Market Overview

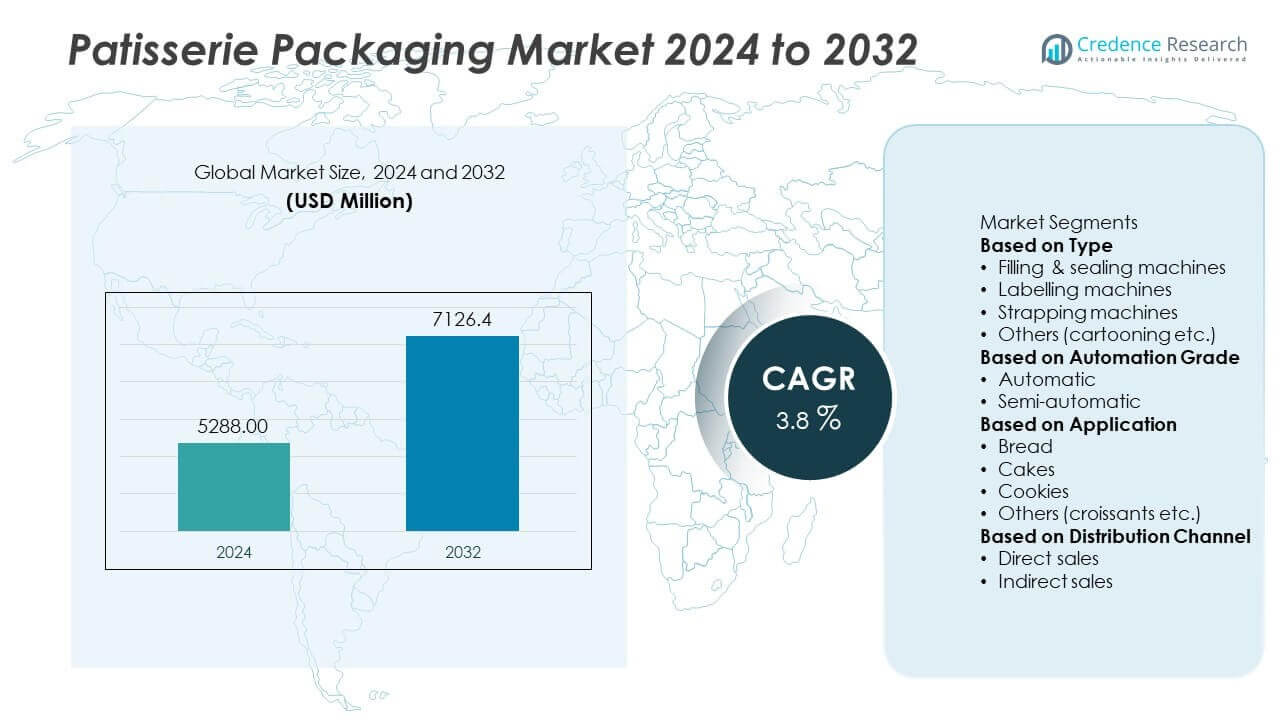

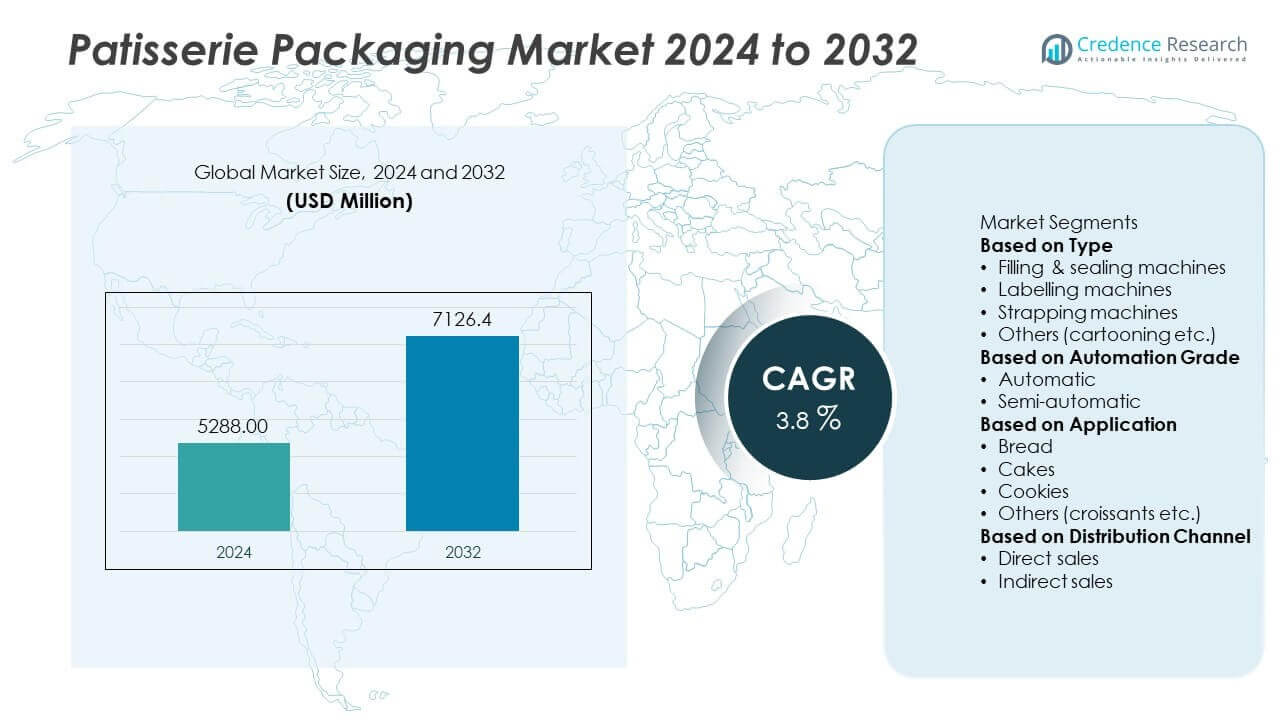

The Patisserie Packaging Market was valued at USD 5,288.00 million in 2024 and is expected to reach USD 7,126.4 million by 2032, growing at a CAGR of 3.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Patisserie Packaging Market Size 2024 |

USD 5,288.00 Million |

| Patisserie Packaging Market, CAGR |

3.8% |

| Patisserie Packaging Market Size 2032 |

USD 7,126.4 Million |

The patisserie packaging market is driven by leading players such as Amcor Plc, Mondi Group, Smurfit Kappa Group, Huhtamaki Oyj, and WestRock Company, who focus on sustainable packaging innovations, advanced printing solutions, and product customization to meet growing consumer demand. These companies are expanding their global presence through strategic acquisitions and capacity enhancements to cater to premium and mass-market bakery segments. North America leads the market with 32% share, supported by strong demand from café chains, premium bakeries, and e-commerce channels. Europe follows with 29% share, driven by luxury packaging demand and strict sustainability regulations, while Asia Pacific holds 25% share and is the fastest-growing region due to rising disposable incomes and expanding bakery consumption.

Market Insights

Market Insights

- The patisserie packaging market was valued at USD 5,288.0 million in 2024 and is projected to reach USD 7,126.4 million by 2032, growing at a CAGR of 3.8%.

- Rising demand for premium, visually appealing, and sustainable packaging is driving growth, supported by the expansion of bakeries, cafés, and online bakery sales worldwide.

- Key trends include adoption of eco-friendly materials, recyclable cartons, and digital printing solutions to enhance branding and meet regulatory compliance.

- The market is moderately consolidated, with players like Amcor, Mondi, Smurfit Kappa, Huhtamaki, and WestRock focusing on innovation, sustainability, and capacity expansion to strengthen their presence.

- North America leads with 32% share, followed by Europe at 29% and Asia Pacific at 25%; by type, filling and sealing machines dominate with over 40% share, while automatic systems hold nearly 60% share under automation grade, driven by efficiency and high-volume production needs.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Filling and sealing machines dominated the patisserie packaging market in 2024, accounting for over 40% share. Their dominance is driven by high demand for airtight packaging that preserves product freshness and extends shelf life. Automated filling and sealing systems offer consistent quality and high-speed operations, meeting the needs of large-scale bakeries and patisserie chains. Labelling machines follow, supported by growing demand for branding and compliance with food labeling regulations. Strapping machines and cartooning equipment hold niche shares, used mainly in secondary packaging for bulk handling and transport of bakery products.

- For instance, Grace Food Machinery offers various automatic filling and sealing machines, some capable of speeds up to 120 bags per minute, though specific models like a VFFS machine might reach 70 to 80 bags per minute. Their equipment supports different filling technologies, and while no single machine covers the entire 10-gram to 10-kilogram range, the company’s product line includes packaging machines that can fill from as low as 10 grams to up to 25 kilograms for certain products like grains.

By Automation Grade

Automatic systems led the market with nearly 60% share in 2024, driven by rising need for efficiency and reduced labor costs. Fully automated lines ensure faster throughput, minimal product handling, and improved hygiene compliance for baked goods. Semi-automatic machines remain relevant for small and mid-scale patisseries where flexibility and lower capital investment are crucial. Demand for automation is further supported by increasing adoption of Industry 4.0 technologies and digital monitoring solutions, allowing real-time quality checks and predictive maintenance to maximize uptime and minimize wastage in production cycles.

- For instance, Sampack India’s fully automatic packaging machines achieve production capacities of up to 4,000 pieces per hour with PLC-enabled digital temperature control and servo motor precision for consistent quality and minimal downtime in patisserie packaging lines.

By Application

Cakes represented the largest application segment with more than 45% share in 2024, as premium cakes and desserts drive higher packaging demand for aesthetics and protection. Patisserie brands prioritize tamper-evident, decorative, and customizable packaging to enhance product appeal and customer experience. Bread packaging follows, supported by demand for flexible films and bags that maintain softness and prevent contamination. Cookies and other bakery items such as croissants hold significant shares, with packaging focusing on portion control, resealability, and convenience for on-the-go consumption in retail and online distribution channels.

Key Growth Drivers

Rising Demand for Premium and Aesthetic Packaging

Growing consumer preference for visually appealing, innovative, and eco-friendly packaging is driving market growth. Premium patisserie brands focus on luxury boxes, windowed cartons, and printed labels to enhance shelf appeal and brand identity. Demand is fueled by gifting culture, seasonal launches, and premiumization trends across developed markets. Manufacturers are investing in custom shapes, embossing, and recyclable materials to attract eco-conscious buyers while maintaining elegance. This push for differentiation supports sustained demand for advanced packaging formats in both offline retail and online bakery sales channels globally.

- For instance, in August 2025, Mondi Group announced it was ramping up production of its FunctionalBarrier Paper Ultimate line following a €16 million investment at its plant in Solec, Poland. This recyclable, paper-based solution is intended for high-barrier applications in food products like confectionery, dried foods, and muesli bars, serving as a sustainable alternative to conventional unrecyclable packaging materials.

Expansion of Bakery and Confectionery Industry

The rapid growth of bakeries, patisserie chains, and cafés worldwide is a major driver for packaging demand. Urbanization, changing lifestyles, and rising disposable incomes have increased consumption of cakes, cookies, and desserts. Growing franchise networks and online bakery platforms require consistent, branded packaging solutions to maintain product quality during delivery. Demand is particularly strong in Asia Pacific and Europe, where artisanal and specialty bakeries are expanding. This growth creates opportunities for packaging suppliers to offer scalable, customizable, and cost-effective solutions that cater to small and large production volumes.

- For instance, Globe Print n Pack, a leading bakery packaging manufacturer in India, runs production lines equipped to handle high-volume and custom orders for a wide range of bakery items. The company offers packaging made with certified food-grade materials and uses eco-friendly inks, ensuring fast turnaround and compliance for artisanal and larger bakery chains.

Shift Toward Sustainable and Recyclable Materials

Regulatory pressures and consumer demand are pushing patisserie brands to adopt eco-friendly packaging solutions. Paper-based, compostable, and recyclable materials are replacing single-use plastics in many regions. Manufacturers are developing lightweight, biodegradable cartons and water-based coatings to comply with sustainability targets. This shift is supported by initiatives like EPR (Extended Producer Responsibility) and brand commitments to reduce carbon footprints. The transition not only enhances environmental compliance but also improves brand image, making sustainability a strong driver of innovation and competitive advantage in the market.

Key Trends & Opportunities

Growth of E-commerce and Food Delivery Channels

Online bakery orders and food delivery platforms are fueling demand for durable, tamper-proof, and insulated packaging. Brands are focusing on packaging that ensures product safety, maintains freshness, and prevents spillage during transit. The rise of cloud kitchens and third-party delivery services presents opportunities for suppliers to offer cost-efficient, scalable solutions for single-serve and bulk orders. Packaging designed for branding in unboxing experiences also supports online visibility, creating a dual benefit of protection and marketing for patisserie businesses.

- For instance, in April 2025, Amcor Plc launched new mono-material Liquiflex AmPrima pouches in Europe for the foodservice industry. The product launch was focused on sustainability, with claims of significantly lower carbon footprint and reduced water consumption compared to canned packaging.

Technological Integration in Packaging Processes

Automation, robotics, and digital printing are reshaping patisserie packaging production. High-speed filling, sealing, and labeling machines enable consistent quality and reduce operational costs. Smart packaging solutions with QR codes and traceability features enhance customer engagement and supply chain transparency. These technologies allow manufacturers to reduce downtime, track inventory, and maintain compliance with food safety regulations. The integration of Industry 4.0 solutions offers a strong opportunity for packaging producers to differentiate and improve productivity in competitive markets.

- For instance, in July 2024, DS Smith installed a single automated digital printing line—a Nozomi 14000 AQ single-pass inkjet printer—at its facility in Torrelavit, Spain. This system prints directly onto corrugated board with water-based inks, enabling real-time variable data, such as QR codes, and reducing waste

Key Challenges

Volatility in Raw Material Prices

Fluctuating prices of paper, board, and bioplastics pose a challenge for manufacturers. Rising input costs can reduce profit margins and lead to price instability in the supply chain. Small and medium-scale patisserie businesses face difficulty absorbing these costs, limiting their packaging upgrades. Suppliers must balance affordability and quality to stay competitive, often requiring long-term contracts or bulk procurement strategies. This volatility adds pressure on packaging producers to optimize operations and explore alternative materials without compromising performance.

Stringent Regulatory Compliance

Compliance with food safety, labeling, and environmental regulations is becoming increasingly complex. Global standards vary across regions, requiring packaging producers to adapt materials and designs to meet local requirements. Non-compliance risks include fines, recalls, and reputational damage. Adopting certified food-grade materials, sustainable inks, and tamper-evident designs increases costs and extends production timelines. For many smaller producers, meeting these evolving regulatory standards can be a significant barrier to scaling operations in international markets.

Regional Analysis

North America

North America held 32% share of the patisserie packaging market in 2024, driven by strong demand from premium bakeries and café chains. The United States leads the region with high adoption of sustainable and branded packaging for cakes and desserts. Growth is fueled by e-commerce bakery sales and seasonal gifting trends, which require visually appealing and protective packaging. Manufacturers are investing in recyclable cartons, compostable wrappers, and advanced labeling solutions to meet stringent food safety and sustainability regulations. Canada contributes with rising artisanal bakery culture, further supporting demand for high-quality packaging formats.

Europe

Europe accounted for 29% share in 2024, supported by its rich patisserie tradition and emphasis on aesthetic, eco-friendly packaging. France, Italy, and Germany are major contributors, driven by strong consumption of pastries, tarts, and chocolates. The EU’s strict packaging waste directives accelerate the shift toward recyclable and biodegradable materials. Brands focus on luxury boxes, embossed labels, and windowed cartons to maintain premium positioning. Growth is reinforced by tourism and café culture, which boost packaged dessert sales. Online ordering and click-and-collect services are increasing demand for durable and tamper-evident packaging solutions across the region.

Asia Pacific

Asia Pacific captured 25% share of the market in 2024, emerging as the fastest-growing region due to rapid urbanization and rising disposable incomes. China, Japan, and India are key markets where bakery and patisserie consumption is expanding. Demand is driven by premium packaging for festive seasons and growing café chains. Manufacturers are focusing on lightweight, cost-effective, and eco-friendly packaging to cater to mass-market demand. E-commerce platforms drive sales of packaged desserts, creating opportunities for secure, tamper-proof designs. Government initiatives promoting sustainable materials are further shaping the regional packaging landscape.

Latin America

Latin America held 8% share in 2024, with Brazil and Mexico leading market growth. Rising popularity of Western-style bakeries and premium dessert outlets is increasing demand for innovative packaging. Growth is driven by urban middle-class consumers seeking attractive, convenient, and hygienic packaging formats. Manufacturers are adopting paperboard cartons and printed labels to enhance brand identity and comply with food safety regulations. Investment in local packaging production is improving availability and affordability. Online bakery sales and food delivery platforms are also boosting demand for protective and visually appealing packaging solutions across major cities.

Middle East & Africa

The Middle East & Africa region accounted for 6% share in 2024, supported by growing café culture and rising bakery consumption in urban areas. The UAE, Saudi Arabia, and South Africa are the leading markets, with demand for premium and luxury packaging formats. Tourism and hospitality sectors are major drivers, requiring customized, branded boxes for desserts and pastries. Manufacturers are introducing recyclable and sustainable materials to align with regional environmental initiatives. Growth is further supported by increasing adoption of online bakery ordering, which drives demand for tamper-evident and durable packaging solutions.

Market Segmentations:

By Type

- Filling & sealing machines

- Labelling machines

- Strapping machines

- Others (cartooning etc.)

By Automation Grade

By Application

- Bread

- Cakes

- Cookies

- Others (croissants etc.)

By Distribution Channel

- Direct sales

- Indirect sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the patisserie packaging market is moderately consolidated, with key players such as Amcor Plc, Mondi Group, Smurfit Kappa Group, Huhtamaki Oyj, and WestRock Company leading the industry. These companies focus on product innovation, sustainable material development, and strategic partnerships to strengthen their market position. Investments in lightweight, recyclable, and compostable packaging solutions are rising to meet global sustainability mandates and consumer demand for eco-friendly products. Players are also leveraging advanced printing technologies to offer customizable and visually appealing designs for premium patisserie products. Expansion strategies include acquisitions and capacity expansions in emerging markets to cater to the growing bakery and confectionery sectors. The competitive environment is shaped by a mix of global packaging leaders and regional suppliers who provide cost-efficient solutions for small and medium bakeries, creating a dynamic balance between premium quality offerings and affordable mass-market alternatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Amcor Plc

- Mondi Group

- Smurfit Kappa Group

- Huhtamaki Oyj

- WestRock Company

- DS Smith Plc

- Sonoco Products Company

- Berry Global Inc.

- Sealed Air Corporation

- Graphic Packaging Holding Company

Recent Developments

- In January 2025, Smurfit Westrock won 10 awards at WorldStar for packaging innovation, including a paper-based tray for plant-based meals.

- In 2025, Graphic Packaging Holding Company added PaperSeal Pressed MAP Tray for chilled bakery lines.

- In November 2024, Smurfit Westrock unveiled its EasySplit Bag-in-Box® design to meet new European packaging regulation (PPWR) focusing on separability of components for better recyclability.

- In June 2024, Smurfit Kappa invested over €30 million in Spain to reduce CO₂ emissions.

Report Coverage

The research report offers an in-depth analysis based on Type, Automation Grade, Application, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for eco-friendly and recyclable packaging materials will continue to rise globally.

- Automation adoption will increase, with more bakeries investing in fully automated packaging lines.

- Digital printing and customization will gain traction to enhance product branding and shelf appeal.

- Growth of e-commerce and food delivery will boost demand for tamper-proof and durable packaging.

- Lightweight and sustainable packaging designs will become a key focus for manufacturers.

- Asia Pacific will remain the fastest-growing region due to urbanization and rising bakery consumption.

- Premium packaging for cakes and desserts will see strong demand from luxury and gifting segments.

- Smart packaging with QR codes and traceability will improve customer engagement and supply chain tracking.

- Strategic mergers and acquisitions will expand the presence of global players in emerging markets.

- Regulatory compliance will drive innovation in food-safe inks, coatings, and biodegradable packaging solutions.

Market Insights

Market Insights