Market Overview

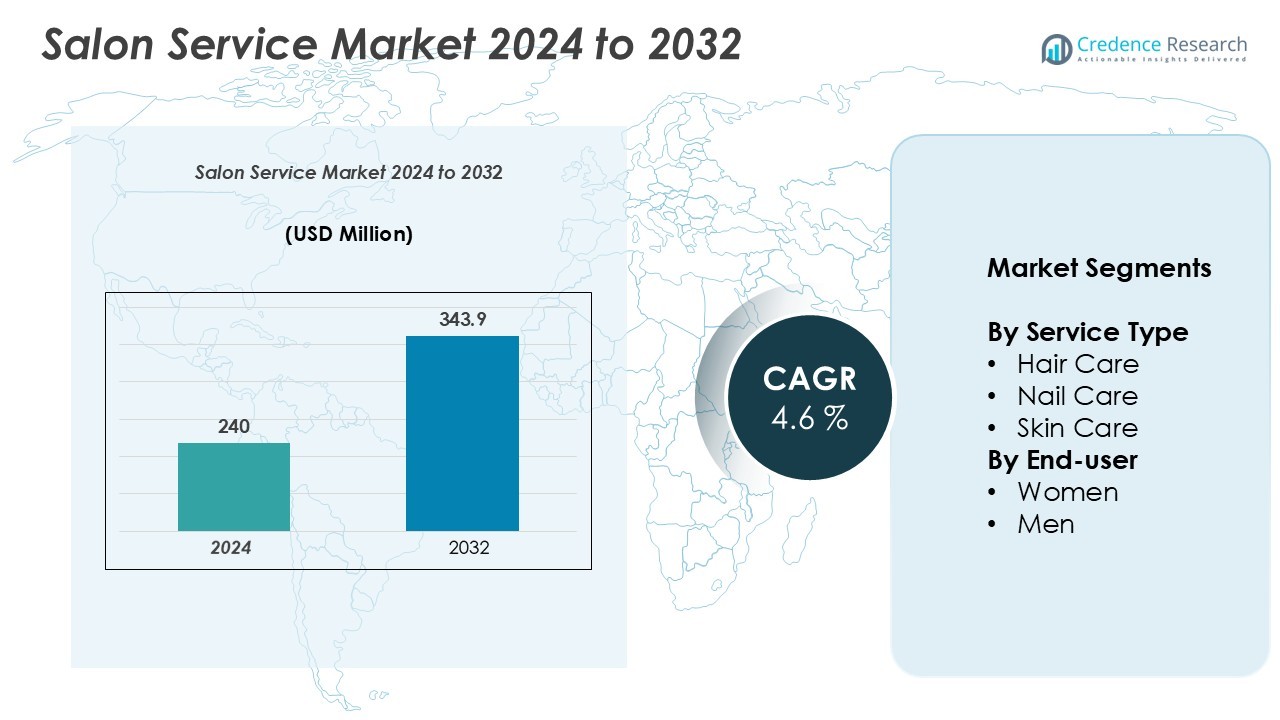

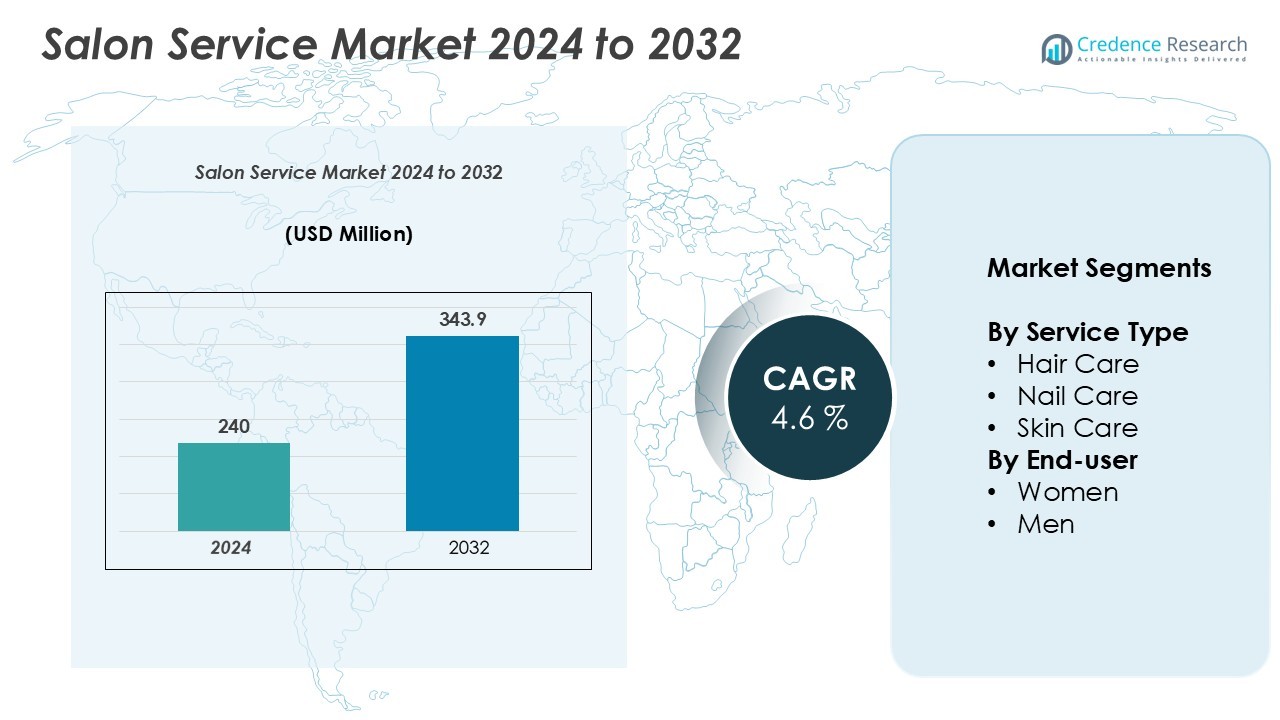

Salon Service Market size was valued at USD 240 billion in 2024 and is anticipated to reach USD 343.9 billion by 2032, at a CAGR of 4.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Salon Service Market Size 2024 |

USD 240 billion |

| Salon Service Market, CAGR |

4.6% |

| Salon Service Market Size 2032 |

USD 343.9 billion |

The salon service market is led by prominent players such as Great Clips, Ulta Beauty, Drybar, Regis Corporation, Dessange International, The Lounge Hair Salon, Seva Beauty, Skin Rich, The Leading Salons of the World, LLC., and Snip-its, which collectively drive innovation, brand recognition, and service quality across global markets. North America dominates the market with a 28% share, supported by high disposable income, urbanization, and a mature salon culture. Asia-Pacific follows with 32%, fueled by rapid urban growth, changing lifestyles, and rising awareness of personal grooming. Europe accounts for 25%, driven by established salon networks, fashion trends, and sustainability initiatives. These leading companies focus on premium services, digital integration, and customer-centric offerings, while leveraging technological advancements and eco-friendly products to strengthen their market presence. The combination of strategic expansion and regional market leadership ensures sustained growth and competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The global salon service market was valued at USD 240 billion in 2024 and is expected to reach USD 343.9 billion by 2032, growing at a CAGR of 4.6% during the forecast period.

- Growth is driven by rising disposable incomes, urbanization, and increasing awareness of personal grooming and wellness among both women and men, particularly in hair care, skincare, and nail services.

- Key trends include the rapid adoption of digital booking platforms, eco-friendly and organic products, the growing male grooming segment, and the expansion of premium and personalized service offerings.

- The market is highly competitive with players like Great Clips, Ulta Beauty, Drybar, Regis Corporation, Dessange International, and Skin Rich, focusing on service innovation, technology integration, and brand differentiation, while market fragmentation and workforce dependence pose challenges.

- Regionally, Asia-Pacific leads with 32% share, followed by North America at 28%, Europe at 25%, Latin America at 9%, and Middle East & Africa at 6%, with hair care being the dominant segment across all regions.

Market Segmentation Analysis:

By Service Type

The salon service market by service type is primarily segmented into hair care, nail care, and skin care. Among these, hair care dominates the segment, accounting for approximately 45% of the market share. The high demand for professional hair treatments, coloring, and styling services drives this growth, fueled by rising fashion consciousness and increasing disposable income. Nail care is growing steadily due to the popularity of manicures, pedicures, and nail art services, while skin care services benefit from the expanding awareness of dermatological treatments and personalized beauty regimens.

- For instance, L’Oréal’s Professional Products division, which includes brands like L’Oréal Professionnel and Redken, generated €4.66 billion in sales in 2023, reflecting the strong consumer demand for professional hair care services.

By End-user

In terms of end-users, the salon service market is divided between women and men. Women constitute the dominant sub-segment, representing nearly 70% of the total market, driven by their higher engagement in personal grooming, beauty treatments, and spa services. The growing preference for professional styling and wellness routines among women continues to fuel market expansion. Meanwhile, the men’s segment is witnessing significant growth due to rising awareness of male grooming, skincare, and wellness treatments, indicating an emerging opportunity for tailored salon services.

- For instance, L’Oréal’s consumer products division, which includes brands like Garnier and Maybelline, generated €15.17 billion in sales in 2023. A significant portion of this revenue is attributed to products targeted at female consumers.

Key Growth Drivers

Rising Disposable Income and Urbanization

The growth of the salon service market is strongly supported by rising disposable income and rapid urbanization, particularly in metropolitan and tier-1 cities. Consumers now have greater spending power and are increasingly prioritizing personal grooming, wellness, and beauty services as part of their lifestyle. Urban populations, exposed to global beauty standards and trends, are demanding professional hair care, skincare, and nail services, driving consistent market expansion. The proliferation of high-end salons and wellness centers in urban hubs, along with a growing preference for premium and customized treatments, further stimulates market growth. Additionally, younger generations, influenced by social media and fashion trends, are seeking regular salon visits, contributing to higher service frequency and boosting revenue for salon operators across all service types.

- For instance, in 2024, L’Oréal’s Professional Products Division reported robust growth of +5.3% on a like-for-like basis, a change from the +7.6% growth it achieved in 2023. In 2023, the division’s new channels, including e-commerce and specialty retail, accounted for 35% of its total sales.

Increasing Awareness of Personal Grooming and Wellness

Awareness of personal grooming, hygiene, and wellness is a significant driver for the salon service market. Consumers today are more informed about skin health, hair care, and nail maintenance, leading to higher adoption of specialized treatments. Educational campaigns, influencer marketing, and digital content highlighting the benefits of professional grooming services have strengthened consumer interest, especially among women and the emerging male grooming segment. This awareness is complemented by innovations in treatment techniques, such as advanced facials, hair spa therapies, and nail art technologies, which encourage repeat visits and customer loyalty. The focus on holistic wellness—combining relaxation, beauty, and self-care—has created opportunities for salons to expand service portfolios, thereby driving higher market penetration and consistent growth across both service type and end-user segments.

- For instance, L’Oréal signed an agreement in June 2025 to acquire a majority stake in British skincare brand Medik8. This follows L’Oréal’s acquisition of Aesop in 2023 and highlights the beauty industry’s investment in advanced skincare, aligning with growing consumer interest.

Technological Advancements and Digital Integration

Technological advancements and digital integration play a pivotal role in expanding the salon service market. Salons are increasingly adopting digital booking platforms, mobile applications, and customer management systems, improving operational efficiency and customer experience. Advanced equipment and treatment technologies, such as laser hair removal, microdermabrasion, and automated hair styling tools, enhance service quality and attract tech-savvy consumers. Furthermore, online marketing and social media engagement allow salons to reach a broader audience, highlight service innovations, and build brand loyalty. Digital loyalty programs, virtual consultations, and AI-based service recommendations are transforming consumer interactions, making salon services more accessible and convenient. This integration of technology not only increases footfall but also drives repeat visits, positioning salons as modern, customer-centric service providers and fueling overall market growth.

Key Trends & Opportunities

Growth of Male Grooming Segment

The male grooming segment presents a significant growth opportunity within the salon service market. Historically dominated by female consumers, the market is witnessing a surge in male clients seeking haircuts, skincare treatments, beard grooming, and spa services. Changing societal norms, increased awareness of personal appearance, and rising urban lifestyles among men have led to a higher frequency of salon visits. Salons are now offering tailored services, specialized products, and male-focused wellness packages to capitalize on this trend. Additionally, marketing campaigns targeting men, celebrity endorsements, and social media engagement are raising visibility and interest. The expanding male consumer base not only diversifies revenue streams but also encourages the development of innovative services and premium offerings, creating long-term growth potential within the salon industry.

- For instance, Philips India claims a 50–60% market share in the electric male grooming segment, and its premium shavers launched in April 2025 experienced demand that outpaced supply.

Adoption of Organic and Sustainable Products

The shift toward organic, cruelty-free, and sustainable beauty products is a key trend shaping the salon service market. Increasing consumer awareness regarding the environmental and health impact of chemical-based treatments has driven demand for eco-friendly alternatives in hair care, skin care, and nail services. Salons incorporating natural ingredients, herbal therapies, and biodegradable products are attracting environmentally conscious clients and differentiating themselves from competitors. This trend also creates opportunities for partnerships with sustainable product manufacturers and the introduction of premium, eco-focused service packages. As regulatory frameworks and consumer preferences evolve, salons offering green and wellness-oriented services are positioned to benefit from repeat clientele, stronger brand loyalty, and enhanced market share, while promoting a responsible, modern approach to beauty and personal care.

- For instance, L’Oréal India’s Consumer Products Division outperformed the market in 2023, boosted by a dynamic haircare category with products like Hyaluron Moisture, and also by its leading category, makeup.

Key Challenges

High Operational Costs and Workforce Dependence

One of the major challenges in the salon service market is the high operational cost and heavy reliance on skilled professionals. Salons require significant investment in premium equipment, advanced treatment technologies, and quality product inventories to maintain service standards. Additionally, the market heavily depends on trained and experienced beauticians, hairstylists, and therapists, whose recruitment, training, and retention can be costly and challenging. High turnover rates in the workforce further exacerbate operational instability, affecting service consistency and customer satisfaction. Rising rental costs in urban areas, utility expenses, and regulatory compliance also add to the financial burden. These factors can limit profitability, particularly for small- and mid-sized salons, necessitating strategic cost management, skill development programs, and technology adoption to streamline operations and ensure sustainable growth.

Intense Competition and Market Fragmentation

The salon service market faces intense competition and fragmentation, with numerous players ranging from unbranded local salons to high-end international chains. This competitive landscape drives pricing pressures and necessitates constant innovation to retain customer loyalty. Small salons often struggle to differentiate their services, invest in premium technologies, or implement effective marketing strategies, which can affect market positioning. Additionally, the proliferation of home-based services, freelance stylists, and online booking platforms increases competitive intensity, offering consumers multiple alternatives. Market fragmentation also challenges standardized service quality and customer experience, which can impact brand reputation. To overcome these issues, salons must focus on specialized offerings, consistent service quality, loyalty programs, and technological integration to maintain competitiveness and drive sustainable market growth.

Regional Analysis

North America

North America holds a significant share of the salon service market, accounting for approximately 28% of the global market. Growth is driven by high disposable income, urbanization, and strong consumer awareness regarding personal grooming and wellness. The region benefits from the presence of established salon chains, premium service offerings, and advanced beauty technologies. The increasing adoption of digital booking platforms, loyalty programs, and online marketing has enhanced customer convenience and engagement. Additionally, the rising male grooming segment and demand for eco-friendly, organic products are further fueling market expansion across both hair care and skin care services.

Europe

Europe contributes around 25% of the global salon service market, driven by strong fashion trends, wellness awareness, and an established professional salon culture. Countries such as the UK, Germany, and France exhibit high demand for premium hair, skin, and nail care services. Growth is supported by innovations in treatment technologies, such as laser hair removal and advanced skincare therapies. The region also emphasizes sustainability, with a growing preference for organic and cruelty-free products. Digitalization of services, social media influence, and a rising focus on male grooming provide additional growth opportunities, sustaining Europe’s leadership in the global salon service market.

Asia-Pacific

Asia-Pacific represents approximately 32% of the global salon service market, making it the fastest-growing region. Rapid urbanization, rising disposable incomes, and changing lifestyles are driving demand for professional beauty services. Countries like China, India, Japan, and South Korea are witnessing increased adoption of hair care, skincare, and nail treatments, influenced by social media trends and celebrity endorsements. Expansion of organized salon chains, the introduction of advanced technologies, and rising awareness of male grooming further fuel growth. Additionally, younger populations are seeking personalized and premium salon services, providing ample opportunities for market players to expand presence and diversify service offerings across the region.

Latin America

Latin America accounts for roughly 9% of the global salon service market, supported by increasing urban population and growing beauty consciousness. Brazil and Mexico are key contributors, driven by high demand for professional hair and skin care services. The market is witnessing rising adoption of advanced treatments, including hair coloring, facials, and nail art services. Growth is further supported by the emergence of premium salons, wellness centers, and international brands entering the market. Additionally, digital booking platforms and social media marketing are enhancing customer engagement. While economic fluctuations pose challenges, expanding awareness of grooming and wellness is steadily increasing market penetration across the region.

Middle East & Africa

The Middle East & Africa region represents around 6% of the global salon service market, fueled by rising urbanization, affluent populations, and growing interest in luxury grooming services. Countries such as the UAE, Saudi Arabia, and South Africa are witnessing increased demand for premium hair care, skincare, and spa treatments. The presence of high-end salon chains and international beauty brands enhances market growth. Cultural emphasis on personal appearance, coupled with increasing male grooming awareness, supports service adoption. However, market growth is moderated by economic disparities and limited penetration in rural areas. Investment in modern technologies and personalized service offerings is expanding market opportunities.

Market Segmentations:

By Service Type

- Hair Care

- Nail Care

- Skin Care

By End-user

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The salon service market is highly competitive and fragmented, comprising global chains, regional operators, and independent salons. Major players, including Great Clips, Ulta Beauty, Drybar, and Regis Corporation, focus on brand differentiation through premium service offerings, loyalty programs, and advanced treatment technologies. International brands such as Dessange International and Skin Rich leverage global expertise and luxury positioning to capture high-end segments, while emerging regional players cater to niche markets and local preferences. Companies are increasingly adopting digital strategies, including online booking platforms, app-based customer engagement, and social media marketing, to enhance convenience and attract tech-savvy consumers. Innovation in personalized services, eco-friendly products, and male grooming packages is becoming a key competitive differentiator. Strategic partnerships, acquisitions, and service diversification are frequently employed to expand market presence. Overall, competition drives continuous improvements in quality, customer experience, and technology adoption, ensuring sustained market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Drybar (U.S.)

- Seva Beauty (U.S.)

- Snip-its (U.S.)

- Skin Rich (U.K.)

- The Leading Salons of the World, LLC. (U.S.)

- The Lounge Hair Salon (Thailand)

- Dessange International (France)

- Regis Corporation (U.S.)

- Ulta Beauty, Inc. (U.S.)

- Great Clips, Inc. (U.S.)

Recent Developments

- In November 2022, Salon Azure, a Tennessee, U.S.-based brand, opened its first outlet in Guwahati, India, in 2022. The salon provides haircuts, coloring & styling, waxing & tanning, and a wide range of facial and skin care treatments and nail treatments.

- In June 2022, Hotel Sahara Star, a Mumbai, India-based hotel business, announced the launch of Jean- Claude Biguine Salon & Spa, a French beauty house in Mumbai. The salon offers hair, skin, nail, and beauty services.

- In April 2022, Sola Salons, a U.S.-based salon studio franchise, announced the signing of four franchise agreements across Canada, including Toronto, Durham, Kitchener, Markham, Richmond Hill, and Hamilton. The franchise announced that these new agreements would establish nine locations across Canada in the near future.

Report Coverage

The research report offers an in-depth analysis based on Service Type, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The salon service market is expected to continue steady growth driven by increasing personal grooming awareness.

- Demand for premium and personalized hair, skin, and nail care services will expand across urban regions.

- Male grooming services will witness a significant rise, creating new revenue streams for salons.

- Adoption of digital booking platforms and app-based customer engagement will enhance convenience and client retention.

- Eco-friendly, organic, and sustainable products will gain popularity among environmentally conscious consumers.

- Integration of advanced technologies such as laser treatments, microdermabrasion, and automated styling tools will improve service quality.

- Social media influence and celebrity endorsements will continue shaping consumer preferences and trends.

- Expansion of organized salon chains and franchising opportunities will increase market penetration globally.

- Loyalty programs and subscription-based services will strengthen customer engagement and repeat visits.

- Emerging markets in Asia-Pacific, Latin America, and the Middle East will offer significant growth opportunities.