Market Overview

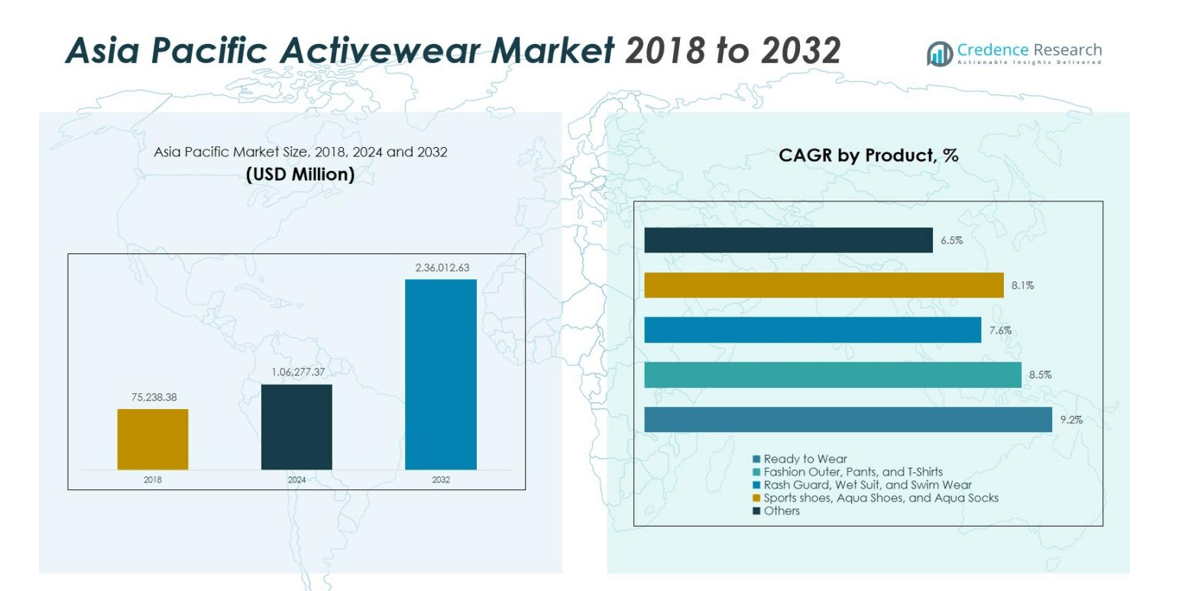

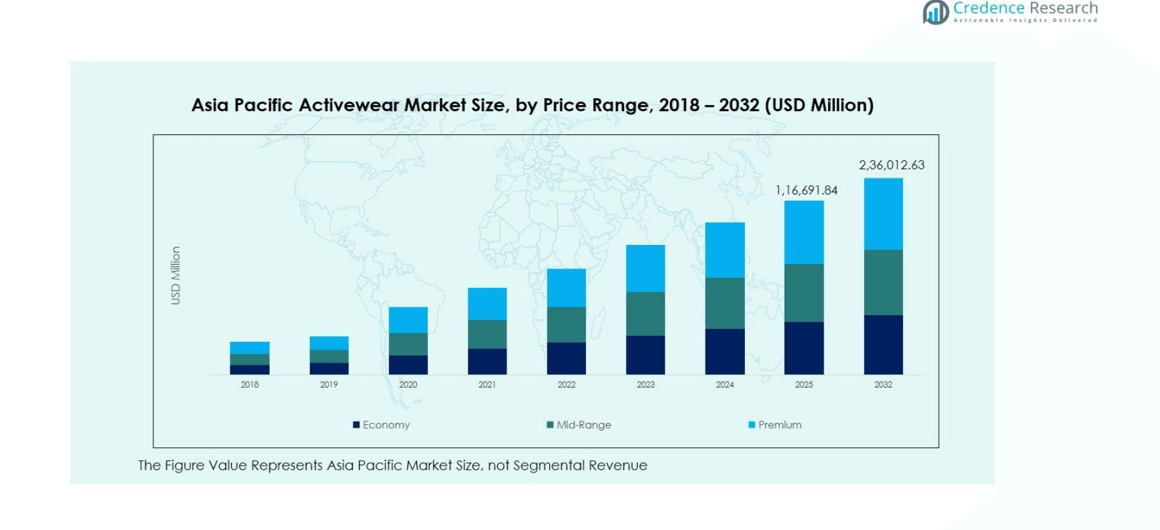

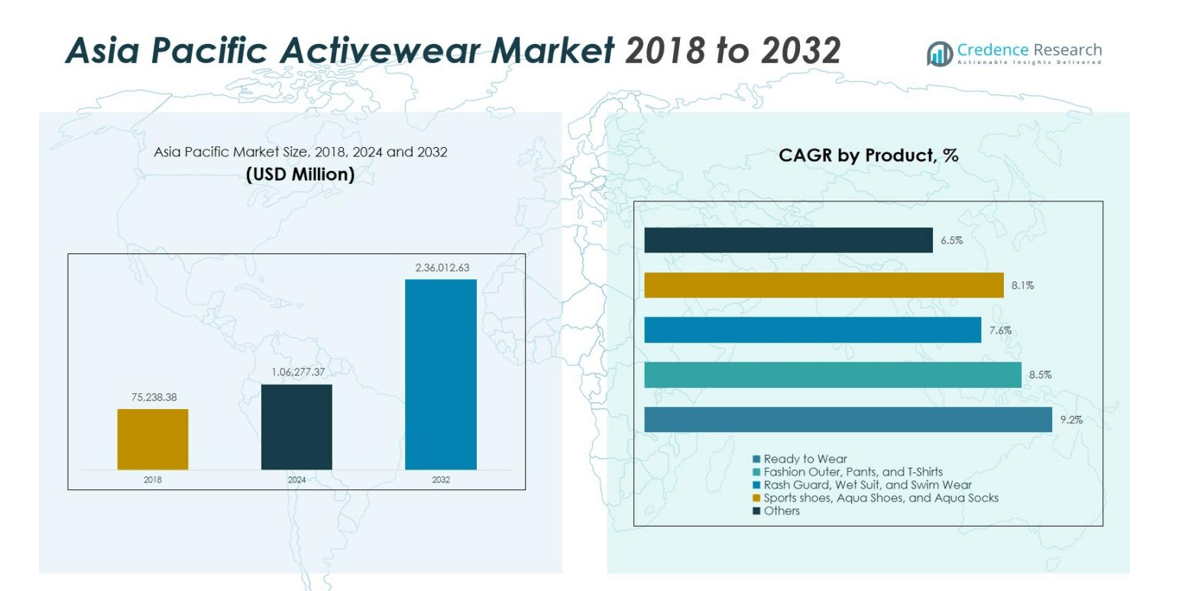

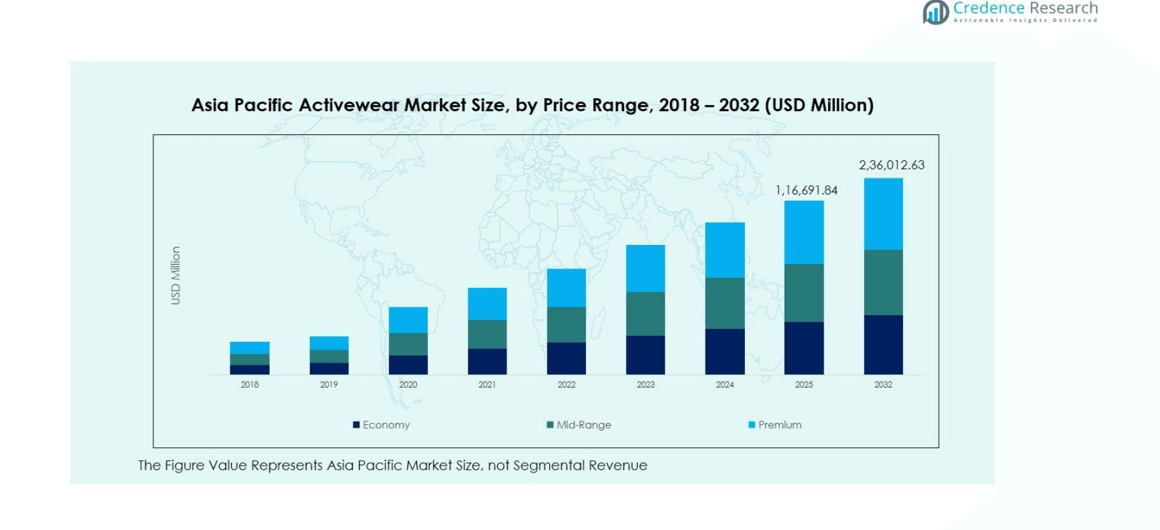

The Asia Pacific Activewear Market was valued at USD 75,238.38 million in 2018, increased to USD 1,06,277.37 million in 2024, and is anticipated to reach USD 2,36,012.63 million by 2032, growing at a CAGR of 8.51% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Asia Pacific Activewear Market Size 2024 |

USD 1,06,277.37 million |

| Asia Pacific Activewear Market, CAGR |

8.51% |

| Asia Pacific Activewear Market Size 2032 |

USD 2,36,012.63 million |

The Asia Pacific Activewear Market features key players such as Adidas AG, Nike, Inc., Puma SE and Lululemon Athletica Inc. driving growth through strong brand equity and product innovation. The region’s leading market is China, capturing over 25 % of the Asia Pacific market, supported by rapid urbanization, rising disposable incomes and expanding e‑commerce channels. Japan follows with more than 15 % share, powered by premium consumer preferences and fitness culture. These brands invest in localized marketing, digital platforms and diverse product portfolios to strengthen their position and address the evolving activewear demands across the region.

Market Insights

- The Asia Pacific Activewear Market recorded a size of USD 1,06,277.37 million in 2024 and is projected to reach USD 2,36,012.63 million by 2032, reflecting a CAGR of 8.51%.

- Increasing health consciousness and fitness participation across urban populations drive demand for activewear, with the Ready to Wear product segment capturing the largest share owing to its dual appeal for performance and daily wear.

- The blend of ergonomic design and fashion in activewear has shifted consumer preference toward athleisure, with synthetic fabrics such as polyester dominating the fabric segment and synthetic material types holding a larger share than natural alternatives.

- Established brands and new entrants alike intensify brand‑building through digital channels and influencer partnerships, though price sensitivity and counterfeit product prevalence restrain margin growth and brand integrity in emerging markets.

- Regionally, China leads the Asia–Pacific region with a market share of over 25 %, followed by Japan with more than 15 %, while Southeast Asia accounts for around 6 %, demonstrating significant growth potential for brands expanding beyond mature markets.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

The Asia Pacific Activewear Market is driven by diverse product segments, with “Ready to Wear” emerging as the dominant sub-segment, commanding a significant market share. This category is fueled by increasing consumer demand for convenient and stylish activewear suitable for both fitness and daily use. “Fashion Outer, Pants, and T-Shirts” also holds a notable share, reflecting the growing trend of athleisure wear across the region. Sports Shoes, Aqua Shoes, and Aqua Socks are gaining traction, particularly in countries with a strong focus on sports and water activities. Overall, the Ready to Wear segment holds the largest market share, benefiting from its widespread appeal and growing integration into everyday fashion.

- For instance, Lululemon and Adidas have responded to this trend by integrating performance fabrics with fashion-forward designs, launching collections that blend comfort and style suited for both workout and casual wear.

By Fabric

In the Asia Pacific Activewear Market, Polyester is the leading fabric, holding a dominant share of the market due to its durability, moisture-wicking properties, and cost-effectiveness. It is highly favored in both sports and casual wear. Nylon follows closely, prized for its lightweight and resilient qualities, often used in activewear that requires flexibility. Spandex has also emerged as a key fabric for its stretchability, allowing for enhanced comfort and movement in activewear, contributing to its growing share in the market. The market is primarily driven by the increasing demand for functional, high-performance fabrics that combine comfort and versatility.

- For instance, DuPont’s Asia Pacific facilities have increasingly supplied elastic polyester fibers for sportswear, emphasizing moisture management and fabric durability, vital for high-performance activewear.

By Material

The Asia Pacific Activewear Market’s material segment is divided into Natural and Synthetic categories, with Synthetic materials holding a larger share, primarily driven by their durability, stretchability, and moisture-wicking capabilities. Polyester and Spandex are dominant materials within this sub-segment, offering exceptional performance and comfort for activewear. Natural materials like cotton are preferred for their softness and breathability but have a smaller share due to their lower performance in moisture management compared to synthetic alternatives. The demand for synthetic materials is fueled by the growing interest in high-performance activewear that caters to both athletic and lifestyle needs.

Key Growth Drivers

Increasing Health Awareness and Fitness Trends

The rising health consciousness among consumers in the Asia Pacific region is a major driver for the activewear market. As more people adopt active lifestyles and prioritize fitness, the demand for functional and comfortable activewear has surged. This shift is evident in the growing participation in sports, fitness activities, and outdoor adventures. Activewear is no longer limited to sports settings, with athleisure becoming a daily wear trend. This trend is particularly strong in urban areas, where the younger population increasingly seeks clothing that blends performance with style.

- For instance, Nike has introduced Aerogami, a novel apparel technology with moisture-reactive vents that autonomously open and close upon sensing sweat, enhancing breathability during exercise.

Rising Disposable Income and Urbanization

With the increasing disposable income and rapid urbanization across Asia Pacific, consumers are spending more on premium activewear. As cities continue to grow, more people are engaging in fitness activities, further fueling demand for high-quality, durable activewear. The region’s expanding middle class is driving the demand for branded and high-performance products, especially in countries like China, India, and Japan. Urbanization is also linked to changes in lifestyle, where fitness becomes a priority, creating a broader market for diverse activewear categories catering to different consumer needs.

- For instance, Decathlon’s large-format experiential stores in India combine retail with recreation, helping build fitness engagement among urban populations and expanding access to affordable, diverse activewear ranges.

E-commerce Growth and Digital Transformation

The growth of e-commerce and digital platforms is significantly driving the Asia Pacific activewear market. Consumers are increasingly shopping for activewear online due to the convenience, variety, and competitive pricing offered by online stores. Social media platforms also play a crucial role in driving trends and influencing purchasing decisions, especially among younger demographics. With online retailers offering a wide range of products, easy returns, and home delivery options, the market is seeing a shift from traditional retail to more digitally oriented shopping experiences, expanding market reach.

Key Trends & Opportunities

Athleisure as a Lifestyle

The athleisure trend is one of the most prominent growth drivers in the activewear market. As comfort, style, and performance blend, activewear is no longer confined to gyms or fitness centers but has seamlessly integrated into everyday fashion. Consumers are increasingly choosing activewear for both its functionality and its ability to complement casual, urban lifestyles. This trend is providing opportunities for brands to innovate by creating stylish yet performance-oriented products that cater to the demand for versatile clothing, especially in metropolitan areas across Asia Pacific.

- For instance, Lululemon’s Align High‑Rise Pant is built from its Nulu™ fabric, described as “weightlessly soft” and designed without a front seam to enhance everyday wear beyond workouts.

Sustainability in Activewear

Sustainability is becoming a significant focus for both consumers and brands in the Asia Pacific activewear market. With the rising environmental awareness among consumers, there is growing demand for eco-friendly products made from sustainable materials such as recycled fabrics and organic cotton. Brands are increasingly investing in sustainable production processes, including reducing carbon footprints and using water-saving technologies. This shift toward sustainability not only meets consumer demand but also provides companies with a competitive edge, as more environmentally conscious consumers prefer brands with strong sustainability credentials.

- For instance, Japan’s ASICS launched the GEL-LYTE III CM 1.95 sneaker in 2023, featuring the lowest CO2 emissions of just 1.95 kg per pair, highlighting efforts to reduce carbon footprints in production.

Key Challenges

Intense Competition and Price Sensitivity

The Asia Pacific activewear market faces intense competition, especially with the entry of numerous international and local brands offering similar products. This has led to significant price sensitivity among consumers, especially in emerging markets. Brands are pressured to provide high-quality products at competitive prices, which can squeeze profit margins. Additionally, new entrants often offer lower-priced alternatives to gain market share, making it difficult for established players to maintain a leading position without continuous innovation and strategic pricing.

Counterfeit Products and Brand Authenticity

Another challenge for the activewear market in Asia Pacific is the widespread availability of counterfeit products. As the demand for branded activewear grows, counterfeit goods have flooded the market, undermining brand reputation and causing significant revenue losses. Consumers often find it challenging to differentiate between authentic and fake products, leading to concerns over product quality. This issue is particularly prevalent in markets where enforcement of intellectual property rights is weaker. Brands need to invest in anti-counterfeiting technologies and strategies to maintain consumer trust and brand integrity.

Regional Analysis

China

China leads the Asia Pacific activewear market with a substantial market share, exceeding 25%. The country’s growing middle class, along with the increasing interest in fitness and sports, has spurred demand for high-quality activewear. Urbanization is driving the shift toward healthier lifestyles, creating a robust market for performance-oriented activewear. Additionally, China’s growing e-commerce sector plays a crucial role in the distribution of activewear products, enhancing accessibility and market reach. The market is also witnessing significant expansion from both domestic and international brands, making it one of the most competitive and dynamic activewear markets in the region.

Japan

Japan holds a significant share of the Asia Pacific activewear market, accounting for over 15%. The market is driven by the country’s high standards for product quality, with consumers favoring durable and stylish activewear. Japan has a strong culture of fitness, particularly in sports such as running, cycling, and yoga, which further boosts demand for performance-oriented activewear. Moreover, the growing popularity of athleisure wear among the younger population is contributing to market expansion. E-commerce is also thriving in Japan, making activewear more accessible and facilitating the growth of both local and international activewear brands.

India

India’s activewear market is experiencing rapid growth, with a market share of around 10%. The country’s young and urbanizing population is increasingly adopting fitness and wellness trends, fueling demand for activewear products. With rising disposable income and the expansion of the e-commerce sector, more consumers are able to access a wide range of activewear brands. In addition, the growing middle class and a shift towards athleisure as a daily fashion choice further drive the market. As the fitness culture continues to evolve in India, the demand for stylish, functional, and affordable activewear is expected to grow.

South Korea

South Korea holds a prominent share in the Asia Pacific activewear market, representing over 7%. The market is driven by the country’s strong fitness culture, high participation in sports, and the increasing popularity of wellness activities such as yoga and running. South Korean consumers place a high value on the quality and performance of activewear, fueling demand for premium products. The country also has a thriving athleisure trend, with activewear seamlessly integrated into daily fashion. E-commerce platforms are growing rapidly in South Korea, further boosting the reach of activewear brands in the market.

Australia

Australia contributes significantly to the Asia Pacific activewear market, holding a market share of around 5%. The country’s focus on outdoor activities, sports, and fitness has led to a strong demand for activewear, particularly for running, swimming, and gym activities. The Australian market is also driven by the growing trend of athleisure wear, as consumers seek comfortable yet stylish options for both fitness and everyday wear. The rise of online shopping and the presence of global activewear brands have made it easier for consumers to access a wide range of activewear products.

Southeast Asia

Southeast Asia is witnessing robust growth in the activewear market, holding a combined market share of 6%. The region’s expanding middle class, increased participation in sports, and rising health consciousness are key factors driving demand for activewear products. Countries like Indonesia, Malaysia, and the Philippines are seeing a rise in fitness trends, creating opportunities for both local and international brands. The rapid growth of e-commerce platforms in Southeast Asia also plays a crucial role in expanding the availability of activewear, further accelerating market growth and offering new opportunities for expansion.

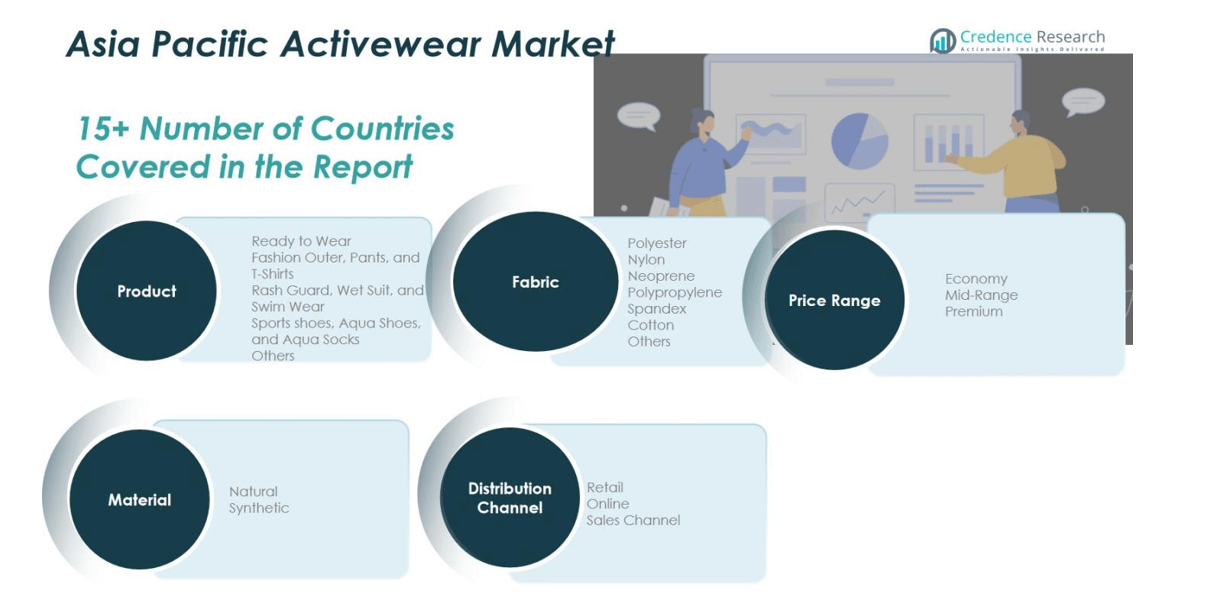

Market Segmentations:

By Product

- Ready to Wear

- Fashion Outer, Pants, and T-Shirts

- Rash Guard, Wet Suit, and Swim Wear

- Sports Shoes, Aqua Shoes, and Aqua Socks

- Others

By Fabric

- Polyester

- Nylon

- Neoprene

- Polypropylene

- Spandex

- Cotton

- Others

By Material Segment:

By Price Range

- Economy

- Mid-Range

- Premium

By Distribution Channel

By Region

- China

- Japan

- India

- South Korea

- Australia

- South East Asia

Competitive Landscape

Competitive analysis of the Asia Pacific Activewear Market reveals a dynamic and highly competitive environment, with major players such as Adidas AG, Nike, Inc., Puma SE, and Lululemon Athletica Inc. leading the charge. These brands dominate the market through continuous innovation, strong brand recognition, and strategic marketing campaigns. Adidas and Nike, with their extensive product portfolios and significant market presence, are particularly influential in the region, catering to both performance-oriented and athleisure segments. Regional players are also gaining traction by focusing on local consumer preferences and affordability. The market is witnessing increasing competition from both established and emerging brands, as the demand for activewear continues to rise. Additionally, e-commerce platforms have become a key distribution channel, allowing brands to reach a wider audience and enhance accessibility. Strategic collaborations, endorsements by sports celebrities, and product diversification are also becoming common tactics for companies to maintain a competitive edge in the rapidly evolving market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Adidas AG

- Nike, Inc.

- Puma SE

- Lululemon Athletica Inc.

- The Columbia Sportswear Company

- VF Corporation

- ASICS Corporation

- Skechers USA, Inc.

- Under Armour, Inc.

- Hanesbrands Inc.

Recent Developments

- In March 2025, Frasers Group announced that it will open over 350 stores of its Sports Direct chain across India and Southeast Asia (including Thailand, Vietnam, Cambodia) under its partnership with Indonesian retailer MAP Active.

- In July 2025, Lululemon revealed a partnership with Indian e‑commerce and retail giant Tata CLiQ to launch its first physical store and online presence in India, targeted for the second half of 2026.

- In April 2024, Agilitas Sports acquired exclusive rights to design, manufacture and distribute the Italian sports‑brand Lotto in India and Australia.

- In September 2025, Lehar Footwear Limited launched its new sports & athleisure brand RANNR in India to tap into the growing activewear/footwear market among younger consumers.

Report Coverage

The research report offers an in-depth analysis based on Product, Material, Fabric, Price Range, Distribution Channel and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The Asia Pacific Activewear Market is expected to continue its robust growth, driven by increasing consumer interest in health, fitness, and wellness

- The demand for athleisure wear will continue to rise as consumers seek comfort and style for both sports and everyday use

- E-commerce platforms will play a pivotal role in driving market expansion, providing brands with wider access to a broader consumer base

- Consumers will increasingly prefer sustainable and eco-friendly activewear products, pushing brands to adopt environmentally responsible materials and production processes.

- The market will see greater product diversification, with brands offering specialized activewear for different sports, outdoor activities, and wellness practices.

- Technological advancements in fabric and garment manufacturing will enhance the functionality of activewear, offering better performance and comfort.

- The younger demographic will remain a significant driving force, with millennials and Gen Z investing more in activewear as part of their lifestyle

- Regional players will expand their presence by focusing on affordability, while international brands will continue to cater to premium market segments

- Fitness trends, including home workouts and outdoor activities, will increase demand for versatile activewear products suited for various purposes.

- The rise of social media and influencer marketing will drive brand awareness and consumer purchasing decisions, especially among younger consumers.