Market Overview:

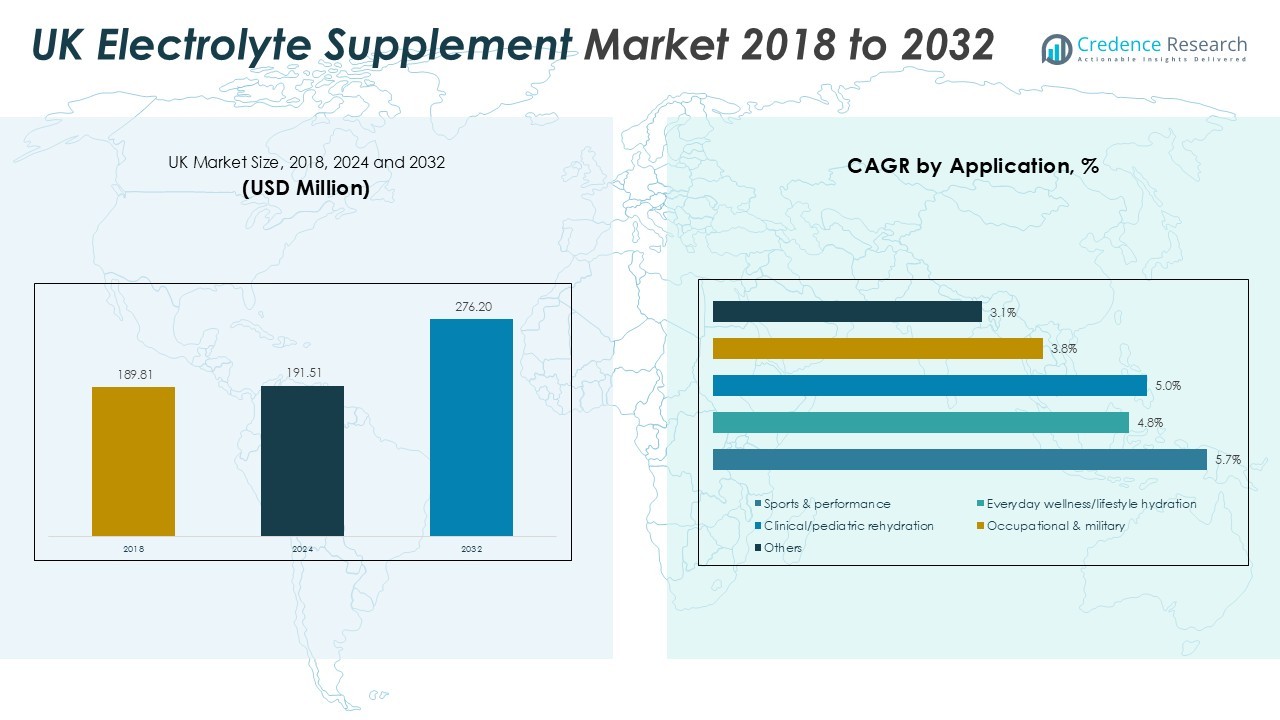

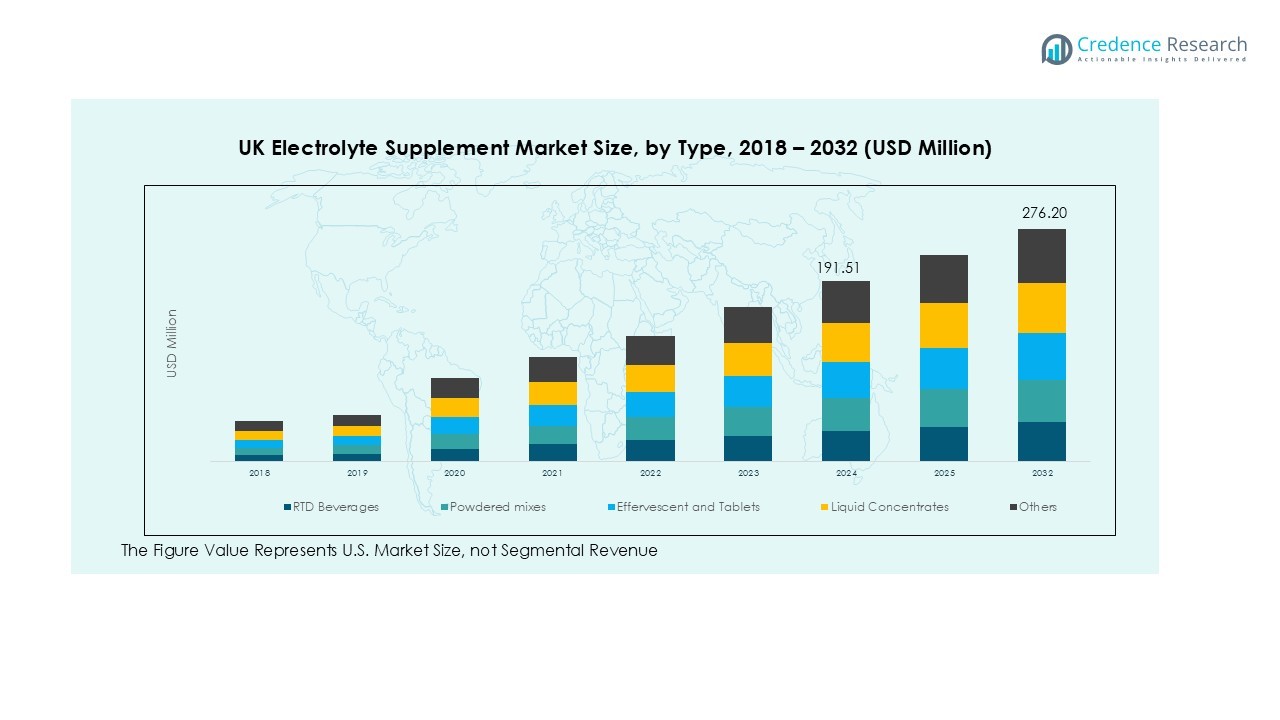

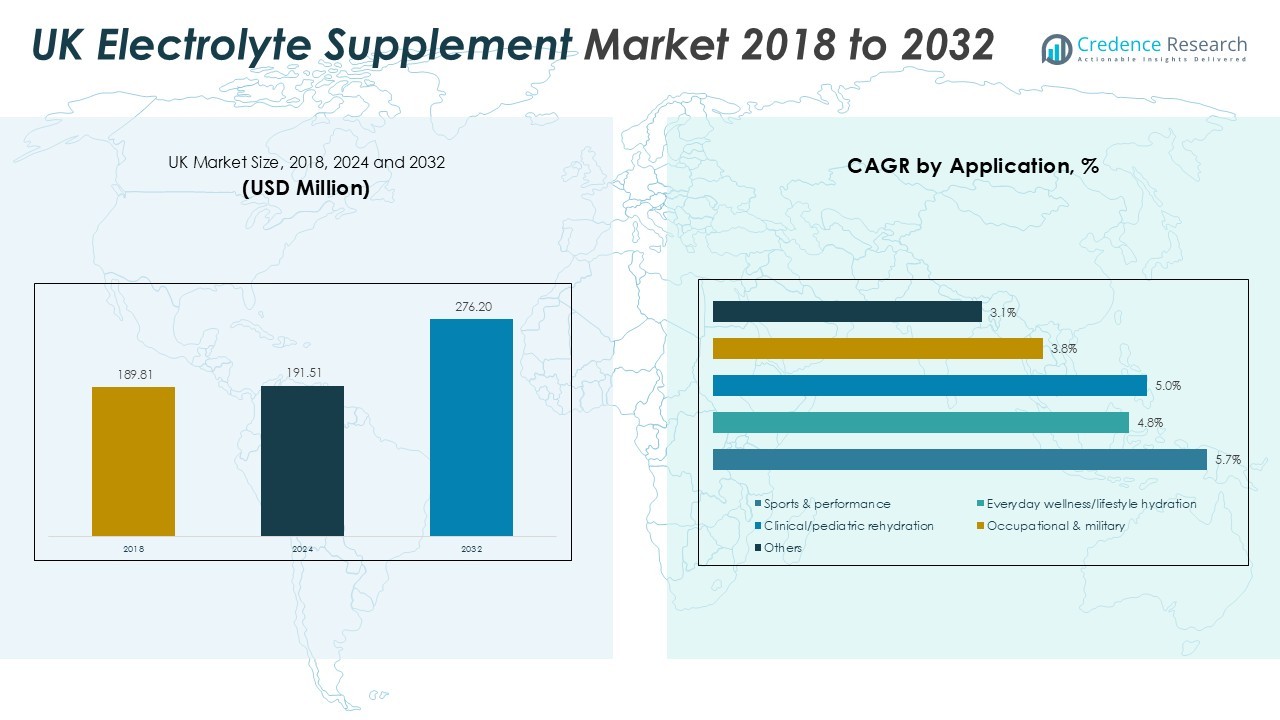

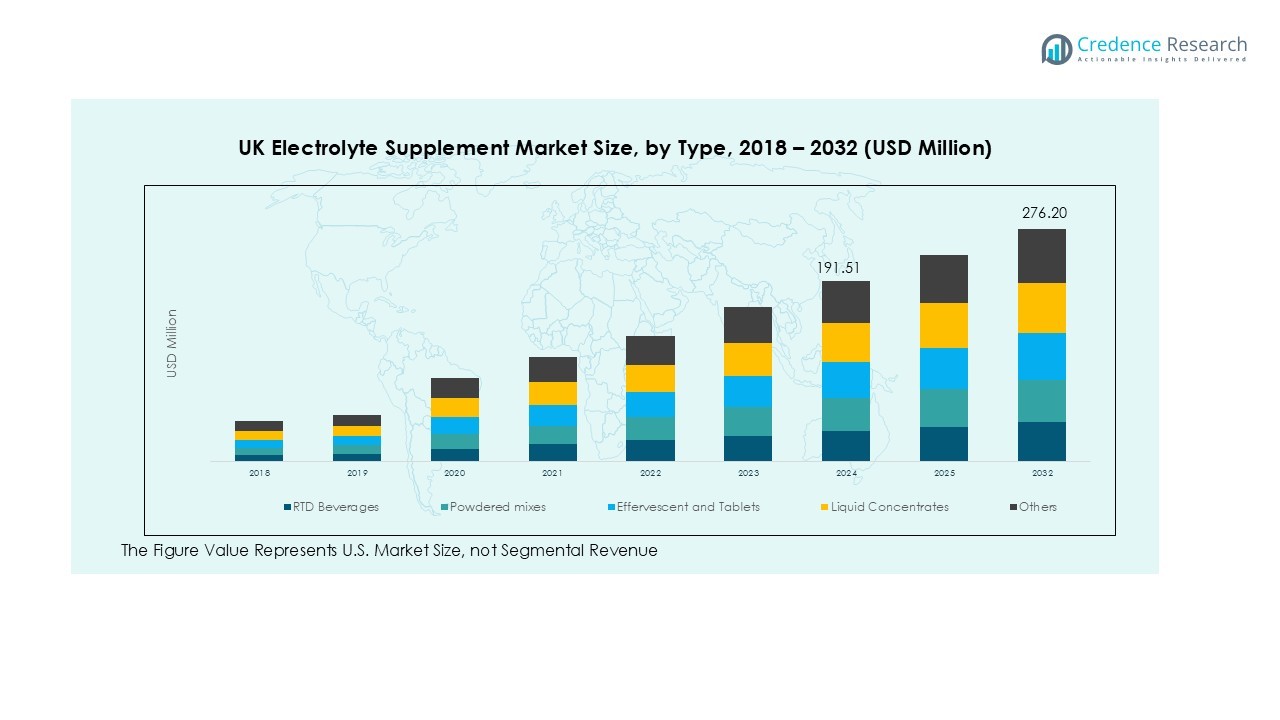

The UK Electrolyte Supplement Market size was valued at USD 189.81 million in 2018 to USD 191.51 million in 2024 and is anticipated to reach USD 276.20 million by 2032, at a CAGR of 4.68% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| UK Electrolyte Supplement Market Size 2024 |

USD 191.51 Million |

| UK Electrolyte Supplement Market, CAGR |

4.68% |

| UK Electrolyte Supplement Market Size 2032 |

USD 276.20 Million |

Key market drivers include rising demand for health and fitness products, especially among athletes and fitness enthusiasts. The growing popularity of sports drinks and powders as a means to replenish electrolytes after physical exertion further contributes to market expansion. Additionally, the increasing prevalence of health conditions such as dehydration and muscle cramps has prompted a surge in electrolyte supplement consumption. The shift toward natural and organic electrolyte supplements also aligns with the broader consumer trend toward clean, functional foods.

In terms of regional distribution, England dominates the market, driven by the concentration of sports and fitness enthusiasts and high awareness of wellness. London, in particular, accounts for a significant share, owing to its large population and active lifestyle trends. The market in Scotland and Wales is also growing steadily, driven by rising consumer demand for fitness and wellness products. Regional growth is further supported by improved availability and accessibility of these supplements across retail and online platforms.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights:

- The UK Electrolyte Supplement Market, valued at USD 189.81 million in 2018, is expected to reach USD 276.20 million by 2032, with a CAGR of 4.68%.

- Increasing health and fitness awareness has led to higher demand for electrolyte supplements, particularly among athletes and fitness enthusiasts.

- Sports drinks and powders are gaining traction for replenishing electrolytes and improving recovery after exercise, significantly contributing to market growth.

- The rising prevalence of dehydration-related health issues, such as muscle cramps and fatigue, has further boosted the demand for electrolyte supplements.

- Consumers are shifting towards natural and organic electrolyte supplements, aligning with broader trends for clean, functional products.

- England dominates the UK market with a 55% share, driven by urbanization and high fitness and wellness engagement, particularly in London.

- Scotland and Wales account for 28% of the market share, with increasing fitness interest driving steady demand for electrolyte supplements.

Market Drivers:

Increasing Health and Fitness Awareness Driving Demand in the UK Electrolyte Supplement Market

The growing focus on health and fitness in the UK is a primary driver of the electrolyte supplement market. More consumers are turning to fitness regimes that require better hydration and recovery strategies, which electrolyte supplements support. Increased participation in sports, fitness programs, and wellness activities fuels the need for effective hydration solutions. This trend is particularly notable among athletes and individuals who engage in intensive physical activity, encouraging a surge in demand for electrolyte supplements.

- For instance, Styrkr’s SLT07 hydration tablets are formulated with a quad-blend of electrolytes, including 500mg of sodium, to mimic the ratio of electrolytes lost in sweat during endurance sports.

Rising Popularity of Sports Drinks and Powders

Sports drinks and electrolyte powders are gaining widespread popularity in the UK, further supporting the market growth. These products are widely used by individuals looking to replenish electrolytes lost during exercise. They provide quick hydration and help in preventing conditions such as dehydration and muscle cramps. With many options available on the market, consumers are increasingly turning to these supplements to enhance their workout performance and recovery, thereby boosting the UK electrolyte supplement market.

Prevalence of Dehydration and Related Health Conditions

The increasing prevalence of dehydration-related health issues is another driver for the UK electrolyte supplement market. Dehydration can lead to various health problems, including fatigue, headaches, and muscle cramps, especially during warmer months or physical exertion. The growing awareness of these conditions encourages individuals to turn to electrolyte supplements to maintain hydration levels and prevent health complications.

- For instance, Lucozade Sport is an isotonic sports drink that provides carbohydrates and electrolytes to enhance hydration, offering approximately 16g of carbohydrates per 250ml serving to help maintain performance during endurance exercise.

Shift Toward Natural and Organic Electrolyte Supplements

Consumers in the UK are increasingly opting for natural and organic electrolyte supplements, which align with the broader trend toward clean and functional foods. The demand for products free from artificial additives and preservatives is growing, as consumers prioritize health-conscious choices. This shift is propelling the electrolyte supplement market toward more natural offerings, such as plant-based powders and organic ingredients, further expanding the market reach.

Market Trends:

Rise in Consumer Preference for Plant-Based and Organic Electrolyte Supplements in the UK Electrolyte Supplement Market

The demand for plant-based and organic electrolyte supplements is growing in the UK, driven by shifting consumer preferences towards clean and natural products. With a heightened focus on health and wellness, consumers are increasingly looking for supplements free from artificial additives, preservatives, and synthetic ingredients. Products derived from natural sources such as coconut water, sea minerals, and organic herbs are gaining popularity, appealing to health-conscious buyers. This trend aligns with the broader movement towards sustainable and eco-friendly products, as consumers seek brands that support both personal health and environmental sustainability. The increasing availability of organic-certified electrolyte powders and drinks further strengthens this trend in the UK electrolyte supplement market. This shift towards plant-based options is expected to continue, shaping future product developments and market dynamics.

- For instance, LMNT’s electrolyte drink mix, which is popular in the UK, is formulated without sugar and contains a robust dose of 1,000mg of sodium in each serving to support optimal hydration.

Growth of Online and E-Commerce Channels for Electrolyte Supplements

The rise of online and e-commerce platforms has significantly impacted the UK electrolyte supplement market. More consumers are choosing the convenience of online shopping, allowing them to easily access a wide range of electrolyte supplements. E-commerce platforms provide greater product variety, detailed customer reviews, and the ability to compare prices, enhancing the purchasing experience. This shift towards digital sales channels is especially prominent among younger consumers who prefer to shop online. The accessibility and convenience of online platforms enable brands to reach a broader audience and improve their market penetration. As a result, companies are increasingly focusing on digital marketing strategies and offering direct-to-consumer sales models to capitalize on this growing trend in the UK electrolyte supplement market.

- For instance, Unilever introduced its Liquid I.V. brand to the UK, leveraging the product’s status as the #1 powdered hydration brand in the US.

Market Challenges Analysis:

Regulatory Challenges and Product Labeling Compliance in the UK Electrolyte Supplement Market

One of the major challenges in the UK electrolyte supplement market is navigating the regulatory landscape and ensuring compliance with stringent product labeling standards. The market faces evolving regulations from authorities such as the Food Standards Agency (FSA) and the European Food Safety Authority (EFSA) regarding ingredient safety, health claims, and labeling practices. Manufacturers must ensure their products meet these standards to avoid legal issues or product recalls. With growing concerns about consumer health and safety, maintaining transparency in labeling becomes critical, especially as consumers increasingly seek out clean, natural, and organic products. Companies must carefully adhere to these regulations while maintaining consumer trust and meeting demand for functional products.

Intense Competition and Price Sensitivity in the UK Electrolyte Supplement Market

The UK electrolyte supplement market is highly competitive, with numerous brands offering a wide variety of products. This intense competition often leads to price sensitivity, as consumers compare products based on price, quality, and brand reputation. Smaller companies may struggle to differentiate themselves in a crowded market, and larger brands dominate shelf space in retail environments. Moreover, with the rise of e-commerce, price wars have become more pronounced, forcing companies to constantly adjust their pricing strategies. To stand out, brands must innovate with unique formulations or benefits, further intensifying market pressure.

Market Opportunities:

Expansion of Product Range and Innovation in the UK Electrolyte Supplement Market

A key opportunity in the UK electrolyte supplement market lies in expanding the product range to cater to diverse consumer needs. Manufacturers can tap into niche segments such as sugar-free, vegan, or organic electrolyte supplements to meet the growing demand for clean and functional nutrition. Innovations in formulation, such as incorporating probiotics, adaptogens, or added vitamins, can further differentiate products and appeal to health-conscious buyers. The increasing focus on personalized nutrition also opens avenues for creating customized electrolyte supplements tailored to specific needs, such as post-workout recovery or hydration for the elderly. Expanding product offerings will help companies address a broader audience and gain a competitive edge in this evolving market.

Growth of Sports and Wellness Influencer Partnerships in the UK Electrolyte Supplement Market

Collaborations with sports personalities and wellness influencers present a significant opportunity for growth in the UK electrolyte supplement market. Leveraging the influence of athletes and health experts can help brands increase their visibility and credibility, particularly among fitness enthusiasts. Endorsements from well-known figures in the health and sports sectors can drive consumer trust and enhance product adoption. Additionally, these partnerships offer a platform to educate the public on the benefits of electrolyte supplementation in maintaining hydration and improving performance. By aligning with fitness trends, brands can tap into new customer segments and boost market share.

Market Segmentation Analysis:

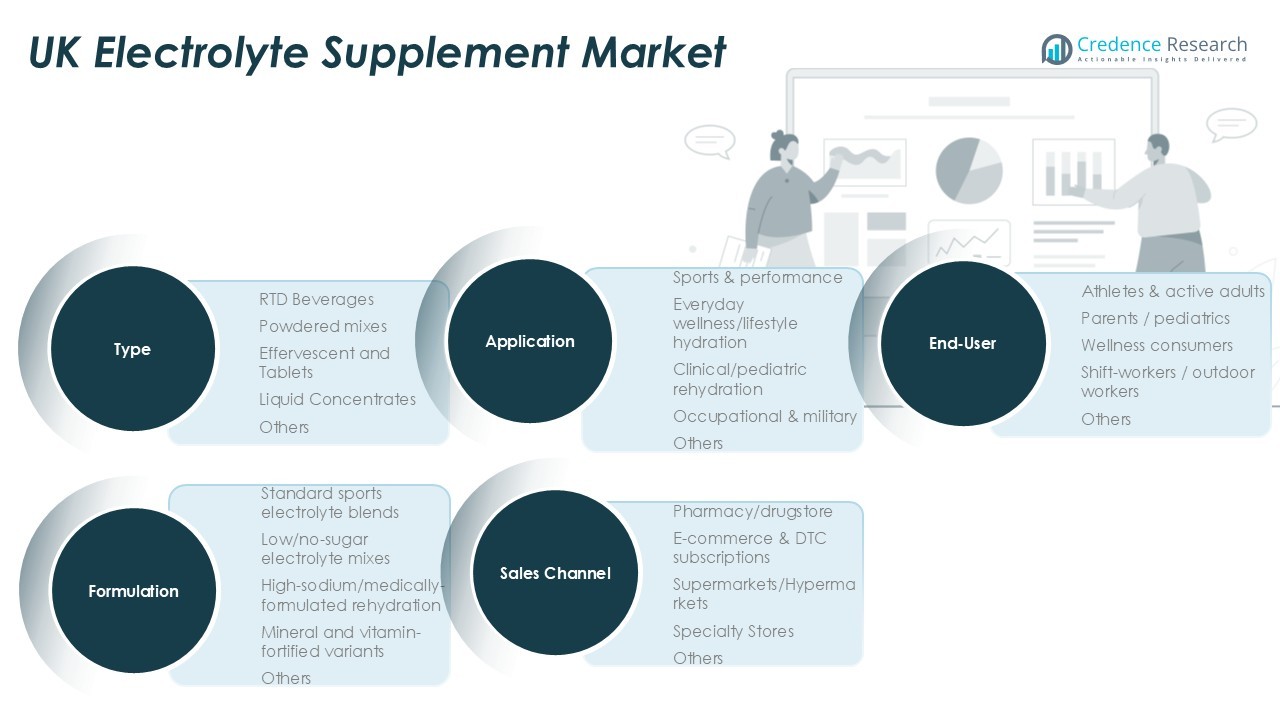

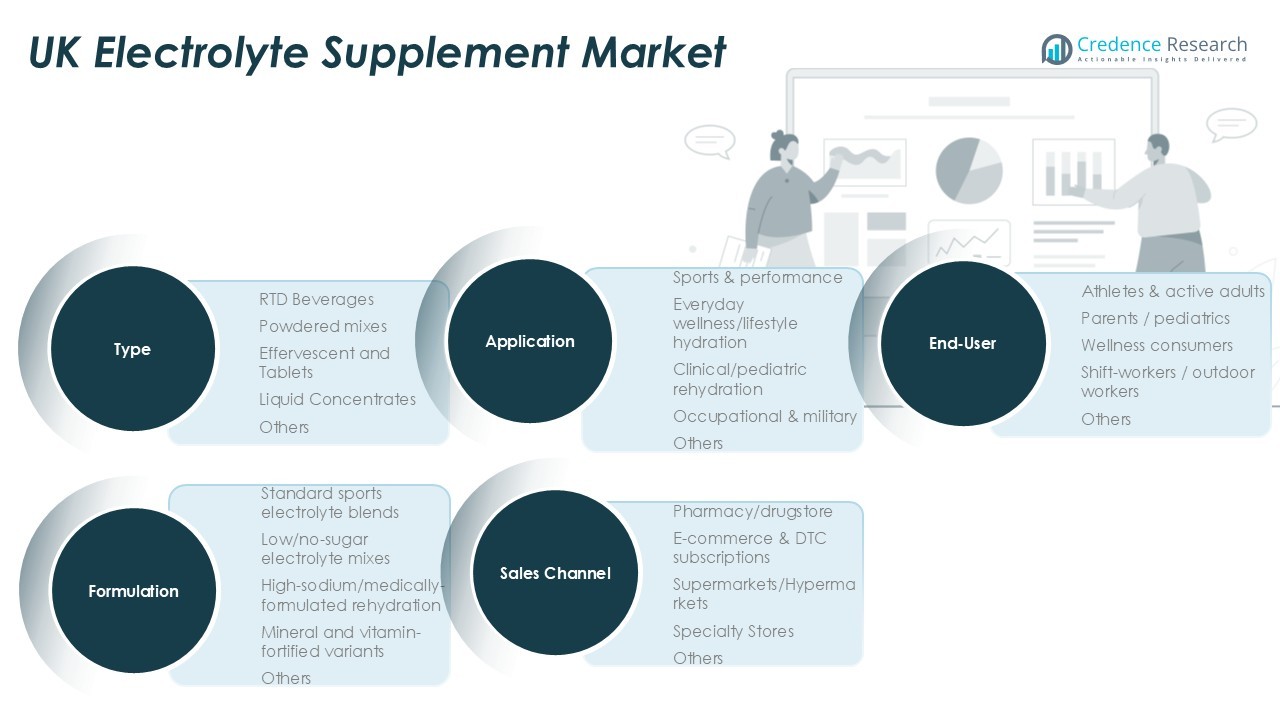

By Type

The UK Electrolyte Supplement Market is segmented into various types, including RTD (ready-to-drink) beverages, powdered mixes, effervescent tablets, liquid concentrates, and others. RTD beverages lead the market due to their convenience and on-the-go usage. Powdered mixes and effervescent tablets are popular among consumers seeking portability and ease of use. Liquid concentrates are gaining popularity due to their cost-effectiveness and concentration of electrolytes. Each type addresses the diverse needs of consumers for hydration and performance enhancement.

- For instance, the UK-based company Styrkr developed its SLT07 Hydration Tablets, which provide 1000mg of sodium in a single effervescent tablet to rapidly replenish the primary electrolyte lost through sweat.

By Application

The market is driven by several key applications, with sports and performance taking the lead. Electrolyte supplements are essential for athletes to maintain hydration during physical exertion and to enhance performance. Everyday wellness and lifestyle hydration have seen increasing demand, as consumers look for convenient ways to stay hydrated throughout the day. Clinical and pediatric rehydration is another important segment, particularly for individuals with health conditions requiring electrolyte replenishment. Occupational and military applications are growing, as hydration solutions are vital in harsh working conditions or environments that demand physical endurance.

- For instance, Precision Fuel & Hydration offers its PH 1500 electrolyte drink mix, which is scientifically formulated with 1500mg of sodium per litre to help athletes start hydrated and recover faster after intense exercise.

By End-User

The primary consumers of electrolyte supplements in the UK are athletes and active adults, who rely on them for hydration and recovery. The growing awareness of hydration in children has made parents and pediatric consumers a significant segment. Wellness consumers also represent a large market, driven by their focus on overall health. Shift-workers and outdoor workers, who face dehydration risks due to prolonged activity, form another crucial group, further contributing to the market’s expansion.

Segmentations:

By Type

- Overview by Type Segment

- RTD Beverages

- Powdered mixes

- Effervescent and Tablets

- Liquid Concentrates

- Others

By Application

- Overview by Application Segment

- Sports & Performance

- Everyday wellness/lifestyle hydration

- Clinical/pediatric rehydration

- Occupational & military

- Others

By End-User

- Overview by End-user Segment

- Athletes & active adults

- Parents / pediatrics

- Wellness consumers

- Shift-workers / outdoor workers

- Others

By Formulation

- Overview by Formulation Segment

- Standard sports electrolyte blends

- Low/no-sugar electrolyte mixes

- High-sodium/medically-formulated rehydration

- Mineral and vitamin-fortified variants

- Others

By Sales Channel

- Overview by Sales Channel Segment

- Pharmacy/drugstore

- E-commerce & DTC subscriptions

- Supermarkets/Hypermarkets

- Specialty Stores

- Others

Regional Analysis:

England Holds the Largest Share in the UK Electrolyte Supplement Market

England dominates the UK electrolyte supplement market with a share of 55%. The region’s urban centers, particularly London, contribute significantly to market growth, driven by an increasing focus on wellness trends and active lifestyles. Consumers in these areas are highly engaged in fitness activities, such as gym workouts and recreational sports, which drives the demand for electrolyte supplements. Both physical and digital retail channels are well-established, providing convenient access to these products. This urbanization and lifestyle shift strongly support England’s leading position in the market.

Scotland and Wales Drive Growing Demand for Electrolyte Supplements

Scotland and Wales collectively hold 28% of the UK electrolyte supplement market share. Both regions are witnessing a rising interest in fitness and wellness, particularly among the younger population. With the increasing number of fitness clubs, sports events, and health-conscious initiatives, the demand for electrolyte supplements continues to grow. Local and international brands are responding by offering products tailored to the preferences of these markets. The emphasis on preventive healthcare in both regions further drives the consumption of electrolyte products, particularly among athletes and outdoor enthusiasts.

Northern Ireland Presents Key Opportunities for Market Growth

Northern Ireland accounts for 17% of the UK electrolyte supplement market share. While smaller than England, the region shows significant growth potential due to a rising awareness of health and hydration. Outdoor activities, such as hiking and cycling, contribute to an increasing need for hydration solutions, including electrolyte supplements. Retailers are expanding their product lines to cater to the local demand, and digital channels provide a means for brands to reach a broader audience. As interest in fitness and health continues to rise, Northern Ireland presents valuable opportunities for market players.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Nestlé S.A.

- GlaxoSmithKline plc

- Otsuka Pharmaceutical Co., Ltd.

- GU Energy Labs

- Hammer Nutrition

- SOS Hydration Inc.

- Tailwind Nutrition

- Liquid I.V.

- Denver Bodega LLC

- Sequel Natural LLC

- Kent Corporation

- Roar Organic

- Purity Organic, LLC

Competitive Analysis:

The UK Electrolyte Supplement Market is competitive, with leading players like Nestlé, GlaxoSmithKline, and Otsuka Pharmaceutical dominating through strong brand presence and broad distribution networks. These companies focus on innovation, offering new flavors, formulations, and convenient product formats to meet consumer demand. Smaller brands, emphasizing natural, organic, and sugar-free options, cater to health-conscious consumers, creating a diverse market landscape. E-commerce platforms have further expanded reach, intensifying competition as brands compete on price and differentiation. To maintain or grow market share, companies must continue innovating and adapting to evolving consumer preferences, driving further product diversification and development.

Recent Developments:

- In September 2025, Nestlé’s new CEO, Philipp Navratil, in his first public comments, stated his intent for the company to be fast-moving and open to new ideas.

- In May 2025, GSK announced its acquisition of efimosfermin alfa from Boston Pharmaceuticals for a potential total of $2 billion to bolster its pipeline for steatotic liver disease (SLD) treatment.

Report Coverage:

The research report offers an in-depth analysis based on Type, Application, End-User, Formulation and Sales Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- The UK Electrolyte Supplement Market will continue to see growth driven by increasing awareness of the importance of hydration for overall health and fitness.

- Consumers will increasingly opt for natural, organic, and low-sugar electrolyte products, aligning with broader health trends.

- E-commerce will remain a key sales channel, offering brands greater visibility and a direct connection to consumers.

- Innovative product offerings, including new flavors and formulations, will be critical for brands to stay competitive and meet diverse consumer preferences.

- The demand for electrolyte supplements in sports and performance applications will remain strong, with a growing number of athletes and fitness enthusiasts seeking hydration solutions.

- Everyday wellness and lifestyle hydration will drive product consumption among general consumers looking for convenient hydration options.

- Pediatric and clinical rehydration markets will expand as more people recognize the importance of proper electrolyte balance for children and those with specific health conditions.

- The market will see further expansion in specialized areas, such as hydration solutions for shift-workers and outdoor workers in physically demanding environments.

- Regional growth will be supported by increased product availability and accessibility across both retail and online platforms.

- Strategic partnerships, acquisitions, and regional expansions will be key strategies for brands to strengthen their market position and capture a larger share of the growing market.