Market Overview:

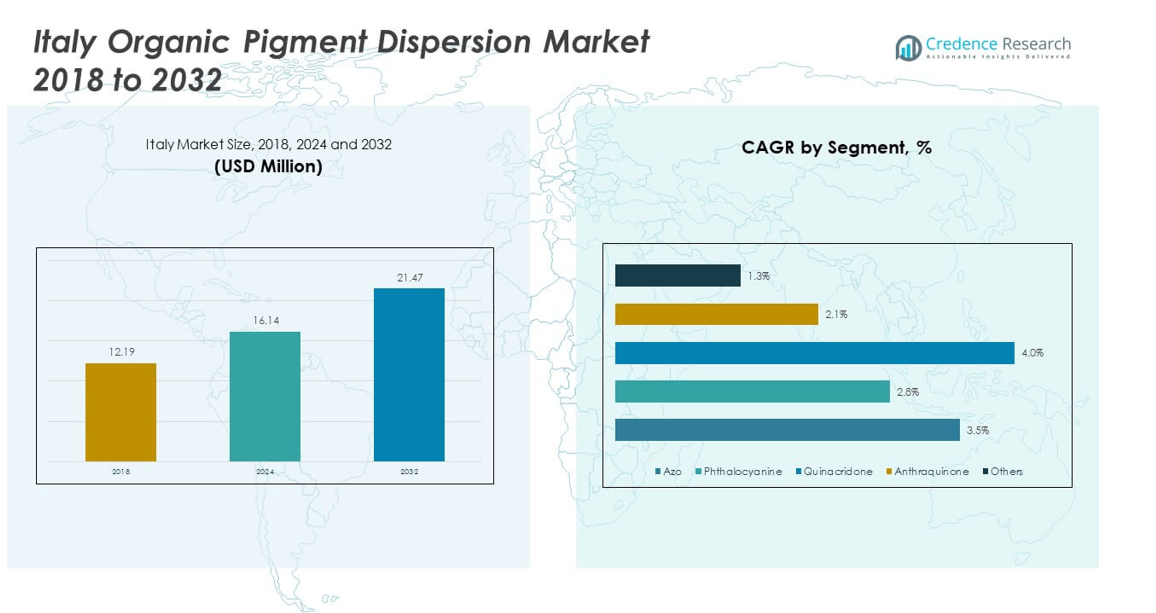

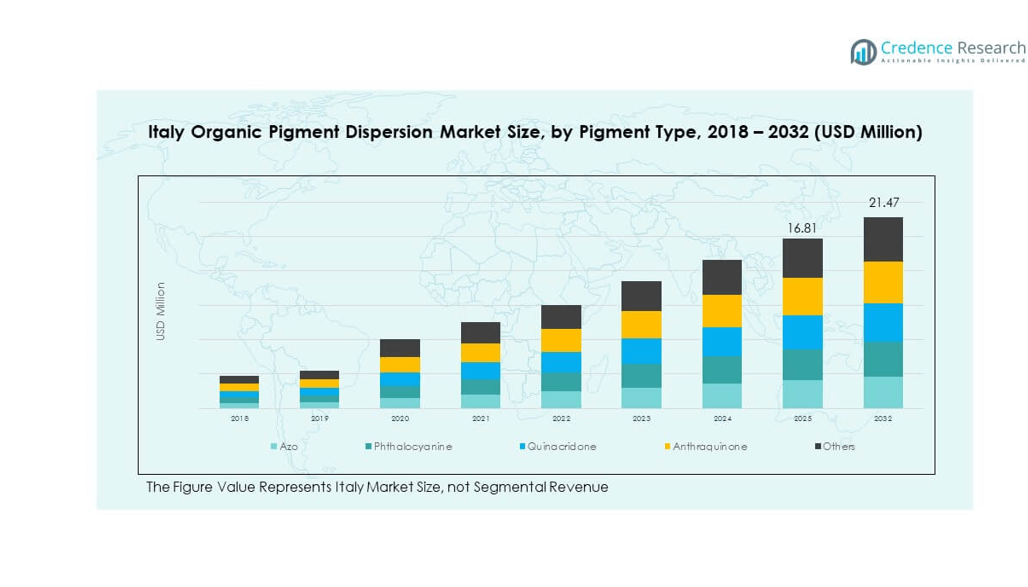

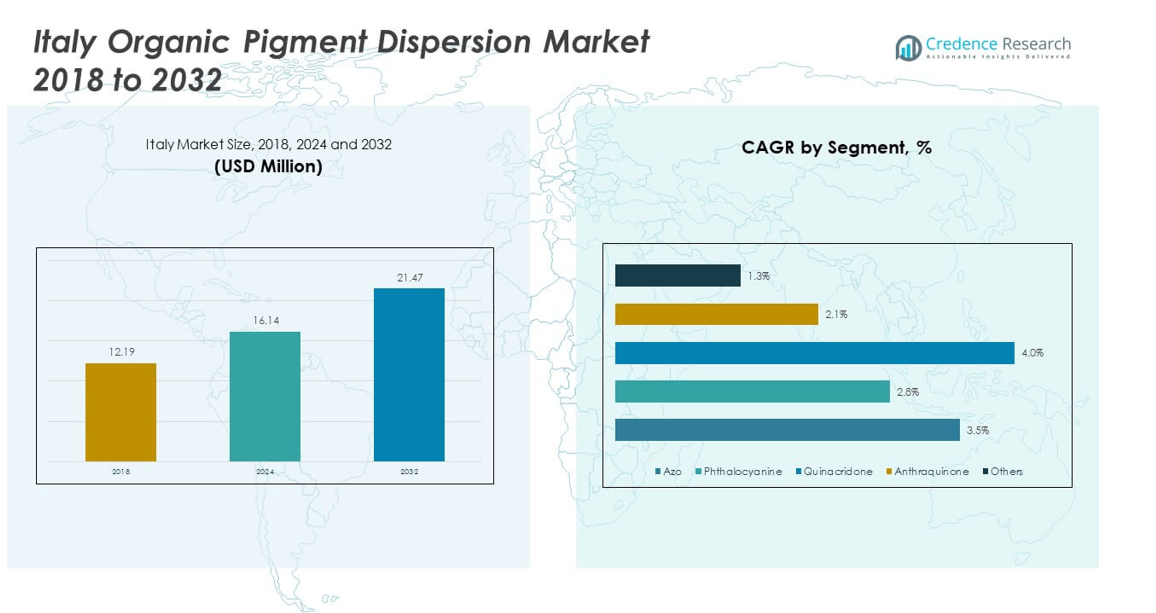

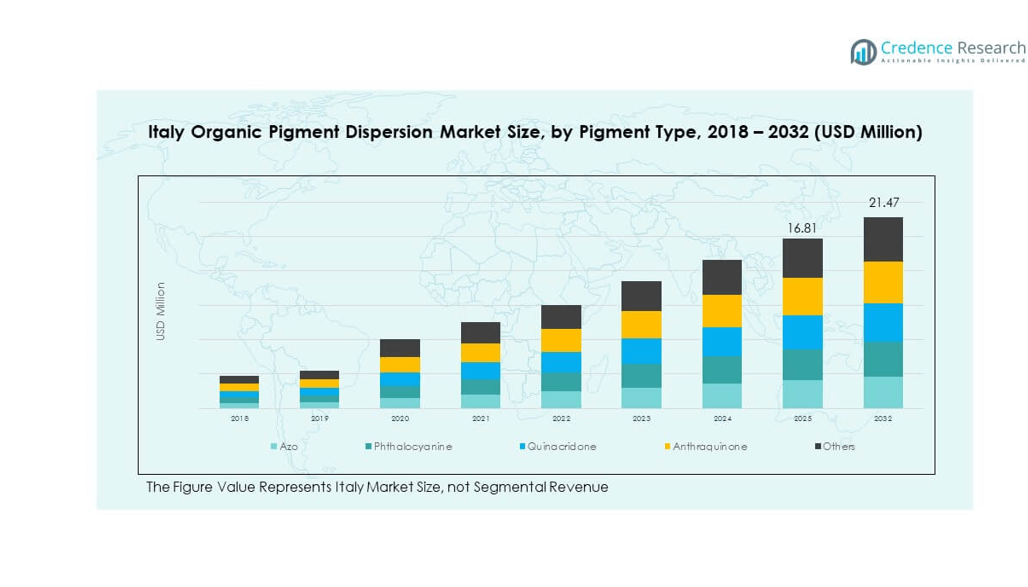

The Italy Organic Pigment Dispersion Market size was valued at USD 12.19 million in 2018 to USD 16.14 million in 2024 and is anticipated to reach USD 21.47 million by 2032, at a CAGR of 3.56% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Italy Organic Pigment Dispersion Market Size 2024 |

USD 16.14 million |

| Italy Organic Pigment Dispersion Market, CAGR |

3.56% |

| Italy Organic Pigment Dispersion Market Size 2032 |

USD 21.47 million |

Growth in this market is fueled by rising demand across paints, coatings, packaging, and printing applications. Expanding use of eco-friendly pigments supports regulatory compliance while meeting sustainability goals. Industries prioritize dispersions that deliver high color strength, durability, and low toxicity. Increasing use of pigments in plastics, textiles, and cosmetics broadens end-use opportunities. Technological innovations in dispersion processes enhance performance while ensuring uniformity and stability. These drivers collectively reinforce steady growth.

Regional analysis highlights Northern Italy as the dominant market, supported by its advanced industrial clusters and strong manufacturing base. Central Italy contributes significantly with its focus on packaging, publishing, and textiles, while Southern Italy shows steady momentum due to construction and agricultural packaging sectors. Emerging opportunities exist in regions adopting sustainable practices and innovative coatings. The geographic distribution reflects both mature industrial zones and developing areas aligning with eco-friendly trends, positioning Italy as a key hub for pigment dispersions within Europe.

Market Insights

- The Italy Organic Pigment Dispersion Market size was valued at USD 12.19 million in 2018 to USD 16.14 million in 2024 and is anticipated to reach USD 21.47 million by 2032, at a CAGR of 3.56% during the forecast period.

- Northern Italy accounted for 45% of the share, supported by strong industrial clusters; Central Italy held 30% with packaging and textile strength; Southern Italy captured 25% due to rising food packaging and construction activity.

- Central Italy remains the fastest-growing subregion with 30% share, driven by printing inks, publishing, and expanding cosmetics demand.

- By pigment type, Azo pigments led with 38% share in 2024, followed by Phthalocyanine at 28%, reflecting demand in coatings and plastics.

- Quinacridone, Anthraquinone, and Others collectively held 34% share, with high-performance pigments gaining ground in specialty and eco-friendly applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand From Paints and Coatings Industry Supporting Long-Term Market Expansion

The Italy Organic Pigment Dispersion Market is strongly driven by the paints and coatings industry, where demand for vibrant and durable colors continues to grow. Expanding construction and renovation projects in both residential and commercial sectors increase the requirement for eco-friendly pigments. Regulatory restrictions on solvent-based systems encourage the shift toward water-based dispersions with lower emissions. Consumer preference for safe and non-toxic coatings drives manufacturers to adopt sustainable pigment solutions. It aligns with Europe’s push for green building certifications, where pigments play a critical role in aesthetic appeal and compliance. Rapid urban development in Italian cities strengthens coatings consumption, further supporting pigment dispersions. The growth of decorative paints with enhanced weather resistance and UV stability adds momentum. These developments sustain strong demand for organic pigment dispersions in this sector.

- For example, in 2025, BASF Coatings expanded its portfolio of sustainable water-based pigment dispersions for decorative paints and construction coatings in Europe. The solutions are designed to improve surface durability and meet low-emission standards aligned with green building requirements.

Regulatory Support and Environmental Policies Encouraging Adoption of Sustainable Pigments

Environmental regulations across Italy push industries to replace synthetic pigments with eco-friendly alternatives. Policies restricting hazardous chemicals and VOC emissions reinforce adoption of organic dispersions. The European Union’s REACH compliance framework supports transparency in chemical use, making organic pigment dispersions more attractive to buyers. It aligns with Italy’s sustainability goals, creating favorable conditions for pigment suppliers. Strong awareness among consumers about health impacts of synthetic chemicals drives this transition. Large manufacturers adapt their product lines to meet compliance while ensuring consistent performance. Collaboration between Italian research institutes and companies supports development of new bio-based dispersions. These efforts ensure long-term regulatory compliance and market growth.

Growing Packaging Industry Driving Use of Pigments for Attractive Product Designs

The Italian packaging industry is expanding rapidly, creating strong demand for pigments in flexible and rigid packaging solutions. Organic pigment dispersions provide color intensity and safety required for food and cosmetic packaging. Brand owners focus on vibrant and consistent shades to strengthen consumer appeal. It supports the use of pigment dispersions that meet both aesthetic and safety standards. Sustainability in packaging also drives adoption of recyclable and biodegradable materials enhanced by safe pigments. Growth in e-commerce packaging adds further scope for pigments with durability and color stability. Regulations on packaging waste management encourage eco-friendly pigment use. This sector’s consistent expansion directly drives demand for organic pigment dispersions.

- For example, Heubach Group supplies high-performance organic pigments and colorants that comply with regulations for food-contact packaging, including EU and FDA standards. These products are used by plastics and packaging converters in Italy to ensure strong coloration and regulatory compliance in both rigid and flexible applications.

Increasing Automotive Applications Enhancing Growth of Organic Pigment Dispersions

The automotive sector plays an important role in boosting demand for organic pigment dispersions in Italy. High-quality pigments are used in exterior coatings, plastics, and interior components. It supports durability and resistance against UV light and harsh weather conditions. Automotive manufacturers prioritize coatings with enhanced color depth and gloss, where pigment dispersions prove essential. Lightweight plastic components with colored finishes further expand usage. Growing electric vehicle production in Italy increases demand for advanced coatings with sustainable pigments. Partnerships between pigment producers and automotive OEMs foster innovation in specialized dispersions. This collaboration strengthens product development and long-term growth in the market.

Market Trends

Growing Shift Toward High-Performance Pigments With Advanced Functional Properties

The Italy Organic Pigment Dispersion Market experiences a rising trend toward high-performance pigments offering greater stability and functionality. Automotive, electronics, and packaging industries demand pigments with improved resistance to heat, light, and chemicals. Manufacturers focus on producing dispersions that maintain color quality under challenging conditions. It highlights the industry’s move from traditional pigments to advanced grades. Growing interest in long-lasting finishes for outdoor applications strengthens this trend. Research in nanoparticle dispersions offers new opportunities for superior dispersion quality. Pigment producers invest in advanced milling and surface treatment technologies. These shifts redefine performance standards and raise competitive advantage in the market.

Expanding Demand for Customized Shades and Aesthetic Appeal Across Applications

Consumer preference for unique and customized colors creates a strong trend in the market. The Italy Organic Pigment Dispersion Market benefits from demand in fashion, packaging, and home décor sectors. Brands increasingly use pigments to differentiate products with distinct shades and visual effects. It encourages pigment producers to expand portfolios with tailored color solutions. Digital printing technologies also drive the need for precise color dispersions. High-quality dispersions ensure consistency in brand packaging and promotional materials. Rising demand for luxury and premium goods adds importance to unique pigment formulations. This trend continues to strengthen across consumer-driven industries.

- For example, Heubach Group supplies organic and inorganic pigments for the packaging sector in Italy. Its portfolio includes solutions such as HEUCOTINT™ and AQUIS™ ranges, which support custom color matching and tinting applications.

Integration of Digital Printing Driving Use of Pigment Dispersions in Packaging

Digital printing adoption across Italy’s packaging sector accelerates the demand for organic pigment dispersions. Brands prefer digital technologies for shorter production cycles and personalized packaging. It creates opportunities for pigment dispersions that deliver high resolution and accurate color reproduction. The growing use of e-commerce packaging boosts requirements for vibrant, durable prints. Pigment dispersions designed for inkjet and digital systems gain traction. Expansion of food and beverage labeling further drives this trend. Italian converters prefer dispersions compatible with high-speed printing technologies. This integration sets a steady growth path for pigment suppliers.

- For example, BASF provides high-performance pigment dispersions and resins, including Joncryl® grades, optimized for water-based digital and inkjet printing. These dispersions are designed for controlled particle size distribution, strong color performance, and stability, making them suitable for packaging and labeling applications in markets such as Italy.

Sustainable Sourcing and Bio-Based Pigments Emerging as a Key Industry Trend

Sustainability shapes the future of pigment dispersions in Italy. Bio-based pigments sourced from renewable feedstocks gain popularity among manufacturers. The Italy Organic Pigment Dispersion Market reflects this trend through investments in green chemistry. It aligns with consumer demand for eco-friendly products across packaging, textiles, and coatings. Collaborations with biotechnology companies help pigment producers develop safer alternatives. Brands seek certifications ensuring eco-compliance, pushing suppliers toward sustainable offerings. Research on algae-based and plant-derived pigments widens future applications. These initiatives create a strong positioning for sustainable pigment dispersions in Italy.

Market Challenges Analysis

Rising Competition From Low-Cost Imports and Pricing Pressure on Domestic Producers

The Italy Organic Pigment Dispersion Market faces challenges from increasing imports of low-cost pigments from Asia. Domestic producers encounter pricing pressure, limiting their ability to maintain profitability while adhering to quality and regulatory standards. It creates difficulty for smaller companies competing with global suppliers offering cost advantages. The growing dependence on imports risks supply chain vulnerabilities in times of disruption. Italian manufacturers often need to focus on high-performance or specialty dispersions to stay competitive. Maintaining balance between affordability and performance remains a complex challenge. High costs of compliance with European regulations further intensify these pressures. This challenge slows adoption of locally manufactured dispersions across certain sectors.

Technological Barriers and Limited Awareness Impacting Adoption in Niche Applications

Another major challenge lies in limited technological awareness among smaller end-users, slowing adoption of advanced pigment dispersions. The Italy Organic Pigment Dispersion Market encounters barriers in industries where cost-sensitive buyers prioritize price over performance. It restricts the uptake of eco-friendly pigments despite regulatory support. Technical limitations in compatibility with certain substrates also create hurdles. High research and development costs prevent smaller firms from introducing innovative pigment solutions. Lack of skilled workforce in dispersion technology hampers consistent quality. These obstacles reduce penetration in niche applications like specialty textiles or electronics. Overcoming these barriers requires significant education and technological investment.

Market Opportunities

Rising Investment in Sustainable Packaging and Eco-Friendly Pigment Dispersions

The Italy Organic Pigment Dispersion Market offers opportunities through rising adoption of sustainable packaging solutions. Growing consumer awareness and regulations on plastic waste drive investment in recyclable packaging enhanced with eco-friendly pigments. It supports innovation in bio-based dispersions, creating growth for suppliers. Companies adopting green certifications seek organic pigments to improve brand image. Partnerships between packaging firms and pigment producers encourage product development. Expansion of premium food and beverage packaging further strengthens this opportunity. These drivers open long-term growth paths for pigment suppliers in Italy.

Innovation in Specialty Applications and High-Value Industry Segments

Pigment dispersions find growing opportunities in specialty segments such as electronics, textiles, and automotive interiors. The Italy Organic Pigment Dispersion Market benefits from increasing demand for high-value dispersions offering superior functionality. It creates room for advanced pigments tailored for durability, safety, and unique visual effects. Rapid growth in electric vehicles adds scope for specialized coatings. Textile industries adopt innovative pigments for sustainable fashion trends. Research on nanoparticle-based dispersions provides new innovation prospects. These specialty applications open premium opportunities for Italian producers focused on advanced pigment solutions.

Market Segmentation Analysis

By Pigment Type, the Italy Organic Pigment Dispersion Market demonstrates strong demand across Azo, Phthalocyanine, Quinacridone, Anthraquinone, and other categories. Azo pigments dominate due to their versatility, cost-effectiveness, and widespread use in printing inks and coatings. Phthalocyanine pigments hold significant share for their excellent stability, brightness, and suitability in plastics and decorative coatings. Quinacridone pigments gain traction in high-performance applications requiring superior lightfastness and weather resistance. Anthraquinone pigments maintain niche applications in textiles and specialty industries, while the “Others” category supports growth through new eco-friendly and bio-based dispersions. It reflects a balanced portfolio where performance, cost, and sustainability guide choices.

- For example, SIOF S.p.A., an Italian pigment manufacturer based in Pozzolo Formigaro, introduced its SolidFlow process in 2024 to produce granular pigments with very high pigment content. The process is designed to significantly reduce energy consumption compared to conventional dispersion methods and is powered using electricity from the company’s photovoltaic systems.

By Application, the Italy Organic Pigment Dispersion Market is shaped by key industries such as printing inks, paints and coatings, plastics and polymers, textiles, cosmetics, and other emerging sectors. Printing inks remain essential, driven by demand in packaging and labeling with high-color accuracy needs. Paints and coatings account for a large share, supported by construction, automotive, and decorative markets. Plastics and polymers rely on pigments for consistent coloration and durability across consumer and industrial products. Textiles benefit from dispersions that enhance dyeing performance and colorfastness. Cosmetics increasingly adopt organic pigments for safety and compliance in formulations. It shows consistent application diversity that supports market resilience.

- For example, ICEA (Istituto per la Certificazione Etica ed Ambientale) is Italy’s leading certifier for eco-bio cosmetics, conducting strict ingredient and finished product controls to guarantee safety, dermo-compatibility, and environmental sustainability.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Northern Italy Driving Market Expansion With Strong Industrial Base

Northern Italy holds the largest share of the Italy Organic Pigment Dispersion Market at 45%. The region benefits from its established industrial clusters in Lombardy, Emilia-Romagna, and Veneto. Paints, coatings, and plastics manufacturers drive significant consumption of organic pigment dispersions. It is supported by strong export activity in automotive, packaging, and machinery. Research collaborations with universities and chemical hubs foster innovation in eco-friendly dispersions. Regulatory compliance and advanced infrastructure sustain Northern Italy’s leadership in this market.

Central Italy Supporting Growth Through Printing and Packaging Industries

Central Italy accounts for 30% of the market share, with Tuscany and Lazio playing key roles. Strong growth in printing inks and packaging applications sustains demand for pigment dispersions. It benefits from the concentration of publishing houses, textile producers, and cosmetic brands. The adoption of high-performance and safe dispersions supports consumer-driven industries. Government sustainability initiatives encourage manufacturers to use eco-compliant pigments. This balance between tradition and innovation strengthens Central Italy’s market contribution.

Southern Italy and Islands Emerging With Rising Manufacturing Activity

Southern Italy, including Sicily and Sardinia, represents 25% of the Italy Organic Pigment Dispersion Market. It shows steady growth due to expanding food packaging, textile, and construction sectors. Demand for cost-effective dispersions supports small and medium enterprises in the region. It is also influenced by growing agricultural exports that rely on packaging pigments. Infrastructure development projects create new opportunities for pigment-based coatings. Rising interest in sustainable practices positions the South as a potential growth hub.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Clariant AG

- Heubach GmbH

- Lanxess AG

- Venator Materials PLC

- Cabot Corporation

- Ferro Corporation

- DIC Corporation

- Sudarshan Chemical Industries

- Heubach Group

Competitive Analysis

The Italy Organic Pigment Dispersion Market features strong competition among global and regional companies. BASF SE, Clariant AG, Heubach GmbH, and Lanxess AG dominate with broad product portfolios and advanced technologies. It is also shaped by Venator Materials, Cabot Corporation, and Ferro Corporation, which focus on serving packaging, plastics, and coatings industries. DIC Corporation and Sudarshan Chemical Industries strengthen their presence through cost-effective and customized pigment solutions. Heubach Group enhances competition by emphasizing sustainable and high-performance products. Companies compete on innovation, regulatory compliance, and color quality to secure contracts with automotive, textile, and packaging firms. Strategic expansions, acquisitions, and product launches remain core tactics to maintain leadership in this market.

Recent Developments

- In March 2025, Cologne-based specialty chemicals company LANXESS unveiled a comprehensive portfolio of water-based pigment dispersions for the paints and coatings sector at the European Coatings Show (ECS) in Nuremberg. The showcased range included Levanyl (organic) and Levanox (inorganic) dispersions, recognized for their superior color strength and low viscosity, as well as enhanced environmental credentials.

- In March 2025, Venator launched the TIOXIDE® TR81 pigment, an advanced and sustainable solution that eliminates trimethylolpropane (TMP) and trimethylolethane (TME) from its titanium dioxide pigment formulation.

- In November 2023, Heubach GmbH expanded its cooperation with TER Chemicals to include inorganic colored pigments, anti-corrosion pigments, and pigment preparations in Germany and Austria. This partnership aims to enhance product availability for coatings and related applications.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Italy Organic Pigment Dispersion Market will see expanding demand across packaging, coatings, and plastics industries.

- Sustainability initiatives will encourage broader adoption of eco-friendly and bio-based pigment dispersions.

- Automotive applications will grow with rising need for durable, UV-resistant, and high-gloss pigment formulations.

- Digital printing advancements will increase reliance on precise and high-quality pigment dispersions.

- Regulatory support in Italy will shape long-term opportunities for safe and compliant pigment technologies.

- Research in nanotechnology will open pathways for high-performance dispersions with superior color stability.

- Cosmetics and textiles will emerge as promising segments, driving consumption of non-toxic pigments.

- Regional manufacturers will expand capabilities to compete against imports and secure niche markets.

- Collaborations between pigment producers and universities will strengthen innovation pipelines in Italy.

- Expanding exports of Italian manufactured goods will support pigment dispersion demand across global markets.