Market Overview:

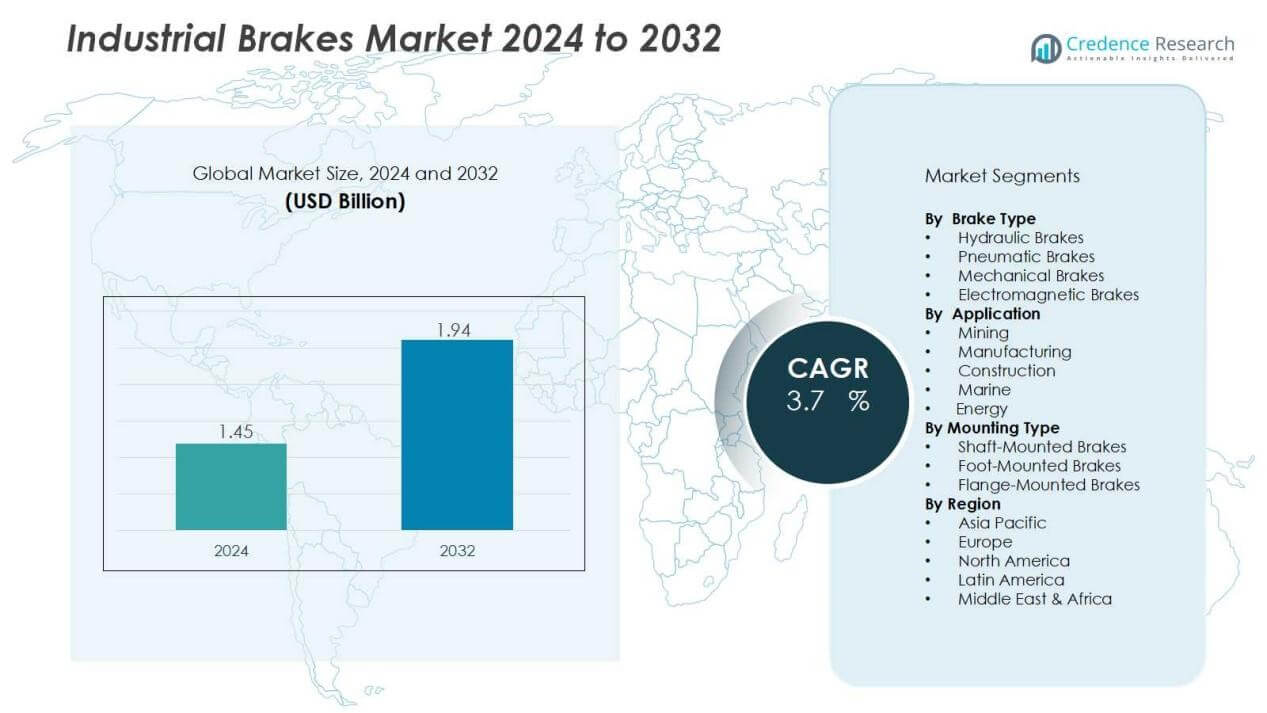

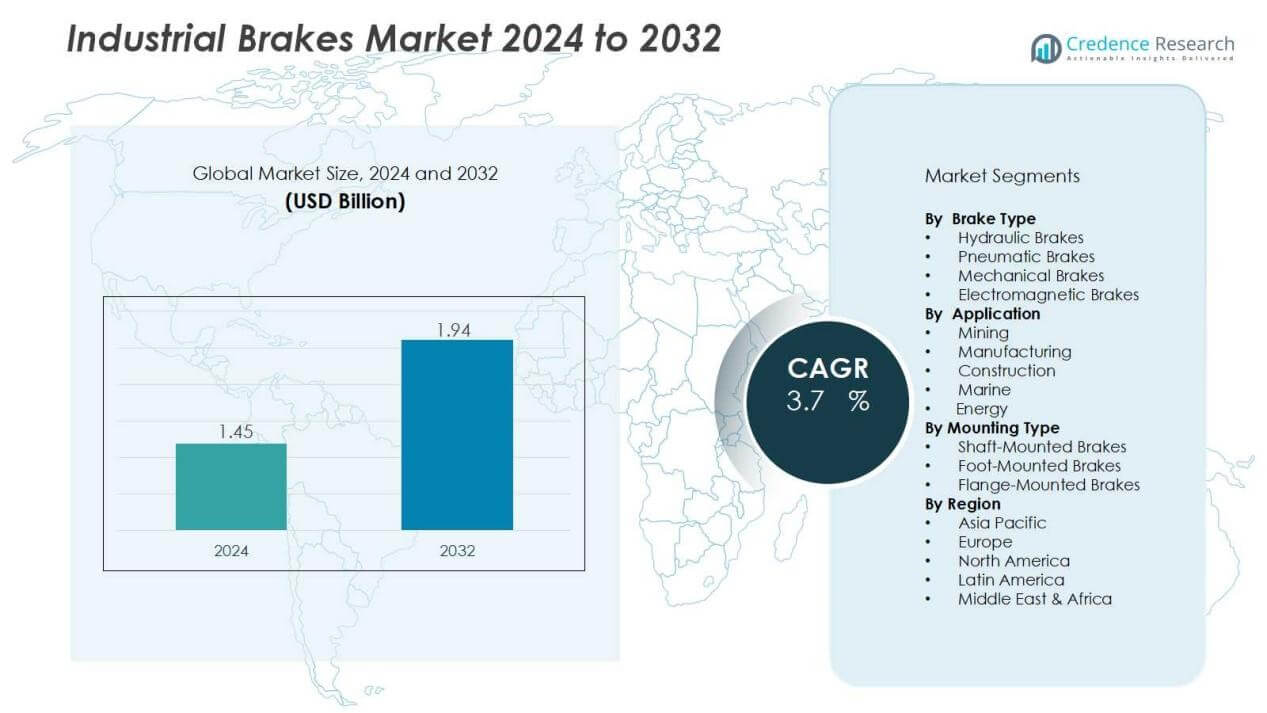

The industrial brakes market size was valued at USD 1.45 billion in 2024 and is anticipated to reach USD 1.94 billion by 2032, at a CAGR of 3.7% during the forecast period (2024-2032).

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Industrial Brakes Market Size 2024 |

USD 1.45 Billion |

| Industrial Brakes Market, CAGR |

3.7% |

| Industrial Brakes Market Size 2032 |

USD 1.94 Billion |

Key drivers include the increasing need for safety, efficiency, and precision in industrial operations. Rising investments in material handling, construction, and renewable energy projects further boost demand for braking systems. Innovations in braking technologies, such as fail-safe brakes, hydraulic and pneumatic systems, and low-maintenance solutions, also support market growth. Moreover, stricter regulations regarding worker safety and machinery standards are compelling industries to upgrade to reliable and high-performance brake systems.

Regionally, Asia-Pacific dominates the industrial brakes market due to rapid industrialization, expanding construction activity, and strong demand from mining operations in China, India, and Southeast Asia. North America follows with strong uptake in oil and gas, manufacturing, and automotive industries. Europe maintains significant share, driven by strict safety regulations and modernization of industrial equipment. Meanwhile, the Middle East and Africa present promising growth opportunities, supported by infrastructure development and expansion of mining projects.

Market Insights:

- The industrial brakes market was valued at USD 1.45 billion in 2024 and is expected to reach USD 1.94 billion by 2032, growing at a CAGR of 3.7%.

- Safety and reliability are key drivers, with industries such as mining, oil and gas, and manufacturing requiring advanced braking solutions to reduce risks.

- Rising industrialization and the use of heavy-duty equipment, including cranes and conveyors, are creating strong demand for high-performance brakes.

- Technological advancements such as hydraulic, pneumatic, fail-safe systems, and IoT-enabled predictive maintenance are improving efficiency and adoption.

- High maintenance costs and frequent downtime remain major challenges, especially for industries relying on heavy machinery under extreme conditions.

- Asia-Pacific led with 42.3% share in 2024, supported by rapid industrial growth, construction expansion, and wind energy projects in China, India, and Southeast Asia.

- North America held 27.6% share and Europe 21.4% share, with both regions driven by strict safety standards, advanced industrial bases, and increasing adoption of automated braking systems.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Growing Demand for Safety and Reliability in Industrial Operations:

The industrial brakes market is driven by the critical role brakes play in ensuring operational safety. Industries such as mining, oil and gas, and manufacturing face high risks of accidents without reliable braking systems. Safety regulations across regions push companies to adopt advanced brakes that minimize hazards. It is increasingly necessary to meet global safety standards, encouraging investment in modern solutions.

- For instance, Knorr-Bremse AG introduced the SYNACT® modular disc brake family in September 2024, which reduces vehicle weight by up to 48 kilograms, thereby enhancing safety and energy efficiency in commercial vehicles.

Expansion of Manufacturing and Heavy-Duty Equipment Usage:

Rising industrialization and the growing use of heavy-duty equipment create consistent demand for braking systems. The industrial brakes market benefits from increased use of cranes, conveyors, and material handling equipment in large-scale operations. Heavy machinery requires reliable braking to maintain precision and efficiency. It is essential for companies to invest in high-performance brakes to reduce downtime and extend equipment life.

- For instance, RINGSPANN’s electro-hydraulic DX brakes for heavy-duty crane hoists, launched in late 2024, feature fast closing times of under 80 milliseconds and generate lifting forces up to 8 kN, enabling reliable and efficient emergency stops in port cranes.

Technological Advancements and Integration of Automation:

Continuous innovations in braking technology act as a major growth driver. The industrial brakes market sees advancements such as hydraulic, pneumatic, and fail-safe systems tailored to automated and smart machinery. Integration of IoT and predictive maintenance tools enhances reliability and efficiency. It is becoming vital for industries to adopt these solutions to improve performance and reduce operational costs.

Rising Infrastructure and Energy Sector Investments:

Global investments in infrastructure and renewable energy projects are fueling brake system demand. The industrial brakes market benefits from the growing need in wind turbines, construction machinery, and mining equipment. Expansion of energy and infrastructure projects requires robust braking systems that can withstand heavy loads and harsh environments. It is contributing to sustained demand across emerging and developed regions.

Market Trends:

Market Trends:

Adoption of Advanced Braking Technologies and Smart Integration:

The industrial brakes market is witnessing strong adoption of advanced braking technologies to enhance performance, safety, and reliability. Manufacturers are focusing on hydraulic, pneumatic, and electromagnetic braking systems tailored for heavy-duty machinery. Integration of smart technologies such as IoT sensors and predictive maintenance platforms is becoming common. These features allow operators to monitor brake performance in real time, reducing the risk of unexpected failures. It is helping industries lower maintenance costs and improve operational efficiency. Growing interest in energy-efficient braking solutions also reflects the push toward sustainable operations across sectors.

- For Instance, Knorr-Bremse passed the 13 million milestone for ABS/EBS systems delivered worldwide during 2022, not by April 2022. The company did not specify the exact date the milestone was reached, but it occurred sometime within the 2022 fiscal year.

Rising Focus on Customization and Industry-Specific Applications:

Customization is emerging as a key trend shaping the industrial brakes market. Companies are developing specialized brakes to meet unique requirements across mining, construction, manufacturing, and renewable energy applications. Demand for compact yet durable systems is rising in automated facilities and high-capacity equipment. It is also notable that the wind energy sector is driving demand for brakes designed to withstand extreme environmental conditions. Manufacturers are offering modular designs that enable easier integration with existing systems. This trend highlights the shift toward tailored solutions that improve efficiency, safety, and adaptability in diverse industrial environments.

- For Instance, Mayr Power Transmission manufactures the ROBA-stop®-M Cold Climate Version (CCV), a safety brake for wind turbines certified to operate reliably down to –40 °C.

Market Challenges Analysis:

High Maintenance Costs and Operational Downtime:

The industrial brakes market faces challenges linked to high maintenance costs and operational downtime. Braking systems in heavy-duty equipment are exposed to extreme loads and harsh environments, which accelerates wear and tear. Frequent replacement of parts and specialized servicing increases expenses for operators. It also leads to downtime, reducing overall productivity and efficiency. Many industries hesitate to upgrade systems due to the recurring costs of maintenance. This creates a barrier to adoption of advanced solutions, particularly in cost-sensitive markets.

Technical Complexity and Supply Chain Constraints:

The industrial brakes market is also challenged by the technical complexity of modern braking systems. Advanced brakes with hydraulic, pneumatic, or electromagnetic designs require skilled technicians for installation and servicing. A shortage of trained professionals often slows adoption in developing regions. It also complicates integration with existing machinery, especially in industries relying on legacy equipment. Global supply chain disruptions and raw material price fluctuations add further pressure on manufacturers. These challenges limit smooth production and timely delivery, impacting customer confidence and growth potential.

Market Opportunities:

Growing Potential in Renewable Energy and Infrastructure Development:

The industrial brakes market holds strong opportunities in renewable energy and infrastructure projects. The expansion of wind power installations requires advanced braking systems to ensure safe turbine operation under varying conditions. Infrastructure growth in emerging economies fuels demand for brakes in cranes, construction machinery, and material handling systems. It creates a favorable environment for manufacturers offering durable and efficient braking solutions. Rising global investment in smart cities further supports adoption across automated facilities and logistics hubs. Companies focusing on specialized applications can capture significant market share in these high-growth sectors.

Rising Demand for Automation and Customized Solutions:

The industrial brakes market is also positioned to benefit from rising automation in manufacturing and heavy industries. Automated equipment requires advanced brakes that deliver precision, safety, and reduced downtime. It provides manufacturers an opportunity to develop intelligent braking systems integrated with IoT and predictive maintenance features. Customization is gaining traction, with industries seeking tailored solutions to meet unique operational requirements. Growth in aerospace, mining, and marine applications highlights opportunities for compact and high-performance systems. Players that prioritize innovation, modular designs, and flexible solutions can strengthen their global presence.

Market Segmentation Analysis:

By Brake Type:

The industrial brakes market is segmented into hydraulic, pneumatic, mechanical, and electromagnetic brakes. Hydraulic brakes dominate due to their high efficiency and durability in heavy-duty operations. Pneumatic brakes are preferred in industries requiring clean and quick actuation. Electromagnetic brakes are gaining traction in automated and high-precision equipment. It benefits from rising adoption of advanced technologies that reduce maintenance and improve safety.

- For instance, Regal Rexnord Corporation manufactures hydraulic and pneumatic industrial brakes with torque ratings ranging from 80 to 200,000 Nm, suitable for heavy-duty applications like cranes and excavators, showcasing their robustness and reliability.

By Application:

Applications include mining, manufacturing, construction, marine, and energy sectors. The industrial brakes market sees strong demand in mining and material handling due to safety-critical operations. Manufacturing and construction also contribute significantly with increasing use of cranes, conveyors, and heavy machinery. The energy sector, particularly wind power, requires advanced brakes for turbine safety. It is further reinforced by rising infrastructure projects that drive adoption across diverse equipment.

- For instance, Siemens integrates robust safety features into its robotic automation solutions for manufacturing, improving safety in automated industries. The surge in this sector saw global industrial robot installations reach a record high of over 550,000 units in 2022.

By Mounting Type:

Mounting types include shaft-mounted, foot-mounted, and flange-mounted brakes. Shaft-mounted brakes hold a large share due to ease of installation and compact design. Foot-mounted brakes are favored in applications requiring stability and high torque capacity. Flange-mounted brakes cater to customized machinery and specialized equipment needs. It is supported by industry demand for reliable and adaptable systems across varying operational environments.

Segmentations:

By Brake Type

- Hydraulic Brakes

- Pneumatic Brakes

- Mechanical Brakes

- Electromagnetic Brakes

By Application

- Mining

- Manufacturing

- Construction

- Marine

- Energy

By Mounting Type

- Shaft-Mounted Brakes

- Foot-Mounted Brakes

- Flange-Mounted Brakes

By Region

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis:

Asia-Pacific :

Asia-Pacific held 42.3% market share in 2024, making it the leading regional segment of the industrial brakes market. China, India, and Southeast Asia are key contributors due to rapid industrial growth and infrastructure development. It benefits from strong demand in mining, construction, and renewable energy sectors. The region also sees growing investments in wind energy, where specialized braking systems are essential for turbine safety. Expanding manufacturing facilities and automation initiatives strengthen the demand for reliable brakes. Regional players and global manufacturers are actively investing to meet rising requirements across diverse industries.

North America :

North America accounted for 27.6% market share in 2024, supported by robust demand across oil and gas, aerospace, and manufacturing sectors. The industrial brakes market in the region benefits from strong adoption of advanced technologies and automation. It is further supported by strict workplace safety regulations that encourage upgrades to high-performance braking systems. The U.S. dominates demand with extensive use of heavy machinery in energy and construction. Canada also contributes significantly through investments in mining and renewable energy. Established infrastructure and strong presence of leading manufacturers enhance regional competitiveness.

Europe:

Europe represented 21.4% market share in 2024, driven by stringent safety regulations and modernization initiatives. The industrial brakes market in the region is shaped by demand across manufacturing, material handling, and marine industries. It is reinforced by consistent investment in automation and sustainability-focused equipment upgrades. Germany, France, and the U.K. lead adoption, supported by advanced industrial bases and regulatory compliance needs. The renewable energy sector, particularly wind energy, further increases demand for customized braking solutions. Regional innovation in low-maintenance and energy-efficient systems strengthens its position in global competition.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Rexnord

- Dana Incorporated

- NSK

- Parker Hannifin

- Sew-Eurodrive

- Altra Industrial Motion

- ZF Friedrichshafen

- KTR

- Oriental Motor

- Siemens

- Eaton

- Brembo

- Rockwell Automation

- Tsubaki

Competitive Analysis:

The industrial brakes market is defined by strong competition among global and regional players. Key companies include Rexnord, Dana Incorporated, NSK, Parker Hannifin, Sew-Eurodrive, Altra Industrial Motion, ZF Friedrichshafen, KTR, and Oriental Motor. These players compete through technological advancements, product innovation, and strong distribution networks. It benefits from rising demand in mining, construction, manufacturing, and renewable energy sectors, encouraging companies to focus on tailored solutions. Partnerships with equipment manufacturers and investments in smart braking systems are strengthening competitive positions. Companies are also emphasizing energy-efficient and low-maintenance designs to meet evolving customer needs. Strategic expansion in Asia-Pacific and emerging markets continues to be a core focus for gaining long-term growth.

Recent Developments:

- In March 2025, Regal Rexnord completed a $5 billion acquisition of Altra Industrial Motion Corp., expanding its automation and industrial powertrain portfolio including brakes, gears, and clutches across various end markets.

- In May 2025, Dana Incorporated was recognized as the “2025 Educational Partner of the Year” by HDA Truck Pride.

Report Coverage:

The research report offers an in-depth analysis based on Brake Type, Application, Mounting Type and Region . It details leading Market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current Market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven Market expansion in recent years. The report also explores Market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on Market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the Market.

Future Outlook:

- The industrial brakes market will see rising adoption of smart braking systems with IoT integration for predictive maintenance.

- Growing demand from renewable energy, particularly wind turbines, will continue to fuel specialized brake development.

- Manufacturers will prioritize customization to meet sector-specific requirements in mining, marine, and construction applications.

- Automation across industries will increase reliance on advanced brakes for safety, precision, and operational efficiency.

- Focus on sustainability will drive innovation in energy-efficient and low-maintenance braking technologies.

- Global infrastructure expansion will create new opportunities for heavy-duty brakes in cranes and material handling equipment.

- Emerging economies will strengthen demand through industrialization, urbanization, and renewable energy investments.

- Supply chain optimization and localization strategies will gain importance to reduce delays and maintain competitiveness.

- Collaborations between brake manufacturers and equipment OEMs will enhance system integration and product innovation.

- The market will evolve toward modular, compact, and durable designs to support next-generation industrial applications.

Market Trends:

Market Trends: