Market Overview

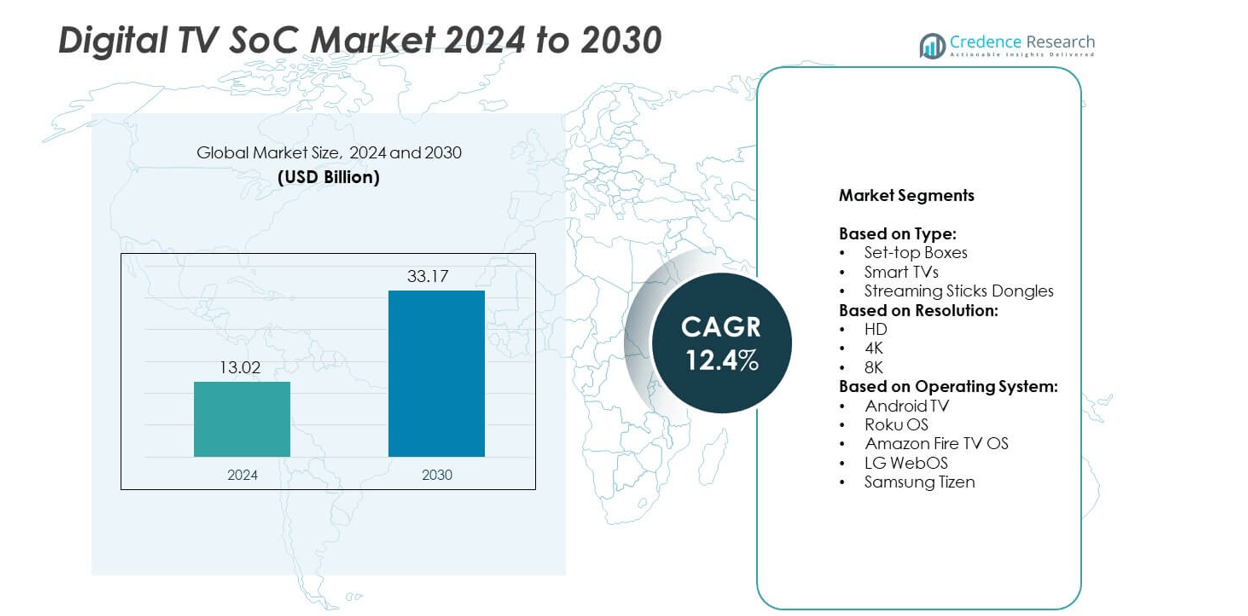

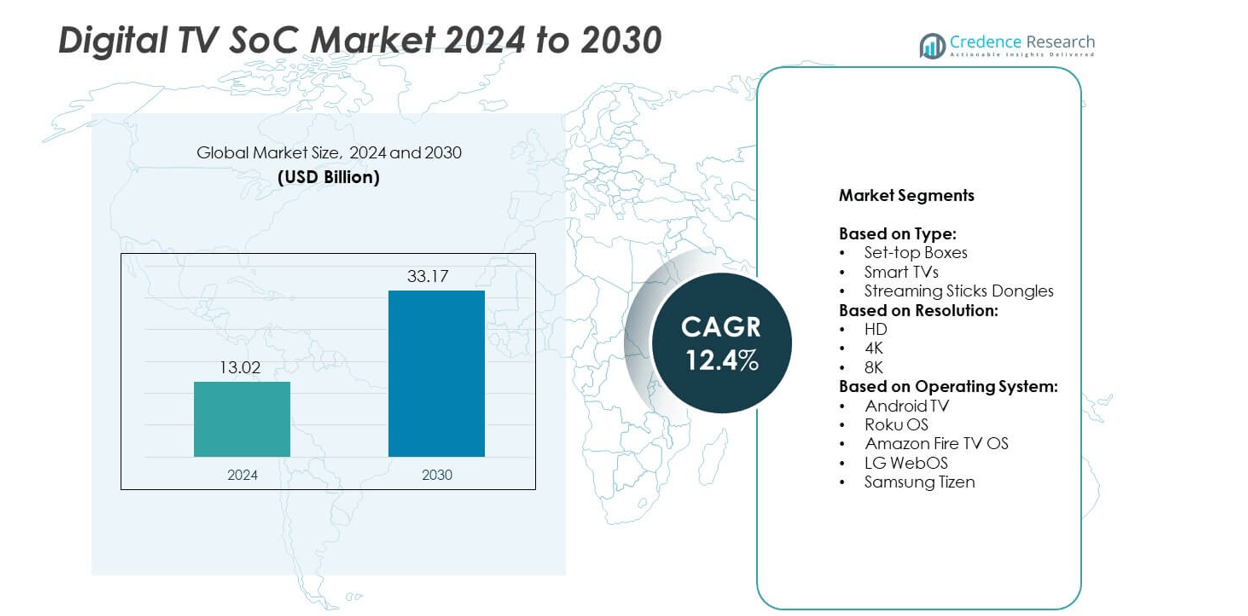

The digital TV SoC market size was valued at USD 13.02 billion in 2024 and is anticipated to reach USD 33.17 billion by 2030, growing at a CAGR of 12.4% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Digital TV SoC Market Size 2024 |

USD 13.02 billion |

| Digital TV SoC Market, CAGR |

12.4% |

| Digital TV SoC Market Size 2032 |

USD 33.17 billion |

The Digital TV SoC market grows with rising adoption of smart TVs, streaming platforms, and demand for high-resolution content. AI-powered image processing, voice control, and energy-efficient chip designs drive innovation. Consumers prefer 4K and 8K TVs, pushing manufacturers to deliver advanced SoCs with faster processing and multi-codec support. Streaming-first habits increase demand for optimized SoCs supporting OTT services. Advancements in semiconductor nodes improve power efficiency and performance, enabling compact designs and supporting the shift toward connected entertainment devices worldwide.

North America leads the Digital TV SoC market with strong demand for smart TVs and streaming devices, followed by Europe with rising adoption of energy-efficient solutions. Asia-Pacific shows fastest growth supported by urbanization and rising incomes in China and India. Latin America and Middle East & Africa witness steady adoption with improving digital infrastructure. Key players include Samsung Electronics, LG Electronics, Sony Corporation, and TCL Technology, focusing on AI integration, 4K and 8K support, and strategic partnerships with OTT platforms.

Market Insights

- The Digital TV SoC market was valued at USD 13.02 billion in 2024 and is projected to reach USD 33.17 billion by 2030, growing at a CAGR of 12.4%.

- Rising adoption of smart TVs, streaming platforms, and AI-driven features drives strong demand for advanced SoCs.

- Key trends include the shift toward 4K and 8K content, AI-powered image upscaling, and energy-efficient chip designs.

- The market is highly competitive with leading players such as Samsung Electronics, LG Electronics, Sony Corporation, and TCL Technology focusing on innovation and partnerships.

- High design complexity, increased R&D costs, and volatile semiconductor supply chains restrain growth for some manufacturers.

- North America leads with strong replacement demand, while Asia-Pacific emerges as the fastest-growing region supported by rising incomes and digitalization efforts.

- Europe focuses on energy-efficient solutions, while Latin America and Middle East & Africa show steady growth with expanding digital infrastructure and increasing streaming adoption.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Adoption of Smart TVs and Streaming Platforms Driving Demand

The Digital TV SoC market benefits from the growing penetration of smart TVs worldwide. Consumers prefer smart TVs to access OTT platforms and on-demand content. Manufacturers integrate advanced SoCs to deliver faster processing and seamless streaming. High-definition and 4K content consumption pushes the need for powerful video decoders. Smart home ecosystems boost demand for devices with connectivity and AI features. It supports continuous innovation in SoC design for enhanced viewing experience.

- For instance, MediaTek’s Pentonic 2000 is an 8K TV SoC built on a 7 nm-class node. It supports 8K at 120 Hz refresh rate and includes video decoding of HEVC, VP9, AVS3, and AV1.

Shift Toward Energy-Efficient and Cost-Effective SoC Solutions

he market grows with demand for energy-efficient chipsets that reduce power consumption. Manufacturers focus on compact, cost-effective SoCs to lower production costs. Integration of multiple functions on a single chip helps save space and improve efficiency. Growing focus on low-power designs makes products more suitable for mass adoption. It enables manufacturers to meet regulatory requirements for energy efficiency. The trend supports the development of advanced semiconductor nodes.

- For instance, Samsung’s 2025 S95F OLED TV is powered by the NQ4 AI Gen3 processor, which uses 128 AI neural networks to enable AI upscaling of content up to 4K resolution.

Integration of AI and Advanced Graphics Capabilities in Television Sets

The Digital TV SoC market gains momentum with the use of AI-driven image processing. Viewers expect improved picture clarity, upscaling, and personalized content recommendations. SoC developers integrate advanced GPUs and machine learning accelerators. These features enable real-time enhancements such as noise reduction and dynamic tone mapping. It also supports voice assistants and smart home integration. AI integration creates a competitive edge for TV makers.

Growing Demand for Ultra-HD, 4K, and 8K Content Across Regions

Demand for UHD, 4K, and 8K resolution drives SoC performance requirements higher. Broadcasters expand availability of high-resolution content across multiple regions. SoC vendors design chips that support HEVC and AV1 decoding standards. It allows faster transmission with reduced bandwidth needs. Rising consumer interest in immersive experiences fuels adoption of large-screen TVs. The market benefits from strong replacement demand in developed economies.

Market Trends

Emergence of AI-Powered and Voice-Enabled Television Experiences

The Digital TV SoC market observes a clear trend toward AI-driven features. TV makers use AI for real-time image upscaling and voice recognition. Viewers demand intuitive interfaces and smart assistants for navigation. SoC vendors integrate neural processing units to handle these tasks efficiently. It improves overall system responsiveness and enhances personalization. AI adoption becomes a key differentiator for premium television models.

- For instance, Hisense’s Hi-View HV8107 TV SoC is an 8K AI perceptual processor. It features a neural processing unit with a peak performance of 1.2 TFLOPS.

Growing Popularity of Streaming-First and Cord-Cutting Lifestyles

Consumers increasingly prefer streaming services over traditional cable or satellite TV. The market shifts toward SoCs designed to handle multiple streaming codecs. Support for AV1 and HEVC becomes essential for smooth content delivery. It ensures faster data transfer and better video quality at lower bandwidth. Manufacturers align with this trend by optimizing SoCs for OTT platforms. Streaming-focused designs help TV brands stay competitive in urban markets.

- For instance, LG’s α5 AI Processor 4K Gen 6 (used in TVs like the LG 65UR801C hotel/commercial TV) is a quad-core CPU setup that provides full support for AI-based 4K upscaling and Dynamic Tone Mapping. This processor’s AI capabilities also enhance picture and sound quality.

Advancements in Semiconductor Process Technology for SoC Development

Smaller semiconductor nodes dominate new product designs in the Digital TV SoC market. Chipmakers move toward 7nm and below to enhance power efficiency. Higher transistor density allows better performance without increasing heat. It reduces manufacturing cost per function and supports mass adoption. Improved process technology helps integrate AI engines and GPUs in compact form factors. This trend drives innovation across premium and mid-range television segments.

Rise of 4K and 8K Content Accelerating High-Performance SoC Adoption

High-resolution formats gain global traction, pushing SoC developers to enhance capabilities. 4K adoption becomes standard, while 8K gains attention in high-end markets. It requires chips with advanced memory bandwidth and faster processing. SoC makers introduce multi-core architectures to meet these needs. Wide availability of UHD content from broadcasters and streaming platforms supports this growth. Consumers expect smooth playback even on large, high-refresh-rate displays.

Market Challenges Analysis

Rising Complexity of SoC Design and Higher Development Costs

The Digital TV SoC market faces growing challenges from complex chip architectures. Integrating AI, GPU, and multiple codecs on a single chip raises design difficulty. It increases development timelines and requires significant R&D investments. Smaller semiconductor nodes add to manufacturing costs and yield risks. Companies must balance performance, power efficiency, and affordability. Delays in product launches can impact competitiveness and reduce market share.

Supply Chain Disruptions and Volatile Semiconductor Pricing

The market struggles with supply chain issues affecting timely production. Shortages of critical components raise lead times for TV manufacturers. It leads to fluctuating prices and pressure on profit margins. Geopolitical tensions and trade restrictions further disrupt semiconductor availability. Companies need strong supplier partnerships to ensure continuity. Rising production costs often force manufacturers to pass expenses to consumers, affecting demand.

Market Opportunities

Expansion of Smart Home Ecosystems and Connected Entertainment Devices

The Digital TV SoC market has strong opportunities in the growing smart home space. Consumers seek seamless integration between TVs, speakers, and connected devices. It drives demand for SoCs with advanced connectivity features like Wi-Fi 6 and Bluetooth 5. SoC vendors can develop solutions that enable interoperability across multiple platforms. Rising interest in voice control and IoT-enabled devices creates new product opportunities. Smart home adoption ensures sustained demand for high-performance chipsets.

Growing Penetration of 4K and 8K Televisions in Emerging Markets

Emerging economies present untapped potential for high-resolution TV adoption. Rising disposable incomes encourage consumers to upgrade to UHD and large-screen TVs. It creates demand for cost-efficient SoCs with 4K and 8K support. Manufacturers targeting these markets can benefit from high replacement cycles. Government digitalization initiatives also promote adoption of advanced broadcasting standards. Expanding distribution networks allow brands to reach rural and semi-urban regions effectively.

Market Segmentation Analysis:

By Type:

The Digital TV SoC market is segmented into set-top boxes, smart TVs, and streaming sticks or dongles. Smart TVs dominate due to their integration of content streaming, connectivity, and gaming features in one device. Consumers prefer smart TVs for their convenience and wide access to OTT platforms. It encourages manufacturers to design SoCs with higher processing power and advanced graphics. Streaming sticks and dongles grow quickly due to affordability and portability. Set-top boxes maintain relevance in regions with strong cable and satellite TV networks.

- For instance, Samsung’s commercial “QPA-8K” Neo QLED displays, powered by the Neo Quantum Processor 8K, utilize 12-bit (4,096 levels) contrast levels and Quantum Matrix Technology Pro with Mini LEDs to distinguish details from the darkest blacks to the brightest whites.

By Resolution:

The market includes HD, 4K, and 8K segments. 4K resolution leads adoption with rising availability of UHD content across streaming services and broadcasters. It drives demand for SoCs with efficient video decoding and HDR support. 8K resolution remains a niche but gains traction in premium segments and large-screen TVs. HD continues to serve cost-sensitive markets but faces replacement pressure from UHD devices. The transition toward higher resolutions accelerates innovation in memory bandwidth and processing efficiency.

- For instance, Sharp’s 8M-B120C 120-inch display features an 8K (7680×4320) resolution at 60 Hz, and when rendering 4K content, it can push the refresh to 120 Hz using HDMI 2.1 input.

By Operating System:

The Digital TV SoC market covers Android TV, Roku OS, Amazon Fire TV OS, LG WebOS, and Samsung Tizen. Android TV leads due to its wide adoption across multiple brands and access to Google Play services. Roku OS gains strong traction in North America with its user-friendly interface and extensive content library. It pushes SoC vendors to offer optimized solutions for smooth performance. Amazon Fire TV OS grows with integration of Alexa voice services and Prime ecosystem. LG WebOS and Samsung Tizen remain key in proprietary ecosystems, supporting differentiated user experiences and brand loyalty.

Segments:

Based on Type:

- Set-top Boxes

- Smart TVs

- Streaming Sticks Dongles

Based on Resolution:

Based on Operating System:

- Android TV

- Roku OS

- Amazon Fire TV OS

- LG WebOS

- Samsung Tizen

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Digital TV SoC market, driven by high adoption of smart TVs and streaming platforms. Consumers across the U.S. and Canada shift from traditional cable subscriptions to OTT services, boosting demand for advanced SoCs. It encourages manufacturers to integrate high-performance processors and AI-based features for superior user experience. The presence of leading content providers and strong broadband infrastructure supports continued market expansion. Growing sales of 4K and 8K televisions push SoC developers to innovate with faster memory and efficient power consumption. The region also benefits from strong competition among TV brands, which accelerates adoption of next-generation chipsets. Replacement demand for large-screen TVs and streaming devices further strengthens the market outlook.

Europe

Europe accounts for 27% of the Digital TV SoC market, supported by growing demand for connected televisions and energy-efficient solutions. Countries such as Germany, the UK, and France see rising sales of UHD and smart TVs, driving SoC adoption. It pushes chipmakers to design SoCs that comply with stringent energy efficiency and sustainability regulations. The region benefits from strong digital infrastructure and rollout of advanced broadcasting standards such as DVB-T2. Consumers seek enhanced viewing experiences with HDR and AI-driven content recommendations, fueling innovation. Streaming platforms expand aggressively, creating demand for devices with multi-codec compatibility. Increasing focus on low-latency streaming and multi-device connectivity supports steady growth in this market.

Asia-Pacific

Asia-Pacific captures 29% of the Digital TV SoC market and emerges as the fastest-growing region. Rising urbanization and income levels in China, India, and Southeast Asia drive demand for smart and affordable televisions. It encourages global and regional manufacturers to expand production capacity and introduce cost-effective SoC solutions. The availability of local streaming platforms and aggressive price competition boosts market penetration. Rapid adoption of 4K televisions and early interest in 8K models stimulate growth in premium segments. Governments promote digital broadcasting transitions, creating opportunities for set-top boxes and streaming devices. Expanding e-commerce platforms and wide retail networks accelerate consumer access to connected TVs.

Latin America

Latin America holds a market share of 7%, with growth led by Brazil, Mexico, and Argentina. The Digital TV SoC market in this region benefits from the increasing shift to digital broadcasting and internet-enabled TVs. It drives demand for affordable SoCs that deliver reliable performance in mid-range devices. Streaming adoption rises steadily as broadband penetration improves across urban areas. Local content production and partnerships with streaming providers boost device sales. Manufacturers focus on offering budget-friendly solutions to meet price-sensitive consumer demand. Rising interest in 4K content and sports broadcasting events further supports future growth.

Middle East & Africa

Middle East & Africa represent 5% of the Digital TV SoC market, showing steady but slower adoption compared to other regions. Growing middle-class population and rising internet penetration contribute to higher smart TV sales. It encourages television makers to introduce feature-rich models at competitive price points. Demand for streaming devices grows in markets with expanding broadband infrastructure. Regional broadcasters launch HD and 4K content, creating need for compatible SoCs. Governments support digital switchover projects, further driving demand for set-top boxes. Continued economic development is expected to support gradual but consistent market expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Skyworth Group

- Sony Corporation

- Toshiba Corporation

- Seiki Digital

- Konka

- Vizio

- Haier Group

- Samsung Electronics

- Hisense Group

- Sharp Corporation

- LG Electronics

- Changhong Group

- Panasonic Corporation

- Westinghouse Digital

- TCL Technology

Competitive Analysis

The Digital TV SoC market is led by key players such as Skyworth Group, Sony Corporation, Toshiba Corporation, Seiki Digital, Konka, Vizio, Haier Group, Samsung Electronics, Hisense Group, Sharp Corporation, LG Electronics, Changhong Group, Panasonic Corporation, Westinghouse Digital, and TCL Technology. These companies focus on delivering high-performance SoCs that support 4K and 8K resolutions, AI-driven picture enhancements, and smooth streaming. Many players invest in developing energy-efficient designs to meet global regulatory standards and reduce power consumption. Competitive advantage often depends on integrating advanced GPUs and neural processing units for superior user experiences. Strategic partnerships with OTT platforms and content providers strengthen their market reach. Leading brands also expand manufacturing capabilities and collaborate with semiconductor foundries to ensure supply stability. Continuous product innovation and frequent portfolio upgrades help them stay ahead in a rapidly evolving market. Strong global distribution networks and localized marketing strategies further enhance their presence in both developed and emerging economies.

Recent Developments

- In 2025, Sony released a TV lineup that includes the Bravia 8 II QD-OLED and the Bravia 5 Mini-LED.

- In 2025, LG announced U.S. rollout of its 2025 OLED evo TV lineup, featuring its enhanced brightness, gaming features, and AI personalization.

- In 2024, Samsung announced its 2024 TV and audio lineup at CES, updating Tizen OS with a cleaner layout and personalized profiles for different household users.

Report Coverage

The research report offers an in-depth analysis based on Type, Resolution, Operating System and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will grow with rising adoption of smart TVs and connected devices.

- Demand for SoCs supporting AI-powered features will increase across premium television models.

- 4K resolution will remain dominant while 8K adoption will expand in high-end segments.

- Streaming-first consumer habits will push vendors to optimize SoCs for OTT platforms.

- Energy-efficient chip designs will gain importance to meet sustainability regulations.

- Integration of GPUs and neural engines will improve picture quality and real-time processing.

- Asia-Pacific will continue to lead growth with high demand in China and India.

- Partnerships between TV manufacturers and streaming platforms will drive new product launches.

- Edge AI capabilities will expand personalization and enhance user experience in smart TVs.

- Continuous innovation in semiconductor nodes will lower power use and improve performance