Market Overview

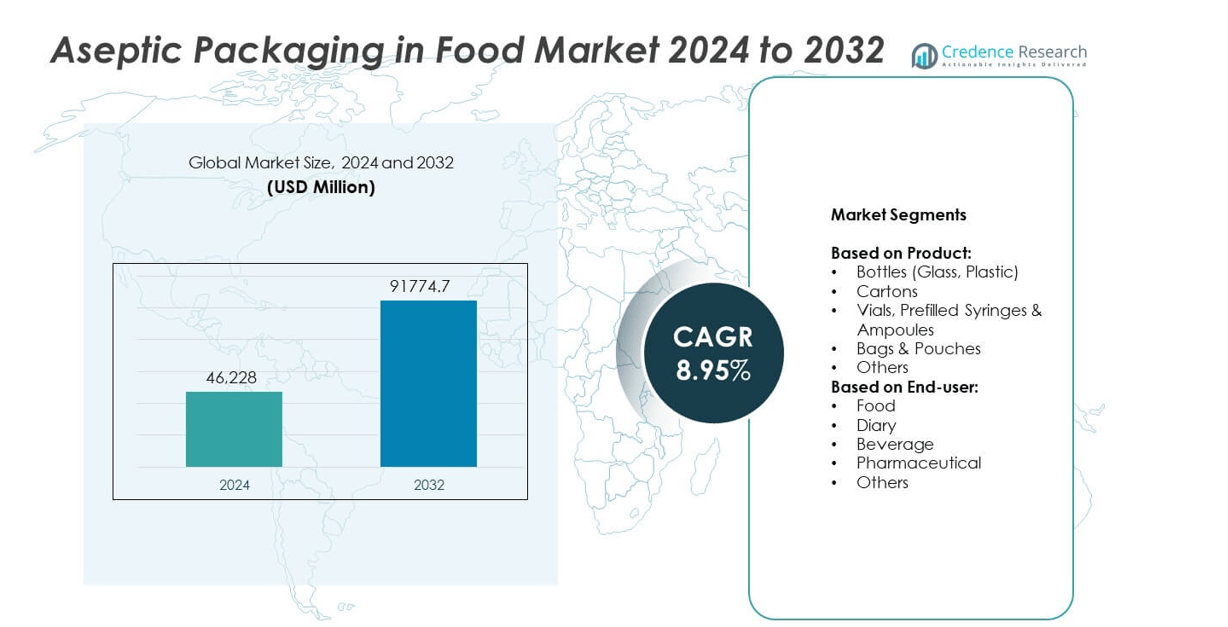

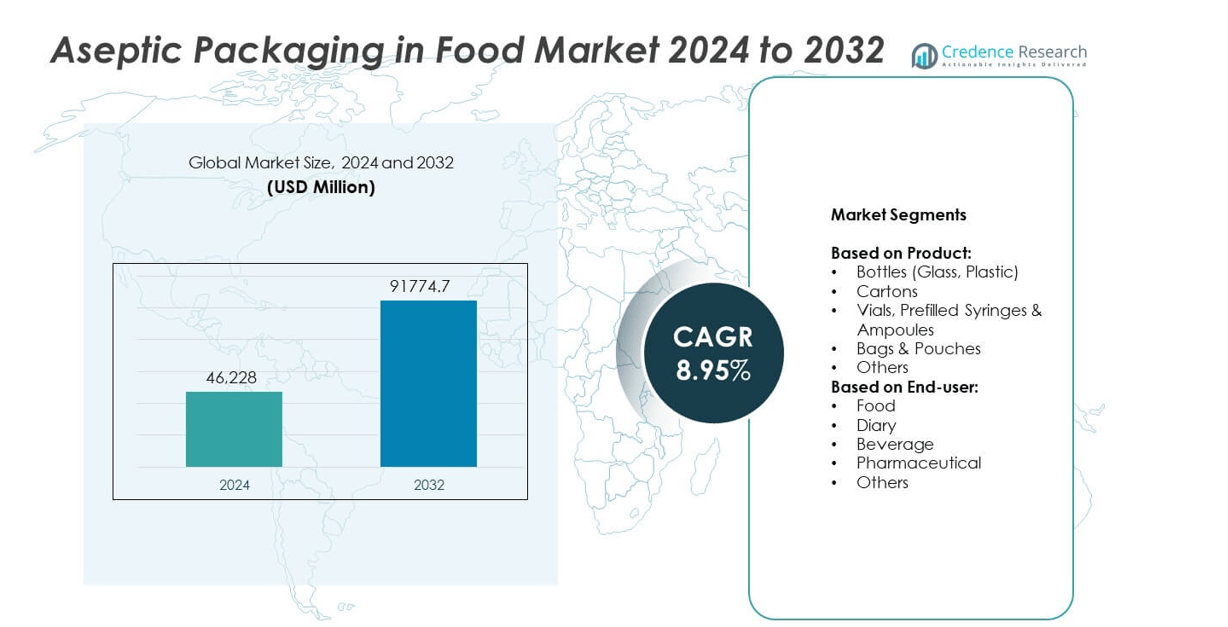

Aseptic Packaging in Food Market size was valued at USD 46,228 million in 2024 and is expected to reach USD 91,774.7 million by 2032, growing at a CAGR of 8.95% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aseptic Packaging in Food Market Size 2024 |

USD 46,228 million |

| Aseptic Packaging in Food Market, CAGR |

8.95% |

| Aseptic Packaging in Food Market Size 2032 |

USD 91,774.7 million |

The aseptic packaging in food market grows with rising demand for shelf-stable and convenient products. Consumers prefer preservative-free options, driving adoption of advanced sterilization techniques. Manufacturers focus on recyclable and lightweight materials to meet sustainability goals. Smart packaging and automation improve quality control and efficiency. Expanding use in plant-based beverages and ready-to-eat meals supports market penetration. Strict food safety regulations accelerate adoption across regions. Innovation in filling lines enables higher production capacity and consistent product quality.

North America leads the aseptic packaging in food market with strong adoption in dairy, beverages, and ready-to-eat meals. Europe follows with high demand for sustainable and recyclable packaging solutions. Asia-Pacific shows fastest growth driven by urbanization and rising consumption of packaged food. Latin America and Middle East & Africa expand steadily with increasing investments in food safety and processing facilities. Key players shaping the market include Tetra Pak, SIG Combibloc, Amcor, and Mondi Group, focusing on innovation and capacity expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The aseptic packaging in food market was valued at USD 46,228 million in 2024 and is expected to reach USD 91,774.7 million by 2032, growing at a CAGR of 8.95% during 2025–2032.

- Rising demand for shelf-stable food, dairy, and beverages is driving adoption of aseptic packaging solutions across industries.

- Trends include the use of lightweight, recyclable materials and growth in plant-based and functional beverage segments.

- Competition is shaped by key players like Tetra Pak, SIG Combibloc, Amcor, Mondi Group, and Sealed Air Corporation focusing on innovation and sustainability.

- High initial setup costs and technical complexity of sterile infrastructure act as restraints for small and mid-sized manufacturers.

- North America leads growth with strong demand from dairy and ready-to-drink products, while Asia-Pacific shows fastest expansion with urbanization and retail growth.

- Focus on digital monitoring, automation, and sustainable materials is expected to drive future investments and create new opportunities for packaging suppliers.

Market Drivers

Rising Demand for Shelf-Stable and Convenient Food Products

Aseptic Packaging in Food market grows with demand for products that require no refrigeration. Consumers prefer ready-to-eat meals, dairy alternatives, and beverages with longer shelf life. It helps maintain nutritional value and taste without chemical preservatives. The technology supports transportation and storage in regions with limited cold chain infrastructure. Urban lifestyles and rising disposable income encourage purchases of packaged food with extended usability. This demand pushes manufacturers to adopt aseptic solutions to meet consumer expectations.

- For instance, SIG launched the SIG Terra Alu-free + Full barrier aseptic carton material, a 1-liter carton pack now available in Germany. It is made of over 80% paper, removes the aluminum layer, and yields the same shelf life.

Technological Advancements in Filling and Packaging Equipment

Continuous improvements in aseptic filling lines boost production efficiency and safety. Automation and robotics reduce human intervention and contamination risks. It ensures consistent sealing and sterilization across large batches. Advanced equipment lowers downtime and supports higher throughput for food producers. Manufacturers integrate digital monitoring systems for better quality control. These innovations make aseptic packaging cost-effective and reliable for mass-scale food processing.

- For instance, Sidel operates an aseptic PET bottle line in Fischbach that fills 18,000 bottles per hour for 0.5 L formats, and can handle 1 L and 1.5 L formats on the same line.

Growing Focus on Food Safety and Regulatory Compliance

Strict food safety regulations drive adoption of aseptic processes to prevent contamination. Regulatory agencies promote sterilized packaging to reduce foodborne illnesses. It helps producers meet standards set by international food authorities. Compliance builds trust among retailers and consumers in high-growth markets. Companies invest in validated sterilization methods to avoid product recalls. This regulatory push strengthens the overall market penetration of aseptic packaging.

Sustainability and Reduced Food Waste Initiatives

The market benefits from demand for eco-friendly solutions and waste reduction. Aseptic packaging minimizes spoilage and extends product life, reducing food loss. It supports global efforts to cut greenhouse gas emissions from wasted food. Lightweight and recyclable materials lower transportation costs and carbon footprint. Brands leverage sustainable packaging to align with corporate ESG goals. This shift improves brand image and attracts environmentally conscious consumers.

Market Trends

Adoption of Smart and Connected Packaging Solutions

Aseptic Packaging in Food market witnesses rising adoption of IoT-enabled packaging systems. Smart sensors track temperature and pressure throughout the supply chain. It improves visibility for manufacturers and ensures compliance with safety standards. Data analytics help detect potential failures early and optimize operations. This trend supports predictive maintenance of packaging equipment. Brands use connected packaging to enhance traceability and build consumer trust.

- For instance, While Elopak offers a range of filling machines with various speeds, a single platform does not apply to all of them, and some exceed this speed, the E-PS120A aseptic filling machine has an output of up to 12,000 cartons per hour. However, another machine, the S-PSF140UC, can fill up to 14,000 cartons per hour. The company also has other fillers with different capacities, such as the S-PS65 that runs at 6,500 cartons per hour.

Shift Toward Lightweight and Recyclable Materials

Manufacturers focus on lightweight cartons, pouches, and bottles to lower environmental impact. Aseptic packaging benefits from recyclable and renewable materials that meet sustainability targets. It reduces transportation costs while maintaining product integrity. Innovation in bio-based polymers supports companies seeking greener alternatives. Packaging suppliers work on multilayer structures with reduced plastic content. This shift aligns with global sustainability regulations and consumer preferences.

- For instance, Tetra Pak introduced its Aseptic Dosing Unit F which handles a dosing range of 0.5–30 litres per hour and product flow from 1,000 to 20,000 litres per hour.

Rising Use in Plant-Based and Functional Beverages

The market grows with demand for plant-based milks, protein drinks, and probiotic beverages. Aseptic Packaging in Food market enables preservation of functional ingredients without refrigeration. It supports product launches targeting health-conscious consumers. Producers leverage aseptic systems to extend shelf life without additives. Premium beverage brands choose aseptic formats to maintain natural taste and color. This trend expands opportunities for beverage innovation worldwide.

Integration of High-Speed and Flexible Production Lines

Producers invest in high-speed aseptic filling lines to meet growing demand. It reduces downtime and allows quick changeovers between product types. Flexibility supports small-batch production for niche markets. Automation improves consistency and lowers labor costs. Digital control systems enable precise sterilization and filling accuracy. This trend boosts efficiency and helps companies scale production quickly.

Market Challenges Analysis

High Initial Investment and Complex Infrastructure Requirements

Aseptic Packaging in Food market faces challenges from high setup costs for equipment and facilities. Specialized filling lines, sterilization units, and controlled environments require significant capital expenditure. It limits entry for small and mid-sized manufacturers. Maintenance of sterile conditions demands skilled workforce and regular monitoring. Downtime due to technical issues can disrupt supply chains and raise operational costs. These factors make adoption slower for emerging players seeking rapid market entry.

Regulatory Compliance and Material Compatibility Issues

Strict regulatory approvals delay product launches and increase compliance costs. Aseptic packaging materials must be compatible with diverse food products and withstand sterilization. It creates technical complexity in selecting the right packaging format. Frequent updates in global food safety standards require continuous process validation. Non-compliance can lead to product recalls and reputational risks. These challenges push companies to invest in R&D to meet safety and quality expectations.

Market Opportunities

Expansion in Emerging Economies and Untapped Rural Markets

Aseptic Packaging in Food market holds strong potential in developing regions with rising urbanization. Growing middle-class populations drive demand for safe, packaged food and beverages. It enables distribution in rural areas where cold chain infrastructure is limited. Manufacturers can expand presence by offering affordable, shelf-stable products. Government programs supporting food safety and nutrition boost adoption of aseptic technology. These factors open opportunities for market players to scale operations globally.

Innovation in Sustainable and Customizable Packaging Solutions

Demand for eco-friendly and customizable packaging formats creates room for innovation. It encourages development of recyclable, bio-based, and lightweight materials. Brands leverage unique designs to differentiate products and attract premium customers. Smart packaging features like QR codes support consumer engagement and transparency. Collaboration between material suppliers and food producers accelerates commercialization of new solutions. This focus on sustainability strengthens brand reputation and drives long-term growth.

Market Segmentation Analysis:

By Product:

Bottles hold a major share due to their wide use in dairy, juice, and liquid food packaging. Both glass and plastic bottles offer strong barrier properties and convenient handling for consumers. It supports preservation of flavor and nutrients for extended periods without refrigeration. Cartons follow closely, driven by demand for milk, soups, and ready-to-drink beverages. Lightweight structure and recyclability make cartons attractive for brands targeting sustainable packaging goals. Vials, prefilled syringes, and ampoules dominate pharmaceutical applications, ensuring sterility for injectable drugs and nutraceuticals. Bags and pouches are gaining traction for sauces, baby food, and liquid condiments, offering flexibility and space-efficient storage. The “others” category includes niche formats like cups and trays designed for specific product types.

- For instance, KHS’s modular Innofill PET DRV filler achieves an output of up to 90,000 PET bottles per hour.

By End-User:

Food applications dominate the Aseptic Packaging in Food market due to growing consumption of packaged meals, soups, and sauces. It helps manufacturers meet demand for shelf-stable products that do not require preservatives. Dairy remains a strong segment supported by milk, yogurt, and cream producers using aseptic solutions to extend freshness. Beverage applications are expanding with plant-based drinks, coffee, and nutritional beverages adopting aseptic formats for taste and safety retention. Pharmaceutical end-users rely heavily on sterile packaging for parenteral drugs and oral solutions. The “others” segment includes nutraceuticals, baby food, and specialty health products that benefit from extended shelf life. This broad adoption across industries ensures consistent growth opportunities for packaging providers focused on efficiency, sustainability, and compliance.

- For instance, Krones delivered “wet aseptic” filling lines in China capable of more than 48,000 bottles per hour, handling still and carbonated products including milk, tea, coffee and juice.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Product:

- Bottles (Glass, Plastic)

- Cartons

- Vials, Prefilled Syringes & Ampoules

- Bags & Pouches

- Others

Based on End-user:

- Food

- Diary

- Beverage

- Pharmaceutical

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 34% share of the aseptic packaging in food market, supported by strong demand for packaged dairy, ready-to-drink beverages, and convenience foods. The region benefits from advanced processing infrastructure and widespread adoption of automation in packaging facilities. It drives innovation through investments in sustainable and lightweight materials that align with regulatory requirements and consumer preferences. Manufacturers focus on enhancing shelf life while reducing energy use in sterilization processes. It benefits from robust distribution networks and strong presence of leading food and beverage companies. Growth in plant-based and functional drinks further boosts the adoption of aseptic packaging across the United States and Canada.

Europe

Europe accounts for 28% market share, driven by strict food safety regulations and high consumer awareness regarding product quality. Countries such as Germany, France, and the U.K. lead adoption of recyclable and bio-based packaging solutions. It benefits from established dairy and beverage industries that rely on aseptic cartons and bottles for extended shelf life. EU directives encouraging waste reduction and carbon footprint control push companies toward innovative and eco-friendly packaging formats. Demand for premium, clean-label products accelerates carton and pouch usage. Investment in smart packaging technology enhances traceability and supports the growing need for supply chain transparency.

Asia-Pacific

Asia-Pacific commands 25% of the market, emerging as the fastest-growing region due to rising population and urbanization. It experiences strong demand for shelf-stable dairy, baby food, and flavored beverages, especially in China, India, and Southeast Asia. Government programs promoting food safety drive investments in aseptic filling lines and packaging facilities. It benefits from rapid retail sector expansion and increasing disposable incomes. Local producers adopt cost-effective aseptic pouches and cartons to serve rural markets where refrigeration remains limited. Innovation in affordable packaging formats accelerates penetration in mid-tier and value segments.

Latin America

Latin America represents 7% market share, led by Brazil, Mexico, and Argentina with strong dairy and beverage production. It supports demand for milk, juice, and nutritional drink packaging that can withstand long-distance distribution. Regional players invest in localized production facilities to reduce import dependency and costs. It benefits from growing consumption of processed foods as urbanization expands. Cartons and pouches dominate the segment due to affordability and ease of disposal. Rising interest in sustainable packaging offers opportunities for bio-based material suppliers in the region.

Middle East & Africa

Middle East & Africa hold 6% share of the market, driven by rising demand for safe and long-lasting food products. Countries like Saudi Arabia, UAE, and South Africa invest in food security initiatives that encourage aseptic packaging adoption. It allows distribution of milk, juices, and ready meals in arid regions with limited cold chain infrastructure. Demand for compact, lightweight packaging supports cost-efficient imports and storage. Multinational players expand partnerships with local producers to strengthen regional supply chains. Growing health awareness and preference for fortified beverages create additional growth prospects.

Key Player Analysis

Competitive Analysis

The competitive landscape of the aseptic packaging in food market features major players such as Tetra Pak, SIG Combibloc, Elopak, Amcor, Sealed Air Corporation, Greatview Aseptic Packaging, Mondi Group, DS Smith, Smurfit Kappa, and Uflex Ltd. These companies focus on expanding production capacity and enhancing their product portfolios with sustainable and innovative solutions. They invest in research and development to introduce lightweight, recyclable, and bio-based packaging materials. Strategic partnerships with food and beverage manufacturers strengthen their distribution networks and regional presence. Companies emphasize automation and digitalization of aseptic filling lines to improve operational efficiency and product quality. Mergers, acquisitions, and joint ventures help leading players enter new markets and diversify offerings. Continuous focus on reducing carbon footprint and aligning with global sustainability standards drives competition. Manufacturers also compete on cost-effectiveness, reliability, and customization to meet evolving consumer preferences. The market remains moderately consolidated, with global leaders holding significant influence over pricing and technology trends.

Recent Developments

- In 2025, Amcor completed its merger with Berry Global, creating a diversified packaging leader with enhanced capabilities.

- In 2025, SIG unveiled an aluminum-free full-barrier material for aseptic cartons, reducing carbon footprint by up to 61% while maintaining 12-month shelf life

- In 2023, Elopak reported progress in aseptic packaging solutions with new filling machines, cartons, and tethered cap solutions being tested. Expansion in India and plant upgrades in Casablanca were noted.

Report Coverage

The research report offers an in-depth analysis based on Product, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for ready-to-drink and shelf-stable beverages.

- Adoption of sustainable and recyclable materials will grow due to stricter environmental regulations.

- Automation in filling and sealing processes will improve production speed and consistency.

- Demand for plant-based and functional food products will boost aseptic packaging use.

- Investment in digital monitoring and smart packaging will enhance supply chain transparency.

- Flexible pouches and lightweight bottles will gain popularity for cost and storage efficiency.

- Emerging markets will drive growth with rising urbanization and expanding retail networks.

- Pharmaceutical and nutraceutical sectors will increasingly adopt aseptic packaging for sterile products.

- Collaboration between packaging suppliers and food manufacturers will accelerate innovation.

- Consumer preference for preservative-free products will continue to favor aseptic technologies.