Market Overview

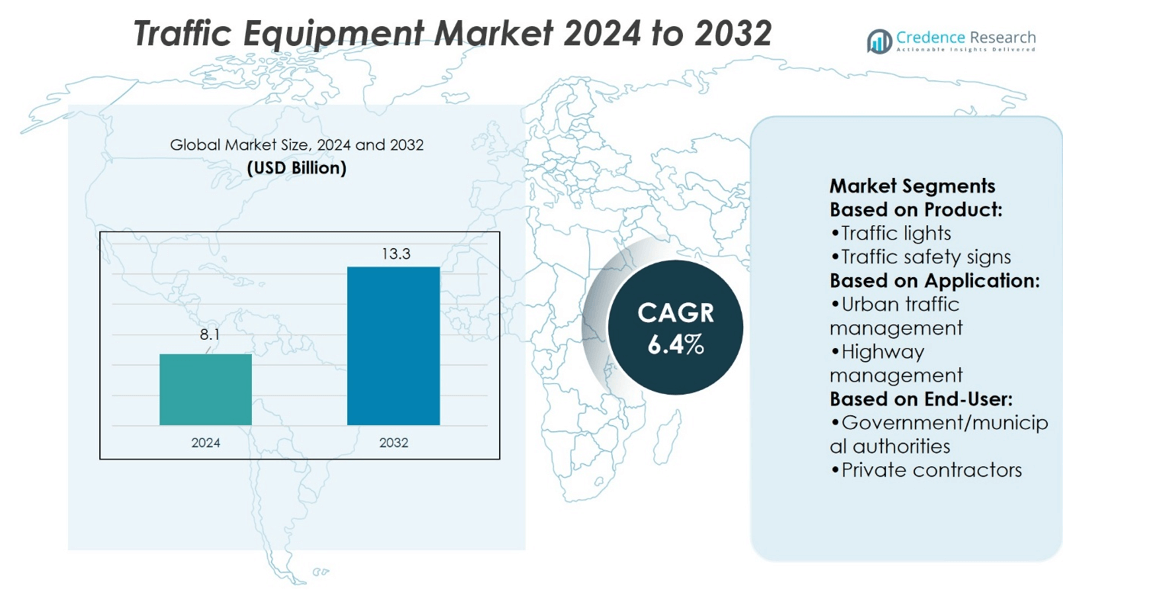

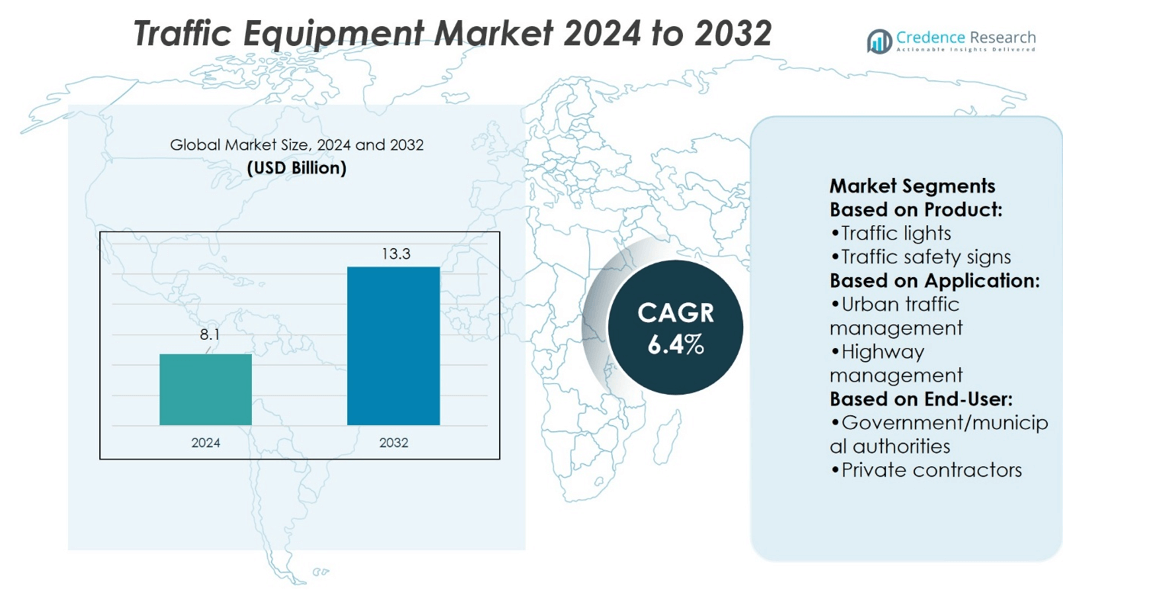

Traffic Equipment Market size was valued at USD 8.1 billion in 2024 and is anticipated to reach USD 13.3 billion by 2032, at a CAGR of 6.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Traffic Equipment Market Size 2024 |

USD 8.1 billion |

| Traffic Equipment Market, CAGR |

6.4% |

| Traffic Equipment Market Size 2032 |

USD 13.3 billion |

The Traffic Equipment Market grows with rising urbanization, increasing vehicle ownership, and the urgent need for safer roads. Governments enforce stricter regulations and invest in advanced signaling, barriers, and monitoring devices to improve traffic efficiency. The market benefits from smart city initiatives that integrate IoT-enabled sensors, AI-based surveillance, and adaptive traffic control systems. Sustainability trends drive demand for energy-efficient and solar-powered solutions, reducing operational costs while meeting environmental goals. Real-time data platforms and connected mobility technologies strengthen traffic coordination and safety compliance. These drivers and trends collectively accelerate the modernization of global traffic management infrastructure and equipment adoption.

The Traffic Equipment Market shows strong regional diversity, with Asia-Pacific leading due to rapid urbanization and large-scale smart city projects, while North America and Europe follow with high adoption of intelligent traffic systems and strict safety regulations. Latin America and the Middle East & Africa record steady growth through infrastructure expansion and rising road safety initiatives. Key players such as Indra, Northrop Grumman, Cobham Limited, L3Harris Technologies, Inc., Endeavor Business Media, LLC., Intelcan Technosystems Inc, Verdict Media Limited, Advanced Navigation and Positioning Corporation, Lockheed Martin Corporation, and BAE Systems.

Market Insights

- Traffic Equipment Market size was valued at USD 8.1 billion in 2024 and is projected to reach USD 13.3 billion by 2032, at a CAGR of 6.4%.

- Rising urbanization, growing vehicle ownership, and the urgent need for safer roads drive market growth.

- Smart city initiatives boost adoption of IoT-enabled sensors, AI surveillance, and adaptive traffic control systems.

- Competition remains strong with players focusing on innovation, advanced monitoring tools, and smart traffic solutions.

- High installation and maintenance costs act as restraints for widespread adoption, especially in developing regions.

- Asia-Pacific leads with large-scale infrastructure projects, while North America and Europe follow with strict regulations and advanced adoption.

- Latin America and Middle East & Africa expand steadily through infrastructure upgrades and rising road safety investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Urbanization and Traffic Congestion

The Traffic Equipment Market benefits from rapid urbanization and increasing vehicle ownership. Growing populations in metropolitan areas drive higher traffic density, requiring advanced management solutions. Governments and city planners focus on reducing congestion through intelligent traffic systems and signal upgrades. It ensures smoother vehicle movement while minimizing delays and accidents. Investments in adaptive signal control and surveillance cameras support real-time traffic flow monitoring. Rising urban density strengthens the need for efficient traffic infrastructure worldwide.

- For instance, Northrop Grumman’s Utah hydrotesting team evaluated over 150 solid rocket motor cases annually, including 64 GEM 63 and 38 GEM 63XL cases. Each GEM 63XL casing holds 8,000 gallons of water, withstands over 1,900 psi for nearly six minutes, and faces 500,000 pounds of external force.

Government Regulations and Road Safety Initiatives

Stringent safety regulations and road management policies fuel adoption of modern traffic equipment. Governments mandate compliance with standards for road markings, signals, and pedestrian crossings to enhance safety. Public authorities deploy speed monitoring systems and automated enforcement tools to reduce violations. It improves driver behavior and lowers accident rates significantly. National road safety programs often allocate funding for advanced signaling and monitoring devices. Strong regulatory frameworks push both developed and developing nations toward consistent traffic equipment upgrades.

- For instance, Cobham Antenna Systems’ ultra-wideband omni antenna OA-0.4-6.0V/2028 operates across 0.38 to 6.00 GHz, offering 360° coverage, –1 to +5 dBi gain, and sizes of 182 mm by 352 mm—ideal for in-building traffic control systems demanding wide-band urban coverage.

Technological Advancements in Smart Mobility Solutions

Integration of smart technologies drives growth in the Traffic Equipment Market. The adoption of AI-based surveillance, IoT-enabled sensors, and adaptive signaling enhances efficiency. It enables authorities to collect and analyze real-time traffic data for better planning. Connected vehicle technologies further strengthen system performance and incident detection. Automation in traffic monitoring reduces human error and increases reliability. Rising interest in smart city projects across global regions accelerates demand for intelligent traffic equipment.

Infrastructure Development and Smart City Investments

Large-scale infrastructure projects and smart city initiatives create opportunities for advanced traffic equipment. Urban planners prioritize intelligent intersections, digital signage, and connected traffic lights to improve safety and mobility. It aligns with global efforts to modernize transportation networks and optimize commuter experiences. Rising investments in highways, expressways, and urban transport hubs fuel adoption of signaling and monitoring systems. Growing demand for sustainable mobility also encourages integration of energy-efficient traffic solutions. Infrastructure upgrades remain a long-term driver for this market.

Market Trends

Adoption of Intelligent Traffic Management Systems

The Traffic Equipment Market experiences strong momentum with the integration of intelligent traffic systems. Smart sensors, adaptive signals, and automated monitoring tools improve traffic efficiency and safety. It allows real-time adjustments to traffic flow, reducing congestion during peak hours. Cities invest in digital platforms that connect traffic lights, cameras, and roadside units. The shift toward data-driven decision-making enhances urban mobility planning. Growing reliance on intelligent systems transforms traditional traffic equipment into connected infrastructure.

- For instance,L3Harris supports air traffic modernization with managed services covering nearly 30% of global airspace across three continents, handling real-time tracking for over 10,000 aircraft airborne at any moment via communications, surveillance, and ATM systems.

Expansion of Smart City Projects Worldwide

Smart city development fuels significant growth in modern traffic solutions. Governments and private investors allocate budgets to integrate advanced signaling, surveillance, and automated control systems. It ensures seamless traffic operations within urban ecosystems. Demand rises for digital signage, real-time navigation aids, and AI-driven analytics. The alignment of transport infrastructure with sustainability goals strengthens adoption of energy-efficient equipment. Global smart city initiatives expand the role of traffic technology in urban planning.

- For instance,Endeavor Business Media, now rebranded as EndeavorB2B, operates over 90 media brands and hosts more than 45 in-person events, offering deep insights into smart city advancements and infrastructure technology trends.

Growing Emphasis on Sustainable and Energy-Efficient Solutions

Sustainability remains a critical trend in the Traffic Equipment Market. Manufacturers focus on solar-powered traffic signals, LED-based lights, and low-energy surveillance systems. It helps reduce environmental impact while lowering operational costs for municipalities. Eco-friendly materials in road equipment and markings also gain acceptance. Urban authorities prioritize green technologies to meet climate targets and energy efficiency standards. The market reflects a shift toward sustainable innovations in traffic management infrastructure.

Integration of Connected Vehicle Technologies

The rise of connected mobility reshapes demand for advanced traffic equipment. Communication between vehicles and infrastructure enables faster incident detection and smoother traffic flow. It supports initiatives for autonomous and semi-autonomous driving systems. Roadside sensors, V2X communication devices, and integrated control platforms expand in adoption. Traffic data from connected vehicles assists in predictive modeling and proactive management. This trend strengthens the link between modern transportation systems and advanced traffic equipment.

Market Challenges Analysis

High Installation and Maintenance Costs

The Traffic Equipment Market faces challenges from high costs of installation and upkeep. Advanced systems such as adaptive traffic lights, AI-driven monitoring, and IoT-enabled sensors require significant investment. It limits adoption in regions with restricted budgets, particularly in developing economies. Ongoing expenses for calibration, repair, and software upgrades further increase the financial burden. Municipalities often struggle to allocate consistent funding, slowing project execution. These cost barriers reduce the pace of modernization in traffic infrastructure.

Complex Integration and Interoperability Issues

Integration challenges create hurdles for widespread adoption of advanced traffic solutions. Traffic equipment must align with existing infrastructure, which often varies across cities and regions. It complicates system standardization and delays deployment. Different equipment providers use varied technologies, creating interoperability concerns for authorities. The lack of unified communication protocols limits the efficiency of connected systems. These issues make large-scale integration slower, affecting the effectiveness of modern traffic management initiatives.

Market Opportunities

Rising Demand for Smart and Automated Traffic Solutions

The Traffic Equipment Market presents opportunities through growing adoption of smart and automated systems. Governments and city planners seek intelligent traffic lights, AI-based monitoring, and IoT-enabled devices to improve safety and reduce congestion. It enables predictive analysis and real-time control, supporting smoother urban mobility. Increasing focus on road safety compliance further boosts demand for advanced enforcement technologies. Public-private partnerships open new investment channels for large-scale projects. The integration of automation and smart connectivity creates strong prospects for equipment providers.

Expansion in Emerging Economies and Infrastructure Development

Emerging markets create significant opportunities for traffic equipment manufacturers. Rapid urbanization and rising vehicle ownership drive demand for advanced signaling, surveillance, and traffic control systems. It aligns with national programs to modernize transport infrastructure and develop smart cities. Growing investments in highways, metro corridors, and urban expressways strengthen market potential. Adoption of energy-efficient and solar-powered solutions gains traction in regions seeking sustainable growth. Expanding infrastructure in developing economies ensures long-term opportunities for innovative traffic technologies.

Market Segmentation Analysis:

By Product

The Traffic Equipment Market divides into traffic lights, traffic safety signs, traffic barriers, traffic cones, traffic entry gates, and others. Traffic lights dominate due to their central role in urban and highway control. It supports adaptive signal control and ensures compliance with growing safety regulations. Traffic safety signs and barriers remain vital for guiding drivers and reducing collision risks. Cones and entry gates address temporary control and restricted access, particularly in construction and event zones. The “others” category includes digital signage and modern electronic warning systems that enhance visibility and real-time communication.

- For instance,Intelcan delivers precision navigation through its SKYNAV ILS system, offering 10 to 34 antenna elements configurable for CAT I, II, or III operations and supporting single or dual-frequency modes with detailed Built-In Test Equipment (BITE) diagnostics.

By Application

Application segments include urban traffic management, highway management, parking management, work zone safety, and others. Urban traffic management leads with rising congestion and smart city deployments. It emphasizes real-time monitoring, intelligent signals, and integrated surveillance systems. Highway management also records strong adoption with growing investments in expressways and intercity road projects. Parking management technologies, such as automated gates and digital indicators, support rising urban vehicle density. Work zone safety requires portable equipment and clear signage to ensure worker and driver protection. The “others” category includes emergency response systems and integrated control platforms.

- For instance,Lockheed Martin’s Radar Center of Excellence has delivered its 500th Q-53 ground-based radar system, a key milestone in high-altitude surveillance and precision tracking technologies—highlighting their sustained leadership in radar deployments.

By End User

End users include government and municipal authorities, private contractors, and transportation agencies. Government and municipal authorities account for the largest share, driven by responsibility for public safety and infrastructure upgrades. It involves consistent procurement of traffic lights, safety barriers, and digital monitoring systems. Private contractors play a key role in construction projects, deploying temporary traffic solutions for regulated work zones. Transportation agencies focus on broader mobility planning, often integrating advanced systems across regional networks. Their role in coordinating large-scale projects ensures sustained demand for high-quality traffic equipment. This segmentation highlights diverse demand drivers across multiple user categories.

Segments:

Based on Product:

- Traffic lights

- Traffic safety signs

Based on Application:

- Urban traffic management

- Highway management

Based on End-User:

- Government/municipal authorities

- Private contractors

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 31 % of the Traffic Equipment Market and remains a key region for advanced adoption. The region benefits from strong federal and state-level investments in traffic management programs. It emphasizes intelligent traffic lights, smart surveillance cameras, and connected road safety systems to manage congestion and reduce accidents. Cities in the United States and Canada actively deploy adaptive signaling technology to optimize vehicle flow. It also benefits from smart city programs where real-time traffic platforms and digital monitoring tools are implemented. Growing focus on road safety compliance and strict regulatory enforcement support widespread adoption of modern equipment. North America sustains steady growth due to high technology readiness, consistent funding, and strong public-private collaborations.

Europe

Europe represents 20 % of the Traffic Equipment Market and is driven by strict safety regulations and sustainability policies. The region prioritizes high-quality traffic lights, safety signs, and barriers aligned with EU road standards. It emphasizes the adoption of energy-efficient systems, such as LED-based signals and solar-powered devices. Western Europe, led by Germany, France, and the UK, accounts for a large share due to strong infrastructure investments. Eastern Europe also records steady growth through highway upgrades and new urban mobility projects. It shows strong demand for eco-friendly materials and connected traffic systems that align with long-term sustainability goals. Europe remains a mature and regulation-driven market with consistent opportunities for innovation.

Asia-Pacific

Asia-Pacific leads the global Traffic Equipment Market with 35 % share, supported by rapid urbanization, rising vehicle ownership, and smart city projects. The region deploys advanced traffic management technologies to handle heavy congestion in megacities. China invests heavily in intelligent traffic lights, solar-powered signals, and digital signage as part of large-scale infrastructure programs. India records strong demand for safety barriers, cones, and smart entry gates under national road modernization schemes. Japan and South Korea contribute through advanced adoption of connected systems, including AI-powered monitoring platforms. Southeast Asia strengthens the region’s growth with significant highway construction and urban road expansion. It continues to be the fastest-growing regional market due to population growth and increasing government investments.

Latin America

Latin America accounts for 8 % of the Traffic Equipment Market, showing steady expansion through infrastructure development. Countries such as Brazil and Mexico lead demand due to ongoing urban growth and government-led transport projects. The region adopts traffic lights, safety barriers, and digital signage in expanding cities and major highways. It also emphasizes portable equipment like traffic cones and temporary barriers for construction and work zones. Funding limitations slow widespread adoption, but international partnerships help bridge the gap. It represents a developing market with opportunities tied to modernization of existing road networks. Growing urban populations continue to create demand for efficient traffic management solutions in this region.

Middle East & Africa

The Middle East & Africa hold 6 % of the Traffic Equipment Market, driven by infrastructure expansion and smart city initiatives. Gulf countries such as the UAE and Saudi Arabia invest in intelligent signaling, advanced monitoring systems, and integrated traffic platforms. It aligns with long-term visions to modernize urban mobility and reduce road accidents. Africa shows rising demand for basic traffic equipment such as signs, barriers, and cones, primarily in fast-growing urban centers. Limited financial resources remain a challenge, but international funding supports gradual adoption. Road expansion projects in both urban and intercity areas help sustain market demand. The region represents an emerging market with untapped potential, especially as governments prioritize safety and modernization.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Indra

- Northrop Grumman

- Cobham Limited

- L3Harris Technologies, Inc.

- Endeavor Business Media, LLC.

- Intelcan Technosystems Inc

- Verdict Media Limited

- Advanced Navigation and Positioning Corporation

- Lockheed Martin Corporation

- BAE Systems

Competitive Analysis

The Traffic Equipment Market players such as Indra, Northrop Grumman, Cobham Limited, L3Harris Technologies, Inc., Endeavor Business Media, LLC., Intelcan Technosystems Inc, Verdict Media Limited, Advanced Navigation and Positioning Corporation, Lockheed Martin Corporation, and BAE Systems. The Traffic Equipment Market is driven by rising investments in intelligent traffic management systems and smart city infrastructure. Growing urban populations create higher demand for efficient traffic lights, digital signage, and adaptive control solutions. Governments prioritize road safety through stricter regulations, leading to the deployment of advanced barriers, cones, and monitoring devices. The market also benefits from technological progress, including IoT-enabled sensors, AI-powered analytics, and real-time data platforms. Increasing emphasis on sustainability supports adoption of energy-efficient lighting and solar-powered systems. These factors collectively shape a competitive environment where innovation, compliance, and infrastructure modernization remain the core growth drivers.

Recent Developments

- In February 2025, Canada’s Department of National Defense (DND) has awarded Indra a contract exceeding. The contract focuses on overhauling DND’s ground-to-air communications. As part of this upgrade, DND will receive around 600 cutting-edge, adaptable radios, integrated with advanced technologies to bolster air traffic management and defense operations.

- In September 2024, Traffic & Mobility Consultants (TMC) completed the acquisition of Propel Engineering, a West Palm Beach, Florida-based civil engineering firm specializing in highway design and traffic analysis. With the acquisition, TMC aims to deliver enhanced services to its clients, address the growing demands of urban infrastructure projects, and strengthen its position in the competitive traffic consultancy market.

- In August 2024, Altus Group Holdings, ANZ’s traffic management provider, executed transaction documents to acquire 100% of the Warp Group’s Traffic Management businesses in Western Australia and Queensland, expanding its presence in the Australian market.

- In April 2023, Boeing, a player in aerospace, took a significant step in advancing sustainable aviation technology by expanding its ecoDemonstrator program. The company has introduced a series of specially modified aircraft, called ‘Explorer’ airplanes, to further its flight testing initiatives.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of intelligent traffic management systems.

- Demand for smart city infrastructure will drive continuous investments in advanced traffic solutions.

- AI-based surveillance and IoT-enabled sensors will enhance real-time traffic monitoring.

- Energy-efficient and solar-powered traffic equipment will gain wider acceptance.

- Integration of connected vehicle technologies will improve road safety and traffic flow.

- Governments will continue enforcing stricter road safety regulations supporting modernization.

- Emerging economies will offer growth opportunities through infrastructure expansion projects.

- Portable and digital traffic solutions will see stronger demand in work zones.

- Automation in traffic control will reduce reliance on manual operations.

- The market will grow steadily as urban populations and vehicle density increase.