Market Overview

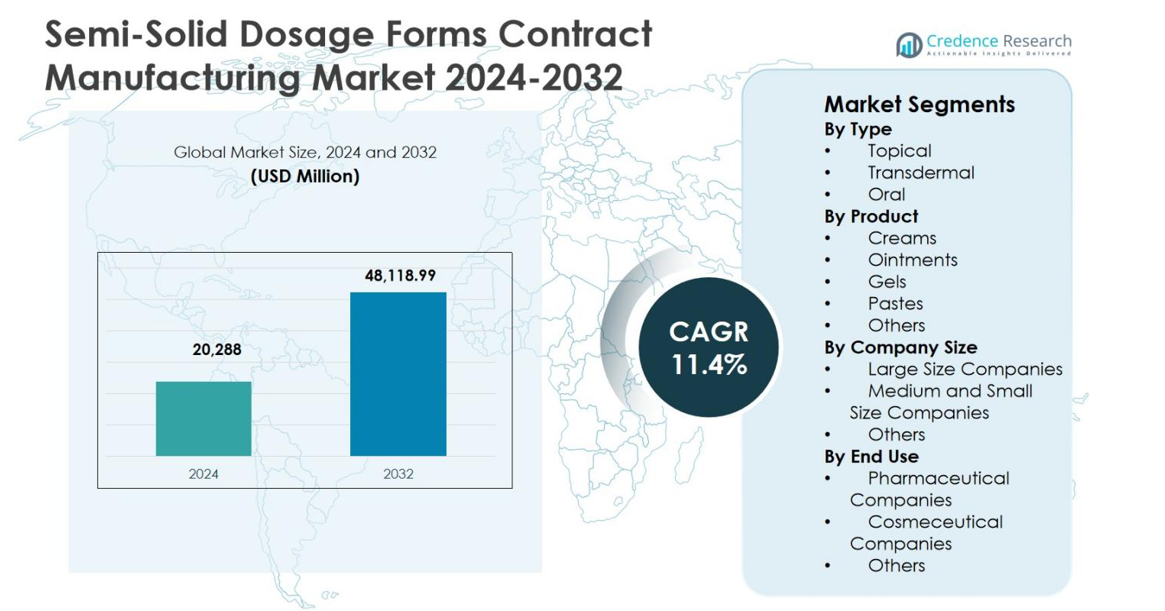

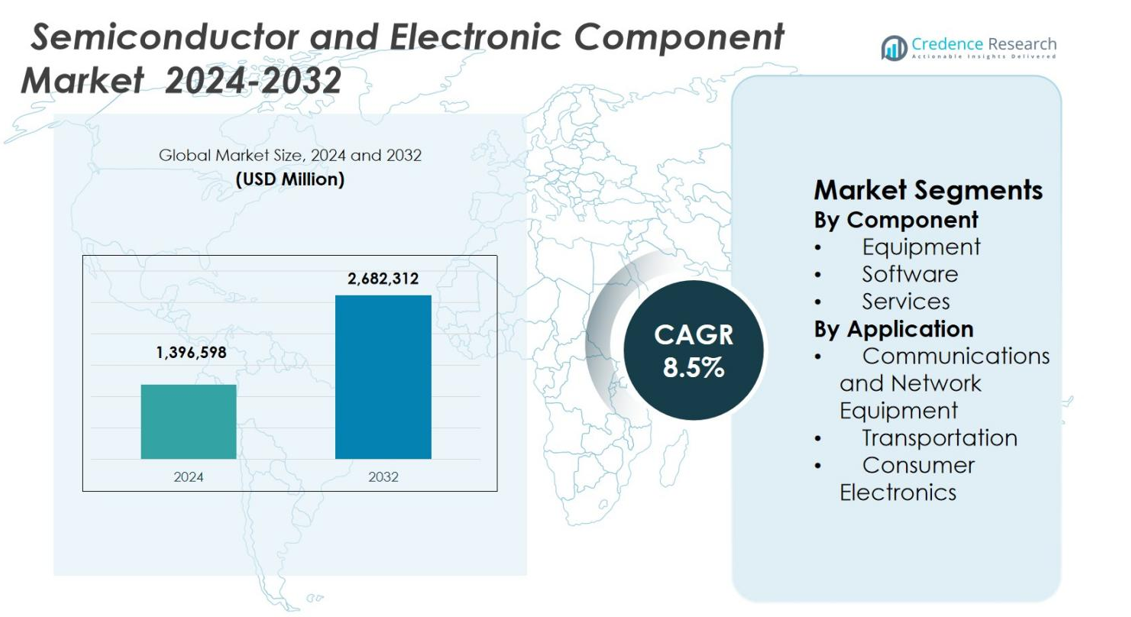

Semiconductor and Electronic Component Market size was valued at USD 1,396,598 million in 2024 and is anticipated to reach USD 2,682,312 million by 2032, at a CAGR of 8.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Semiconductor and Electronic Component Market Size 2024 |

USD 1,396,598 million |

| Semiconductor and Electronic Component Market, CAGR |

8.5% |

| Semiconductor and Electronic Component Market Size 2032 |

USD 2,682,312 million |

Semiconductor and Electronic Component Market is characterized by the strong presence of leading players such as Intel Corporation, Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Limited (TSMC), NVIDIA Corporation, Qualcomm Incorporated, Broadcom Inc., Texas Instruments Incorporated, Micron Technology, Inc., SK Hynix Inc., and Jabil Inc. These companies focus on advanced process technologies, high-performance computing chips, memory solutions, and integrated electronic services to address rising demand across consumer electronics, communications, automotive, and industrial applications. Asia-Pacific leads the market with an exact 47.6% share, supported by large-scale manufacturing hubs and high consumer electronics production. North America follows with a 26.4% share, driven by AI, data centers, and defense electronics, while Europe holds an 18.1% share, supported by automotive and industrial electronics demand.

Market Insights

- The Semiconductor and Electronic Component Market was valued at USD 1,396,598 million in 2024, is projected to reach USD 2,682,312 million by 2032, and is expected to grow at a CAGR of 8.5% during the forecast period.

- Market growth is driven by rising demand for AI-enabled high-performance computing, expanded digitalization across industries, and increasing electrification in transportation, boosting semiconductor consumption.

- Key trends include the adoption of advanced packaging and chiplet architectures to enhance performance and efficiency and expansion of regional manufacturing to strengthen supply chain resilience.

- Leading players such as Intel Corporation, Samsung Electronics Co., Ltd., TSMC, NVIDIA Corporation, and Qualcomm Incorporated compete through investments in advanced process nodes and memory technologies, while segment dominance is seen in equipment at 8% share in 2024.

- Regionally, Asia-Pacific leads with a 6% share, followed by North America at 26.4%, and Europe at 18.1%, supported by strong manufacturing and industry demand.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Component:

The Semiconductor and Electronic Component Market, by component, includes equipment, software, and services, with equipment dominating at a 46.8% market share in 2024. Equipment leads due to sustained investments in wafer fabrication tools, semiconductor manufacturing equipment, and advanced packaging systems required for smaller node sizes. Rapid expansion of foundry capacities, rising demand for AI and high-performance computing chips, and continuous upgrades in lithography, deposition, and etching technologies support equipment dominance. Software and services grow steadily, driven by automation, design optimization, predictive maintenance, and lifecycle support across semiconductor manufacturing facilities.

- For instance, Samsung Electronics increased its 2-nanometer production capacity by 163 percent, expanding from 8,000 wafers per month in 2024 to 21,000 wafers by the end of 2025, with yield rates stabilizing to enable mass production scaling.

By Application:

By application, the Semiconductor and Electronic Component Market is segmented into communications and network equipment, transportation, and consumer electronics, with consumer electronics holding the largest share at 38.6% in 2024. This dominance is driven by high-volume demand for smartphones, laptops, wearables, smart home devices, and gaming consoles. Short product replacement cycles, increasing device functionality, and integration of AI-enabled features accelerate semiconductor consumption. Communications and network equipment benefit from 5G rollout and data traffic growth, while transportation gains momentum from electric vehicles, ADAS systems, and automotive electrification trends.

- For instance, Analog Devices launched a millimeter-wave 5G front-end chipset in March 2022, including the ADMV4828 16-channel beamformer that delivers over 12.5 dBm output power at 3% EVM for 24-47 GHz radios while consuming only 310 mW per channel. The chipset simplifies designs for 5G NR FR2 bands in base stations and network gear.

Key Growth Driver

Expanding Demand for Advanced Computing and AI Technologies

The Semiconductor and Electronic Component Market benefits strongly from rising adoption of artificial intelligence, machine learning, and high-performance computing across data centers, cloud platforms, and enterprise IT environments. AI workloads require advanced processors, memory solutions, and specialized accelerators, significantly increasing semiconductor content per system. Growing investments in hyperscale data centers and edge computing infrastructure further stimulate demand for high-speed logic chips, power management components, and advanced interconnect technologies. This driver continues to accelerate semiconductor innovation and capacity expansion across global manufacturing ecosystems.

- For instance, NVIDIA’s H100 GPU triples the floating-point operations per second of double-precision Tensor Cores to deliver 60 teraflops of FP64 computing for high-performance computing in data centers.

Rapid Digitalization Across Consumer and Industrial Applications

Widespread digitalization across consumer electronics, industrial automation, healthcare, and smart infrastructure drives sustained growth in the Semiconductor and Electronic Component Market. Increasing penetration of connected devices, IoT sensors, and embedded systems expands demand for microcontrollers, analog ICs, and discrete components. Industrial digital transformation initiatives, including smart factories and predictive maintenance systems, require reliable and energy-efficient electronic components. Rising adoption of digital payment systems, smart appliances, and connected healthcare devices further reinforces long-term semiconductor demand across diversified end-use sectors.

- For instance, STMicroelectronics’ STM32WBA6 wireless microcontrollers support Bluetooth, Zigbee, Thread, and Matter protocols concurrently for smart home hubs that communicate with mobile apps while managing thermostats via mesh networks.

Electrification and Advanced Electronics in Transportation

The transition toward electric and hybrid vehicles significantly strengthens demand in the Semiconductor and Electronic Component Market. Modern vehicles integrate advanced power semiconductors, battery management systems, infotainment units, and driver assistance technologies, increasing electronic content per vehicle. Government regulations promoting emission reduction and vehicle safety accelerate adoption of advanced automotive electronics. Growth in charging infrastructure, autonomous driving development, and connected vehicle ecosystems further amplifies semiconductor requirements, making transportation electrification a critical growth driver for the market.

Key Trend & Opportunity

Expansion of Advanced Packaging and Chiplet Architectures

Advanced packaging technologies and chiplet-based architectures are emerging as a key trend and opportunity in the Semiconductor and Electronic Component Market. Manufacturers increasingly adopt heterogeneous integration to improve performance, reduce power consumption, and optimize manufacturing yields. Technologies such as system-in-package and 3D integration enable higher functionality within compact form factors. This trend opens opportunities for equipment suppliers, materials providers, and design software vendors to support complex packaging requirements while extending Moore’s Law economics.

- For instance, Amkor provides System-in-Package assembly with over 3000 formats, including stacked die and 3D packaging for RF front-end modules in 5G mobile devices.

Growth of Regional Manufacturing and Supply Chain Localization

Supply chain resilience and geopolitical considerations drive increased regional semiconductor manufacturing investments, creating new opportunities across the Semiconductor and Electronic Component Market. Governments and enterprises prioritize domestic production capabilities to reduce dependency on single-source suppliers. This shift supports expansion of fabrication plants, assembly units, and testing facilities across multiple regions. Localization initiatives stimulate demand for manufacturing equipment, automation software, and technical services, while fostering innovation ecosystems and long-term capacity stability.

- For instance, Intel secured $7.86 billion under the CHIPS Act for two new leading-edge logic fabs and modernization of an existing one in Chandler, Arizona. The plants will manufacture chips using Intel 18A process with RibbonFET transistors and PowerVia technology.

Key Challenge

High Capital Intensity and Technology Complexity

The Semiconductor and Electronic Component Market faces challenges related to high capital expenditure requirements and escalating technological complexity. Advanced fabrication facilities demand multibillion-dollar investments, long development cycles, and specialized expertise. Continuous node shrinkage and integration of new materials increase production risks and operational costs. Smaller players struggle to keep pace with rapid technology evolution, leading to industry consolidation. These factors constrain market entry and intensify competitive pressure across the semiconductor value chain.

Supply Chain Volatility and Demand Cyclicality

Supply chain disruptions and cyclical demand patterns remain significant challenges for the Semiconductor and Electronic Component Market. Fluctuations in end-market demand, inventory imbalances, and geopolitical tensions create uncertainty in production planning and pricing stability. Dependence on geographically concentrated manufacturing hubs heightens exposure to logistical and regulatory risks. Managing long lead times, raw material availability, and sudden demand shifts requires robust forecasting, diversified sourcing strategies, and adaptive capacity management to sustain market stability.

Regional Analysis

North America

The Semiconductor and Electronic Component Market in North America accounted for a 26.4% market share in 2024, supported by strong demand from data centers, cloud computing, aerospace, defense, and advanced automotive electronics. The region benefits from a robust ecosystem of fabless semiconductor companies, integrated device manufacturers, and design software providers. Rising investments in AI accelerators, high-performance computing chips, and advanced memory solutions drive component demand. Government-backed semiconductor manufacturing initiatives and continued innovation in chip design, automation software, and electronic services further strengthen North America’s strategic position in the global market.

Europe

Europe represented an 18.1% share of the Semiconductor and Electronic Component Market in 2024, driven by strong demand from automotive electronics, industrial automation, renewable energy systems, and smart manufacturing. The region’s leadership in automotive engineering increases adoption of power semiconductors, sensors, and control units for electric and autonomous vehicles. Industrial digitization initiatives support demand for embedded systems and analog components. European policy support for semiconductor self-sufficiency and sustainable electronics manufacturing encourages investments in fabrication, packaging, and R&D, reinforcing long-term growth across equipment, software, and service segments.

Asia-Pacific

Asia-Pacific dominated the Semiconductor and Electronic Component Market with a 47.6% market share in 2024, led by large-scale manufacturing hubs in China, Taiwan, South Korea, and Japan. The region benefits from high-volume semiconductor fabrication, strong consumer electronics production, and expanding 5G and data center infrastructure. Rising demand for smartphones, computing devices, and network equipment significantly increases component consumption. Government incentives, continuous capacity expansion by foundries, and leadership in memory and advanced packaging technologies position Asia-Pacific as the primary growth engine of the global market.

Latin America

Latin America held a 4.5% share of the Semiconductor and Electronic Component Market in 2024, supported by growing adoption of consumer electronics, industrial automation, and telecommunications infrastructure. Expanding digital connectivity, rising smartphone penetration, and modernization of manufacturing facilities drive regional semiconductor demand. Automotive electronics and renewable energy projects further contribute to component usage. While the region relies heavily on imports, increasing foreign investment in electronics assembly and testing operations improves market accessibility. Gradual development of local electronics ecosystems supports steady growth across applications.

Middle East & Africa

The Middle East & Africa accounted for a 3.4% market share in 2024, driven by infrastructure modernization, smart city initiatives, and expanding telecommunications networks. Increasing investments in data centers, renewable energy systems, and digital government services stimulate demand for electronic components. Industrial automation and defense electronics also contribute to market growth. Although semiconductor manufacturing remains limited, rising adoption of advanced electronics across construction, transportation, and energy sectors supports demand for components, equipment, and associated services, positioning the region for gradual expansion.

Market Segmentations:

By Component

- Equipment

- Software

- Services

By Application

- Communications and Network Equipment

- Transportation

- Consumer Electronics

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis of the Semiconductor and Electronic Component Market highlights the presence of major players including Intel Corporation, Samsung Electronics Co., Ltd., Taiwan Semiconductor Manufacturing Company Limited (TSMC), Qualcomm Incorporated, NVIDIA Corporation, Broadcom Inc., Texas Instruments Incorporated, Micron Technology, Inc., and SK Hynix Inc. The market remains highly consolidated at the manufacturing level while maintaining intense competition across design, fabrication, and integrated service offerings. Leading companies focus on advanced process nodes, high-performance computing chips, AI accelerators, and next-generation memory solutions to strengthen product portfolios. Strategic investments in capacity expansion, advanced packaging, and design automation enable players to improve performance efficiency and reduce time-to-market. Partnerships with cloud providers, automotive OEMs, and telecom companies support application-specific customization. Continuous R&D spending, intellectual property development, and supply chain optimization remain central to sustaining long-term competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Micron Technology, Inc.

- Qualcomm Incorporated

- Jabil Inc.

- NVIDIA Corporation

- Texas Instruments Incorporated

- Samsung Electronics Co., Ltd.

- Broadcom Inc.

- Intel Corporation

- SK Hynix Inc.

- Taiwan Semiconductor Manufacturing Company Limited (TSMC)

Recent Developments

- In December 2025, Tata Electronics and Intel entered a strategic partnership to manufacture and assemble semiconductors in India, focusing on producing and packaging Intel products and developing advanced packaging solutions tailored to the Indian market.

- In December 2025, Navitas Semiconductor and Cyient Semiconductors announced a long-term strategic partnership to accelerate the adoption of GaN technology in India’s AI, mobility, and industrial sectors.

- In December 2025, Virtusa acquired Bengaluru-based SmartSoC Solutions to enhance semiconductor engineering and IC design capabilities.

Report Coverage

The research report offers an in-depth analysis based on Component, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Semiconductor and Electronic Component Market will continue to expand as digital transformation accelerates across consumer, industrial, and enterprise applications.

- Adoption of artificial intelligence and high-performance computing will increase demand for advanced logic, memory, and specialized accelerators.

- Electrification of transportation will drive sustained growth in power semiconductors, sensors, and automotive-grade electronic components.

- Advanced packaging and chiplet architectures will gain wider adoption to enhance performance, efficiency, and scalability.

- Regional manufacturing expansion will strengthen supply chain resilience and reduce dependency on single-source production hubs.

- Rising deployment of 5G, cloud infrastructure, and edge computing will boost demand for high-speed and low-latency components.

- Sustainability initiatives will encourage development of energy-efficient chips and environmentally optimized manufacturing processes.

- Automation and digital twins in semiconductor fabs will improve yield optimization and operational efficiency.

- Integration of electronics into smart infrastructure and industrial IoT systems will broaden application diversity.

- Continuous innovation in materials, design software, and manufacturing technologies will shape long-term market competitiveness.