Market Overview:

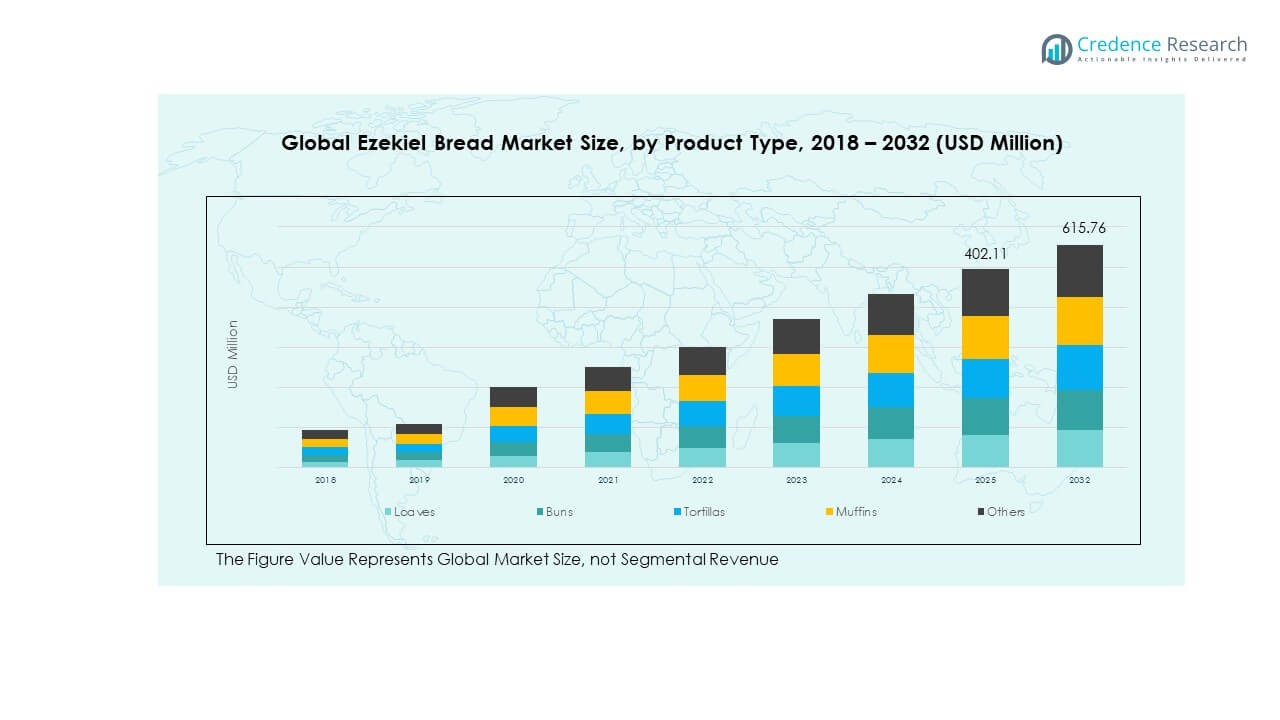

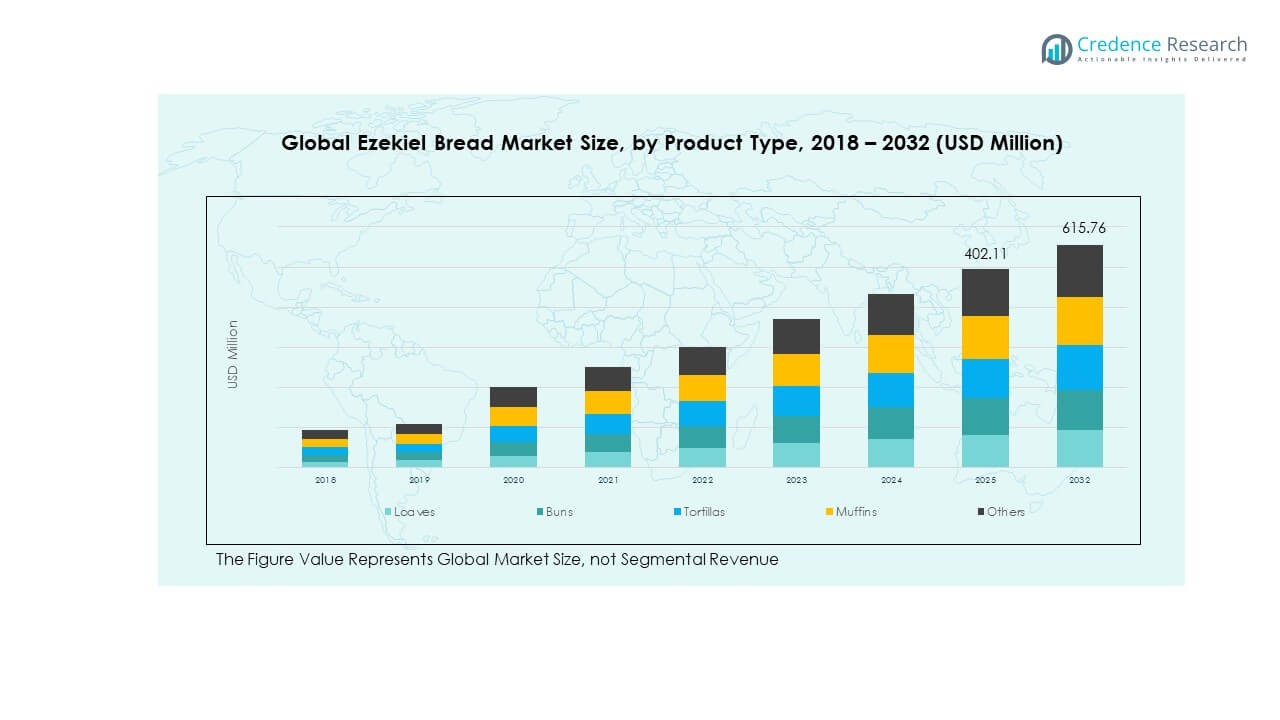

The Global Ezekiel Bread Market size was valued at USD 239.48 million in 2018 to USD 365.38 million in 2024 and is anticipated to reach USD 615.76 million by 2032, at a CAGR of 6.28% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Ezekiel Bread Market Size 2024 |

USD 365.38 Million |

| Ezekiel Bread Market, CAGR |

6.28% |

| Ezekiel Bread Market Size 2032 |

USD 615.76 Million |

Demand for Ezekiel bread is growing as consumers prefer nutrient-dense and sprouted grain options. The market is driven by increasing awareness of health benefits such as high protein, fiber, and low glycemic index. Rising vegan and clean-label trends further boost demand. Manufacturers focus on innovation in flavor and packaging to appeal to fitness-conscious and gluten-sensitive consumers.

North America leads the market due to strong health-conscious consumer bases in the U.S. and Canada. Europe follows, supported by growing demand for organic bakery products and sustainable food options. The Asia-Pacific region is emerging rapidly, driven by urbanization, western dietary influences, and expanding retail distribution. Latin America and the Middle East also show gradual adoption as healthy eating awareness rises.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Ezekiel Bread Market was valued at USD 239.48 million in 2018, reached USD 365.38 million in 2024, and is projected to attain USD 615.76 million by 2032, expanding at a CAGR of 6.28% during the forecast period.

- North America led the market with 43.7% share due to strong consumer preference for organic and plant-based bakery products. Europe followed with 27.6%, supported by its mature organic food industry, while Asia Pacific held 20.3%, fueled by expanding middle-class demand and retail accessibility.

- Asia Pacific emerged as the fastest-growing region with 8.0% CAGR, driven by rapid urbanization, westernized diets, and the growing popularity of health-focused bakery alternatives.

- By product type, loaves accounted for about 42% of total market revenue in 2024, making them the most consumed category across households and foodservice outlets.

- Buns and tortillas together represented roughly 33% share, boosted by increasing demand for convenient and versatile bakery options in retail and quick-service restaurants.

Market Drivers:

Rising Consumer Awareness Toward Nutrient-Rich and Sprouted Grain Products

The Global Ezekiel Bread Market is witnessing strong growth due to rising consumer preference for sprouted grain products rich in nutrients. Consumers are increasingly aware of the benefits of whole grains that support better digestion and stable blood sugar. The market benefits from increased education around plant-based and high-protein diets. Ezekiel bread’s composition of lentils, barley, and spelt offers complete protein and fiber. It appeals to individuals seeking healthier alternatives to refined flour products. Fitness-conscious and vegan consumers actively prefer it over conventional breads. Growing availability in specialty and organic food stores strengthens accessibility. This awareness is driving consistent demand across both developed and developing economies.

- For instance, The Big 16 by Silver Hills Bakery features 43 g whole grains, 12 g protein and 8 g fibre per two-slice serving. Sprouted grain breads promote better digestion and more stable blood sugar thanks to breakdown of antinutrients. The barley and spelt mix offers complete protein and fiber. It appeals to individuals seeking healthier alternatives to refined bread. Fitness-conscious and vegan consumers prefer it over conventional breads.

Growing Vegan and Clean-Label Food Adoption Among Health-Conscious Consumers

Shifting consumer lifestyles toward plant-based eating habits supports the expansion of the Global Ezekiel Bread Market. Vegan diets have gained traction across North America and Europe, where consumers demand transparency and purity in food ingredients. Ezekiel bread, free from preservatives and artificial additives, fits perfectly into this preference. The clean-label trend highlights natural, non-GMO, and chemical-free food production, which strengthens trust. Producers respond by emphasizing traceable sourcing and transparent nutritional labeling. It attracts consumers with dietary restrictions such as lactose intolerance and gluten sensitivity. The combination of ethical eating and sustainability consciousness is reinforcing demand. The trend aligns closely with broader global movements toward holistic wellness and ethical consumption.

- For instance, the Ezekiel 4:9bread by Food for Life claims all 18 amino acids from vegetable sources and uses only sprouted whole grains and legumes. The clean-label trend highlights natural, non-GMO and chemical-free food production that builds trust. Producers emphasise traceable sourcing and transparent nutritional labels. It attracts consumers with dietary restrictions like lactose intolerance or gluten sensitivity.

Expansion of Health-Focused Retail Chains and Online Distribution Channels

The retail landscape supports growth for the Global Ezekiel Bread Market by improving accessibility and visibility. Health-centric supermarkets and organic retail chains are expanding shelf space for nutrient-rich bakery products. Online grocery platforms and e-commerce stores allow consumers to access specialty breads without regional limitations. Manufacturers leverage digital marketing to promote health benefits and product diversity. The inclusion of Ezekiel bread in fitness and wellness subscription boxes is boosting recognition. Partnerships with health influencers and dieticians increase brand awareness. The convenience of home delivery complements consumer demand for easy access to nutritious food. This omnichannel expansion ensures steady market penetration across global urban centers.

Innovation in Product Formulation and Packaging Enhancing Consumer Appeal

Product innovation remains a key driver in the Global Ezekiel Bread Market, enhancing consumer experience through flavor and functionality. Manufacturers are introducing variants with added seeds, nuts, and fortified nutrients to attract diverse tastes. Eco-friendly and resealable packaging improves shelf life and sustainability appeal. Research into improved baking processes ensures better texture and extended freshness. Companies integrate plant-based protein sources to appeal to gym-goers and athletes. Continuous product refinement aligns with consumer expectations for convenience and nutrition. The introduction of frozen and ready-to-eat variants supports busy lifestyles. Such developments reinforce Ezekiel bread’s image as a premium and performance-driven food product.

Market Trends:

Rising Integration of Functional Ingredients and Fortified Nutrition in Bakery Products

The Global Ezekiel Bread Market is shaped by the growing demand for functional and fortified bakery items. Consumers increasingly prefer breads enriched with omega-3, probiotics, and minerals. The inclusion of ancient grains such as quinoa and amaranth enhances nutritional diversity. Brands are promoting targeted health benefits like gut health and energy balance. Functional innovation also extends to gluten-free and high-protein formulations. Health professionals endorse these variants for balanced diets. The trend bridges traditional bakery products with performance nutrition. It highlights the merging of taste, convenience, and functionality in modern eating habits.

- For example, Silver Hills’ “Full Seed Ahead” sprouted bread provides 600 mg omega-3 ALA, 12 g protein and 9 g fibre per two-slice serving. Consumers prefer breads enriched with omega-3, minerals and ancient grains like quinoa and amaranth. Brands promote health benefits such as gut health and sustained energy. Functional innovation extends to gluten-free and high-protein formulations.

Adoption of Sustainable and Organic Sourcing Practices in Bread Production

Sustainability is a major trend influencing the Global Ezekiel Bread Market, with brands prioritizing eco-friendly sourcing and production. Consumers increasingly value transparency in farming and ingredient origin. Organic certifications and fair-trade sourcing improve brand credibility. Bakeries invest in renewable packaging materials to reduce carbon impact. Manufacturers collaborate with local farmers to strengthen sustainable supply chains. Awareness campaigns highlight environmental responsibility in bakery production. These initiatives attract eco-conscious consumers and strengthen long-term loyalty. The trend reflects a broader shift toward responsible food consumption worldwide.

- For instance, Silver Hills markets sprouted breads made from certified organic whole grains, non-GMO project verified and vegan, with 50% sprouted grains in the Soft Wheat variety. Consumers value transparency in farming and origin. Organic certifications and fair-trade sourcing improve brand credibility. Bakeries invest in renewable packaging and reduce carbon impact through local sourcing. Manufacturers partner with regional farmers to strengthen sustainable supply chains.

Rising Popularity of Frozen and Ready-to-Eat Sprouted Bread Variants

The Global Ezekiel Bread Market is seeing growth in frozen and ready-to-eat bread options that meet modern lifestyle needs. Consumers value the convenience of longer shelf life without compromising nutritional quality. Retailers allocate more freezer space to health-focused bread products. Companies introduce vacuum-sealed packaging that retains freshness. Busy professionals and students find these variants ideal for quick meals. Technological advances in preservation maintain softness and taste. Online sales channels are promoting frozen Ezekiel bread to a wider audience. The demand surge aligns with the global trend toward convenient and health-conscious eating habits.

Incorporation of Digital Branding and Nutritional Transparency in Marketing Strategies

The Global Ezekiel Bread Market benefits from rising digital engagement between brands and consumers. Producers leverage social media platforms to promote nutritional education and product differentiation. QR codes on packaging provide ingredient traceability and manufacturing details. Nutrition-based storytelling enhances consumer connection and trust. Influencer marketing helps expand reach among fitness communities and diet-conscious audiences. Companies focus on visually engaging online campaigns to highlight health benefits. Brand authenticity and transparency encourage repeat purchases. This digital evolution reinforces awareness and strengthens competitive positioning in the bakery sector.

Market Challenges Analysis:

Limited Awareness and High Price Sensitivity Among Mainstream Consumers

The Global Ezekiel Bread Market faces challenges due to limited awareness in developing markets. Many consumers still prefer traditional white or multigrain bread over sprouted variants. The higher price point restricts mass adoption, especially in cost-sensitive regions. Limited product availability in rural and semi-urban retail channels also constrains visibility. Retailers often hesitate to stock niche products with shorter shelf lives. Consumers unfamiliar with sprouted grain benefits hesitate to shift from conventional choices. Price competitiveness with standard bread brands remains a major issue. Expanding consumer education and distribution reach will be crucial for broader acceptance.

Regulatory Complexities and Shorter Product Shelf Life Affecting Distribution Efficiency

The Global Ezekiel Bread Market encounters logistical and regulatory hurdles related to product freshness and labeling compliance. Maintaining quality during storage and transit is challenging due to minimal preservatives. Regulatory frameworks around organic and clean-label claims differ across regions, increasing operational complexities. High dependency on cold-chain logistics raises cost structures for producers. Limited production scalability among small bakeries restricts export opportunities. Retailers demand consistent supply and uniform packaging standards, adding to operational strain. Shelf-life limitations reduce retailer interest in long-distance stocking. Addressing these challenges requires technological solutions and harmonized certification systems.

Market Opportunities:

Expanding Penetration in Emerging Markets Through Localized Production and Distribution

The Global Ezekiel Bread Market holds strong opportunities across emerging economies with rising health-conscious populations. Localized production can reduce logistics costs and improve affordability. Regional bakeries adopting sprouted grain formulations can meet evolving dietary needs. Partnerships with supermarkets and fitness stores increase accessibility in tier-2 and tier-3 cities. Awareness campaigns focused on nutritional benefits can create new consumer bases. Government nutrition initiatives may further boost adoption. The trend of urban wellness living supports sustained market entry. Expanding retail and digital networks will accelerate penetration across untapped markets.

Technological Advancements in Food Processing and Product Preservation Techniques

Innovation in food technology offers major opportunities for the Global Ezekiel Bread Market. Advanced baking techniques help improve texture, taste, and nutrient retention. Developments in natural preservatives extend shelf life without chemical additives. Automation and smart packaging enhance consistency and freshness. Producers can adopt AI-driven quality monitoring to optimize ingredient balance. Cold-chain efficiency improvements can reduce wastage. Nutritional fortification technology creates customized variants for specific consumer needs. These advancements enhance competitiveness and scalability across international markets.

Market Segmentation Analysis:

By Product Type

The Global Ezekiel Bread Market is segmented by product type into loaves, buns, tortillas, muffins, and others. Loaves hold a leading share due to their everyday consumption and easy availability in retail stores. Buns are gaining traction among younger consumers preferring convenient and portion-controlled options. Tortillas and muffins are expanding in demand across health cafés and foodservice chains. The “others” category, including specialty and flavored variants, is growing with innovation in taste and packaging aimed at health-conscious buyers.

- For example, Silver Hills Bakery sprouted bun variants report 8 g protein and 6 g fibre per serving. Tortillas and muffins are expanding in demand across health cafés and foodservice chains

By Grain Source

The market is divided by grain source into sprouted wheat, barley, millet, and others. Sprouted wheat dominates due to its high nutritional profile and strong acceptance among consumers. Barley-based products are witnessing growth for their fiber content and digestive benefits. Millet-based variants appeal to gluten-sensitive and diabetic consumers. The inclusion of diverse sprouted grains enhances protein and mineral content, catering to a broad wellness-oriented demographic.

- For instance, Food For Life’s 7-Sprouted Grains bread blends millet among sprouted grains and notes over 10% protein by weight. The inclusion of diverse sprouted grains enhances protein and mineral content, catering to a broad wellness-oriented demographic.

By Application

Based on application, the market includes retail, foodservice, online sales, and institutional segments. Retail remains the primary distribution channel, supported by rising supermarket presence. Foodservice outlets increasingly incorporate Ezekiel bread in healthy menu options. Online platforms are emerging strongly, driven by e-commerce convenience and subscription models. Institutional demand, including healthcare and educational settings, is also rising due to the emphasis on nutrient-rich food options.

By End User

By end user, the market includes households, restaurants, bakeries, and others. Households dominate consumption due to health-focused meal habits. Restaurants and bakeries are key adopters, integrating Ezekiel bread into premium menus. The others category includes specialty diet stores and fitness centers supporting niche demand growth.

Segmentation:

By Product Type:

- Loaves

- Buns

- Tortillas

- Muffins

- Others

By Grain Source:

- Sprouted Wheat

- Barley

- Millet

- Others

By Application:

- Retail

- Foodservice

- Online Sales

- Institutional

By End User:

- Households

- Restaurants

- Bakeries

- Others

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Ezekiel Bread Market size was valued at USD 105.96 million in 2018 to USD 160.01 million in 2024 and is anticipated to reach USD 270.39 million by 2032, at a CAGR of 6.3% during the forecast period. North America holds around 43.7% of the global market share, led by strong consumer awareness of functional and sprouted grain products. The United States dominates, supported by a mature organic food sector and extensive retail distribution networks. Rising adoption of vegan and plant-based diets continues to drive demand across major cities. Canada shows steady growth driven by premium bakery chains and clean-label consumption trends. Brands emphasize nutritional labeling and sustainability to meet evolving consumer preferences. E-commerce platforms and subscription models are expanding accessibility in urban and suburban markets. The regional market benefits from innovation in flavors and fortified variants catering to fitness-conscious consumers.

Europe

The Europe Global Ezekiel Bread Market size was valued at USD 68.57 million in 2018 to USD 100.89 million in 2024 and is anticipated to reach USD 160.17 million by 2032, at a CAGR of 5.5% during the forecast period. Europe accounts for 27.6% of the global market share, driven by rising health and wellness awareness among consumers. The United Kingdom, Germany, and France lead demand due to established organic and artisanal bread industries. Consumers prefer natural, preservative-free, and fiber-rich products aligned with sustainable food consumption. Retailers promote Ezekiel bread through specialty health stores and eco-friendly supermarket sections. Government support for healthy eating initiatives fosters awareness of sprouted grains. Manufacturers invest in recyclable packaging and low-emission production systems. The regional market continues to mature through innovation and regulatory encouragement for clean-label products.

Asia Pacific

The Asia Pacific Global Ezekiel Bread Market size was valued at USD 43.96 million in 2018 to USD 72.97 million in 2024 and is anticipated to reach USD 139.99 million by 2032, at a CAGR of 8.0% during the forecast period. Asia Pacific represents about 20.3% of the global market share and is the fastest-growing regional market. Growth is driven by expanding urban middle-class populations and increasing interest in Western health food products. Countries like Japan, Australia, and India are experiencing rapid adoption of sprouted and whole-grain bread variants. Online platforms and global retail chains facilitate easy access to premium bakery products. Rising fitness culture and awareness of plant-based nutrition are stimulating regional demand. Local manufacturers are entering the segment through private-label and organic bakery collaborations. The market continues to benefit from aggressive marketing campaigns promoting health-focused lifestyles.

Latin America

The Latin America Global Ezekiel Bread Market size was valued at USD 11.34 million in 2018 to USD 17.08 million in 2024 and is anticipated to reach USD 25.49 million by 2032, at a CAGR of 4.7% during the forecast period. Latin America contributes about 4.4% of the global market share, supported by growing awareness of functional foods in urban centers. Brazil and Mexico lead regional demand through increasing organic retail presence. Health-conscious consumers are gradually shifting toward sprouted and nutrient-dense bakery options. Local bakeries and supermarket chains are introducing Ezekiel-inspired bread formulations. E-commerce growth has made specialty health foods more accessible across metropolitan regions. Rising disposable incomes and digital health trends contribute to steady expansion. The market remains at an early adoption phase but exhibits strong potential with increasing urban dietary diversification.

Middle East

The Middle East Global Ezekiel Bread Market size was valued at USD 6.31 million in 2018 to USD 8.75 million in 2024 and is anticipated to reach USD 12.28 million by 2032, at a CAGR of 3.8% during the forecast period. The Middle East holds about 2.3% of the global market share, led by affluent consumers seeking premium bakery alternatives. The United Arab Emirates and Saudi Arabia drive adoption through international retail chains and high-end supermarkets. Consumers value nutrient-dense, organic, and low-sugar bread options aligning with wellness trends. Regional manufacturers are increasingly collaborating with European and North American brands. Rising tourism and hospitality sectors stimulate bakery product diversification. Imports dominate supply due to limited local production capacities. Market penetration is supported by awareness campaigns promoting fitness and healthy diets.

Africa

The Africa Global Ezekiel Bread Market size was valued at USD 3.34 million in 2018 to USD 5.69 million in 2024 and is anticipated to reach USD 7.44 million by 2032, at a CAGR of 2.9% during the forecast period. Africa accounts for approximately 1.7% of the global market share, representing the smallest but emerging segment. South Africa remains the primary market with strong exposure to health-focused bakery products. Urban consumers are gradually adopting sprouted and whole-grain bread varieties. Limited distribution and high product costs restrict wider market access in developing economies. Awareness of clean-label and vegan food options is increasing through international media influence. Local bakeries are exploring small-scale production of nutrient-dense breads. Imports from Europe and the Middle East currently meet premium segment demand. The region holds long-term potential driven by gradual income growth and changing dietary habits.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Food for Life

- Allied Bakeries

- Silver Hills Bakery

- ShaSha Bread Co.

- Alvarado Street Bakery

- Rainbows Health Food

- Pepperidge Farm

- Panera Bread

- Oasis Bread

- Berlin Natural Bakery

Competitive Analysis:

The Global Ezekiel Bread Market is characterized by moderate competition, driven by a mix of established bakery brands and emerging health-focused producers. Key players such as Food for Life, Silver Hills Bakery, and Alvarado Street Bakery dominate through strong brand identity, wide product distribution, and emphasis on organic certification. It is defined by innovation in flavors, packaging, and nutritional formulation to attract health-conscious consumers. Companies invest in sustainable sourcing and partnerships with retail chains to strengthen presence. The growing preference for plant-based diets and clean-label bakery products intensifies brand competition, encouraging continuous product development and differentiation.

Recent Developments:

- On July 25 2025, Silver Hills Bakery (via Vibrant Health Products, Inc.) announced the acquisition of a former Kellogg manufacturing facility in Rossville, Tennessee, investing USD 48.5 million to establish its first U.S. production site and create 394 jobs, enhancing its supply chain for sprouted grain breads.

- On April 2024, Panera Bread launched its “New Era” menu with more than 20 new or enhanced items at its bakery-cafes across North America, signalling a broader shift toward premium, whole-grain and higher-quality ingredients in bread-based offerings.

- In March 2023, Silver Hills Bakery introduced a refreshed brand identity with updated packaging and new sprouted whole grain loaf named “Omegamazing” rich in Omega-3 ALA, strengthening its positioning in the healthy bakery segment.

Report Coverage:

The research report offers an in-depth analysis based on product type, grain source, application, and end user. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Growing consumer shift toward plant-based and sprouted grain diets will drive expansion.

- Increased retail visibility of clean-label and organic bakery products will sustain market momentum.

- Product innovation focusing on flavor diversification and nutritional enhancement will gain traction.

- E-commerce channels will strengthen distribution reach and brand accessibility.

- Sustainable and eco-friendly packaging adoption will enhance brand perception.

- Health awareness campaigns will influence broader consumer adoption in emerging markets.

- Technological advances in baking and preservation will improve product quality and shelf life.

- Strategic collaborations between global and regional bakeries will expand production capacity.

- Rising demand from restaurants and institutional buyers will create stable growth avenues.

- Focus on gluten-free and allergen-free variants will diversify consumer appeal.