Market Overview

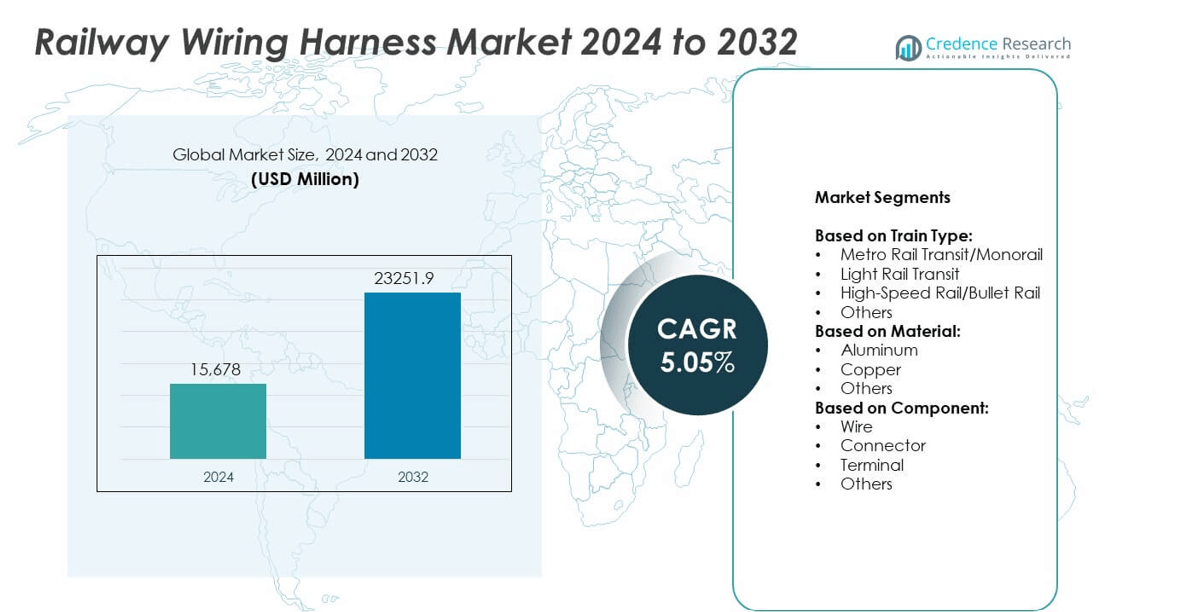

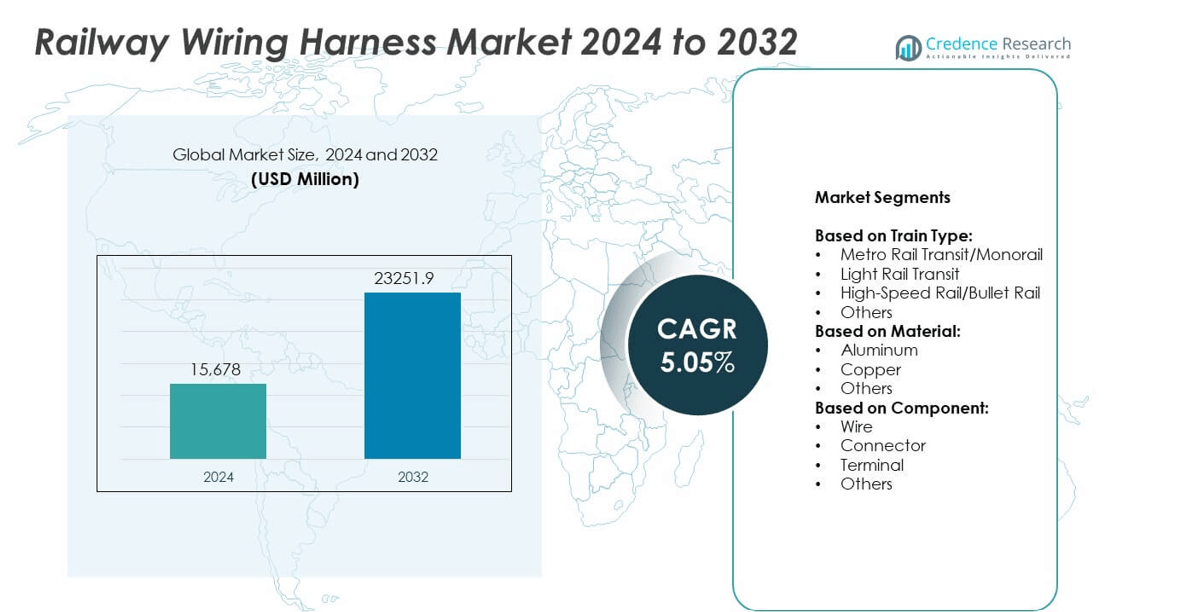

The Railway Wiring Harness Market size was valued at USD 15,678 million in 2024 and is projected to reach USD 23,251.9 million by 2032, growing at a CAGR of 5.05% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Railway Wiring Harness Market Size 2024 |

USD 15,678 million |

| Railway Wiring Harness Market, CAGR |

5.05% |

| Railway Wiring Harness Market Size 2032 |

USD 23,251.9 million |

The Railway Wiring Harness market grows with rising rail electrification, metro expansion, and high-speed train projects. Demand increases for lightweight, fire-safe materials and modular harness designs that improve efficiency. It benefits from adoption of IoT-enabled monitoring systems and predictive maintenance solutions. Urbanization and government investments in rail infrastructure boost installation of advanced wiring systems. Manufacturers focus on energy-efficient, compact designs to support modern rolling stock. Integration of smart connectivity and digital control systems further drives long-term market growth.

North America and Europe lead with strong investments in rail modernization and high-speed projects, while Asia-Pacific shows fastest growth driven by metro and bullet train expansion. Latin America and Middle East & Africa witness steady demand with urban rail developments and freight upgrades. Key players in the Railway Wiring Harness market include Motherson, Sumitomo Electric, TE Connectivity, and HUBER+SUHNER – Phoenix Dynamics, focusing on innovative, fire-safe, and modular harness solutions to meet global safety standards and project-specific requirements.

Market Insights

- Railway Wiring Harness market was valued at USD 15,678 million in 2024 and will reach USD 23,251.9 million by 2032 at a CAGR of 5.05%.

- Rising demand for electrification of rail networks and metro expansion projects drives consistent growth worldwide.

- Growing adoption of smart, IoT-enabled wiring systems supports predictive maintenance and reduces operational downtime.

- Competition is intense with players such as Motherson, Sumitomo Electric, TE Connectivity, and HUBER+SUHNER focusing on innovation.

- High installation complexity and fluctuating raw material prices challenge cost control and project timelines.

- Asia-Pacific leads growth with large-scale metro and bullet train projects, while Europe focuses on ERTMS upgrades.

- North America invests in high-speed rail corridors and commuter rail modernization, creating strong opportunities for suppliers.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Investments in Rail Infrastructure Expansion

Governments and private operators invest heavily in modern rail infrastructure. The Railway Wiring Harness market benefits from electrification projects and network expansions. High-speed rail projects in Europe, China, and India drive adoption of advanced wiring systems. It supports efficient power transmission and reliable signal communication. Growing urbanization pushes metro and light rail projects worldwide. Wiring harness suppliers focus on durable, low-maintenance solutions for long operational life.

- For instance, Indian Railways has electrified 45,922 route-km of its broad-gauge network between 2014-2025, compared with 21,801 route-km before 2014.

Shift Toward Energy Efficiency and Lightweight Solutions

Rail operators demand wiring harnesses that reduce energy loss and improve efficiency. The Railway Wiring Harness market advances with lightweight materials like aluminum and high-performance polymers. These solutions reduce overall train weight and improve fuel efficiency. It also improves heat resistance and extends service intervals. Manufacturers innovate compact designs to support modern railcar layouts. Demand grows for components that meet strict energy efficiency standards.

- For instance, CORE (Central Organisation for Railway Electrification, India) reports 68,701 route-km electrified out of 69,512 route-km total broad-gauge network.

Increasing Adoption of Advanced Safety and Digital Systems

Safety and reliability remain a top priority for rail operators. The Railway Wiring Harness market grows with integration of sensors, automated controls, and IoT solutions. It supports real-time monitoring and predictive maintenance systems. Advanced wiring solutions reduce signal interference and enhance communication reliability. Rising adoption of driver-assistance systems boosts demand for robust harnesses. Suppliers work on shielding technologies for better electromagnetic compatibility.

Stringent Regulatory Standards and Quality Compliance

Compliance with international safety and quality standards drives demand for certified wiring solutions. The Railway Wiring Harness market benefits from regulations set by IEC, EN, and ISO. It ensures fire safety, smoke resistance, and durability under extreme conditions. Operators prefer suppliers offering fully tested, standard-compliant products. Growth in cross-border rail projects accelerates harmonization of quality requirements. Companies invest in R&D to meet evolving certification norms.

Market Trends

Growing Integration of Smart and Connected Technologies

Rail operators adopt smart wiring harnesses that support data transmission and diagnostics. The Railway Wiring Harness market benefits from demand for real-time monitoring and predictive maintenance. It enables fault detection and reduces downtime. Digital connectivity supports condition-based maintenance strategies for operators. Suppliers design harnesses with enhanced data shielding and improved signal quality. Rising focus on smart railways accelerates integration of these advanced solutions.

- For instance, While Hitachi supplies rolling stock components and power systems for rail, the provision of 30 kV high-voltage cables for rolling stock is specifically handled by Proterial, formerly Hitachi Metals. Proterial manufactures the NH-WEP Series of halogen-free cables, which are rated for 30 kV and used in high-speed and other rolling stock for power distribution systems, including under-roof and coach-to-coach connections.

Rising Demand for Modular and Customizable Harness Designs

Manufacturers offer modular wiring harnesses to suit various train models and configurations. The Railway Wiring Harness market experiences demand for easy-to-install and serviceable solutions. It supports faster production cycles and reduces maintenance time. Modular systems allow upgrades without complete rewiring. OEMs prefer solutions that can adapt to multiple railcar platforms. Customization improves operational flexibility for operators and suppliers alike.

- For instance, Cleveland Cable Company produces railway signaling cables of types A1, A2, A3, B1, and B2, which are designed for use in railway signaling systems. While the cables have a voltage rating of 650 V / 1.1 kV and an operating temperature range of −25 °C to +85 °C, the cross-sectional area varies by type. Specifically, Type A cables have core sizes ranging from 0.75 mm² to 1.5 mm², whereas the Type B cables have a larger cross-sectional range from 0.75 mm² up to 95 mm².

Focus on Fire-Safe and Environmentally Compliant Materials

Safety regulations push development of low-smoke, halogen-free wiring materials. The Railway Wiring Harness market evolves with eco-friendly insulation and jacketing. It helps meet global fire safety and emission standards. Suppliers invest in recyclable materials to support sustainability goals. Demand grows for harnesses resistant to extreme temperature and mechanical stress. These materials improve passenger safety and lower long-term operating risks.

Adoption of High-Voltage and Electrification-Ready Solutions

Electrification projects worldwide create demand for high-voltage wiring harnesses. The Railway Wiring Harness market benefits from solutions that handle higher current loads safely. It supports power supply to traction motors and onboard systems. High-voltage harnesses are designed to minimize energy losses and improve reliability. Growth in hybrid and electric rail solutions drives innovation in insulation technology. Manufacturers focus on compact, space-efficient high-voltage assemblies.

Market Challenges Analysis

High Installation and Maintenance Complexity

Railway Wiring Harness market faces challenges from complex installation requirements. It demands precise routing and secure fastening across long train lengths. Improper installation can lead to signal loss and safety issues. Skilled labor shortages increase project timelines and costs. Operators must frequently inspect harnesses to avoid faults and downtime. Integration with modern control systems adds to complexity and technical demands.

Volatility in Raw Material Prices and Supply Chain Issues

Fluctuations in copper, aluminum, and polymer prices affect production costs. The Railway Wiring Harness market experiences pressure to maintain profitability. It struggles with disruptions in global supply chains and longer lead times. Delays impact rail projects and reduce operator confidence. Manufacturers face challenges in sourcing certified, fire-safe materials consistently. Unstable logistics networks increase costs for suppliers and end users.

Market Opportunities

Expansion of High-Speed Rail and Metro Projects Globally

Growing investments in high-speed rail corridors and metro systems create strong growth prospects. The Railway Wiring Harness market gains from demand for advanced, high-capacity wiring solutions. It supports reliable power delivery and communication across modern trains. Urbanization and government funding drive new metro lines in Asia-Pacific and Europe. Suppliers can collaborate with OEMs to provide project-specific harness designs. This trend opens opportunities for long-term supply contracts and partnerships.

Rising Adoption of Electrification and Smart Rail Technologies

Electrification of rail networks fuels need for high-voltage harnesses and energy-efficient designs. The Railway Wiring Harness market benefits from smart wiring systems that integrate sensors and IoT features. It enables real-time performance monitoring and predictive maintenance. Growing focus on green transportation promotes development of eco-friendly, halogen-free materials. Manufacturers can expand portfolios with modular and lightweight harnesses. Demand for connected and sustainable rail solutions offers significant business potential.

Market Segmentation Analysis:

By Train Type:

The Railway Wiring Harness market sees strong demand across metro rail transit and monorail systems. Metro projects in Asia-Pacific and Europe drive high-volume requirements for wiring harnesses. It supports power, communication, and safety functions in dense urban networks. Light rail transit adopts compact and flexible harness solutions for shorter routes. High-speed rail and bullet trains require high-performance, vibration-resistant wiring for traction and signaling. Other train categories, including regional and freight, contribute steadily to market growth.

- For instance, according to Prysmian’s product information, cables for applications like signal lights and axle counters often have small conductor cross-sections, typically up to 2.5 mm². Other specific cable designs for signaling may have conductor diameters of 0.9 mm, 1.3 mm, or 1.4 mm.

By Material:

Copper remains the preferred material due to superior conductivity and durability. The Railway Wiring Harness market benefits from copper’s reliability in high-current applications. It ensures consistent performance under extreme operating conditions. Aluminum harnesses gain popularity in lightweight train designs, reducing overall vehicle mass. It lowers energy consumption and supports efficiency targets. Other materials, including hybrid alloys, are explored for cost reduction and specific design needs.

- For instance, CablesCom supplies signalling multicore cables with up to 61 conductors, each conductor of 1.4 mm nominal diameter, insulated with solid polyethylene and sheath protected with LSZH materials.

By Component:

Wire dominates the segment due to its essential role in power and signal transfer. The Railway Wiring Harness market experiences rising demand for advanced insulation and fire-safe wires. It ensures compliance with strict safety regulations. Connectors form the second-largest share, enabling secure and reliable interconnections. Terminals support efficient current flow and reduce maintenance requirements. Other components, including clamps and conduits, enhance protection and improve installation efficiency.

Segments:

Based on Train Type:

- Metro Rail Transit/Monorail

- Light Rail Transit

- High-Speed Rail/Bullet Rail

- Others

Based on Material:

Based on Component:

- Wire

- Connector

- Terminal

- Others

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 28% and remains one of the leading regions. The region benefits from strong investments in urban rail transit systems and freight modernization projects. The Railway Wiring Harness market gains from the presence of major OEMs and Tier-1 suppliers. It supports upgrades in metro networks across cities such as New York, Chicago, and Toronto. Rising adoption of electric and hybrid locomotives fuels demand for high-voltage wiring solutions. Suppliers focus on advanced, fire-resistant materials to meet stringent Federal Railroad Administration (FRA) safety standards. Growth is also supported by projects like Amtrak’s high-speed rail expansion and public-private partnerships for commuter rail improvements.

Europe

Europe accounts for a market share of 31%, making it the largest regional contributor. The region leads in high-speed rail adoption with extensive networks in France, Germany, Spain, and Italy. The Railway Wiring Harness market benefits from continuous upgrades to signaling and communication systems under the European Rail Traffic Management System (ERTMS). It enables better interoperability and safety compliance for cross-border train operations. OEMs like Alstom, Siemens Mobility, and Stadler drive innovation in harness designs for electric and hydrogen-powered trains. The EU’s green mobility initiatives encourage lightweight, recyclable wiring solutions that lower carbon emissions. Rising investments in metro networks across Eastern Europe create additional demand.

Asia-Pacific

Asia-Pacific holds a market share of 33% and stands as the fastest-growing regional market. Rapid urbanization in China, India, and Southeast Asia drives massive investments in metro and bullet train projects. The Railway Wiring Harness market benefits from large-scale electrification of freight and passenger networks. It supports the needs of high-speed rail projects such as China’s CRH network and India’s Mumbai–Ahmedabad bullet train. Local suppliers collaborate with global OEMs to deliver cost-efficient and high-performance harness solutions. Governments promote domestic manufacturing through initiatives like “Make in India,” boosting regional production capacity. Rising safety standards and smart rail initiatives fuel adoption of IoT-enabled harness systems.

Latin America

Latin America captures a market share of 5% and shows steady but smaller growth potential. The Railway Wiring Harness market gains from ongoing investments in urban rail systems in Brazil, Mexico, and Chile. It supports modernization of freight rail infrastructure to handle mining and agricultural exports efficiently. Public-private partnerships help accelerate metro projects in cities like São Paulo and Mexico City. Demand grows for cost-effective, durable harnesses that can withstand harsh environments. Suppliers focus on providing solutions that balance performance with affordability. Emerging adoption of electrification projects may create future opportunities for high-voltage harness suppliers.

Middle East & Africa

Middle East & Africa account for a market share of 3%, contributing modestly to global revenues. The Railway Wiring Harness market benefits from major rail infrastructure projects like Saudi Arabia’s Riyadh Metro and UAE’s Etihad Rail. It supports connectivity between urban centers and industrial hubs. Governments invest in rail to diversify economies and reduce road congestion. Suppliers provide harness solutions tailored for desert conditions with high temperature resistance. African nations, including South Africa and Egypt, invest in modernization of passenger and freight rail networks. Rising interest in smart city projects creates long-term prospects for advanced wiring solutions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Motherson (India)

- Excel Connection (U.S.)

- HUBER+SUHNER – Phoenix Dynamics Limited (U.K.)

- Sumitomo Electric (Japan)

- Jeanuvs Pvt Ltd. (India)

- Schleuniger (Switzerland)

- RPI Manufacturing (U.S.)

- Harness Techniques Pvt. Ltd (India)

- Control Cable, Inc. (U.S.)

- Proterial, Ltd. (Japan)

- Questex LLC (U.S.)

- Cheers Electronic Technical Ltd. (China)

- Voitas Engineering (Poland)

- TE Connectivity (Switzerland)

- Schrade Kabeltechnik GmbH (Germany)

Competitive Analysis

The Railway Wiring Harness market features strong competition with key players including Motherson (India), Excel Connection (U.S.), HUBER+SUHNER – Phoenix Dynamics Limited (U.K.), Sumitomo Electric (Japan), Jeanuvs Pvt Ltd. (India), Schleuniger (Switzerland), RPI Manufacturing (U.S.), Harness Techniques Pvt. Ltd (India), Control Cable, Inc. (U.S.), Proterial, Ltd. (Japan), Questex LLC (U.S.), Cheers Electronic Technical Ltd. (China), Voitas Engineering (Poland), TE Connectivity (Switzerland), and Schrade Kabeltechnik GmbH (Germany). These companies focus on innovation, cost efficiency, and compliance with global railway safety standards to stay competitive. The market sees continuous investment in lightweight materials, modular harness designs, and fire-safe insulation technologies. Players strengthen their presence through partnerships with OEMs and strategic acquisitions to expand product portfolios. R&D efforts target solutions supporting high-voltage applications and smart monitoring capabilities. Local manufacturing facilities and regional supply networks help reduce lead times and meet project-specific requirements. Competitive differentiation often depends on product reliability, customization options, and technical support services. Companies also adopt digital design tools to optimize harness layouts and improve installation efficiency. The market remains dynamic, with growing opportunities in electrification projects, high-speed rail expansion, and metro system upgrades worldwide.

Recent Developments

- In 2024, Proterial, Ltd. introduced the GT-SNNSK110 durable contact wire on the Keio Line, featuring 20% higher tensile strength, wear grooves for easier maintenance, and longer service life to reduce costs and improve efficiency.

- In 2023 Sumitomo Electric accelerated development of automotive optical harnesses, targeting commercial samples by 2026.

- In 2023, Motherson opened a new wiring harness manufacturing facility in Ras Al Khaimah’s RAKEZ zone, UAE.

Report Coverage

The research report offers an in-depth analysis based on Train Type, Material, Component and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Railway Wiring Harness market will grow steadily with rising rail electrification projects worldwide.

- Demand will increase for high-voltage harnesses to support electric and hybrid locomotives.

- Smart and IoT-enabled wiring harnesses will gain adoption for real-time monitoring and diagnostics.

- Lightweight aluminum and eco-friendly materials will become more common in wiring solutions.

- Suppliers will focus on modular harness designs to reduce installation time and improve flexibility.

- Safety compliance will drive innovation in fire-resistant and halogen-free insulation technologies.

- Asia-Pacific will continue to dominate growth with metro and bullet train expansion projects.

- Europe will lead in standardization, encouraging harmonized harness specifications for cross-border networks.

- Digital twins and simulation tools will be used more to design efficient wiring systems.

- Strategic partnerships between OEMs and harness suppliers will rise to meet customized project needs.