Market Overview

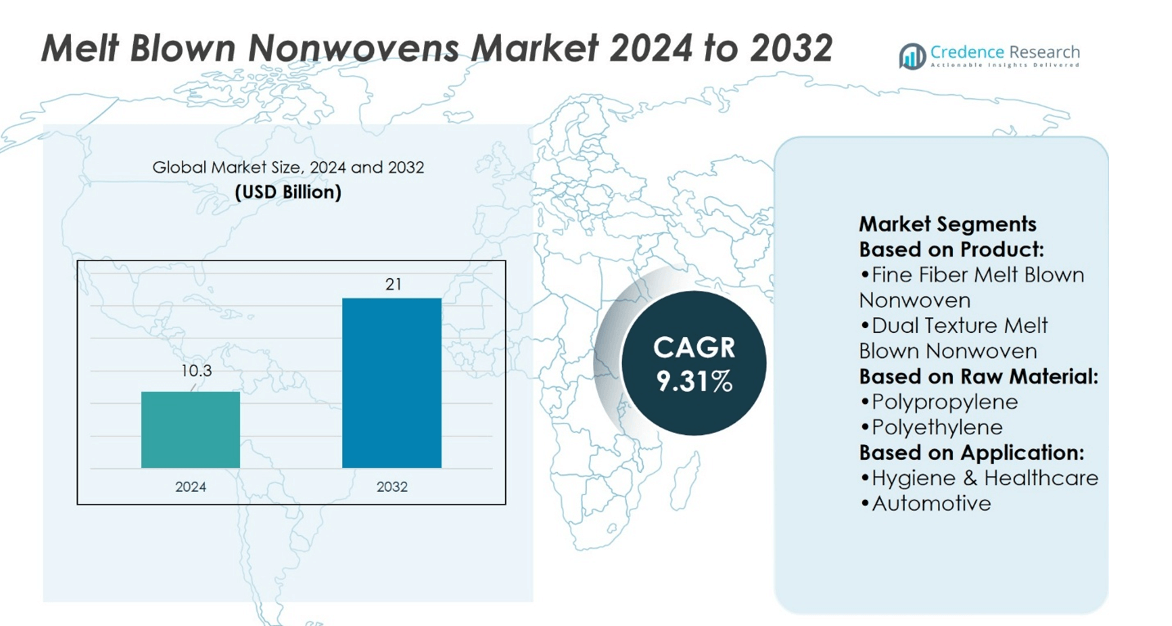

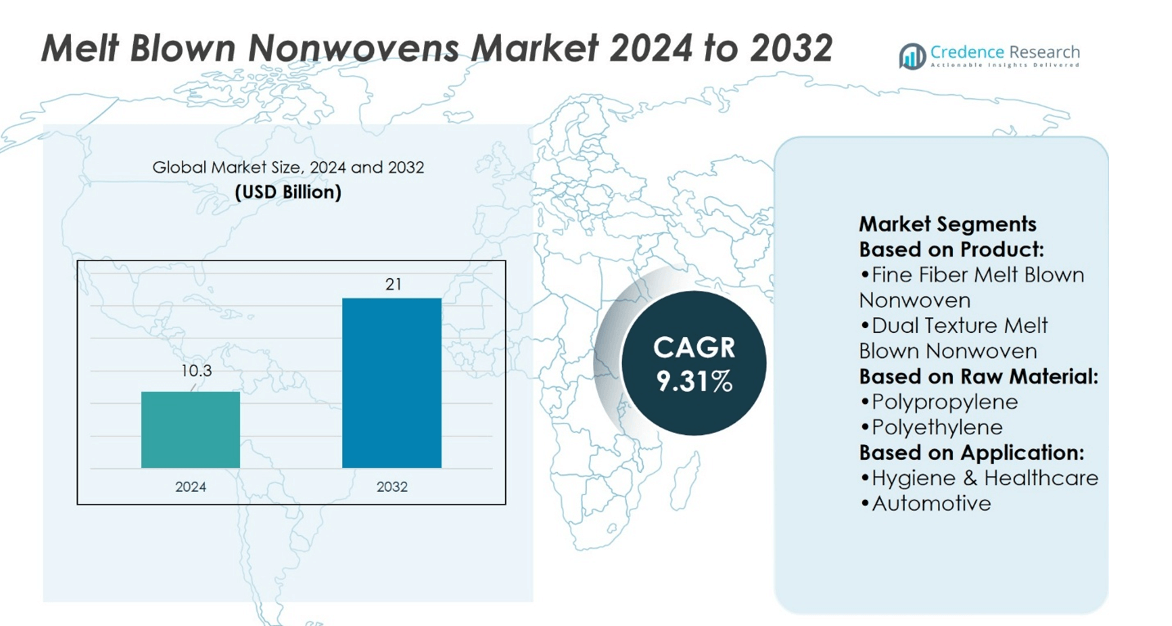

Melt Blown Nonwovens Market size was valued at USD 10.3 billion in 2024 and is anticipated to reach USD 21 billion by 2032, at a CAGR of 9.31% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Melt Blown Nonwovens Market Size 2024 |

USD 10.3 billion |

| Melt Blown Nonwovens Market, CAGR |

9.31% |

| Melt Blown Nonwovens Market Size 2032 |

USD 21 billion |

The Melt Blown Nonwovens Market grows with rising demand for high-performance filtration, hygiene, and healthcare applications. Fine fiber structure delivers superior efficiency, driving adoption in masks, gowns, and air filtration systems. Automotive and industrial sectors strengthen usage in fuel, oil, and cabin filters, while HVAC systems expand reliance on advanced nonwoven media. Growing focus on clean air standards and infection control accelerates consumption globally. Sustainability trends push producers to adopt bio-based polymers and energy-efficient processes. It reflects a market defined by healthcare resilience, industrial expansion, and continuous innovation in materials and manufacturing technologies to meet evolving global standards.

The Melt Blown Nonwovens Market shows diverse regional dynamics, with North America and Europe leading in healthcare adoption, while Asia-Pacific emerges as the fastest-growing hub due to large-scale production and rising demand. Latin America and the Middle East & Africa record steady but smaller contributions, supported by healthcare expansion and hygiene awareness. Key players such as DuPont, The Dow Chemical Company, Oerlikon, PFNonwovens, Don & Low, Mogul, and Irema Ireland strengthen competitiveness through innovation, capacity expansion, and global distribution networks.

Market Insights

- Melt Blown Nonwovens Market size was valued at USD 10.3 billion in 2024 and is anticipated to reach USD 21 billion by 2032, at a CAGR of 9.31%.

- Rising demand for high-performance filtration in healthcare, hygiene, and HVAC systems drives market growth.

- Fine fiber structure enables superior efficiency, supporting adoption in masks, gowns, and medical textiles.

- Competition intensifies with key players investing in innovation, sustainability, and capacity expansion.

- High production costs and raw material price fluctuations restrain smaller manufacturers.

- North America and Europe lead in healthcare adoption, while Asia-Pacific emerges as the fastest-growing hub.

- Latin America and Middle East & Africa contribute steadily with expanding healthcare and hygiene awareness.\

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Performance Filtration Materials

The Melt Blown Nonwovens Market benefits from strong demand in filtration applications. Its fine fiber structure ensures high efficiency in capturing particulates, bacteria, and viruses. Healthcare, HVAC, and industrial sectors rely on this material for reliable air and liquid filtration. Increasing awareness of clean air standards supports its adoption worldwide. The demand accelerated after the pandemic, and it continues to drive investments in advanced filter production. It remains a core material for protective masks, respirators, and water filtration units.

- For instance, Mogul added two new meltblown lines, each 160 cm wide and able to produce fabrics in the 15–100 gsm range with electrostatic charging, enabling production of N95-level and higher-efficiency mask and filter media.

Expanding Use in Medical and Hygiene Applications

Medical and hygiene industries represent major growth drivers for the Melt Blown Nonwovens Market. Rising consumption of surgical masks, gowns, and drapes reinforces consistent demand. It provides softness, fluid resistance, and barrier properties required in healthcare protection. Hygiene products such as diapers, wipes, and sanitary items also depend on its absorbent features. Growing populations and higher healthcare awareness fuel broader usage. Manufacturers expand capacity to serve both developed and emerging markets. It maintains relevance by meeting strict quality and safety requirements.

- For instance, Oerlikon’s hycuTEC hydro-charging system achieves over 99.99% filtration efficiency in 35 g/m² meltblown filter media, with pressure loss reduced to a quarter or less of standard levels.

Industrial and Automotive Sector Adoption

Industrial and automotive manufacturers strengthen demand for melt blown nonwovens through specialized applications. Oil sorbents, insulation, and acoustic barriers benefit from its lightweight yet durable structure. Automotive filters for fuel, oil, and cabin air increasingly integrate this material. The sector values its efficiency in extending engine life and improving air quality. Growing industrialization in Asia-Pacific adds further momentum. Investments in cleaner and more efficient production methods boost reliability. It supports sustainable performance across multiple heavy-use industries.

Push for Sustainable and Energy-Efficient Production

Sustainability goals and cost reduction strategies create new opportunities for the Melt Blown Nonwovens Market. Manufacturers focus on bio-based polymers and recycling initiatives to reduce environmental impact. Advanced production lines optimize energy usage while improving fiber consistency. Rising global regulations push producers to adopt greener materials. Government programs supporting eco-friendly manufacturing further enhance adoption. Companies invest in R&D to balance performance with reduced carbon footprints. It aligns with global sustainability priorities while ensuring long-term market growth.

Market Trends

Increasing Focus on Advanced Filtration Technologies

The Melt Blown Nonwovens Market shows a clear trend toward advanced filtration uses. Its fine microfibers enable high-performance air, gas, and liquid filtration. Growing demand for cleanroom environments and high-efficiency HVAC systems strengthens this trend. Healthcare facilities and industries expand adoption to ensure safety and compliance. Demand for particulate and virus filtration continues to influence innovation in product design. It pushes manufacturers to refine fiber uniformity and improve filtration grades. Global standards for air quality accelerate product development efforts.

- For instance, Don & Low’s electrostatically charged meltblown PP fabric has a bacterial filtration efficiency above 98%, with air permeability exceeding 390 L/m²/s, and pressure drop below 28 Pa, demonstrating high filtration performance with low flow resistance.

Rising Integration in Medical and Hygiene Products

Medical and hygiene sectors continue to shape new trends in the Melt Blown Nonwovens Market. Rising consumption of single-use surgical masks, gowns, and hygiene goods fuels steady expansion. Properties such as softness, absorbency, and barrier resistance make it indispensable. Consumer preference for high-quality sanitary products encourages ongoing upgrades in product design. Healthcare suppliers demand consistent materials to meet international safety benchmarks. It remains central to critical protective equipment used in hospitals and clinics. Growing hygiene awareness ensures long-term relevance.

- For instance, DuPont’s Spruance, Virginia Tyvek® facility holds ISCC PLUS certification, enabling production of Tyvek® with 100% mass-balance bio-based raw material—ensuring completely sustainable supply chains for medical packaging and protective gear.

Expansion into Industrial and Automotive Applications

Industrial and automotive applications highlight another trend in the Melt Blown Nonwovens Market. Lightweight, durable, and efficient, the material supports fuel, oil, and cabin filters. Increasing environmental regulations push automakers to use advanced filter media. Industrial producers integrate it into oil sorbents, insulation, and protective layers. Growth in manufacturing hubs across Asia-Pacific strengthens industrial uptake. It supports performance improvement while addressing stricter efficiency standards. The shift toward engineered nonwovens for complex applications drives innovation.

Strong Emphasis on Sustainability and Eco-Friendly Materials

Sustainability goals drive material innovation in the Melt Blown Nonwovens Market. Producers adopt bio-based polymers, recycled inputs, and energy-efficient manufacturing. Government policies encourage eco-friendly materials across healthcare and industrial supply chains. Corporate sustainability commitments promote research into biodegradable nonwovens. It aligns with global initiatives to reduce plastic waste and carbon impact. Market leaders invest in technologies that lower production costs while maintaining quality. Sustainable solutions position the material as future-ready in global markets.

Market Challenges Analysis

High Production Costs and Limited Raw Material Availability

The Melt Blown Nonwovens Market faces challenges from high production costs and raw material dependence. Polypropylene, the primary input, experiences frequent price fluctuations linked to global oil markets. Volatile supply chains create risks for manufacturers who rely on consistent input quality. Energy-intensive processes further increase production expenses, pressuring profit margins. Smaller players struggle to compete with large-scale producers that manage costs through integration. It creates entry barriers and limits flexibility in responding to market shifts. Rising demand often clashes with constrained supply, slowing expansion opportunities.

Quality Consistency and Environmental Compliance Pressures

Maintaining consistent fiber quality presents another challenge for the Melt Blown Nonwovens Market. Precision control during production is essential for meeting strict medical and filtration standards. Any inconsistency reduces product performance and undermines customer trust. Environmental compliance adds further pressure as regulators tighten controls on polymer use and emissions. Companies must invest in costly upgrades to align with sustainability and waste reduction policies. It raises financial and operational risks, particularly for mid-sized manufacturers. The dual demand for quality assurance and environmental responsibility intensifies competitive strain across the sector.

Market Opportunities

Expanding Healthcare and Hygiene Applications

The Melt Blown Nonwovens Market offers strong opportunities in healthcare and hygiene sectors. Rising demand for surgical masks, gowns, and protective apparel sustains growth momentum. Hygiene products such as diapers, wipes, and sanitary goods also provide consistent consumption. Governments and organizations invest in strengthening public health infrastructure, which supports wider adoption. It addresses requirements for high-performance barrier materials with proven reliability. Emerging economies with growing healthcare needs further expand the scope of applications. Strategic partnerships with medical suppliers enhance long-term growth potential.

Growth in Sustainable and High-Performance Materials

Sustainability trends open significant opportunities for the Melt Blown Nonwovens Market. Manufacturers explore bio-based polymers, recycled inputs, and energy-efficient processes to meet global demand. Eco-friendly filtration solutions align with stricter environmental standards across industrial and consumer sectors. Expanding use in automotive, HVAC, and industrial filtration creates space for high-performance grades. It enables companies to differentiate through advanced fiber designs and greener product lines. Supportive regulations and corporate commitments amplify adoption of sustainable nonwovens. Innovation in eco-friendly production secures a competitive edge for forward-looking players.

Market Segmentation Analysis:

By Product

The Melt Blown Nonwovens Market divides by product into fine fiber melt blown nonwoven and dual texture melt blown nonwoven. Fine fiber variants dominate demand due to superior filtration efficiency and softness. They remain essential in masks, medical apparel, and high-grade filters. Dual texture nonwovens show rising demand in wipes, hygiene items, and specialty cleaning products. It benefits from improved absorbency and durability, supporting applications in consumer and industrial use. Product innovation strengthens growth across both categories.

- For instance, Dow’s ASPUN™ Fiber Resins, used in fine fiber and dual texture nonwovens, operate efficiently at 200–300 °C processing temperatures, enabling faster bonding and enhanced energy efficiency in hygiene product production—improving performance in diapers, wipes, and feminine care fabrics.

By Raw Material

Segmentation by raw material includes polypropylene, polyethylene, polybutylene terephthalate, and others. Polypropylene leads the market due to cost efficiency, widespread availability, and excellent processing qualities. It remains the preferred choice for filtration, hygiene, and healthcare applications. Polyethylene supports applications requiring softness and lightweight performance, often in hygiene and packaging solutions. Polybutylene terephthalate addresses niche demand in technical and industrial applications, valued for strength and thermal resistance. It highlights how material versatility supports diverse industry needs. The “others” category includes advanced polymers driving specialty performance improvements.

- For instance, Atex’s melt-blown production line handles up to 1,000 tons of material annually, forming nonwoven webs with net widths up to 1,600 mm, and material weights ranging from 10 to 1,000 g/m².

By Application

By application, the Melt Blown Nonwovens Market spans hygiene & healthcare, automotive, electrical & electronics, and others. Hygiene and healthcare dominate demand, driven by masks, gowns, diapers, and sanitary goods. Automotive use focuses on fuel, oil, and cabin filters, where efficiency and lightweight properties are critical. Electrical and electronics applications grow with demand for insulation, filtration, and protective layers. The “others” category includes industrial and consumer uses such as wipes, sorbents, and protective fabrics. It demonstrates broad adaptability across industries. Rising requirements for safety, hygiene, and efficiency ensure strong demand in every segment.

Segments:

Based on Product:

- Fine Fiber Melt Blown Nonwoven

- Dual Texture Melt Blown Nonwoven

Based on Raw Material:

- Polypropylene

- Polyethylene

Based on Application:

- Hygiene & Healthcare

- Automotive

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 32% share of the Melt Blown Nonwovens Market, supported by its advanced healthcare infrastructure and strong adoption of filtration technologies. The region benefits from established demand in medical and hygiene sectors, where masks, gowns, and surgical drapes drive large-scale consumption. Automotive manufacturers in the United States and Canada also integrate melt blown nonwovens into high-efficiency fuel, oil, and cabin filters, reinforcing industrial applications. Rising focus on air quality standards encourages further demand in HVAC and industrial filtration systems. The region also leads in innovation, with companies investing in high-performance nonwoven production lines to improve fiber uniformity and energy efficiency. Stringent regulatory frameworks around healthcare safety and environmental protection push consistent adoption of these materials. It remains a strategic hub for both production and consumption, ensuring stable long-term growth in global demand.

Europe

Europe accounts for 28% share of the Melt Blown Nonwovens Market, with strong demand across healthcare, automotive, and industrial sectors. Strict regulations around medical safety and sustainable manufacturing practices drive consistent adoption of nonwoven products. Germany, France, and the United Kingdom stand out as leading countries, supported by advanced medical infrastructure and robust automotive industries. European consumers show higher preference for sustainable and eco-friendly nonwovens, encouraging producers to invest in bio-based polymers and recycling processes. The region’s automotive sector integrates melt blown nonwovens for emission control and cabin air filtration, reflecting growing emphasis on passenger health and regulatory compliance. Demand for hygiene products such as diapers and wipes also supports market expansion, particularly in Western Europe. It highlights the region’s strong focus on safety, sustainability, and technological leadership in nonwoven manufacturing.

Asia-Pacific

Asia-Pacific represents 30% share of the Melt Blown Nonwovens Market, emerging as the fastest-growing regional segment. China, Japan, India, and South Korea lead demand, driven by large populations, expanding healthcare systems, and growing industrialization. The COVID-19 pandemic accelerated production capacity in China and India, positioning them as major exporters of melt blown nonwovens for global healthcare needs. Rising automotive manufacturing across the region boosts consumption in fuel, oil, and cabin filter production. Rapid urbanization also increases demand for HVAC filtration in residential and commercial buildings. Producers in Asia-Pacific emphasize both scale and cost efficiency, often leveraging lower production costs to strengthen competitiveness. It remains a critical region for supply chain development, innovation, and large-scale adoption across both healthcare and industrial applications.

Latin America

Latin America captures 6% share of the Melt Blown Nonwovens Market, driven by increasing investments in healthcare and hygiene sectors. Brazil and Mexico are the largest contributors, supported by expanding medical infrastructure and growing consumer awareness of hygiene products. Demand for diapers, wipes, and sanitary goods supports steady consumption in urban centers. Industrial adoption remains moderate but is expected to grow with investments in automotive manufacturing and filtration technologies. The region also shows increasing demand for protective apparel and medical textiles, reflecting heightened awareness of infection control. Limited domestic production capacity creates reliance on imports from North America and Asia-Pacific, though regional players are expanding to meet growing needs. It represents an emerging opportunity zone where healthcare access and industrial modernization will continue to drive adoption.

Middle East & Africa

The Middle East & Africa holds 4% share of the Melt Blown Nonwovens Market, characterized by gradual but steady adoption. Healthcare expansion across Gulf Cooperation Council (GCC) countries drives demand for medical and hygiene nonwovens. Nations such as Saudi Arabia, the United Arab Emirates, and South Africa invest in modern medical infrastructure, which increases reliance on nonwoven masks, gowns, and protective fabrics. Industrial adoption remains limited but is growing in automotive filtration and oil sorbent applications. Consumer awareness of hygiene products is rising, supporting gradual expansion in wipes, sanitary items, and personal care segments. Supply chain dependence on imports limits domestic growth, yet ongoing government healthcare investments create opportunities for local production. It remains a developing market with significant potential once regional manufacturing capacity strengthens.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Irema Ireland

- Mogul

- PFNonwovens (Pegas Nonwovens)

- Jinan Xinghua Nonwoven Fabric

- Oerlikon

- Don & Low

- DuPont

- The Dow Chemical Company

- Atex

- Name

Competitive Analysis

The Melt Blown Nonwovens Market players including Irema Ireland, Mogul, PFNonwovens (Pegas Nonwovens), Jinan Xinghua Nonwoven Fabric, Oerlikon, Don & Low, DuPont, The Dow Chemical Company, Atex, and Name. The Melt Blown Nonwovens Market remains highly competitive, driven by continuous innovation, global demand shifts, and sustainability requirements. Producers focus on developing advanced filtration materials that deliver higher efficiency, durability, and consistency across healthcare, hygiene, and industrial applications. Rising environmental regulations encourage investment in bio-based polymers, recycled inputs, and energy-efficient production technologies. Competitive strategies also emphasize expansion of production capacity to meet surging healthcare needs and growing demand in Asia-Pacific markets. Companies differentiate through product performance, cost efficiency, and the ability to supply at scale. It reflects a dynamic industry where technology leadership and sustainable practices define long-term success.

Recent Developments

- In September 2025, Thermo Fisher Scientific announced the acquisition of Solventum’s Purification and Filtration business, thus expanding its melt-blown polypropylene filters market.

- In February 2024, Freudenberg Performance Materials introduced a 100% synthetic wetlaid nonwoven product line for filtration applications, featuring polymer-based fibers, glass fibers, viscose, and cellulose, suitable for both liquid and air filtration.

- In February 2024, Amazon Filters Ltd. introduced sustainable melt-blown filters using Borealis’ Bornewables polypropylene derived from renewable feedstocks, targeting water, oil and gas, food, chemical, and pharma applications.

- In February 2023, Non-woven fabric manufacturer Roswell Textiles officially launched Ecofuse, a low-carbon material derived from plant extracts. Designed to replace traditional synthetic raw materials, Ecofuse offers a sustainable and environmentally friendly alternative, as well as a carbon offset.

Report Coverage

The research report offers an in-depth analysis based on Product, Raw Material, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with strong demand from healthcare and hygiene sectors.

- Advanced filtration applications will remain a primary growth driver worldwide.

- Sustainability initiatives will encourage adoption of bio-based and recyclable polymers.

- Automotive and electronics sectors will increase usage for filtration and insulation.

- Producers will invest in energy-efficient production technologies to lower costs.

- Asia-Pacific will continue to lead in capacity expansion and exports.

- Regulatory standards will push for higher-quality and consistent nonwoven products.

- Innovation in fiber design will enhance performance across diverse applications.

- Strategic partnerships will strengthen global supply chains and product reach.

- The market will evolve around technology leadership and sustainable practices.