Market Overview

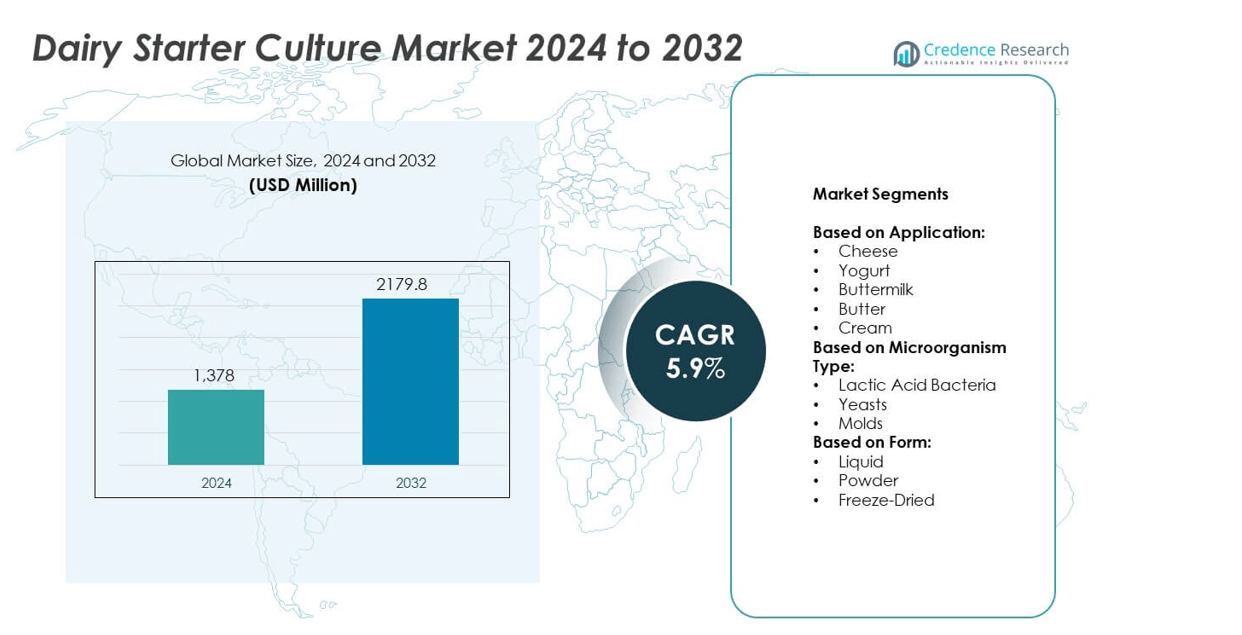

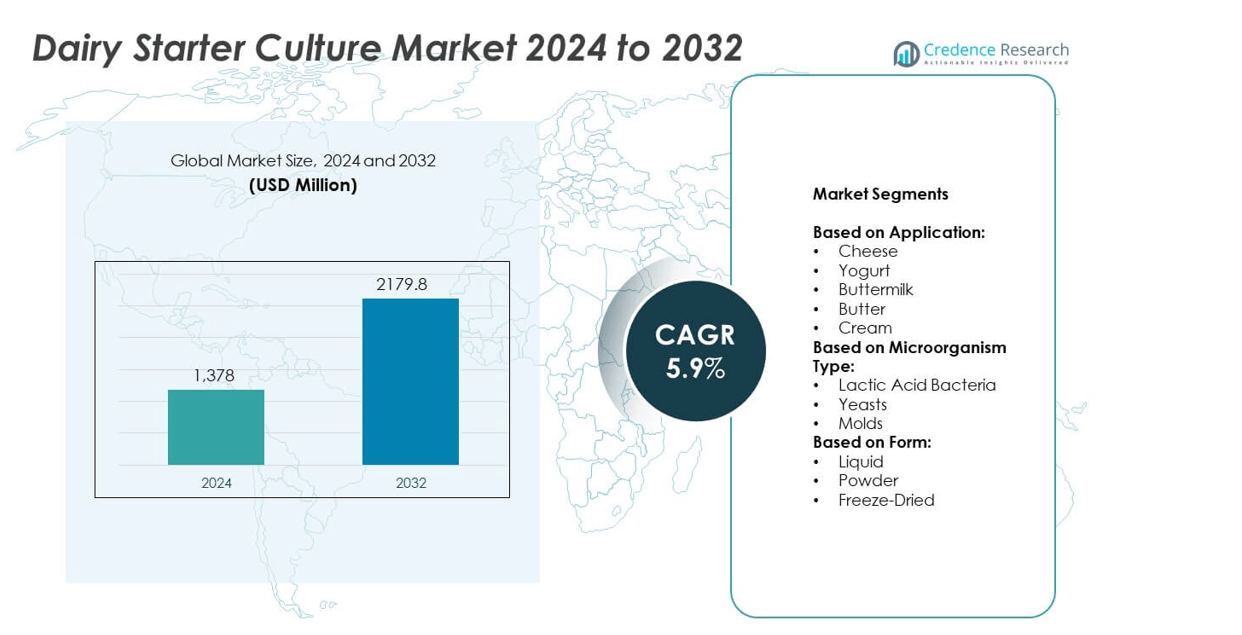

Dairy Starter Culture Market size was valued at USD 1,378 million in 2024 and is anticipated to reach USD 2,179.8 million by 2032, at a CAGR of 5.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Dairy Starter Culture Market Size 2024 |

USD 1,378 million |

| Dairy Starter Culture Market, CAGR |

5.9% |

| Dairy Starter Culture Market Size 2032 |

USD 2,179.8 million |

The Dairy Starter Culture market grows with rising demand for probiotic-rich, clean-label dairy products across global markets. Manufacturers focus on developing stable, multi-strain cultures that enhance product safety, texture, and shelf life. Functional strains offering digestive and immune benefits attract health-conscious consumers. Technological advances in freeze-drying and microencapsulation improve culture performance and storage. The market also benefits from the expanding dairy sector in emerging economies and increased use of customized cultures for regional taste preferences and traditional recipes.

Europe leads the Dairy Starter Culture market due to its strong dairy traditions, advanced processing infrastructure, and demand for high-quality fermented products. North America follows, supported by high yogurt and cheese consumption and innovation in probiotic cultures. Asia-Pacific shows rapid growth driven by urbanization, dietary shifts, and government-backed dairy programs. Latin America and the Middle East & Africa offer growth potential through infrastructure expansion and rising dairy intake. Key players include DuPont, Hansen, Danone, and FrieslandCampina, each focusing on innovation and regional expansion.

Market Insights

- The Dairy Starter Culture market was valued at USD 1,378 million in 2024 and is projected to reach USD 2,179.8 million by 2032, growing at a CAGR of 5.9%.

- Growth is driven by rising demand for probiotic-rich, clean-label, and functional dairy products.

- Trends include adoption of freeze-dried and microencapsulated cultures to improve shelf life and transport.

- Leading players focus on multi-strain innovations, probiotic functionality, and digital fermentation systems.

- Regulatory barriers, cold chain limitations, and strain-specific approvals pose challenges in developing markets.

- Europe dominates due to advanced dairy processing and demand for premium cheese and yogurt; Asia-Pacific grows fastest with increased dairy consumption.

- Companies expand regionally through localization, public-private partnerships, and tailored starter culture blends.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Fermented Dairy Products Across Diverse Consumer Segments

The Dairy Starter Culture market is driven by growing global consumption of fermented dairy products like yogurt, cheese, and buttermilk. Health-conscious consumers seek probiotic-rich foods to support gut health and immunity. Rising awareness of digestive disorders accelerates demand for fermented options. It fuels adoption of starter cultures to standardize taste and ensure microbial safety. The market benefits from increased product launches with functional health claims. Manufacturers focus on incorporating multi-strain cultures to enhance texture and shelf life.

- For instance, Chr. Hansen maintains a collection of approximately 40,000 microbial strains. This large strain library supports its innovations in starter culture performance, bio-protection, and flavor consistency, enabling faster selection and scale-up of new culture blends.

Growing Penetration of Clean-Label and Organic Dairy Products

The shift toward natural and clean-label dairy products strongly influences demand for biological fermentation agents. Consumers reject artificial preservatives and chemical additives, preferring naturally processed alternatives. The Dairy Starter Culture market gains traction through its alignment with organic labeling and minimal processing. It supports claims of authenticity and traditional fermentation processes. Regulatory bodies encourage clean-label transparency, pushing producers to adopt natural culture solutions. Rising consumption of premium and artisanal dairy further drives starter culture use.

- For instance, DuPont Nutrition & Biosciences launched its YO-MIX PRIME culture series (Prime 800 and Prime 900) which allows yogurt makers to cut back on skimmed-milk powder, reduce sugar content while maintaining sweetness perception, and retain quality through fluctuating storage temperatures.

Expansion of Industrial Dairy Processing and Globalization of Dairy Trade

Large-scale dairy production and exports create need for consistent, high-quality fermentation cultures. Manufacturers seek reliable cultures to maintain product uniformity across global supply chains. It ensures microbial stability during long-distance transportation and storage. The Dairy Starter Culture market supports commercial operations by reducing batch variation and spoilage. Increased investment in automated dairy processing lines integrates culture inoculation systems for precision. Global dairy trade liberalization enables rapid adoption of commercialized starter blends.

Supportive Government Nutrition Programs and Fortified Dairy Initiatives

Government-backed nutrition programs in developing countries promote dairy consumption to combat malnutrition. Fortified dairy products, such as vitamin-enriched yogurt, require defined microbial cultures for efficacy. The Dairy Starter Culture market sees rising adoption in public health food supply chains. It plays a critical role in producing safe, nutritious dairy for mass distribution. Policy incentives and subsidies for dairy cooperatives improve accessibility to standardized cultures. Public-private partnerships enhance supply and education around cultured dairy benefits.

Market Trends

Advancements in Freeze-Drying and Microencapsulation Technologies for Culture Stability

Innovations in preservation techniques support the growth of stable, longer-lasting dairy cultures. Freeze-drying enhances shelf stability without compromising strain viability or activity. Microencapsulation protects sensitive cultures from heat and acidity during processing. The Dairy Starter Culture market benefits from these technologies by extending product reach in export-focused markets. It enables producers to reduce refrigeration dependence and improve logistics. These advancements also support customized blends with targeted release properties.

- For instance, as of an August 2021 update, Lallemand operated 9 bacteria plants and 27 yeast facilities worldwide, with one bacteria plant in La Ferté-Sous-Jouarre, France, dedicated to Lallemand Specialty Cultures. The company does operate on 5 continents, with offices and production facilities strategically located to serve its markets.

Rising Popularity of Plant-Based and Lactose-Free Dairy Alternatives

Consumers with lactose intolerance or plant-based preferences demand non-dairy fermented products. This trend encourages development of starter cultures tailored to plant-based substrates like soy, almond, and oats. The Dairy Starter Culture market adapts by offering strains capable of fermenting non-traditional bases. It requires innovation in strain selection and nutrient compatibility to match dairy-like taste and texture. Manufacturers also explore hybrid fermentation techniques to support cleaner flavor profiles. This diversification broadens the culture application scope beyond animal-based dairy.

- For instance, Chr. Hansen specifies that its frozen DVS dairy starter cultures contain at least 1 × 10¹⁰ viable cells per gram, while its freeze-dried DVS cultures guarantee a minimum of 5 × 10¹⁰ viable cells per gram under proper storage.

Increased Emphasis on Functional Strains with Probiotic Properties

Consumers seek dairy products that offer digestive and immune system support. This trend fuels demand for cultures that deliver probiotic benefits beyond fermentation. The Dairy Starter Culture market responds by incorporating strains like Lactobacillus rhamnosus and Bifidobacterium lactis. It creates value-added products with health claims that appeal to both mainstream and clinical markets. Research on strain efficacy and survivability under gastrointestinal conditions gains importance. Product labels now highlight specific probiotic strains to attract informed buyers.

Customized Culture Solutions for Regional Tastes and Local Recipes

Regional diversity in fermented dairy preferences creates opportunities for culture customization. Companies tailor starter blends to produce localized flavor, texture, and aroma profiles. The Dairy Starter Culture market supports this trend by offering flexible, modular culture systems. It enables dairy processors to replicate traditional recipes on a commercial scale. Markets in Asia and the Middle East show strong interest in localized yogurt and curd products. Cultural adaptation through microbial design strengthens brand differentiation.

Market Challenges Analysis

Stringent Storage, Handling, and Cold Chain Requirements for Live Cultures

Live bacterial cultures require precise storage and transport conditions to maintain viability. Any deviation in temperature or humidity can degrade culture activity and spoil product quality. The Dairy Starter Culture market faces challenges from regions lacking cold chain infrastructure. It limits penetration in rural or underdeveloped areas where demand for dairy is rising. It also raises operational costs for manufacturers managing international supply chains. Companies must invest in insulated packaging, real-time monitoring, and regional storage hubs to ensure product integrity.

Complex Regulatory Environment and Strain-Specific Approval Delays

The use of microbial cultures in food faces strict regulatory scrutiny across global markets. Every strain often needs individual approval, which delays product launches and adds compliance costs. The Dairy Starter Culture market contends with fragmented guidelines across regions like the EU, US, and Asia-Pacific. It complicates international trade and slows innovation in multi-strain culture development. Labeling laws on probiotics and claims also vary widely, affecting marketing strategies. Companies must navigate complex documentation, testing, and safety standards to access high-growth regions.

Market Opportunities

Expansion of Probiotic-Fortified Dairy in Functional Food Segment

The rising interest in preventive health opens new avenues for probiotic-rich dairy products. Consumers seek yogurt and fermented milk with proven gut and immune benefits. The Dairy Starter Culture market finds strong potential in delivering high-potency strains that survive digestion. It enables producers to differentiate their offerings with clinical strain efficacy. Functional food expansion also attracts pharmaceutical and wellness brands into the cultured dairy segment. Cross-industry collaboration can accelerate product development and reach health-focused demographics.

Untapped Growth Potential in Emerging Economies with Rising Dairy Demand

Emerging markets in Asia, Africa, and Latin America show increasing demand for safe, standardized dairy. Rapid urbanization and growing middle-class populations drive packaged dairy consumption. The Dairy Starter Culture market sees an opportunity to support regional producers with localized, cost-effective culture solutions. It also benefits from government investments in dairy processing infrastructure and nutritional programs. Low market saturation in rural regions offers room for long-term expansion. Strategic partnerships with local cooperatives and governments can strengthen market presence.

Market Segmentation Analysis:

By Application:

Cheese holds the largest share due to its widespread global consumption and diverse processing needs. Starter cultures play a key role in developing cheese texture, flavor, and shelf life. Yogurt follows closely, driven by its probiotic value and increasing preference among health-conscious consumers. The Dairy Starter Culture market also benefits from growing demand for buttermilk and butter in traditional and culinary applications. These products require specific cultures to ensure consistent acidity and fermentation. Cream-based fermented products occupy a niche but growing segment, especially in artisanal and specialty food categories.

- For instance, Lallemand Specialty Cultures directly manages over 2,000 strains of bacteria, yeasts, and molds for dairy, meat, and plant-based solutions.

By Microorganism Type:

Lactic acid bacteria dominate due to their essential role in dairy fermentation. These bacteria control pH, enhance safety, and contribute to flavor formation across all dairy products. It remains the most reliable choice for large-scale and standardized production. Yeasts are gaining relevance in specialty dairy products where flavor and carbonation are needed, such as certain cheese types and fermented creams. Molds serve limited but high-value segments like blue cheese and surface-ripened varieties. Their role in flavor complexity and textural development keeps them relevant in premium cheese production.

- For instance, The Leibniz Institute DSMZ-German Collection of Microorganisms and Cell Cultures holds a bioresource collection larger and more diverse than stated, according to recent figures. As of recent reports, the DSMZ collection houses over 90,000 bioresources, including more than 39,800 bacterial and archaeal strains (not 32,000) and over 9,800 fungal and yeast strain

By Form:

Freeze-dried cultures lead the market due to their long shelf life, ease of transport, and consistent performance. It enables manufacturers to store and distribute cultures across wide geographies with minimal degradation. Powdered cultures follow closely and remain popular in small to mid-scale operations for their ease of mixing and cost-effectiveness. Liquid cultures hold a niche in artisanal and fresh dairy production where immediate usage and rapid fermentation are essential. Each form addresses different production scales and handling preferences, supporting diverse dairy manufacturing needs.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Application:

- Cheese

- Yogurt

- Buttermilk

- Butter

- Cream

Based on Microorganism Type:

- Lactic Acid Bacteria

- Yeasts

- Molds

Based on Form:

- Liquid

- Powder

- Freeze-Dried

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 29.4% in the global Dairy Starter Culture market, making it one of the most dominant regions. The strong presence of leading dairy processors and advanced cold chain infrastructure supports widespread adoption of starter cultures across cheese, yogurt, and buttermilk segments. The U.S. market is driven by consumer demand for probiotic-rich products and clean-label dairy. Manufacturers focus on incorporating multi-strain cultures to support digestive health and shelf stability. High per capita consumption of cheese and yogurt fuels culture demand, especially in processed and specialty cheese. Regulatory support from agencies such as the FDA further ensures microbial safety and promotes innovation in strain development. Demand for customized cultures in organic and lactose-free dairy also grows steadily across the region.

Europe

Europe accounts for 32.1% of the Dairy Starter Culture market, making it the largest regional contributor by value. Strong dairy traditions in France, Germany, the Netherlands, and Italy drive demand for high-quality fermentation cultures. Cheese remains the dominant application segment in Europe, supported by extensive artisanal and industrial cheese production. The region is also known for strict regulations on microbial strains and labeling, which drives demand for certified, traceable culture solutions. Yogurt and fermented creams also see high adoption due to the region’s focus on digestive wellness. Multinational players based in Europe invest heavily in R&D to develop strain-specific benefits and regional flavor profiles. Clean-label trends and sustainable sourcing practices influence purchasing decisions among European consumers and dairy manufacturers.

Asia-Pacific

Asia-Pacific holds a market share of 21.7% and is the fastest-growing region in the Dairy Starter Culture market. Rising disposable incomes, urbanization, and changing dietary patterns increase the consumption of packaged and probiotic dairy. China, India, and Japan lead in demand for starter cultures used in yogurt, curd, and fermented milk products. It benefits from large-scale investments in dairy processing facilities, especially in India, where the cooperative model boosts production. Korea and Japan drive innovation in functional dairy, favoring strains that offer immune and digestive benefits. The region also shows strong growth in plant-based dairy alternatives, encouraging tailored culture solutions for soy, oat, and almond bases. Governments promote dairy fortification and safety through national health programs, further supporting demand for standardized cultures.

Latin America

Latin America holds a market share of 8.2%, driven by growing dairy consumption in Brazil, Mexico, and Argentina. Cheese and yogurt remain the primary applications for starter cultures, especially in urban markets where cold chain logistics are improving. It also sees rising awareness of probiotic dairy and fermented drinks like kefir. Smaller dairy processors increasingly seek culture solutions to maintain consistency and extend shelf life in warm climates. Regional suppliers collaborate with global players to introduce adapted cultures suitable for local taste profiles and raw milk conditions. Demand for freeze-dried and powdered forms is strong due to limited refrigeration access in rural zones. Regulatory improvements and industry incentives help expand starter culture usage across mid-scale production.

Middle East & Africa

The Middle East & Africa region holds a market share of 8.6% in the global Dairy Starter Culture market. Demand is supported by population growth, urban expansion, and government-backed dairy development programs. Countries like Saudi Arabia, Egypt, and South Africa show increasing adoption of yogurt and laban, both of which rely heavily on starter cultures. It also sees demand from industrial processors aiming to replace traditional fermentation with standardized culture systems for safety and efficiency. Challenges include limited cold chain infrastructure and high import reliance for premium cultures. However, local manufacturing initiatives and rising interest in fortified dairy products create new opportunities. The region also shows interest in customized culture blends for ethnic and fermented dairy drinks, opening room for long-term growth.

Key Player Analysis

- DuPont

- Synergy Flavors

- Agropur

- Almarai

- Hansen

- FrieslandCampina

- Kerry Group

- Nestlé

- Calpis

- Fonterra

- Lactalis

- Groupe Lactalis

- Saputo

- Danone

- Arla Foods

Competitive Analysis

The Dairy Starter Culture market features strong competition among key players such as DuPont, Synergy Flavors, Agropur, Almarai, Hansen, FrieslandCampina, Kerry Group, Nestlé, Calpis, Fonterra, Lactalis, Groupe Lactalis, Saputo, Danone, and Arla Foods. These companies compete on strain innovation, application diversity, and culture stability. Most leading firms offer multi-strain and customized solutions for cheese, yogurt, and buttermilk production. They invest in R&D to develop functional strains with probiotic, digestive, and immunity-boosting properties. Manufacturers also expand freeze-dried and encapsulated forms to support cold chain efficiency and export needs. Many players focus on clean-label compatibility and natural formulations to meet regulatory and consumer demands. Strategic partnerships with dairy cooperatives and food processors help expand their regional presence. Some companies integrate digital tools for precision fermentation and process optimization. Emerging markets present new growth areas, pushing firms to localize culture development for traditional products. Capacity expansion and technology upgrades in Asia and Latin America are top priorities. Mergers, acquisitions, and licensing agreements also support their competitive positioning. Overall, differentiation through innovation, shelf stability, and regional adaptability shapes the competitive landscape.

Recent Developments

- In 2024, Danone announced a partnership with Novonesis to leverage their combined scientific expertise and create unique, sustainable dairy products with improved taste and texture, aligning with Danone’s strategic focus on health and sustainability.

- In 2024, BDF Ingredients launched an innovative line of freeze-dried starter cultures for low-fat yogurt and sour cream, designed to maintain creamy texture and robust flavor while meeting demand for healthier products.

- In 2023, FrieslandCampina Ingredients launched several new products focusing on functional dairy applications, including the fermented ingredient Biotis® Fermentis, which combines whey proteins, probiotics, and prebiotics to target the gut-muscle axis for health-conscious consumers.

Report Coverage

The research report offers an in-depth analysis based on Application, Microorganism Type, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for probiotic-rich dairy products will continue to drive culture innovation.

- Freeze-dried starter cultures will gain preference for their longer shelf life and export suitability.

- Functional strains with immunity and gut health benefits will see increased adoption.

- Plant-based dairy alternatives will create new demand for non-dairy compatible cultures.

- Regulatory approvals for novel strains will influence product development timelines.

- Regional customization of cultures will expand to meet local taste and texture preferences.

- Cold chain expansion in developing markets will support higher penetration of starter cultures.

- Industry partnerships between dairy processors and biotech firms will accelerate culture innovation.

- Clean-label and organic dairy trends will strengthen the demand for natural starter cultures.

- Investments in automated and precision fermentation systems will optimize culture application.