Market Overview

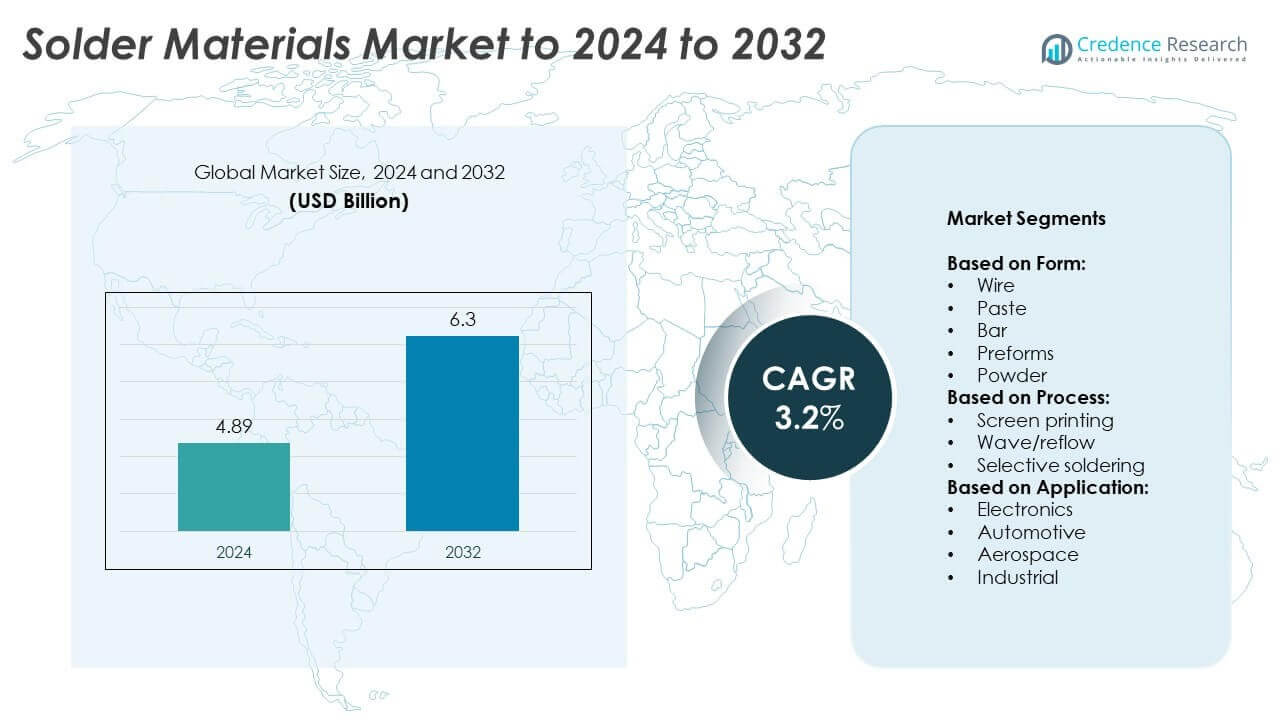

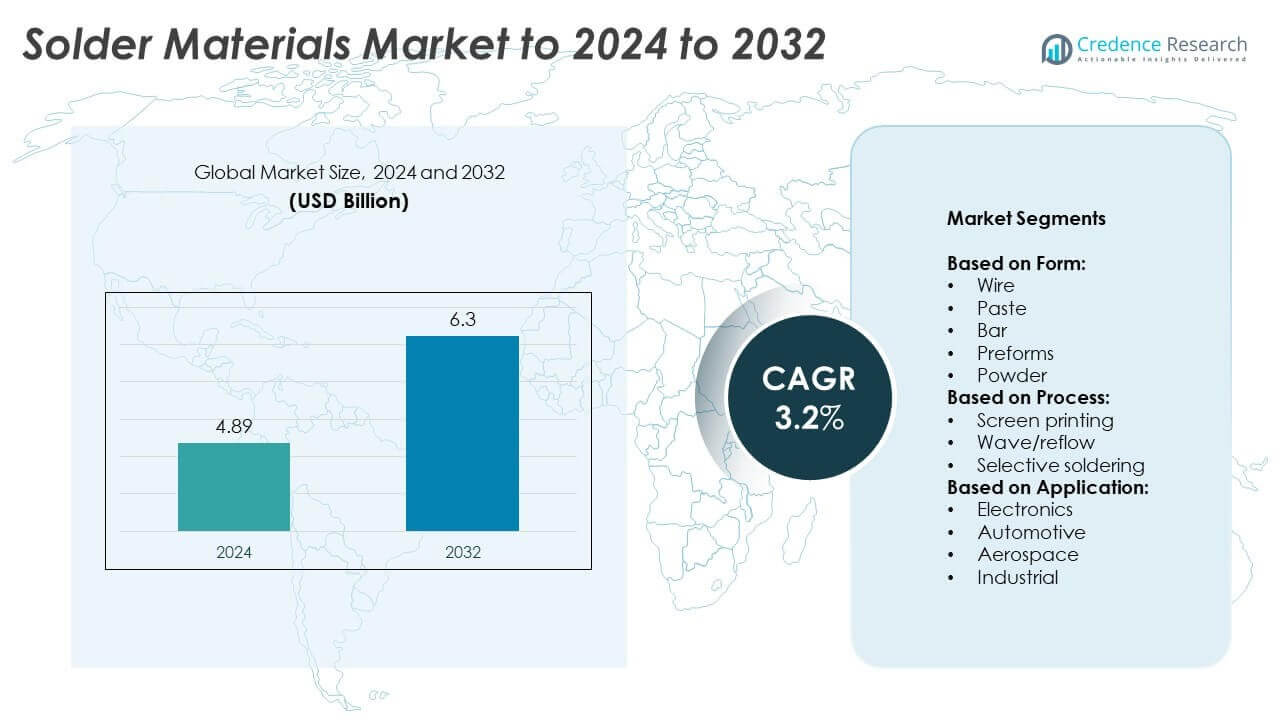

The Solder Materials Market size was valued at USD 4.89 billion in 2024 and is anticipated to reach USD 6.3 billion by 2032, at a CAGR of 3.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Solder Materials Market Size 2024 |

USD 4.89 Billion |

| Solder Materials Market, CAGR |

3.2% |

| Solder Materials Market Size 2032 |

USD 6.3 Billion |

The solder materials market is shaped by leading companies including Qualitek International, Inc, Stannol GmbH Co. KG, Fusion, Inc, Indium Corporation, Shital Metals Pvt Ltd, Henkel AG & Co. KGaA, Premier Industries, Lucas Milhaupt, Senju Metal Industry Co., Ltd, Element Solution Inc, and Koki Company Limited. These players focus on expanding portfolios of lead-free alloys, advanced solder pastes, and reliable materials for high-performance applications across electronics, automotive, and aerospace sectors. Regionally, Asia Pacific leads the global market with a 35% share in 2024, driven by large-scale electronics and semiconductor production. Europe follows with 25%, supported by strict regulatory standards and strong automotive demand, while North America holds 28% share due to semiconductor investments and aerospace advancements.

Market Insights

Market Insights

- The solder materials market size was USD 4.89 billion in 2024 and will reach USD 6.3 billion by 2032 at a CAGR of 3.2%.

- Growth is driven by rising electronics manufacturing, expanding automotive electronics, and increasing demand from aerospace and industrial automation sectors.

- Key trends include a global shift toward lead-free solder alloys, innovation in solder paste technologies, and growing demand from 5G, IoT, and EV applications.

- Competition is defined by continuous R&D, product diversification, and sustainability efforts, with players focusing on advanced formulations to meet regulatory compliance and performance needs.

- Asia Pacific leads with 35% market share, supported by large-scale electronics production, followed by North America at 28% with strong semiconductor and aerospace demand, Europe at 25% driven by automotive and regulations, Latin America at 7%, and the Middle East and Africa holding 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Form

The form segment in the solder materials market is dominated by solder paste, holding the largest share due to its extensive use in surface-mount technology (SMT) for electronics assembly. Paste ensures strong mechanical and electrical connections, supporting miniaturization trends in consumer electronics and advanced devices. Wire and bar forms follow, primarily serving through-hole and large-scale industrial soldering applications. Preforms and powder are growing steadily, driven by specialized applications in aerospace and microelectronics. Rising demand for compact electronic devices and precision manufacturing continues to fuel the dominance of paste in this segment.

- For instance, tin/lead solder consumption stood at 48% of the total in the Americas as of 2014, and was expected to drop to 17% in 2024. Similarly, the program forecasted global tin/lead solder consumption to be 11% in 2024 (down from 27% at the time of the report).

By Process

Wave/reflow soldering emerged as the leading process, accounting for the largest market share, mainly due to its efficiency in handling mass production of PCBs and surface-mount components. This process offers consistency, reliability, and reduced production time, making it a preferred choice in high-volume electronics manufacturing. Screen printing maintains strong usage for precise solder paste deposition, while selective soldering is gaining momentum in automotive and aerospace applications that require high accuracy. The widespread adoption of automated production lines has reinforced wave/reflow soldering as the dominant process in this market.

- For instance, in 2023, AIM Solder released its NC259FPA ultrafine no-clean solder paste, engineered for Type 6 and smaller alloy powders, to support precise printing for advanced semiconductor applications like micro-LED, micro-BGA, and high-density interconnect (HDI) boards. This product was developed to meet the requirements of miniaturization and precision in the electronics industry.

By Application

Electronics is the dominant application, securing the highest market share owing to the rising production of smartphones, laptops, wearables, and consumer gadgets. The growing shift toward 5G infrastructure, IoT-enabled devices, and electric vehicles further strengthens electronics demand for solder materials. Automotive applications are expanding rapidly due to increased integration of electronic systems in vehicles, while aerospace and industrial sectors contribute steadily with specialized performance needs. The rapid pace of technological innovation and mass adoption of compact, multifunctional consumer electronics remain the primary drivers behind electronics holding the largest application share.

Key Growth Drivers

Rising Electronics Production

The increasing global demand for consumer electronics, including smartphones, laptops, and wearables, is a primary growth driver in the solder materials market. Solder materials, especially paste, are essential for surface-mount technology in compact and multifunctional devices. Expanding 5G infrastructure and IoT-connected products are further accelerating production volumes, boosting solder consumption. The miniaturization trend and high-performance requirements in electronics assembly continue to strengthen the market. This factor stands as the key growth driver due to its direct and consistent influence on demand across industries.

- For instance, while Samsung shipped 226.6 million smartphones in 2023, Apple shipped an estimated 234.6 million units, making Apple the leading global smartphone vendor for the year. In 2023, the overall global smartphone market saw a 3.2% year-over-year decline to 1.17 billion units, the lowest full-year volume in a decade.

Automotive Electronics Expansion

The growing use of electronic systems in vehicles, from advanced driver assistance systems (ADAS) to electric vehicle battery management, is fueling demand for solder materials. Automotive applications require high reliability and durability, making advanced solder formulations critical for performance. The shift toward electrification and smart mobility solutions enhances the importance of solder materials in ensuring secure connections. As the automotive industry continues integrating sophisticated electronics, solder demand in this segment is set to expand steadily, reinforcing its role as a core driver.

- For instance, Tesla produced 1,845,985 vehicles in 2023 and delivered 1,808,581 of them.

Industrial and Aerospace Demand

Industrial automation and aerospace electronics are emerging contributors to solder material demand. High-performance solder is needed for mission-critical applications such as avionics, sensors, and control systems. The aerospace sector requires solders that withstand extreme environments, while industrial automation depends on reliable electronic assemblies to ensure productivity. Increasing investments in smart manufacturing and defense modernization are pushing the use of advanced solder materials. This segment, though smaller compared to electronics, adds long-term stability and growth potential to the market landscape.

Key Trends & Opportunities

Shift Toward Lead-Free Alloys

A major trend shaping the solder materials market is the shift toward lead-free solder alloys, driven by global environmental regulations like RoHS and REACH. Lead-free materials, such as tin-silver-copper alloys, are gaining popularity due to their compliance with safety standards and improved performance characteristics. This transition creates opportunities for manufacturers to innovate and provide eco-friendly solutions without compromising strength and reliability. The adoption of lead-free solders is expanding in electronics and automotive applications, positioning sustainability as both a trend and opportunity for the industry.

- For instance, Aurubis Beerse, which was known as Metallo-Chimique until its acquisition by Aurubis AG in 2020, produced 9,300 metric tons of refined tin in 2023. The company specializes in producing pure tin exclusively from recycled materials, such as metal scrap and waste from the electronics sector. As a major European producer of pure, low-lead tin, Aurubis Beerse supplies the environmentally conscious lead-free solder market.

Advancements in Solder Paste Technologies

Solder paste is witnessing continuous innovation, particularly for fine-pitch and high-density applications. Developments include low-voiding formulations, improved flux systems, and enhanced thermal stability to meet advanced packaging requirements. These advancements support miniaturization trends in electronics and improve production yields in high-volume manufacturing. The opportunity lies in offering materials that address the challenges of 5G, IoT, and high-power automotive electronics. As manufacturers demand greater reliability and efficiency, advanced solder pastes open significant opportunities in expanding market segments, reinforcing this as a key trend and opportunity.

- For instance, LOCTITE GC 18 has been shown in published datasheets to produce voiding levels below 25 % on both small and large bottom-terminated components

Key Challenges

Volatility in Raw Material Prices

Fluctuations in the prices of raw materials, such as tin and silver, present a major challenge for solder material manufacturers. Price instability affects production costs and can reduce profitability for both suppliers and end-users. Companies face difficulties in long-term planning and maintaining competitive pricing strategies. This volatility often forces manufacturers to explore alternative alloys or recycling processes. However, ensuring consistent performance while managing costs remains a balancing act, making raw material price fluctuations one of the most critical challenges in the market.

Technical Limitations in High-Performance Applications

The increasing complexity of electronic devices and automotive systems requires solder materials with advanced performance capabilities. Issues such as voiding, thermal fatigue, and joint reliability under harsh operating conditions challenge current formulations. In applications like aerospace and high-power automotive electronics, these limitations may impact safety and efficiency. Manufacturers need continuous research and development to overcome these barriers and provide next-generation solder solutions. Until these issues are resolved, technical limitations will remain a significant challenge for sustained adoption in high-performance sectors.

Regional Analysis

North America

North America accounted for around 28% of the solder materials market in 2024, driven by strong demand from electronics, automotive, and aerospace sectors. The U.S. leads the region with extensive production of consumer electronics and growing adoption of electric vehicles, which rely on high-performance solder solutions. Aerospace applications further support demand due to stringent reliability standards. Rising investments in semiconductor manufacturing, particularly through government-backed initiatives, also contribute to steady growth. The market in North America continues to benefit from advanced R&D and strong supply chains, positioning the region as a key contributor to overall market expansion.

Europe

Europe held about 25% of the global solder materials market share in 2024, supported by robust automotive and industrial manufacturing. Germany, France, and the U.K. are major contributors due to high adoption of electric vehicles and advanced electronics systems. Regulatory measures such as RoHS and REACH drive the transition toward lead-free solder alloys, pushing manufacturers to innovate sustainable solutions. The aerospace sector also adds steady demand, requiring solders that perform under extreme conditions. With strong emphasis on environmental compliance and technological innovation, Europe maintains a competitive position in the global solder materials landscape.

Asia Pacific

Asia Pacific dominated the global solder materials market with a 35% share in 2024, making it the leading region. China, Japan, South Korea, and India drive growth with large-scale electronics manufacturing, rising automotive production, and rapid industrialization. The region benefits from cost-effective raw material access and strong export capacity in semiconductors and consumer devices. Demand for solder paste remains particularly high due to widespread adoption of surface-mount technology in electronics assembly. With increasing investments in 5G infrastructure, IoT-enabled devices, and electric vehicles, Asia Pacific is expected to retain its leading position throughout the forecast period.

Latin America

Latin America accounted for nearly 7% of the solder materials market in 2024, with Brazil and Mexico being the key contributors. Growth in the region is supported by rising automotive production and gradual expansion of consumer electronics manufacturing. The industrial sector also provides steady demand, particularly in automation and electrical equipment. However, market expansion is limited by slower adoption of advanced technologies compared to other regions. Investments in electronics assembly and automotive supply chains are gradually improving the outlook, making Latin America a growing but still smaller participant in the global solder materials landscape.

Middle East and Africa

The Middle East and Africa held around 5% of the global solder materials market share in 2024. Growth is primarily driven by industrial and aerospace applications, along with increasing interest in electronics assembly. Countries like the UAE and Saudi Arabia are making investments in industrial diversification, which supports demand for solder materials. However, the market remains relatively small due to limited large-scale electronics manufacturing compared to other regions. Despite this, opportunities are emerging as governments push for technology-driven growth, positioning the region for gradual expansion in specialized applications such as aerospace and defense electronics.

Market Segmentations:

By Form:

- Wire

- Paste

- Bar

- Preforms

- Powder

By Process:

- Screen printing

- Wave/reflow

- Selective soldering

By Application:

- Electronics

- Automotive

- Aerospace

- Industrial

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

Competitive landscape in the solder materials market features key players such as Qualitek International, Inc, Stannol GmbH Co. KG, Fusion, Inc, Indium Corporation, Shital Metals Pvt Ltd, Henkel AG & Co. KGaA, Premier Industries, Lucas Milhaupt, Senju Metal Industry Co., Ltd, Element Solution Inc, and Koki Company Limited. The market remains moderately consolidated, with companies competing through technological innovation, global distribution networks, and product diversification. Strategic focus is on developing advanced lead-free alloys, enhancing solder paste performance, and meeting strict environmental compliance standards. Increasing demand from electronics, automotive, and aerospace sectors drives innovation in reliability and efficiency. Regional expansion strategies, partnerships with OEMs, and consistent investment in R&D strengthen competitiveness. Rising production of consumer electronics and growing electric vehicle adoption push suppliers to offer materials suited for miniaturization and high-reliability applications. Overall, competition is defined by continuous product development and the ability to align with evolving sustainability and performance requirements.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Qualitek International, Inc

- Stannol GmbH Co. KG

- Fusion, Inc

- Indium Corporation

- Shital Metals Pvt Ltd

- Henkel AG & Co. KGaA

- Premier Industries

- Lucas Milhaupt

- Senju Metal Industry Co., Ltd

- Element Solution Inc

- Koki Company Limited

Recent Developments

- In 2025, Indium Corporation showcased its high-reliability solder solutions, including Durafuse® LT, at IPC APEX EXPO.

- In 2025, KOKI Company Ltd. introduced the SB6NX58-G850 solder paste. This paste features a solid-solution-strengthened solder alloy that reduces microstructural transformation at solder joints and provides enhanced thermal mechanical resistance, making it suitable for demanding applications in automotive and industrial equipment operating in demanding environments.

- In 2023, Senju Metal Industry Co., Ltd. released “MILATERA,” a low-temperature soldering solution.

Report Coverage

The research report offers an in-depth analysis based on Form, Process, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The solder materials market will expand steadily with consistent demand from electronics manufacturing.

- Miniaturization of consumer devices will continue driving demand for advanced solder paste.

- Automotive electronics and EV adoption will strengthen the use of high-reliability solder materials.

- Aerospace and defense applications will require specialized solder for extreme performance conditions.

- Lead-free alloys will dominate due to strict global environmental and safety regulations.

- Asia Pacific will maintain leadership supported by large-scale electronics and semiconductor production.

- Europe will emphasize sustainable and eco-friendly solder material innovations.

- North America will benefit from semiconductor investments and electric vehicle growth.

- Technological advancements in flux chemistry will enhance solder joint reliability and performance.

- Rising adoption of IoT and 5G devices will create long-term opportunities for solder materials.

Market Insights

Market Insights