Market Overview:

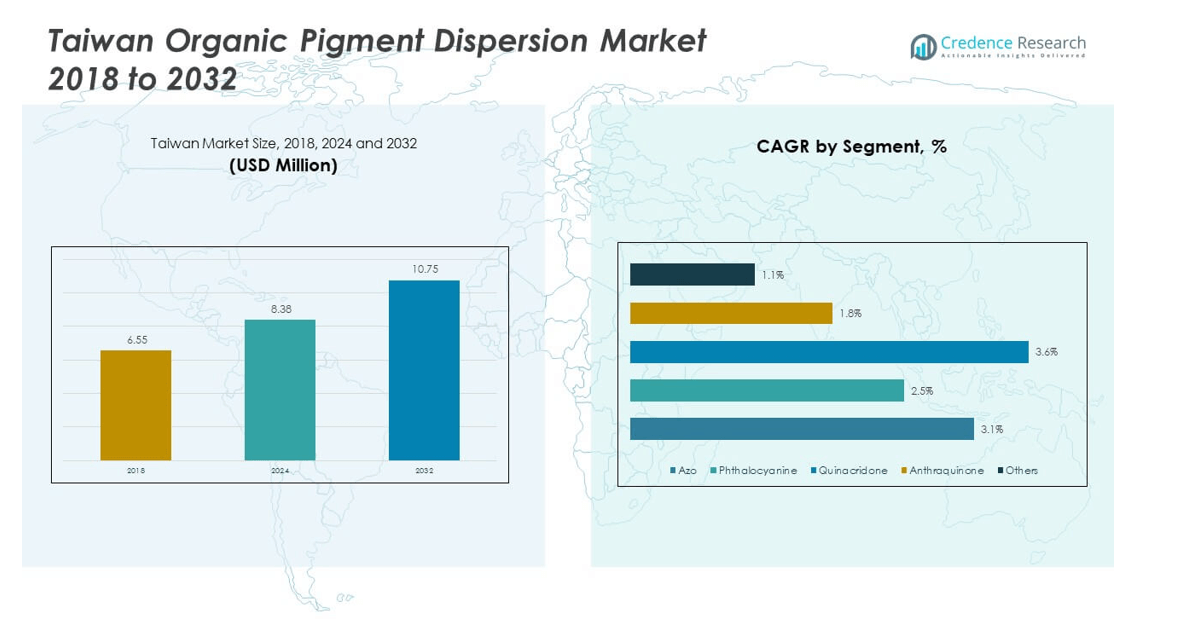

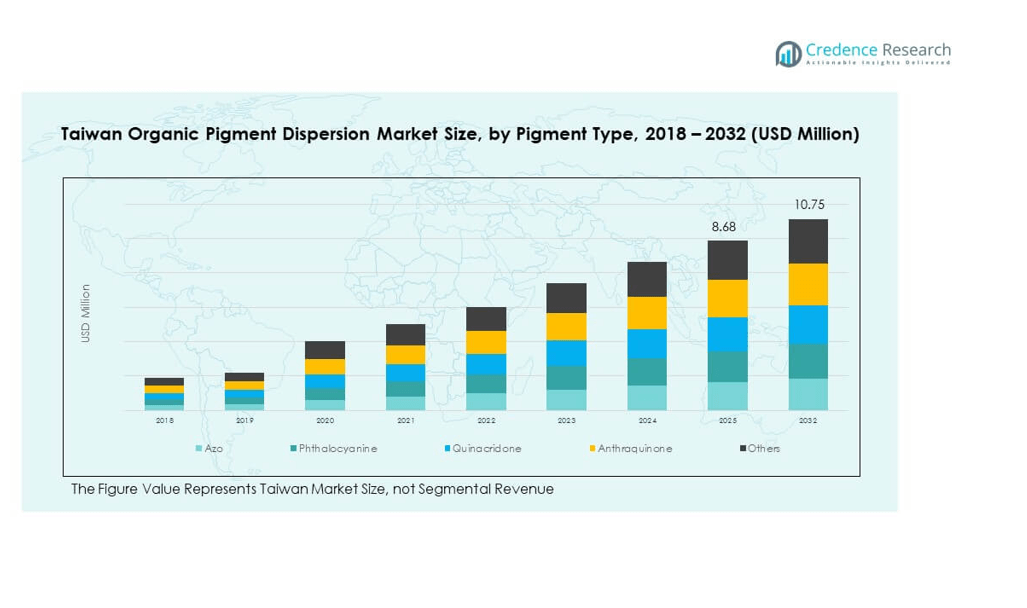

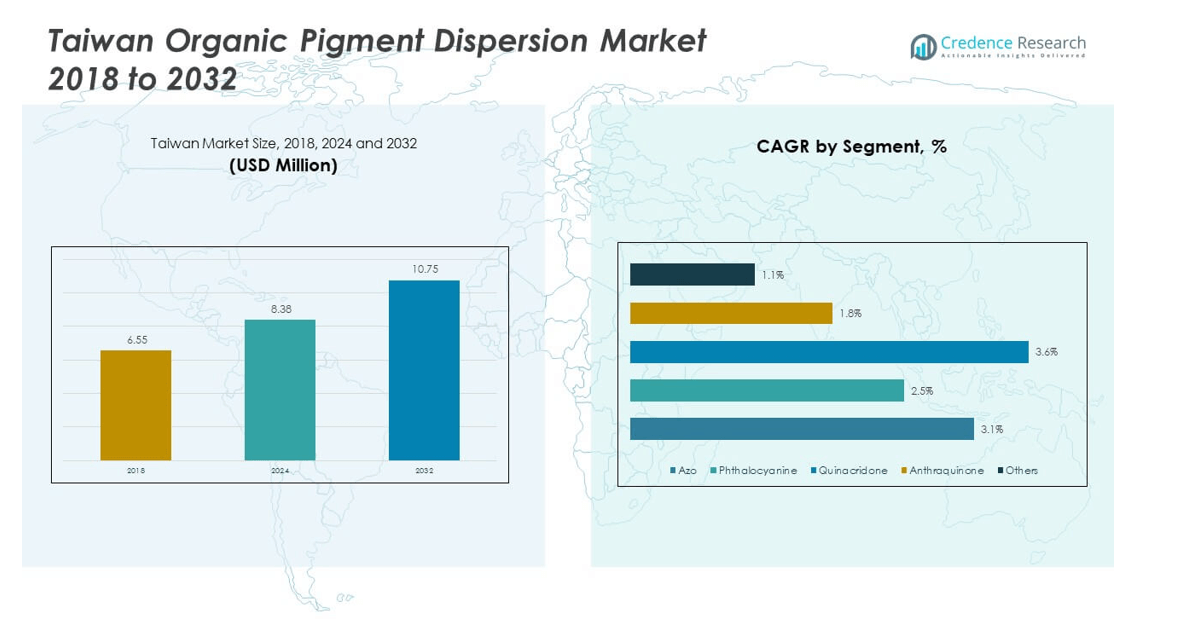

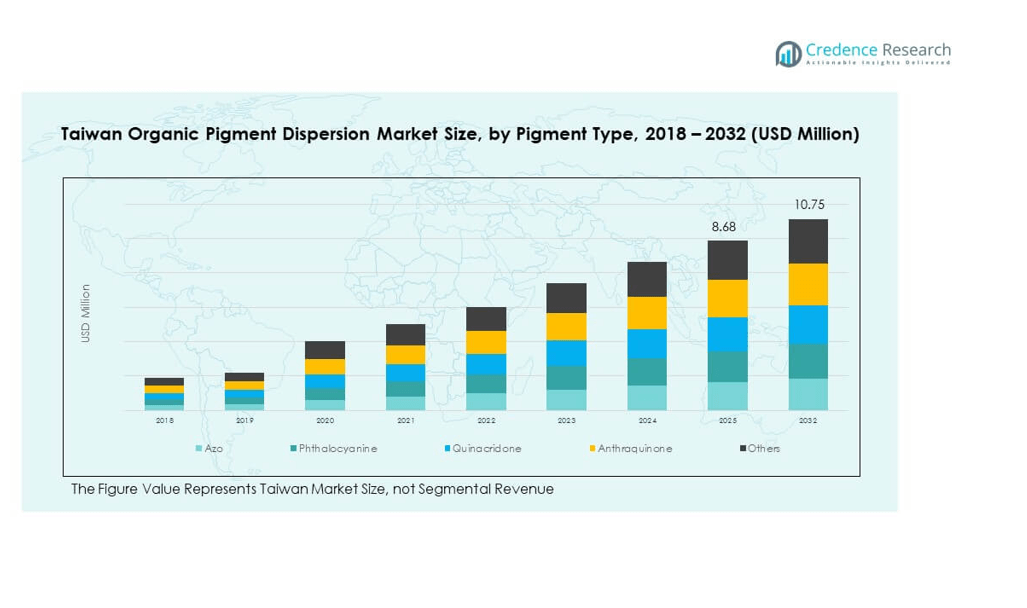

The Taiwan Organic Pigment Dispersion Market size was valued at USD 6.55 million in 2018 to USD 8.38 million in 2024 and is anticipated to reach USD 10.75 million by 2032, at a CAGR of 3.10% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Taiwan Organic Pigment Dispersion Market Size 2024 |

USD 8.38 million |

| Taiwan Organic Pigment Dispersion Market, CAGR |

3.10% |

| Taiwan Organic Pigment Dispersion Market Size 2032 |

USD 10.75 million |

Growth in the Taiwan Organic Pigment Dispersion Market is supported by rising demand across packaging, printing, textiles, and plastics industries. Strong adoption in packaging and printing inks highlights the need for consistent color performance and sustainability. Textiles and plastics rely on dispersions for durability, colorfastness, and compatibility with advanced processing techniques. Increasing consumer preference for eco-friendly and non-toxic materials further strengthens the market. Innovation in pigment formulations, supported by technological improvements in milling and dispersion processes, enhances product quality. Demand for high-performance pigments in automotive and electronics also contributes to expansion.

Regionally, Taiwan benefits from strong industrial clusters that support both domestic consumption and exports. Northern Taiwan leads with demand from packaging, coatings, and electronics due to its industrial hubs and trade networks. Central Taiwan plays an important role through its textile and plastics industries, driving steady adoption of dispersions. Southern Taiwan contributes with heavy industries, petrochemicals, and growing packaging needs. Emerging markets in Southeast Asia also create opportunities for Taiwan through export-driven trade. This geographic distribution ensures balanced growth and strengthens the country’s position in the wider Asia Pacific pigment dispersion value chain.

Market Insights

- The Taiwan Organic Pigment Dispersion Market was valued at USD 6.55 million in 2018, reached USD 8.38 million in 2024, and is projected to hit USD 10.75 million by 2032 at a CAGR of 3.10%.

- Northern Taiwan leads with 46% share due to strong packaging, coatings, and electronics industries, while Central Taiwan holds 32% supported by textiles and plastics, and Southern Taiwan accounts for 22% driven by petrochemicals and industrial demand.

- Northern Taiwan remains the fastest-growing subregion with its 46% share, supported by advanced infrastructure, trade integration, and high industrial concentration.

- Printing inks dominate applications with 34% share, driven by demand in packaging and labeling across multiple industries.

- Paints and coatings account for 27% share, reflecting strong use in construction, automotive, and industrial applications.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Growing Demand from Packaging and Coatings Applications

The Taiwan Organic Pigment Dispersion Market benefits strongly from rising demand in packaging and coatings. Packaging manufacturers seek organic dispersions for their high color strength, excellent consistency, and reduced environmental footprint. It supports increasing use in flexible packaging, food containers, and consumer goods packaging. Coatings industries adopt dispersions to enhance durability, gloss retention, and resistance to harsh environmental conditions. Strong integration with printing inks further fuels adoption in high-quality graphics and labels. Consumer expectations for vibrant colors and sustainable finishes encourage wider market penetration. Rising industrial production and trade activities ensure steady consumption in these sectors. The stable outlook in packaging and coatings secures long-term growth momentum.

- For example, BASF’s Joncryl® FLX pigment dispersions, including grades such as FLX 5000 and FLX 5060, are zero-VOC, water-based solutions developed for flexible packaging. According to BASF’s technical literature, they support high-performance, durable inks suitable for both surface and reverse laminated printing applications.

Expansion in the Textile and Plastics Industry

Textiles and plastics industries play a vital role in driving pigment dispersion demand across Taiwan. The Taiwan Organic Pigment Dispersion Market gains traction from apparel manufacturers who prioritize colorfastness and uniform dyeing performance. It ensures consistency across synthetic fabrics and technical textiles. Plastics manufacturers rely on dispersions to deliver improved weather resistance and appealing aesthetics in consumer goods. Rising demand for plastic packaging, toys, and automotive parts strengthens usage. Innovations in polymer compatibility boost product versatility in multiple applications. Consumer preference for eco-friendly and safe materials further pushes adoption. Growing exports of plastic and textile products expand demand at the regional level. This strong industrial base supports market resilience.

- For example, Heubach Group’s Colanyl® 500 range, including Colanyl Orange H5GD 500, offers binder-free, waterborne pigment dispersions designed for high lightfastness and long-term stability with a 24-month shelf life. The series is APEO-free, low-VOC, and provides broad compatibility for coatings applications, as confirmed in Heubach’s technical literature.

Shift Toward Eco-Friendly and Non-Toxic Formulations

Growing environmental concerns accelerate the shift toward eco-friendly pigment dispersions in Taiwan. The Taiwan Organic Pigment Dispersion Market aligns with sustainability initiatives promoting non-toxic and biodegradable formulations. It provides manufacturers with solutions that reduce hazardous emissions and improve workplace safety. Regulatory frameworks encourage adoption of dispersions with lower VOC levels and safer ingredients. Growing consumer awareness of product safety in packaging and textiles fuels acceptance. Demand for water-based dispersions continues to expand across various industries. This creates new product development opportunities focused on green chemistry. Long-term adoption is sustained by alignment with global sustainability goals and export requirements. The eco-friendly focus builds a strong competitive advantage.

Technological Advancements in Dispersion Processes

Continuous improvement in manufacturing processes strengthens the performance of pigment dispersions. The Taiwan Organic Pigment Dispersion Market benefits from advanced grinding, milling, and dispersing technologies that deliver finer particle sizes and stable suspensions. It ensures higher opacity, better dispersibility, and superior color intensity across applications. Automation in production enhances precision and reduces variability. Integration of digital monitoring systems allows manufacturers to maintain consistency and optimize efficiency. These technological upgrades reduce production costs and improve scalability. Strong investment in R&D supports the development of high-performance dispersions tailored for specialized industries. Increasing collaboration between local producers and international suppliers accelerates innovation. Such advancements create higher product value and market competitiveness.

Market Trends

Adoption of High-Performance Pigments for Niche Applications

The Taiwan Organic Pigment Dispersion Market witnesses rising adoption of high-performance pigments in niche applications. Electronics and automotive sectors seek dispersions offering superior heat stability and weather resistance. It provides manufacturers with advanced solutions for coatings on high-value products. Growing use in functional textiles expands opportunities for durable and vibrant finishes. Specialty inks in packaging and security printing adopt dispersions for improved longevity. The rise of branded consumer goods also drives demand for premium finishes. Industry stakeholders prioritize dispersions capable of performing in complex conditions. This trend highlights the market’s shift toward performance-driven innovation.

Integration with Advanced Printing and Digital Technologies

The integration of organic pigment dispersions with advanced printing technologies reshapes industrial adoption. The Taiwan Organic Pigment Dispersion Market benefits from digital printing’s growth in textiles, packaging, and signage. It enables quick color changes, higher customization, and lower production waste. Manufacturers align with growing e-commerce and retail branding needs through vibrant designs. Inkjet technologies expand the scope for dispersions compatible with water-based systems. It improves efficiency in high-speed printing applications and lowers operational costs. Adoption of dispersions in 3D printing opens emerging opportunities. These innovations reflect the alignment of pigments with digital transformation across industries.

- For example, Sun Chemical’s Streamline inkjet ink technologies are designed for wide-format printers, featuring low-odor chemistry and compatibility with major printhead brands such as Ricoh and Epson. They are tailored for wide-format and textile digital printing applications, as highlighted in Sun Chemical’s product literature.

Increased Focus on Functional and Smart Pigments

Functional and smart pigments drive a new phase of market adoption across Taiwan. The Taiwan Organic Pigment Dispersion Market responds to rising demand for UV-resistant, thermochromic, and luminescent pigments. It creates unique opportunities in automotive coatings, electronics, and smart packaging. Growing consumer interest in interactive product designs supports expansion in retail-focused applications. Manufacturers emphasize dispersions that combine aesthetics with protective properties. This includes resistance against chemicals, heat, and sunlight exposure. It offers value-added advantages for industries targeting premium and durable finishes. The push for multifunctional pigments demonstrates an evolution from standard applications to advanced solutions.

- For example, Clariant’s Hostatint A 100-ST range is a highly transparent pigment preparation line designed for industrial coatings. According to Clariant’s official releases, these preparations are halogen-free and suitable for durable applications in sectors such as automotive, electronics, and glass.

Regional Collaboration and Supply Chain Strengthening

Regional integration supports continuous growth of pigment dispersions across Taiwan. The Taiwan Organic Pigment Dispersion Market benefits from collaboration with neighboring countries that dominate raw material and technological inputs. It provides access to high-quality intermediates and advanced dispersion systems. Strong trade ties with China, Japan, and South Korea ensure supply stability. Manufacturers leverage these partnerships to expand exports to Southeast Asia. Supply chain improvements enhance competitiveness against global producers. Taiwan’s domestic players integrate with regional hubs to strengthen innovation and efficiency. These collaborations ensure balanced growth and stronger market presence.

Market Challenges Analysis

High Production Costs and Raw Material Volatility

The Taiwan Organic Pigment Dispersion Market faces challenges from rising production costs and raw material price fluctuations. It depends on stable supply of intermediates, which are often influenced by global petrochemical trends. Frequent cost changes impact profitability and pricing flexibility. Smaller manufacturers find it difficult to sustain competitiveness against larger global players. Compliance with environmental regulations further increases operational expenses. Market participants struggle to balance innovation with affordability in this context. The volatility reduces long-term planning efficiency and investment confidence. This persistent challenge shapes pricing strategies across the value chain.

Intense Global Competition and Technological Barriers

Competitive pressure from international producers limits growth opportunities for local players. The Taiwan Organic Pigment Dispersion Market competes with established suppliers in China, Japan, and Europe that dominate global pigment technologies. It creates barriers for smaller firms with limited R&D budgets. Technological expertise in high-performance and smart pigments remains concentrated among leading global players. Domestic companies face challenges in scaling innovations while ensuring cost efficiency. Intellectual property restrictions restrict easy transfer of advanced technologies. Limited access to high-end processing equipment slows competitive progress. The competitive intensity makes differentiation and sustained market presence difficult.

Market Opportunities

Growth in Sustainable and Bio-Based Dispersions

The Taiwan Organic Pigment Dispersion Market holds significant opportunities in developing bio-based and sustainable products. It responds to strong regional and global demand for safer and eco-friendly materials. Expanding adoption in packaging, food contact applications, and consumer goods highlights potential. Manufacturers can invest in bio-based intermediates to reduce dependency on petrochemical inputs. Growing export requirements for green products enhance opportunities in developed markets. Collaboration with academic and research institutions accelerates product innovation. Strong alignment with sustainability policies ensures long-term adoption. This shift opens new pathways for differentiation and market expansion.

Rising Applications in Advanced Manufacturing Sectors

Emerging applications in electronics, automotive, and specialty coatings offer promising opportunities. The Taiwan Organic Pigment Dispersion Market benefits from the country’s strong presence in electronics manufacturing. It enables dispersions to support advanced displays, circuit boards, and durable coatings. Automotive industries adopt dispersions for weather-resistant finishes and decorative features. Growth in smart textiles creates new demand channels. Manufacturers focusing on advanced functional pigments can strengthen regional export opportunities. Collaboration with global technology companies further enhances adoption. These advanced sectors provide high-value opportunities for future growth and competitiveness.

Market Segmentation Analysis

By pigment type, the Taiwan Organic Pigment Dispersion Market demonstrates strong demand across multiple categories. Azo pigments account for a significant share due to their cost efficiency, wide color range, and broad use in printing inks and plastics. Phthalocyanine pigments dominate high-performance applications with excellent stability, weather resistance, and vibrant shades. Quinacridone pigments serve premium coatings and textiles where superior durability and brilliance are essential. Anthraquinone pigments provide unique hues for specialized applications, while the “Others” category covers emerging formulations catering to niche demands. The diverse pigment portfolio ensures balanced growth across industries and enhances market competitiveness.

- For example, Sun Chemical has developed surface treatment technologies for phthalocyanine pigments to improve dispersion stability in water-based systems. The company reports that its enhanced pigment dispersions deliver strong weathering and lightfastness performance for use in automotive coatings.

By application, the Taiwan Organic Pigment Dispersion Market is led by printing inks, which hold the largest share due to strong adoption in packaging and labeling. It supports high-quality graphics and consistent color performance in flexible packaging, a key sector in Taiwan’s export-driven economy. Paints and coatings represent another major segment, supported by construction, automotive, and industrial uses. Plastics and polymers rely on dispersions for aesthetic appeal and performance, while textiles adopt them for colorfastness and eco-friendly processing. Cosmetics form a smaller but growing segment, driven by consumer preference for safe and vibrant formulations. The “Others” category reflects opportunities in specialty applications across electronics and functional materials.

- For example, Lubrizol’s Diamond Dispersions™ brand provides water-based pigment dispersions developed for digital textile printing, including solutions targeting the direct-to-film (DTF) market. In June 2025, Lubrizol highlighted innovative pigment dispersions for DTF applications, focusing on consistent print quality and reliable performance for large-scale textile production.

Segmentation

By Pigment Type

- Azo

- Phthalocyanine

- Quinacridone

- Anthraquinone

- Others

By Application

- Printing Inks

- Paints & Coatings

- Plastics & Polymers

- Textiles

- Cosmetics

- Others

Regional Analysis

Northern Taiwan

Northern Taiwan dominates the Taiwan Organic Pigment Dispersion Market with a market share of 46%. The region benefits from strong industrial concentration in Taipei, New Taipei, and Taoyuan, where packaging, printing, and electronics industries are highly developed. It supports high consumption of dispersions in inks, coatings, and specialty applications. Export-driven activities and proximity to major ports strengthen trade competitiveness. The region also benefits from research institutions that enhance product innovation. It remains the most attractive subregion for both domestic and global players. The high level of infrastructure ensures stable demand across multiple industries.

Central Taiwan

Central Taiwan accounts for 32% share of the Taiwan Organic Pigment Dispersion Market. The subregion supports textile, plastics, and automotive supply chains, making dispersions vital for coloring and coating processes. Taichung and nearby areas have developed manufacturing bases that rely on high-performance pigments. It serves both local demand and export opportunities, particularly in functional textiles. Strong SME presence drives steady adoption of cost-effective dispersions. The region also emphasizes eco-friendly pigments due to rising environmental awareness. Industrial diversification across polymers and coatings ensures consistent growth.

Southern Taiwan

Southern Taiwan contributes 22% of the Taiwan Organic Pigment Dispersion Market. The region is supported by Kaohsiung and Tainan, known for petrochemicals, plastics, and heavy industries. It provides a stable demand base for dispersions in industrial coatings and plastic manufacturing. Emerging use in packaging and consumer goods industries further enhances regional consumption. The strong port infrastructure facilitates exports, supporting Taiwan’s role in regional pigment trade. Focus on advanced pigment processing and compliance with sustainability standards strengthens competitiveness. The subregion remains vital for balancing domestic supply and international trade flows.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- Cheng Feng Group

- Crown Color Technology Co., Ltd.

- Taiwan Dyestuffs & Pigments

- Colorwen

- Tah Kong Chemical Industrial Corp.

Competitive Analysis

The Taiwan Organic Pigment Dispersion Market features a mix of multinational corporations and established domestic players. BASF SE remains a global leader with advanced R&D capabilities and a diversified product portfolio that strengthens its presence in Taiwan. Local companies such as Cheng Feng Group, Crown Color Technology Co., Ltd., and Taiwan Dyestuffs & Pigments hold significant market positions by serving regional industries with cost-effective solutions and customized formulations. It benefits from their ability to respond quickly to local demand and regulatory requirements. Colorwen and Tah Kong Chemical Industrial Corp. expand their reach through specialty pigment offerings and strong ties with Taiwan’s plastics, coatings, and packaging sectors. Competition is shaped by product innovation, environmental compliance, and regional trade dynamics. Strategic moves include new product launches, capacity expansion, and partnerships with downstream manufacturers. The competitive environment continues to balance global innovation with local expertise, ensuring steady market resilience.

Recent Developments

- In August 2025, BASF SE relocated its Taiwan office to a new site in Taipei, establishing a strategic base for its global Electronic Materials business unit and deepening its commitment to the Taiwan market. This move allows BASF to deliver innovative, sustainable solutions and foster closer collaboration with key customers in the semiconductor and pigments sector while supporting growth in engineering plastics and specialty chemicals for Taiwan’s industries.

- In July 2025, Sun Chemical, a wholly owned subsidiary of DIC Corporation, launched a new effect pigment called Chione Electric Amber SB90D, expanding its Chione Electric product line with a shimmering amber hue. This pigment is designed for vegan beauty products in cosmetics, skin, and sun care, offering enhanced chroma, UV stability, and non-staining properties.

Report Coverage

The research report offers an in-depth analysis based on Pigment Type and Application. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Taiwan Organic Pigment Dispersion Market will expand steadily due to sustained demand from packaging and coatings.

- Rising use in textiles and plastics will create new opportunities across consumer and industrial applications.

- Eco-friendly dispersions will gain traction as regulations and consumer preferences emphasize sustainability.

- Advanced pigment types such as high-performance and smart pigments will strengthen specialized applications.

- Investments in digital and inkjet printing technologies will accelerate market penetration in packaging and signage.

- Regional trade integration will enhance Taiwan’s export potential, especially toward Southeast Asian economies.

- Ongoing R&D will support development of dispersions with improved resistance, dispersibility, and functional performance.

- Collaborations between domestic and multinational companies will drive technological transfer and innovation.

- Expansion in electronics and automotive industries will foster new pigment applications with higher durability.

- Competitive focus on bio-based products will differentiate market players and open premium growth channels.