Market Overview

Global Catharanthine market size was valued at USD 658.42 million in 2018, increasing to USD 879.91 million in 2024, and is anticipated to reach USD 1,270.26 million by 2032, at a CAGR of 4.37% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Catharanthine Market Size 2024 |

USD 879.91 Million |

| Catharanthine Market, CAGR |

4.37% |

| Catharanthine Market Size 2032 |

USD 1,270.26 Million |

The Global Catharanthine market is led by established players such as Merck KGaA, Thermo Fisher Scientific Inc., Avantor, Inc., and Abcam Corporation, alongside specialized suppliers including Cayman Chemical Company, Selleck Chemicals, and AK Scientific Inc. These companies dominate through extensive product portfolios, strong supply chains, and investment in biotechnological production methods. Regionally, North America holds the largest share at 43.3%, driven by advanced pharmaceutical infrastructure and high oncology drug demand. Europe follows with 28.8%, supported by strong biotech research, while Asia Pacific captures 18.3%, emerging as the fastest-growing hub due to expanding healthcare investments and rising cancer prevalence.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Global Catharanthine market was valued at USD 658.42 million in 2018, reached USD 879.91 million in 2024, and is projected to hit USD 1,270.26 million by 2032 at a CAGR of 4.37%.

- Rising demand for oncology drugs drives the market, with catharanthine sulfate holding over 60% share as the primary precursor for anti-cancer formulations such as vinblastine and vincristine.

- Key trends include a shift toward biotechnological production methods, accounting for fast growth compared to traditional plant extraction, ensuring consistent yields and sustainable supply.

- The competitive landscape features Merck KGaA, Thermo Fisher Scientific Inc., Avantor, and Abcam Corporation, alongside niche suppliers like Cayman Chemical Company and Selleck Chemicals, focusing on high-purity compounds.

- Regionally, North America leads with 43.3% share, followed by Europe at 28.8% and Asia Pacific at 18.3%, with Asia Pacific recording the fastest CAGR of 6.0%, driven by healthcare investments and rising cancer prevalence.

Market Segmentation Analysis:

By Product Type

Catharanthine Sulfate holds the dominant share in the global catharanthine market, accounting for over 60% of total revenue. Its leadership comes from extensive use in producing anti-cancer drugs such as vinblastine and vincristine. The compound’s high demand in oncology applications continues to drive growth, supported by rising cancer incidence worldwide. Other catharanthine derivatives and formulations capture a smaller share but are gaining attention for experimental therapies and niche pharmaceutical applications. Their potential role in expanding drug pipelines positions them as an emerging area of interest.

- For instance, Eli Lilly was instrumental in developing the chemotherapy drugs vinblastine (trade name Velban) and vincristine (trade name Oncovin) from the Catharanthus roseus (Madagascar periwinkle) plant in the late 1950s.

By Application

Pharmaceutical synthesis dominates the application segment, representing more than 70% of the market share. Catharanthine serves as a key precursor in semi-synthetic processes for essential oncology drugs, ensuring its strong presence in the pharmaceutical value chain. The increasing investment in cancer treatment solutions, coupled with rising approvals of plant-derived compounds, sustains its demand. Research and development contribute a smaller portion but remains vital. Institutions and biotech companies explore catharanthine for novel formulations and advanced drug delivery methods, driving steady adoption in experimental and academic studies.

- For instance, Pierre Fabre Médicament utilizes Catharanthus roseus (Madagascar periwinkle) to produce semi-synthetic vinca alkaloids like vinorelbine (Navelbine®) and vinflunine (Javlor®), which are used in cancer treatment.

By Production Method

Traditional plant extraction leads the production method segment with approximately 65% market share. This approach remains widespread due to established infrastructure and reliance on Catharanthus roseus as a primary raw material source. However, fluctuating crop yields and high extraction costs present challenges. Biotechnological production is growing at a faster pace, driven by advances in metabolic engineering and synthetic biology. Scalable fermentation processes and genetically modified organisms offer consistent yields and cost efficiencies. These innovations are expected to gradually shift production preferences toward biotechnological platforms in the forecast period.

Key Growth Drivers

Rising Demand for Oncology Drugs

Catharanthine is a critical precursor for producing anti-cancer drugs such as vinblastine and vincristine. The global burden of cancer continues to grow, with increasing patient populations driving pharmaceutical demand. This rising need for effective chemotherapeutic agents secures catharanthine’s role in the pharmaceutical supply chain. Expanding oncology research, coupled with supportive government initiatives for cancer treatment, further strengthens market growth. As pharmaceutical companies scale production capacity, demand for catharanthine sulfate in particular is expected to remain a primary growth driver for the global market.

- For instance, Vincristine sulfate, a chemotherapy drug originally developed and marketed by Eli Lilly and Company under the brand name Oncovin, is a semi-synthetic product. Its production is complex and involves coupling two precursor alkaloids, catharanthine and vindoline, extracted from the Madagascar periwinkle plant (Catharanthus roseus).

Advancements in Biotechnological Production

Biotechnological innovations in metabolic engineering and synthetic biology have enhanced catharanthine yield beyond traditional plant extraction methods. Engineered microbial platforms enable scalable, reliable, and cost-effective production of alkaloids, reducing reliance on seasonal crops. Research institutions and biotech companies invest in fermentation-based processes to address rising pharmaceutical demand. These breakthroughs improve production stability while lowering costs associated with crop cultivation and extraction. The adoption of biotechnological platforms offers strong growth potential by ensuring consistent supply, meeting regulatory standards, and enabling broader industrial-scale commercialization.

- For instance, Vincristine sulfate, a chemotherapy drug derived from the Madagascar periwinkle plant (Catharanthus roseus), is used to treat a variety of cancers. The drug was originally developed and marketed as Oncovin by Eli Lilly in the 1960s, but it is now manufactured by other generic companies.

Expanding Research and Development Applications

Research institutions and biotech firms increasingly use catharanthine in experimental drug formulations. Beyond oncology, studies explore its potential role in neurological and metabolic disorders, creating new therapeutic avenues. Government and private funding support academic projects, boosting compound utilization in preclinical and clinical studies. This expanding application scope positions catharanthine as a versatile research input. Growing collaboration between universities, pharmaceutical firms, and contract research organizations ensures its sustained demand, making research and development an essential growth driver for market expansion in the forecast period.

Key Trends & Opportunities

Shift Toward Sustainable Production

The market is witnessing a growing shift from traditional extraction toward biotechnological and sustainable production. Synthetic biology and gene-editing technologies provide opportunities to reduce environmental impact while ensuring supply stability. Companies adopting eco-friendly production processes gain a competitive advantage by aligning with global sustainability targets. This trend supports long-term resource management and positions catharanthine as a sustainable pharmaceutical input. The adoption of advanced bioprocessing technologies creates opportunities for both established pharmaceutical companies and emerging biotech innovators in the market.

- For instance, Phyton Biotech, a specialist in Plant Cell Fermentation (PCF®) Technology, operates a manufacturing facility in Germany with commercial-scale bioreactors, including multiple vessels up to 75,000 liters in size. While the company does use plant-cell fermentation to produce high-value pharmaceutical ingredients, its key products are the vinca alkaloids paclitaxel and docetaxel for oncology, which it produces with stable, year-round output. Catharanthine, another vinca alkaloid, is not currently a marketed product from their industrial PCF® process.

Rising Global Collaborations and Partnerships

Collaborations between pharmaceutical companies, biotech firms, and academic research institutions are expanding catharanthine’s application scope. Joint ventures focus on developing scalable production technologies and exploring new therapeutic applications. These partnerships strengthen intellectual property portfolios while accelerating clinical validation of catharanthine-based compounds. Multinational alliances also ensure broader geographic penetration and enhance funding access for large-scale projects. This trend creates opportunities for innovation, efficient commercialization, and expansion of the compound’s use beyond oncology into wider therapeutic markets, boosting its strategic importance in global healthcare.

- For instance, in 2022, researchers at Stanford University engineered yeast strains for the de novo biosynthesis of catharanthine and vindoline. They achieved a catharanthine yield of 527.1 $\mu$g per liter.

Key Challenges

High Production Costs from Plant Extraction

Traditional catharanthine production relies heavily on extraction from Catharanthus roseus plants, a resource-intensive and costly process. Low alkaloid concentration in raw materials demands extensive cultivation and processing, raising costs significantly. Fluctuations in crop yields due to weather and disease further disrupt supply chains. These challenges constrain scalability and limit affordable availability of catharanthine in pharmaceutical synthesis. Although biotechnological solutions are emerging, high upfront investment and slow adoption still make extraction-based production a persistent barrier for broader market expansion.

Regulatory and Quality Compliance Barriers

Catharanthine used in pharmaceutical synthesis must meet stringent regulatory and quality compliance standards. Variability in supply sources and extraction methods complicates standardization, making global approvals difficult. Regulatory agencies require consistent purity, traceability, and validated production methods, increasing costs for producers. Meeting international pharmaceutical compliance frameworks often delays commercialization and raises entry barriers for smaller companies. Failure to achieve strict quality benchmarks can lead to rejection of batches, affecting supply security. These compliance challenges remain a critical obstacle for the market’s growth trajectory.

Regional Analysis

North America

North America dominates the global catharanthine market with a market share of 43.3% in 2018, valued at USD 287.95 million. The region grew to USD 380.83 million in 2024 and is projected to reach USD 551.30 million by 2032, expanding at a CAGR of 4.4%. Strong pharmaceutical manufacturing capacity and extensive oncology drug development drive regional demand. The U.S. remains the core market, supported by advanced research facilities and robust funding in cancer-related therapeutics. Favorable regulatory approvals further sustain catharanthine adoption in large-scale pharmaceutical synthesis across the region.

Europe

Europe accounted for 28.8% of the global share in 2018, with the market valued at USD 191.75 million. The region reached USD 247.26 million in 2024 and is forecasted to grow to USD 336.63 million by 2032 at a CAGR of 3.6%. The presence of leading biotech research institutions and established pharmaceutical companies enhances demand. High adoption of plant-derived alkaloids in oncology treatment supports steady growth. Germany, France, and the UK remain leading contributors, with research funding and clinical trials strengthening catharanthine’s role in pharmaceutical synthesis and innovative drug development.

Asia Pacific

Asia Pacific held 18.3% of the global share in 2018, valued at USD 122.03 million. The market expanded to USD 177.28 million in 2024 and is expected to reach USD 291.04 million by 2032, growing at a CAGR of 6.0%, the fastest among regions. Rising healthcare investments and increasing cancer prevalence drive demand in China, India, and Japan. Strong government initiatives for biotechnology research further support growth. Local pharmaceutical companies expand production capacity, creating opportunities for catharanthine applications in both synthesis and R&D, positioning Asia Pacific as a high-growth hub.

Latin America

Latin America represented 4.5% of the global market in 2018, valued at USD 29.71 million. The market grew to USD 39.19 million in 2024 and is projected to reach USD 49.76 million by 2032, advancing at a CAGR of 2.7%. Brazil and Mexico drive regional demand, with growing pharmaceutical outsourcing and clinical research activities. Limited local production capacity restricts faster growth, yet increasing cancer awareness supports steady demand for catharanthine. Partnerships with global pharmaceutical firms strengthen regional availability and utilization, particularly in oncology drug production and specialized R&D activities.

Middle East

The Middle East accounted for 2.6% of the global market in 2018, valued at USD 17.27 million. It expanded to USD 20.97 million in 2024 and is projected to reach USD 25.19 million by 2032, registering a CAGR of 2.0%. The market is shaped by rising healthcare investments in countries like Saudi Arabia and the UAE. However, reliance on imports limits regional independence. Demand grows steadily due to increasing focus on cancer treatment infrastructure. Regional governments’ emphasis on diversifying healthcare research creates gradual opportunities for catharanthine adoption in specialized applications.

Africa

Africa contributed 1.5% of the global share in 2018, with the market valued at USD 9.70 million. The region expanded to USD 14.39 million in 2024 and is expected to reach USD 16.35 million by 2032 at a CAGR of 1.3%, the lowest globally. Limited healthcare infrastructure and low pharmaceutical production restrict catharanthine utilization. Demand is concentrated in South Africa and select North African countries with stronger oncology treatment facilities. Rising international support for clinical research and healthcare initiatives gradually strengthens awareness, though adoption remains constrained by affordability and access challenges.

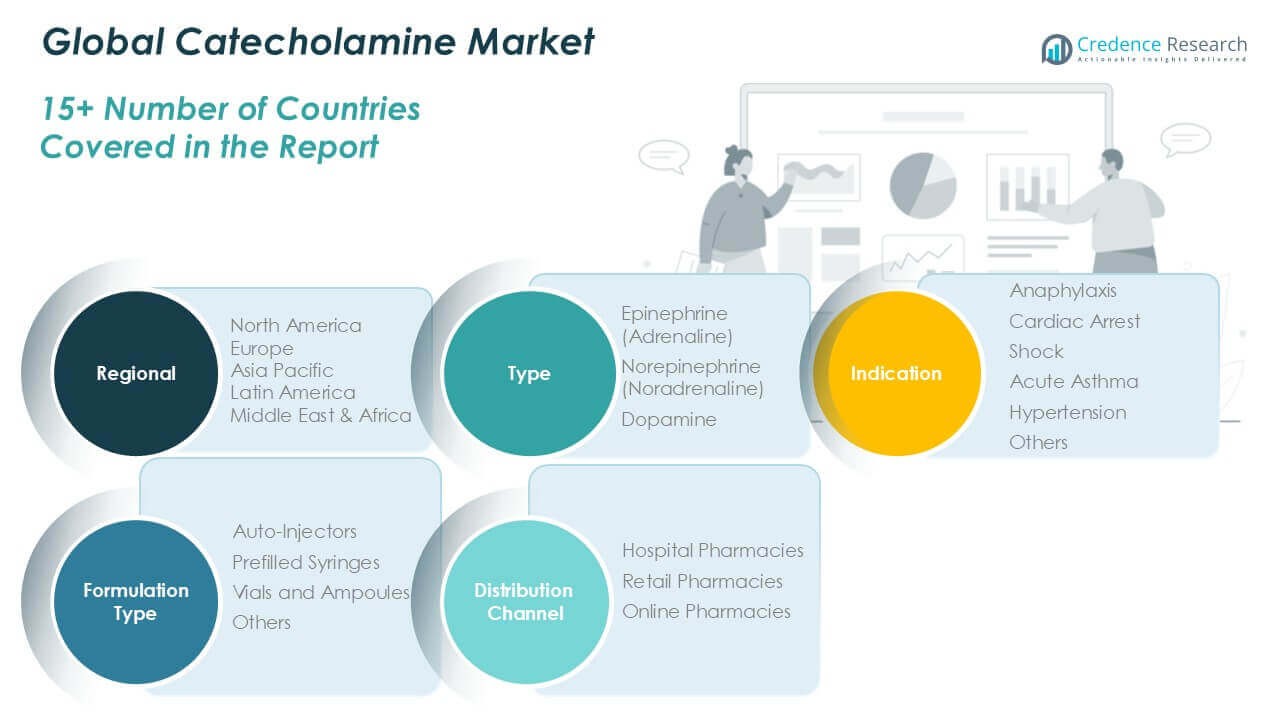

Market Segmentations:

By Product Type

- Catharanthine Sulfate

- Other catharanthine derivatives and formulations

By Application

- Pharmaceutical synthesis

- Research and development

By Production Method

- Traditional plant extraction

- Biotechnological production

By End User

- Pharmaceutical companies

- Biotech research institutions

- Contract manufacturing organizations (CMOs)

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The global catharanthine market features a moderately fragmented landscape, with competition shaped by pharmaceutical suppliers, chemical manufacturers, and biotech firms. Key players such as Merck KGaA, Thermo Fisher Scientific Inc., Avantor, Inc., and Abcam Corporation maintain strong positions through extensive distribution networks and diversified product portfolios. Specialized suppliers including AK Scientific Inc., Cayman Chemical Company, and Selleck Chemicals focus on high-purity catharanthine compounds for pharmaceutical synthesis and research use. Emerging biotech firms like Hainan Yueyang Biotech Co. Ltd. and ChemFaces Corporation strengthen their market presence by offering competitively priced plant-extracted alkaloids. Strategic partnerships, R&D investments, and advances in biotechnological production remain central to competitive advantage. Players increasingly prioritize compliance with pharmaceutical-grade quality standards and expand manufacturing capabilities to meet rising demand from oncology drug developers and research institutions worldwide.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- AK Scientific Inc.

- Cayman Chemical Company

- Stanford Chemicals

- BioVision Inc.

- Enzo Biochem Inc.

- Abcam Corporation

- ChemFaces Corporation

- Hainan Yueyang Biotech Co. Ltd.

- Selleck Chemicals

- Merck KGaA

- Thermo Fisher Scientific Inc.

- Avantor, Inc.

Recent Developments

- In September 2025, Cayman Chemical continued expanding its compound libraries, including catharanthine derivatives for small molecule screening in cancer and neuropharmacology applications.

- In July 2025, Thermo Fisher expanded its drug manufacturing capacity by acquiring Sanofi’s sterile fill-finish facility in New Jersey, enabling increased U.S. output of critical medicines (potentially including chemotherapy agents derived from catharanthine).

- In April 2025, AK Scientific strengthened its distribution network in Europe and Asia to meet rising demand for catharanthine, crucial for anti-cancer drug manufacturing and pharmaceutical research.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Application, Production Method, End User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with strong demand from oncology drug manufacturing.

- Catharanthine sulfate will continue to dominate due to its critical role in chemotherapy drugs.

- Biotechnological production will gain wider adoption, reducing dependence on plant extraction.

- Research applications will increase as biotech firms explore new therapeutic areas.

- Partnerships between pharma companies and research institutions will drive innovation.

- North America will maintain leadership supported by advanced pharmaceutical infrastructure.

- Europe will grow steadily, leveraging strong biotech and clinical research networks.

- Asia Pacific will emerge as the fastest-growing hub with rising healthcare investments.

- Supply chain resilience and compliance with quality standards will remain a priority.

- Sustainability-focused production methods will create new opportunities for long-term market growth.