Market Overview:

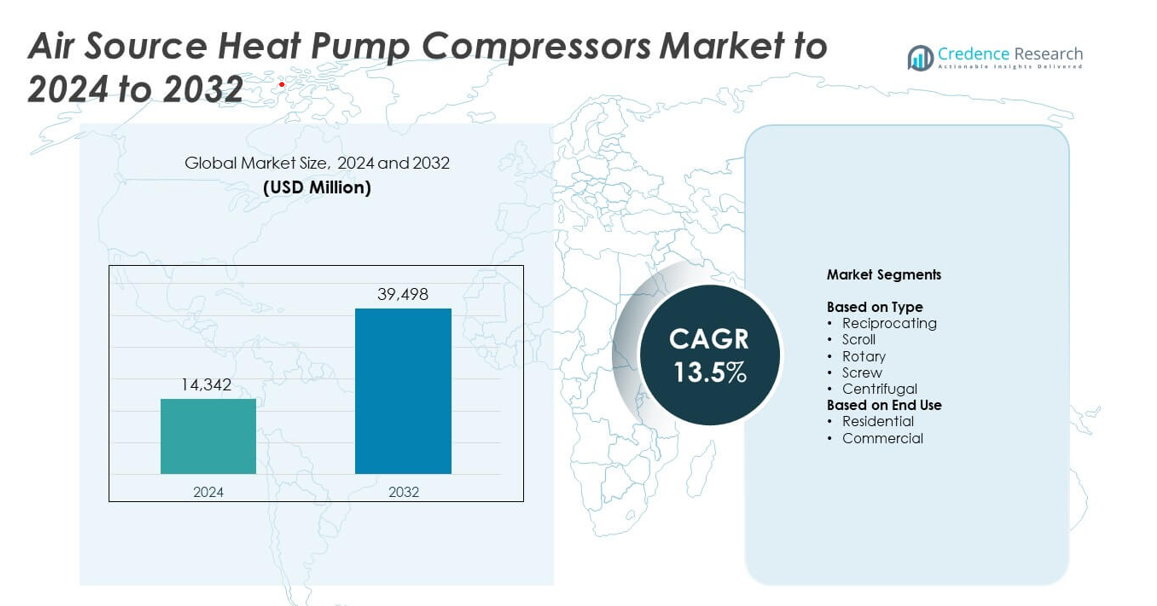

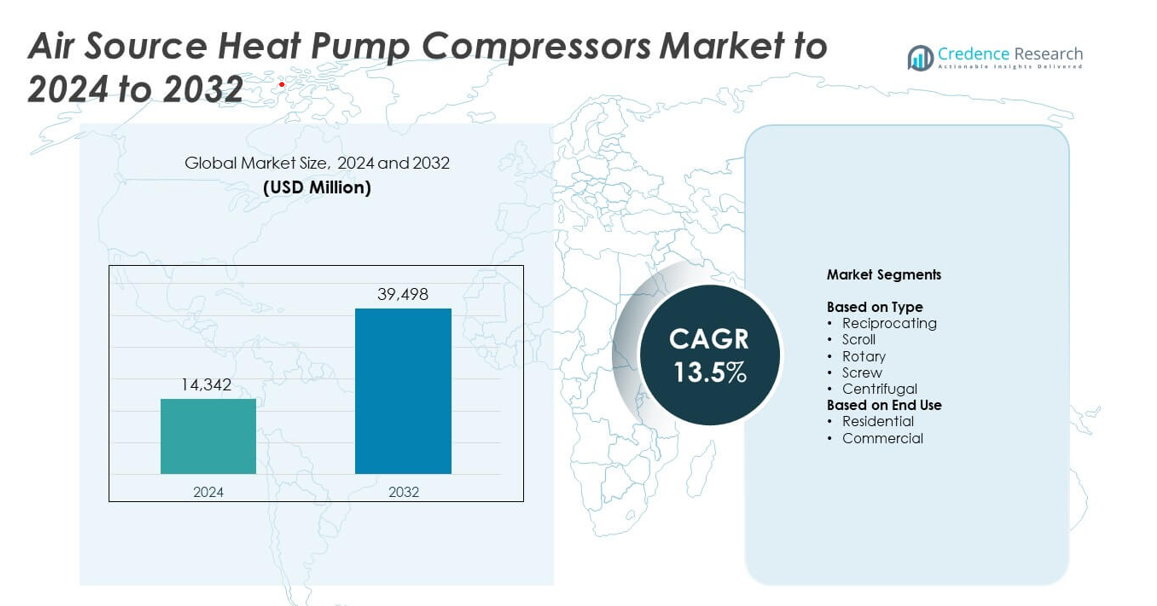

Air Source Heat Pump Compressors market size was valued at USD 14,342 million in 2024 and is anticipated to reach USD 39,498 million by 2032, at a CAGR of 13.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Air Source Heat Pump Compressors Market Size 2024 |

USD 14,342 million |

| Air Source Heat Pump Compressors Market, CAGR |

13.5% |

| Air Source Heat Pump Compressors Market Size 2032 |

USD 39,498 million |

The air source heat pump compressors market is led by major players such as Daikin, Panasonic, Emerson Electric Co, Mitsubishi Electric Corporation, Carrier, LG Electronics, Danfoss, BITZER Group, Midea Group, and Atlas Copco. These companies dominate through technological innovation, global distribution networks, and advanced inverter-driven compressor solutions. They focus on improving energy efficiency, using low-GWP refrigerants, and expanding production capacity to meet rising demand across residential and commercial sectors. Europe emerged as the leading region in 2024, holding a 34.6% market share, driven by strong regulatory support, decarbonization goals, and widespread adoption of sustainable heating systems.

Market Insights

- The air source heat pump compressors market was valued at USD 14,342 million in 2024 and is projected to reach USD 39,498 million by 2032, growing at a CAGR of 13.5% during the forecast period.

- Growing demand for energy-efficient and low-carbon heating systems is a major driver, supported by government incentives promoting renewable energy adoption across residential and commercial buildings.

- Technological advancements such as inverter-based and variable-speed compressors, along with low-GWP refrigerants, are shaping market trends toward sustainability and operational efficiency.

- The market is highly competitive, with global players focusing on R&D, strategic partnerships, and product differentiation to enhance energy efficiency and reduce emissions.

- Europe led with a 34.6% share in 2024, followed by Asia-Pacific at 29.8% and North America at 28.4%, while scroll compressors dominated the product segment with a 46.8% share due to their compact design and superior efficiency.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Scroll compressors dominated the air source heat pump compressors market with a 46.8% share in 2024. Their compact design, low noise, and high energy efficiency make them ideal for residential and light commercial heat pumps. The growing preference for variable-speed and inverter-driven scroll compressors enhances operational flexibility and reduces energy consumption. Manufacturers are focusing on using eco-friendly refrigerants and advanced motor technologies to improve performance. The rising adoption of air-to-water heat pumps in colder regions further supports demand for scroll compressors in sustainable HVAC applications.

- For instance, Copeland’s ZW heat-pump scrolls use EVI to raise efficiency by 22% and deliver hot water up to 85 °C, with operation down to –30 °C ambient.

By End Use

The residential segment accounted for a 57.3% share of the air source heat pump compressors market in 2024. Increasing household adoption of energy-efficient heating and cooling systems drives this dominance. Government incentives and carbon reduction goals across Europe, North America, and Asia-Pacific encourage residential heat pump installations. Advancements in inverter-driven compressors allow better temperature control and reduced power use in homes. Rapid urbanization, rising electricity prices, and the replacement of fossil-fuel-based boilers further boost demand within the residential sector globally.

- For instance, Mitsubishi Electric’s Ecodan ‘Ultra Quiet’ monobloc range (specifically the newer R290 models) offers 5, 6, 8.5, 10, and 12 kW models aimed at residential retrofits.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Growing awareness of energy conservation and carbon neutrality is driving demand for energy-efficient heating systems. Air source heat pump compressors play a vital role in reducing electricity use compared to traditional HVAC units. Supportive government incentives and strict emission regulations are encouraging the shift toward renewable-based heating solutions. The adoption of inverter-based and variable-speed compressor technologies further enhances performance and energy efficiency, making them preferred options across residential and commercial sectors.

- For instance, Bosch’s Compress 6800i AW provides several output classes, typically ranging from 3.9–11.6 kW, and uses R290 refrigerant to reach high seasonal efficiency. The specific number of output classes (e.g., four or five) depends on the region where the product is sold.

Expanding Residential Construction and Retrofit Projects

The expansion of residential infrastructure, particularly in Europe and Asia-Pacific, is a major driver for compressor demand. Increased housing development and renovation activities are promoting the replacement of conventional systems with advanced air source heat pumps. Homeowners are increasingly adopting sustainable solutions to lower operational costs and improve comfort. The integration of smart home systems and connected thermostats enhances compressor efficiency and long-term reliability, accelerating adoption in both new and existing housing projects.

- For instance, Viessmann’s Vitocal 250-A achieves a 70 °C flow temperature, enabling radiator-based retrofits without underfloor heating.

Government Policies Supporting Decarbonization

Global decarbonization initiatives are strongly influencing the air source heat pump compressors market. Governments in major economies are offering subsidies and rebates to promote eco-friendly heating technologies. Programs like the EU Green Deal and U.S. Inflation Reduction Act provide incentives for heat pump adoption. These policies boost investment in R&D and product innovation, encouraging manufacturers to develop compressors with low-GWP refrigerants and higher seasonal energy efficiency ratings to align with environmental goals.

Key Trends and Opportunities

Integration of Smart and Connected Technologies

he adoption of IoT-enabled air source heat pump compressors is transforming operational monitoring and maintenance. Smart sensors allow real-time tracking of performance, predictive maintenance, and fault detection. This digital integration enhances system efficiency and extends product lifespan. Growing consumer preference for connected HVAC systems creates strong opportunities for compressor manufacturers to collaborate with technology providers and develop advanced digital control platforms.

- For instance, Panasonic’s Aquarea L Series uses R290 with a GWP of 3, delivers water up to 75 °C, and operates down to –25 °C.

Shift Toward Low-GWP and Eco-Friendly Refrigerants

Environmental regulations are driving a transition toward compressors compatible with low-global warming potential (GWP) refrigerants such as R32 and CO₂. Manufacturers are focusing on improving compressor design to handle new refrigerants while maintaining performance. The shift toward sustainable refrigerants reduces environmental impact and supports compliance with global climate targets. This trend is opening new opportunities for companies to expand into regions with strict emission standards.

- For instance, LG’s Therma V R32 Monobloc shows SCOP up to 4.67 and heating operation typically down to –25 °C (though some specific models can reach –28 °C), illustrating inverter-driven efficiency at varying loads.

Increasing Adoption of Variable-Speed Compressors

Variable-speed compressor technology is emerging as a key trend due to its superior energy efficiency and adaptability. These compressors automatically adjust their operating speed to match heating or cooling demand, minimizing energy losses. The growing use of inverter technology across HVAC systems is enhancing comfort levels and reducing operating costs. Manufacturers are leveraging this opportunity to differentiate products with higher performance and noise reduction features.

Key Challenges

High Initial Installation Costs

Despite long-term savings, the high upfront cost of air source heat pump compressors remains a major challenge. Installation expenses, including system components and skilled labor, often discourage adoption in developing markets. Limited consumer awareness about lifecycle savings further slows growth. Addressing cost barriers through local manufacturing, bulk production, and financing schemes is crucial for wider market penetration.

Performance Limitations in Cold Climates

Air source heat pump compressors face efficiency issues in extremely cold regions, where heat extraction becomes less effective. The drop in outdoor temperature reduces system performance and increases electricity consumption. Manufacturers are working on hybrid systems and advanced refrigerant cycles to improve low-temperature efficiency. However, the need for technological adaptation and additional energy input continues to hinder large-scale deployment in colder areas.

Regional Analysis

North America

North America held a 28.4% share of the air source heat pump compressors market in 2024, driven by strong demand for energy-efficient HVAC systems. The United States leads the region, supported by tax credits and government incentives for residential heat pump installations. Growing adoption in commercial buildings and renovation projects also contributes to market growth. Advancements in inverter compressor technology and low-GWP refrigerants are further improving system efficiency. Increasing awareness of sustainable heating and cooling solutions positions the region as a key contributor to global market expansion through 2032.

Europe

Europe accounted for a 34.6% share of the air source heat pump compressors market in 2024, dominating the global landscape. The region benefits from strict carbon reduction policies and the European Union’s decarbonization targets. Countries such as Germany, France, and the United Kingdom are witnessing large-scale adoption of heat pumps in residential retrofits and public infrastructure. Supportive initiatives under the EU Green Deal and regional rebate programs are accelerating replacement of gas-based systems. Growing emphasis on zero-emission buildings and energy-efficient housing continues to drive compressor demand across the continent.

Asia-Pacific

Asia-Pacific captured a 29.8% share of the air source heat pump compressors market in 2024, emerging as a rapidly expanding region. Strong growth in residential and commercial construction, coupled with rising urbanization, boosts compressor installation. China, Japan, and South Korea lead regional adoption, supported by government energy-efficiency policies and environmental initiatives. The shift toward inverter-based compressors and smart control systems enhances performance and consumer adoption. Expanding middle-class households and increasing electrification of heating systems further strengthen the regional outlook through the forecast period.

Latin America

Latin America represented a 4.2% share of the air source heat pump compressors market in 2024. Demand is growing steadily in countries like Brazil, Mexico, and Chile due to rising awareness of sustainable energy systems. Government-led programs encouraging renewable energy integration in buildings are supporting adoption. Expanding construction activity and a gradual shift toward eco-friendly HVAC solutions drive market development. However, high installation costs and limited technical expertise slow large-scale deployment. Manufacturers are focusing on partnerships and regional production to make systems more affordable and accessible.

Middle East and Africa

The Middle East and Africa held a 3% share of the air source heat pump compressors market in 2024. Growing infrastructure projects and the push for sustainable building solutions are fueling adoption across the Gulf Cooperation Council countries and South Africa. Hot climatic conditions are encouraging the use of air-to-air systems with high-efficiency compressors. Government sustainability programs and net-zero carbon goals are supporting regional investments. However, limited consumer awareness and high initial setup costs restrain faster growth, though long-term potential remains strong with urban development initiatives.

Market Segmentations:

By Type

- Reciprocating

- Scroll

- Rotary

- Screw

- Centrifugal

By End Use

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The air source heat pump compressors market is highly competitive, with key players including Daikin, Panasonic, Emerson Electric Co, BITZER Group, LG Electronics, ELGi, GREE ELECTRIC APPLIANCES, INC, Mitsubishi Electric Corporation, Danfoss, Carrier, Atlas Copco, Midea Group, JOHNSON CONTROLS – HITACHI AIR CONDITIONING COMPANY, CAREL INDUSTRIES S.p.A., Embraco LLC, and Guangzhou SPRSUN New Energy Technology Development Co., Ltd. The market features intense competition driven by technological innovation, energy efficiency, and sustainability goals. Leading manufacturers are focusing on product differentiation through advanced inverter technology, variable-speed systems, and low-GWP refrigerant compatibility. Companies are expanding production capacity, forming strategic partnerships, and investing in R&D to enhance performance and cost efficiency. Continuous innovation in smart control systems and compressor design supports broader application across residential and commercial sectors. Regional players are also strengthening their presence through local manufacturing and after-sales services, contributing to market competitiveness and global expansion.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Daikin

- Panasonic

- Emerson Electric Co

- BITZER Group

- LG Electronics

- ELGi

- GREE ELECTRIC APPLIANCES, INC

- Mitsubishi Electric Corporation

- Danfoss

- Carrier

- Atlas Copco

- Midea Group

- JOHNSON CONTROLS – HITACHI AIR CONDITIONING COMPANY

- CAREL INDUSTRIES S.p.A.

- Embraco LLC

- Guangzhou SPRSUN New Energy Technology Development Co., Ltd.

Recent Developments

- In 2023, Daikin Industries launched the Daikin Altherma 3 R MT, a residential air-source heat pump system, in Europe

- In 2023, Hitachi Global Air Power, which is the new corporate name for Sullair, launched the Sullair E1035H electric portable air compressor as part of the company’s environmental goals.

- In 2023, ELGi showcased improved efficiency oil-lubricated screw compressors featuring a new permanent magnet synchronous motor (PMSM) at the Hannover Messe event.

Report Coverage

The research report offers an in-depth analysis based on Type, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Rising global adoption of energy-efficient heating systems will continue to drive compressor demand.

- Technological advancements in inverter and variable-speed compressors will enhance energy savings.

- Governments will expand subsidies and incentives promoting low-carbon heat pump systems.

- Integration of IoT and smart controls will improve monitoring and predictive maintenance capabilities.

- Manufacturers will focus on compressors compatible with low-GWP and natural refrigerants.

- Residential retrofitting projects will boost market penetration in developed regions.

- Cold-climate performance improvements will expand adoption in northern and high-altitude areas.

- Asia-Pacific will emerge as the fastest-growing regional market with large-scale construction growth.

- Partnerships between HVAC manufacturers and tech firms will drive innovation in digital control systems.

- Increasing emphasis on decarbonization will strengthen the long-term outlook for sustainable compressor solutions.