Market Overview:

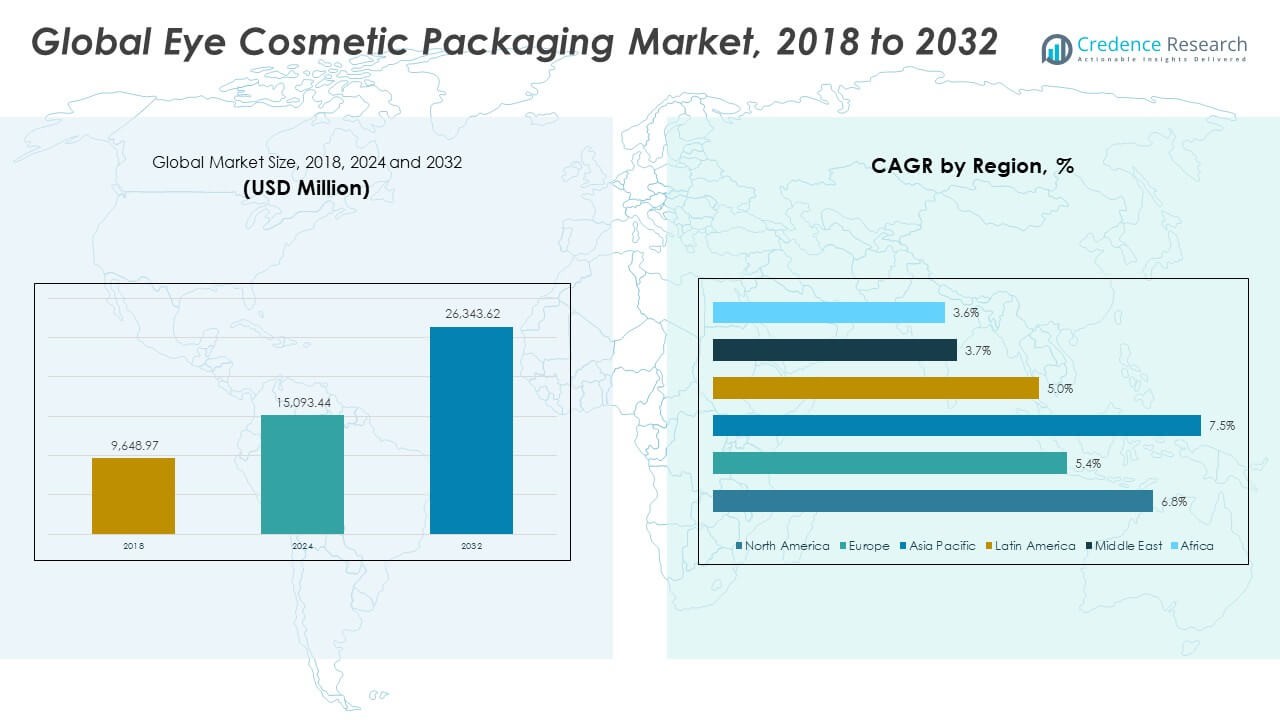

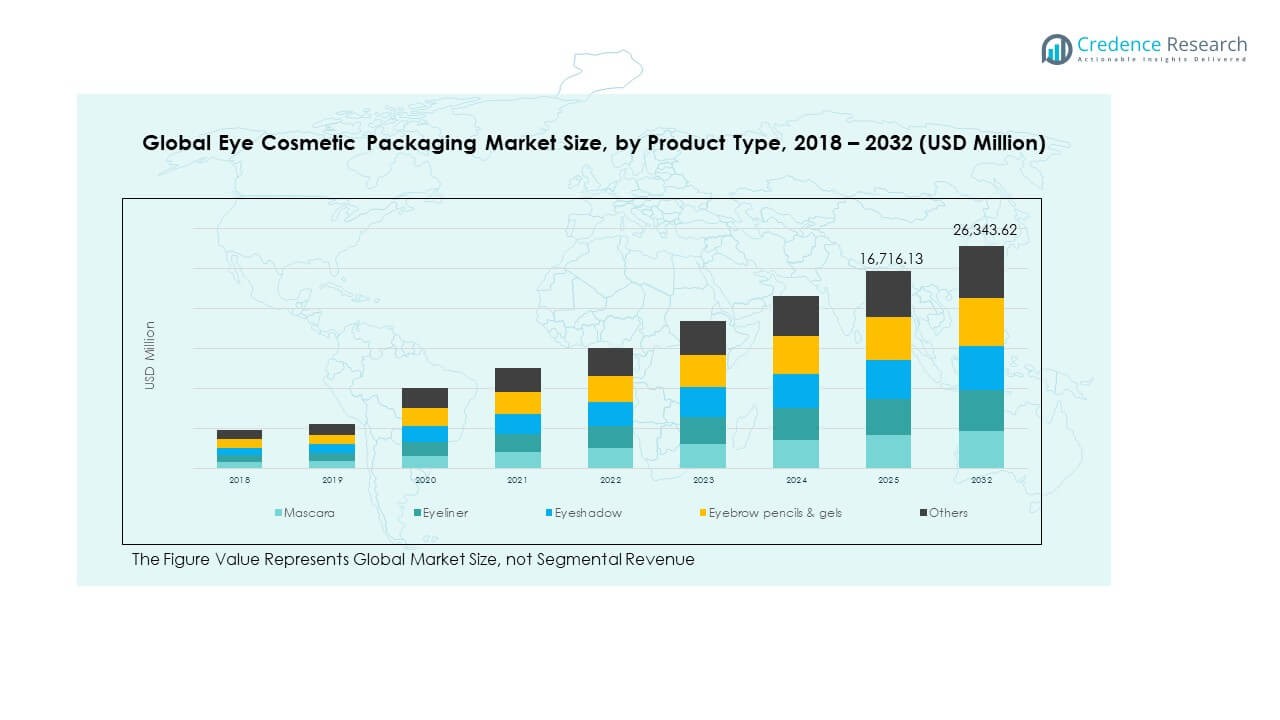

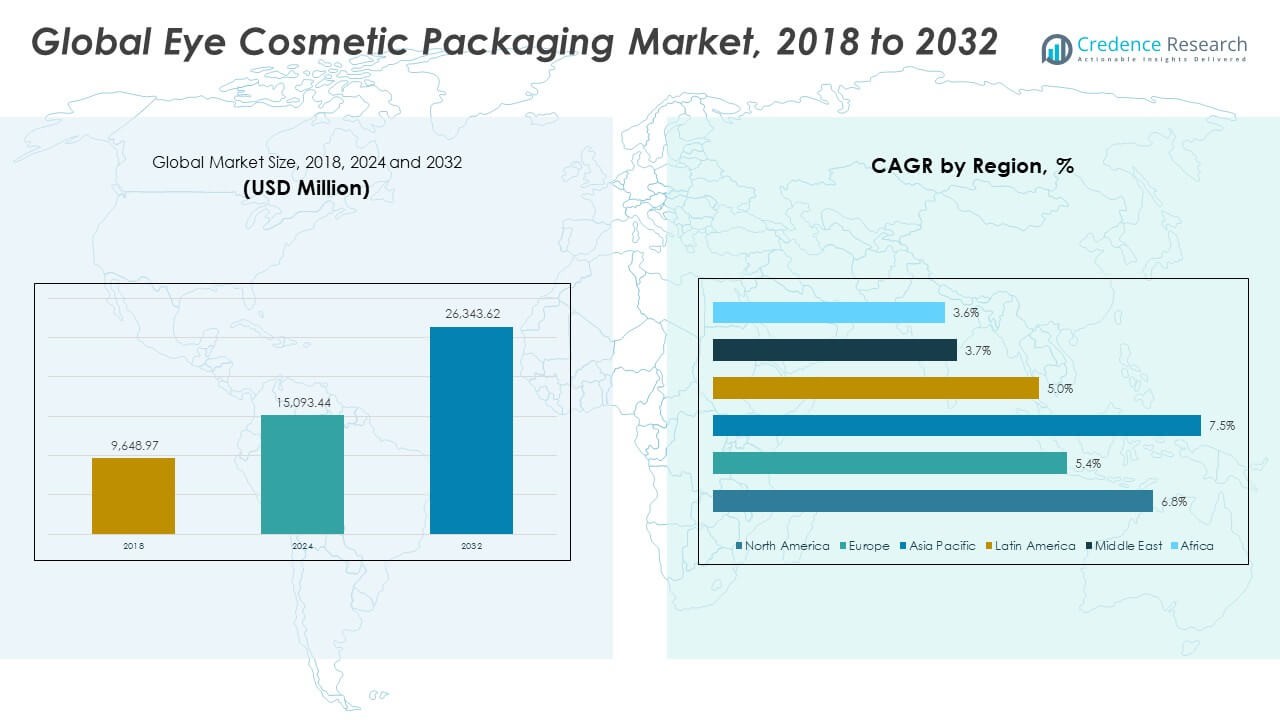

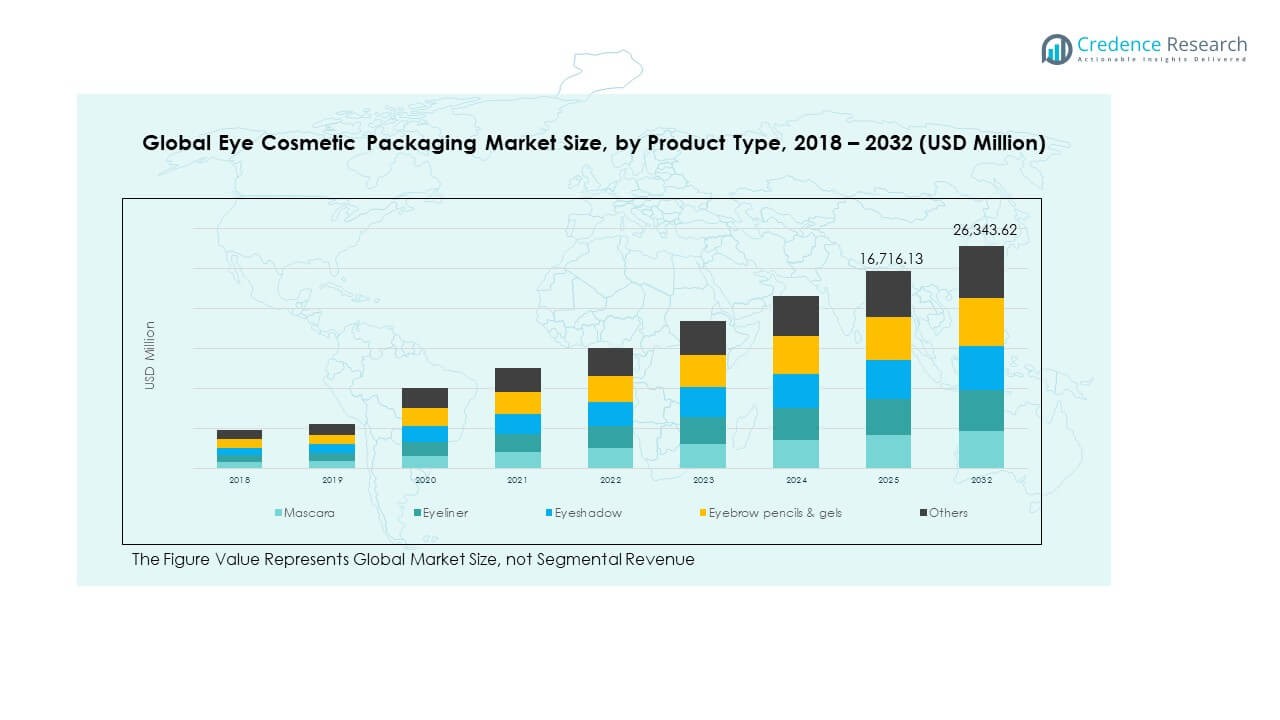

The Global Eye Cosmetic Packaging Market size was valued at USD 9,648.97 million in 2018 to USD 15,093.44 million in 2024 and is anticipated to reach USD 26,343.62 million by 2032, at a CAGR of 6.71% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Eye Cosmetic Packaging Market Size 2024 |

USD 15,093.44 Million |

| Eye Cosmetic Packaging Market, CAGR |

6.71% |

| Eye Cosmetic Packaging Market Size 2032 |

USD 26,343.62 Million |

The market is growing due to increasing demand for premium and sustainable packaging in eye cosmetics. Rising consumer preference for mascara, eyeliner, and eyeshadow packaging with aesthetic appeal and functionality drives growth. Brands are adopting recyclable and lightweight materials to align with eco-friendly trends. Innovation in design, portability, and safety features enhances user experience and supports higher sales across luxury and mass-market segments.

North America leads the Global Eye Cosmetic Packaging Market owing to established beauty brands and strong consumer purchasing power. Europe follows due to its focus on sustainable and minimalist designs. The Asia-Pacific region is emerging rapidly with expanding beauty industries in China, Japan, and South Korea. Rising e-commerce and young consumer demographics are also fostering strong regional demand growth.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Eye Cosmetic Packaging Market was valued at USD 9,648.97 million in 2018, reached USD 15,093.44 million in 2024, and is projected to attain USD 26,343.62 million by 2032, growing at a CAGR of 6.71% during the forecast period.

- Asia Pacific holds the largest share of 41%, driven by expanding beauty industries in China, Japan, and South Korea and strong online retail growth. North America follows with 29%, supported by premium packaging innovation and established brand presence. Europe contributes 16%, backed by sustainable material use and high-end design trends.

- Asia Pacific remains the fastest-growing region, led by rapid urbanization, rising disposable income, and expanding consumer awareness of cosmetic quality and packaging aesthetics.

- Mascara packaging represents around 34% of total market value, driven by the dominance of volumizing and waterproof products requiring airtight, precision designs.

- Eyeshadow and eyeliner collectively hold about 38% of the segment share, supported by growing color diversity and innovations in compact, travel-friendly packaging formats.

Market Drivers:

Rising Demand for Premium and Functional Cosmetic Packaging

The Global Eye Cosmetic Packaging Market is driven by rising consumer demand for premium and functional packaging solutions. Consumers prefer aesthetically designed containers that enhance user experience and protect sensitive eye products. Brands focus on ergonomic applicators and tamper-proof closures to maintain hygiene and usability. It benefits from the growing popularity of eye cosmetics such as mascara, eyeliner, and eyeshadow. Innovation in dispensing systems supports convenient and precise application. Companies emphasize packaging that reflects brand identity and appeals to diverse consumer preferences. The combination of durability, lightweight design, and visual appeal strengthens product adoption across both premium and mass-market segments.

- For instance, HCP Packaging introduced its “Smart Volume” precision-moulded applicator, featuring 12 rows of curved bristles and delivering full lash definition in one coat for a major mascara launch. Brands focus on ergonomic applicators and tamper-proof closures to maintain hygiene and usability

Sustainability and Eco-Friendly Material Innovation Boosting Growth

Growing environmental concerns are pushing brands to adopt recyclable and biodegradable materials in packaging design. It encourages the use of glass, aluminum, and bio-based plastics that reduce environmental footprint. Major players are investing in circular packaging systems and refillable product lines. Sustainable practices also attract eco-conscious consumers, expanding brand loyalty. The integration of renewable resources supports regulatory compliance in developed markets. Manufacturers are optimizing production techniques to minimize waste and energy use. This shift toward sustainability strengthens competitiveness and brand image across global markets.

- For instance, Eurovetrocap produced a cosmetic jar made from 60 % post-consumer recycled glass that retains crystal-clear transparency. It encourages use of glass, aluminium and bio-based plastics that reduce environmental footprint.

Advancements in Packaging Technology and Material Customization

Continuous innovation in packaging materials and manufacturing technology supports market expansion. It drives adoption of airless pumps, smart dispensing caps, and moisture-resistant containers. Companies invest in 3D modeling and digital printing to create precise and attractive product designs. Customization through laser engraving, embossing, and holographic labeling enhances product differentiation. The use of advanced polymers improves durability, transparency, and recyclability. Technological improvements lower production costs while maintaining quality standards. Such developments help brands meet both functional and aesthetic expectations of modern consumers.

Influence of Beauty E-Commerce and Changing Consumer Preferences

The growth of online beauty platforms has transformed the way consumers interact with packaging design. It encourages compact, durable, and visually appealing packaging that performs well in digital displays. Eye cosmetic brands focus on unboxing experiences that influence social media engagement and brand perception. Portable packaging formats appeal to travel-friendly consumers seeking convenience. Personalization and visual storytelling through packaging are becoming central marketing tools. The integration of QR codes and augmented reality enhances consumer engagement. This evolution in consumer behavior continues to shape design strategies across global brands.

Market Trends:

Shift Toward Refillable and Zero-Waste Packaging Systems

The Global Eye Cosmetic Packaging Market is witnessing a strong shift toward refillable packaging models. Brands are developing modular containers that allow easy replacement of used components. Refill stations in stores and online refill programs are gaining popularity among eco-conscious buyers. It enables reduction in material waste and encourages repeat purchases. Sustainable product refills align with global zero-waste initiatives. Major cosmetic houses promote long-lasting containers made from metal or glass. The movement toward circular design supports both environmental and commercial goals for manufacturers.

- For instance, a luxury line now uses detachable magnetic pods for eyeliner refills with over 25 uses per container. Refill stations in stores and online refill programs are gaining popularity among eco-conscious buyers. It enables reduction in material waste and encourages repeat purchases.

Growing Use of Smart Packaging with Interactive Features

Smart packaging technology is enhancing product interaction and authentication within the beauty segment. It includes QR codes, NFC tags, and AR-based product visualization. It helps consumers access ingredient details, tutorials, and authenticity checks instantly. Eye cosmetic brands use digital packaging to create immersive experiences for online shoppers. Integration of connected features strengthens transparency and builds trust. The trend also aids in tracking supply chain efficiency and product origin. Smart packaging bridges marketing, safety, and consumer education in a single format.

- For instance, a beauty brand implemented NFC-enabled lipstick packaging which delivered successful consumer taps in trial markets. It helps consumers access ingredient details, tutorials and authenticity checks instantly. Eye cosmetic brands use digital packaging to create immersive experiences for online shoppers

Minimalist and Aesthetic Design Preferences in Luxury Segments

Consumers increasingly prefer minimalist packaging with refined textures and subtle color tones. It reflects a growing appreciation for simplicity and elegance in beauty products. Premium brands use monochrome palettes, matte finishes, and clear materials to convey sophistication. Lightweight packaging with clean typography improves brand visibility on shelves and screens. The minimalist approach aligns with modern design trends and sustainability goals. Functional elegance is replacing ornate, heavy packaging styles. The trend underscores the industry’s focus on sensory experience and brand storytelling.

Regional Adaptation of Packaging Styles and Cultural Appeal

Brands are tailoring packaging design to fit regional beauty preferences and cultural aesthetics. It reflects growing localization strategies in emerging economies. In Asia-Pacific, intricate and colorful designs attract younger consumers with creative appeal. Western markets favor sleek and durable packaging aligned with luxury perception. The Middle East and Latin America prefer decorative finishes and premium materials. Regional customization enhances emotional connection and product relevance. Cultural alignment in design continues to be a decisive factor for competitive success.

Market Challenges Analysis:

Rising Raw Material Costs and Supply Chain Instability

The Global Eye Cosmetic Packaging Market faces major challenges due to volatile raw material prices. It depends heavily on plastics, metals, and glass, which are affected by oil and energy costs. Sudden supply chain disruptions and logistic delays raise production costs and limit timely delivery. Manufacturers struggle to maintain profitability while meeting sustainable packaging targets. Fluctuating import regulations further complicate global sourcing operations. Smaller firms face higher vulnerability to market fluctuations and input shortages. Managing consistent supply while maintaining product quality becomes a persistent challenge.

Counterfeit Products and Stringent Regulatory Standards

Counterfeit cosmetic packaging remains a critical issue affecting brand reputation and consumer trust. It drives the need for tamper-proof seals, serialized tracking, and secure labeling systems. The Global Eye Cosmetic Packaging Market also faces tightening global regulations regarding material safety and recyclability. Compliance with FDA, EU, and REACH standards increases operational costs and design restrictions. Frequent policy revisions demand ongoing adaptation and certification investments. Companies must balance aesthetic innovation with legal and environmental obligations. This dynamic environment creates continuous pressure on packaging producers to ensure safety and authenticity.

Market Opportunities:

Expansion of Smart and Sustainable Packaging Solutions

Technological progress and sustainability initiatives create promising growth avenues for manufacturers. The Global Eye Cosmetic Packaging Market benefits from demand for biodegradable materials and refillable containers. Brands introducing smart packaging with digital engagement tools gain higher customer retention. It encourages innovation in lightweight and multi-use materials for eye cosmetic applications. Manufacturers entering partnerships with beauty tech firms can explore next-generation packaging ecosystems. Such integration strengthens market differentiation and long-term consumer loyalty.

Growing Penetration in Emerging Beauty Markets and Online Retail

Rapid urbanization and rising disposable incomes in Asia-Pacific, Latin America, and the Middle East create untapped opportunities. It encourages global brands to localize packaging designs and distribution models. E-commerce growth expands visibility and accessibility for innovative eye cosmetic packaging solutions. Companies investing in region-specific branding and eco-friendly design gain a competitive edge. Increasing collaboration between local packaging firms and multinational beauty brands fosters market penetration. Digital marketing trends further accelerate the adoption of visually appealing packaging designs.

Market Segmentation Analysis:

By Product Type

The Global Eye Cosmetic Packaging Market includes mascara, eyeliner, eyeshadow, eyebrow pencils and gels, and others. Mascara packaging dominates due to rising demand for volumizing and waterproof products requiring secure, airtight containers. Eyeliner packaging follows, supported by innovation in liquid and gel formats. Eyeshadow packaging gains traction from compact, multi-color palettes catering to travel convenience. Eyebrow pencils and gels continue to grow with the popularity of natural brow styling trends. Each category drives material advancements, precision applicator development, and ergonomic design focus to enhance user experience and product protection.

- For instance, HCP Packaging developed a fibre-brush applicator system with six twisted-wire rows and a patented “Spider” tip designed to boost lash volume and improve brush-wand payload for leading mascara brands. Eyeliner packaging follows, supported by innovation in liquid and gel formats.

By Packaging Type

Packaging type includes tubes, bottles, jars, sticks, and others. Tubes hold a major share due to their flexibility, light weight, and compatibility with various cosmetic formulations. Bottles are preferred for premium liquid-based eye cosmetics requiring durability and precise dispensing. Jars serve cream and gel-based products demanding easy accessibility. Stick packaging finds use in solid or balm-type cosmetics offering portability and precision. Continuous innovation in closures and sustainable materials supports strong adoption across all formats.

- For instance, Ramaplast also offers jars made from I’m green™ HDPE SGF 4950, supporting biobased standards while preserving barrier performance. Stick packaging finds use in solid or balm-type cosmetics offering portability and precision.

By Distribution Channel

The distribution channel is divided into online and offline segments. Online retail is expanding rapidly with the influence of e-commerce, influencer marketing, and digital beauty platforms. It allows brands to showcase customizable packaging and exclusive collections. Offline channels, including specialty and department stores, retain importance for premium brands offering personalized consultation and sampling. The dual-channel strategy enhances global accessibility and brand presence across diverse consumer demographics.

Segmentation:

By Product Type:

- Mascara

- Eyeliner

- Eyeshadow

- Eyebrow Pencils & Gels

- Others

By Packaging Type:

- Tubes

- Bottles

- Jars

- Sticks

- Others

By Distribution Channel:

By Region:

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East

- Africa

Regional Analysis:

North America

The North America Global Eye Cosmetic Packaging Market size was valued at USD 2,832.55 million in 2018 to USD 4,362.38 million in 2024 and is anticipated to reach USD 7,645.58 million by 2032, at a CAGR of 6.8% during the forecast period. North America holds around 29% of the global market share, driven by strong demand for luxury and sustainable cosmetic packaging. The region benefits from the presence of major beauty brands and advanced manufacturing capabilities. It emphasizes recyclable materials, innovative applicators, and premium design finishes. Growing consumer interest in clean beauty and eco-friendly packaging enhances adoption. The United States dominates due to high disposable income and innovation-led product launches. Canada and Mexico support growth through expanding cosmetic retail networks and online sales.

Europe

The Europe Global Eye Cosmetic Packaging Market size was valued at USD 1,799.11 million in 2018 to USD 2,659.90 million in 2024 and is anticipated to reach USD 4,221.00 million by 2032, at a CAGR of 5.4% during the forecast period. Europe accounts for about 16% of the global market share, supported by its strong beauty heritage and sustainable packaging regulations. It is home to several leading cosmetic packaging manufacturers emphasizing circular economy principles. Stringent EU directives promote biodegradable and recyclable material use. Countries like France, Germany, and Italy lead with advanced design capabilities and high-end packaging aesthetics. Growing preference for refillable containers and glass-based packaging strengthens regional growth. The region’s fashion-driven consumer base continues to fuel premium product adoption.

Asia Pacific

The Asia Pacific Global Eye Cosmetic Packaging Market size was valued at USD 4,219.93 million in 2018 to USD 6,844.58 million in 2024 and is anticipated to reach USD 12,674.46 million by 2032, at a CAGR of 7.5% during the forecast period. Asia Pacific holds the largest market share of around 41%, driven by rising disposable incomes and increasing cosmetic consumption among younger demographics. The region benefits from rapid urbanization, growing online beauty platforms, and innovative local packaging suppliers. China, Japan, and South Korea are major production and consumption hubs. It focuses on lightweight, affordable, and visually appealing packaging formats suitable for digital retail. India’s fast-growing beauty segment adds momentum through domestic manufacturing expansion. The region’s diversity in design preferences and rapid technological adoption make it a vital growth engine.

Latin America

The Latin America Global Eye Cosmetic Packaging Market size was valued at USD 436.47 million in 2018 to USD 673.88 million in 2024 and is anticipated to reach USD 1,034.97 million by 2032, at a CAGR of 5.0% during the forecast period. Latin America represents nearly 6% of the global market share. Brazil and Mexico dominate due to the strong presence of local beauty brands and rising makeup trends. It is witnessing growing demand for affordable yet high-quality packaging solutions. Expanding retail and e-commerce penetration support regional product accessibility. Manufacturers focus on cost-effective materials such as polypropylene and PET to serve mass markets. Sustainability awareness is growing, but adoption remains gradual due to cost constraints. The influence of social media beauty trends continues to fuel product innovation and packaging upgrades.

Middle East

The Middle East Global Eye Cosmetic Packaging Market size was valued at USD 216.68 million in 2018 to USD 302.62 million in 2024 and is anticipated to reach USD 422.80 million by 2032, at a CAGR of 3.7% during the forecast period. The region holds approximately 4% of the global market share, supported by increasing luxury beauty consumption and high-end retail expansion. Countries like the UAE and Saudi Arabia drive growth through premium cosmetic demand and strong tourism-linked sales. It emphasizes gold-accented, ornate, and high-gloss packaging reflecting regional preferences. Local beauty brands are emerging, contributing to demand for custom packaging. Rising e-commerce adoption broadens distribution for international brands. Ongoing investments in beauty infrastructure support long-term packaging innovation.

Africa

The Africa Global Eye Cosmetic Packaging Market size was valued at USD 144.23 million in 2018 to USD 250.08 million in 2024 and is anticipated to reach USD 344.81 million by 2032, at a CAGR of 3.6% during the forecast period. Africa contributes about 3% of the global market share, driven by growing middle-class spending and expansion of beauty retail. South Africa remains the leading market, supported by local cosmetic production and international brand presence. Nigeria and Egypt are emerging with increasing awareness of personal grooming products. It faces challenges in packaging material supply and manufacturing standardization. Affordable and durable packaging solutions see strong demand in mass-market segments. The rise of local e-commerce platforms and regional distribution hubs enhances future opportunities for packaging suppliers.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Albea Group

- Amcor Limited

- HCP Packaging

- Anomatic

- Alpha Packaging

- Cosmopak

- Color Carton Corporation

- Epopack

- 3C Inc.

- Arcade Beauty

Competitive Analysis:

The Global Eye Cosmetic Packaging Market is moderately competitive with the presence of global and regional manufacturers. Companies such as Albea Group, Amcor Limited, HCP Packaging, Anomatic, and Cosmopak dominate through innovation and strong brand partnerships. It focuses on advanced materials, sustainable packaging, and design differentiation to meet rising consumer preferences. Firms compete on visual appeal, durability, and recyclability while maintaining cost efficiency. Strategic collaborations with beauty brands and investment in digital customization tools strengthen market positions. Continuous product innovation and expansion into emerging regions define competition intensity.

Recent Developments:

- On April 14, 2025, Albéa Group launched its North America sustainable packaging collection for mascaras, lipsticks, jars and more, making it available from its Matamoros factory and highlighting ten new sustainable packaging solutions.

- On November 19, 2024, Amcor Limited and Berry Global Group, Inc. entered into a definitive all-stock merger agreement to create a global leader in consumer and healthcare packaging, expanding beauty-packaging capabilities and global reach.

- In April 2024, Anomatic launched its next-generation Evercycle™ alloy for cosmetics packaging, offering a minimum of 94 % post-consumer recycled (PCR) aluminum content and reducing greenhouse-gas emissions by 89 % compared to standard aluminum.

Report Coverage:

The research report offers an in-depth analysis based on Product Type, Packaging Type, and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing emphasis on recyclable and biodegradable packaging materials across leading brands.

- Increasing integration of smart packaging with QR and AR-based interactive features.

- Rising consumer preference for refillable and modular cosmetic packaging formats.

- Expansion of e-commerce channels driving demand for durable and aesthetic packaging.

- Strong growth in Asia Pacific driven by urbanization and beauty brand proliferation.

- Advancements in 3D printing and digital design tools enabling product customization.

- Collaboration between packaging manufacturers and beauty tech firms intensifying innovation.

- Shifting consumer focus toward compact, travel-friendly packaging designs.

- Regulatory support for sustainable material use influencing global supply chains.

- Competitive differentiation based on design appeal, sustainability, and material innovation.