Market Overview

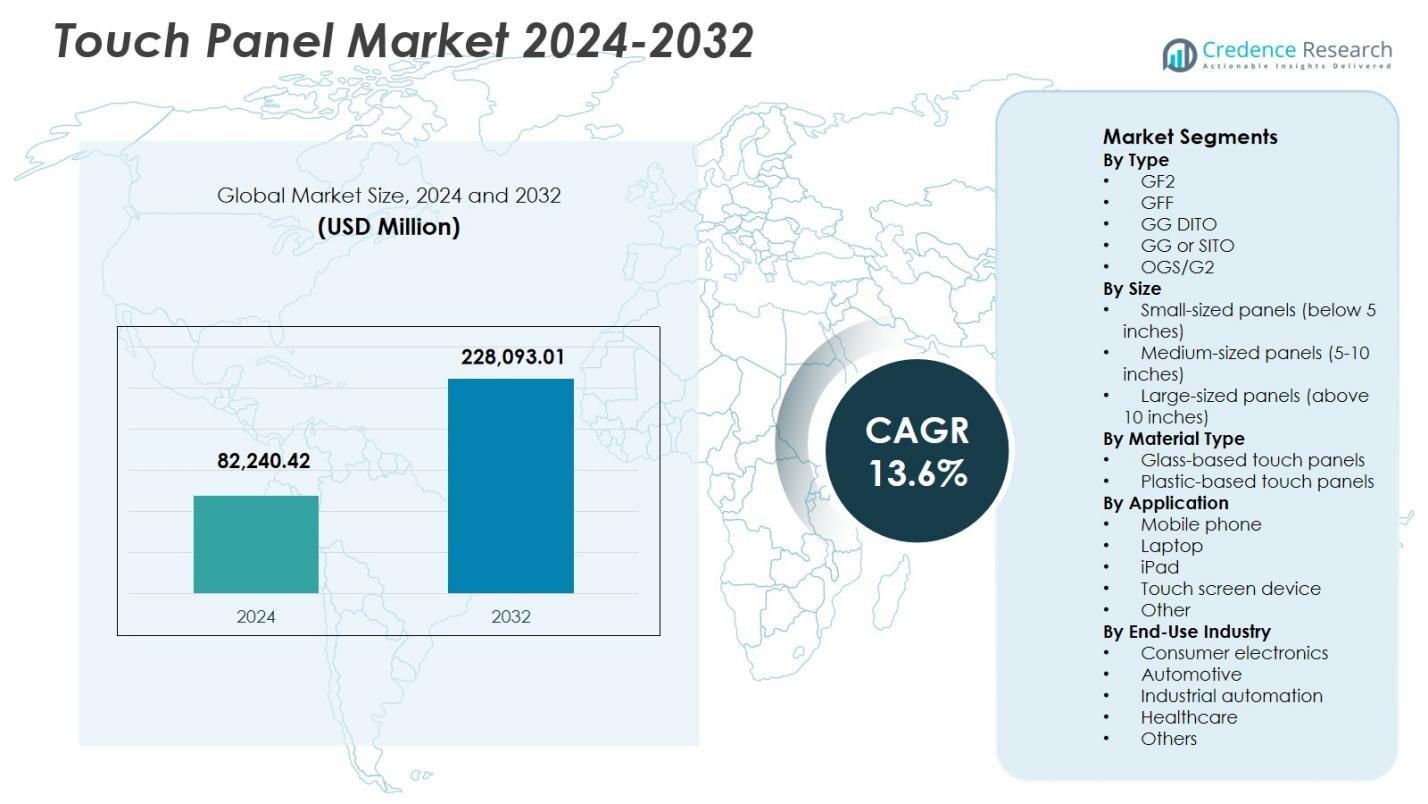

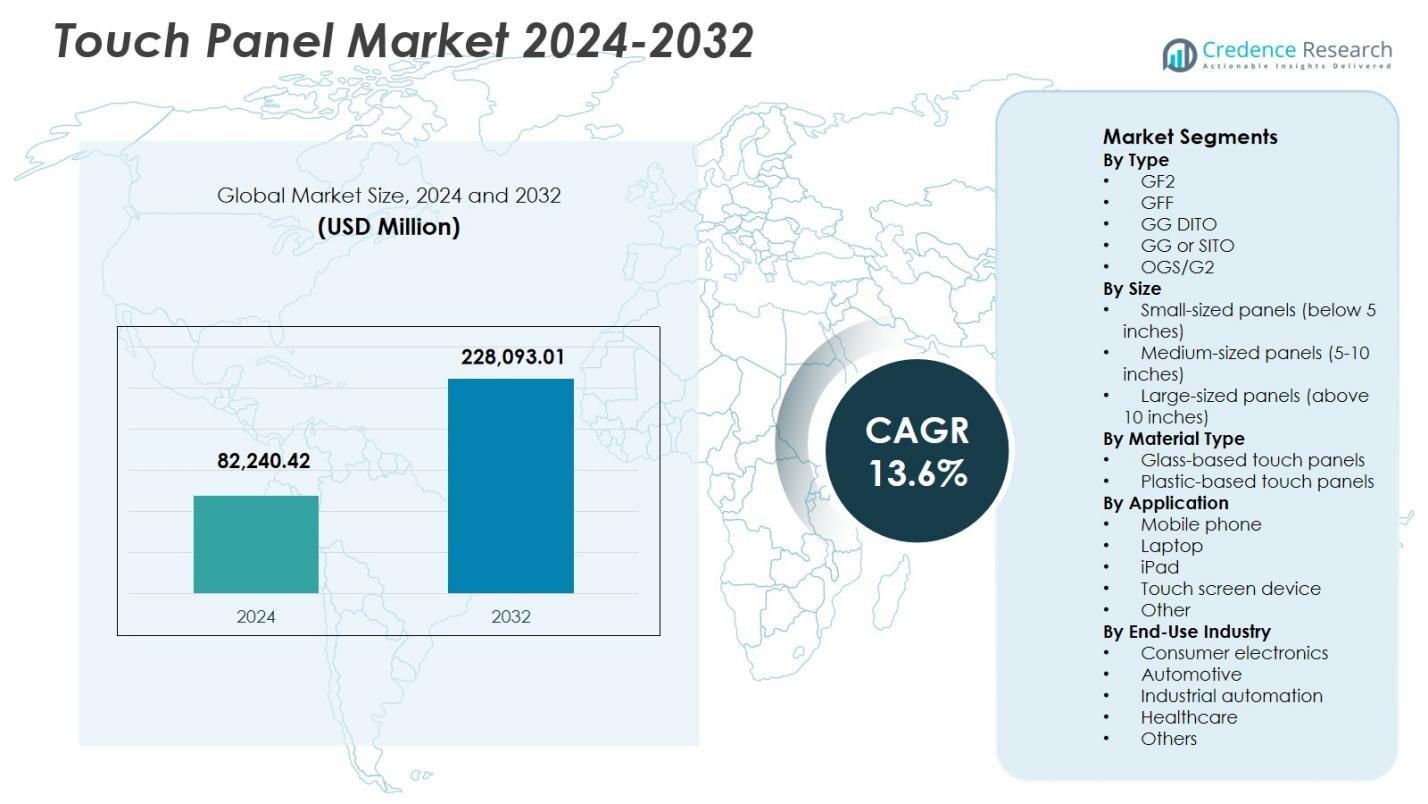

Touch Panel Market size was valued at USD 82,240.42 million in 2024 and is anticipated to reach USD 228,093.01 million by 2032, growing at a CAGR of 13.6% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Touch Panel Market Size 2024 |

USD 82,240.42 Million |

| Touch Panel Market, CAGR |

13.6% |

| Touch Panel Market Size 2032 |

USD 228,093.01 Million |

Touch Panel Market demonstrates strong presence of global display manufacturers and touch technology specialists, including BOE Technology Group, AU Optronics Corporation, Innolux Corporation, Corning Incorporated, Elo Touch Solutions, Fujitsu Limited, General Interface Solution (GIS), DISplax Interactive Systems, Atmel Corporation, and Cypress Semiconductor. These players focus on advanced glass technologies, sensor integration, and scalable production to serve consumer electronics, automotive, industrial, and commercial applications. Asia-Pacific leads the Touch Panel Market with a 38.9% share, supported by large-scale electronics manufacturing, robust supply chains, and high demand from smartphones and automotive displays. North America and Europe follow, driven by automotive digitization, industrial automation, and healthcare adoption, reinforcing the global expansion of touch-enabled interfaces.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Touch Panel Market was valued at USD 82,240.42 million in 2024 and is projected to grow at a CAGR of 13.6% through 2032, reflecting strong momentum across consumer, automotive, and industrial applications.

- Rising adoption of smartphones, tablets, automotive infotainment systems, and industrial HMIs is driving Touch Panel Market growth, with GG (Glass–Glass) or SITO type leading the segment landscape with a 36.8% share due to durability and optical clarity.

- Key trends in the Touch Panel Market include ultra-thin designs, advanced glass coatings, in-cell and on-cell integration, and growing use of large-format interactive displays across retail, healthcare, and smart infrastructure projects.

- Intense price pressure, high manufacturing capacity, and technical complexity act as restraints in the Touch Panel Market, compelling players to focus on cost optimization, process efficiency, and value-added customization strategies.

- Asia-Pacific leads the Touch Panel Market with a 38.9% share, followed by North America at 24.8% and Europe at 21.6%, supported by electronics manufacturing strength, automotive digitization, and industrial automation adoption.

Market Segmentation Analysis:

By Type:

The Touch Panel Market by type shows strong dominance of the GG (Glass–Glass) or SITO segment, which accounted for 36.8% market share in 2024. GG/SITO touch panels deliver superior optical clarity, high durability, and enhanced multi-touch accuracy, making them widely adopted in smartphones, tablets, industrial HMIs, and premium consumer electronics. Rising demand for scratch-resistant, high-transparency displays in automotive infotainment systems and commercial displays continues to support this segment. Meanwhile, GFF and OGS/G2 segments maintain steady adoption due to thinner form factors and cost efficiency in mid-range devices.

- For instance, Sony’s Xperia 5 IV smartphone incorporates Corning Gorilla Glass Victus in a GG structure for its front and back covers, providing scratch and drop resistance while supporting advanced imaging on a high-clarity display.

By Size:

By size, medium-sized touch panels (5–10 inches) dominated the Touch Panel Market with a 42.5% share in 2024. This segment benefits from extensive deployment across smartphones, POS terminals, infotainment systems, and portable medical devices. Growth is driven by rising smartphone penetration, increasing adoption of touch-enabled retail systems, and demand for compact yet interactive displays. Large-sized panels gain momentum in interactive kiosks and digital signage, while small-sized panels continue to serve wearables and handheld electronics, sustaining balanced demand across size categories.

- For instance, Tata Nexon employs a 10.25-inch touchscreen infotainment system in its Creative Plus variant and higher, supporting wireless Android Auto and Apple CarPlay for enhanced driver interaction.

By Material Type:

Based on material type, glass-based touch panels led the market with a 61.4% share in 2024, driven by their high optical performance, durability, and resistance to wear. Glass-based solutions are preferred in smartphones, tablets, automotive displays, and industrial control panels where precision and long-term reliability are critical. Growing integration of advanced coatings, strengthened glass, and high-resolution displays further accelerates adoption. Plastic-based touch panels retain relevance in cost-sensitive and flexible applications, but glass-based panels remain the primary choice for performance-driven end-use sectors.

Key Growth Drivers

Expanding Adoption of Touch-Enabled Consumer Electronics

Rapid growth in smartphones, tablets, laptops, and wearable devices remains a core driver for the Touch Panel Market. Consumers increasingly demand intuitive, responsive, and visually enhanced interfaces, pushing manufacturers to integrate advanced capacitive touch panels across product lines. Continuous device replacement cycles, rising disposable income in emerging economies, and increased penetration of multi-touch displays accelerate volume demand. Additionally, OEMs are adopting thinner and bezel-less designs, further reinforcing the need for high-performance touch panels that deliver accuracy, durability, and seamless user interaction across consumer electronics.

- For instance, Apple equips iPhones with capacitive touch screens featuring high sensitivity and multi-touch capability, enabling gesture recognition like pinch-to-zoom through a grid of sensing lines that detect electrical conductivity from touches.

Rising Integration in Automotive and Transportation Systems

The increasing digitization of vehicle interiors significantly drives growth in the Touch Panel Market. Automotive manufacturers are integrating touch panels into infotainment systems, digital dashboards, navigation units, and climate controls to enhance user experience and vehicle aesthetics. The shift toward connected vehicles and electric mobility amplifies demand for large, high-resolution, and durable touch displays capable of operating under extreme conditions. Growing investments in autonomous driving technologies and smart cockpit designs further strengthen long-term demand from the automotive and transportation sectors.

- For instance, Mercedes-Benz equips its EQS electric sedan with the MBUX Hyperscreen, a curved 56‑inch glass surface that integrates three separate high-resolution displays, including a 17.7‑inch OLED central display and a 12.3‑inch OLED passenger display, all protected by scratch- and reflection-resistant aluminum silicate glass.

Growing Deployment in Industrial and Commercial Applications

Industrial automation and commercial digitization are strong growth contributors to the Touch Panel Market. Touch panels are widely deployed in industrial HMIs, medical equipment, self-service kiosks, POS terminals, and smart appliances. Businesses favor touch interfaces for operational efficiency, reduced mechanical wear, and improved human-machine interaction. Expansion of smart factories, healthcare digitization, and retail automation continues to generate consistent demand. Touch panels offering high durability, glove compatibility, and resistance to dust and moisture gain preference in demanding industrial environments.

Key Trends & Opportunities

Advancements in Display Technology and Material Innovation

Technological advancements create significant opportunities in the Touch Panel Market. Manufacturers are developing ultra-thin panels, flexible displays, and improved sensor architectures to support next-generation devices. Innovations such as in-cell and on-cell touch integration, strengthened glass, and advanced coatings enhance optical clarity and responsiveness while reducing component layers. These developments support foldable devices, edge-to-edge screens, and lightweight electronics. Material innovation enables suppliers to differentiate offerings and capture demand from premium consumer electronics and automotive display applications.

- For instance, HKC launched a 27-inch in-cell touch display that embeds touch sensors within the TFT array substrate, supporting 3,600 touch zones and 10-point simultaneous touch recognition at a 120Hz refresh rate.

Growth of Interactive Displays and Smart Infrastructure

Rising adoption of interactive displays across smart cities, education, and public infrastructure presents strong opportunities. Touch panels are increasingly used in digital signage, interactive kiosks, ticketing systems, and smart classroom solutions. Governments and enterprises invest in smart infrastructure to improve public services and user engagement. Large-format touch panels benefit from this trend, supported by urbanization and digital transformation initiatives. Suppliers offering scalable, durable, and high-brightness touch solutions are well positioned to capitalize on expanding public and commercial deployment.

- For instance, GEA implemented a mobile showroom with POPcomms’ interactive touchscreen technology to demonstrate heating, refrigeration, and process equipment for food, beverage, and pharmaceutical clients worldwide.

Key Challenges

Price Pressure and Intense Competitive Landscape

The Touch Panel Market faces sustained price pressure due to intense competition and high manufacturing capacity. Standardization of touch technologies and aggressive pricing by large-scale manufacturers compress profit margins. OEMs demand cost-effective solutions without compromising performance, forcing suppliers to balance pricing and innovation. Smaller players face challenges competing with vertically integrated manufacturers that benefit from economies of scale. This competitive environment limits pricing flexibility and requires continuous operational efficiency to maintain profitability.

Technical Complexity and Reliability Requirements

Increasing technical complexity poses challenges for the Touch Panel Market. Demand for thinner designs, higher sensitivity, multi-touch accuracy, and durability increases engineering requirements. Touch panels must perform reliably under varying environmental conditions, including heat, moisture, and mechanical stress. Meeting stringent quality standards across automotive, industrial, and medical applications raises development and testing costs. Manufacturers must invest in advanced production processes and quality assurance, which can impact time-to-market and overall cost structures.

Regional Analysis

North America

North America accounted for 24.8% of the Touch Panel Market in 2024, supported by strong demand from consumer electronics, automotive infotainment, and industrial automation sectors. The region benefits from high adoption of advanced technologies, early integration of touch-enabled systems, and strong presence of leading OEMs and technology innovators. Growth is reinforced by rising deployment of touch panels in medical devices, retail self-service systems, and smart infrastructure projects. Continuous investments in electric vehicles, digital cockpits, and interactive commercial displays further sustain demand for high-performance and durable touch panel solutions across the region.

Europe

Europe held a 21.6% market share in 2024, driven by steady demand from automotive manufacturing, industrial equipment, and public infrastructure applications. The region’s strong automotive base accelerates adoption of touch panels in dashboards, infotainment systems, and control interfaces. Increasing focus on smart factories, healthcare digitization, and energy-efficient buildings supports sustained demand. Regulatory emphasis on safety and quality favors high-reliability touch solutions, particularly glass-based panels. Adoption of interactive displays in transportation hubs, retail environments, and smart city projects continues to strengthen the regional market outlook.

Asia-Pacific

Asia-Pacific dominated the Touch Panel Market with a 38.9% share in 2024, led by large-scale electronics manufacturing and strong consumer device demand. Countries such as China, South Korea, Japan, and Taiwan serve as major production hubs for smartphones, tablets, and display components. Rapid urbanization, expanding middle-class population, and high smartphone penetration drive volume growth. Additionally, increasing investments in automotive electronics, industrial automation, and digital retail accelerate regional adoption. Cost-efficient manufacturing, robust supply chains, and continuous technological innovation reinforce Asia-Pacific’s leadership position.

Latin America

Latin America captured a 7.9% share of the Touch Panel Market in 2024, supported by gradual growth in consumer electronics, retail automation, and transportation infrastructure. Expanding smartphone usage, modernization of retail systems, and rising adoption of digital kiosks contribute to demand. Governments and private enterprises increasingly invest in smart public services and healthcare infrastructure, supporting touch panel integration. While price sensitivity remains a factor, improving economic conditions and growing digital awareness drive steady adoption of medium-sized and cost-efficient touch panel solutions across the region.

Middle East & Africa

The Middle East & Africa accounted for 6.8% of the market share in 2024, driven by smart city initiatives, infrastructure development, and digital transformation programs. Touch panels are increasingly deployed in transportation systems, government services, retail environments, and commercial buildings. The region benefits from rising investments in smart infrastructure, hospitality, and healthcare modernization. Demand is particularly strong for large-format and durable touch panels suited for public and outdoor applications. Ongoing urban development and technology-driven service delivery continue to support long-term market growth.

Market Segmentations:

By Type

- GF2

- GFF

- GG DITO

- GG or SITO

- OGS/G2

By Size

- Small-sized panels (below 5 inches)

- Medium-sized panels (5-10 inches)

- Large-sized panels (above 10 inches)

By Material Type

- Glass-based touch panels

- Plastic-based touch panels

By Application

- Mobile phone

- Laptop

- iPad

- Touch screen device

- Other

By End-Use Industry

- Consumer electronics

- Automotive

- Industrial automation

- Healthcare

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape analysis highlights a moderately consolidated structure shaped by global display manufacturers and specialized touch technology providers. BOE Technology Group, AU Optronics Corporation, Innolux Corporation, Corning Incorporated, Elo Touch Solutions, Fujitsu Limited, General Interface Solution (GIS), DISplax Interactive Systems, Atmel Corporation, and Cypress Semiconductor form the core competitive ecosystem. Leading players focus on vertical integration, advanced glass technologies, and sensor innovation to strengthen cost efficiency and performance differentiation. Strategic priorities include development of ultra-thin panels, improved optical clarity, and durability for automotive, industrial, and large-format applications. Companies increasingly invest in capacity expansion across Asia-Pacific, while strengthening partnerships with OEMs in consumer electronics and automotive sectors. Continuous R&D, supply chain optimization, and customization for end-use requirements remain central to sustaining competitive positioning in the Touch Panel Market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Innolux Corporation

- Elo Touch Solutions

- Corning Incorporated

- AU Optronics Corporation

- Fujitsu Limited

- General Interface Solution Ltd. (GIS)

- Cypress Semiconductor

- BOE Technology Group Co., Ltd.

- Atmel Corporation

- DISplax Interactive Systems

Recent Developments

- In August 2025, Zebra Technologies announced it will acquire Elo Touch Solutions in a definitive agreement aimed at expanding its touchscreen and self-service solutions portfolio.

- In November 2025, Synaptics and Qualcomm Technologies entered a strategic partnership to advance touch and fingerprint sensor technology for mobile and AI PC platforms.

- In July 2025, Delta launched its new DOP-300S Series Touch Panel HMI designed for smart manufacturing and IIoT applications.

Report Coverage

The research report offers an in-depth analysis based on Type, Size, Material Type, Application, End Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Touch Panel Market will continue expanding with sustained demand from smartphones, tablets, and emerging wearable devices.

- Automotive adoption will accelerate as digital cockpits, infotainment systems, and touch-based controls become standard features.

- Industrial automation and smart manufacturing will increase reliance on durable and high-precision touch interfaces.

- Integration of touch panels into medical equipment and healthcare digital systems will strengthen long-term demand.

- Technological advancements will drive thinner, lighter, and more responsive touch panel designs.

- Growth of interactive displays in retail, education, and public infrastructure will support large-format panel adoption.

- Asia-Pacific will remain the primary manufacturing and consumption hub due to strong electronics ecosystems.

- Material innovation will improve durability, optical clarity, and environmental resistance of touch panels.

- Competitive intensity will push manufacturers toward cost optimization and value-added customization.

- Increasing focus on smart cities and digital services will create new application opportunities across regions.