Market Overview:

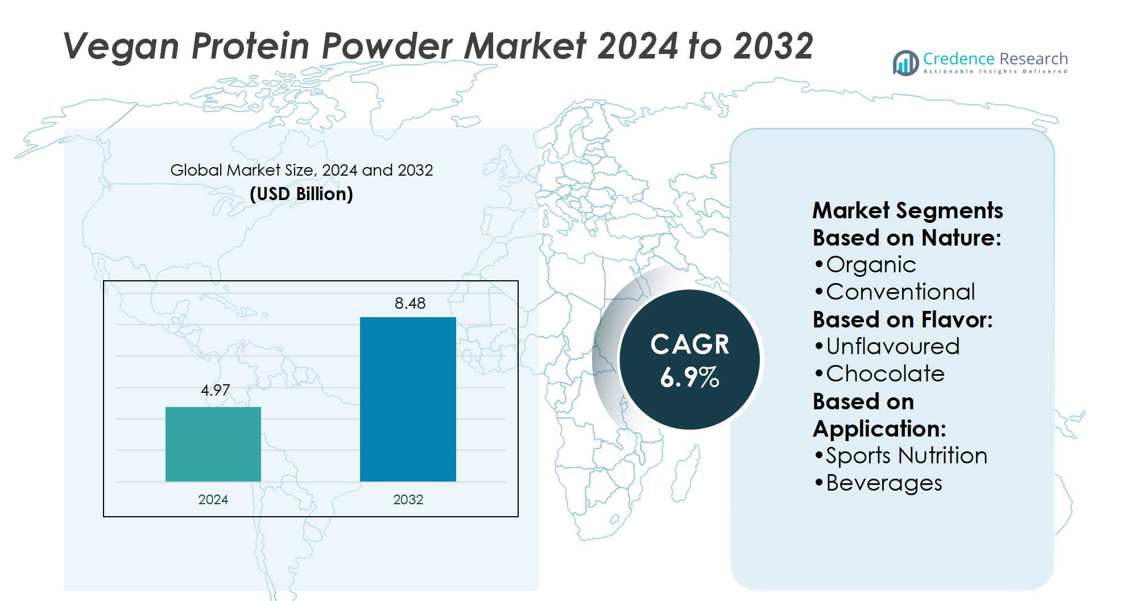

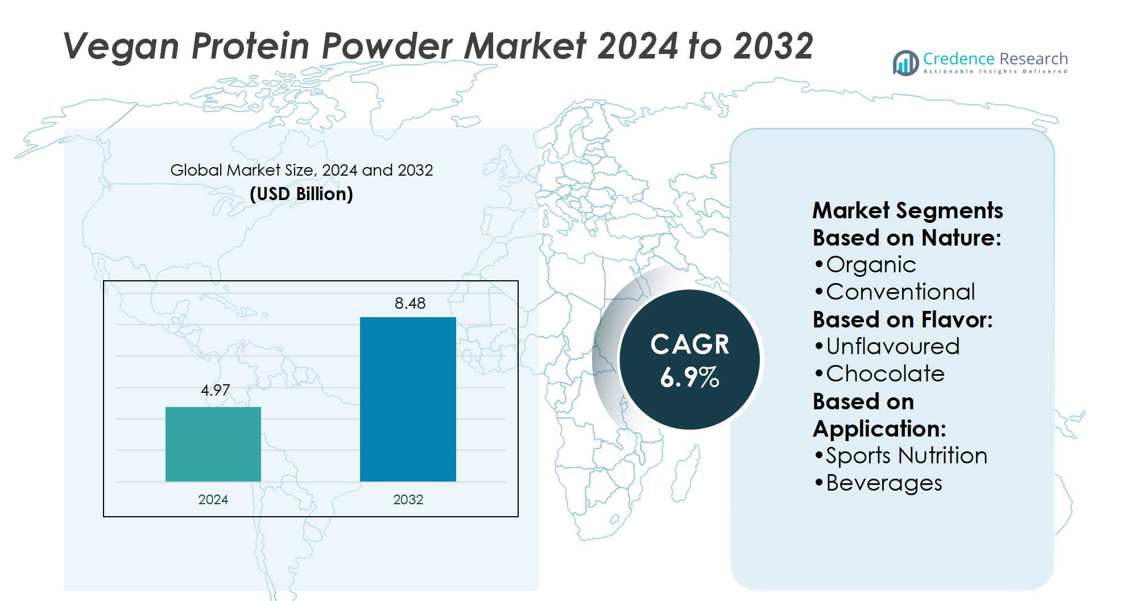

Vegan Protein Powder Market size was valued USD 4.97 billion in 2024 and is anticipated to reach USD 8.48 billion by 2032, at a CAGR of 6.9% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Vegan Protein Powder Market Size 2024 |

USD 4.97 billion |

| Vegan Protein Powder Market, CAGR |

6.9% |

| Vegan Protein Powder Market Size 2032 |

USD 8.48 billion |

The vegan protein powder market is shaped by top players including Archer-Daniels-Midland Company, Cargill, Incorporated, Bunge Global SA, Glanbia plc, Ingredion Incorporated, AMCO Proteins, Garden of Life, Orgain, PlantFusion, and Now Foods. These companies focus on innovation, clean-label formulations, and strategic partnerships to strengthen their market presence. Agricultural giants such as ADM, Cargill, and Bunge dominate raw material supply and scalable production, while consumer-focused brands like Orgain, Garden of Life, and PlantFusion drive demand in the premium and organic segments. Glanbia and Now Foods leverage global distribution to serve diverse consumer bases, while Ingredion and AMCO Proteins lead in tailored ingredient solutions. Regionally, North America leads the global vegan protein powder market with a 34% share in 2024, supported by strong adoption of plant-based diets, expanding sports nutrition demand, and a mature e-commerce ecosystem. This leadership underscores the region’s role as the most influential hub in market growth.

Market Insights

- The vegan protein powder market size was valued at USD 4.97 billion in 2024 and is projected to reach USD 8.48 billion by 2032, growing at a CAGR of 6.9%.

- Rising adoption of plant-based diets, demand for sports nutrition, and increasing lactose intolerance cases are key drivers fueling steady market expansion.

- Clean-label, organic, and flavored innovations such as chocolate and vanilla dominate trends, with chocolate leading the flavor segment with a 38% share in 2024.

- High product costs compared to conventional proteins and challenges in taste and texture remain major restraints limiting adoption, particularly in emerging markets.

- Regionally, North America leads with a 34% market share in 2024, driven by advanced e-commerce channels and fitness culture, while Europe holds 28%, Asia Pacific 22%, and Latin America and Middle East & Africa collectively account for 16%, highlighting strong global growth opportunities across diverse consumer bases.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Nature

The conventional segment dominates the vegan protein powder market with a 62% share in 2024. Its growth is supported by cost-effectiveness, higher availability, and wide distribution through mainstream retail. Conventional variants appeal to price-sensitive consumers and fitness enthusiasts who prioritize affordability over organic certification. While organic protein powders are expanding with rising demand for clean-label and chemical-free nutrition, their higher costs limit accessibility. The shift toward sustainable agriculture and increasing awareness of health risks tied to synthetic inputs are expected to drive organic segment growth, though conventional remains the market leader.

- For instance, The MaxFlex™ pea & rice protein blend (PR003) has a protein concentration of at least 85% and a PDCAAS (Protein Digestibility-Corrected Amino Acid Score) of 0.95, with claims for beverages, bars, cookies.

By Flavor

The chocolate flavor leads the market with a 38% share in 2024, supported by strong consumer preference for taste and versatility. Chocolate-flavored powders integrate easily into smoothies, shakes, and bakery products, making them the most widely adopted. Vanilla holds the second-largest share, appealing to consumers who prefer a neutral taste adaptable to various recipes. Unflavoured powders target health-conscious users and formulators in the functional food sector but capture a smaller share due to limited taste appeal. Innovation in strawberry and exotic flavors continues, yet chocolate’s consumer loyalty secures its dominant position.

- For instance, PlantFusion Complete Plant Protein is a line of supplements based on plant protein blends. Product labels consistently show 21 grams of protein per 30-gram scoop.

By Application

Sports nutrition represents the largest application segment with a 44% share in 2024, driven by demand from athletes, fitness enthusiasts, and gym-goers. Vegan protein powders offer a plant-based alternative to whey, aligning with trends in performance nutrition and dietary sustainability. Beverages follow closely, with protein shakes and ready-to-drink formats gaining popularity among busy consumers seeking convenience. Functional foods, including protein-fortified snacks and cereals, contribute significantly as manufacturers enhance product portfolios to target health-driven consumers. Growth in the sports nutrition segment is further supported by endorsements, increased gym memberships, and awareness of muscle recovery benefits.

Market Overview

Rising Adoption of Plant-Based Diets

The growing preference for plant-based lifestyles significantly drives demand for vegan protein powder. Consumers are shifting from animal-derived proteins to plant-based options due to ethical, health, and environmental concerns. Rising lactose intolerance and dairy allergies further accelerate this transition. Fitness enthusiasts, athletes, and health-conscious individuals prefer vegan protein powder as a sustainable and allergen-free protein source. Increased availability of high-quality raw materials such as pea, hemp, and rice proteins strengthens product innovation, ensuring consistent growth across both developed and emerging markets.

- For instance, Bunge’s new soy protein concentrate line delivers about 70% protein and about 17% fiber on a dry basis in its powdered and textured formats, with both non-GMO and conventional options.

Expansion of Sports Nutrition Segment

Sports nutrition is a critical growth driver, with vegan protein powder gaining traction as an alternative to whey-based products. Rising gym memberships and athletic participation support strong demand for plant-based protein supplements. Endorsements by fitness influencers and athletes enhance brand credibility, expanding consumer reach. The emphasis on muscle recovery, endurance, and energy balance drives consistent use among professional and recreational users. Innovations in formulations that blend multiple protein sources improve amino acid profiles, positioning vegan protein powders as reliable and effective for performance-focused consumers.

- For instance, NOW Foods’ Plant Protein Complex delivers 22 grams of protein per serving from a non-GMO blend of pea, hemp, and quinoa, incorporating approximately 3,900 milligrams of branched-chain amino acids and about 1,800 milligrams of arginine per scoop.

Innovation in Flavors and Functional Products

Continuous product innovation in flavors, formats, and functional enhancements boosts consumer adoption of vegan protein powders. Manufacturers introduce chocolate, vanilla, and exotic fruit flavors to improve palatability, addressing common taste barriers in plant proteins. Functional variants enriched with vitamins, probiotics, and adaptogens expand product appeal beyond basic nutrition. Ready-to-drink formats and single-serve sachets cater to convenience-driven consumers. These innovations create differentiation in a competitive market, driving premium sales while appealing to lifestyle-oriented customers seeking both health benefits and variety in their protein intake.

Key Trends & Opportunities

Growing Demand for Clean-Label and Organic Products

Consumers increasingly prefer vegan protein powders with clean-label formulations and certified organic sourcing. The shift toward transparency in ingredients drives demand for products free from artificial sweeteners, preservatives, and genetically modified organisms. Organic powders appeal to health-focused buyers willing to pay premium prices for chemical-free nutrition. Brands adopting sustainable farming practices and eco-friendly packaging gain an edge in market positioning. This trend creates opportunities for companies to differentiate their offerings, expand in niche premium categories, and build long-term consumer trust.

- For instance, Cargill’s plant protein solutions deliver protein content between 50-80%, with options that are certified organic and non-GMO; its EverSweet® stevia-based sweetener + ClearFlo™ natural flavour system enables full sugar replacement in formulations while improving solubility of flavour compounds.

E-Commerce Expansion and Direct-to-Consumer Models

Online platforms play a crucial role in expanding the vegan protein powder market. Direct-to-consumer sales through brand websites and subscription models enhance customer engagement and retention. E-commerce channels provide global reach, allowing smaller brands to compete with established players effectively. Digital marketing, influencer collaborations, and targeted promotions strengthen online sales growth. Consumers benefit from customization, easy access to reviews, and competitive pricing. This trend presents opportunities for companies to invest in digital ecosystems and tap into fast-growing online health and wellness communities.

- For instance, Glanbia operates 17 Innovation & Collaboration Centres globally which support rapid co-development of products. Its extensive flavour capabilities, bolstered by acquisitions and a focus on customization, enable the fast rollout of customized taste profiles for D2C high-protein vegan lines

Key Challenges

High Product Costs Compared to Conventional Proteins

One of the major challenges for the vegan protein powder market is high pricing compared to conventional whey and soy proteins. Production costs remain elevated due to limited raw material availability, complex processing, and sourcing from organic or sustainable farms. These costs often translate into higher retail prices, restricting accessibility for middle-income consumers. Price sensitivity in emerging markets further limits adoption, while premium positioning narrows the customer base. Addressing affordability while maintaining quality and sustainability is critical for wider market penetration.

Taste and Texture Limitations

Despite advancements in formulations, many vegan protein powders still face challenges with taste and texture. Plant-based proteins often have a grainy or earthy aftertaste, which can deter consumers accustomed to the smoothness of dairy-based products. Limited flavor profiles and lower solubility reduce product appeal, particularly among first-time buyers. Although innovation in flavors and blending techniques improves sensory experience, overcoming negative perceptions remains essential. Manufacturers must focus on enhancing taste, mixability, and overall palatability to compete effectively with conventional protein powders.

Regional Analysis

North America

North America leads the vegan protein powder market with a 34% share in 2024. The region benefits from strong consumer adoption of plant-based diets, widespread lactose intolerance awareness, and robust demand for sports nutrition products. The U.S. dominates due to high gym memberships, advanced product innovation, and a mature e-commerce ecosystem. Canada also contributes significantly, with rising clean-label and organic product demand. Established brands leverage influencer marketing and direct-to-consumer models to expand reach. Government support for plant-based food innovation further boosts the market, positioning North America as the largest and most influential regional contributor.

Europe

Europe holds a 28% market share, driven by increasing veganism and sustainability awareness. Countries such as Germany, the UK, and France are at the forefront, supported by strong regulatory frameworks promoting plant-based nutrition. Consumer demand for organic, clean-label products drives premium product growth, particularly among younger demographics. The region’s fitness culture and emphasis on health-focused lifestyles support protein supplement consumption. Retail expansion across supermarkets, specialty health stores, and online platforms ensures easy accessibility. With ongoing innovation in flavors and formulations, Europe remains a key growth hub, aligning closely with environmental and ethical consumer values.

Asia Pacific

Asia Pacific accounts for a 22% share, emerging as one of the fastest-growing regions. Rising health consciousness, increasing disposable incomes, and growing acceptance of plant-based diets fuel demand. China and India drive growth, supported by expanding middle-class populations and rising fitness culture. Japan, South Korea, and Australia contribute through innovation in functional foods and beverages. E-commerce adoption accelerates market penetration, making products more accessible to urban consumers. Despite pricing challenges, growing awareness of sustainable nutrition positions Asia Pacific as a high-potential region expected to gain share in the coming years.

Latin America

Latin America captures an 8% share, supported by increasing awareness of plant-based nutrition and urban health trends. Brazil and Mexico lead the regional market, with strong adoption of sports nutrition and protein-enriched beverages. Rising middle-class purchasing power and growing interest in sustainable food sources expand demand. Distribution through supermarkets, gyms, and e-commerce platforms enhances accessibility. However, high product costs and limited raw material availability remain challenges. Still, ongoing innovation and local brand expansion offer opportunities, positioning the region for steady growth as consumer lifestyles shift toward healthier dietary preferences.

Middle East & Africa

The Middle East & Africa region holds an 8% share, with growth supported by increasing health awareness and adoption of fitness-driven lifestyles. The UAE and South Africa lead, driven by expanding urban populations and rising gym memberships. Growing interest in organic and premium products further strengthens market penetration among affluent consumers. However, challenges such as high pricing and limited availability constrain broader adoption. International brands are expanding through retail partnerships and e-commerce to tap into urban demand. With improving consumer education, the region is expected to witness steady long-term growth in vegan protein powder consumption.

Market Segmentations:

By Nature:

By Flavor:

By Application:

- Sports Nutrition

- Beverages

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the vegan protein powder market features key players such as Orgain, Archer-Daniels-Midland Company, PlantFusion, Bunge Global SA, Now Foods, Cargill, Incorporated, Glanbia plc, AMCO Proteins, Ingredion Incorporated, and Garden of Life. The vegan protein powder market is defined by continuous innovation, strategic expansions, and evolving consumer preferences. Companies are investing heavily in research and development to improve taste, texture, and nutritional profiles of plant-based proteins, addressing long-standing barriers to adoption. The market is witnessing a surge in clean-label, organic, and functional variants, catering to health-conscious consumers seeking both quality and sustainability. E-commerce and direct-to-consumer models play a pivotal role in expanding global reach, while partnerships with gyms, health retailers, and wellness influencers strengthen brand visibility. Intense competition has encouraged differentiation through flavor innovation, ready-to-drink formats, and eco-friendly packaging. Manufacturers are also focusing on affordability to penetrate emerging markets, where price sensitivity remains a challenge. With rising demand across sports nutrition, beverages, and functional foods, the landscape continues to evolve, creating opportunities for both established players and new entrants to expand market presence globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Orgain

- Archer-Daniels-Midland Company

- PlantFusion

- Bunge Global SA

- Now Foods

- Cargill, Incorporated

- Glanbia plc

- AMCO Proteins

- Ingredion Incorporated

- Garden Of Life

Recent Developments

- In April 2025, TREK, the UK’s number one protein bar and one of the fastest-growing brands in Cereal and Sports Nutrition Bars, has reinvented the category with the launch of its all-new High Protein Low Sugar range, the first of its kind, and a milestone in high protein snacking.

- In May 2024, Gelita launched Optibar, intended to be used as an ingredient to make the softest sugar-free protein bar. The hard-to-beat content is formulated in a way that increases protein levels but maintains an indulgent texture.

- In June 2023, Synthite launched Protein, a plant-protein drink powder, and Just Plants, a plant-based dairy alternative, in JV, a food tech joint venture with the IISc (Indian Institute of Science) and a U.S.-based nutraceutical company, PMEDS.

- In March 2023 Glanbia plc, jointly with Leprino Foods, passed over their mozzarella joint ventures. With the transition, Glanbia Cheese Company will become Leprino Foods UK Limited and Leprino Foods EU Limited

Report Coverage

The research report offers an in-depth analysis based on Nature, Flavor, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising adoption of plant-based diets worldwide.

- Sports nutrition will remain the leading application, supported by fitness and athletic trends.

- Organic and clean-label protein powders will gain stronger consumer preference.

- Flavor innovation will enhance taste appeal and increase consumer retention.

- E-commerce and subscription models will drive direct consumer engagement.

- Emerging markets will witness faster adoption despite price sensitivity challenges.

- Functional protein powders enriched with probiotics and vitamins will see higher demand.

- Sustainable sourcing and eco-friendly packaging will shape brand competitiveness.

- Strategic partnerships and product launches will intensify market rivalry.

- Technological advancements in processing will improve texture and solubility of powders.