Market Overview:

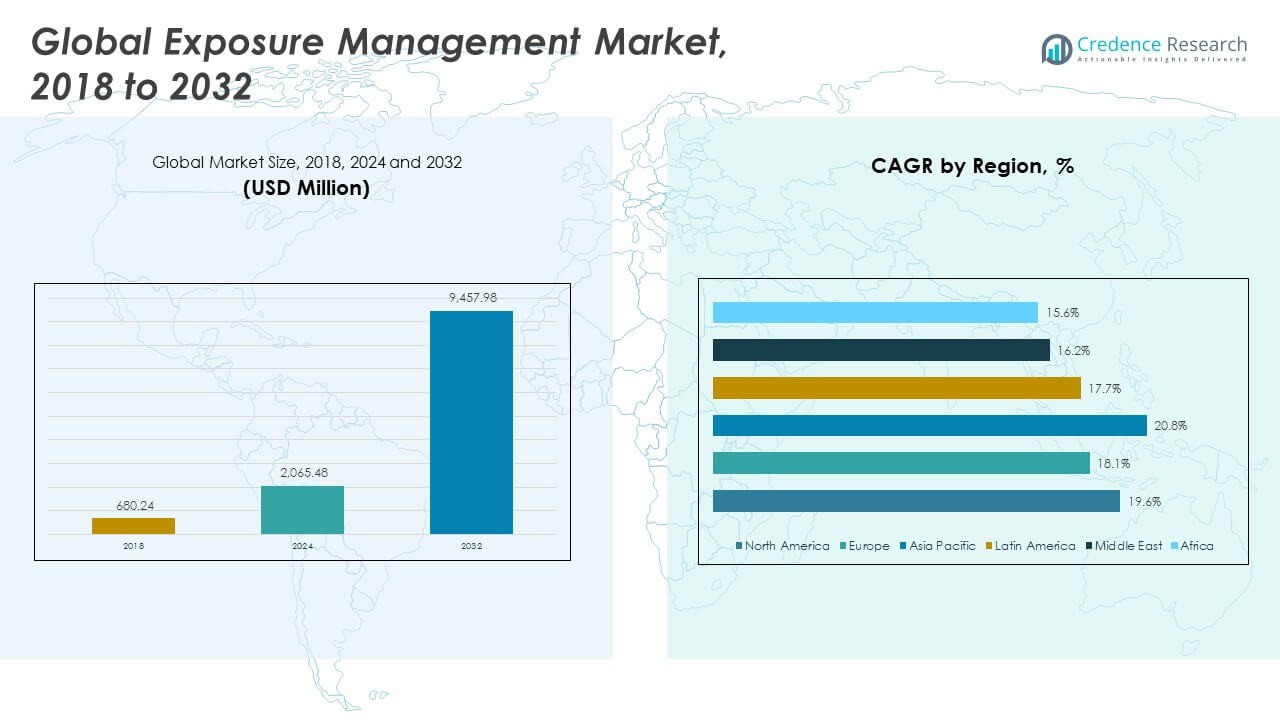

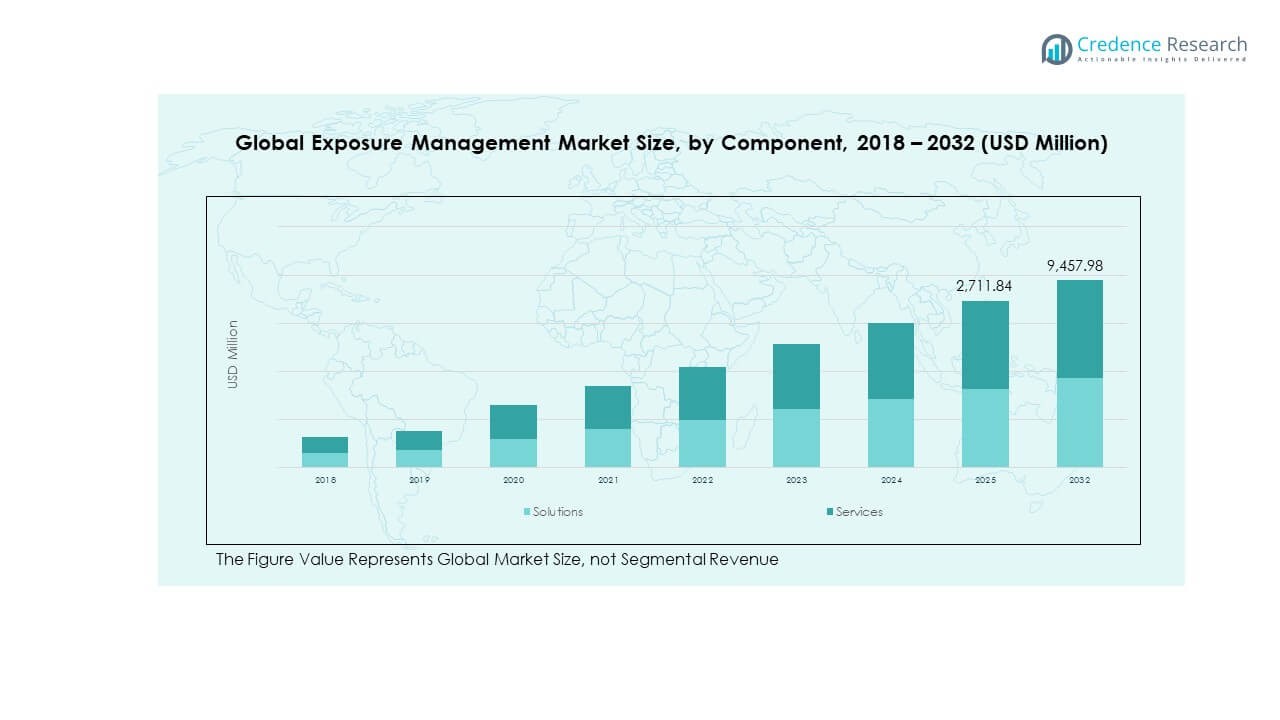

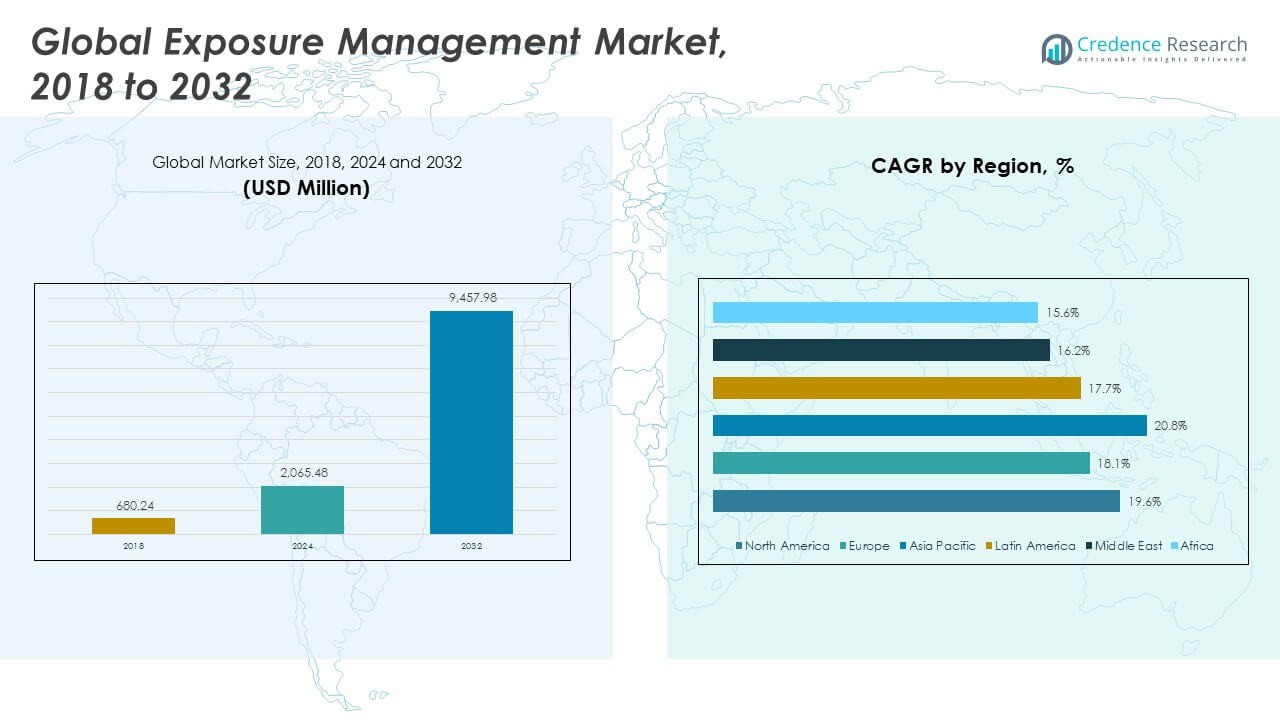

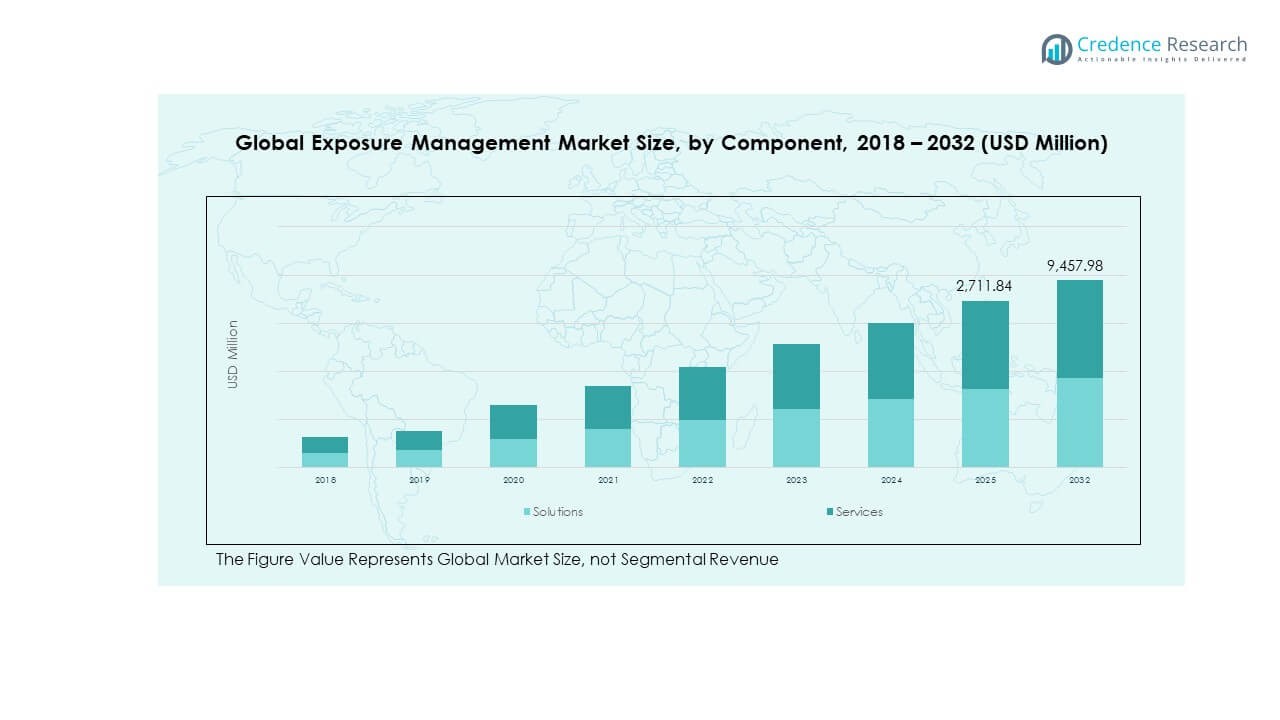

The Global Exposure Management Market size was valued at USD 680.24 million in 2018 to USD 2,065.48 million in 2024 and is anticipated to reach USD 9,457.98 million by 2032, at a CAGR of 19.54% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Exposure Management Market Size 2024 |

USD 2,065.48 Million |

| Exposure Management Market, CAGR |

19.54% |

| Exposure Management Market Size 2032 |

USD 9,457.98 Million |

The Global Exposure Management Market is expanding due to rising cyber threats and increasing digitalization across industries. Businesses are investing in advanced exposure management platforms to identify, monitor, and mitigate potential vulnerabilities in their IT ecosystems. Demand is further driven by stricter regulatory frameworks, growing adoption of cloud-based security solutions, and integration of AI-driven analytics that improve real-time risk visibility and decision-making.

North America leads the market due to strong technological infrastructure, high cybersecurity awareness, and regulatory compliance mandates. Europe follows with robust investments in enterprise risk management and data protection standards. The Asia-Pacific region is emerging rapidly, supported by accelerating digital transformation, increasing cloud adoption, and growing cybersecurity initiatives across sectors such as banking, government, and healthcare.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The Global Exposure Management Market was valued at USD 680.24 million in 2018, reached USD 2,065.48 million in 2024, and is projected to attain USD 9,457.98 million by 2032, expanding at a CAGR of 19.54% during the forecast period.

- North America (44%), Asia Pacific (33%), and Europe (16%) hold the top three regional shares. North America leads due to advanced cybersecurity infrastructure, while Asia Pacific’s growth is driven by rapid digitalization, and Europe maintains steady demand through strong compliance frameworks.

- Asia Pacific is the fastest-growing region, supported by increasing cloud adoption, expanding manufacturing and e-commerce sectors, and government-led cybersecurity initiatives across China, India, and Japan.

- The Solutions segment accounts for approximately 70% of the total market share, reflecting enterprise preference for integrated exposure detection and automation tools.

- The Services segment holds around 30% share, driven by rising demand for consulting, managed services, and customized implementation support across global enterprises.

Market Drivers:

Rising Frequency of Cyber Threats and Data Breaches Across Enterprises

The Global Exposure Management Market is driven by the growing volume of cyberattacks targeting enterprise networks and digital assets. Increasing reliance on connected devices and cloud infrastructure has heightened vulnerability levels across organizations. Enterprises are adopting proactive exposure management solutions to continuously assess and mitigate potential risks before exploitation occurs. It benefits industries such as banking, healthcare, and manufacturing that manage sensitive data. Stringent data protection laws have further accelerated the adoption of automated exposure visibility tools. Demand for integrated risk assessment platforms is increasing among large and mid-sized companies. It supports the need for real-time monitoring and early warning systems. Continuous investments in cybersecurity infrastructure strengthen market adoption globally.

- For instance, XM Cyber’s Continuous Exposure Management platform uncovered over 40 million exposures affecting 5 million critical business entities during 2023. Enterprises are adopting proactive exposure management solutions to continuously assess and mitigate potential risks before exploitation occurs. It benefits industries such as banking, healthcare, and manufacturing that manage sensitive data.

Growing Emphasis on Compliance and Regulatory Requirements in Risk Management

Regulatory compliance mandates are fueling adoption of exposure management frameworks across multiple industries. Governments are enforcing stricter cybersecurity standards to reduce digital vulnerabilities in critical sectors. Companies must demonstrate transparency in their cybersecurity posture to meet evolving compliance frameworks like GDPR, HIPAA, and ISO 27001. It encourages enterprises to adopt centralized exposure monitoring and documentation systems. Businesses are prioritizing real-time data mapping and reporting to meet regulatory audits. Exposure management tools simplify policy enforcement and automate compliance tracking. The market benefits from partnerships between technology providers and compliance consulting firms. Organizations across finance and defense sectors are leading in the adoption of compliance-oriented exposure management systems.

- For instance, Microsoft reported that its Defender for Cloud service now supports audit-ready compliance reporting across 90+ regulations and frameworks globally. It encourages enterprises to adopt centralized exposure-monitoring and documentation systems. Businesses are prioritizing real-time data mapping and reporting to meet regulatory audits. Exposure-management tools simplify policy enforcement and automate compliance tracking.

Increasing Integration of Artificial Intelligence and Machine Learning in Risk Detection

AI and ML technologies are transforming exposure detection, prediction, and response capabilities. Integration of these technologies enables predictive analytics to identify unknown risks before they occur. Automated systems help enterprises analyze vast security data and recognize behavioral anomalies. It enhances decision-making by providing deeper insights into attack surfaces. AI-driven solutions reduce manual intervention and accelerate vulnerability assessments. Vendors are offering adaptive learning tools that improve accuracy with continuous data input. The Global Exposure Management Market is benefiting from this shift toward intelligent automation. It enables enterprises to respond quickly to emerging cyber threats while minimizing response costs. Continuous AI innovation is creating opportunities for smarter, scalable exposure management systems.

Expanding Adoption of Cloud-Based Security Platforms Across Organizations

Cloud-based exposure management platforms are gaining traction due to their scalability and cost efficiency. Enterprises are shifting toward SaaS-based models to simplify integration across multi-cloud environments. It allows real-time monitoring of distributed digital ecosystems and supports hybrid IT infrastructures. Cloud deployment helps organizations achieve faster implementation and remote accessibility. Vendors are expanding offerings that integrate vulnerability assessment, asset discovery, and remediation functions. The Global Exposure Management Market is growing due to increased preference for centralized cloud-native risk visibility. Companies are using automated dashboards for continuous exposure scoring and prioritization. The combination of flexibility, scalability, and automation is enhancing operational security performance.

Market Trends:

Growing Use of Attack Surface Management (ASM) for Continuous Risk Visibility

Attack Surface Management is becoming a critical trend in exposure management strategies. Companies are adopting ASM tools to identify all internet-facing assets and detect misconfigurations. Continuous scanning and mapping of digital assets enable real-time awareness of vulnerabilities. The Global Exposure Management Market is seeing rising demand for solutions that unify ASM with vulnerability management. It helps organizations reduce blind spots and respond faster to emerging threats. Businesses are moving from periodic assessments to continuous exposure evaluation models. Vendors are enhancing ASM tools with automated discovery and risk prioritization. The integration of ASM capabilities is redefining how enterprises secure their digital perimeter.

Rising Popularity of Zero Trust Architectures in Exposure Mitigation

Zero Trust frameworks are influencing exposure management adoption across sectors. Organizations are adopting identity-centric security policies that minimize unauthorized access. It limits exposure by ensuring verification at every network layer. The Global Exposure Management Market is witnessing strong integration of Zero Trust principles within exposure management systems. Enterprises are deploying micro-segmentation and continuous authentication to prevent lateral attacks. Vendors are developing exposure management solutions that complement Zero Trust ecosystems. Demand for continuous verification tools is increasing among government and financial institutions. Zero Trust implementation supports a shift toward proactive, prevention-based cybersecurity models.

- For instance, research shows that roughly 81 % of organizations either have adopted or are actively implementing Zero Trust, while about 52 % have full deployments. It limits exposure by ensuring verification at every network layer. The Global Exposure Management Market is witnessing strong integration of Zero Trust principles within exposure-management systems. Enterprises are deploying micro-segmentation and continuous authentication to prevent lateral attacks.

Increasing Collaboration Between Security Vendors and Cloud Providers

Partnerships between cybersecurity vendors and cloud service providers are shaping market evolution. Companies are integrating exposure management tools directly within cloud platforms for seamless deployment. This collaboration helps enterprises enhance multi-cloud security posture management. The Global Exposure Management Market benefits from these alliances as they deliver unified visibility across diverse environments. Vendors are developing joint solutions that include automated policy enforcement and real-time risk analytics. Enterprises are prioritizing cloud-native integration to maintain consistent security across dynamic workloads. Such partnerships also improve scalability and interoperability among different security tools. The trend strengthens end-to-end protection and simplifies exposure control.

Adoption of Risk-Based Vulnerability Management for Strategic Decision-Making

Organizations are transitioning from volume-based to risk-based vulnerability management models. It allows prioritization of threats based on business impact rather than technical severity. The Global Exposure Management Market is adopting contextual analytics to align exposure insights with enterprise objectives. Companies are using predictive modeling to focus resources on critical risk areas. Vendors are offering dashboards that link exposure data with business functions and asset value. It encourages smarter allocation of security budgets and proactive defense strategies. Risk-based vulnerability management reduces alert fatigue and improves decision-making efficiency. This trend drives organizations toward more strategic and outcome-oriented exposure management practices.

Market Challenges Analysis:

Complexity in Integrating Exposure Management with Legacy IT Systems

Integrating exposure management platforms with outdated IT infrastructures remains a major challenge. Many enterprises still depend on legacy applications that lack interoperability with modern security tools. It causes data fragmentation and limits visibility across hybrid environments. The Global Exposure Management Market faces hurdles in aligning new solutions with existing workflows. Upgrading older systems often demands significant financial and time investments. Security teams struggle to synchronize data between cloud and on-premise systems. Limited expertise in integration further slows adoption rates. Vendors must focus on offering adaptable platforms and scalable APIs to overcome integration barriers.

Shortage of Skilled Cybersecurity Professionals and Budget Limitations

The lack of cybersecurity talent is restraining widespread deployment of exposure management systems. Many organizations face challenges in operating advanced analytics and risk assessment tools. The Global Exposure Management Market experiences adoption gaps due to insufficient in-house expertise. Budget constraints among small and medium enterprises further restrict solution implementation. High subscription costs and training requirements hinder scalability. It limits real-time response capabilities and weakens organizational resilience. Vendors are addressing this by introducing managed services and simplified user interfaces. Increasing investment in workforce development and automation could mitigate these limitations in the future.

Market Opportunities:

Emerging Demand for Automated and Predictive Exposure Intelligence Solutions

Automation is creating major opportunities for next-generation exposure management systems. Predictive analytics and machine learning enhance real-time identification of evolving risks. The Global Exposure Management Market is witnessing demand for solutions capable of dynamic threat correlation. Enterprises aim to automate vulnerability scoring and remediation prioritization. Vendors are expanding product portfolios with AI-based exposure intelligence platforms. It supports faster decision-making and proactive defense strategies. The integration of automation is enabling companies to enhance agility and reduce human error in cybersecurity processes.

Rising Adoption Across Small and Medium Enterprises Through Managed Security Services

SMEs are embracing managed exposure management services to overcome resource limitations. Managed service providers offer cost-effective and scalable exposure monitoring solutions. It helps smaller organizations achieve enterprise-grade protection without heavy infrastructure costs. The Global Exposure Management Market is expanding in this segment due to flexible pricing models and easy deployment. SMEs are increasingly opting for cloud-based managed solutions for 24/7 threat visibility. Vendors are customizing offerings to meet specific compliance and industry needs. Growing digital transformation among SMEs strengthens this opportunity and widens market reach.

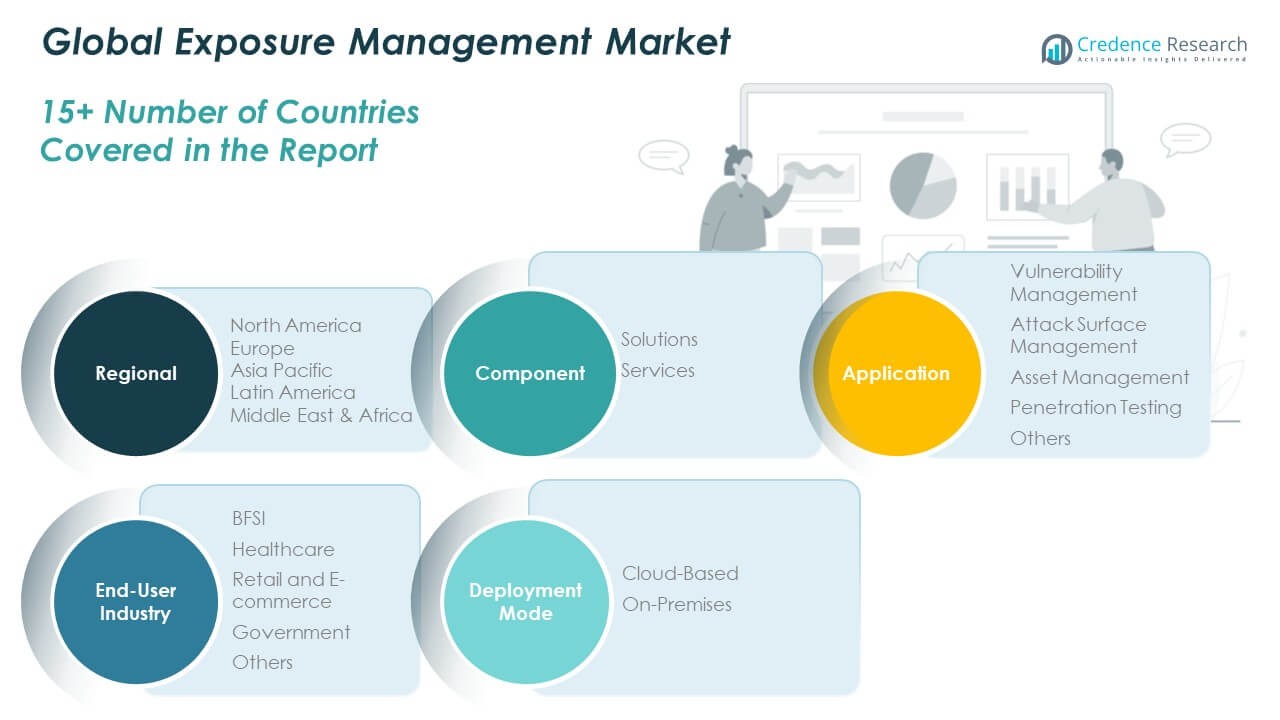

Market Segmentation Analysis:

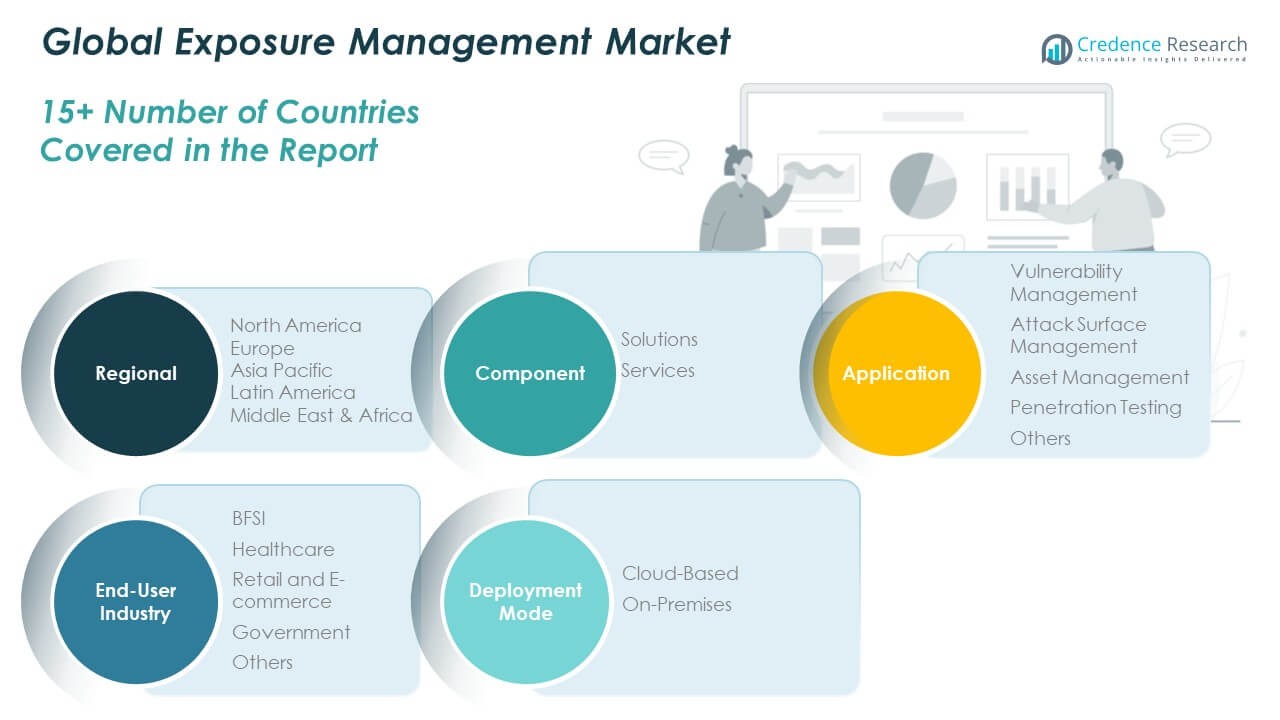

By Component

The Global Exposure Management Market is categorized into solutions and services. Solutions dominate the segment due to their role in continuous risk identification, assessment, and remediation across digital infrastructures. It provides organizations with integrated tools to monitor vulnerabilities and manage exposure in real time. Services, including consulting, integration, and support, are witnessing growing demand as enterprises seek specialized expertise to optimize implementation and compliance. Managed service providers are gaining traction for offering cost-efficient and scalable exposure management options.

- For instance, Bitsight collects over 7 million intelligence items daily from more than 1,000 underground forums to power its exposure-management solutions, enabling real-time visibility across cloud and supply-chain assets. It provides organizations with integrated tools to monitor vulnerabilities and manage exposure in real time.

By Application

The application segment includes vulnerability management, attack surface management, asset management, penetration testing, and others. Vulnerability management holds a major share due to its necessity in identifying and prioritizing security weaknesses. Attack surface management is growing rapidly with the expansion of digital ecosystems and remote work infrastructures. Asset management supports visibility and control over connected systems, while penetration testing strengthens defensive readiness. Other applications include configuration analysis and threat exposure monitoring, enhancing overall enterprise resilience.

- For instance, MetricStream reports a 38% reduction in the cost of managing vulnerabilities and a 30% decrease in person-days needed for scaling its vulnerability management solution in customer deployments. Attack surface management is growing rapidly with the expansion of digital ecosystems and remote-work infrastructures. Asset management supports visibility and control over connected systems, while penetration testing strengthens defensive readiness.

By End-User Industry

Key industries adopting exposure management include BFSI, healthcare, retail and e-commerce, government, and others. BFSI leads the market due to stringent regulatory demands and high-value data protection needs. Healthcare organizations are rapidly adopting solutions to safeguard patient information and comply with data standards. Retail and e-commerce sectors focus on protecting customer data, while government agencies integrate exposure management for national cybersecurity frameworks.

By Deployment Mode

Deployment models include cloud-based and on-premises platforms. Cloud-based deployment dominates due to scalability, flexibility, and centralized visibility. On-premises solutions remain preferred by enterprises requiring higher data control and compliance assurance.

Segmentation:

- By Component

- By Application

- Vulnerability Management

- Attack Surface Management

- Asset Management

- Penetration Testing

- Others

- By End-User Industry

- BFSI

- Healthcare

- Retail and E-commerce

- Government

- Others

- By Deployment Mode

- By Region

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Global Exposure Management Market size was valued at USD 303.55 million in 2018 to USD 912.32 million in 2024 and is anticipated to reach USD 4,188.94 million by 2032, at a CAGR of 19.6% during the forecast period. North America holds around 44% share of the global market, driven by advanced cybersecurity infrastructure and strong regulatory compliance frameworks. The United States leads due to high adoption of AI-based exposure management and enterprise-grade security solutions. Canada and Mexico contribute through expanding digitalization and increasing investments in IT modernization. It benefits from well-established cloud networks, rising cyber insurance adoption, and a mature threat intelligence ecosystem. Leading companies such as IBM, Microsoft, and Palo Alto Networks are reinforcing regional dominance. Continuous innovation and growing awareness of proactive exposure monitoring sustain market growth across all major industries.

Europe

The Europe Global Exposure Management Market size was valued at USD 126.68 million in 2018 to USD 363.54 million in 2024 and is anticipated to reach USD 1,513.34 million by 2032, at a CAGR of 18.1% during the forecast period. Europe accounts for around 16% share of the global market, supported by robust data protection regulations and strong enterprise risk management frameworks. Countries like Germany, the UK, and France drive adoption through increasing cybersecurity budgets and digital transformation initiatives. The enforcement of GDPR has accelerated the use of exposure management solutions for compliance and reporting. It benefits from the region’s focus on safeguarding critical infrastructure and financial systems. Growing collaboration between public and private sectors strengthens cybersecurity readiness. The market continues to expand across sectors such as BFSI, healthcare, and manufacturing.

Asia Pacific

The Asia Pacific Global Exposure Management Market size was valued at USD 194.10 million in 2018 to USD 622.70 million in 2024 and is anticipated to reach USD 3,112.81 million by 2032, at a CAGR of 20.8% during the forecast period. Asia Pacific represents around 33% share of the global market, emerging as the fastest-growing region. Rapid digital transformation in China, India, Japan, and South Korea is fueling demand for exposure management platforms. It benefits from increasing cloud adoption, rising cyberattack incidents, and government-led cybersecurity programs. Organizations across manufacturing, banking, and e-commerce sectors are prioritizing vulnerability assessment and continuous risk management. Startups and tech firms are driving innovation with AI-driven solutions. Expanding 5G infrastructure and growing data volumes are further enhancing regional opportunities.

Latin America

The Latin America Global Exposure Management Market size was valued at USD 31.53 million in 2018 to USD 94.51 million in 2024 and is anticipated to reach USD 382.08 million by 2032, at a CAGR of 17.7% during the forecast period. Latin America captures around 4% share of the global market, supported by increasing cybersecurity investments and regional digitalization. Brazil and Mexico lead due to strong government support for IT modernization and digital security frameworks. It is gaining momentum with growing awareness of cyber resilience and data protection. The expansion of online retail, financial services, and telecommunications drives market growth. Partnerships with global cybersecurity vendors are improving solution accessibility. Demand for cloud-based exposure monitoring is increasing among enterprises. Localized compliance standards and growing talent availability are strengthening the regional ecosystem.

Middle East

The Middle East Global Exposure Management Market size was valued at USD 15.20 million in 2018 to USD 41.18 million in 2024 and is anticipated to reach USD 150.75 million by 2032, at a CAGR of 16.2% during the forecast period. The Middle East holds around 2% share of the global market, led by countries such as Saudi Arabia, the UAE, and Israel. Governments are implementing cybersecurity regulations to protect national digital infrastructure. It benefits from large-scale investments in smart cities, financial systems, and energy networks. Regional enterprises are focusing on exposure visibility and cloud-based security tools. Growing integration of AI and automation supports early risk detection. The presence of international cybersecurity firms enhances competitive strength. Continuous investments in infrastructure modernization and awareness programs are fueling long-term market expansion.

Africa

The Africa Global Exposure Management Market size was valued at USD 9.18 million in 2018 to USD 31.22 million in 2024 and is anticipated to reach USD 110.06 million by 2032, at a CAGR of 15.6% during the forecast period. Africa accounts for around 1% share of the global market, reflecting gradual but steady adoption. South Africa leads in regional implementation, followed by Egypt and Nigeria. It benefits from growing cloud penetration and government initiatives promoting cybersecurity awareness. Limited budgets and skill shortages remain key barriers to large-scale adoption. Demand is rising in financial services, telecommunications, and public sectors. Vendors are targeting the region with cost-effective and managed exposure management solutions. Increasing partnerships with international cybersecurity organizations are supporting market maturity and resilience.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Tenable Holdings, Inc.

- Qualys, Inc.

- Rapid7, Inc.

- IBM Corporation

- Microsoft Corporation

- Palo Alto Networks, Inc.

- CrowdStrike Holdings, Inc.

- Check Point Software Technologies Ltd.

- Cisco Systems, Inc.

- FireEye, Inc.

- McAfee Corp.

- Broadcom Inc. (Symantec)

- F-Secure Corporation

- Fortinet, Inc.

- Darktrace Holdings Limited

- SentinelOne, Inc.

- Arctic Wolf Networks, Inc.

- Skybox Security, Inc.

- XM Cyber

- Balbix, Inc.

Competitive Analysis:

The Global Exposure Management Market is highly competitive, with major players focusing on advanced analytics, automation, and AI-driven platforms. It includes leading firms such as Tenable, Qualys, Rapid7, IBM, Microsoft, Palo Alto Networks, and CrowdStrike. These companies compete on innovation, scalability, and integration capabilities. Strategic alliances and continuous R&D investments are key to maintaining market leadership. Vendors emphasize cloud-native architectures and real-time vulnerability management to enhance cybersecurity resilience. The market is witnessing increasing mergers and product enhancements to expand regional presence and strengthen portfolio diversity.

Recent Developments:

- On September 30 2025, Qualys, Inc. announced its recognition as a Leader in the 2025 IDC MarketScape for Worldwide Exposure Management, highlighting its Enterprise TruRisk™ platform which enables cyber risk quantification and remediation.

- On August 27 2025, Rapid7, Inc. was named a Leader in the IDC MarketScape for Worldwide Exposure Management, with its Exposure Command platform supporting over 275 integrations and 550+ automation workflows.

- In August 2025, Tenable Holdings, Inc. expanded its exposure management platform to secure enterprise AI platforms, adding capabilities for ChatGPT Enterprise and Microsoft Copilot.

- On July 22 2025, Palo Alto Networks, Inc. completed its acquisition of Protect AI, augmenting its AI-security capabilities across the full AI application lifecycle in its Prisma AIRS platform.

- On July 30 2025, Palo Alto Networks announced a definitive agreement to acquire CyberArk Software, Inc., the identity-security leader, extending its platform to cover human, machine and agent identities across the enterprise.

Report Coverage:

The research report offers an in-depth analysis based on component, application, end-user industry, and deployment mode. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Demand for AI-powered exposure management platforms will accelerate across industries.

- Cloud-based deployment will remain the dominant model for scalability and agility.

- Continuous monitoring and real-time threat detection will become standard practice.

- Integration with Zero Trust frameworks will drive enterprise adoption.

- Third-party and supply chain risk management will gain higher importance.

- Cyber insurance providers will increasingly rely on exposure data analytics.

- SMEs will adopt managed exposure services for cost-efficient protection.

- Governments will invest in national cybersecurity exposure frameworks.

- Predictive vulnerability management will define next-generation solutions.

- Collaboration between security vendors and cloud providers will intensify global reach.