Market Overview

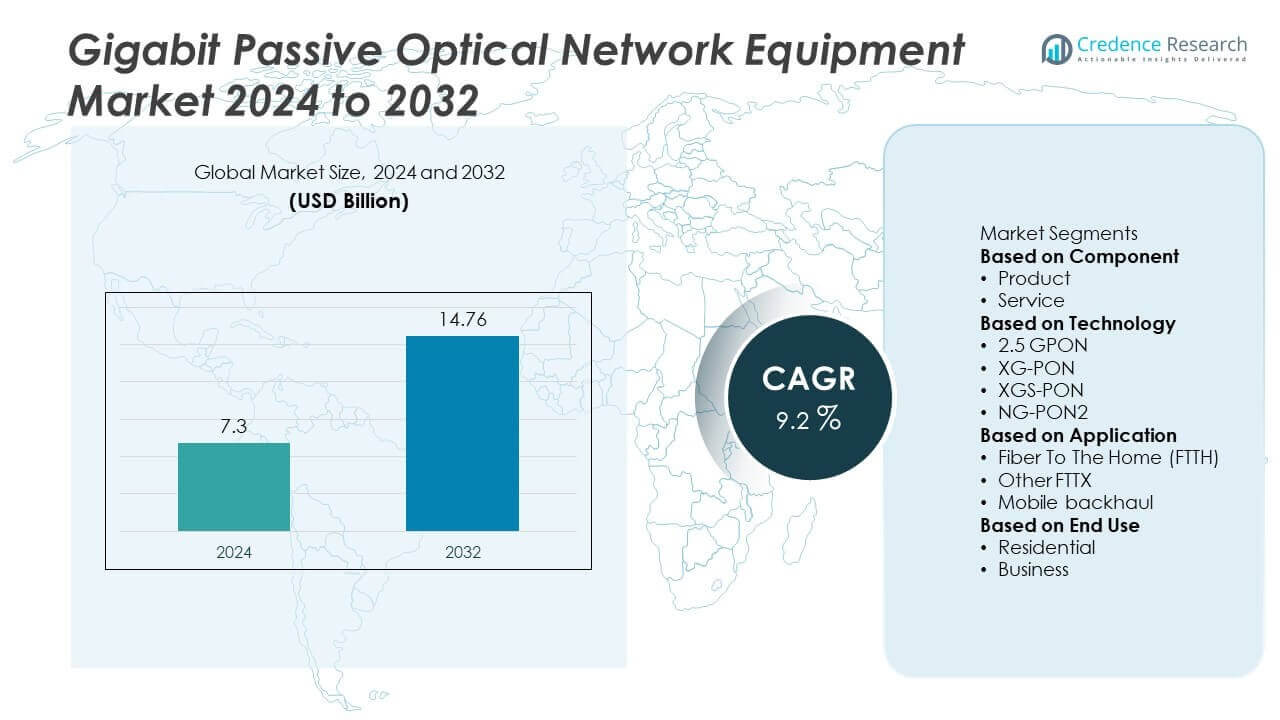

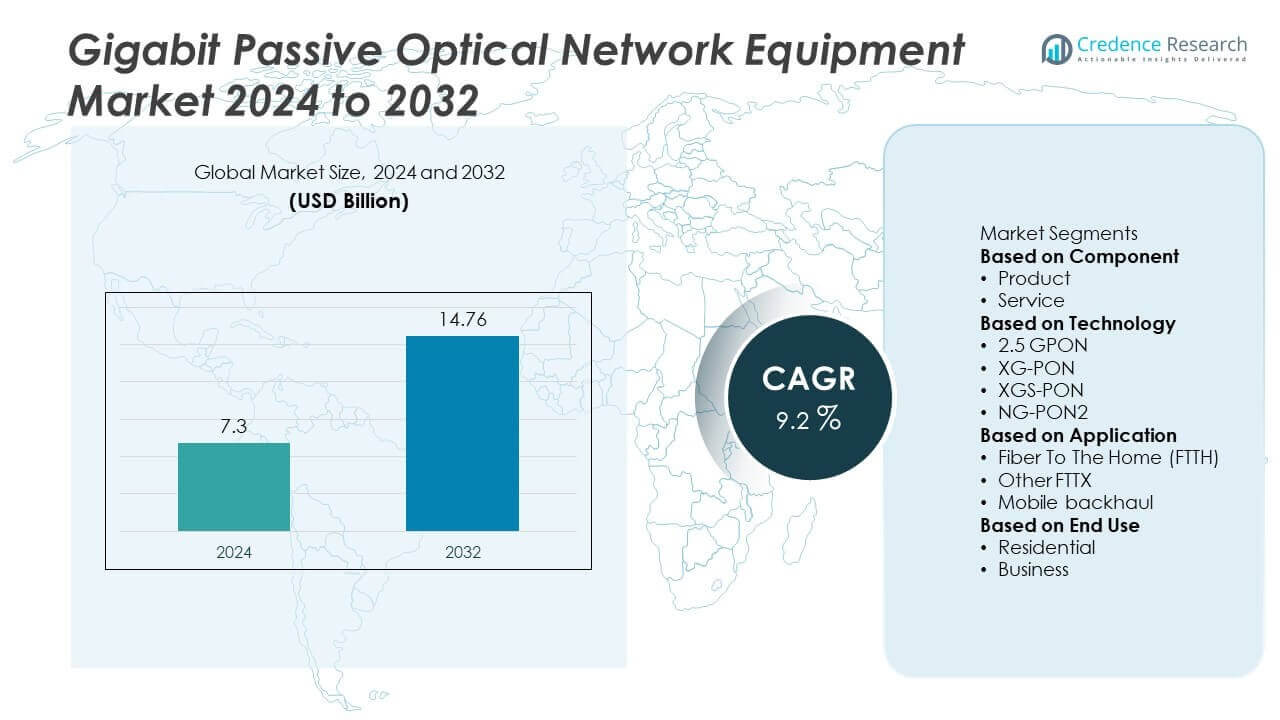

The global Gigabit Passive Optical Network (GPON) Equipment Market was valued at USD 7.3 billion in 2024 and is projected to reach USD 14.76 billion by 2032, growing at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Gigabit Passive Optical Network (GPON) Equipment Market Size 2024 |

USD 7.3 Billion |

| Gigabit Passive Optical Network (GPON) Equipment Market, CAGR |

9.2% |

| Gigabit Passive Optical Network (GPON) Equipment Market Size 2032 |

USD 14.76 Billion |

The Gigabit Passive Optical Network Equipment Market grows with rising demand for high-speed broadband, fueled by streaming, cloud computing, and remote work. Telecom operators invest in fiber-to-the-home rollouts to meet customer expectations for reliable connectivity.

Geographically, the Gigabit Passive Optical Network Equipment Market shows strong growth across Asia-Pacific, North America, and Europe, supported by rising fiber-to-the-home deployments and high-speed broadband demand. Asia-Pacific leads expansion with large-scale investments in China, India, and Japan to support urban digital infrastructure and 5G backhaul. North America focuses on rural broadband initiatives and network upgrades driven by federal funding and private operator investment. Europe emphasizes digital transformation through gigabit connectivity goals and smart city projects. These regions witness strong demand from both residential and enterprise users seeking low-latency, high-capacity networks. Key players driving this market include Huawei, Nokia, ADTRAN, and Cisco, who invest in next-generation GPON technologies, interoperability standards, and energy-efficient solutions to meet evolving bandwidth needs. Strategic partnerships, R&D investments, and regional expansion initiatives help these companies strengthen their presence and capture opportunities in both developed and emerging markets.

Market Insights

- The Gigabit Passive Optical Network Equipment Market was valued at USD 7.3 billion in 2024 and is projected to reach USD 14.76 billion by 2032, growing at a CAGR of 9.2% during the forecast period.

- Rising demand for high-speed broadband, remote work, and streaming services drives large-scale fiber-to-the-home deployments globally.

- Adoption of next-generation technologies like XGS-PON and NG-PON2 is accelerating, enabling higher bandwidth and supporting 5G backhaul applications.

- Key players such as Huawei, Nokia, Cisco, ADTRAN, and Ericsson focus on product innovation, interoperability, and partnerships with telecom operators to expand market reach.

- High initial infrastructure costs, complex deployment processes, and shortage of skilled fiber technicians remain major challenges for rapid network rollouts.

- Asia-Pacific leads growth with aggressive broadband expansion in China and India, while North America invests heavily in rural connectivity and Europe focuses on gigabit society targets.

- Growing adoption across residential, commercial, and industrial applications ensures strong demand, supported by smart city projects and enterprise digital transformation initiatives.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for High-Speed Broadband Connectivity

The Gigabit Passive Optical Network Equipment Market benefits from the growing need for faster internet and high-bandwidth applications. Increasing adoption of streaming services, online gaming, and cloud computing drives network upgrades. It provides reliable, high-capacity connections with minimal latency, making it ideal for residential and enterprise users. Telecom operators invest heavily in fiber-to-the-home (FTTH) deployments to meet customer expectations. The shift toward work-from-home and remote learning further strengthens demand for GPON infrastructure. This trend fuels large-scale adoption across urban and semi-urban areas worldwide.

- For instance, ADTRAN and Netomnia deployed the SDX 6400 OLT platform to launch the UK’s first commercial 50G-PON service in May 2025, enabling symmetrical 50 Gbps connectivity for a customer using existing fiber infrastructure, and demonstrating a path to extend service to a broader base of premises.

Expansion of Smart Cities and Digital Infrastructure

Global initiatives to develop smart cities boost the Gigabit Passive Optical Network Equipment Market. Governments and municipalities invest in advanced communication networks to support IoT, traffic management, and surveillance systems. It offers the scalability required for connecting multiple devices and applications seamlessly. Public-private partnerships accelerate fiber optic rollouts to enhance urban connectivity. Integration of GPON technology helps create robust, future-ready digital infrastructure. These investments ensure consistent demand for GPON equipment across regions.

- For instance, in December 2024 Nokia and Hotwire Communications trialed 25G- and 50G-PON over a live Florida fiber network using Nokia Lightspan, delivering multi-gigabit service across a 10-mile service area.

Growing Adoption in Enterprises and Industrial Applications

The Gigabit Passive Optical Network Equipment Market experiences growth from enterprise and industrial sectors adopting fiber-based networks. Large corporations deploy GPON solutions to connect data centers, branch offices, and production facilities. It delivers secure, high-speed data transmission supporting critical applications like video conferencing and real-time analytics. Industries such as healthcare, education, and manufacturing use GPON to improve operational efficiency. The rising trend of digital transformation encourages businesses to replace legacy copper networks with fiber solutions. This enterprise adoption drives market expansion.

Cost Efficiency and Technological Advancements

Falling fiber installation costs and advances in GPON technology strengthen the Gigabit Passive Optical Network Equipment Market. Vendors develop next-generation solutions supporting higher split ratios and bandwidth efficiency. It reduces overall operating expenses for service providers while enhancing service quality. Innovations like XGS-PON and NG-PON2 enable symmetric gigabit speeds, meeting future data demands. Standardization efforts improve interoperability and promote widespread deployment. These developments encourage network operators to accelerate investment in GPON infrastructure.

Market Trends

Market Trends

Shift Toward Next-Generation PON Technologies

The Gigabit Passive Optical Network Equipment Market is witnessing a transition toward advanced technologies such as XGS-PON and NG-PON2. Service providers adopt these solutions to deliver higher bandwidth and symmetric gigabit speeds. It supports emerging applications like 4K video streaming, cloud gaming, and enterprise-grade connectivity. Growing competition in telecom drives operators to upgrade networks for better customer experience. Vendors invest in R&D to offer scalable and interoperable equipment. This shift accelerates fiber network modernization worldwide and strengthens market growth.

- For instance, Nokia launched a high-density 16-port 25G-PON line card for its Lightspan FX platform, enabling operators to deliver 25 Gbps symmetrical speeds over existing fiber infrastructure. The number of ONT connections supported per chassis depends on the platform and line card combination, as well as the split ratio.

Rising Fiber-to-the-Home (FTTH) Deployments

The Gigabit Passive Optical Network Equipment Market benefits from rapid expansion of FTTH networks across developed and emerging regions. Governments and telecom operators focus on bridging the digital divide and improving rural broadband access. It enables high-speed internet delivery to homes, supporting remote work, education, and entertainment services. Subsidies and funding programs promote large-scale fiber rollouts in underserved areas. Increasing household demand for reliable connectivity fuels GPON adoption. This trend ensures steady equipment demand throughout the forecast period.

- For instance, ADTRAN reported its SDX OLT platforms powered 8.6 million FTTH premises for Openreach, with each deployment delivering up to 10 Gbps XGS-PON capacity per user.

Integration with Smart City and IoT Initiatives

The Gigabit Passive Optical Network Equipment Market gains momentum from smart city projects and IoT ecosystem growth. High-speed fiber backbones are essential for connecting sensors, cameras, and public services. It offers scalability and reliability for applications like traffic control, public Wi-Fi, and surveillance systems. Municipalities partner with telecom operators to deploy GPON infrastructure as part of urban digital transformation plans. Adoption of smart energy meters and connected devices further boosts bandwidth requirements. This trend creates consistent opportunities for GPON vendors.

Growing Preference for Green and Energy-Efficient Networks

The Gigabit Passive Optical Network Equipment Market experiences rising demand for energy-efficient and sustainable solutions. Service providers look for equipment with lower power consumption to reduce operational costs. It supports eco-friendly initiatives by minimizing carbon footprint in network operations. Manufacturers design GPON components with advanced power-saving features and compact form factors. Adoption of passive optical architecture reduces the need for active components, cutting energy usage. This trend aligns with global sustainability goals and drives innovation in the sector.

Market Challenges Analysis

High Initial Investment and Deployment Complexity

The Gigabit Passive Optical Network Equipment Market faces challenges from high upfront infrastructure costs and complex deployment processes. Laying fiber networks requires significant capital expenditure, making it difficult for smaller operators to compete. It involves trenching, civil work, and right-of-way permissions, which can delay project timelines. Rural and remote areas present additional cost barriers due to low population density. Service providers must balance long-term ROI with immediate financial pressure. These factors slow network expansion in cost-sensitive regions and limit adoption speed.

Interoperability and Skilled Workforce Shortage

The Gigabit Passive Optical Network Equipment Market also struggles with interoperability issues among equipment from different vendors. Lack of universal standards sometimes leads to compatibility problems, increasing maintenance complexity. It creates additional costs for operators who must manage multi-vendor networks. Shortage of skilled technicians for fiber splicing and network integration adds to deployment challenges. Training programs are required to build a capable workforce for large-scale rollouts. These operational hurdles can delay service launches and reduce overall efficiency.

Market Opportunities

Expansion of Fiber Networks in Emerging Economies

The Gigabit Passive Optical Network Equipment Market holds strong opportunities with rapid fiber network expansion in emerging economies. Governments invest in broadband infrastructure to bridge the digital divide and support economic growth. It enables high-speed internet access for rural populations and small businesses. Telecom operators deploy GPON solutions to meet rising demand for video streaming, e-commerce, and remote work applications. International funding programs and public-private partnerships accelerate fiber-to-the-home rollouts. These developments create consistent demand for GPON equipment and related services.

Adoption of Next-Generation PON and Enterprise Solutions

The Gigabit Passive Optical Network Equipment Market benefits from growing interest in XGS-PON and NG-PON2 technologies. These platforms support higher bandwidth and symmetrical data speeds, ideal for 5G backhaul and enterprise connectivity. It allows operators to offer premium services to industries such as healthcare, education, and finance. Enterprises adopt GPON to connect campuses, data centers, and smart buildings with secure, scalable networks. Vendors introducing interoperable and energy-efficient solutions gain a competitive edge. This shift toward advanced PON solutions creates significant growth potential in both urban and commercial segments.

Market Segmentation Analysis:

By Component

The Gigabit Passive Optical Network Equipment Market is segmented into optical line terminals (OLT), optical network terminals (ONT), and others. Optical line terminals hold a major share as they serve as the core control point for GPON networks. It manages data distribution, bandwidth allocation, and overall network performance. Demand for OLTs rises with large-scale fiber-to-the-home (FTTH) deployments by telecom operators. Optical network terminals also see strong growth as residential and enterprise broadband adoption increases. Vendors focus on compact, power-efficient ONTs to support mass deployments and reduce operational costs.

- For instance, Huawei’s MA5800T X17 smart OLT can deliver an 8 Tbps payload switching capacity, supporting 16,000 concurrent 4K video users per chassis, while Calix’s GigaSpire BLAST u10e ONT uses Wi-Fi 6E to enable multi-gigabit throughput via its 10 GigE WAN port for high-density deployments.

By Technology

The market is classified by technology into GPON, XGS-PON, and NG-PON2. GPON dominates today due to its widespread adoption and cost-effectiveness for residential broadband. It supports gigabit speeds and reliable data transmission over long distances. XGS-PON gains momentum with its ability to provide symmetrical 10 Gbps services, ideal for enterprises and 5G backhaul. NG-PON2, offering even higher capacity and wavelength flexibility, is being adopted in advanced networks to future-proof infrastructure. Technology upgrades create recurring demand for equipment replacement and network upgrades.

- For instance, Nokia introduced a 16-port high-density 25G-PON optical line card for its Lightspan FX fiber access platforms, while Broadcom announced its BCM68660 chipset for 50G-PON deployments, supporting 50 Gbps downstream and various upstream rates, such as 25 Gbps or 50 Gbps.

By Application

The Gigabit Passive Optical Network Equipment Market serves applications in residential, commercial, and industrial segments. Residential applications lead due to the global focus on FTTH rollouts and high-speed internet demand. It enables seamless streaming, remote work, and online education for households. Commercial use is growing as enterprises deploy GPON for secure, scalable, and cost-efficient connectivity across campuses and offices. Industrial applications include smart factories and utilities where reliable, low-latency communication is critical. Rising adoption across all segments ensures a steady growth trajectory for the market.

Segments:

Based on Component

Based on Technology

- 2.5 GPON

- XG-PON

- XGS-PON

- NG-PON2

Based on Application

- Fiber To The Home (FTTH)

- Other FTTX

- Mobile backhaul

Based on End Use

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 28% market share in the Gigabit Passive Optical Network Equipment Market, driven by high demand for fiber-to-the-home (FTTH) and enterprise connectivity solutions. The region benefits from strong telecom infrastructure and rapid adoption of high-speed broadband services. It witnesses significant investments from leading operators upgrading legacy copper networks to fiber to meet bandwidth demand. The U.S. leads with federal initiatives promoting rural broadband deployment and digital inclusion. Canada follows with large-scale rollouts supported by government funding and private investments. Growth in streaming, online education, and remote work continues to support strong demand for GPON equipment across the region.

Europe

Europe accounts for 25% market share, supported by expanding gigabit connectivity initiatives and cross-border digital programs. The European Union’s Gigabit Society targets drive large-scale fiber deployments across member states. It sees strong activity in countries like Germany, France, and the UK, where operators accelerate FTTH coverage to compete in high-speed broadband markets. Rural connectivity projects and public-private partnerships contribute to steady growth. Vendors collaborate with local players to offer cost-effective and scalable GPON solutions. Rising smart city projects and IoT adoption further boost GPON demand in this region.

Asia-Pacific

Asia-Pacific captures 35% market share, making it the largest and fastest-growing regional market for GPON equipment. China dominates with massive investments in national broadband initiatives and urban digital infrastructure. It focuses on upgrading to XGS-PON technology to meet rising data demand from smart cities and 5G backhaul. India is witnessing aggressive FTTH rollouts supported by government-led programs such as Digital India. Japan, South Korea, and Southeast Asian countries also invest in fiber networks to enhance broadband speeds and coverage. Growing internet penetration and expanding enterprise networks continue to drive equipment demand in this region.

Latin America

Latin America represents 6% market share, with growth supported by gradual modernization of telecom infrastructure. Countries like Brazil, Mexico, and Chile lead GPON adoption through urban FTTH projects. It benefits from increasing demand for video streaming, e-commerce, and online services that require reliable high-speed connections. Regional governments promote connectivity expansion through public initiatives and partnerships with global telecom operators. Despite infrastructure gaps in rural areas, investment momentum remains strong in metropolitan regions. The trend toward digital inclusion will sustain steady growth across the region.

Middle East and Africa

Middle East and Africa hold 6% market share, driven by rising investments in fiber-optic infrastructure and smart city projects. Gulf countries such as the UAE and Saudi Arabia lead with nationwide gigabit connectivity programs. It supports the deployment of GPON solutions for residential, commercial, and government applications. African nations are focusing on bridging the digital divide through international partnerships and funding initiatives. Growing demand for high-capacity networks to support mobile data growth and 5G backhaul fuels GPON equipment installations. Expanding enterprise adoption and e-government projects will continue to create opportunities in this region.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- NEC

- ADTRAN

- Verizon

- Huawei

- DASAN Zhone Solutions

- Nokia

- Calix

- Ericsson

- Cisco

- Broadcom

Competitive Analysis

Competitive landscape of the Gigabit Passive Optical Network Equipment Market is shaped by key players such as Huawei, Nokia, Cisco, ADTRAN, Ericsson, Broadcom, Calix, DASAN Zhone Solutions, NEC, and Verizon. These companies compete by delivering advanced GPON, XGS-PON, and NG-PON2 solutions that meet rising bandwidth demands. They focus on innovation to improve network efficiency, scalability, and energy savings for telecom operators. Strategic partnerships with service providers help secure large-scale fiber-to-the-home and 5G backhaul projects. Continuous R&D investment allows them to introduce interoperable and software-defined solutions, supporting flexible network management. Many players expand their regional presence through collaborations with governments and participation in digital inclusion programs. Mergers, acquisitions, and joint ventures are common strategies to strengthen technology portfolios and global reach. By prioritizing high-performance, cost-efficient, and future-ready solutions, these companies maintain a competitive edge and support the transition toward next-generation broadband infrastructure worldwide.

Recent Developments

- In May 2025, ADTRAN and Netomnia announced what they called the first commercial 50G-PON service deployment, using the SDX 6400 OLT.

- In March 2025, NEC began global sales of a 25G tunable SFP extended-reach transceiver supporting 40 km transmission, up from 15 km in prior products.

- In February 2025, ADTRAN announced that its SDX OLT platform is powering 30% of Openreach’s Full Fibre network. The announcement highlighted that this SDX platform reduces space requirements by over 30% and cuts power consumption by 50% compared to previous-generation OLTs.

- In February 2025, Huawei released its smart OLT called MA5800T X17 at Mobile World Congress (MWC). It delivers ultra-high bandwidth, deterministic experience, and “native intelligence” for intelligent fixed networks.

Report Coverage

The research report offers an in-depth analysis based on Component, Technology, Application, End Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for fiber-to-the-home connections will continue to rise globally.

- Telecom operators will accelerate deployment of XGS-PON and NG-PON2 technologies.

- 5G backhaul and edge computing applications will boost GPON equipment adoption.

- Enterprises will adopt GPON for secure, high-capacity campus and data center connectivity.

- Smart city projects will expand, requiring scalable and low-latency optical networks.

- Vendors will focus on energy-efficient and environmentally friendly GPON solutions.

- Government broadband initiatives will bridge digital gaps in rural and underserved areas.

- Software-defined networking will enable better control and optimization of PON networks.

- Interoperable and standardized solutions will gain preference to reduce deployment complexity.

- Emerging markets will offer strong opportunities as they upgrade legacy copper networks.

Market Trends

Market Trends