Market Overview:

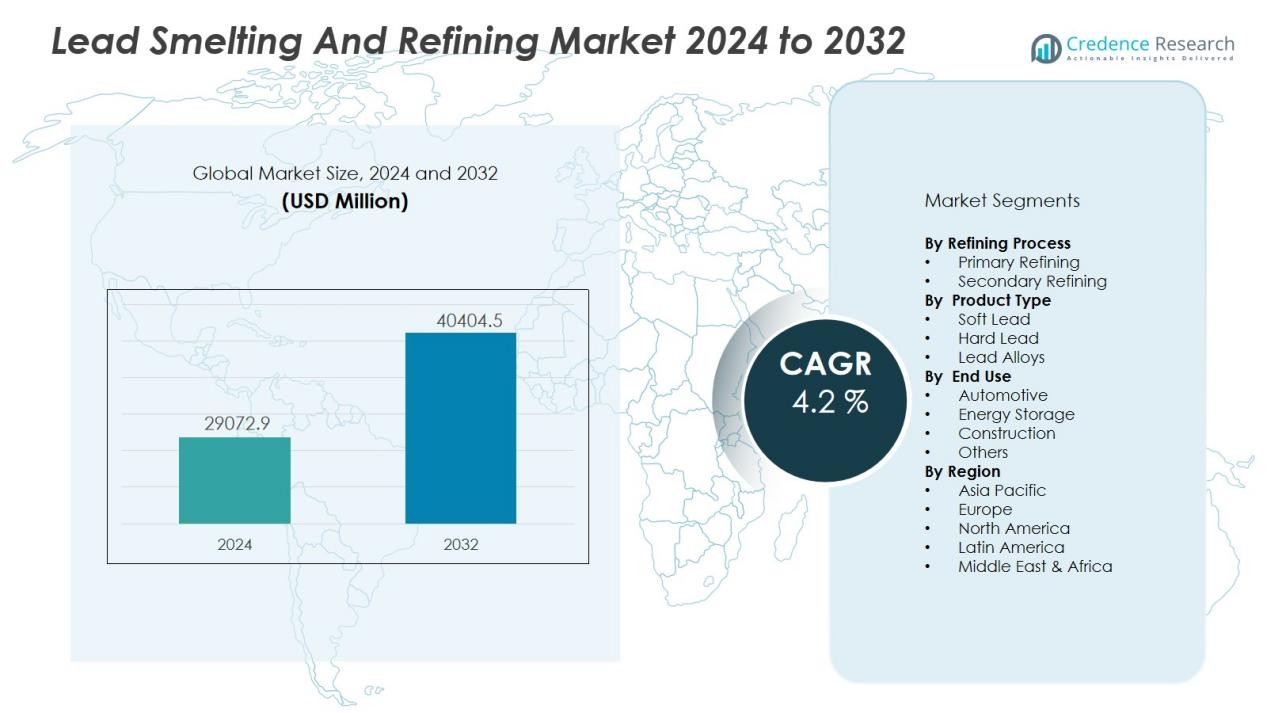

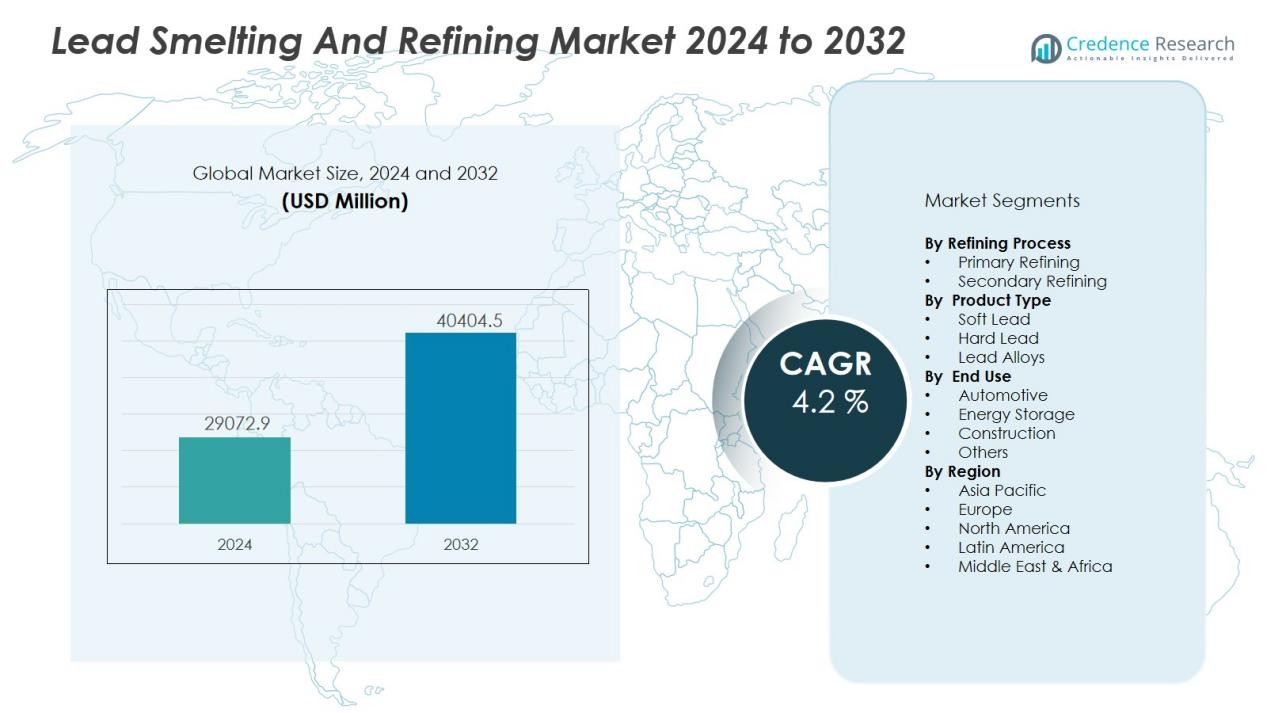

The lead smelting and refining market size was valued at USD 29072.9 million in 2024 and is anticipated to reach USD 40404.5 million by 2032, at a CAGR of 4.2 % during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2024 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lead Smelting And Refining Market Size 2024 |

USD 29072.9 Million |

| Lead Smelting And Refining Market, CAGR |

4.2 % |

| Lead Smelting And Refining Market Size 2032 |

USD 40404.5 Million |

Market growth is propelled by the surge in lead-acid battery demand from automotive, energy storage, and backup power systems, which accounts for the majority of global lead consumption. The rising adoption of renewable energy systems and electric vehicles is indirectly supporting demand for lead-based storage solutions. Additionally, improvements in recycling infrastructure and stringent environmental regulations are encouraging the use of secondary lead, reducing dependence on primary mining while promoting sustainability.

Regionally, Asia-Pacific dominates the lead smelting and refining market, led by China and India, which host extensive production facilities and benefit from high domestic consumption. Europe and North America maintain significant shares due to well-established recycling systems and stringent environmental compliance. Emerging markets in Latin America and Africa are expanding their production capacity, supported by abundant raw material reserves and increasing industrial activity.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The lead smelting and refining market was valued at USD 29,072.9 million in 2024 and is projected to reach USD 40,404.5 million by 2032, growing at a CAGR of 4.2% during 2024–2032.

- Demand growth is strongly supported by the widespread use of lead-acid batteries in automotive, industrial, and renewable energy storage applications.

- Expansion of secondary lead production through advanced recycling systems is reducing dependence on primary mining and supporting sustainability goals.

- Technological innovations in smelting and refining processes, including energy recovery systems and emission controls, are improving efficiency and output quality.

- Stringent environmental regulations are driving investments in cleaner production technologies, increasing operational costs but enhancing long-term compliance and credibility.

- Asia-Pacific dominates the market with over 55% share, followed by Europe with 20% and North America with 15%, supported by strong production capacity and recycling infrastructure.

- Volatility in raw material supply and price fluctuations remains a key challenge, prompting producers to diversify sourcing strategies and strengthen supply chain resilience.

Market Drivers:

Growing Demand from the Lead-Acid Battery Industry:

The lead smelting and refining market is driven by the sustained demand for lead-acid batteries across automotive, industrial, and energy storage applications. Lead-acid batteries remain the preferred choice for backup power systems, uninterruptible power supplies, and renewable energy storage due to their reliability and cost efficiency. The expansion of the automotive industry, particularly in emerging markets, is contributing to higher lead consumption. It continues to serve as the backbone for industrial and residential energy solutions, ensuring consistent demand for refined lead.

- For instance, OPTIMA® YELLOWTOP® deep-cycle AGM battery exceeds 350 complete discharge/recharge cycles at 50% depth of discharge.

Expansion of Recycling and Secondary Lead Production:

Increased emphasis on sustainable practices and environmental compliance is boosting secondary lead production. Modern recycling facilities are recovering lead from spent batteries and industrial waste with higher efficiency, reducing reliance on primary mining. This shift not only supports environmental objectives but also provides a cost-effective supply chain for manufacturers. It allows producers to meet stringent regulations while ensuring a steady availability of refined lead.

- For instance, Battery Council International reports that U.S. lead battery recyclers achieved a remarkable 99% recycling rate across 160 million batteries yearly, representing the highest recovery among consumer products and reducing landfill waste to nearly zero.

Technological Advancements in Smelting and Refining Processes:

The adoption of advanced smelting and refining technologies is enhancing production efficiency and quality in the lead industry. Innovations in furnace design, energy recovery systems, and emission control technologies are enabling higher yields with lower environmental impact. These advancements are vital in addressing regulatory challenges while improving operational profitability. It strengthens the competitive position of producers in both primary and secondary lead markets.

Government Regulations and Environmental Policies;

Stringent regulations on emissions, waste disposal, and worker safety are shaping the operational strategies of lead producers. Compliance with these policies encourages investment in cleaner technologies and advanced refining systems. Governments are promoting closed-loop recycling systems to minimize environmental risks and ensure resource efficiency. It positions compliant companies to benefit from long-term sustainability incentives and market credibility.

Market Trends:

Rising Shift Toward Secondary Lead Production and Sustainable Practices:

The lead smelting and refining market is witnessing a pronounced shift toward secondary lead production, driven by the increasing availability of recyclable materials and stricter environmental regulations. Secondary production from used batteries and industrial scrap is now meeting a significant portion of global demand, reducing dependence on primary ore extraction. Companies are investing in advanced recycling facilities equipped with cleaner technologies to enhance efficiency and minimize emissions. Circular economy principles are gaining traction, with producers adopting closed-loop systems to recover lead more effectively. This transition supports cost savings, lowers environmental impact, and aligns with global sustainability targets. It is expected to remain a core focus area for industry players in the coming years.

- For instance, Exide Industries commissioned a state-of-the-art lead recycling plant at Haldia with an annual capacity of 108,000 tons utilizing advanced spent battery recycling technology.

Integration of Advanced Technologies to Improve Efficiency and Compliance:

Technological advancements in smelting and refining processes are shaping the competitive dynamics of the industry. Automation, digital monitoring systems, and AI-based process optimization are being implemented to improve output quality, reduce energy consumption, and maintain regulatory compliance. The use of cleaner fuels, advanced filtration systems, and energy recovery technologies is lowering the carbon footprint of production. Producers are also exploring hybrid approaches that combine primary and secondary smelting to balance cost and resource availability. It is driving operational flexibility and enhancing resilience in supply chains. These innovations not only improve profitability but also help companies maintain a strong market position in a regulatory-intensive environment.

- For instance, Primetals Technologies installed 100 Melt Expert electrode control systems worldwide over four years, achieving notable productivity gains for electric arc furnace operators.

Market Challenges Analysis:

Stringent Environmental Regulations and Compliance Costs:

The lead smelting and refining market faces significant pressure from stringent environmental regulations that govern emissions, waste disposal, and workplace safety. Compliance requires substantial investment in advanced pollution control systems and cleaner production technologies, increasing operational costs. Governments worldwide are tightening standards to address the environmental and health risks associated with lead processing. Smaller producers often struggle to meet these requirements, leading to reduced competitiveness or market exits. It creates barriers to entry for new players while favoring larger companies with the resources to invest in compliance infrastructure.

Volatility in Raw Material Supply and Market Prices:

Fluctuations in the availability and pricing of lead ore and recyclable feedstock create uncertainty for producers. Supply chain disruptions, geopolitical tensions, and changing mining regulations can impact the steady flow of raw materials. Price volatility affects profitability and complicates long-term planning for both primary and secondary producers. The market also faces challenges from competition with alternative materials in certain applications. It forces companies to adopt risk mitigation strategies, diversify sourcing, and enhance operational flexibility to remain resilient in an unpredictable supply environment.

Market Opportunities:

Growth Potential in Renewable Energy Storage and Electric Mobility;

The lead smelting and refining market holds significant opportunities in supporting the expanding renewable energy and electric mobility sectors. Lead-acid batteries remain a reliable and cost-effective solution for backup power and grid stabilization in solar and wind energy projects. The increasing adoption of electric two-wheelers, hybrid vehicles, and industrial EVs in emerging markets is boosting demand for lead-based energy storage. It enables producers to tap into new segments while maintaining a strong presence in traditional automotive and industrial applications. Strategic partnerships with battery manufacturers can further enhance market penetration.

Advancement in Recycling Technologies and Circular Economy Models;

Rapid improvements in recycling efficiency present opportunities to increase secondary lead output while reducing environmental impact. Automation, AI-driven sorting systems, and advanced smelting methods are making recovery processes more cost-effective and sustainable. Governments and industries are prioritizing closed-loop recycling models to conserve resources and reduce waste. The lead smelting and refining market can leverage these initiatives to strengthen supply security and reduce dependency on primary mining. It positions companies to benefit from both regulatory incentives and growing consumer preference for sustainable products.

Market Segmentation Analysis:

By Refining Process:

The lead smelting and refining market is segmented into primary refining and secondary refining. Primary refining focuses on extracting lead from mined ores through smelting processes, catering to industries that require high-purity lead for specialized applications. Secondary refining recovers lead from recycled materials such as used batteries and industrial scrap, offering a cost-efficient and environmentally sustainable supply source. It is witnessing strong growth in secondary refining due to rising recycling rates, regulatory support, and reduced reliance on mining.

- For instance, RSR Corporation processes about one-third of all spent batteries in the United States, recycling up to 120,000 tons of lead per year through its secondary lead smelting operations.

By Product Type:

The market includes soft lead, hard lead, and lead alloys. Soft lead dominates demand due to its extensive use in lead-acid batteries, cable sheathing, and radiation shielding. Hard lead, containing antimony and other elements, serves in applications requiring enhanced durability, such as grid plates in batteries. Lead alloys find use in diverse industrial applications, including construction, marine equipment, and protective coatings.

- For instance, East Penn Manufacturing operates the world’s largest single-site lead-acid battery facility and produces over 30 million batteries annually using high-purity soft lead for automotive and industrial applications.

By End-User:

Key end-user segments include automotive, energy storage, construction, and others. The automotive sector is the largest consumer, driven by the persistent need for lead-acid batteries in conventional and hybrid vehicles. Energy storage is expanding rapidly with the growth of renewable energy installations requiring stable backup systems. The construction industry utilizes lead in roofing, cladding, and protective structures. It benefits from diversified end-use demand that ensures stable market growth.

Segmentations:

By Refining Process:

- Primary Refining

- Secondary Refining

By Product Type:

- Soft Lead

- Hard Lead

- Lead Alloys

By End-User:

- Automotive

- Energy Storage

- Construction

- Others

By Region:

- Asia-Pacific

- Europe

- North America

- Latin America

- Middle East & Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific holds the largest market share of over 55% in the lead smelting and refining market, driven by dominant production capacities in China and India. The region benefits from extensive primary and secondary lead facilities supported by robust industrial demand. Strong growth in automotive manufacturing, renewable energy projects, and industrial infrastructure sustains high consumption levels. Government initiatives to expand battery recycling networks are further strengthening the secondary lead supply chain. It benefits from abundant raw material availability, competitive labor costs, and rapid technology adoption. The presence of major producers and exporters ensures the region remains the core hub for global supply.

Europe :

Europe commands a significant market share of around 20%, supported by advanced recycling systems and stringent environmental compliance frameworks. The region prioritizes secondary lead production, with high recovery rates from spent batteries and industrial waste. Demand is driven by the automotive, construction, and energy storage sectors, with consistent investment in clean production technologies. Regulatory policies encourage innovation in low-emission smelting and refining processes. It leverages strong technological expertise and a well-established circular economy model to maintain market stability. The region continues to focus on sustainability while ensuring a secure domestic lead supply.

North America :

North America accounts for a notable market share of 15% in the lead smelting and refining market, supported by advanced technological capabilities and established industrial sectors. The region is modernizing production facilities to improve efficiency, reduce emissions, and enhance workplace safety. Strong demand from the automotive, defense, and renewable energy sectors sustains production activity. Recycling initiatives are expanding to secure secondary lead resources and reduce reliance on imports. It benefits from a combination of regulatory support, innovation, and strategic investments in infrastructure. The region’s focus on sustainable production aligns with long-term industry growth strategies.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Southern Cross Metal Management

- Doe Run Resources Corporation

- Glencore International AG

Competitive Analysis:

The lead smelting and refining market is characterized by a mix of multinational corporations and regional producers competing across primary and secondary production. Key players include Tennant Company, ZINC OXIDE Producer, Southern Cross Metal Management, Korea Zinc, Nyrstar NV, Trafigura Pte Ltd, and Doe Run Resources Corporation. These companies leverage advanced refining technologies, integrated supply chains, and strategic sourcing to maintain market presence. Strong emphasis is placed on environmental compliance, cost efficiency, and product quality to meet the needs of automotive, energy storage, and industrial sectors. Leading firms invest in capacity expansion, recycling infrastructure, and technological innovation to strengthen competitive positioning. It remains an industry where technological expertise, raw material access, and regulatory adaptability define long-term success.

Recent Developments:

- In June 2025, Tennant Company launched the Z50 Citadel™ Outdoor Sweeper, targeting industrial and municipal sectors with its dual mechanical broom and vacuum technology to enhance dust and debris capture efficiency.

- In August 2023, Nevada Zinc entered a partnership with BelZinc, granting the Belgian firm rights to Nevada Zinc’s future North American zinc oxide projects and utilizing BelZinc’s technology to produce high-grade zinc oxide from Lone Mountain, while BelZinc received a 10.8% stake through 12 million Nevada Zinc shares.

- In August 2025, Southern Cross Gold announced a significant metallurgical advancement at its Sunday Creek Gold-Antimony Project, where stage 2 selective flotation testwork yielded high-grade, low-arsenic antimony-gold concentrate with native gold recovery rates between 92.3% and 95.6%, and antimony recovery up to 92.7%.

Market Concentration & Characteristics:

The lead smelting and refining market is moderately concentrated, with a mix of global corporations and regional producers competing for market share. It features vertically integrated companies that manage both primary and secondary production, ensuring supply security and cost efficiency. Large players leverage advanced technologies, strong distribution networks, and compliance capabilities to maintain competitive advantages. Smaller producers often focus on niche markets or localized supply, particularly in regions with abundant raw materials. The market is characterized by high entry barriers due to capital-intensive infrastructure, strict environmental regulations, and the need for specialized technical expertise. Demand stability from key industries such as automotive, energy storage, and construction supports long-term growth potential.

Report Coverage:

The research report offers an in-depth analysis based on Refining Process, Product Type, End-User, Region. It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- Increasing demand for lead-acid batteries in automotive, industrial, and renewable energy sectors will sustain market growth.

- Expansion of secondary lead production will strengthen supply chains and reduce environmental impact.

- Adoption of advanced smelting and refining technologies will enhance efficiency and product quality.

- Stricter environmental regulations will encourage investment in cleaner production systems and emission control technologies.

- Growth in electric mobility, particularly in emerging markets, will boost demand for lead-based energy storage solutions.

- Strategic collaborations between producers and battery manufacturers will improve market penetration and supply stability.

- Development of closed-loop recycling systems will align with global sustainability goals and resource conservation efforts.

- Technological innovation in process automation and AI-driven monitoring will increase operational safety and output optimization.

- Geographic expansion in Latin America and Africa will create new production and export opportunities.

- Ongoing modernization of existing facilities will enhance competitiveness and compliance with evolving regulatory frameworks.