Market Overview

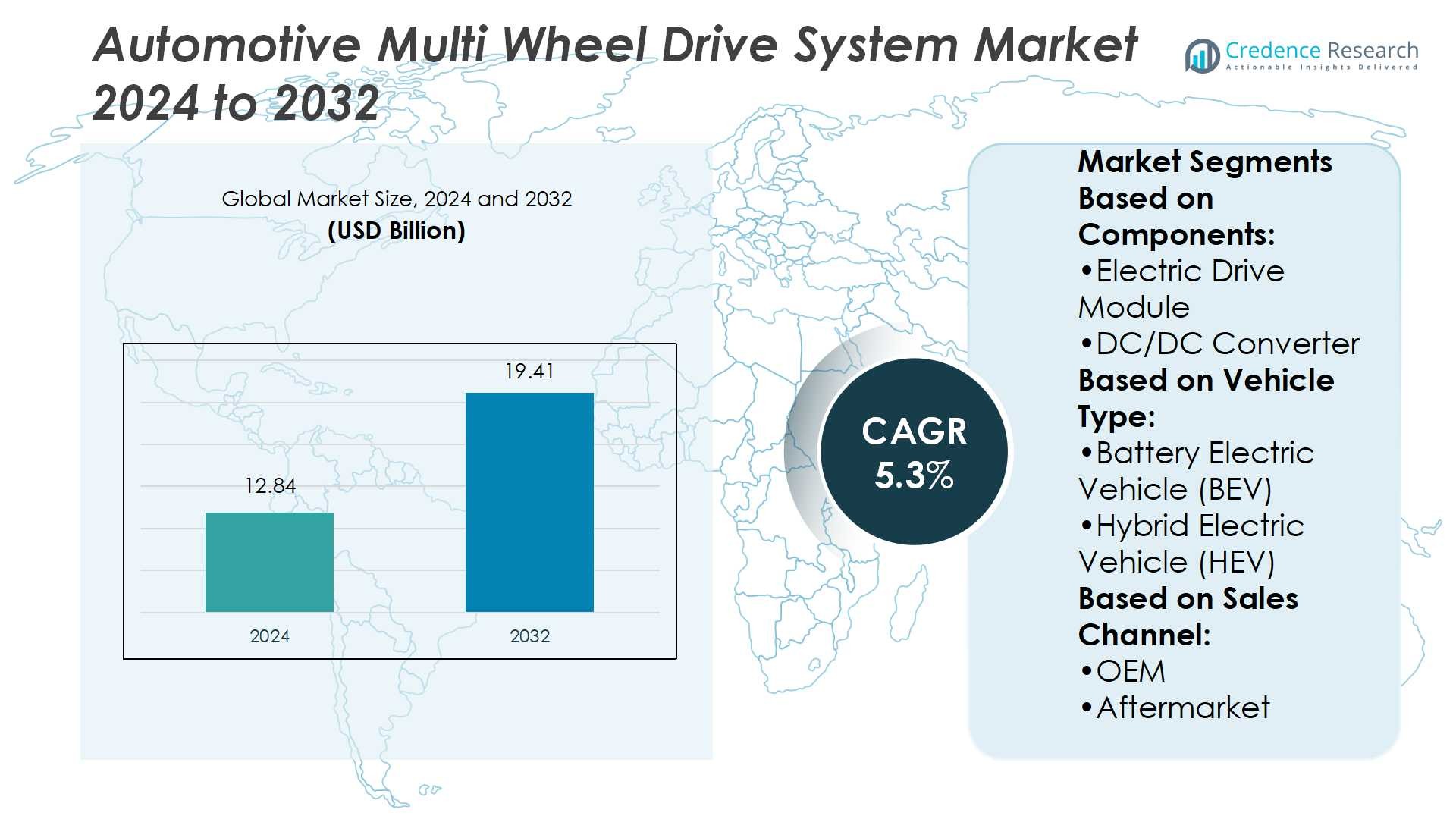

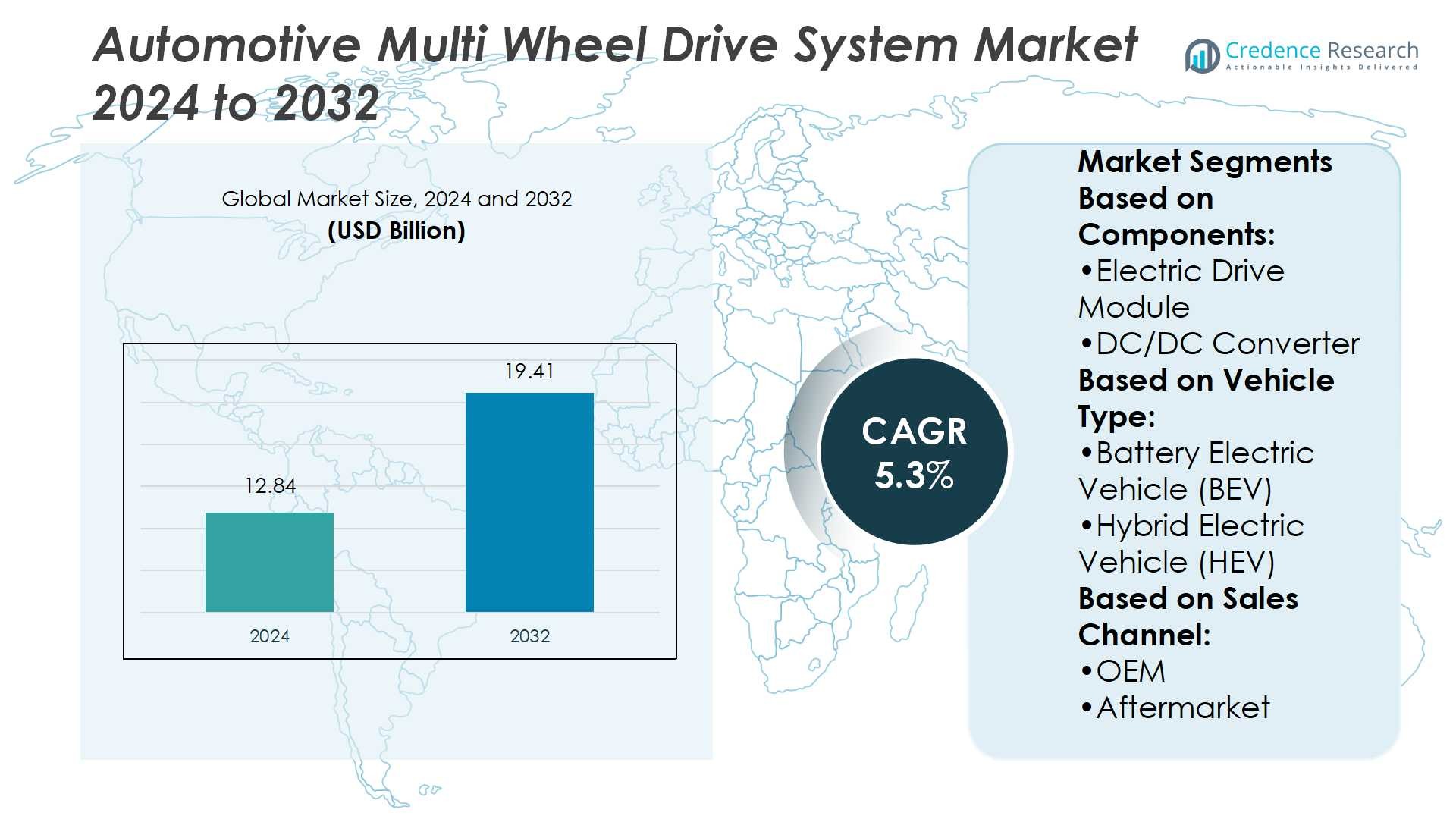

Automotive Multi Wheel Drive System Market size was valued at USD 12.84 billion in 2024 and is anticipated to reach USD 19.41 billion by 2030, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Automotive Multi Wheel Drive System Market Size 2024 |

USD 12.84 billion |

| Automotive Multi Wheel Drive System Market, CAGR |

5.3% |

| Automotive Multi Wheel Drive System Market Size 2032 |

USD 19.41 billion |

The Automotive Multi Wheel Drive System Market experiences strong growth driven by rising demand for electric, hybrid, and fuel cell vehicles, where enhanced traction, stability, and performance are critical. Increasing SUV and crossover sales, combined with consumer preference for comfort and safety, support adoption. It benefits from innovations in compact electric drive modules, DC/AC inverters, battery packs, and torque distribution systems. Trends highlight integration of intelligent control systems, lightweight materials, and energy-efficient components. Expansion of OEM and aftermarket channels further strengthens market reach. Continuous technological advancements and regional electrification initiatives sustain long-term growth and competitive development.

The Automotive Multi Wheel Drive System Market shows varied growth across regions, with Asia Pacific leading due to strong electric and hybrid vehicle adoption. North America and Europe maintain significant shares driven by premium vehicle demand and advanced safety regulations. Latin America and the Middle East & Africa contribute steadily through rising SUV and off-road vehicle sales. It benefits from expanding OEM and aftermarket networks, supportive government incentives, and growing consumer preference for performance, stability, and traction across diverse terrains, sustaining global market expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- Automotive Multi Wheel Drive System Market size was valued at USD 12.84 billion in 2024 and is expected to reach USD 19.41 billion by 2030 at a CAGR of 5.3%.

- Rising demand for electric, hybrid, and fuel cell vehicles drives adoption of advanced multi wheel drive systems.

- Increasing SUV and crossover sales, supported by consumer focus on comfort and safety, boost market growth.

- Innovations in electric drive modules, DC/AC inverters, battery packs, and torque distribution systems enhance performance and efficiency.

- High production costs and complex engineering requirements act as restraints, limiting large-scale adoption.

- Asia Pacific leads regional share, followed by North America and Europe, while Latin America and Middle East & Africa show steady growth.

- Competition intensifies as global players invest in lightweight materials, intelligent control systems, and aftermarket expansion to strengthen market presence.

Market Drivers

Rising Demand for Safety and Vehicle Stability

The Automotive Multi Wheel Drive System Market benefits from the increasing priority on driver safety and vehicle stability. Automakers integrate advanced systems to ensure better handling on diverse road surfaces. Consumers prefer vehicles that minimize risks during adverse weather and off-road conditions. Strong demand in SUVs and premium passenger cars supports steady adoption. Governments emphasize higher safety standards that push manufacturers to include multi wheel drive technology. It strengthens the overall reliability of vehicles across key segments.

- For instance, These robots handle payloads between 90 and 300 kilograms, with a maximum reach of up to 3,900 millimeters across the series. This ensures accurate placement of heavy components, such as electric drive modules and torque distribution systems.

Growth in SUV and Crossover Sales Boosts System Adoption

The Automotive Multi Wheel Drive System Market gains momentum from surging SUV and crossover popularity worldwide. These vehicles dominate consumer preference due to their space, comfort, and off-road capability. Manufacturers equip them with advanced drive systems to meet rising expectations for performance. Expansion of urban markets with higher disposable incomes further stimulates sales. OEMs focus on differentiating models through superior drivetrain features. It creates consistent growth opportunities across both developed and emerging markets.

- For instance, Omron HD-1500 Autonomous Mobile Robot can carry a payload of 1,500 kg while weighing 585 kg itself. It reaches speeds up to 1.8 m/s, and its run time is 9 hours when fully loaded, or 12.5 hours empty.

Electrification of Vehicles Enhances System Integration

The Automotive Multi Wheel Drive System Market experiences growth through electrification trends across global automotive sectors. Electric and hybrid models increasingly incorporate all-wheel drive for efficiency and traction. Manufacturers deploy dual-motor systems that optimize torque distribution without mechanical complexity. Growing investment in electric SUVs accelerates this integration. It improves vehicle performance while aligning with sustainability targets. The shift reinforces multi wheel drive systems as essential in future mobility solutions.

Technological Advancements Drive Performance and Efficiency

The Automotive Multi Wheel Drive System Market advances with continuous innovation in electronic controls and lightweight materials. Intelligent systems enable real-time torque vectoring, enhancing driving dynamics. Automakers invest in reducing weight while maintaining durability to improve fuel economy. Digital simulation tools support faster development cycles for advanced drivetrains. It encourages adoption in mass-market segments beyond premium vehicles. Enhanced system performance ensures competitive positioning for manufacturers globally.

Market Trends

Increasing Integration of Advanced Electronic Control Systems

The Automotive Multi Wheel Drive System Market shows strong adoption of advanced electronic control technologies. Automakers deploy intelligent torque management systems that distribute power efficiently across wheels. These systems improve vehicle handling, fuel economy, and overall driving safety. Continuous upgrades in electronic sensors enhance response times and accuracy. It supports seamless transitions between two-wheel and multi wheel drive modes. The trend strengthens competitiveness in both passenger and commercial vehicle segments.

- For instance, Denso Wave’s SP1 RFID scanner achieves scanning speeds of 700 scans per second, with a reading range of up to approximately 8 meters, even when tags are poorly oriented.

Rising Popularity of SUVs and Luxury Vehicles with Multi Wheel Drive

The Automotive Multi Wheel Drive System Market reflects growth from the rising demand for SUVs and luxury cars. Consumers favor these vehicles for stability, comfort, and off-road performance. Automakers incorporate multi wheel drive systems as standard or premium features in this category. Sales of crossovers in urban areas contribute heavily to this trend. It positions multi wheel drive technology as a core element in differentiating premium offerings. The preference creates lasting opportunities across both established and emerging markets.

- For instance, Harmonic Drive recently added Size 7 to its CSF-mini Series gear line, filling the gap between existing sizes 5 and 8. The new Size 7 model provides more torque than Size 5, though its specific peak torque and tilting moment ratings are dependent on the gear ratio and fall within the broader range of the entire CSF-mini series.

Expansion of Electrified Drivetrain Architectures

The Automotive Multi Wheel Drive System Market evolves with the wider adoption of hybrid and electric vehicle platforms. Dual-motor and distributed drive configurations enable efficient power distribution without mechanical linkages. Automakers highlight performance gains through instant torque delivery and reduced energy loss. Growing investment in electric SUVs and crossovers accelerates system integration. It aligns with sustainability initiatives and consumer demand for greener mobility. The trend reshapes product design and broadens applications across vehicle classes.

Focus on Lightweight Materials and Sustainable Manufacturing

The Automotive Multi Wheel Drive System Market advances through emphasis on weight reduction and eco-friendly production methods. Manufacturers adopt high-strength alloys and composites to improve fuel efficiency. Lightweight components reduce drivetrain losses and enhance performance. It enables automakers to meet stricter emission and efficiency regulations. Increasing focus on recyclable materials supports environmental commitments across the supply chain. This trend ensures sustainable growth while maintaining high system reliability.

Market Challenges Analysis

High Costs and Complex Engineering Requirements

The Automotive Multi Wheel Drive System Market faces challenges from high costs and intricate engineering demands. Multi wheel drive technology requires advanced components such as torque vectoring systems, electronic controls, and durable transmissions. These elements increase production expenses, raising the final vehicle price. It creates barriers for mass-market adoption, especially in cost-sensitive regions. Complex design requirements also extend development cycles, slowing product launches. Manufacturers must balance system performance with affordability to sustain competitiveness.

Impact of Efficiency Concerns and Regulatory Pressures

The Automotive Multi Wheel Drive System Market contends with rising scrutiny on fuel efficiency and emission standards. Multi wheel drive systems often add weight and mechanical resistance, reducing fuel economy compared to two-wheel drive models. Governments enforce strict environmental regulations that limit the appeal of energy-intensive systems. It pushes automakers to adopt lightweight materials and electronic alternatives, which raise development costs. The need to align performance with sustainability goals remains a persistent challenge. This pressure reshapes strategies for long-term adoption across global markets.

Market Opportunities

Expansion Potential Through Electrification and Hybrid Platforms

The Automotive Multi Wheel Drive System Market presents strong opportunities through the rise of electric and hybrid vehicles. Dual-motor configurations in electric platforms allow seamless torque distribution without traditional drivetrains. Automakers integrate these systems to enhance traction, acceleration, and energy efficiency. It supports consumer demand for both performance and sustainability. Growing investment in electric SUVs and premium crossovers accelerates adoption. The trend expands market scope beyond conventional vehicles into future mobility solutions.

Opportunities in Emerging Markets and Off-Road Applications

The Automotive Multi Wheel Drive System Market benefits from rising demand in emerging economies with expanding middle-class populations. Consumers in these regions favor SUVs and multipurpose vehicles that deliver stability and comfort. Off-road, military, and commercial applications create new avenues for system deployment. It positions multi wheel drive technology as vital for both consumer and industrial vehicles. Growth in construction and logistics sectors further strengthens demand. These opportunities provide manufacturers with diverse pathways to expand global presence.

Market Segmentation Analysis:

By Components

The Automotive Multi Wheel Drive System Market demonstrates significant segmentation across components, each enhancing system efficiency and performance. The electric drive module delivers precise torque control for all wheels. DC/DC converters regulate voltage, ensuring stable energy supply. Battery packs provide high-density energy storage for sustained operation. Thermal systems maintain optimal temperature for reliability. DC/AC inverters convert stored DC power into AC for motor operation. Power distribution modules coordinate energy flow, improving drivetrain efficiency. It highlights the importance of integrated component design for superior vehicle dynamics.

- For instance, Fanuc’s M-20iD/35 robot shows how component‐level precision supports drivetrain modules. It handles a 35 kg payload, has a reach of 1,831 mm, and maintains repeatability of ±0.03 mm.

By Vehicle Type

The market shows diverse adoption across vehicle types, driven by electrification trends. Battery Electric Vehicles (BEVs) utilize multi wheel drive systems to optimize traction and extend range. Hybrid Electric Vehicles (HEVs) balance internal combustion engines with electric motors, improving fuel efficiency. Plug-in Hybrid Electric Vehicles (PHEVs) employ it for extended electric driving and dynamic torque distribution. Fuel Cell Electric Vehicles (FCEVs) manage energy from hydrogen fuel cells while maintaining stability. It demonstrates adaptability across emerging electric mobility platforms and advanced powertrain configurations.

- For instance, ABB’s Terra 360 fast charger can supply up to 360 kW of DC power output. It can charge up to four electric vehicles simultaneously, though it is often deployed to serve two EVs at once, dynamically distributing power between them.

By Sales Channel

Sales channels influence market penetration and adoption rates. OEMs lead with factory-fitted multi wheel drive systems, ensuring reliability and warranty-backed performance. Aftermarket channels allow retrofitting for existing vehicles, targeting regions with high vehicle ownership and off-road demand. It provides consumers flexibility while expanding market reach beyond new vehicle sales. OEM collaborations with technology suppliers enhance innovation pipelines and accelerate system deployment, strengthening overall market competitiveness.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Segments:

Based on Components:

- Electric Drive Module

- DC/DC Converter

Based on Vehicle Type:

- Battery Electric Vehicle (BEV)

- Hybrid Electric Vehicle (HEV)

Based on Sales Channel:

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

The Automotive Multi Wheel Drive System Market in North America holds 27% of the global market in 2024. The U.S. leads adoption due to strong demand for SUVs, crossovers, and luxury vehicles. Canada supports growth with investments in hybrid and electric vehicle platforms. It benefits from high safety standards and off-road capability requirements. OEMs focus on integrating multi wheel drive systems to improve performance and traction. Expansion of aftermarket services and R&D initiatives strengthens market presence. Consumer preference for comfort, technology, and advanced mobility drives continued adoption.

Europe

Europe contributes 22% of the global Automotive Multi Wheel Drive System Market. Germany, France, and the UK lead due to high demand for premium vehicles and electrified platforms. Automakers adopt lightweight materials and electronic torque distribution to meet emission regulations. It drives innovations like dual-motor systems and electronic differentials. Government incentives for electric and hybrid vehicles support adoption. High SUV and crossover sales strengthen market demand. Technology-focused consumers continue to influence system deployment.

Asia Pacific

Asia Pacific holds the largest market share at 38% in 2024. China drives adoption through incentives for electric and hybrid vehicles. Japan and South Korea focus on premium cars and advanced technology, boosting demand for torque control and electronic modules. It supports growth across both domestic and international manufacturers. Rising SUV and crossover sales strengthen system integration. Expanding road infrastructure and increasing consumer spending sustain regional market growth.

Latin America

Latin America holds 8% of the global market in 2024. Brazil, Mexico, and Argentina lead adoption through rising SUV and commercial vehicle sales. Off-road and utility vehicle demand supports multi wheel drive integration. It benefits from growing infrastructure and the need for vehicle stability on varied terrain. OEMs and aftermarket providers target cost-effective solutions to expand reach. Consumer awareness of vehicle performance and safety gradually increases adoption. Regional incentives for hybrid vehicles support future growth.

Middle East & Africa

The Middle East & Africa region accounts for 5% of the market in 2024. UAE, Saudi Arabia, and South Africa lead due to luxury SUVs, off-road vehicles, and commercial fleets. Multi wheel drive systems improve traction in extreme weather and terrain. It benefits from investments targeting affluent consumers and infrastructure projects. Growing demand for safety and advanced mobility supports adoption. Electrified vehicle platforms are gradually entering the market, creating future opportunities. Manufacturers focus on premium and performance-oriented solutions.

Key Player Analysis

- KUKA Robotics

- Omron Corporation

- Denso Wave

- Harmonic Drive System

- Fanuc Corporation

- ABB

- Comau SpA

- Nachi-Fujikoshi Corp

- Kawasaki Heavy Industries

- Dürr AG

Competitive Analysis

The Automotive Multi Wheel Drive System Market players include ABB, Comau SpA, Denso Wave, Dürr AG, Fanuc Corporation, Harmonic Drive System, Kawasaki Heavy Industries, KUKA Robotics, Nachi-Fujikoshi Corp, and Omron Corporation. The Automotive Multi Wheel Drive System Market remains highly competitive, driven by technological advancements, efficiency improvements, and increasing demand from electric and hybrid vehicles. Companies focus on developing compact, high-precision drive modules, advanced power distribution systems, and reliable thermal management solutions to enhance vehicle performance and traction. Innovation in DC/AC inverters and battery pack integration supports improved energy efficiency and system durability. OEMs and aftermarket providers compete to offer tailored solutions for BEVs, HEVs, PHEVs, and FCEVs, ensuring compatibility across diverse vehicle platforms. Market players differentiate through rapid adoption of intelligent control systems, automated manufacturing, and integration of lightweight materials to meet emission and safety standards. Global expansion, strategic partnerships, and investment in R&D sustain competitiveness, driving continuous product refinement. It encourages faster adoption of multi wheel drive systems in premium, commercial, and off-road vehicles while supporting broader electrification trends.

Recent Developments

- In April 2025, the Hyundai Motor Group’s next-generation hybrid powertrain system was launched to enhance performance and efficiency, offering two petrol engines, such as a 2.5-litre and a 1.6-litre turbo-petrol. The 2.5-litre engine has debuted on the Palisade SUV.

- In May 2025, Kia Carens Clavis was revealed as the carmaker’s new premium MPV, which is set to launch in June 2025. The Kia Carens Clavis is available in seven variants, including HTE, HTE(O), HTK, HTK Plus, HTK Plus (O), HTX, and HTX Plus (O). Kia Carens Clavis is designed with three engine options and variant-wise powertrain.

- In January 2025, American Axle & Manufacturing (AAM) is going to conduct the 2025 Consumer Electronics Show, the world’s most influential global tech event which will be held in Las Vegas. The event will focus on featuring diversity of driveline and powertrain technologies supporting electric, hybrid and internal combustion vehicles.

- In March 2024, Volkswagen introduced the new ID. Buzz GTX an electric Bulli featuring a high-performance drive system. It will be available with two different wheelbases, two battery size options, and seating configurations for 5, 6, or 7 passengers. Additionally, it includes standard 4MOTION all-wheel drive, ensuring excellent pulling power and traction in all driving conditions.

Report Coverage

The research report offers an in-depth analysis based on Components, Vehicle Type, Sales Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Adoption of multi wheel drive systems will expand across electric and hybrid vehicles.

- Integration of intelligent torque distribution will enhance vehicle stability and performance.

- OEMs will increase focus on lightweight and compact system designs.

- Advanced battery and inverter technologies will improve overall energy efficiency.

- Expansion in aftermarket solutions will support broader consumer access to upgrades.

- Growth in SUV and crossover segments will drive higher system deployment.

- Collaboration between automotive and technology companies will accelerate innovation.

- Rising demand in emerging regions will create new market growth opportunities.

- Implementation of safety and emission regulations will encourage advanced system adoption.

- Development of predictive maintenance and smart diagnostics will strengthen long-term reliability.