Market Overview

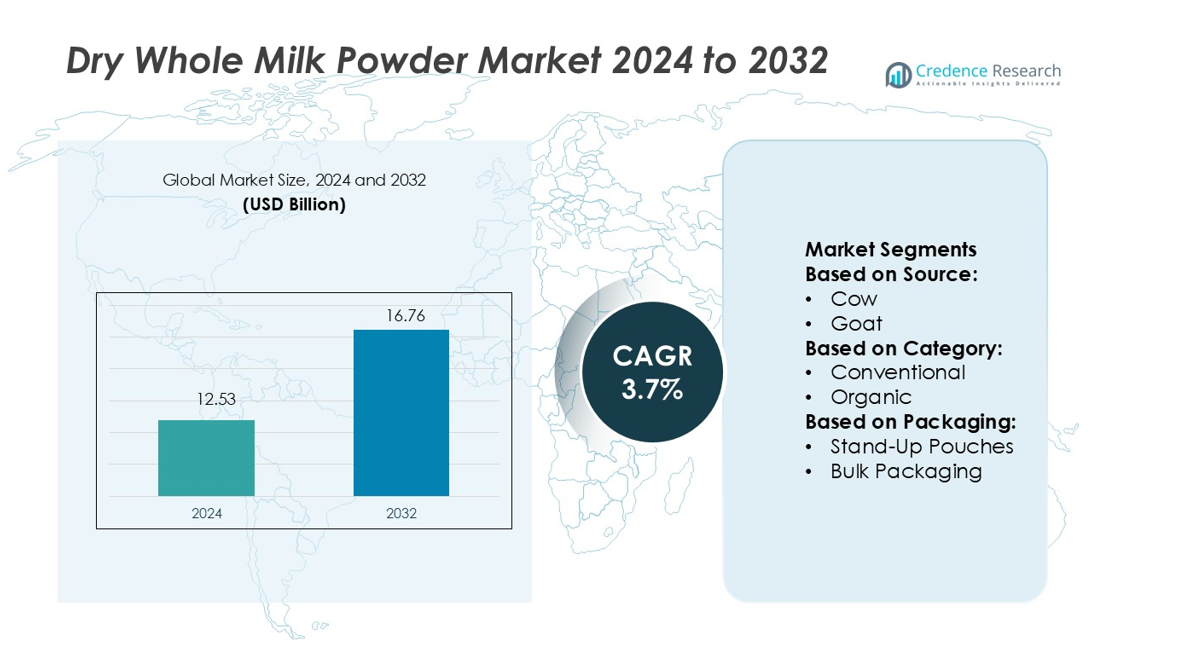

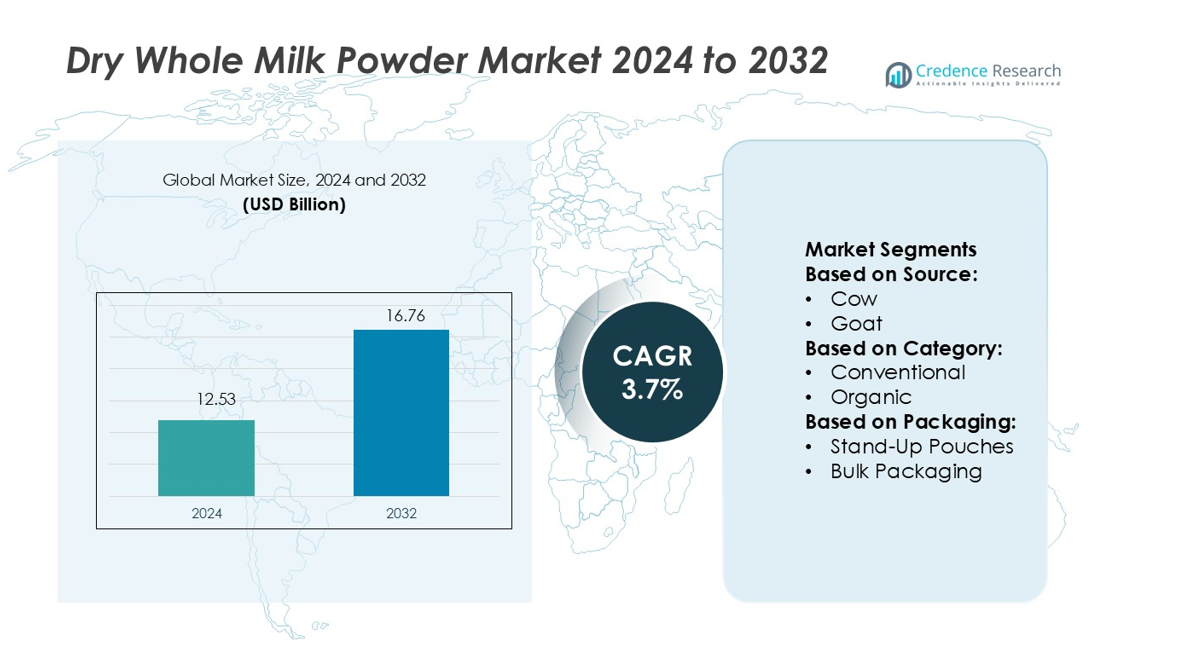

Dry Whole Milk Powder Market size was valued USD 12.53 billion in 2024 and is anticipated to reach USD 16.76 billion by 2032, at a CAGR of 3.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dry Whole Milk Powder Market Size 2024 |

USD 12.53 billion |

| Dry Whole Milk Powder Market, CAGR |

3.7% |

| Dry Whole Milk Powder Market Size 2032 |

USD 16.76 billion |

The top players in the Dry Whole Milk Powder Market include Liberty House Group, CRS Holdings Inc., Sandvik AB, Advanced Technology & Materials Co., Ltd, POLEMA, MolyWorks Materials Corporation, Rio Tinto Metal Powders, Rusal, GKN PLC, Hoganas AB, and Advanced Micro Devices. These companies focus on product innovation, capacity expansion, and sustainable sourcing to strengthen their market positions. Asia-Pacific leads the global market with a 31% share, driven by strong demand from the food and beverage sector, expanding middle-class populations, and rising dairy consumption. Advanced processing technologies, strategic partnerships, and improved supply chain networks enable key players to enhance their reach in both developed and emerging markets, supporting steady industry growth.

Market Insights

- The Dry Whole Milk Powder Market size was valued at USD 12.53 billion in 2024 and is expected to reach USD 16.76 billion by 2032, at a CAGR of 3.7%.

- Strong demand from the food and beverage sector, rising dairy consumption, and growing use in bakery and confectionery drive steady market growth.

- Product innovation, sustainable sourcing, and advanced processing technologies shape competitive strategies among leading players.

- Price volatility, raw material supply fluctuations, and regulatory compliance remain key restraints for producers and exporters.

- Asia-Pacific leads with a 31% share, supported by rising consumer demand and expanding food industries, while other regions show stable segment growth in both retail and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Source

Cow milk leads the dry whole milk powder market with the largest share. Its consistent availability, balanced nutritional profile, and widespread use in bakery and beverage industries strengthen its dominance. Cow milk powder is widely used in infant formula, dairy-based drinks, and confectionery products. Goat milk powder is gaining traction due to its digestibility and growing use in premium nutritional products. The “Others” segment, including sheep and camel milk, remains smaller but is expanding in niche health and wellness applications.

- For instance, Guangdong Yashili Group Co., Ltd. built a milk-powder production facility in New Zealand with an annual capacity of 52,000 tonnes. Cow milk powder is widely used in infant formula, dairy-based drinks, and confectionery products.

By Category

The conventional segment holds the dominant share, supported by its cost-effectiveness and established processing methods. Conventional products benefit from strong global supply chains and stable consumer demand, especially in food and beverage manufacturing. The organic segment is expanding as health-conscious consumers increasingly seek clean-label and chemical-free options. Its growth is further supported by the premium positioning of organic dairy products in developed markets.

- For instance, Sandvik has launched its major new technology-program called “DataDrive’31”, with a six-year budget of EUR 80 million, including EUR 16 million in R&D funding from the Finnish government for the first three years.

By Packaging

Plastic and tin containers dominate the packaging segment, ensuring extended shelf life and strong product protection. Their rigid structure makes them ideal for storage, export, and bulk purchases. Stand-up pouches are growing fast due to lower costs, lightweight design, and eco-friendly appeal. Bulk packaging caters mainly to industrial buyers such as food processors and bakeries that require large volumes. Growing focus on sustainable and convenient packaging formats is shaping this segment’s development.

Key Growth Drivers

Rising Demand in the Food & Beverage Sector

Dry whole milk powder is widely used in bakery, confectionery, and dairy applications. The long shelf life and easy storage make it a preferred ingredient for large-scale food production. Its use in ready-to-eat products, infant formula, and instant beverages continues to rise globally. Food manufacturers are also increasing investments in high-quality milk powder to enhance product texture and flavor. The growing popularity of convenience foods further fuels demand across both developed and emerging markets.

- For instance, MolyWorks Materials Corporation developed its patented “Greyhound” compact recycling-foundry system which has successfully up-cycled 25 different metal alloys for additive manufacturing applications.

Expanding Export Opportunities

Global trade in milk powder is expanding due to rising demand in developing countries. Many regions rely on imports to meet dairy consumption needs. This creates strong opportunities for major producers to scale exports and enter new markets. Countries with advanced dairy processing capabilities are increasing production capacity to meet growing international orders. Supportive trade agreements and favorable export policies also enhance profitability, strengthening the global supply chain of dry whole milk powder.

- For instance, Atomet 4601 product by Rio Tinto Metal Powders contains 1.8 % nickel and 0.55 % molybdenum in its alloy steel powder formulation for high-strength powder metallurgy and forging applications.

Increasing Adoption in Industrial Applications

The use of dry whole milk powder in food processing industries is increasing rapidly. Its versatility and nutrient-rich profile make it suitable for ice cream, yogurt, and chocolate manufacturing. The product also supports consistent quality in large-batch production. Industrial buyers prefer it due to its stable shelf life and reduced transportation costs compared to liquid milk. Rising demand from the HoReCa sector and large-scale food producers accelerates market growth worldwide.

Key Trends & Opportunities

Product Innovation and Nutritional Enhancements

Manufacturers are introducing milk powders with improved solubility and fortified nutrients. These innovations address growing consumer awareness of health and nutrition. High-protein and vitamin-enriched products are gaining strong traction in global markets. Improved drying technologies enhance product quality and dissolve faster, boosting their appeal in food processing. Premium formulations are also opening opportunities in the infant nutrition and sports nutrition segments.

- For instance, AmulFed’s Gandhinagar plant processes 150 metric tonnes per day (TPD) of skimmed milk powder and 120 TPD of dairy whitener using advanced GEA drying technologies. Powdered dry milk is widely used in bakery, confectionery, and dairy processing, where reconstitution flexibility is valued.

Growth of E-Commerce and Direct-to-Consumer Channels

E-commerce platforms are creating new distribution opportunities for dairy brands. Online retail makes it easier for consumers to access premium milk powder products with extended shelf life. This shift helps producers expand into non-traditional markets without heavy infrastructure investments. Growing digital adoption, rising household incomes, and improved cold-chain logistics are expected to strengthen online sales channels for dry whole milk powder.

- For instance, GCMMF consistently confirm that they handle procurement volumes exceeding 23 million litres per day. The peak procurement figure is even higher during the flush season, exceeding 30 million litres per day.

Sustainability and Clean Label Demand

Consumers increasingly prefer clean-label and sustainably sourced dairy products. Producers are focusing on transparent sourcing and minimal processing to meet these expectations. Eco-friendly packaging and reduced carbon footprints enhance brand trust and market positioning. Certifications such as organic and non-GMO labels are driving premiumization trends in both developed and emerging markets. This shift creates strong differentiation opportunities for innovative brands.

Key Challenges

Price Volatility and Supply Chain Risks

Fluctuating raw milk prices and uncertain supply chains create instability in the market. Seasonal production variations and changing feed costs directly impact manufacturing expenses. International trade disruptions and geopolitical tensions can also increase logistics costs. These factors make pricing strategies complex and affect profit margins for producers and distributors of dry whole milk powder.

Regulatory and Quality Compliance Barriers

Strict food safety and labeling regulations create barriers for market entry and expansion. Compliance with international standards such as Codex Alimentarius and regional norms requires high investment. Frequent regulatory updates add operational complexity for exporters. Companies must invest in advanced quality control systems and certifications to maintain compliance, which can strain smaller producers.

Regonal Analysis

North America

North America holds a 29% share of the global dry whole milk powder market, driven by strong demand from the bakery, confectionery, and dairy processing industries. The United States leads the region with high consumption in functional foods and sports nutrition products. Food manufacturers prefer dry milk powder for its long shelf life and ease of transportation. Strong retail networks and advanced processing capabilities support stable supply and distribution. Increasing consumer preference for clean-label dairy products further strengthens market growth across both retail and foodservice channels.

Europe

Europe accounts for 27% of the global market, supported by its well-established dairy sector and strong export capacity. Countries such as Germany, France, and the Netherlands dominate production, supplying both domestic and international markets. Stringent quality standards and sustainable farming practices enhance product reputation globally. Demand is stable in bakery, confectionery, and infant nutrition segments. Europe’s focus on innovation and fortified products boosts product differentiation. Growing consumption of organic dairy products and transparent sourcing practices also contribute to the region’s competitive edge.

Asia-Pacific

Asia-Pacific leads the market with a 31% share, fueled by rising population, urbanization, and increasing dairy consumption. China, India, and Australia are key contributors, with strong import and production activities. Rapid growth in the food processing sector and the popularity of infant formula drive substantial demand. Expanding middle-class populations and rising disposable incomes support product adoption in both retail and industrial channels. E-commerce platforms and modern retail formats further enhance accessibility. The region’s dynamic growth creates attractive opportunities for global and regional producers.

Latin America

Latin America holds a 7% share of the market, with Brazil and Argentina serving as major production hubs. The region benefits from abundant raw milk availability and lower production costs, making it a key supplier to global markets. Growing dairy exports and increasing adoption in the domestic food industry support steady market growth. Economic improvements and expanding retail infrastructure drive demand for packaged dairy products. Manufacturers are investing in processing technologies to enhance product quality and shelf life, strengthening Latin America’s position in the global supply chain.

Middle East & Africa

The Middle East & Africa region accounts for 6% of the market, primarily driven by strong import dependence. Gulf countries, including Saudi Arabia and the UAE, are major consumers due to limited domestic dairy production. Increasing demand for processed dairy products and growing foodservice sectors support market expansion. African nations are gradually expanding processing capabilities to reduce import reliance. Strategic trade partnerships and investments in cold-chain logistics improve product availability. Rising urbanization and changing dietary preferences further drive steady growth in this emerging regional market.

Market Segmentations:

By Source:

By Category:

By Packaging:

- Stand-Up Pouches

- Bulk Packaging

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Dry Whole Milk Powder Market is shaped by key players such as Liberty House Group, CRS Holdings Inc., Sandvik AB, Advanced Technology & Materials Co., Ltd, POLEMA, MolyWorks Materials Corporation, Rio Tinto Metal Powders, Rusal, GKN PLC, Hoganas AB, and Advanced Micro Devices. the Dry Whole Milk Powder Market is defined by continuous innovation, strategic expansion, and strong global distribution networks. Companies are investing in advanced processing technologies to improve product quality, solubility, and nutritional value. Many producers are focusing on sustainable sourcing and clean-label formulations to meet rising consumer expectations and regulatory standards. Strategic collaborations, acquisitions, and partnerships help strengthen market presence and supply chain resilience. In addition, expanding production capacities and optimizing logistics enable companies to address growing demand in both developed and emerging regions. This dynamic competition drives product differentiation and supports steady market growth.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Liberty House Group

- CRS Holdings Inc.

- Sandvik AB

- Advanced Technology & Materials Co., Ltd

- POLEMA

- MolyWorks Materials Corporation

- Rio Tinto Metal Powders

- Rusal

- GKN PLC

- Hoganas AB

- Advanced Micro Devices

Recent Developments

- In May 2025, Oerlikon Metco, headquartered in Winterthur, Switzerland, has launched its new MetcoMed brand with metal powders the release of two materials tailored for the Additive Manufacturing of medical components and implants.

- In March 2024, SSAB is launching the world’s first emission-free steel powder for commercial deliveries, made of recycled SSAB Zero[®] steel. The product will create opportunities for customers to 3D-print their unique designs in steel produced without fossil carbon dioxide emissions.

- In November 2023, 6K Additive acquired the Global Metal Powder company. This acquisition is expected to help the company in the expansion of refractory powder production and sustainable product development.

- In October 2023, Sandvik AB announced that it is going to acquire Buffalo Tungsten, Inc. The acquisition is expected to allow Sandvik to increase its market presence in the U.S, as well as strengthen its regional capabilities within the component manufacturing value chain.

Report Coverage

The research report offers an in-depth analysis based on Source, Category, Packaging and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising demand from the food and beverage sector.

- Product innovation will increase with improved solubility and fortified nutritional content.

- E-commerce will become a major distribution channel for dairy products.

- Sustainability and clean-label preferences will shape product development strategies.

- Export opportunities will grow as demand increases in emerging economies.

- Advanced drying technologies will improve production efficiency and product quality.

- Industrial applications will rise in bakery, confectionery, and infant formula segments.

- Strategic partnerships will strengthen supply chains and global market presence.

- Regulatory compliance and quality standards will drive product differentiation.

- Investments in packaging and shelf-life extension will enhance market competitiveness.