Market Overview

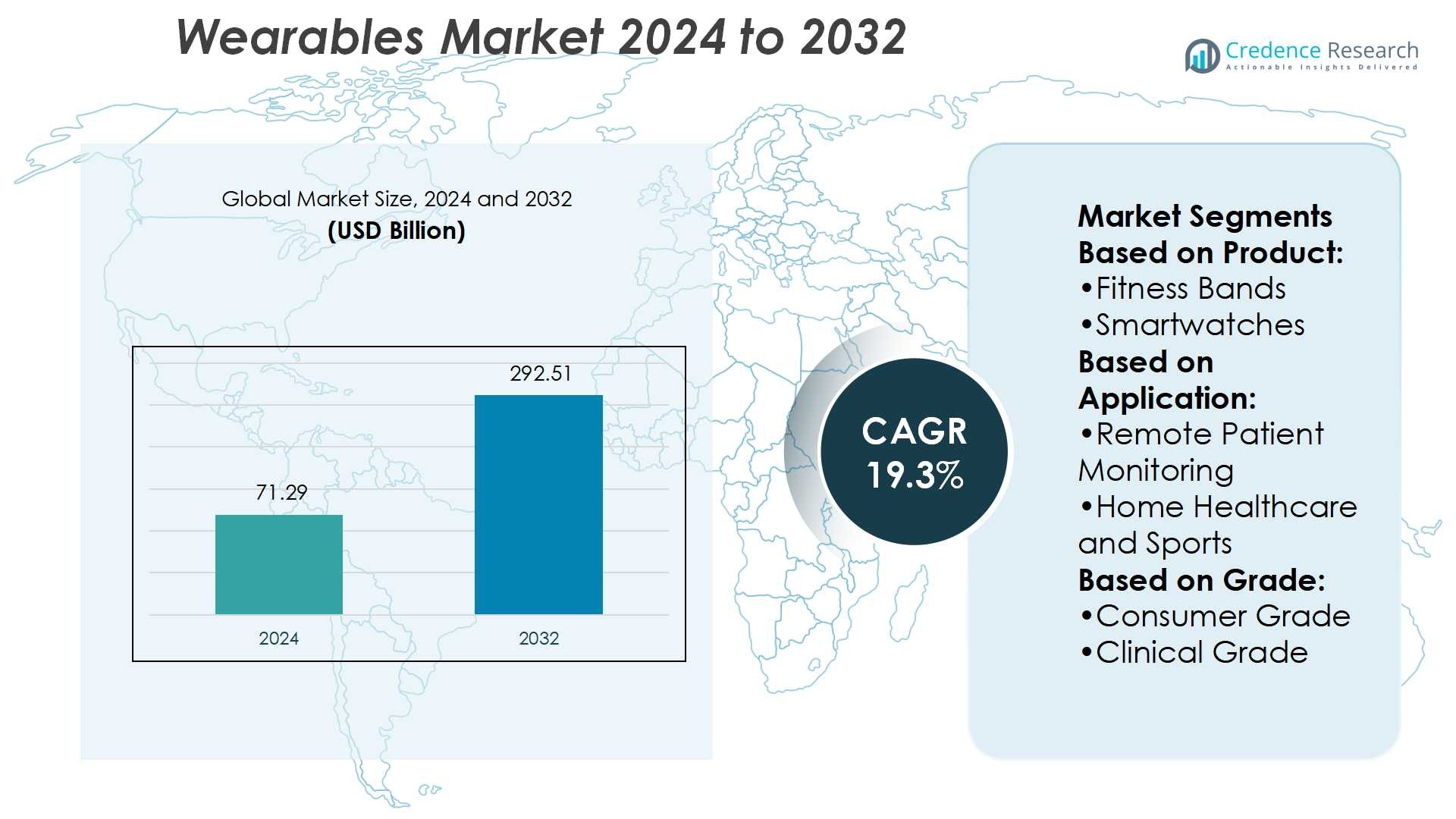

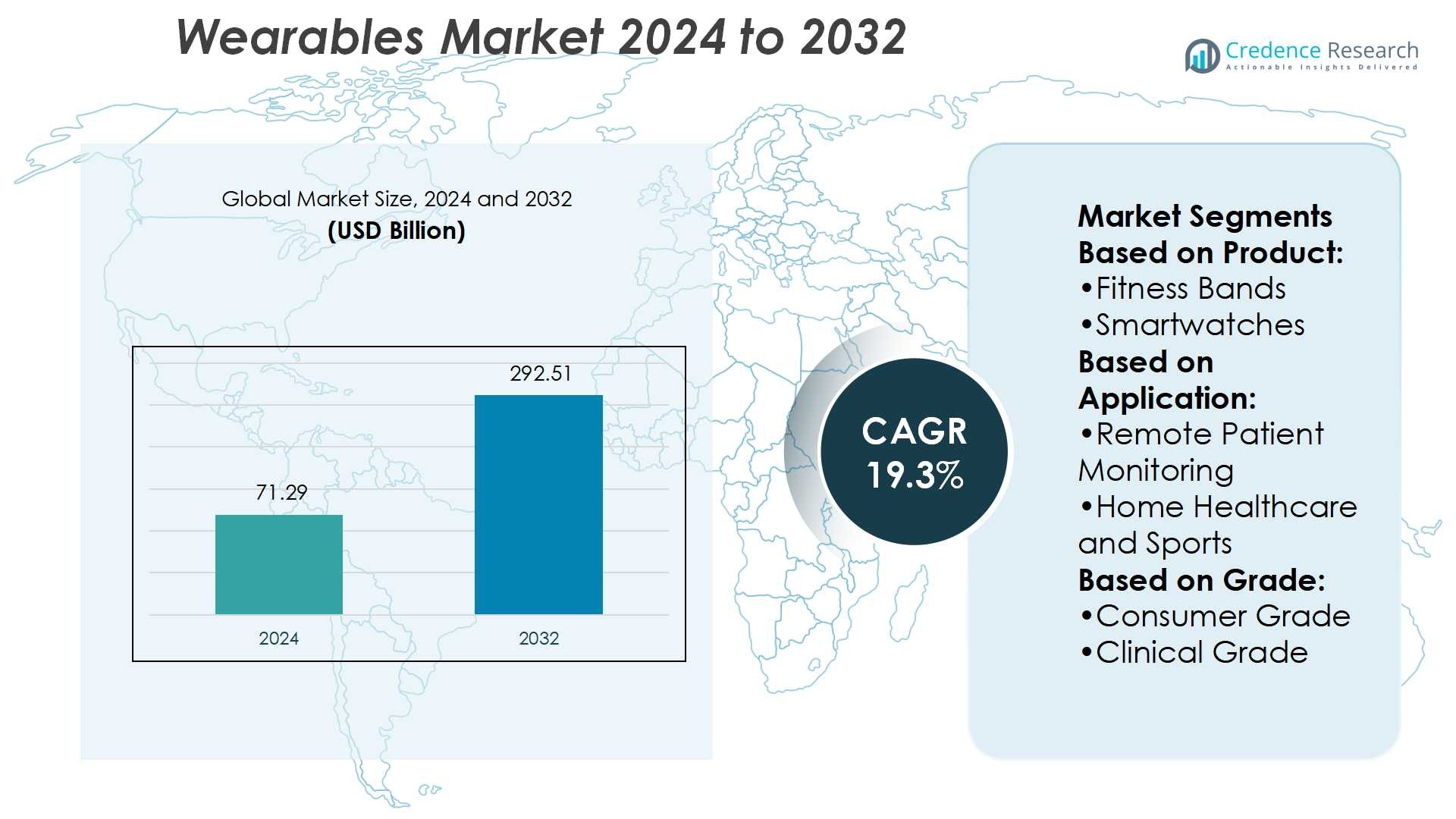

Wearables Market size was valued USD 71.29 billion in 2024 and is anticipated to reach USD 292.51 billion by 2032, at a CAGR of 19.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Wearables Market Size 2024 |

USD 71.29 Billion |

| Wearables Market, CAGR |

19.3% |

| Wearables Market Size 2032 |

USD 292.51 Billion |

The Wearables Market is shaped by leading players such as Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Huawei Technologies Co., Ltd., Xiaomi, Google LLC, Sony Corporation, Nike, Inc., adidas AG, and Imagine Marketing Ltd. These companies drive growth through continuous innovation, strategic partnerships, and ecosystem integration across consumer and healthcare segments. Premium brands dominate with advanced smartwatches, while affordable solutions gain traction in emerging economies. Regionally, North America leads the market with a 34% share, supported by strong consumer adoption, high health awareness, and the presence of global technology leaders that reinforce the region’s competitive advantage.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Wearables Market size was valued at USD 71.29 billion in 2024 and is projected to reach USD 292.51 billion by 2032, growing at a CAGR of 19.3%.

- Strong demand for health and fitness monitoring devices, coupled with rising adoption of remote patient care, acts as a key market driver.

- Market trends highlight the dominance of premium smartwatches, expansion of AI-driven personalization, and growing traction of affordable wearables in emerging economies.

- Competitive intensity remains high, with players such as Apple, Samsung, Huawei, and Xiaomi investing in innovation, though high device costs and data privacy concerns restrain wider adoption.

- Regionally, North America leads with a 34% share, while Europe holds 28% and Asia-Pacific accounts for 25%, with smartwatches dominating the product segment and driving overall market expansion.

Market Segmentation Analysis:

By Product

Within the wearables market, diagnostic and monitoring devices dominate, holding the largest market share led by smartwatches. Their adoption is driven by multifunctional features such as heart rate tracking, ECG monitoring, sleep analysis, and integration with mobile health apps. Fitness bands also remain popular due to affordability and ease of use, while smart clothing is gradually gaining interest in sports and rehabilitation settings. Therapeutic devices, including wearable defibrillators and drug delivery systems, show steady growth but remain secondary. The strong preference for smartwatches reflects consumer demand for all-in-one health and lifestyle solutions.

- For instance, Apple Inc. confirmed through its product documentation that the Apple Watch Series 9 includes a dual-core S9 SiP with 5.6 billion transistors, enabling on-device processing for advanced health metrics.

By Application

Sports and fitness lead the application segment, capturing the highest market share due to rising consumer health awareness and active lifestyle adoption. Remote patient monitoring and home healthcare follow, gaining traction as healthcare systems shift toward preventive and personalized care. Demand in sports and fitness is fueled by athletes and general consumers seeking real-time health insights and performance tracking. Increasing integration of AI-based analytics into wearables further strengthens this sub-segment. Growth in patient monitoring is supported by aging populations and chronic disease prevalence, yet sports and fitness remain the clear leader.

- For instance, Samsung Electronics Co., Ltd. confirmed that its Galaxy Watch6 integrates a BioActive sensor capable of tracking over 90 exercise modes and measuring body composition. Some studies funded by Samsung suggest a high correlation between the watch’s body composition data and DEXA scan results.

By Grade

Consumer-grade wearables dominate the market, accounting for the majority share due to their accessibility, affordability, and appeal to a wide user base. These devices, such as smartwatches and fitness trackers, cater to everyday wellness monitoring and lifestyle applications. Clinical-grade wearables hold a smaller share but are witnessing growth with greater adoption in hospitals and remote healthcare. Their accuracy and regulatory compliance make them critical in chronic disease management. However, the ease of purchase, stylish designs, and integration with mobile ecosystems continue to give consumer-grade devices a stronger foothold in the market.

Key Growth Drivers

Rising Health and Fitness Awareness

The Wearables Market benefits from growing health and fitness awareness. Consumers increasingly adopt fitness trackers and smartwatches to monitor activity, heart rate, and sleep cycles. This trend is supported by rising lifestyle-related diseases, pushing individuals toward proactive health management. Wearables with integrated sensors and AI-driven analytics enable real-time feedback and preventive care. Companies also expand wellness-focused features, such as stress tracking and personalized health coaching. These factors significantly boost adoption across demographics, making health monitoring a central driver for wearable growth.

- For instance, The Garmin Venu 3 smartwatch integrates an optical heart-rate sensor, a Pulse Ox sensor that can track blood oxygen saturation during sleep, and Body Battery tracking that calculates energy reserves from heart rate variability and stress data.

Technological Advancements and Integration

Continuous innovation drives the Wearables Market, with advanced sensors, AI, and IoT integration transforming devices. Wearables now provide accurate biometric data, ECG monitoring, and blood oxygen analysis, once limited to medical-grade tools. The adoption of 5G enhances connectivity, supporting real-time monitoring and telemedicine integration. Hybrid wearables combining health, fitness, and lifestyle functions attract a broad user base. Smart clothing and advanced therapeutic devices also expand applications. This wave of innovation fosters demand by offering multifunctional solutions that address healthcare, sports, and consumer lifestyle needs.

- For instance, Huawei Technologies Co., Ltd. confirms in its product literature that the Huawei Watch GT 4 integrates TruSeen™ 5.5+ technology with an eight-channel optical sensor. This technology enhances the accuracy of heart-rate readings.

Shift Toward Remote Patient Monitoring and Healthcare Support

The rising focus on remote healthcare supports wearable adoption across clinical applications. Hospitals and providers increasingly use wearables to monitor chronic conditions such as cardiovascular disease, diabetes, and respiratory issues. Real-time data collection improves patient outcomes and reduces hospitalization rates. Integration with telehealth platforms enhances doctor-patient communication, enabling efficient treatment adjustments. Insurance companies also support adoption by offering incentives for health tracking. This shift toward digital health ecosystems strengthens wearable penetration in the medical sector, driving long-term market growth.

Key Trends & Opportunities

Expansion of Consumer Grade Devices in Emerging Economies

Consumer-grade wearables dominate adoption in developed markets, but emerging economies present untapped opportunities. Rising disposable incomes, improved internet access, and growing smartphone penetration accelerate demand. Local players introduce cost-effective products, expanding reach in Asia-Pacific, Latin America, and Africa. Partnerships with telecom operators and fitness platforms further support growth. The expansion creates a new wave of adoption, positioning consumer-grade wearables as a high-potential segment in developing regions.

- For instance, Xiaomi confirms in its Mi Smart Band 8 documentation that the device integrates a 1.62-inch AMOLED display with 326 ppi resolution and supports over 150 sports modes. The band provides continuous SpO₂ tracking with alerts for drops below 90%.

Integration of AI and Data Analytics for Personalized Experiences

AI-powered wearables provide personalized insights, transforming consumer engagement. Advanced algorithms analyze large volumes of biometric data, enabling customized fitness and wellness recommendations. Predictive analytics identify potential health risks, offering early intervention opportunities. Companies also use machine learning to enhance voice recognition, gesture control, and adaptive interfaces. This personalization trend not only improves user satisfaction but also strengthens brand loyalty. It represents a strong opportunity for vendors to differentiate products in a highly competitive market.

- For instance, Google LLC confirms in its Pixel Watch 2 documentation that the device integrates Fitbit’s AI-driven algorithm with a multi-path optical sensor for enhanced heart-rate tracking.

Sustainability and Eco-Friendly Product Development

Sustainability emerges as a growing trend in wearable production. Companies explore eco-friendly materials, recyclable packaging, and energy-efficient designs. Solar-powered and kinetic energy-powered wearables reduce dependency on frequent charging. Consumer preference for sustainable technology aligns with global environmental goals. This trend creates opportunities for differentiation while addressing regulatory pressure on electronic waste. Eco-conscious innovation strengthens long-term competitiveness for wearable manufacturers.

Key Challenges

Data Privacy and Security Concerns

Data privacy remains a critical challenge in the Wearables Market. Devices continuously collect sensitive health and personal information, making them targets for cyberattacks. Breaches compromise consumer trust and pose compliance risks under regulations like GDPR and HIPAA. Companies must invest heavily in encryption, secure cloud storage, and user consent frameworks. Failure to address security concerns can limit adoption, especially in healthcare-focused wearables where confidentiality is paramount.

High Cost of Advanced Devices and Limited Accessibility

The high cost of premium wearables restricts penetration in price-sensitive markets. Devices with advanced healthcare features, such as ECG or therapeutic applications, often remain unaffordable for large consumer segments. Limited insurance coverage for wearable-supported healthcare further compounds this challenge. Developing economies face barriers in widespread adoption due to purchasing power gaps. Addressing affordability and accessibility is crucial for ensuring broader market penetration and sustained growth.

Regional Analysis

North America

North America leads the Wearables Market with a 34% share, driven by strong consumer demand for fitness and health monitoring devices. High adoption of smartwatches and fitness trackers among tech-savvy populations supports market dominance. The presence of major players such as Apple, Fitbit, and Garmin strengthens the regional ecosystem. Healthcare applications, including chronic disease monitoring and telemedicine integration, further fuel adoption. Rising health awareness, coupled with supportive insurance incentives, drives sustained growth. The U.S. remains the largest contributor, while Canada shows steady expansion due to its growing digital health initiatives.

Europe

Europe accounts for 28% of the Wearables Market, supported by increasing health-conscious lifestyles and strong sports culture. Countries like Germany, the UK, and France dominate regional adoption, with widespread use of fitness wearables in gyms and wellness programs. Government initiatives promoting digital health solutions also encourage adoption in clinical applications. Leading European brands and collaborations with healthcare providers strengthen market presence. Consumers increasingly prefer devices with advanced analytics and eco-friendly designs, aligning with sustainability goals. The growing elderly population across the region accelerates demand for medical-grade wearables for monitoring chronic health conditions.

Asia-Pacific

Asia-Pacific holds a 25% share of the Wearables Market, emerging as the fastest-growing region due to large-scale adoption in China, Japan, and India. Rising disposable incomes, expanding smartphone penetration, and increasing urbanization drive demand for fitness bands and smartwatches. Local manufacturers like Xiaomi and Huawei offer cost-effective solutions, making wearables accessible to a broader consumer base. Japan leads in advanced healthcare wearables, while India experiences rapid growth through affordable consumer-grade products. The strong fitness culture and government-driven digital health initiatives further expand adoption, positioning Asia-Pacific as a high-potential market for both consumer and clinical-grade wearables.

Latin America

Latin America contributes 7% to the Wearables Market, with growth centered in Brazil, Mexico, and Argentina. Rising middle-class income and urbanization support adoption of fitness-focused devices. Consumers increasingly purchase smartwatches and fitness trackers through expanding e-commerce platforms. Regional players collaborate with telecom operators to bundle wearable products with digital health apps. Healthcare adoption remains slower but is gradually increasing as hospitals pilot remote monitoring solutions. Brazil leads the regional share, supported by a vibrant sports culture, while Mexico shows strong momentum in wellness-focused wearables. The region holds significant untapped potential for further market expansion.

Middle East & Africa

The Middle East & Africa region holds a 6% share of the Wearables Market, with demand growing steadily in the UAE, Saudi Arabia, and South Africa. Increasing health awareness and rising smartphone penetration support consumer-grade device adoption. Wealthier Gulf countries demonstrate stronger demand for premium smartwatches, while African nations focus on affordable fitness bands. Hospitals in the UAE are integrating wearables into digital healthcare systems, enhancing chronic disease monitoring. Regional governments’ emphasis on e-health initiatives further drives adoption. Despite infrastructure challenges in some parts, rising urbanization and digitalization create opportunities for wearable growth across the region.

Market Segmentations:

By Product:

- Fitness Bands

- Smartwatches

By Application:

- Remote Patient Monitoring

- Home Healthcare and Sports

By Grade:

- Consumer Grade

- Clinical Grade

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The Wearables Market is highly competitive, with key players including Imagine Marketing Ltd., Apple Inc., Samsung Electronics Co., Ltd., Garmin Ltd., Nike, Inc., Huawei Technologies Co., Ltd., Xiaomi, Google LLC, Sony Corporation, and adidas AG. The Wearables Market is characterized by intense competition, rapid innovation, and strong consumer demand across multiple segments. Companies compete by focusing on advanced health monitoring features, seamless connectivity, and integration with digital ecosystems. The market shows a clear divide between premium devices offering multifunctional applications and affordable wearables targeting price-sensitive consumers. Product differentiation, design aesthetics, and battery efficiency remain critical success factors. Continuous investment in research and development supports the introduction of AI-driven insights, cloud-based services, and personalized health solutions. Strategic partnerships with healthcare providers, fitness platforms, and telecom operators further enhance market presence. Overall, competitive dynamics push vendors to balance innovation with accessibility, ensuring wearables remain relevant across healthcare, fitness, and lifestyle applications.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Imagine Marketing Ltd.

- Apple Inc.

- Samsung Electronics Co., Ltd.

- Garmin Ltd.

- Nike, Inc.

- Huawei Technologies Co., Ltd.

- Xiaomi

- Google LLC

- Sony Corporation

- adidas AG

Recent Developments

- In April 2025, Stanford Medicine and Samsung announced a research partnership aimed at enhancing the Galaxy Watch sleep apnea detection capabilities and investigating AI-enabled solutions for continuous sleep health management.

- In April 2025, Somnology teamed up with Samsung to introduce a groundbreaking hybrid sleep care model. This innovative solution combines telehealth services with asynchronous support, delivering a personalized and accessible approach to managing sleep health.

- In January 2025, Smart Meter, a technology and infrastructure supplier in the remote patient monitoring industry, reported substantial milestones in its growth. The company has experienced an impressive 300% sales increase and quadrupled its commercial customer base.

- In August 2024, Huawei introduced the TruSense system for its next generation of wearable devices, focusing on health and fitness. The system monitors over 60 health indicators, including heart rate, blood pressure, and stress, using advanced sensor technology.

- In July 2024, Titan launched the Titan Celestor, a high-performance GPS smartwatch targeting Indian fitness enthusiasts. Featuring GPS, altimeter, barometer, compass, and swim mode, the Celestor is tailored for outdoor activities.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Grade and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will see stronger adoption of clinical-grade wearables for chronic disease monitoring.

- AI and machine learning will enhance personalization and predictive health insights in devices.

- Consumer demand will shift toward multifunctional wearables combining fitness, health, and lifestyle features.

- Integration with telehealth platforms will expand wearable use in remote patient care.

- Battery efficiency and energy-harvesting technologies will drive product development.

- Emerging economies will experience rapid growth through affordable consumer-grade wearables.

- Sustainability will influence design, with eco-friendly materials and recyclable packaging gaining traction.

- Data privacy and cybersecurity innovations will become central to consumer trust.

- Sports and fitness culture will continue fueling wearable adoption among younger demographics.

- Collaborations between technology firms and healthcare providers will strengthen wearable healthcare ecosystems.