Market Overview

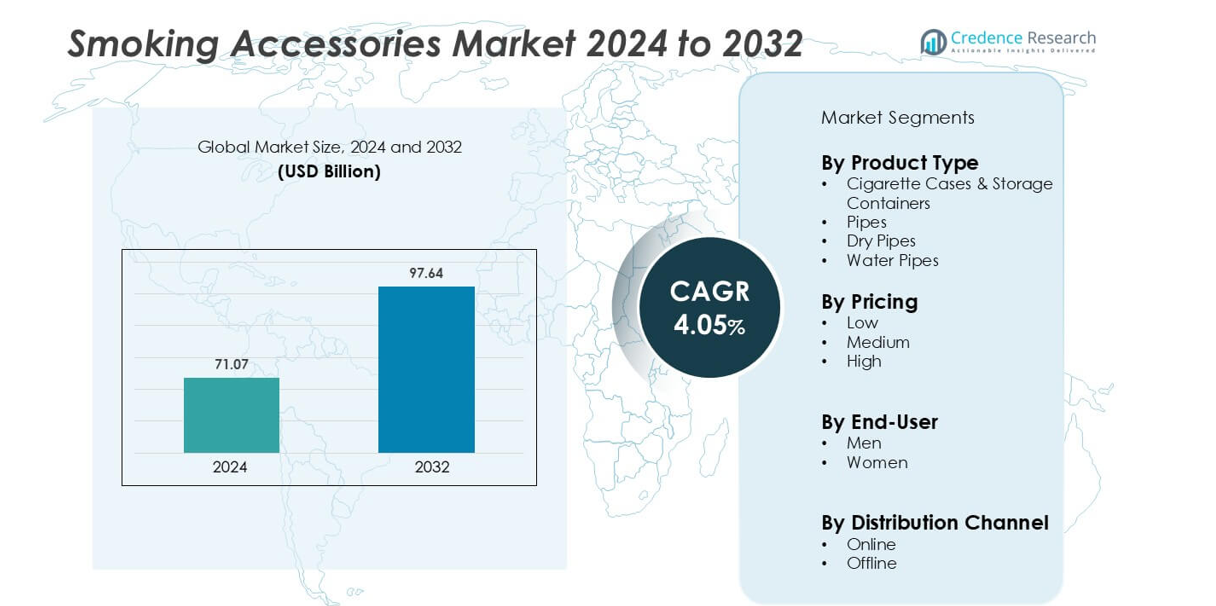

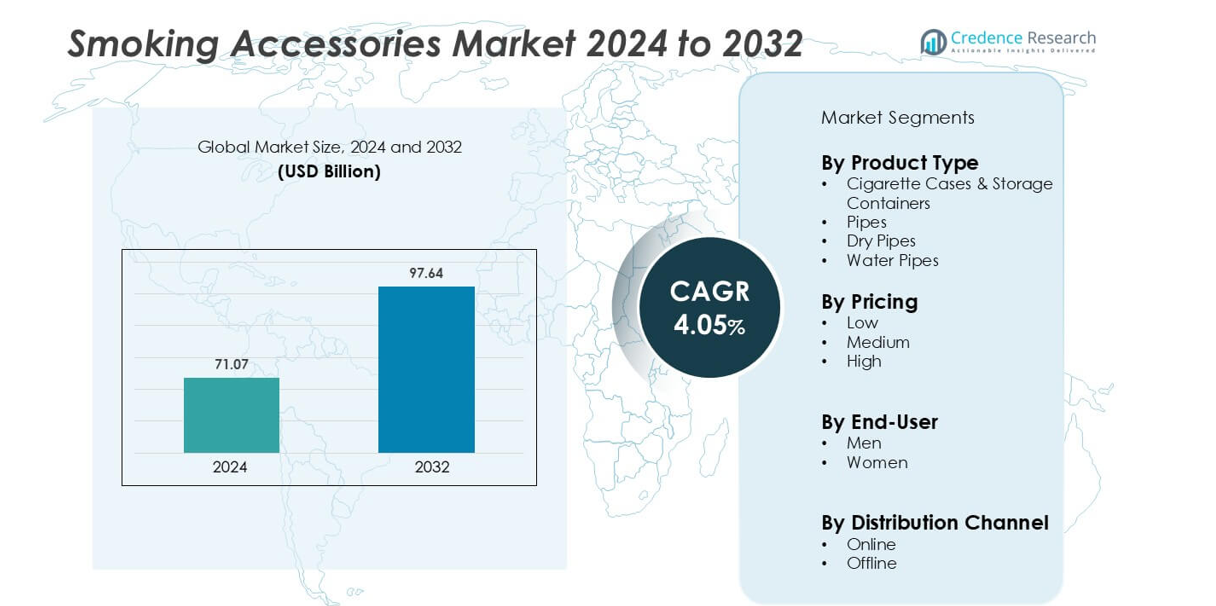

Smoking Accessories Market size was valued USD 71.07 billion in 2024 and is anticipated to reach USD 97.64 billion by 2032, at a CAGR of 4.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Smoking Accessories Market Size 2024 |

USD 71.07 billion |

| Smoking Accessories Market, CAGR |

4.05% |

| Smoking Accessories Market Size 2032 |

USD 97.64 billion |

The smoking accessories market is led by major players such as British American Tobacco PLC, Imperial Brands, and Republic Technologies International, which maintain dominance through strong brand portfolios, advanced distribution networks, and continuous product innovation. Mid-tier manufacturers like BBK Tobacco & Foods, Bull Brand, and Elements Rolling Papers contribute significantly through product diversification and eco-friendly offerings. Niche brands including Empire Glassworks, Curved Papers, Inc., Moondust Paper Pvt. Ltd., and Jinlin Smoking Accessories Co., Ltd. strengthen market competition with unique designs and regional expertise. Asia-Pacific emerges as the leading region, accounting for approximately 40% of the global market share, supported by its robust manufacturing base, growing urban population, and expanding consumer demand for both traditional and alternative smoking accessories.

Market Insights

- The global smoking accessories market size was valued at approximately USD 71.07 billion in 2024 and is forecast to grow at a CAGR of around 4.05% from 2025-2033.

- Growth is primarily driven by rising consumer demand for premium and personalized smoking accessories, increased legalization of cannabis which expands accessory usage, and greater penetration of online channels in emerging markets.

- Trends include increasing uptake of eco-friendly materials (e.g., bamboo, recycled plastics), smart connected accessories, and modular designs that cater to younger, design-conscious consumers.

- The competitive landscape remains intense with established tobacco firms and specialized accessory manufacturers expanding range and global footprint; however, regulatory constraints, health-awareness campaigns, and advertising restrictions pose significant restraints.

- Regionally, Asia-Pacific leads with roughly 46.8% of market share in 2021, followed by North America and Europe, highlighting strong growth opportunities in the APAC region.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Within the “By Product Type” segment of the smoking accessories market, the dominant sub-segment is pipes & water pipes (including both dry and water types). This category held the largest share in recent years, driven by the rising popularity of social and alternative smoking formats and the presence of lounges and cafés promoting water-pipe usage. Manufacturers responded by launching modular glass water-pipes and premium dry pipes, which directly contributed to the segment’s leadership. As smoking preferences evolve and users seek differentiated experience, the pipes & water-pipes sub-segment continues to command market leadership and serve as the primary growth engine for accessory producers.

- For instance, Shenzhen Ebloom Technology Co., Ltd. in Guangdong launched a “Modular Glass Water Pipe with E-Liquid Smoking Tools” line with a production capacity of 500,000 pieces per month.

By Pricing Segment

In the “By Pricing” segment, the medium-price tier dominates across regions. This tier captures the bulk of volume because it balances affordability with quality features, appealing to mainstream consumers who seek value without sacrificing design or functionality. Suppliers in the medium tier invest in offering higher-grade materials such as borosilicate glass or metal alloys and enhanced finishes, which in turn reinforce demand from both new and repeat purchasers. The pressure on manufacturers to move up-market from low-price variants, yet remain accessible compared to high-price luxury accessories, underpins the medium-pricing segment’s strength and dominance.

- For instance, Guangdong Sirui Optical Co., Ltd. primarily manufactures professional photographic equipment such as lenses, tripods, and other optical and video-related products.

By End-User & Distribution Channel Segments

On the End-User side, the male consumer category dominates, reflecting historical smoking demographics and accessory purchases. The majority of spending occurs within the men’s sub-segment, as brands cater product design, marketing and retail positioning to male smokers and herbal-use consumers. Meanwhile, in the Distribution Channel segment, the offline channel leads in market share. Brick-and-mortar stores specialty smoke shops, convenience stores and head stores offer in-person product trials, immediate availability and bundled accessory displays, delivering strong traction. These complement the male-led accessory purchases and underpin the offline channel’s dominance in the market structure.

Key Growth Drivers

Legalisation and expansion of alternate smoking formats

The global acceptance of recreational and medicinal cannabis alongside herbal vaping has significantly enlarged the accessory market. For instance, markets where cannabis use is legal are seeing accelerated demand for water-pipes, grinders and vaporizers, thereby elevating the accessory ecosystem. are responding by offering specialised accessories aligned with herb-based products, which in turn drives upstream component and accessory supply. The embrace of alternative formats opens new end-user bases beyond traditional cigarette smokers, strengthening the overall growth prospects for the smoking-accessories segment.

- For instance, Storz & Bickel GmbH & Co. KG, a German-based vaporiser manufacturer, released its VENTY model in 2023 featuring a 20-second heat-up time and adjustable air flow up to 20 litres per minute.

Premiumisation, personalization and lifestyle-driven purchasing

Consumers are increasingly treating smoking accessories as lifestyle and collectible items rather than purely functional tools. Reports show demand for luxury pipes, designer lighters, eco-materials and custom finishes is rising. This shift enables manufacturers to command higher margins, develop capsule collections, and build brand equity. Accessory makers are investing in premium materials and bespoke design services, which fuels growth in segments focused on consumer preference for individuality and status. The lifestyle orientation of products thus becomes a strong expansion factor.

- For instance,T. Dupont’s Le Grand lighter series is composed of more than 70 individual components and requires between 500 and 600 distinct manufacturing steps, with each piece taking four to five months to complete.

Growth of distribution channels and online penetration

The proliferation of organised retail outlets and the growth of e-commerce platforms have substantially improved access to smoking accessories. For example, the increase in organised retail coverage alongside digital retail is cited as a key growth factor. while online platforms provide wider selection, customisation options and global reach. The combined omni-channel distribution infrastructure lowers barriers for entry and widens consumer reach, hence driving overall market momentum.

Key Trends & Opportunities

Smart, sustainable and modular product innovation

Innovation is shifting away from mere aesthetic upgrades toward smart and sustainable accessory offerings. The emergence of biodegradable rolling papers, accessory systems with modular components, and smart vaporizers with digital control are increasingly prevalent. This trend not only resonates with younger, eco-aware users but also creates recurring-revenue models through replaceable modules. For manufacturers and component suppliers, the opportunity lies in designing smart, upgradeable systems and eco-friendly product lines that align with evolving consumer values.

- For instance,The Rolling Paper Co. manufactures its products in both Indonesia and China. Its headquarters are in Kabupaten Bekasi, West Java, Indonesia.

Rising personalization, collaborations and lifestyle-centric branding

Customization and branding collaborations are becoming central to accessory differentiation. Reports highlight that consumers now seek personalised rolling trays, limited edition pipes and branded lighters with niche appeal. This trend opens opportunities for co-branding, artist collaborations and lifestyle-driven product sets, enabling smaller brands to create premium niches and loyal communities. For players in the supply chain, strategic partnerships and bespoke manufacturing may drive market share gains in this space.

- For instance, Zippo routinely issues artist and commemorative collectible runs with strict production limits one recent Zippo x D*Face release was limited to 1,760 pieces worldwide, underscoring how numbered editions create collectible scarcity and premium positioning.

Emerging markets and new user-segments are under-penetrated

Regions such as Asia-Pacific, Latin America and Africa show rising adoption of smoking accessories as disposable incomes rise, urbanisation accelerates and western-influenced lifestyle trends expand. global manufacturers. Entry strategies focusing on regional distribution, tailored designs and local regulatory compliance promise to unlock new consumer bases, thus constituting a significant opportunity for expansion.

Key Challenges

Stringent regulation, taxation and health-driven restrictions

The smoking accessories market faces heavy regulatory headwinds: many jurisdictions impose strict advertising bans, heavy taxation, child-safety mandates and restrictions on accessory sales linked to tobacco or cannabis use. These regulatory pressures constrain marketing freedom, raise compliance cost and limit product rollout in certain geographies. For manufacturers and retailers, navigating complex legislation becomes a material challenge to sustainable growth and market expansion.

Shifting consumer behaviour and supply-chain complexity

Growing health consciousness, declining traditional cigarette use and the rise of alternative nicotine-delivery systems can divert consumers away from conventional smoking accessories. At the same time, manufacturing specialised accessories (e.g., borosilicate glass pipes, smart vaporizers) involves complex supply chains, materials sourcing and quality control. Interruptions due to supply-chain disruption, material shortages or counterfeiting can impact brand reputation and cost structures. These operational and behavioural challenges impede market players from fully scaling.

Regional Analysis

North America

North America remains a leading region, with established retail networks, mature e-commerce penetration and rapid adoption of premium and cannabis-related accessories driving demand. Data Bridge reports North America holding roughly 33.9% of the global market in 2024, led by strong U.S. aftermarket sales and widespread recreational cannabis legalization that has expanded accessory categories such as vaporizers, water pipes and premium lighters. Distribution strength specialty smoke shops, convenience chains and online marketplaces support trial and repeat purchases, while product innovation (smart vaporizers, sustainable materials) and targeted marketing sustain category growth across the region.

Asia-Pacific

Asia-Pacific registers the largest regional footprint in many analyses, with several reports indicating the region accounts 46.8%. Growth is fuelled by large consumer bases, expanding youth adoption of vaping and alternative formats, strong manufacturing capacity (notably for vaporizers and components) and rising disposable incomes prompting premiumisation. Urbanisation and lifestyle trends in China, India and Southeast Asia are increasing demand for designer and reusable accessories. Regional dynamics also favour domestic OEMs and exporters, creating integrated value chains that amplify both domestic consumption and cross-border distribution.

Europe

Europe represents a significant share of the market with strong demand for regulated, higher-quality accessories and a notable shift toward vaporizers and harm-reduction products. Grand View Research reported European revenues of USD 18,716.2 million in 2021; when placed against commonly cited global 2021 totals, this implies roughly a 29% regional share. Drivers include stringent product standards that favour reputable brands, rising premiumisation (designer lighters, borosilicate glass pipes), and mature offline retail combined with growing online specialty channels. Regulatory complexity and strong sustainability preferences shape product design and go-to-market strategies.

Latin America

Latin America occupies a smaller but growing portion of the global market, typically reported in single-digit to low-teens shares depending on the dataset. Expansion is led by urban centres in Brazil and Mexico where rising disposable income and shifting social norms boost accessory adoption particularly vaporizers, rolling papers and low-cost lighters. Market development relies on improving organised retail, cross-border e-commerce and localized product assortments that respect regional preferences. Regulatory uncertainty and informal channels remain constraints, but targeted distribution and localized branding are enabling steady market entrance for both regional manufacturers and international entrants.

Middle East & Africa

Middle East & Africa accounts for a relatively small share of the global smoking-accessories market but shows niche growth in urbanized Gulf states and selected African metros. Demand centers around premium and hospitality channels (lounges, hotels), water-pipe accessories and imported luxury items. Market expansion is concentrated in countries with permissive regulations or established tourism sectors; elsewhere, strict tobacco controls and customs barriers limit formal growth. Manufacturers pursuing this region emphasize compliance, high-margin luxury assortments and B2B partnerships with hospitality chains to capture concentrated pockets of affluent consumers.

Market Segmentations:

By Product Type

- Cigarette Cases & Storage Containers

- Pipes

- Dry Pipes

- Water Pipes

By Pricing

By End-User

By Distribution Channel

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the smoking accessories market is moderately fragmented, featuring a mix of multinational tobacco corporations, specialized accessory manufacturers, and emerging independent brands. Established players such as British American Tobacco PLC, Imperial Brands, and Republic Technologies International dominate through extensive distribution networks, product diversification, and continuous brand consolidation. Mid-tier and niche companies including BBK Tobacco & Foods, Bull Brand, and Elements Rolling Papers strengthen their positions through innovation in rolling materials, eco-friendly papers, and customization features. Specialty producers like Empire Glassworks and Curved Papers, Inc. differentiate with handcrafted designs and sustainable production techniques. Meanwhile, regional manufacturers such as Jinlin Smoking Accessories Co., Ltd. and Moondust Paper Pvt. Ltd. leverage cost-efficient manufacturing and localized market access to compete in price-sensitive segments. Across the board, leading companies are focusing on product innovation, sustainability, and digital marketing strategies to retain consumer loyalty and capture emerging growth in alternative and premium smoking accessories.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- British American Tobacco PLC

- Imperial Brands

- Republic Technologies International

- BBK Tobacco & Foods

- Elements Rolling Papers

- Bull Brand

- Empire Glassworks

- Curved Papers, Inc.

- Moondust Paper Pvt. Ltd.

- Jinlin Smoking Accessories Co., Ltd.

Recent Developments

- In January 2023, Dopeboo, an online headshop based in the United States, unveiled an enhanced assortment of exclusive smoking accessories. The updated collection features a variety of products, including bongs, pipes, dab rigs, vapes, and more. Dopeboo sources top brands such as Grav, Puffco, Marley Naturals, DaVinci, Freeze Pipe, and others to offer a diverse and premium selection to its customers.

- In November 2022 Las Vegas-based cannabis technology firm, Dr. Dabber, unveiled its latest product – the XS Nano eRig, a compact and portable. Priced at an introductory rate of US$159.95, this innovative device is now accessible through the company’s website. The XS Nano eRig stands out as the smallest vaporizer of its kind currently available in the market.

Report Coverage

The research report offers an in-depth analysis based on Type, Pricing, End-User, Distribution and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The smoking accessories market will continue expanding as consumer preferences shift toward premium and customized products.

- Manufacturers will increasingly adopt sustainable materials such as biodegradable papers and recycled metals.

- Technological integration like smart vaporizers and temperature-controlled devices will enhance user experience.

- Online retail platforms will gain stronger traction as consumers prefer convenience and discreet purchasing.

- Regulatory compliance and product transparency will remain critical for long-term market credibility.

- Regional manufacturers in Asia and Latin America will play a growing role in global supply chains.

- Brand collaborations and limited-edition product launches will drive consumer engagement.

- Investment in eco-friendly packaging and responsible marketing will become an industry standard.

- Diversification into herbal and non-tobacco smoking accessories will broaden the consumer base.

- Continuous innovation in design, portability, and multifunctional accessories will sustain competitive advantage.