Market Overview

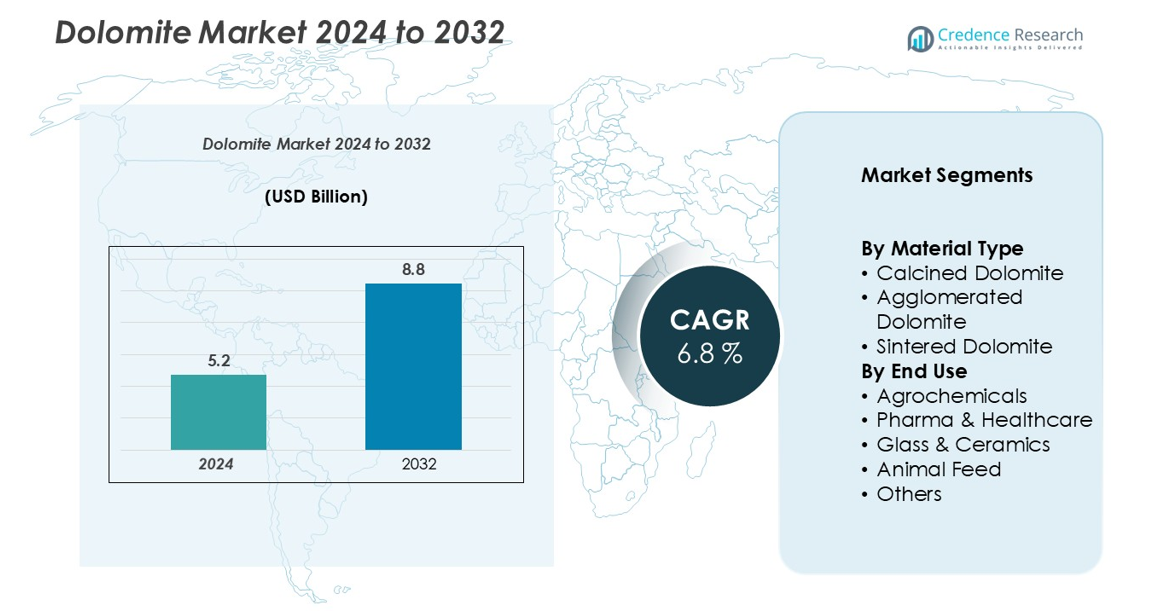

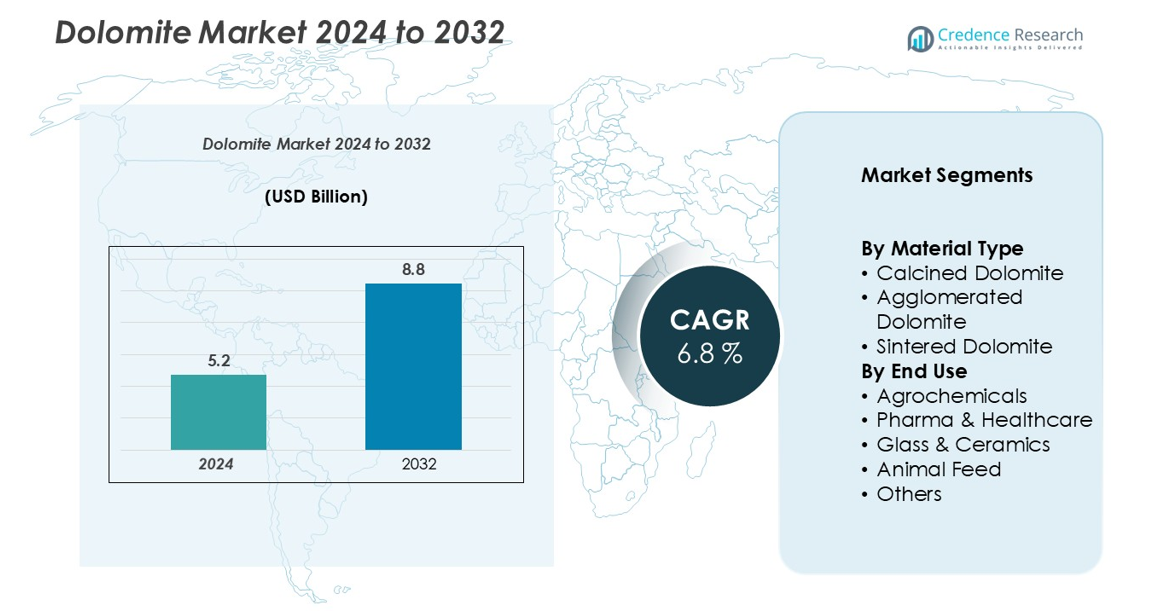

The Dolomite market size was valued at USD 5.2 billion in 2024 and is anticipated to reach USD 8.8 billion by 2032, at a CAGR of 6.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dolomite Market Size 2024 |

USD 5.2 billion |

| Dolomite Market, CAGR |

6.8% |

| Dolomite Market Size 2032 |

USD 8.8 billion |

The global dolomite market is led by prominent players such as Nordkalk Corporation, Carmeuse, Sibelco, JFE Mineral & Alloy Company Ltd., Lhoist, Imerys, Omya AG, Calcinor, Dillon, Arij Global Trading, Beihei Group, and Rawedge. These companies collectively dominate the market through strong production capabilities, advanced processing technologies, and strategic distribution networks. Asia-Pacific remains the leading region, accounting for over 45% of the global market share in 2024, driven by robust demand from the steel, construction, and agriculture sectors in China, India, and Japan. Europe and North America follow, supported by established industrial infrastructure and increasing adoption of sustainable mineral solutions, while Latin America and the Middle East & Africa represent emerging growth opportunities for market expansion.

Market Insights

- The global Dolomite market was valued at USD 5.2 billion in 2024 and is projected to reach USD 8.8 billion by 2032, growing at a CAGR of 6.8% during the forecast period.

- Market growth is driven by rising demand from the construction, steel, and agriculture sectors, supported by rapid urbanization and infrastructure development in emerging economies.

- Key trends include increasing adoption of high-purity dolomite for pharmaceutical and environmental applications, along with technological advancements in sustainable mining and processing techniques.

- The competitive landscape features major players such as Nordkalk Corporation, Carmeuse, Lhoist, Sibelco, JFE Mineral & Alloy Company Ltd., and others, focusing on capacity expansion, product innovation, and eco-friendly operations.

- Asia-Pacific leads with over 45% market share, followed by Europe (25%) and North America (18%), while the agrochemical segment dominates end-use applications due to growing use of dolomite as a soil conditioner and nutrient enhancer.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Material Type:

The dolomite market by material type is segmented into calcined dolomite, agglomerated dolomite, and sintered dolomite. Calcined dolomite dominated the market in 2024, accounting for the largest share, owing to its extensive use in steel manufacturing, glass production, and water treatment. Its high thermal stability and ability to neutralize acids make it an essential material in industrial processes. The increasing demand for steel in infrastructure and automotive applications continues to drive the growth of this sub-segment, while sintered dolomite is gaining traction in refractory applications due to its superior strength and durability.

- For instance, RHI Magnesita uses sintered dolomite in its refractory products, such as those in the Radex® series, which are used for steel ladles to enhance thermal resistance and process efficiency.

By End Use:

Based on end use, the market is categorized into agrochemicals, pharma & healthcare, glass & ceramics, animal feed, and others. The agrochemicals segment held the dominant share in 2024, driven by the growing adoption of dolomite as a soil conditioner and pH regulator in farming. Its calcium and magnesium content improves soil fertility and crop productivity, supporting sustainable agriculture practices. Meanwhile, the glass & ceramics segment is expanding rapidly, fueled by increasing demand for high-quality glass in construction and consumer electronics.

- For instance, AGC Inc. is a major global glass manufacturer that utilizes dolomite in its float glass production, including at plants in Asia and Europe. Dolomite, a raw material that contains calcium and magnesium carbonate, helps lower the glass mixture’s melting point and enhances the durability and optical clarity of the final product.

Key Growth Drivers

Expanding Construction and Infrastructure Sector

The rapid pace of urbanization and infrastructure development worldwide is a major driver of the dolomite market. Dolomite is extensively used as an aggregate in concrete and asphalt, as well as a filler in cement, due to its high durability and strength-enhancing properties. Large-scale residential, commercial, and transportation projects, particularly in emerging economies across Asia-Pacific, are significantly increasing demand. Additionally, government initiatives promoting smart cities and sustainable infrastructure are fueling consumption. The rising use of dolomite in road base materials and building facades further strengthens its market position in the construction sector, ensuring consistent growth in the coming years.

- For instance, Building materials companies, such as local brands associated with Holcim Group, utilized dolomite aggregate in 2023 for various infrastructure projects across Southeast Asia to enhance concrete strength and durability in construction.

Rising Steel and Glass Production

Dolomite plays a crucial role as a fluxing material in iron and steel manufacturing, where it helps remove impurities and enhance product quality. The steady growth of the global steel industry, driven by increasing demand from automotive, machinery, and construction sectors, directly supports dolomite consumption. Moreover, dolomite’s application in glass manufacturing—as a source of magnesium oxide—enhances durability, chemical resistance, and transparency in glass products. The rising use of flat and specialty glass in electronics, renewable energy, and architectural applications further propels market demand. This synergy between the steel and glass industries underpins dolomite’s long-term growth prospects.

- For instance, JSW Steel achieved 7.63 million tonnes of crude steel production in Q4 FY25, requiring high-quality fluxing inputs for its blast furnace

Growing Demand in Agriculture and Environmental Applications

In agriculture, dolomite serves as a natural soil conditioner, providing essential nutrients such as calcium and magnesium while neutralizing soil acidity. The shift toward sustainable farming and organic cultivation practices has amplified its adoption among farmers worldwide. Moreover, dolomite’s role in water treatment, waste management, and air pollution control contributes to its growing environmental applications. As concerns about soil degradation, water quality, and carbon emissions intensify, industries are increasingly adopting eco-friendly mineral solutions like dolomite. These environmental and agricultural benefits position dolomite as a key material supporting the global transition toward sustainability.

Key Trends & Opportunities

Development of High-Purity and Specialty Dolomite Grades

The market is witnessing increasing demand for high-purity dolomite grades used in pharmaceuticals, healthcare, and environmental engineering applications. These specialty grades offer superior chemical composition and minimal impurities, making them ideal for use in dietary supplements, water treatment systems, and advanced ceramics. Manufacturers are investing in refining technologies and beneficiation processes to improve purity levels and consistency. This trend not only opens new revenue streams but also strengthens the position of dolomite suppliers in high-value industries. The shift from commodity-based usage to specialized applications represents a major opportunity for market differentiation and premium pricing.

- For instance, Peroglio S.p.A. markets high-purity dolomite from its Costa Alta quarry with near-total absence of iron oxides, verifying purity via laboratory analyses.

Technological Advancements and Sustainable Mining Practices

Innovation in extraction and processing technologies is reshaping the dolomite industry. Automation, digital mapping, and precision blasting techniques are improving yield efficiency and reducing waste. At the same time, mining companies are adopting sustainable practices such as dust suppression, waste recycling, and energy-efficient operations to minimize environmental impact. Regulatory pressures and corporate sustainability goals are accelerating these changes. The integration of green technologies and eco-friendly production methods not only enhances brand reputation but also appeals to environmentally conscious consumers and industries, paving the way for long-term, sustainable growth opportunities.

Key Challenges

Environmental Concerns and Regulatory Constraints

While dolomite mining is essential for industrial growth, it poses environmental challenges, including habitat disruption, dust emissions, and groundwater contamination. Governments across major producing countries have introduced stricter environmental regulations and land rehabilitation mandates, which increase operational costs and limit expansion. Compliance with safety standards, waste management, and emission control requirements remains a key challenge for market players. Failure to adhere to these regulations can result in penalties and production halts. Balancing economic growth with environmental responsibility continues to be a pressing issue in the dolomite industry.

Volatility in Raw Material Prices and Supply Chain Disruptions

Fluctuations in raw material and energy prices significantly impact production costs in the dolomite market. Transportation and logistics challenges—especially in remote mining regions—further add to price instability. Global trade disruptions, such as port congestion or geopolitical tensions, can restrict the steady supply of dolomite to end-user industries. Additionally, dependence on region-specific reserves increases vulnerability to local policy changes and export restrictions. To mitigate these challenges, manufacturers are focusing on diversifying supply chains, improving inventory management, and investing in local production capacities to ensure market stability and cost competitiveness.

Regional Analysis

Asia-Pacific:

The Asia-Pacific region dominated the global dolomite market in 2024, accounting for over 45% of the total market share. Rapid industrialization, urbanization, and infrastructure expansion in countries such as China, India, and Japan are driving strong demand. The region’s robust steel and construction industries, coupled with growing agricultural applications, contribute significantly to market growth. China remains the largest producer and consumer of dolomite, supported by abundant mineral reserves and large-scale industrial operations. Rising investments in cement production and sustainable construction further enhance the region’s market outlook through 2032.

Europe:

Europe held a market share of around 25% in 2024, driven by established industries such as glass, ceramics, and steel manufacturing. Countries like Germany, Italy, and Spain are major consumers of dolomite, particularly in high-purity applications for environmental and industrial uses. The region’s emphasis on sustainable mining practices and technological innovation enhances production efficiency. Additionally, the presence of leading dolomite producers and regulatory support for eco-friendly materials sustain market demand. Europe’s transition toward green building materials and renewable energy infrastructure continues to boost dolomite consumption across key sectors.

North America:

North America accounted for approximately 18% of the global market share in 2024, supported by steady growth in construction, agriculture, and environmental applications. The United States and Canada are key markets, leveraging dolomite in steelmaking, water treatment, and soil conditioning. Rising infrastructure investments and the adoption of sustainable agricultural practices are driving regional demand. Moreover, advancements in processing technologies and the expansion of local mining operations are enhancing product availability. The region’s commitment to infrastructure modernization and green initiatives positions it as a consistent contributor to the global dolomite market.

Latin America:

Latin America captured nearly 7% of the global dolomite market share in 2024, with growth primarily driven by Brazil, Mexico, and Argentina. The expanding construction and agricultural sectors are key contributors to market expansion. Dolomite’s use as a soil conditioner and as a flux in steel manufacturing supports its rising demand across the region. Ongoing industrialization and public infrastructure development initiatives are further fueling consumption. Although mining operations remain concentrated in select countries, increasing foreign investments in mineral processing facilities are expected to strengthen the region’s production capacity over the forecast period.

Middle East & Africa:

The Middle East & Africa (MEA) region held about 5% of the global market share in 2024, with notable potential for future growth. The region’s market is driven by rising steel production, construction activities, and growing agricultural demand in countries such as Saudi Arabia, the UAE, and South Africa. Investments in mining infrastructure and diversification of non-oil industries are enhancing dolomite utilization. Furthermore, increasing government focus on industrial self-sufficiency and mineral exploration projects is expected to create new opportunities, positioning MEA as an emerging growth market in the global dolomite industry.

Market Segmentations:

By Material Type

- Calcined Dolomite

- Agglomerated Dolomite

- Sintered Dolomite

By End Use

- Agrochemicals

- Pharma & Healthcare

- Glass & Ceramics

- Animal Feed

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global dolomite market is moderately consolidated, with key players focusing on expanding production capacities, enhancing product quality, and adopting sustainable mining practices to strengthen their market position. Leading companies such as Nordkalk Corporation, Carmeuse, Sibelco, JFE Mineral & Alloy Company Ltd., Lhoist, Imerys, Omya AG, Calcinor, Dillon, Arij Global Trading, Beihei Group, and Rawedge play a significant role in shaping the competitive dynamics. These companies emphasize vertical integration, advanced processing technologies, and regional expansion to ensure consistent supply and cost efficiency. Strategic initiatives, including mergers, acquisitions, and long-term supply contracts, are helping players secure their presence in high-demand sectors like steel, construction, and agriculture. Moreover, the growing focus on high-purity and eco-friendly dolomite grades is encouraging innovation and differentiation among major manufacturers, positioning them to capitalize on emerging opportunities in green materials and specialty applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Nordkalk Corporation

- Carmeuse

- Sibelco

- JFE Mineral & Alloy Company, Ltd.

- Dillon

- Lhoist

- Arij Global Trading

- Omya AG

- Beihei Group

- Imerys

- Rawedge

- Calcinor

Recent Developments

- In 2022, RHI Magnesita inaugurated the Dolomite Hub in Austria, after two years of development with an investment of more than USD 50.6 million. The new dolomite center boosts plant productivity while making substantial contribution to environmental preservation.

- In March 2023, Refractarios Kelsen S.A., (Calcinor), a well-known manufacturer of dolomite bricks and mixes, established a new fired brick facility with a footprint of over 6,000 m2 for business expansion in Aduna.

Report Coverage

The research report offers an in-depth analysis based on Material Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for dolomite is expected to grow steadily due to expanding construction and infrastructure projects worldwide.

- The steel and glass industries will continue to drive consumption as industrial production increases.

- High-purity and specialty dolomite grades will gain traction in pharmaceuticals, healthcare, and environmental applications.

- Adoption of sustainable mining and processing practices will shape the market’s future growth.

- Agrochemical applications will expand as farmers increasingly use dolomite for soil conditioning and nutrient management.

- Technological advancements in extraction and beneficiation will improve product quality and operational efficiency.

- Emerging economies in Asia-Pacific and Latin America will offer significant growth opportunities.

- Strategic partnerships, mergers, and acquisitions will help key players strengthen market presence.

- Environmental regulations will encourage the production and use of eco-friendly dolomite products.

- Innovation in high-value and specialized applications will create new revenue streams for manufacturers.