Market Overview

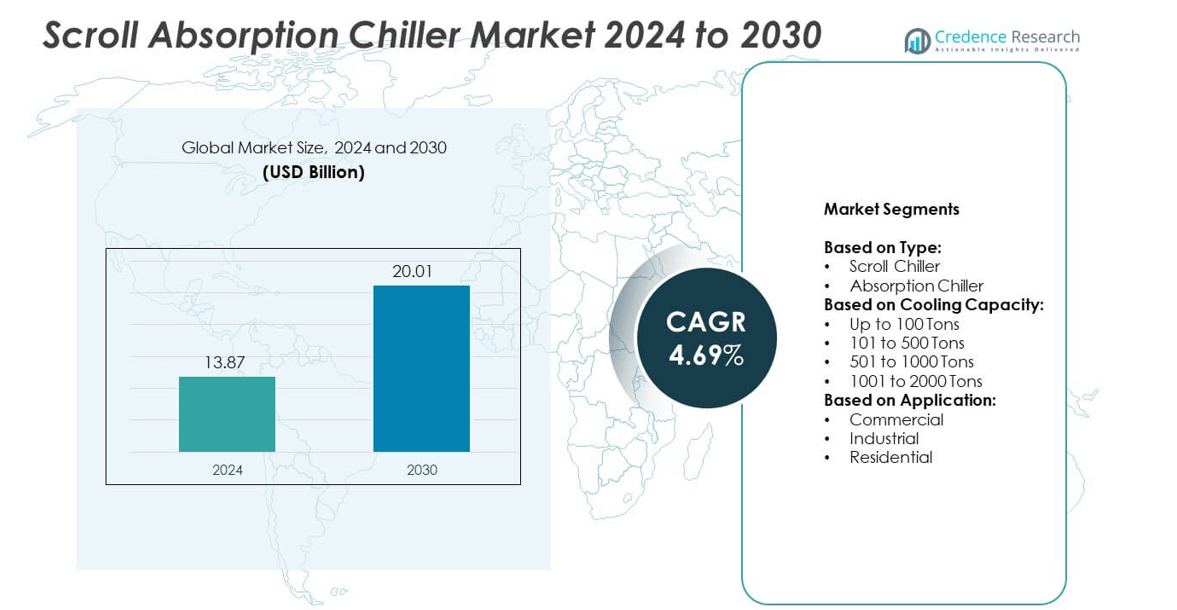

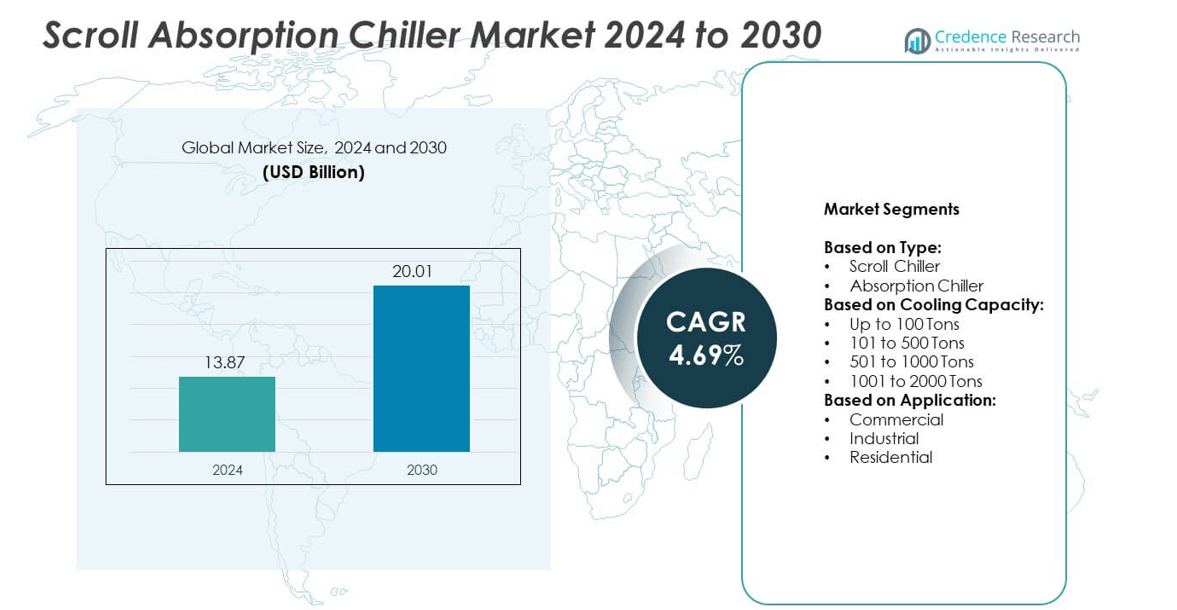

Scroll Absorption Chiller Market size was valued at USD 13.87 billion in 2024 and is expected to reach USD 20.01 billion by 2030, growing at a CAGR of 4.69% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Scroll Absorption Chiller Market Size 2024 |

USD 13.87 billion |

| Scroll Absorption Chiller Market, CAGR |

4.69% |

| Scroll Absorption Chiller Market Size 2032 |

USD 20.01 billion |

The Scroll Absorption Chiller market grows with rising demand for energy-efficient and sustainable cooling solutions. Industries adopt systems that use waste heat and renewable energy to cut electricity consumption. Governments support adoption through incentives and strict emission regulations. Digital monitoring and IoT integration enhance performance and reduce downtime. Compact and modular designs expand installation options for commercial and industrial users. Growth in district cooling networks and green building projects further boosts market adoption across global regions.

North America leads adoption of Scroll Absorption Chiller systems due to strong demand in commercial, healthcare, and data center projects. Europe follows with high focus on emission reduction and energy efficiency regulations. Asia Pacific experiences rapid growth driven by urbanization and large infrastructure investments in China and India. Key players include Midea Group, Lennox International, York International Corporation, and Carrier Corporation. These companies focus on innovation, IoT integration, and localized manufacturing to strengthen market presence globally.

Market Insights

- The Scroll Absorption Chiller market was valued at USD 13.87 billion in 2024 and is projected to reach USD 20.01 billion by 2030, growing at a CAGR of 4.69%.

- Rising demand for energy-efficient cooling and emission reduction drives adoption across commercial, industrial, and residential sectors.

- Market trends highlight growing use of hybrid systems, integration with renewable energy, and compact modular designs for flexible installations.

- Competition remains intense with key players such as Midea Group, Lennox International, York International, Carrier Corporation, and Samsung Electronics focusing on innovation and partnerships.

- High upfront investment costs and the need for skilled technicians for maintenance act as major restraints for small and medium enterprises.

- North America leads due to strong demand from hospitals, data centers, and green building projects, while Europe grows on the back of strict EU energy efficiency directives.

- Asia Pacific emerges as the fastest-growing region, driven by industrialization, district cooling projects, and large infrastructure investments in China, India, and Southeast Asia.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Energy-Efficient Cooling Solutions

The Scroll Absorption Chiller market grows due to demand for efficient cooling systems. Industries and commercial facilities look for solutions that reduce energy use and operational costs. It uses heat sources such as waste heat, steam, or hot water to deliver cooling. This approach helps lower electricity consumption and improve sustainability goals. Governments promote energy-efficient systems through strict regulations and incentives. Companies invest in systems that align with green building certifications. Adoption strengthens in regions with rising energy costs.

- For instance, Carrier’s 16DE absorption chiller model has a typical sound pressure level of 80 dB(A) and uses hermetically sealed pumps to reduce maintenance issues.

Growing Focus on Reducing Carbon Emissions

Environmental regulations drive industries to cut greenhouse gas emissions. The Scroll Absorption Chiller market benefits from technologies that use natural refrigerants. It supports organizations in meeting emission standards and climate action targets. Facilities replace conventional systems with low-emission alternatives. This shift aligns with corporate sustainability programs and public commitments. Demand rises in power plants, district cooling, and industrial manufacturing. Market growth continues with global efforts to decarbonize cooling.

- For instance, Robur’s GA ACF TK gas absorption chiller delivers a cooling capacity of 17.72 kW at standard working point A35/W7. Its nominal electrical power for the standard version is 0.82 kW, and for the low-noise version 0.87 kW.

Expanding Industrial and Commercial Applications

Wider adoption across sectors strengthens market momentum. The Scroll Absorption Chiller market finds applications in pharmaceuticals, food processing, and chemical industries. It provides stable cooling performance under varying loads. Hotels, hospitals, and data centers adopt these systems to ensure reliable operation. Demand also grows in regions with high cooling needs and grid limitations. Manufacturers design compact units to fit space-constrained facilities. Customizable solutions attract small and medium enterprises.

Technological Advancements and Product Innovation

Continuous innovation enhances performance and reliability. The Scroll Absorption Chiller market sees development of units with improved coefficient of performance. It integrates with smart monitoring systems to support predictive maintenance. Enhanced controls optimize energy use and minimize downtime. New materials improve corrosion resistance and lifespan. Manufacturers focus on reducing noise levels and maintenance intervals. These innovations create stronger value for end-users and improve competitiveness.

Market Trends

Adoption of Hybrid Cooling Systems

The Scroll Absorption Chiller market observes rising adoption of hybrid cooling systems. These systems combine absorption chillers with mechanical chillers to improve efficiency. It allows facilities to switch between heat-driven and electric-driven cooling. Hybrid setups help balance energy costs and reduce peak power demand. Industries adopt them to maintain continuous operation during power fluctuations. The trend supports better integration with district cooling networks. Demand grows in large campuses and industrial clusters.

- For instance, Broad U.S.A., Inc. offers a direct-gas-fired absorption chiller model “BZ” with cooling capacity ranging from 30 to 3,300 tons.

Integration with Renewable Energy Sources

Use of renewable heat sources becomes a key trend. The Scroll Absorption Chiller market benefits from solar thermal and biomass-based systems. It supports low-carbon cooling in industrial and commercial facilities. Integration with renewable energy lowers operational costs and emissions. Manufacturers develop units designed for variable heat supply from renewables. This trend aligns with net-zero energy targets in multiple regions. Governments provide incentives to accelerate adoption of such solutions.

- For instance, Mitsubishi Heavy Industries developed a steam-driven absorption chiller with capacity 5,000 USRt (tons refrigeration) and reduced steam consumption by about 10% compared to older units

Focus on Smart Monitoring and Automation

Digitalization transforms the performance of absorption chillers. The Scroll Absorption Chiller market integrates IoT-enabled sensors and smart controllers. It enables remote monitoring, fault detection, and predictive maintenance. Automation improves operational reliability and reduces downtime. Data-driven insights help optimize heat input and water flow. Adoption of cloud-based platforms improves decision-making for facility managers. The trend reduces maintenance costs and increases equipment lifespan.

Shift Toward Compact and Modular Designs

Manufacturers introduce compact and modular systems for flexible installation. The Scroll Absorption Chiller market benefits from space-saving designs. It helps facilities upgrade systems without major structural changes. Modular solutions allow capacity expansion in phases to match demand growth. Lightweight designs simplify transportation and installation. The trend supports adoption in retrofitting projects for older buildings. Smaller systems gain popularity among small and medium-sized enterprises.

Market Challenges Analysis

High Initial Investment and Installation Complexity

The Scroll Absorption Chiller market faces challenges from high upfront costs and complex installation. It requires significant capital for equipment, auxiliary systems, and skilled labor. Many small and medium enterprises delay adoption due to budget limitations. Installation often demands redesign of piping, heat sources, and utility connections. This adds time and disrupts facility operations during commissioning. Limited awareness of long-term cost savings further slows market penetration. Financial incentives and leasing options are needed to encourage wider use.

Maintenance Requirements and Technical Expertise Gaps

Ongoing maintenance and technical skill shortages create operational challenges. The Scroll Absorption Chiller market requires trained professionals to ensure proper performance. It demands regular checks of solution concentration, vacuum levels, and heat exchanger cleaning. Lack of expertise can lead to efficiency loss and unexpected downtime. In some regions, service infrastructure remains underdeveloped. Limited availability of spare parts increases repair time. These factors impact reliability and deter new buyers in emerging markets.

Market Opportunities

Expansion of District Cooling and Waste Heat Utilization Projects

The Scroll Absorption Chiller market has strong opportunities in district cooling networks and waste heat recovery projects. It uses heat from industrial processes, power plants, and incineration facilities to produce cooling. Growing investment in sustainable urban infrastructure supports large-scale adoption. District cooling systems in Middle East, Asia, and Europe create strong demand. Governments promote projects that lower electricity demand during peak hours. Industrial zones seek technologies that improve energy efficiency and reduce emissions. Partnerships between utilities and technology providers can accelerate deployment.

Rising Demand from Emerging Economies and Green Building Initiatives

Rapid urban growth in emerging economies creates new opportunities for absorption chillers. The Scroll Absorption Chiller market benefits from construction of energy-efficient commercial buildings and hospitals. It aligns with global green building certifications like LEED and BREEAM. Rising energy costs encourage adoption of heat-driven systems over electric chillers. Manufacturers can tap demand by offering compact, cost-effective models for small businesses. Local production and service networks will strengthen competitiveness in price-sensitive markets. Collaborations with developers and EPC contractors can expand market reach.

Market Segmentation Analysis:

By Type:

The Scroll Absorption Chiller market is divided into scroll chillers and absorption chillers. Scroll chillers gain traction in small and medium-sized commercial facilities due to compact size and low noise operation. It offers efficient cooling for offices, retail spaces, and hospitality applications. Absorption chillers dominate in large-scale projects where waste heat or steam is available. They are preferred for district cooling, manufacturing plants, and power generation facilities. Demand for hybrid solutions combining both types grows in mixed-use developments. Manufacturers focus on improving efficiency and service life across both segments.

- For instance, Carrier Corporation’s “16DN” double-effect, direct-fired absorption chiller/heater series includes 12 model sizes spanning 150 to 660 tons cooling capacity (~ 528 to 2,321 kW).

By Cooling Capacity:

Capacity-based segmentation shows adoption patterns across diverse industries. Systems up to 100 tons are widely used in small commercial facilities and residential complexes. It supports limited cooling loads with a cost-efficient design. Units between 101 and 500 tons serve mid-sized hotels, hospitals, and office campuses. Larger units from 501 to 1000 tons find use in industrial plants and data centers. Very large systems from 1001 to 2000 tons dominate district cooling and centralized air conditioning networks. Growth is strong in regions investing in industrial and urban infrastructure expansion.

- For instance, Robur produces the AY Series boiler-heater module with nominal heating output from 110,900 to 554,500 BTU/h, and maximum hot water supply temperature up to 185°F.

By Application:

Applications span commercial, industrial, and residential sectors. Commercial users lead adoption due to rising demand for energy-efficient cooling in malls, hotels, and offices. It ensures reliable operation and compliance with green building standards. Industrial applications include process cooling in pharmaceuticals, chemicals, and food processing plants. These users leverage waste heat recovery to improve overall efficiency. Residential adoption grows in premium housing projects and gated communities seeking sustainable cooling options. The trend toward centralized systems supports demand across mixed-use developments and smart city projects.

Segments:

Based on Type:

- Scroll Chiller

- Absorption Chiller

Based on Cooling Capacity:

- Up to 100 Tons

- 101 to 500 Tons

- 501 to 1000 Tons

- 1001 to 2000 Tons

Based on Application:

- Commercial

- Industrial

- Residential

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds a market share of 32% in the Scroll Absorption Chiller market, driven by strong adoption in commercial and industrial sectors. It benefits from increasing investment in energy-efficient cooling systems and district cooling projects. The region’s focus on reducing electricity demand during peak hours supports wider use of heat-driven chillers. It finds major applications in hospitals, hotels, data centers, and manufacturing plants. Government programs and green building standards such as LEED certifications push industries to adopt low-emission technologies. Demand for scroll chillers is strong in small and medium commercial facilities due to compact design and easy installation. Rising construction of mixed-use buildings in the U.S. and Canada continues to generate opportunities for both scroll and absorption chillers.

Europe

Europe accounts for 28% market share, supported by stringent environmental regulations and ambitious carbon reduction targets. The region leads in adoption of waste heat recovery systems in industrial zones. It drives growth of absorption chillers for district cooling and cogeneration projects. Commercial sectors, including retail, healthcare, and hospitality, deploy these systems to comply with EU energy efficiency directives. It also benefits from government funding for sustainable building renovation programs. Demand is strong in countries like Germany, France, and the U.K., where adoption of low-emission cooling solutions aligns with net-zero targets. Manufacturers develop advanced systems with high efficiency to meet strict performance standards.

Asia Pacific

Asia Pacific commands 30% of the market, making it the fastest-growing regional segment. Rapid urbanization and industrial expansion in China, India, and Southeast Asia create significant demand. The Scroll Absorption Chiller market thrives on large-scale infrastructure projects, including metro rail systems, industrial parks, and data centers. It gains traction in commercial real estate as developers adopt green building solutions to attract tenants. Governments invest in district cooling systems to manage rising urban heat loads. Affordable manufacturing capabilities in the region lower equipment costs and support high-volume adoption. Partnerships between global players and local manufacturers enhance availability of cost-effective solutions.

Middle East & Africa

Middle East & Africa represent 6% of the global market share, with strong potential for growth in district cooling networks. High ambient temperatures in Gulf countries create a large requirement for reliable and efficient cooling systems. It is widely deployed in commercial complexes, airports, and large residential developments. Government initiatives promoting sustainable urban development and reduced electricity consumption drive adoption. Absorption chillers using waste heat from desalination and power plants are increasingly popular. Local players collaborate with global manufacturers to introduce advanced solutions suited for extreme climate conditions. Expansion of hospitality and tourism infrastructure further boosts demand.

Latin America

Latin America holds 4% share, with Brazil and Mexico leading demand in the region. Growth is supported by rising investments in commercial buildings, manufacturing facilities, and healthcare infrastructure. It provides a reliable alternative to electric chillers in areas facing power supply fluctuations. Governments encourage energy-efficient equipment adoption through incentives and awareness programs. Industrial zones use absorption chillers for process cooling to lower operational costs. The region sees growing demand from data centers and large office complexes. Manufacturers expand after-sales service networks to strengthen presence in emerging urban markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Midea Group

- Lennox International, Inc.

- York International Corporation

- Samsung Electronics

- Carrier Corporation

- Hitachi, Ltd.

- LG Electronics

- Hisense Group

- Gree Electric Appliances, Inc. of Zhuhai

- Haier Group

- Johnson Controls International

- Mitsubishi Electric Corporation

- Daikin Industries, Ltd.

- TCL Corporation

Competitive Analysis

The Scroll Absorption Chiller market is competitive, with leading players such as Midea Group, Lennox International, York International Corporation, Samsung Electronics, Carrier Corporation, Hitachi, LG Electronics, Hisense Group, Gree Electric Appliances, Haier Group, Johnson Controls International, Mitsubishi Electric Corporation, Daikin Industries, and TCL Corporation driving innovation and market growth. These companies focus on expanding their product portfolios to meet rising demand for energy-efficient cooling solutions. They invest in R&D to develop compact, modular systems with improved efficiency and lower maintenance requirements. Strategic partnerships with EPC contractors and facility managers help them penetrate large-scale projects, including district cooling and industrial applications. Players emphasize integration of IoT-enabled monitoring and smart control systems to enhance performance and reliability. Global expansion remains a key strategy, with manufacturing and service facilities being set up closer to demand centers. Companies compete on technology differentiation, system reliability, and after-sales support to gain market share. Sustainability initiatives and compliance with environmental regulations play a vital role in shaping product development and positioning. The competitive landscape remains dynamic, with mergers, acquisitions, and collaborations strengthening supply capabilities and enabling access to new markets.

Recent Developments

- In 2025, Carrier introduced a new heat pump variant of its modular chiller line to improve performance flexibility.

- In 2024, Haier Smart Home completed its acquisition of Carrier Commercial Refrigeration. This acquisition significantly expanded Haier’s presence from home refrigeration into the broader commercial and food retail refrigeration market.

- In 2023, Daikin Applied launched the Trailblazer® HP, a heat-pump scroll chiller that switches between cooling and heating modes for commercial buildings

Report Coverage

The research report offers an in-depth analysis based on Type, Cooling Capacity, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Scroll Absorption Chiller market will see steady growth supported by rising demand for energy-efficient cooling.

- Adoption will increase in district cooling networks and waste heat recovery projects.

- Manufacturers will focus on compact, modular designs for space-constrained facilities.

- Integration with renewable heat sources like solar thermal and biomass will expand.

- Digital monitoring and IoT-enabled systems will enhance predictive maintenance and uptime.

- Industrial sectors will adopt systems to meet stricter emission reduction regulations.

- Demand from data centers and hospitals will strengthen due to reliable operation needs.

- Emerging economies will drive installations through infrastructure development and green building projects.

- Service and maintenance networks will expand to support higher adoption rates globally.

- Partnerships between global suppliers and regional players will boost localized production and affordability.