Market Overview:

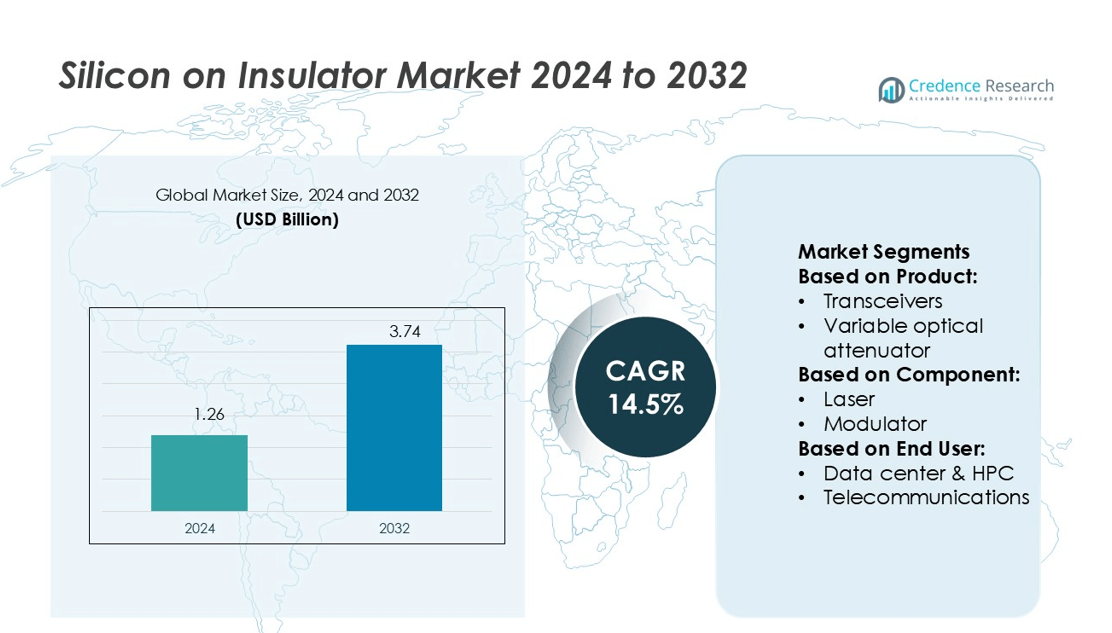

Silicon on Insulator Market size was valued USD 1.26 billion in 2024 and is anticipated to reach USD 3.74 billion by 2032, at a CAGR of 14.5% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Silicon on Insulator Market Size 2024 |

USD 1.26 billion |

| Silicon on Insulator Market, CAGR |

14.5% |

| Silicon on Insulator Market Size 2032 |

USD 3.74 billion |

The silicon on insulator (SOI) market is driven by major players such as Intel, Global Foundries, STMicroelectronics N.V., Infineon Technologies AG, Cisco, Acacia (acquired by Cisco), Mellanox, Finisar, ROHM Co., Ltd., and Hamamatsu. These companies focus on advancing SOI-based transceivers, modulators, and sensors to serve growing demand across data centers, telecommunications, automotive, and medical applications. North America leads the global market with a 38% share in 2024, supported by strong investments in high-performance computing, 5G infrastructure, and advanced semiconductor manufacturing. Strategic collaborations, acquisitions, and R&D initiatives continue to define competition and reinforce regional dominance.

Market Insights

- The silicon on insulator market size was USD 1.26 billion in 2024 and will reach USD 3.74 billion by 2032, growing at a CAGR of 14.5%.

- Growth is driven by rising demand for high-performance computing, 5G infrastructure, and automotive electronics where SOI-based transceivers and sensors play a key role.

- A major trend is the integration of silicon photonics with SOI substrates, enabling higher bandwidth, energy efficiency, and scalability across data centers and telecommunications networks.

- Competition is strong with players like Intel, Global Foundries, STMicroelectronics, Infineon, Cisco, Acacia, Mellanox, Finisar, ROHM, and Hamamatsu focusing on R&D, acquisitions, and advanced component development, though high manufacturing costs remain a restraint.

- Regionally, North America leads with a 38% share in 2024, followed by Europe at 27% and Asia Pacific at 29%, while transceivers dominate the product segment with over 35% share, supported by data centers and cloud infrastructure expansion.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

In the Silicon on Insulator (SOI) market, transceivers dominate the product segment with over 35% share in 2024. Their adoption is driven by high-speed data transmission needs across data centers and telecommunications infrastructure. Growing demand for low-power, high-bandwidth optical interconnects further strengthens transceiver adoption, particularly in hyperscale data centers. Variable optical attenuators and switches follow, supporting signal integrity and routing in dense network environments. Sensors are also gaining momentum in medical and industrial applications, though their contribution remains smaller compared to transceivers.

- For instance, ROHM’s RLD90QZW3 laser diode provides 75 W optical output at 905 nm with a 225 µm emission width for LiDAR sensing, while the RLD90QZW8 variant delivers 120 W with a 270 µm emission width for longer-range detection.

By Component

Active components lead the SOI market, holding nearly 60% share in 2024. Within this, lasers and modulators are key drivers due to their role in optical communication systems and advanced computing. Demand for efficient photodetectors further boosts growth in high-performance computing and telecommunication networks. Passive components, including filters and waveguides, support integration and signal management but capture a smaller share. The preference for active components stems from rising investment in optical interconnects and photonic integrated circuits that demand superior speed, efficiency, and scalability.

- For instance, ST’s official website and product announcements explicitly state that the platform supports bandwidths for modulators beyond 50 GHz and for photodiodes exceeding 80 GHz. This allows for the high data rates required for 800 Gbps and 1.6 Tbps solutions.

By Application

Data centers and high-performance computing (HPC) represent the largest application segment, accounting for over 40% share in 2024. Rapid expansion of cloud computing, AI workloads, and big data analytics drives this dominance. Telecommunications follow closely, supported by 5G rollouts and fiber-optic network upgrades. Medical applications are steadily rising, with SOI-based sensors enabling precision diagnostics and imaging solutions. Other applications, including automotive LiDAR and defense, are emerging growth areas. The strong focus on energy efficiency and high-speed connectivity ensures data centers and HPC remain the leading demand drivers.

Market Overview

Rising Demand for High-Performance Computing

The growing adoption of artificial intelligence, machine learning, and data-intensive applications is driving demand for high-performance computing. Silicon on insulator (SOI) technology enables faster data processing and lower power consumption, making it ideal for data centers and cloud infrastructure. Companies are increasingly deploying SOI-based solutions to enhance system efficiency, support larger workloads, and reduce operational costs. The ability of SOI to deliver high bandwidth and low latency positions it as a critical enabler in advancing next-generation computing environments.

- For instance, Intel’s RibbonFET transistor design (used in its 18A process node) improves transistor density and performance per watt compared to older FinFET technology. In addition, its PowerVia architecture, which relocates the power delivery network beneath the active transistor plane, reduces resistive power droop and improves density.

Expansion of 5G and Optical Communication Networks

The rollout of 5G networks and rapid upgrades in optical communication infrastructure strongly support SOI market growth. SOI-based transceivers, lasers, and modulators provide the performance required for ultra-fast data transfer and reliable connectivity. Telecom operators are investing heavily in SOI-enabled solutions to handle increasing traffic from connected devices and IoT ecosystems. This technology also ensures reduced signal loss and enhanced energy efficiency, meeting the rising demand for seamless high-speed communication across global telecommunications networks.

- For instance, the FTLC1156RDPL QSFP28 transceiver supports an aggregate data rate of 103.1 Gb/s, while consuming less than 3.5 W of power, and is capable of links up to 10 km on single-mode fiber.

Adoption in Automotive and Medical Applications

SOI technology is gaining traction in automotive electronics, particularly in advanced driver assistance systems (ADAS) and LiDAR sensors, due to its precision and thermal stability. The medical sector is also adopting SOI-based sensors for diagnostics and imaging systems that demand high accuracy and miniaturization. These applications highlight the versatility of SOI technology beyond computing and telecommunications. Growing investments in autonomous vehicles and precision healthcare further accelerate adoption, positioning SOI as a core enabler of innovation across multiple high-growth industries.

Key Trends & Opportunities

Integration with Photonic ICs

The integration of silicon photonics with SOI substrates is emerging as a significant trend, enabling higher bandwidth and lower energy consumption in optical interconnects. Companies are focusing on developing SOI-based photonic integrated circuits (PICs) to support cloud data centers, AI workloads, and 5G applications. This trend creates opportunities for cost reduction and scalability while driving innovation in advanced computing architectures. The convergence of electronics and photonics positions SOI as a strategic material in addressing future connectivity challenges.

- For instance, Hamamatsu high-speed Si PIN photodiodes can achieve cut-off frequencies of 1 GHz or more and very low dark currents, with some devices having dark currents in the tens of picoamps.

Growth of Emerging Applications

SOI technology is witnessing rising opportunities in sectors such as aerospace, defense, and industrial automation. Its ability to support harsh-environment operations, provide radiation resistance, and deliver superior thermal performance makes it suitable for mission-critical applications. Additionally, the growing adoption of IoT and smart infrastructure further expands demand for SOI-based sensors and processors. These new applications open revenue streams for manufacturers and strengthen the market’s long-term growth prospects by diversifying its industrial footprint.

- For instance, Cisco’s Silicon One G200 device achieves 51.2 Tbps throughput with 512 × 112 Gbps SerDes lanes, which feature Cisco’s internally developed technology capable of driving 4-meter DACs for optimal in-rack connectivity.

Key Challenges

High Manufacturing Costs

One of the major challenges in the SOI market is the high cost of manufacturing wafers. Complex fabrication processes, including layer transfer and wafer bonding, require significant capital investment and advanced equipment. These costs limit adoption among small and mid-sized enterprises and create barriers to entry for new players. Reducing production costs through process optimization and scaling remains critical for expanding market accessibility and supporting broader commercialization of SOI-based solutions across industries.

Supply Chain Constraints

The SOI market faces challenges from limited raw material availability and supply chain disruptions. Dependence on specialized suppliers for wafers and components exposes the industry to risks of shortages and price volatility. Geopolitical tensions and global semiconductor supply imbalances further add pressure to the market. Companies must focus on securing diversified supply sources, strategic partnerships, and regional manufacturing bases to reduce vulnerabilities and ensure steady growth in a highly competitive landscape.

Regional Analysis

North America

North America leads the silicon on insulator (SOI) market with a 38% share in 2024, driven by strong adoption across data centers, cloud computing, and telecommunications. The United States plays a central role, with significant investments in 5G infrastructure, high-performance computing, and advanced semiconductor manufacturing. Key players are expanding local production capacities to reduce reliance on imports and address growing demand from hyperscale data centers. The region also benefits from government support for semiconductor innovation and R&D, reinforcing its leadership position. Adoption in automotive electronics and medical devices further strengthens North America’s long-term SOI market growth trajectory.

Europe

Europe accounts for 27% share of the SOI market in 2024, supported by advancements in automotive and industrial applications. Germany and France lead adoption due to rising demand for SOI-based sensors and LiDAR systems in autonomous vehicles. The European Union’s initiatives to strengthen domestic semiconductor production and reduce import dependency further boost growth. Investments in renewable energy and smart infrastructure are also fueling adoption of SOI technologies for energy-efficient solutions. The presence of leading automotive manufacturers and medical device companies ensures steady demand, positioning Europe as a strategic growth hub for specialized SOI applications.

Asia Pacific

Asia Pacific holds 29% share of the SOI market in 2024, making it the fastest-growing region. China, Japan, South Korea, and Taiwan dominate due to strong semiconductor manufacturing capabilities and high consumer electronics demand. Government-backed programs, such as China’s push for semiconductor independence and Japan’s investment in photonic ICs, support market expansion. The region’s leadership in 5G rollouts and cloud adoption further drives SOI-based component demand. Rapid growth in automotive electronics and industrial automation strengthens the regional outlook, with Asia Pacific expected to surpass North America in market share during the forecast period.

Latin America

Latin America captures 3% share of the SOI market in 2024, reflecting its nascent stage of adoption. Brazil and Mexico are the key contributors, with demand concentrated in telecommunications and automotive electronics. The growing penetration of 5G networks and increased adoption of cloud computing services are expected to drive regional growth. However, limited semiconductor manufacturing infrastructure remains a restraint, leading to reliance on imports from Asia and North America. Despite challenges, expanding investments in digital transformation and industrial automation open growth opportunities, gradually increasing the region’s role in the global SOI market landscape.

Middle East & Africa

The Middle East & Africa represent 3% share of the SOI market in 2024, with adoption primarily driven by telecommunications and defense applications. Countries such as the United Arab Emirates and Saudi Arabia are investing heavily in 5G networks and smart city projects, which require SOI-based solutions for efficient connectivity. The region’s growing defense and aerospace sector also supports niche adoption of radiation-resistant SOI wafers. However, limited local production capabilities and high import dependency constrain faster growth. Ongoing infrastructure modernization and digital transformation initiatives provide long-term opportunities, positioning the region as an emerging market for SOI applications.

Market Segmentations:

By Product:

- Transceivers

- Variable optical attenuator

By Component:

By End User:

- Data center & HPC

- Telecommunications

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The silicon on insulator (SOI) market features strong competition with key players including Mellanox, ROHM Co., Ltd., STMicroelectronics N.V., Intel, Infineon Technologies AG, Finisar, Hamamatsu, Cisco, Global Foundries, and Acacia (acquired by Cisco). The silicon on insulator (SOI) market is highly competitive, driven by continuous innovation and technological advancements. Companies are focusing on expanding production capacity, enhancing wafer quality, and integrating advanced photonic and electronic components. The market is shaped by rising demand for SOI-based transceivers, modulators, and sensors across sectors such as telecommunications, automotive, and data centers. Strategic investments in research and development, along with partnerships and acquisitions, are common approaches to strengthen market presence. Additionally, emphasis on cost reduction, energy efficiency, and scalability remains central to competition, ensuring long-term growth opportunities in this evolving industry.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In March 2025, Nvidia announced plans to integrate silicon photonics and co-packaged optics directly into its switch ASICs. This move will enable network port speeds beyond 1.6 Tb/s, reduce power use, and improve performance for large-scale AI infrastructure.

- In January 2025, Onsemi announced that it had completed its acquisition of the Silicon Carbide Junction Field-Effect Transistor (SiC JFET) technology business, including the United Silicon Carbide subsidiary, from Qorvo.

- In June 2024, Intel Corporation unveiled a groundbreaking milestone at the OFC 2024, showcasing its first fully integrated optical compute interconnect (OCI) chiplet, co-packaged with an Intel CPU. This innovation promises to revolutionize high-speed data transmission, enhancing bandwidth and efficiency in AI and HPC applications, significantly impacting the market.

- In March 2024, StatIC and GlobalFoundries (GF) announced a strategic partnership to advance the silicon photonics ecosystem. The collaboration introduces a new library of high-speed silicon photonics components, including Micro Ring Modulator drivers and Trans Impedance Amplifiers, optimized for GF Fotonix™ 45 SPCLO process.

Report Coverage

The research report offers an in-depth analysis based on Product, Component, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with growing adoption of high-performance computing and AI workloads.

- 5G deployment will drive demand for SOI-based transceivers and modulators.

- Data centers will remain the leading consumer of SOI technology for efficiency gains.

- Automotive applications will grow with increasing use in ADAS and LiDAR systems.

- Medical devices will adopt SOI sensors for diagnostics and imaging solutions.

- Integration of silicon photonics with SOI will enhance bandwidth and reduce energy use.

- Manufacturers will focus on lowering wafer production costs to increase accessibility.

- Supply chain diversification will strengthen resilience against geopolitical and material risks.

- Emerging markets will create new opportunities in telecommunications and smart infrastructure.

- Strategic partnerships and R&D investments will shape innovation and long-term competitiveness.