Market Overview:

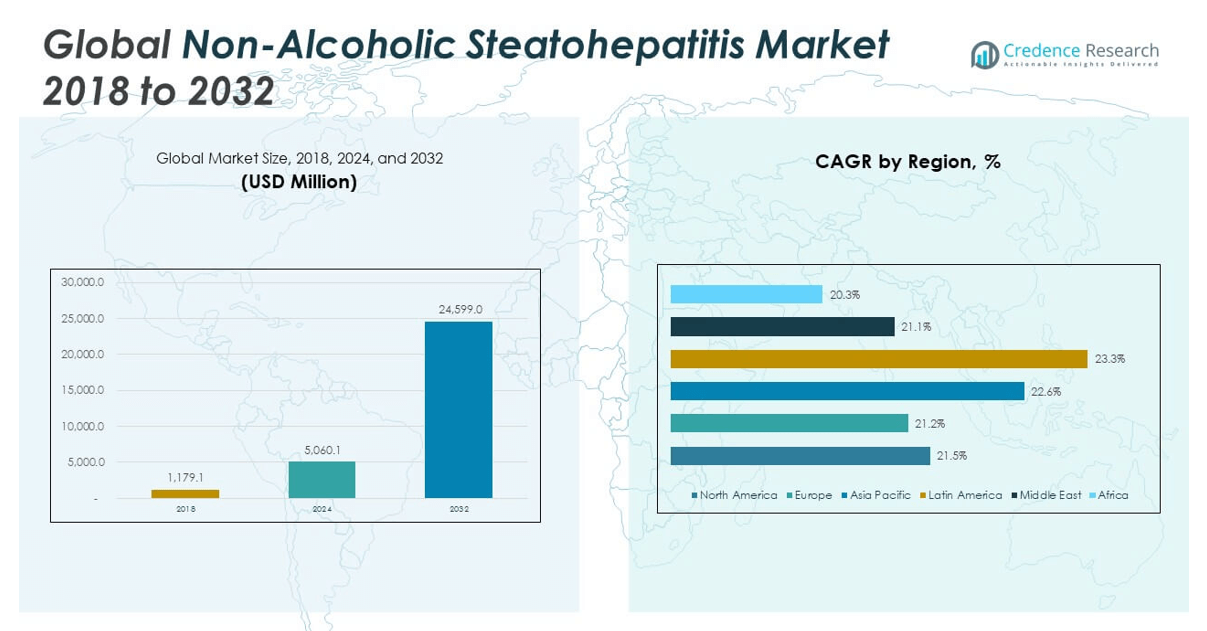

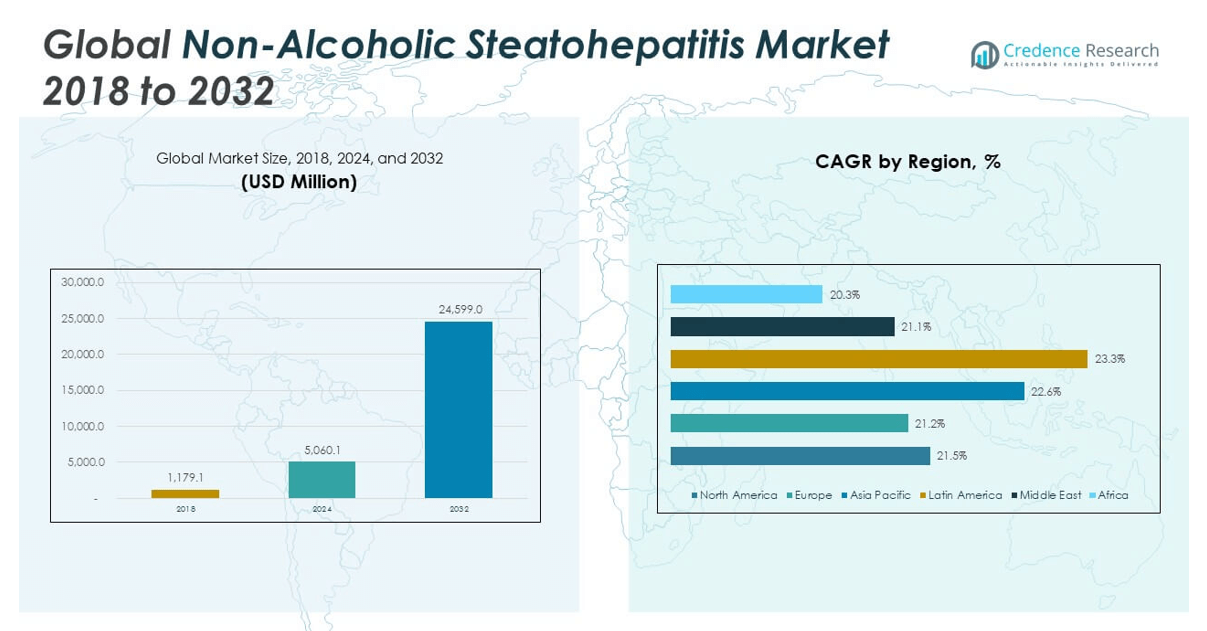

The Non-Alcoholic Steatohepatitis Market size was valued at USD 1,179.1 million in 2018 to USD 5,060.1 million in 2024 and is anticipated to reach USD 24,599.0 million by 2032, at a CAGR of 21.83% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Non-Alcoholic Steatohepatitis Market Size 2024 |

USD 5,060.1 million |

| Non-Alcoholic Steatohepatitis Market, CAGR |

21.38% |

| Non-Alcoholic Steatohepatitis Market Size 2032 |

USD 24,599.0 million |

The Non-Alcoholic Steatohepatitis (NASH) market is driven by the rising global prevalence of obesity, type 2 diabetes, and metabolic syndrome, which significantly increase the risk of NASH. As sedentary lifestyles and poor dietary habits become more widespread, healthcare systems are witnessing a surge in diagnosed and undiagnosed NASH cases. Regulatory support and breakthrough therapy designations are accelerating drug development, as evidenced by the FDA approval of resmetirom (Rezdiffra) in 2024, the first drug to treat noncirrhotic NASH with fibrosis. Pharmaceutical companies are heavily investing in advanced therapies, while innovation in non-invasive diagnostics and AI-powered biomarker tools is improving disease detection and management. Growing awareness, improved patient screening, and expanding reimbursement frameworks are further stimulating market adoption. Stakeholders are leveraging telemedicine platforms and digital health ecosystems to increase accessibility. These combined factors are not only improving clinical outcomes but also creating significant commercial opportunities in a market with high unmet medical needs.

North America dominates the NASH market with the largest revenue share, supported by high obesity and diabetes rates, advanced healthcare infrastructure, and rapid regulatory approvals. The U.S. leads due to robust screening protocols, wide insurance coverage, and early access to innovative therapies like resmetirom. Europe ranks second, benefiting from government-funded trials, aging populations, and early adoption of precision diagnostics. Countries like Germany and the U.K. show strong investment in liver disease awareness and research. Asia-Pacific represents the fastest-growing region, fueled by increasing NASH prevalence in urban populations of China, India, and Japan. Rising healthcare expenditures, public awareness initiatives, and expanding pharmaceutical presence drive regional growth. Latin America and the Middle East & Africa show moderate but consistent development. Brazil and Saudi Arabia, in particular, are strengthening their diagnostic capabilities and public health campaigns. Across regions, strategic collaborations and improved care pathways are accelerating NASH diagnosis and treatment uptake, driving long-term market growth.

Market Insights:

- The Non-Alcoholic Steatohepatitis Market grew from USD 1,179.1 million in 2018 to USD 5,060.1 million in 2024 and is projected to reach USD 24,599.0 million by 2032, registering a strong CAGR of 21.83%.

- Rising global incidence of obesity, type 2 diabetes, and sedentary lifestyles is significantly expanding the NASH patient base and fueling demand for both diagnostics and targeted therapies.

- The 2024 FDA approval of Resmetirom (Rezdiffra) marked a turning point for the market, encouraging investment in late-stage trials and accelerating drug pipeline development.

- Innovations in non-invasive diagnostics, including AI-driven biomarker tools and advanced imaging, are enabling earlier detection and improving patient stratification.

- Digital health platforms, telemedicine, and mobile apps are broadening treatment access, particularly in underserved and rural regions with limited clinical infrastructure.

- Limited approved therapies, complex disease mechanisms, and high late-stage trial failure rates continue to challenge drug developers and delay large-scale adoption.

- North America dominates the market due to robust healthcare systems and early regulatory approvals, while Asia Pacific is the fastest-growing region, driven by urbanization and rising public health investments.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers:

Increasing Global Incidence of Obesity and Type 2 Diabetes is Fueling Market Expansion

The rising prevalence of obesity and type 2 diabetes is a major factor contributing to the growth of the Non-Alcoholic Steatohepatitis Market. These conditions are key risk factors for the development of non-alcoholic fatty liver disease (NAFLD), which can progress to NASH. Sedentary lifestyles, high-calorie diets, and limited physical activity continue to affect millions worldwide, increasing the burden on healthcare systems. Urban populations in both developed and developing countries are particularly susceptible. Governments and health agencies are prioritizing early detection and intervention programs to reduce long-term complications. The growing awareness of NASH as a consequence of metabolic disorders is prompting patients and physicians to seek more effective diagnostic and therapeutic options.

- For example, according to Novo Nordisk’s 2024 annual report, the company’s own data show that over 650 million adults worldwide are obese, and more than 537 million people are living with diabetes both conditions recognized as primary risk factors for NAFLD and NASH progression.

Advancements in Diagnostic Technologies Are Enabling Early Detection and Patient Stratification

The Non-Alcoholic Steatohepatitis Market is benefiting from significant advancements in diagnostic tools that enable earlier identification of the disease. Non-invasive tests, including imaging techniques and blood-based biomarkers, are reducing the need for traditional liver biopsies. These technologies help stratify patients based on disease severity, improving clinical decision-making and treatment outcomes. Companies are investing in artificial intelligence and machine learning to enhance diagnostic accuracy and streamline workflows. Biomarker-driven approaches are supporting clinical trials by identifying eligible participants faster. It is also helping to lower costs and improve patient access, especially in primary care and outpatient settings.

Drug Pipeline Progress and Regulatory Support Are Accelerating Therapeutic Development

The drug development pipeline for NASH has gained momentum due to robust clinical research and increasing regulatory engagement. The approval of resmetirom (Rezdiffra) in 2024 by the U.S. FDA marked a breakthrough for the industry, validating the potential of targeted therapies. Many companies are advancing Phase 2 and Phase 3 candidates focused on metabolic modulation, anti-inflammatory agents, and anti-fibrotic treatments. Regulatory bodies are providing fast-track designations and priority reviews to therapies that address significant unmet needs. Strategic collaborations between biotechnology firms and pharmaceutical companies are accelerating research and expanding the scope of drug discovery. It is driving competitive intensity and innovation in the market.

- For example, the therapeutic landscape for NASHhas transformed with the U.S. FDA’s approval of Madrigal Pharmaceuticals’ resmetirom (Rezdiffra) in March 2024 the first approved therapy targeting NASH with liver fibrosis.

Growing Focus on Digital Health, Telemedicine, and Patient Awareness is Strengthening Market Reach

The increasing integration of digital health platforms and telemedicine is expanding access to NASH care, particularly in underserved regions. Patients now receive consultations, disease education, and monitoring through virtual channels, improving adherence and follow-up care. Mobile applications, online pharmacies, and remote diagnostics are helping to reduce barriers in rural and urban communities alike. Public and private sector campaigns are raising awareness about liver health, encouraging early testing and lifestyle modifications. It is also improving patient engagement and fostering a more proactive approach to disease management. These developments are reinforcing the market’s ability to reach wider populations and deliver timely interventions.

Market Trends:

Surge in Strategic Mergers, Acquisitions, and Licensing Deals to Strengthen Product Portfolios

The Non-Alcoholic Steatohepatitis Market is witnessing a sharp rise in mergers, acquisitions, and licensing agreements as companies aim to expand their presence and therapeutic offerings. Large pharmaceutical firms are acquiring biotech startups with promising NASH drug candidates to accelerate entry into the market. Licensing deals are helping firms access proprietary technologies, such as novel drug delivery systems or targeted molecules. Strategic alliances are also enabling the pooling of R&D resources to reduce development time and costs. Several collaborations focus on co-developing combination therapies that address the multifactorial nature of NASH. It is creating a competitive and innovation-driven environment, encouraging new entrants to invest in this high-growth market.

- For example, in 2021, Novo Nordisk acquired Dicerna Pharmaceuticals for $3.3 billion to access Dicerna’s RNAi technology platform, which is being leveraged to develop novel NASH therapeutics.

Shift Toward Combination Therapies to Address Multifaceted Disease Mechanisms

The complex pathophysiology of NASH is prompting a growing trend toward combination therapies targeting multiple disease pathways. Monotherapies have shown limited success in halting or reversing disease progression in late-stage patients. Researchers and companies are now combining agents with anti-inflammatory, anti-fibrotic, and metabolic effects to deliver a more comprehensive treatment approach. This trend reflects the industry’s recognition that no single drug may fully address the heterogeneity of NASH. Clinical trials are increasingly designed to test dual or triple combinations with better efficacy and safety outcomes. The Non-Alcoholic Steatohepatitis Market is expected to shift from single-agent models to integrated multi-drug regimens that improve long-term patient outcomes.

Emergence of Companion Diagnostics for Personalized NASH Treatment Pathways

Personalized medicine is becoming a central theme in the Non-Alcoholic Steatohepatitis Market, with growing interest in companion diagnostics that tailor therapies to individual patient profiles. Pharmaceutical firms are working closely with diagnostic developers to co-launch drugs alongside biomarker-based tests. These diagnostics assess genetic, metabolic, or immunological factors to predict a patient’s response to specific therapies. This approach enables clinicians to avoid trial-and-error prescriptions and instead use targeted therapies from the outset. It also supports regulatory approval by demonstrating clear clinical benefit in biomarker-positive populations. The development of companion diagnostics is fostering a more precise, patient-centered care model within the NASH treatment landscape.

Rising Participation of Contract Research Organizations (CROs) to Support Global Clinical Trials

Contract Research Organizations (CROs) are playing an increasingly vital role in the growth of the Non-Alcoholic Steatohepatitis Market by supporting drug developers through specialized clinical trial services. With a surge in multi-center and international trials, sponsors are outsourcing key functions such as patient recruitment, data management, and regulatory compliance. CROs offer deep expertise in hepatology, helping streamline the design and execution of complex studies. Their global networks allow access to diverse patient populations, accelerating trial timelines and improving data quality. It is enabling pharmaceutical and biotech firms to manage risk while optimizing development efficiency. This trend reflects a broader shift toward external innovation partnerships across the life sciences industry.

- For example, CROs like ICON and Parexel have become crucial partners in NASH (Non-alcoholic Steatohepatitis) drug development, offering end-to-end clinical trial management services.

Market Challenges Analysis:

Lack of Approved Therapies and Complex Disease Mechanisms Continue to Restrain Market Progress

The Non-Alcoholic Steatohepatitis Market faces a persistent challenge due to the limited number of approved therapies despite rising demand. Until recently, treatment options relied primarily on off-label use of diabetes and lipid-lowering drugs, which offer inconsistent results. The multifactorial nature of NASH, involving metabolic, inflammatory, and fibrotic pathways, complicates drug development and clinical trial designs. Failure rates in late-stage trials remain high due to unclear endpoints, patient variability, and difficulties in demonstrating histological improvement. Regulatory agencies require rigorous long-term data, which increases development costs and timeframes. It creates uncertainty for investors and delays the commercial availability of effective treatment options, ultimately affecting patient outcomes and healthcare strategies.

High Diagnostic Costs, Limited Awareness, and Poor Access Hinder Early Detection

Early diagnosis remains a critical bottleneck in the Non-Alcoholic Steatohepatitis Market, largely due to the high costs of advanced imaging and biomarker testing. Most patients remain asymptomatic in early stages, and primary care providers often miss the condition during routine checkups. Limited public awareness and absence of standardized screening guidelines in many countries further complicate timely identification. Many healthcare systems lack reimbursement frameworks for non-invasive diagnostic tools, which restricts their adoption outside tertiary care centers. It prevents widespread patient stratification and delays intervention, leading to disease progression and higher treatment burdens. The combination of financial, structural, and educational barriers continues to limit the effectiveness of market expansion efforts.

Market Opportunities:

Expansion of Biomarker-Based Diagnostics and AI Tools Presents Growth Potential

The Non-Alcoholic Steatohepatitis Market holds significant opportunity through the advancement of biomarker-based diagnostics and AI-enabled screening platforms. Non-invasive technologies that assess fibrosis, inflammation, and liver fat content offer scalable solutions for early-stage detection. AI-driven tools can analyze large datasets to predict disease progression and personalize treatment pathways. Developers that integrate diagnostics with therapeutic solutions may gain competitive advantage through bundled offerings. It creates a pathway for precision medicine while reducing the reliance on liver biopsies. Broader adoption in primary care settings can drive earlier interventions and improve long-term clinical outcomes.

Growth in Emerging Markets and Shift Toward Preventive Care Support Future Expansion

Emerging economies such as India, China, and Brazil offer untapped potential for NASH-focused therapeutics and diagnostics due to growing obesity and metabolic syndrome rates. Rising healthcare investments, expanding insurance coverage, and urbanization trends are reshaping care delivery in these regions. Public health campaigns focused on liver health and lifestyle changes are driving demand for preventive solutions. Pharmaceutical and diagnostic companies entering these markets with affordable, locally adapted solutions can unlock new revenue streams. The Non-Alcoholic Steatohepatitis Market stands to benefit from these shifts, especially as governments prioritize non-communicable disease management. It opens strategic access to high-volume patient populations and long-term market sustainability.

Market Segmentation Analysis:

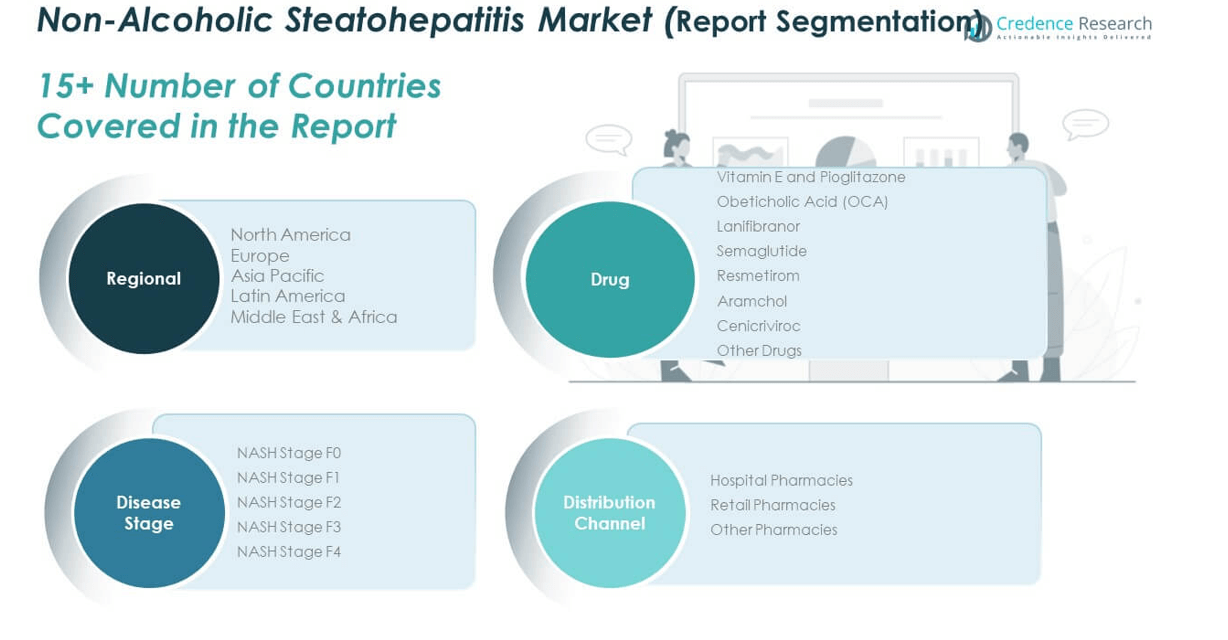

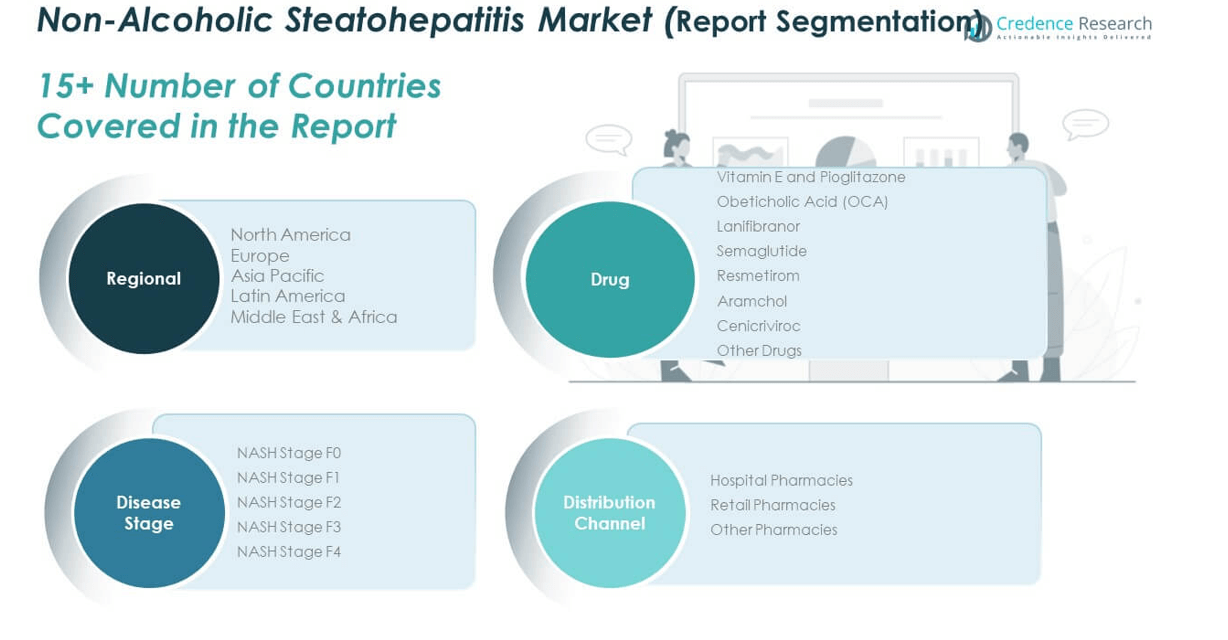

The Non-Alcoholic Steatohepatitis Market is segmented

By drug type, disease stage, and distribution channel. By drug segment, Resmetirom leads due to its FDA approval in 2024, followed by strong demand for Obeticholic Acid (OCA) and Lanifibranor, which are advancing through late-stage trials. Semaglutide and Aramchol are gaining attention for their dual benefits in metabolic control and liver fat reduction. Vitamin E and Pioglitazone remain relevant for early-stage intervention, while Cenicriviroc and other emerging candidates continue to be evaluated for their anti-inflammatory and anti-fibrotic properties.

- For example, In March 2024, Resmetirom became the first drug to receive FDA approval for treating NASH with liver fibrosis (F2-F3). In the pivotal Phase 3 MAESTRO-NASH trial, Resmetirom achieved a 26% relative reduction in liver fibrosis and a 30% improvement in NASH resolution compared to placebo.

By disease stage, NASH Stage F2 and F3 represent the largest market share due to increased diagnosis rates and high clinical focus on preventing progression. Stage F0 and F1 reflect early intervention opportunities, while Stage F4, associated with cirrhosis, requires advanced therapeutic strategies and contributes to complex treatment costs. It emphasizes the need for precise disease stratification.

By distribution channel, hospital pharmacies dominate due to the clinical nature of NASH treatment. Retail pharmacies serve outpatient needs and follow-up medication, while other pharmacies, including specialty and online platforms, are expanding access through digital health channels and chronic care programs.

- For example, Madrigal Pharmaceuticals announced partnerships with specialty pharmacy providers to ensure nationwide access to Resmetirom for eligible patients, including support through digital health platforms and chronic care programs.

Segmentation:

By Drug Segment:

- Vitamin E and Pioglitazone

- Obeticholic Acid (OCA)

- Lanifibranor

- Semaglutide

- Resmetirom

- Aramchol

- Cenicriviroc

- Other Drugs

By Disease Stage Segment:

- NASH Stage F0

- NASH Stage F1

- NASH Stage F2

- NASH Stage F3

- NASH Stage F4

By Distribution Channel Segment:

- Hospital Pharmacies

- Retail Pharmacies

- Other Pharmacies

By Region:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Regional Analysis:

North America

The North America Non-Alcoholic Steatohepatitis Market size was valued at USD 355.04 million in 2018 to USD 1,499.51 million in 2024 and is anticipated to reach USD 7,133.70 million by 2032, at a CAGR of 21.5% during the forecast period. North America holds the largest share of the global Non-Alcoholic Steatohepatitis Market at 33%. High obesity and diabetes prevalence, advanced healthcare infrastructure, and early regulatory approvals are driving strong demand. The U.S. leads the region, supported by the FDA approval of the first NASH drug and favorable reimbursement models. Strategic investments in diagnostics and therapeutic R&D further strengthen the region’s market position. It benefits from a well-established clinical trial ecosystem and a growing number of specialized liver health programs across academic centers. Ongoing partnerships between pharmaceutical firms and digital health platforms are also boosting patient outreach and treatment adherence.

Europe

The Europe Non-Alcoholic Steatohepatitis Market size was valued at USD 315.07 million in 2018 to USD 1,314.75 million in 2024 and is anticipated to reach USD 6,149.74 million by 2032, at a CAGR of 21.2% during the forecast period. Europe accounts for 29% of the total market share and shows strong momentum driven by aging demographics and rising non-communicable disease rates. Countries like Germany, France, and the U.K. are at the forefront of clinical adoption due to government-supported research programs and early use of non-invasive diagnostic tools. Strong pharmaceutical pipelines and centralized health systems facilitate rapid integration of new therapies. It is further supported by favorable public funding and growing awareness of liver-related complications. Academic-industry collaborations in hepatology are creating scalable treatment and monitoring frameworks. The region also sees increased uptake of digital health tools in chronic disease management.

Asia Pacific

The Asia Pacific Non-Alcoholic Steatohepatitis Market size was valued at USD 249.86 million in 2018 to USD 1,114.73 million in 2024 and is anticipated to reach USD 5,694.66 million by 2032, at a CAGR of 22.6% during the forecast period. Asia Pacific captures 25% of the global market, reflecting fast-growing demand driven by urbanization, dietary changes, and rising metabolic disorders. Countries such as China, India, and Japan are witnessing a sharp rise in NASH cases due to lifestyle transitions. Public health initiatives promoting early detection and the expansion of private healthcare services are supporting market growth. It benefits from increasing investments in healthcare infrastructure and a strong presence of international pharmaceutical companies. Government-backed telemedicine and AI screening programs are also gaining momentum. The region presents substantial opportunities for low-cost, scalable diagnostic and treatment models.

Latin America

The Latin America Non-Alcoholic Steatohepatitis Market size was valued at USD 123.93 million in 2018 to USD 576.27 million in 2024 and is anticipated to reach USD 3,089.63 million by 2032, at a CAGR of 23.3% during the forecast period. Latin America holds 7% of the global Non-Alcoholic Steatohepatitis Market, with Brazil and Mexico leading in terms of diagnosis and treatment infrastructure. Rising obesity rates and increasing access to healthcare services are driving awareness and intervention. Governments are launching educational campaigns and screening programs to manage the growing burden of metabolic diseases. Private-sector partnerships are improving the availability of diagnostics and therapeutics. It benefits from localized production initiatives and growing investments in clinical research. The market is steadily expanding through targeted health policies and regional collaborations.

Middle East

The Middle East Non-Alcoholic Steatohepatitis Market size was valued at USD 96.93 million in 2018 to USD 401.62 million in 2024 and is anticipated to reach USD 1,859.68 million by 2032, at a CAGR of 21.1% during the forecast period. The Middle East contributes 4% to the global market, supported by rapid urbanization and a surge in non-communicable lifestyle diseases. Gulf countries such as Saudi Arabia and the UAE are prioritizing liver health through national wellness strategies. Adoption of digital diagnostics and specialist care networks is helping bridge service gaps. It is expanding through public-private partnerships and regional investments in medical innovation. Population health initiatives and international collaborations are further improving early-stage intervention. The region shows potential for higher adoption of advanced diagnostics and targeted therapies.

Africa

The Africa Non-Alcoholic Steatohepatitis Market size was valued at USD 38.32 million in 2018 to USD 153.18 million in 2024 and is anticipated to reach USD 671.55 million by 2032, at a CAGR of 20.3% during the forecast period. Africa currently holds a 2% market share and faces challenges in early diagnosis and treatment availability. Low awareness, limited diagnostic infrastructure, and high out-of-pocket costs constrain patient access. It is slowly gaining momentum through pilot programs and NGO-led health interventions. South Africa and Egypt are leading efforts with urban screening campaigns and specialist care centers. International donors and regional agencies are beginning to invest in metabolic disease education. The market offers long-term potential if infrastructure gaps and access barriers are effectively addressed.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis:

- Intercept Pharmaceuticals, Inc.

- Galmed Pharmaceuticals Ltd.

- Inventiva

- AbbVie Inc.

- Galectin Therapeutics Inc.

- Madrigal Pharmaceuticals Inc.

- NGM Biopharmaceuticals, Inc.

- Novo Nordisk A/S

- Gilead Sciences Inc.

- Enzo Biochem, Inc.

- Raptor Pharmaceuticals

- AstraZeneca plc

- Other Key Players

Competitive Analysis:

The Non-Alcoholic Steatohepatitis Market is characterized by intense competition among pharmaceutical and biotechnology companies focused on developing targeted therapies. Key players such as Madrigal Pharmaceuticals, Intercept Pharmaceuticals, Gilead Sciences, and Novo Nordisk are advancing their pipelines with candidates addressing multiple disease mechanisms. Recent FDA approval of Rezdiffra by Madrigal has set a precedent, prompting competitors to accelerate late-stage trials. Strategic alliances, licensing deals, and mergers are reshaping the landscape as firms aim to strengthen therapeutic portfolios and expand market reach. It is witnessing increased activity in biomarker development, companion diagnostics, and AI-driven research platforms. Companies are investing heavily in innovation, aiming to differentiate based on efficacy, safety, and patient outcomes. Competitive dynamics will continue to evolve as more candidates approach regulatory milestones and healthcare systems adopt structured NASH management pathways.

Recent Developments:

- In June 2025, the European Medicines Agency’s CHMP recommended conditional approval of Madrigal Pharmaceuticals’ Rezdiffra (resmetirom) for metabolic dysfunction-associated steatohepatitis (MASH)—formerly NASH. Approved in the U.S. in March 2024, Rezdiffra is now poised to become the first EU-authorized treatment for MASH, with EU launch expected later in 2025.

- In March 2025, Galmed Pharmaceuticals secured a new patent extending its lead compound Aramchol’s protection through to 2039, which specifically covers its use in combination therapy with Rezdiffra (resmetirom) for treating NASH/MASH and liver fibrosis. This patent strengthens Galmed’s leadership in the emerging combination-therapy landscape.

Market Concentration & Characteristics:

The Non-Alcoholic Steatohepatitis Market exhibits moderate to high concentration, with a few key players holding significant influence due to advanced clinical pipelines and early regulatory successes. It is characterized by high entry barriers driven by complex pathophysiology, long development cycles, and stringent approval requirements. The market demands targeted therapies with proven histological benefits, pushing companies to adopt precision medicine approaches. Innovation centers around multi-mechanism drug candidates and non-invasive diagnostics to improve early detection and treatment outcomes. Strategic collaborations and licensing agreements are common, allowing firms to accelerate development and expand access. The market favors companies with strong R&D capabilities, global reach, and the ability to navigate regulatory complexities across regions.

Report Coverage:

The research report offers an in-depth analysis based on Drug, Disease Stage and Distribution Channel. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook:

- Rising global obesity and diabetes rates will continue to expand the patient pool for NASH therapies.

- Regulatory approvals of novel therapeutics are expected to accelerate over the next five years.

- Adoption of non-invasive diagnostic tools will improve early detection and disease management.

- Combination therapies targeting multiple disease mechanisms will gain prominence in treatment protocols.

- AI-driven predictive analytics will enhance clinical decision-making and patient stratification.

- Emerging markets will offer new growth opportunities due to improved healthcare infrastructure and awareness.

- Strategic partnerships and acquisitions will reshape the competitive landscape and expand market access.

- Companion diagnostics will support personalized treatment approaches and improve therapeutic outcomes.

- Telehealth integration will increase patient reach and adherence in both urban and rural regions.

- Ongoing investment in biomarker research will streamline clinical trials and support regulatory submissions.