastructure Development

The Floor Screed Market is expanding due to rapid infrastructure development worldwide. Increased investments in residential, commercial, and industrial construction projects are driving material demand. Urbanization in emerging economies fuels new building activities, while renovation projects in developed regions boost screed consumption. Builders prefer screeds for their smooth finish, strength, and compatibility with modern flooring systems. Government spending on transportation, housing, and public infrastructure strengthens this growth trend, ensuring consistent demand for floor screed products across multiple sectors.

- For instance, weber.floor 4610 from Saint-Gobain Weber is specified for industrial floors under heavy mechanical use. It boasts a compressive strength of approximately 35 N/mm² at 28 days and a flexural strength of about 10 N/mm².

Growing Demand for Smooth and Durable Flooring

Modern construction requires smooth, level surfaces for the installation of tiles, vinyl, wood, and other flooring materials. Floor screeds provide a strong, stable base that enhances the overall flooring durability. Rising consumer expectations for high-quality finishes and the growth of luxury housing projects further push demand. Commercial and industrial facilities also rely on advanced screeds for heavy-load flooring. This growing preference for seamless, long-lasting flooring systems remains a strong driver of market expansion globally.

- For instance, ARDEX’s A 38™ Rapid Set Screed is a polymer-modified, ultra-rapid drying cement used to produce high-performance floor screeds for interior and exterior applications.

Technological Advancements in Screed Materials

Manufacturers are introducing advanced formulations that improve setting time, strength, and moisture resistance. Self-leveling and fast-drying screeds enable faster project completion, reducing construction timelines. Innovative polymer-modified and fiber-reinforced products enhance performance in both indoor and outdoor applications. These technological improvements make screeds suitable for diverse building types, including energy-efficient and sustainable projects. As construction projects demand higher performance and durability, these advancements significantly accelerate market growth and increase product adoption rates.

Key Trends & Opportunities

Rising Popularity of Underfloor Heating Systems

The adoption of underfloor heating in residential and commercial spaces is creating new opportunities. Screeds offer excellent thermal conductivity and form a smooth surface that supports heating installations. Countries in Europe and North America are leading this trend, with growing adoption in Asia Pacific. The need for energy-efficient solutions further drives interest in compatible floor screeds. Manufacturers are developing specialized screed formulations to enhance heat transfer efficiency and reduce energy loss, making this segment a key growth area.

- For instance, CES Quarry Products’ “Cement Based Liquid Screed” reports a thermal conductivity up to 2.9 W/m·K, enabling thinner layers (minimum 25 mm above UFH pipes) and full coverage of heating pipes to maximise heat transfer.

Focus on Sustainability and Green Building Standards

Sustainability is shaping purchasing decisions in the construction sector. Builders are adopting low-VOC, eco-friendly screeds that align with green building certifications such as LEED and BREEAM. Manufacturers are using recycled content and low-emission binders to meet regulatory goals. These sustainable materials also offer better indoor air quality and lower environmental impact. Growing awareness of green construction practices creates strong opportunities for eco-conscious screed producers to expand their market share and strengthen their competitive position.

- For instance, Sikafloor Curehard 24 is primarily a floor hardening product that improves abrasion resistance and reduces dusting on concrete surfaces. It is distinct from other Sika flooring systems, such as the advanced Sikafloor 24 NA PurCem, which is a multi-component polyurethane screed designed for industrial applications that achieves very low VOC emissions.

Urban Renovation and Smart City Projects

Rapid urbanization and smart city developments are fueling renovation activities. Older buildings are being upgraded with advanced flooring solutions that require high-performance screeds. Governments and private developers are investing in modernizing infrastructure to support smart facilities and energy-efficient buildings. This trend creates consistent demand for self-leveling and fast-curing screeds that speed up project timelines. The growing emphasis on smart construction provides significant expansion opportunities for leading market players.

Key Challenges

High Installation and Material Costs

Advanced screed formulations, while offering improved performance, come with higher costs. Installation also requires skilled labor and specialized equipment. These factors increase the overall flooring project budget, making it challenging for cost-sensitive builders and contractors. Price competition in the construction industry can limit adoption in small- to mid-scale projects. Cost pressures may also delay or reduce investments in high-quality screed materials, affecting market growth in developing economies.

Skilled Labor Shortage

Applying floor screed requires trained professionals to achieve a uniform, smooth finish. Many regions face a shortage of skilled installers, especially in emerging markets. Poor application can lead to cracking, uneven surfaces, or delayed project timelines. This skills gap raises project risks and adds to installation costs. Manufacturers and construction firms are increasingly offering training programs, but the lack of qualified labor remains a significant barrier to wider market penetration and growth.

Regional Analysis

North America

North America holds a 29.4% market share in the Floor Screed Market, driven by strong construction and renovation activity across the U.S. and Canada. High demand for premium flooring solutions in residential and commercial buildings fuels product adoption. Rapid expansion of smart homes and infrastructure modernization projects boosts the use of fast-drying and self-leveling screeds. Stringent building standards encourage the use of high-quality materials, ensuring long-term durability. Major manufacturers are investing in innovative products to meet sustainability goals, further strengthening the region’s leadership position in the global floor screed industry.

Europe

Europe accounts for a 33.1% market share, making it the leading region in the Floor Screed Market. The region benefits from widespread adoption of underfloor heating systems and strict energy efficiency regulations. Countries like Germany, the UK, and France drive high demand for advanced screed formulations with improved thermal conductivity and environmental performance. Renovation activities in older buildings also boost usage, supported by well-established construction standards. Strong focus on sustainable building materials and green certifications continues to shape product preferences, positioning Europe as a key innovation hub for floor screed technologies.

Asia Pacific

Asia Pacific holds a 26.3% market share, fueled by rapid urbanization and infrastructure expansion in China, India, Japan, and Southeast Asia. Large-scale residential construction and commercial development create strong demand for affordable and fast-curing screeds. Governments are investing heavily in housing and smart city projects, supporting market growth. Rising disposable income and growing adoption of modern flooring solutions further accelerate product penetration. Manufacturers are expanding regional production facilities to meet rising local demand. Asia Pacific remains the fastest-growing region due to its high construction activity and modernization initiatives.

Latin America

Latin America represents a 6.2% market share in the Floor Screed Market, supported by growing commercial and residential construction activities. Countries such as Brazil, Mexico, and Chile are investing in infrastructure upgrades and affordable housing projects. Demand for self-leveling and cementitious screeds is increasing as builders seek cost-effective flooring solutions. However, limited skilled labor and moderate adoption of advanced technologies slightly restrict rapid expansion. Rising government investment and international construction partnerships are expected to improve regional capacity and drive steady market growth in the coming years.

Middle East & Africa

The Middle East & Africa hold a 5.0% market share in the Floor Screed Market, with strong growth potential from infrastructure and commercial development. Rapid urbanization in the UAE, Saudi Arabia, and South Africa drives demand for modern flooring solutions. Mega construction projects and smart city initiatives further fuel the use of high-performance screeds. Hot climate conditions also increase demand for moisture-resistant and durable formulations. Although the market is still developing, growing investments in commercial complexes, hospitality, and residential projects are expected to strengthen the region’s position in the global market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Market Segmentations:

By Component:

- One component

- Two components

By Application:

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Floor Screed Market is shaped by leading players including Flowcrete, Colmef Monneli, Saint Gobian, Ardex, Simcrete India, CES Quarry Products, Polycote, Sika Group, Edilteco Group, and Floorex. The Floor Screed Market is characterized by strong competition driven by product differentiation, technological innovation, and strategic expansion. Companies are focusing on developing high-performance screed solutions with faster drying times, improved crack resistance, and better surface finish to meet modern construction needs. Sustainable and low-VOC formulations are gaining traction, supported by stricter environmental regulations and green building initiatives. Market participants are also investing in advanced application technologies, including automated mixing and leveling systems, to enhance precision and efficiency on construction sites. Strategic moves such as capacity expansion, product portfolio diversification, and entry into emerging markets are strengthening their global presence. The growing demand from residential, commercial, and industrial construction projects is pushing companies to optimize costs, improve quality, and deliver innovative solutions. This competitive environment is expected to intensify further as infrastructure investments increase worldwide.

Key Player Analysis

- Flowcrete

- Colmef Monneli

- Saint Gobian

- Ardex

- Simcrete India

- CES Quarry Products

- Polycote

- Sika Group

- Edilteco Group

- Floorex

Recent Developments

- In July 2024, Sherwin-Williams introduced a new line of high-performance flooring systems designed for giga factories producing electric vehicle (EV) batteries. These flooring solutions offer chemical resistance, electrostatic discharge protection, moisture vapor control, and enhanced slip resistance.

- In January 2024, Saint-Gobain acquired two companies in the non-residential flooring market, strengthening its position in the construction chemicals sector. R.SOL, a French company, specializes in resin-based flooring solutions. This acquisition diversifies Saint-Gobain’s portfolio and provides access to R.SOL’s innovative technology and customer network.

- In May 2023, PPG announced a significant expansion of its concrete coating portfolio. The newly expanded range includes integrated systems featuring primers, base coats, and topcoats, specifically designed for environments that demand electrostatic protection.

- In March 2023, Ligchine, a Wisconsin-based manufacturer specializing in remote-control, laser-guided concrete screeds, announced the development of its most productive ScreedSaver model yet. Unveiled at the World of Concrete event in January, the new ScreedSaver Ultra Plus is designed for contractors engaged in flatwork concrete projects

Report Coverage

The research report offers an in-depth analysis based on Component, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The demand for advanced floor screed solutions will rise with global construction growth.

- Green building standards will push manufacturers toward eco-friendly and low-VOC formulations.

- Rapid urbanization will increase the need for quick-drying and durable screed products.

- Automation and digital tools will enhance application accuracy and project efficiency.

- Infrastructure investments will expand the market in developing economies.

- Companies will strengthen their positions through mergers, acquisitions, and partnerships.

- Innovation in lightweight and self-leveling screeds will improve installation speed.

- Sustainability goals will encourage the use of recycled and renewable materials.

- Product diversification will support specialized use in commercial and industrial projects.

- Rising renovation and remodeling activities will boost market penetration globally.