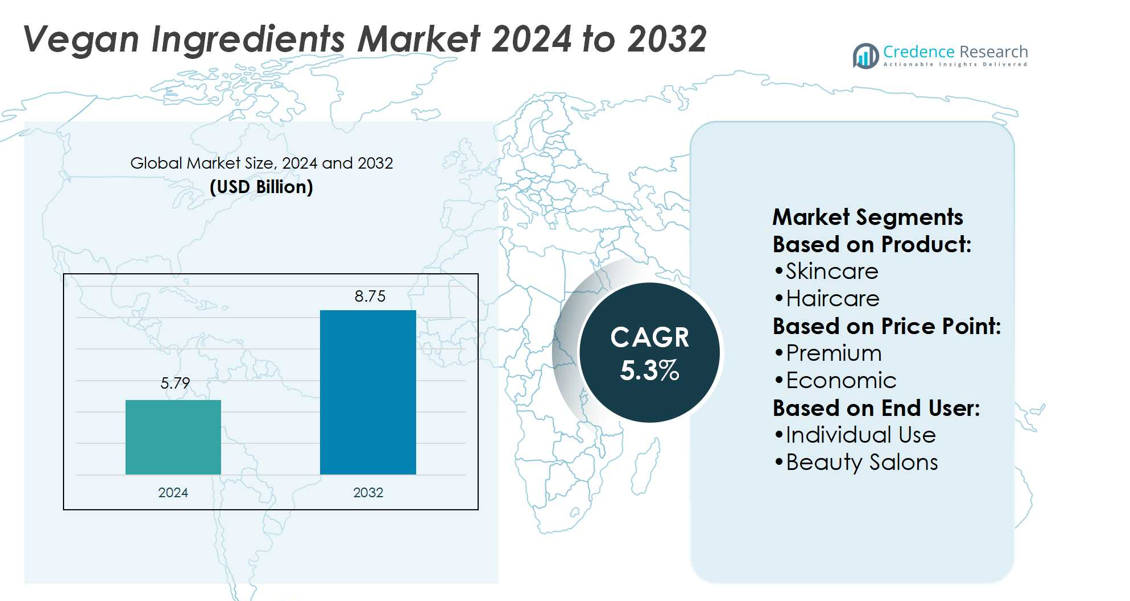

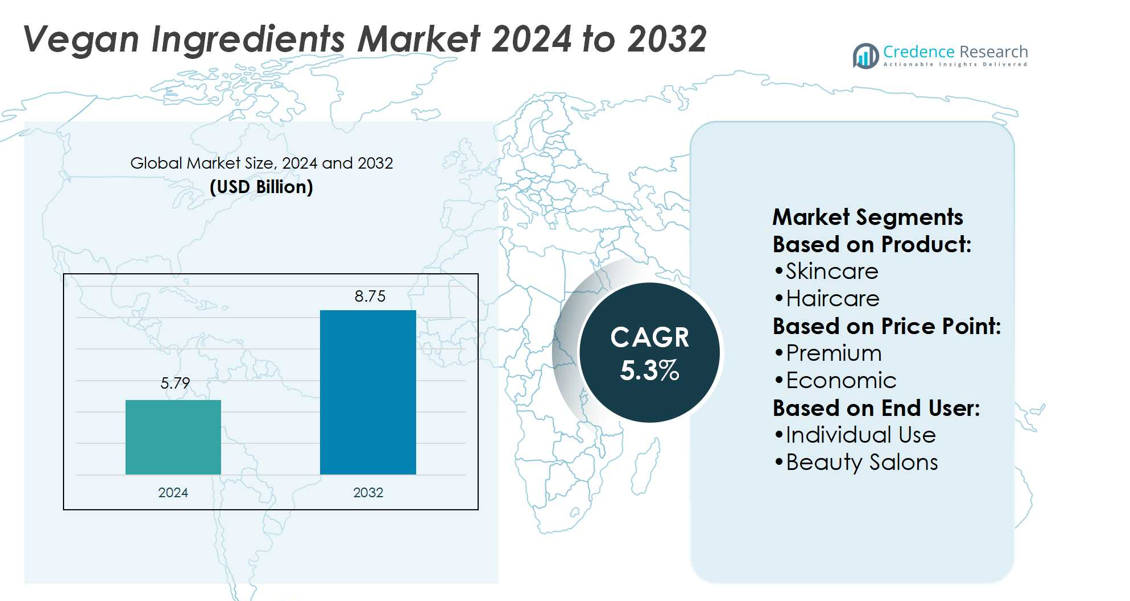

Vegan Ingredients Market size was valued USD 5.79 billion in 2024 and is anticipated to reach USD 8.75 billion by 2032, at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Ingredients Market Size 2024 |

USD 5.79 billion |

| Vegan Ingredients Market, CAGR |

5.3% |

| Vegan Ingredients Market Size 2032 |

USD 8.75 billion |

The vegan ingredients market is highly competitive, with top players including Solvay SA, Givaudan SA, Croda International Plc, BASF SE, Symrise AG, Ashland, Dow Inc., Lonza Group Ltd., Evonik Industries AG, and Eastman Chemical Company. These companies focus on innovation in plant-based formulations, sustainable sourcing, and eco-friendly packaging to capture growing consumer demand for clean-label and cruelty-free products. Strategic partnerships, mergers, and product launches strengthen their global presence and portfolio diversity. Regionally, North America leads the market with a 34% share in 2024, driven by strong consumer awareness, premium product adoption, and regulatory support for sustainability.

Market Insights

- The vegan ingredients market size was valued at USD 5.79 billion in 2024 and is projected to reach USD 8.75 billion by 2032, growing at a CAGR of 5.3%.

- Rising consumer demand for cruelty-free, clean-label, and sustainable beauty products acts as a key driver, boosting adoption across skincare, haircare, and makeup segments.

- A major trend is the premiumization of vegan products, with brands emphasizing organic certifications, eco-friendly packaging, and innovative plant-based formulations to attract affluent consumers.

- The market is highly competitive, with leading players focusing on mergers, partnerships, and product innovation, though high production costs remain a restraint in price-sensitive regions.

- North America leads the market with a 34% share in 2024, supported by strong consumer awareness and regulatory backing, while skincare dominates product segmentation with the largest share, reinforcing its position as the growth engine of the vegan ingredients market globally.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Within the vegan ingredients market, skincare dominates the product segment, holding a 38% market share in 2024. Rising consumer preference for cruelty-free and plant-based solutions drives this leadership. The demand for natural formulations addressing sensitive skin, anti-aging, and hydration further boosts adoption. Haircare and makeup follow, supported by growing innovation in sulfate-free shampoos and chemical-free cosmetics. Fragrances and other categories are gaining traction, though they remain niche compared to skincare. Strong marketing strategies by leading beauty brands and clean-label positioning continue to fuel skincare’s dominance.

- For instance, Givaudan’s PrimalHyal UltraReverse is an ultra-low molecular weight hyaluronic acid (lower than 3 kDa) that increases sirtuin-1 by 136% and boosts collagen-1 production by 48%.

By Price Point

The premium category leads with a 56% market share in 2024, reflecting growing consumer willingness to pay for quality and ethical sourcing. Premium vegan products emphasize organic certifications, sustainable packaging, and advanced formulations, appealing to affluent and eco-conscious buyers. Economic options maintain steady growth, catering to budget-sensitive consumers and expanding markets in emerging economies. Key drivers for premium dominance include brand reputation, clean beauty trends, and celebrity endorsements that reinforce consumer trust and preference for luxury vegan products.

- For instance, Croda’s SP Natrineo™ CR8 MBAL is a PEG-free phosphate ester emulsifier certified 92% natural origin under ISO 16128, capable of forming water-oil-water (W/O/W) emulsions using a single ingredient; it is vegan-suitable and readily biodegradable.

By End-User

Individual users account for the largest share, holding 61% in 2024, as rising awareness of animal welfare and health benefits drives direct consumer demand. E-commerce platforms and social media influence play a vital role in encouraging personal adoption. Beauty salons and spa centers collectively contribute a growing share, driven by increasing demand for vegan-based professional treatments. Salons and spas integrate cruelty-free skincare and haircare ranges to align with consumer values. While “others” remain a minor category, institutional buyers and wellness retreats are showing early adoption trends.

Market Overview

Rising Consumer Preference for Ethical and Sustainable Products

Consumers increasingly prioritize products aligned with ethical values, driving demand for vegan ingredients. Concerns over animal welfare, sustainability, and clean-label formulations significantly influence purchasing behavior. Brands adopting cruelty-free certifications and eco-friendly packaging are strengthening consumer trust and loyalty. This shift is particularly evident in skincare and haircare, where plant-based formulations gain traction. Growing environmental awareness and the rejection of synthetic chemicals reinforce vegan products’ market dominance, positioning them as a core choice in the global beauty and personal care industry.

- For instance, BASF introduced Verdessence® Maize (INCI: Hydrolyzed Corn Starch), a styling polymer sourced 100% from renewable feedstocks, that when used at 7 % in a pump-mousse matches the bending stiffness and surpasses curl retention versus a formulation with 2 % synthetic polymer.

Expansion of E-Commerce and Digital Marketing Channels

The rise of online platforms has accelerated the accessibility of vegan beauty and personal care products. Social media influencers, targeted advertising, and direct-to-consumer models amplify awareness and adoption. E-commerce giants and niche vegan-focused platforms provide wider product availability and convenient purchasing options for global consumers. Digital campaigns highlighting sustainability, transparency, and ingredient sourcing further strengthen engagement. With younger demographics driving online shopping trends, digital channels are expected to remain central in scaling the vegan ingredients market across diverse geographies and consumer segments.

- For instance, Symrise launched PCL-Solid green, an emollient now made entirely from natural-origin ingredients according to ISO 16128, replacing its prior petrochemical feedstocks fully while retaining melting point around 40-45 °C and skin feel performance equals its non-green predecessor.

Innovation in Plant-Based Formulations

Ongoing advancements in plant-derived ingredients drive product differentiation and performance improvements. Companies invest heavily in R&D to develop bioactive compounds that address skincare concerns such as anti-aging, hydration, and sensitivity. Breakthroughs in botanical extracts, algae-based proteins, and natural emollients enhance product appeal. Innovations also extend to haircare and makeup, where vegan formulations now deliver comparable efficacy to conventional products. These developments expand consumer trust in performance-driven vegan products, enabling broader mainstream adoption. Continuous innovation positions the segment for long-term growth across premium and economic product ranges.

Key Trends & Opportunities

Premiumization of Vegan Products

The premium segment offers strong growth potential, driven by affluent consumers seeking high-quality, ethically sourced products. Demand for luxury skincare, advanced serums, and high-performance haircare with vegan claims is rising. Brands highlight organic certifications, sustainable sourcing, and innovative packaging to differentiate themselves. Premiumization creates opportunities for higher margins and brand positioning in competitive markets. With increasing disposable incomes and growing interest in sustainable luxury, this trend provides a clear pathway for companies to expand their vegan product portfolios and strengthen brand equity globally.

- For instance, Ashland introduced Collapeptyl™ biofunctional, a hyalu-peptide hybrid that boosts 20 collagen types; in ex vivo tests it increased collagen I by 44% and hyaluronic acid by 57%.

Integration of Vegan Ingredients in Professional Services

Beauty salons and spa centers are adopting vegan products to meet rising consumer demand for cruelty-free treatments. Professional-grade vegan skincare and haircare ranges offer strong opportunities for B2B expansion. Wellness centers and spas promote natural, plant-based therapies aligned with sustainability values, enhancing customer loyalty. This integration also supports bulk demand, expanding revenue streams beyond individual consumers. With the wellness tourism industry growing globally, the use of vegan ingredients in professional settings is expected to accelerate, creating long-term opportunities for manufacturers and suppliers.

- For instance, Dow’s EcoSense™ Surfactants are plant-derived and readily biodegradable. Certain grades are verified to have a Natural Origin Index of 1 under ISO 16128, indicating they are from natural sources and processed according to the standard.

Key Challenges

High Production and Raw Material Costs

The cost of sourcing premium plant-based ingredients and maintaining sustainable supply chains remains a major challenge. Limited availability of certain raw materials and reliance on organic farming practices increase overall production costs. These costs are often passed on to consumers, making vegan products less accessible in price-sensitive markets. While premium buyers accept higher prices, economic buyers may hesitate, limiting wider adoption. Companies must address cost-efficiency through scale, partnerships, and innovation in sourcing to maintain competitiveness while ensuring sustainable growth.

Limited Consumer Awareness in Emerging Markets

In emerging economies, awareness of vegan products and their benefits is still limited compared to developed markets. Many consumers perceive vegan offerings as niche, premium, or non-essential. Cultural preferences for traditional beauty and personal care products also act as barriers. Lack of marketing campaigns and limited product availability further hinder adoption in these regions. Educating consumers about ethical, health, and environmental benefits remains essential. Expanding distribution networks and localized communication strategies will be critical for unlocking untapped growth potential in developing markets.

Regional Analysis

North America

North America leads the vegan ingredients market with a 34% share in 2024, supported by strong consumer awareness and established clean beauty trends. The U.S. dominates due to high demand for cruelty-free skincare, haircare, and makeup, coupled with regulatory support for sustainable practices. Premium products drive growth, with brands emphasizing organic certifications and eco-friendly packaging. Canada shows increasing adoption through expanding retail availability and wellness-focused consumers. Strategic collaborations and rising investments in R&D strengthen innovation, ensuring North America remains a hub for premium vegan formulations and a key driver of global market expansion.

Europe

Europe holds a 30% share of the vegan ingredients market in 2024, reflecting widespread consumer adoption and strict environmental regulations. Countries like Germany, the U.K., and France lead demand, driven by sustainability-focused policies and growing vegan lifestyles. Skincare dominates, supported by high demand for organic and cruelty-free formulations. Premiumization trends further accelerate market expansion, particularly in Western Europe, where luxury vegan products gain strong traction. Eastern Europe shows rising adoption, supported by expanding retail distribution. Regulatory emphasis on sustainable sourcing and product safety continues to make Europe a critical region for innovation and market leadership.

Asia Pacific

Asia Pacific captures a 24% market share in 2024, fueled by rapid urbanization, rising disposable incomes, and growing awareness of vegan lifestyles. Countries such as China, Japan, South Korea, and India are key growth engines, with beauty-conscious consumers driving demand for skincare and haircare products. E-commerce platforms play a major role in expanding availability, while local startups contribute to innovation with plant-based formulations. Premium vegan products find strong traction in Japan and South Korea, while economic ranges dominate in India and Southeast Asia. The region’s expanding middle class ensures long-term opportunities for market penetration and growth.

Latin America

Latin America accounts for 7% of the vegan ingredients market in 2024, with Brazil and Mexico leading demand. Growing awareness of cruelty-free products and increasing social media influence are driving adoption among younger consumers. Skincare and haircare remain the most popular segments, with premium brands targeting urban populations. Economic ranges also gain traction, offering accessible options in price-sensitive markets. Retail expansion and e-commerce growth support regional availability. Despite lower penetration compared to developed regions, rising consumer awareness and wellness-focused lifestyles position Latin America as an emerging market with significant future growth potential for vegan products.

Middle East & Africa

The Middle East & Africa represent 5% of the global vegan ingredients market in 2024, with growth primarily concentrated in urban centers such as the UAE, Saudi Arabia, and South Africa. Rising disposable incomes and increasing demand for premium beauty products are fueling market expansion. Vegan skincare and fragrances are gaining popularity among affluent consumers seeking ethical and sustainable options. Limited consumer awareness and higher product costs remain barriers in several parts of the region. However, increasing retail presence, tourism-driven demand, and growing focus on wellness present opportunities for gradual adoption and future market development.

Market Segmentations:

By Product:

By Price Point:

By End User:

- Individual Use

- Beauty Salons

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the vegan ingredients market features key players such as Solvay SA, Givaudan SA, Croda International Plc, BASF SE, Symrise AG, Ashland, Dow Inc., Lonza Group Ltd., Evonik Industries AG, and Eastman Chemical Company. The vegan ingredients market is shaped by continuous innovation, sustainability initiatives, and strategic collaborations. Companies focus on developing plant-based formulations that deliver performance comparable to conventional alternatives while meeting consumer expectations for clean-label and cruelty-free solutions. Research and development investments target advanced botanical extracts, bio-based polymers, and natural actives to enhance product quality and efficacy. Expanding distribution networks, leveraging e-commerce platforms, and adopting eco-friendly packaging strengthen market reach and brand appeal. Strategic mergers, acquisitions, and product launches further diversify offerings, enabling players to capture growth opportunities across both premium and economic segments globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Solvay SA

- Givaudan SA

- Croda International Plc

- BASF SE

- Symrise AG

- Ashland

- Dow Inc.

- Lonza Group Ltd.

- Evonik Industries AG

- Eastman Chemical Company

Recent Developments

- In April 2025, BASF added natural-based ingredients with three new products with sustainable, performance-driven, personal care solutions: a natural styling polymer Verdessence Maize, a wax-based opacifier dispersion Lamesoft OP Plus, and a betaine from Rainforest Alliance Certified coconut oil Dehyton PK45 GA/RA.

- In March 2025, Symega announced the opening of a new manufacturing plant in Sonipat, Haryana which doubled their capacity by the end of March 2025. The plant produces extruded proteins, and by the year 2030, India will be a manufacturing hub for plant-based proteins for Europe and Asia.

- In January 2025, British Bakels launched its 2025 Product Guide, integrating the newly acquired Renshaw range. The guide presents detailed information on vegan‑suitable products such as fondants, marzipan, cake mixes, and decorative icings, enabling bakers to access complete vegan-compatible formulation systems in one comprehensive resource.

- In July 2024, Budge’s introduced Beleaf™ Plant Better in North America, a vegan, plant-based butter alternative designed specifically for baking and culinary uses. The product mimics the taste, texture, melting point, and processing performance of dairy butter, while being dairy‑free, lactose‑free, non‑palm, and soy‑free.

Report Coverage

The research report offers an in-depth analysis based on Product, Price Point, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising demand for cruelty-free and sustainable beauty products.

- Skincare will continue to dominate due to strong consumer focus on natural and safe formulations.

- Premium vegan products will gain traction among affluent and eco-conscious buyers worldwide.

- E-commerce platforms will strengthen market access and accelerate consumer adoption across regions.

- Innovation in plant-based actives and bio-based polymers will drive product differentiation.

- Professional salons and spa centers will increasingly adopt vegan-based treatments and solutions.

- Emerging markets will offer growth potential as awareness and availability steadily increase.

- Sustainability-focused regulations will encourage broader adoption of vegan formulations by manufacturers.

- Strategic collaborations and acquisitions will help companies expand portfolios and global reach.

- Consumer education campaigns will play a key role in shaping future demand and loyalty.