Market Overview

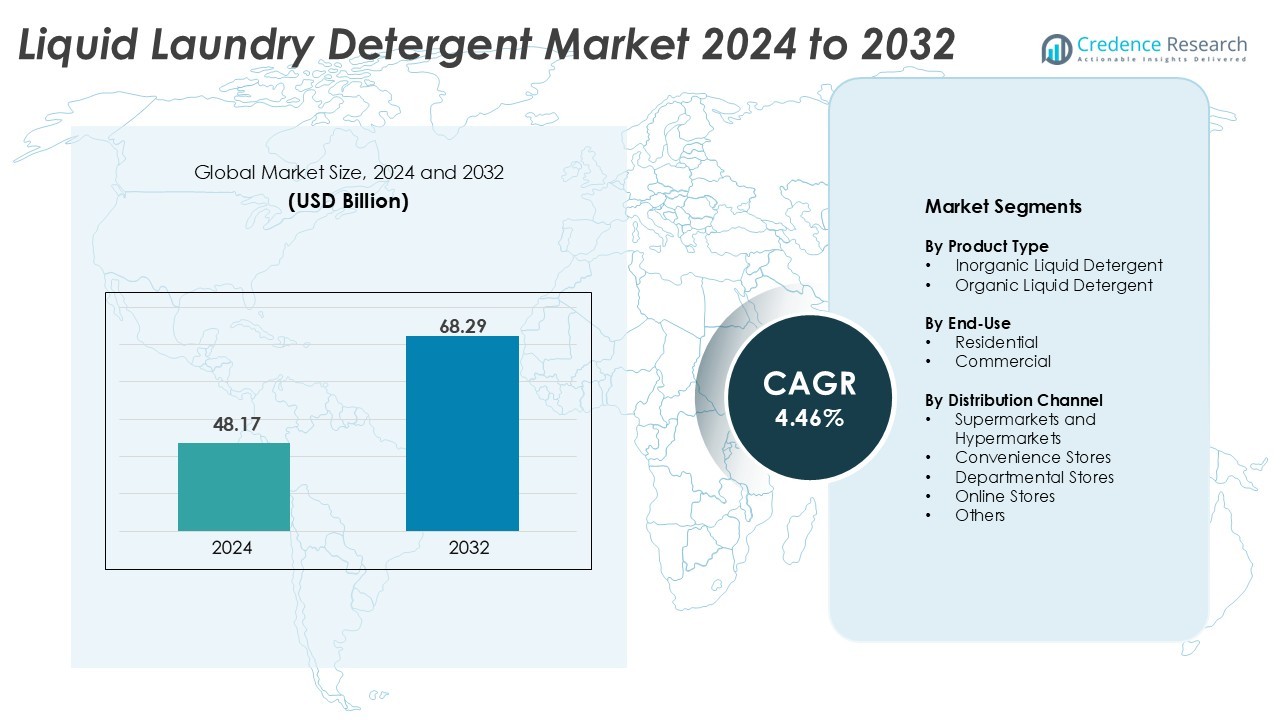

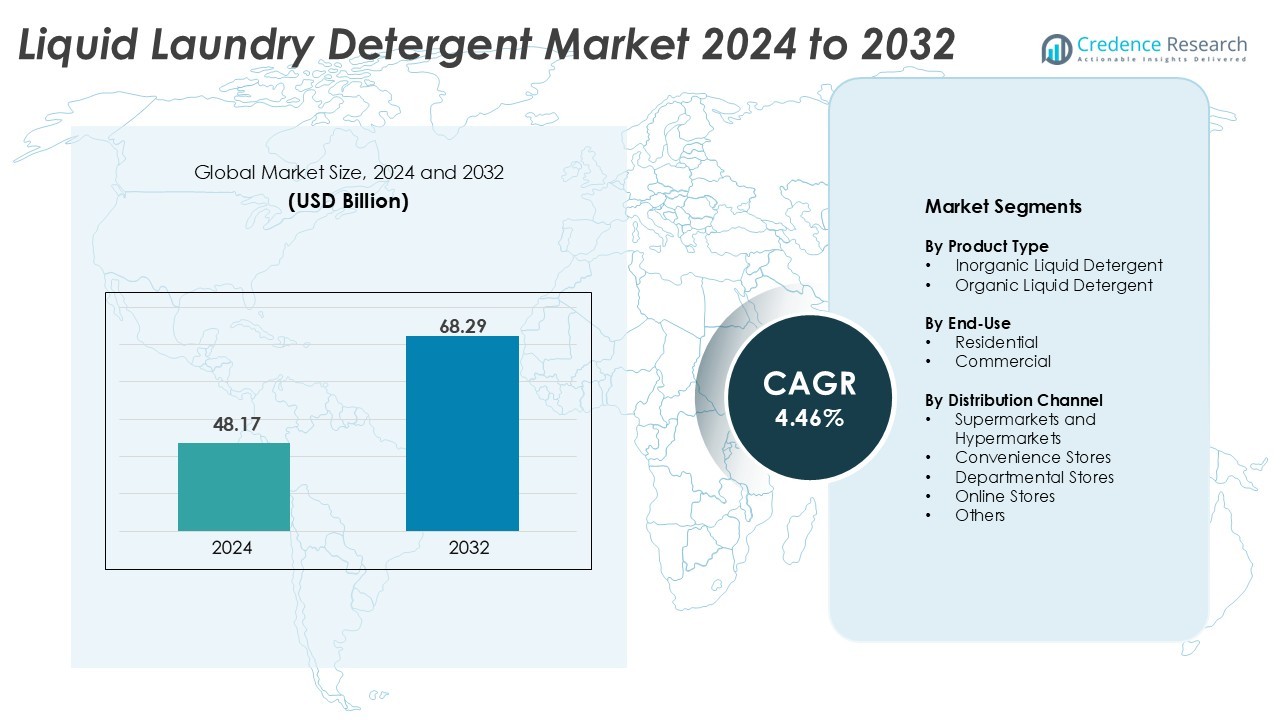

The Liquid Laundry Detergent market size was valued at USD 48.17 billion in 2024 and is anticipated to reach USD 68.29 billion by 2032, at a CAGR of 4.46% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquid Laundry Detergent Market Size 2024 |

USD 48.17 Billion |

| Liquid Laundry Detergent Market, CAGR |

4.46% |

| Liquid Laundry Detergent Market Size 2032 |

USD 68.29 Billion |

The Liquid Laundry Detergent market is shaped by major players including Guangzhou Blue Moon Industrial Co., Ltd., Reckitt Benckiser Group plc., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, KAO Corporation, Procter & Gamble, Seventh Generation Inc., Wipro Consumer Care and Lighting, Unilever, and Lion Corporation. These companies lead through strong product innovation, branding, and global distribution networks. North America dominates the market with a 36% share, driven by high adoption of premium detergents and advanced cleaning solutions. Europe holds a 27% share, supported by eco-friendly product demand and brand loyalty. Asia Pacific, with a 22% share, shows strong growth due to rising urbanization and increased disposable income. This regional leadership, combined with strategic R&D investments, enhances competitive positioning and drives continuous market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Liquid Laundry Detergent market was valued at USD 48.17 billion in 2023 and is projected to reach USD 68.29 billion by 2032, at a CAGR 4.46%.

- Rising demand for convenient and effective cleaning solutions drives market growth, supported by increased adoption of liquid formats over traditional powders.

- Sustainability trends boost demand for eco-friendly, concentrated, and plant-based detergents, encouraging companies to innovate and expand product lines.

- The market is highly competitive, with key players such as Procter & Gamble, Unilever, Henkel AG & Co. KGaA, Reckitt Benckiser Group plc., and Guangzhou Blue Moon focusing on product innovation and branding strategies.

- North America holds a 36% share, Europe 27%, and Asia Pacific 22%, while the household segment dominates with a significant share due to growing preference for premium detergent products across both urban and suburban markets.

Market Segmentation Analysis:

By Product Type

The product type segment in the liquid laundry detergent market is divided into regular, concentrated, and others. The concentrated sub-segment holds the dominant market share, driven by higher cleaning efficiency and lower packaging waste. Its compact formulation reduces storage needs and transportation costs, appealing to both consumers and retailers. Regular detergents maintain steady demand due to their affordability and widespread availability. Manufacturers are focusing on advanced formulations with enhanced stain removal and fabric protection to meet evolving consumer needs. Concentrated products also align with eco-friendly preferences, further strengthening their market leadership.

- For instance, Procter & Gamble introduced Tide Ultra Concentrated Liquid Detergent, which uses 50% less plastic per bottle and delivers twice the cleaning strength per load.

By End-Use

The end-use segment includes residential and commercial applications. The residential sub-segment leads the market, supported by rising urbanization, increasing household incomes, and growing hygiene awareness. Consumers prefer liquid detergents for their ease of use, quick dissolution, and suitability for machine washing. Commercial demand, mainly from hotels, hospitals, and laundromats, is also expanding due to the need for bulk and high-performance products. The residential segment’s strong penetration in both developed and developing economies keeps it ahead in terms of market share and consumer preference.

- For instance, Henkel AG & Co. KGaA reported that its new ultra-concentrated liquid detergent formulas conserve approximately 9 million gallons of water annually.

By Distribution Channel

The distribution channel segment covers supermarkets & hypermarkets, online platforms, and others. Supermarkets & hypermarkets dominate the market, accounting for the highest share due to product variety, strong brand visibility, and discount offers. Consumers prefer these outlets for the convenience of bulk purchasing and immediate availability. However, the online segment is growing fast as e-commerce platforms offer doorstep delivery, subscription options, and competitive pricing. Retailers and manufacturers are integrating omnichannel strategies to strengthen customer reach, but physical stores remain the most influential sales channel.

Key Growth Drivers

Rising Demand for Convenient and Efficient Cleaning Solutions

The growing consumer preference for convenience is a major driver of the liquid laundry detergent market. Urban households increasingly opt for liquid detergents because they dissolve quickly, leave no residue, and work effectively in both cold and hot water. The rise in automatic washing machine adoption further boosts this shift, as liquid detergents are better suited for modern machines compared to powder. Consumers also favor the ease of measuring and pouring liquids, which supports consistent cleaning results. Brands are expanding product ranges with specialized variants like fabric softening, anti-bacterial, and fragrance-enhanced options. These innovations meet diverse household needs and encourage repeat purchases. This combination of user-friendly application and performance efficiency continues to strengthen market expansion globally.

- For instance, Tide by Procter & Gamble introduced a formula in 2025 featuring soil-release polymer technology aimed at preventing re-deposits on fabrics.

Expanding Middle-Class Population and Rising Disposable Income

The rapid expansion of the middle-class population in emerging economies is significantly driving market growth. Higher disposable incomes encourage consumers to shift from low-cost detergents to premium liquid products that offer better performance and fabric care. The increasing awareness of hygiene and cleanliness standards in urban and semi-urban areas also supports this transition. Modern retail formats and organized distribution channels make branded liquid detergents more accessible to a wider population. Consumers are willing to pay more for products that save time, reduce fabric damage, and improve washing outcomes. This behavioral shift is particularly strong in Asia Pacific, Latin America, and parts of Africa. As income levels rise, premiumization trends further accelerate demand for advanced liquid formulations, boosting overall market growth.

- For instance, Unilever expanded its Surf Excel Matic liquid range with concentrated formulas requiring 35 ml per wash, reducing wastage and improving cleaning efficiency across both front-load and top-load machines.

Innovation in Formulation and Sustainability Initiatives

Continuous product innovation is a core growth catalyst in the liquid laundry detergent market. Companies are developing eco-friendly formulations with biodegradable ingredients and reduced chemical content to meet sustainability goals. Concentrated formulas minimize packaging waste and lower transportation emissions, aligning with environmental regulations. In addition, enzyme-based technologies enhance stain removal efficiency and fabric protection, delivering superior performance with less water usage. These advancements support regulatory compliance and appeal to environmentally conscious consumers. Many brands are also investing in refillable packaging and recyclable containers to strengthen their green image. The combination of technological innovation and sustainable solutions not only attracts new consumers but also builds strong brand loyalty in mature markets.

Key Trends & Opportunities

Key Trends & Opportunities

Rising Popularity of E-Commerce and Subscription Models

E-commerce is transforming how consumers purchase liquid laundry detergents. Online platforms offer competitive pricing, broad product variety, and doorstep delivery, driving strong adoption in both developed and emerging economies. Subscription models allow consumers to receive regular deliveries, ensuring convenience and cost savings while building customer loyalty for brands. Digital platforms also enable personalized marketing campaigns and product recommendations based on purchasing behavior. This shift creates opportunities for manufacturers to reduce distribution costs and reach untapped markets. Strategic partnerships with online retailers and the launch of exclusive product lines for digital platforms are further boosting online penetration. E-commerce is expected to remain a strong growth avenue in the coming years.

- For instance, Procter & Gamble reported that e-commerce sales in 2022 accounted for 14% of its total global sales.

Increasing Demand for Premium and Specialized Products

Consumers are showing strong interest in premium liquid detergents with specialized functions such as hypoallergenic formulas, color protection, and fragrance retention. This trend is driven by rising health awareness, a focus on fabric care, and lifestyle upgrades. Brands are leveraging advanced formulations like enzyme-infused and pH-balanced liquids to address specific cleaning needs. Specialized segments such as baby-safe detergents, sportswear detergents, and eco-friendly solutions are gaining traction among niche consumer groups. This product diversification allows manufacturers to capture higher margins and strengthen brand differentiation. As consumers prioritize performance and added benefits, premium and specialty products are becoming a key revenue driver in both mature and emerging markets.

- For instance, Unilever’s Dirt Is Good (DIG) brand, encompassing Persil, Skip, and OMO, has introduced a new laundry capsule designed for top performance in cold (20°C and below), short cycles.

Key Challenge

High Competition and Price Sensitivity

The liquid laundry detergent market faces intense competition from both global giants and regional players. Price sensitivity remains high in developing economies, where consumers often choose powder detergents due to lower costs. Brands are forced to balance premium product offerings with competitive pricing strategies. Private labels and local brands further increase pressure through aggressive pricing and localized marketing. This environment limits the pricing power of established companies and constrains profit margins. Maintaining product quality while managing costs is a key challenge. Manufacturers must innovate to create differentiated value propositions that justify higher prices and build consumer loyalty in price-sensitive markets.

Environmental Concerns and Regulatory Pressure

Environmental sustainability has become a major concern for the detergent industry. Conventional liquid detergents often contain chemicals that can harm aquatic ecosystems and contribute to plastic waste through packaging. Growing regulatory scrutiny on chemical ingredients and single-use plastics increases compliance costs for manufacturers. Companies must invest in R&D to develop biodegradable formulations and sustainable packaging, which can raise production expenses. Consumer awareness of environmental issues is also influencing buying behavior, putting pressure on brands to adapt quickly. Failure to meet evolving environmental standards could lead to reputational risks and market share loss. Balancing performance, affordability, and sustainability remains a complex challenge for the industry.

- For instance, Henkel’s new laundry formulas conserve 9 million gallons of water annually, reduce plastic usage by 5%, and cut transport CO₂ emissions by over 4,000 metric tons per year.

Regional Analysis

North America

North America holds a strong position in the liquid laundry detergent market with a 36% share. High adoption of premium detergents, strong

brand presence, and advanced retail networks drive growth. Product innovations like concentrated liquid formulations and eco-friendly packaging attract consumers. For instance, Procter & Gamble expanded its U.S. Tide production line to meet rising demand. The region also benefits from wide e-commerce distribution, increasing accessibility across urban and rural areas. Strategic promotional campaigns and loyalty programs strengthen customer retention. Sustainability commitments from key manufacturers further boost market penetration in this region.

Europe

Europe accounts for 27% of the global liquid laundry detergent market. Strong regulatory frameworks supporting eco-labelled detergents and sustainable cleaning products shape market trends. For example, Henkel AG invested in energy-efficient detergent manufacturing at its Düsseldorf plant. High penetration of front-loading washing machines supports demand for concentrated and low-suds detergents. Consumer preference for biodegradable ingredients and recyclable packaging drives product innovation. The presence of established brands and private labels creates healthy competition. Expanding retail chains and digital shopping platforms sustain steady market growth across major European countries.

Asia Pacific

Asia Pacific represents 22% of the global market share. Rapid urbanization, rising disposable incomes, and changing washing habits are major growth drivers. Manufacturers are launching compact, cost-effective, and high-performance detergents to meet mass-market needs. For instance, Unilever expanded its liquid detergent operations in India to increase production capacity. E-commerce growth and retail expansion enable easy product access across both urban and rural markets. Growing awareness of hygiene and increasing adoption of washing machines support long-term market expansion. Local and international brands compete to capture the region’s evolving consumer base.

Latin America

Latin America contributes 9% of the global liquid laundry detergent market. Brazil and Mexico dominate regional demand, supported by growing household appliance ownership. Manufacturers focus on affordable pricing and fragrance customization to appeal to local preferences. For example, Colgate-Palmolive upgraded its production facility in Brazil to boost liquid detergent output. Expanding retail distribution networks and private-label offerings strengthen market presence. Promotional campaigns and increasing detergent penetration in rural areas enhance brand visibility. Rising middle-class income levels and urbanization further drive product adoption across the region.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the global market. Growing population, urbanization, and increasing household hygiene awareness drive detergent consumption. Market players emphasize affordable, water-efficient formulas suited for diverse washing conditions. For instance, Unilever expanded its operations in South Africa to cater to rising liquid detergent demand. Supermarket expansion and e-commerce growth improve product availability. Global brands dominate urban centers, while local manufacturers target price-sensitive segments. Rising investments in retail infrastructure and distribution channels support market penetration in key MEA economies.

Market Segmentations:

By Product Type

- Inorganic Liquid Detergent

- Organic Liquid Detergent

By End-Use

By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Departmental Stores

- Online Stores

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Liquid Laundry Detergent market is highly competitive, with global and regional players driving product innovation, brand expansion, and sustainability strategies. Leading companies such as Guangzhou Blue Moon Industrial Co., Ltd., Reckitt Benckiser Group plc., Church & Dwight Co., Inc., Henkel AG & Co. KGaA, KAO Corporation, Procter & Gamble, Seventh Generation Inc., Wipro Consumer Care and Lighting, Unilever, and Lion Corporation maintain strong positions through extensive product portfolios and advanced formulation technologies. These players invest heavily in R&D to enhance cleaning performance, eco-friendly ingredients, and packaging innovation. For instance, top brands focus on concentrated detergent formulas to reduce packaging waste and transportation costs. Strategic mergers, retail partnerships, and omnichannel distribution further strengthen their market reach. Companies are also adopting digital campaigns and loyalty programs to build consumer trust. This intense competition drives continuous innovation, better product quality, and expanded distribution networks, positioning key brands strongly across both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Guangzhou Blue Moon Industrial Co., Ltd. (China)

- Reckitt Benckiser Group plc. (U.K.)

- Church & Dwight Co., Inc. (U.S.)

- Henkel AG & Co. KGaA (Germany)

- KAO Corporation (Japan)

- Procter & Gamble (U.S.)

- Seventh Generation Inc. (U.S.)

- Wipro Consumer Care and Lighting (India)

- Unilever (U.K.)

- Lion Corporation (Japan)

Recent Developments

- In February 2024 Swash Laundry Detergent has unveiled a fresh new look with bold packaging and a re-engineered Auto-Stop Top, enhancing its ultra-concentrated formula. As part of its expansion, the brand has invested in a new advertising campaign featuring Hollywood’s Ronald Gladden.

- In December 2023, Godrej Consumers has unveiled a liquid detergent brand called ‘Godrej Fab’ that is marketed to the mass market of South India, including Tamil Nadu, Andhra Pradesh, Karnataka, and Kerala. In order to support the demand that is growing for the FMCG sector, the company invests in expanding its product portfolio.

Report Coverage

The research report offers an in-depth analysis based on Product Type, End-Use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see strong growth driven by rising household demand.

- Eco-friendly and biodegradable detergent formulas will gain wider acceptance.

- Concentrated liquid detergent products will reduce packaging waste and boost margins.

- Brands will focus on digital marketing to strengthen customer engagement.

- Innovation in cold water wash technology will support energy-efficient washing.

- E-commerce channels will expand market access in both urban and rural areas.

- Premium and specialized detergents will capture a larger consumer base.

- Strategic partnerships and acquisitions will enhance global market presence.

- Asia Pacific will emerge as a key growth region due to urbanization.

- Regulatory focus on sustainable production will influence product development.

Key Trends & Opportunities

Key Trends & Opportunities