Market Overview

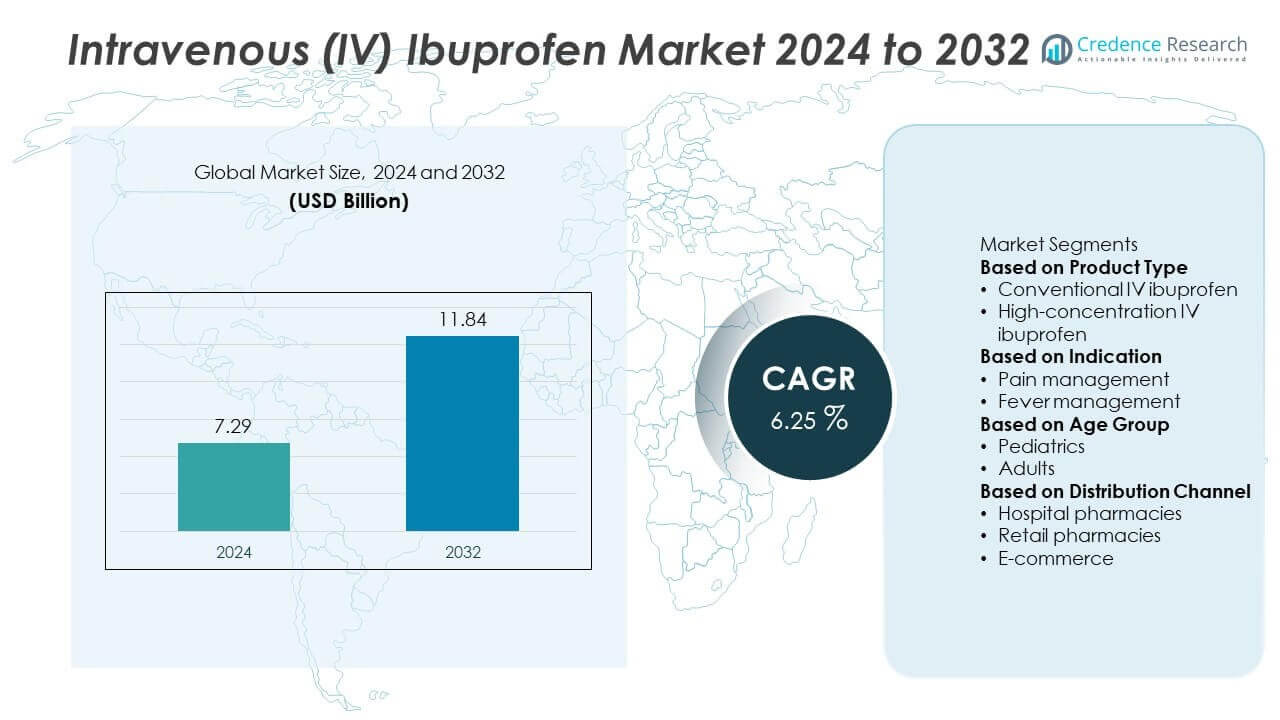

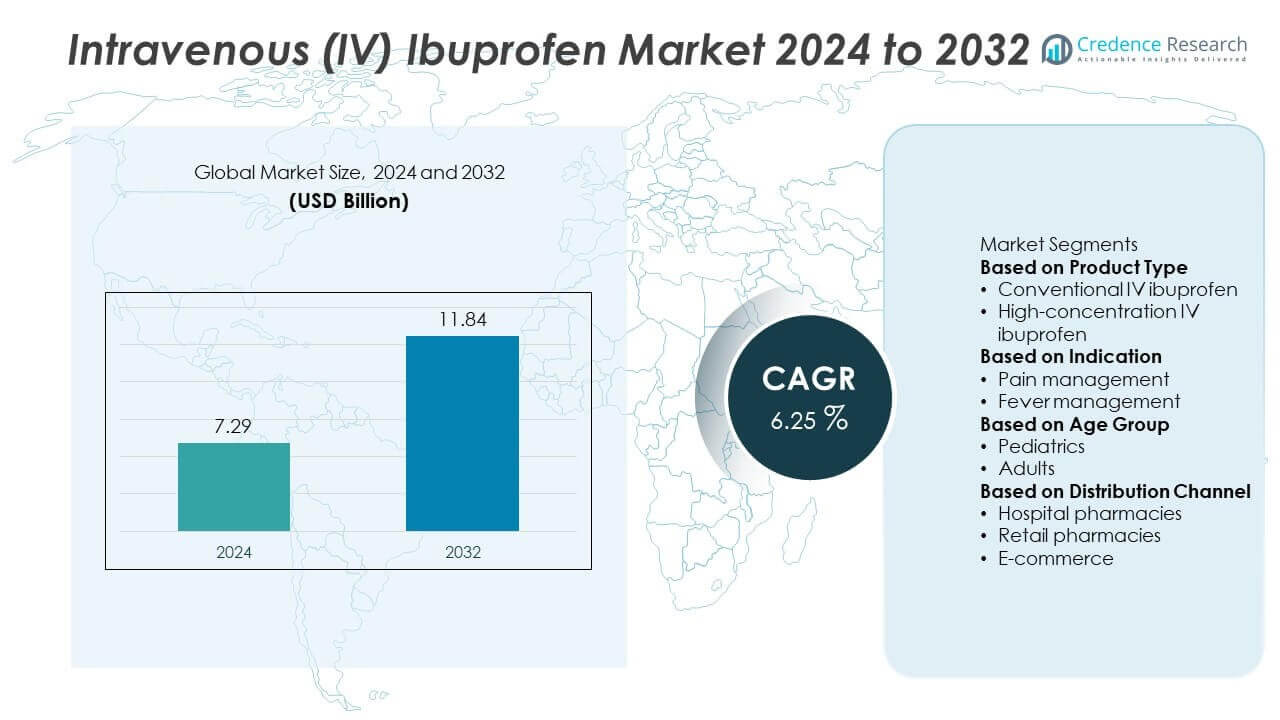

The global Intravenous (IV) Ibuprofen Market was valued at USD 7.29 billion in 2024 and is projected to reach USD 11.84 billion by 2032, growing at a CAGR of 6.25% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Intravenous (IV) Ibuprofen Market Size 2024 |

USD 7.29 Billion |

| Intravenous (IV) Ibuprofen Market, CAGR |

6.25% |

| Intravenous (IV) Ibuprofen Market Size 2032 |

USD 11.84 Billion |

The Intravenous (IV) Ibuprofen Market grows with rising demand for effective pain relief and fever management in surgical and critical care settings. Hospitals adopt IV ibuprofen to support multimodal analgesia protocols and reduce opioid reliance. Geographically, the Intravenous (IV) Ibuprofen Market shows strong growth across North America, Europe, and Asia-Pacific, supported by rising surgical procedures and adoption of multimodal pain management protocols. North America leads with advanced healthcare infrastructure, high surgical volumes, and strong emphasis on opioid-sparing pain control strategies. Europe follows with widespread availability of generic formulations and government-backed healthcare programs that encourage safe, evidence-based analgesic use. Asia-Pacific emerges as the fastest-growing region due to expanding hospital infrastructure, increasing medical tourism, and improving access to advanced pain management therapies. Key players shaping this market include Cumberland Pharmaceuticals Inc., Fresenius Kabi AG, Hikma Pharmaceuticals PLC, and Pfizer Inc. These companies focus on manufacturing high-quality formulations, expanding regulatory approvals, and strengthening global distribution networks. Strategic collaborations with hospitals and healthcare providers enable them to improve accessibility, enhance patient outcomes, and meet growing demand for fast-acting, non-opioid pain relief solutions worldwide.

Market Insights

- The Intravenous (IV) Ibuprofen Market was valued at USD 7.29 billion in 2024 and is projected to reach USD 11.84 billion by 2032, growing at a CAGR of 6.25% during the forecast period.

- Rising demand for effective pain management and fever reduction in surgical and critical care settings drives market growth.

- Growing adoption of multimodal analgesia protocols and opioid-sparing strategies boosts demand for IV ibuprofen in hospitals.

- Key players such as Cumberland Pharmaceuticals Inc., Fresenius Kabi AG, Hikma Pharmaceuticals PLC, and Pfizer Inc. focus on product innovation, global distribution, and regulatory approvals to strengthen their market presence.

- High treatment costs, cold-chain storage requirements, and limited access in low-resource regions remain major challenges for widespread adoption.

- North America leads due to high surgical volumes and strong healthcare infrastructure, while Europe benefits from government-supported healthcare systems and availability of generics.

- Asia-Pacific is the fastest-growing region, supported by expanding hospital networks, rising medical tourism, and growing awareness of advanced pain management therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Drivers

Rising Demand for Effective Pain Management Solutions

The Intravenous (IV) Ibuprofen Market grows with increasing need for rapid pain relief in hospitals and surgical centers. IV ibuprofen is widely used for post-operative pain management, reducing reliance on opioids. It helps control inflammation and improves patient recovery outcomes. Growing incidence of chronic pain conditions, including arthritis and musculoskeletal disorders, drives demand. Healthcare providers prefer IV administration for faster onset of action in acute care settings. This trend supports strong adoption across developed and emerging healthcare systems.

- For instance, Cumberland Pharmaceuticals published a pooled analysis of 1,041 patients using Caldolor IV ibuprofen, including 284 patients aged 60+, showing significant reductions in pain and morphine requirement without increased renal or GI adverse events.

Increasing Surgical Procedures and Hospital Admissions

Global rise in elective surgeries and emergency procedures boosts the Intravenous (IV) Ibuprofen Market. Hospitals use IV ibuprofen for managing perioperative pain and lowering fever in critically ill patients. It plays a vital role in multimodal analgesia strategies that reduce opioid use and shorten hospital stays. Growing geriatric population leads to higher rates of orthopedic and cardiovascular surgeries. Rising prevalence of trauma and injury cases increases hospital admissions, creating steady demand. This surge in procedural volume strengthens the market outlook.

- For instance, a 2025 subgroup analysis of older patients found that Cumberland Pharmaceuticals’ IV ibuprofen (Caldolor) resulted in a 24.0% reduction in pain at rest, a 20.0% reduction in pain with movement, and a 23.2% reduction in total morphine requirement within the first 24 hours after surgery compared with placebo.

Favorable Clinical Guidelines and Opioid-Sparing Policies

Supportive clinical recommendations drive the Intravenous (IV) Ibuprofen Market forward. Medical associations encourage non-opioid analgesics to minimize dependency risks. It aligns with global efforts to curb opioid misuse and enhance patient safety. Hospital formularies include IV ibuprofen as a key option in pain protocols. Awareness among healthcare professionals about its efficacy and safety profile is growing. Adoption of opioid-sparing approaches ensures sustained demand in surgical and acute care settings.

Technological Advancements and Product Availability

Expansion of manufacturing capabilities and formulation improvements enhance the Intravenous (IV) Ibuprofen Market. Pharmaceutical companies focus on producing stable, ready-to-use formulations with longer shelf life. It ensures easier handling and administration in hospital settings. Increasing regulatory approvals in multiple regions improve global availability. Strategic partnerships between drug manufacturers and hospital networks strengthen supply chains. These developments create consistent growth opportunities and improve patient access to treatment.

Market Trends

Growing Preference for Non-Opioid Analgesics

The Intravenous (IV) Ibuprofen Market shows a strong shift toward non-opioid pain management. Hospitals adopt IV ibuprofen to minimize opioid prescriptions and related side effects. It supports multimodal analgesia protocols that improve patient recovery and satisfaction. Rising concerns over opioid misuse and dependence encourage physicians to choose safer alternatives. Clinical studies validate its effectiveness in reducing post-surgical pain and inflammation. This trend accelerates adoption across surgical centers and emergency departments worldwide.

- For instance, Cumberland Pharmaceuticals funded a retrospective database study, which was published in Frontiers in Pain Research in January 2025, comparing Caldolor (IV ibuprofen) with IV/IM ketorolac. The analysis, which included more than 31,000 adult patients and over 5,500 pediatric patients, showed that adult patients receiving IV ibuprofen experienced significantly fewer renal complications (45% reduction) and hematuria events (78% reduction) compared to those receiving ketorolac.

Increasing Adoption in Ambulatory and Day-Care Settings

The Intravenous (IV) Ibuprofen Market experiences rising use in ambulatory surgical centers and outpatient facilities. Shorter procedure times and same-day discharge models require rapid-onset pain relief solutions. It offers predictable results and quick recovery support, aligning with outpatient care goals. Growing preference for minimally invasive surgeries fuels this demand. Healthcare providers invest in stocking IV ibuprofen for routine use in minor surgeries. This shift diversifies its application beyond traditional hospital settings.

- For instance, Hyloris and AFT Pharmaceuticals submitted the New Drug Application (NDA) for Maxigesic® IV based on two Phase 3 trials: one in 276 patients after bunionectomy and another in 232 patients undergoing general, orthopedic, or plastic surgery.

Focus on Pediatric and Geriatric Applications

Expanding clinical use among pediatric and elderly patients supports the Intravenous (IV) Ibuprofen Market. Hospitals administer IV ibuprofen to manage fever and pain safely in populations where oral medications are unsuitable. It ensures controlled dosing and consistent therapeutic outcomes. Rising prevalence of age-related surgeries such as joint replacements drives geriatric usage. Pediatric research continues to strengthen confidence in its safety profile. Broader acceptance in sensitive patient groups widens its treatment scope.

Product Development and Global Market Expansion

Pharmaceutical companies invest in innovative formulations and distribution strategies to grow the Intravenous (IV) Ibuprofen Market. Ready-to-use vials and pre-mixed solutions improve efficiency for hospital staff. It reduces preparation errors and supports faster administration. Expansion into emerging markets improves access in regions with growing surgical volumes. Strategic alliances with hospital networks secure long-term supply contracts. Continuous regulatory approvals across geographies enhance product availability and market reach.

Market Challenges Analysis

High Cost and Limited Availability in Low-Resource Settings

The Intravenous (IV) Ibuprofen Market faces challenges due to high treatment costs and limited access in developing regions. IV formulations are more expensive than oral alternatives, creating affordability issues for smaller hospitals. It requires cold-chain logistics and proper storage conditions, which are difficult to maintain in remote areas. Limited reimbursement coverage in certain countries discourages widespread adoption. Healthcare providers in cost-sensitive markets often rely on cheaper analgesics despite slower onset. These factors restrict market penetration and delay global accessibility.

Safety Concerns and Regulatory Barriers

The Intravenous (IV) Ibuprofen Market also encounters concerns regarding potential adverse effects such as gastrointestinal bleeding and renal complications. It requires careful dosing and monitoring, especially in high-risk patients. Regulatory agencies impose stringent approval processes, lengthening product launch timelines. Supply chain disruptions and raw material shortages impact consistent availability in some regions. Short shelf life of certain formulations adds to hospital inventory challenges. These obstacles slow adoption rates and create hurdles for manufacturers expanding into new markets.

Market Opportunities

Expanding Surgical Volumes and Multimodal Pain Protocols

The Intravenous (IV) Ibuprofen Market holds strong opportunities with rising global surgical volumes and wider adoption of multimodal pain management strategies. Hospitals include IV ibuprofen in enhanced recovery after surgery (ERAS) protocols to reduce opioid dependence. It delivers effective pain control and shortens hospital stays, aligning with cost-containment goals. Growth in orthopedic, cardiovascular, and bariatric surgeries continues to fuel demand. Increasing focus on patient satisfaction drives hospitals to adopt faster-acting, safer analgesic solutions. This creates consistent opportunities for drug manufacturers and suppliers to expand their hospital partnerships.

Emerging Markets and Formulation Innovations

The Intravenous (IV) Ibuprofen Market benefits from expanding access to advanced analgesics in emerging economies. Governments invest in upgrading hospital infrastructure and improving availability of injectable medications. It encourages wider use of IV pain management in tier-2 and tier-3 healthcare facilities. Pharmaceutical companies develop stable, ready-to-administer formulations to simplify hospital workflows. Global players explore partnerships and local manufacturing to reduce costs and improve reach. These factors open significant growth avenues across Asia, Latin America, and the Middle East.

Market Segmentation Analysis:

By Product Type

The Intravenous (IV) Ibuprofen Market is segmented into vials, pre-mixed solutions, and others. Pre-mixed solutions are gaining traction due to their ease of use and reduced preparation time in hospitals. It minimizes medication errors and supports faster administration in emergency settings. Vials continue to hold a significant share as they remain cost-effective for bulk hospital purchases. Pharmaceutical manufacturers are investing in ready-to-use formats with extended shelf life to improve hospital adoption. Growing focus on improving workflow efficiency and reducing labor costs drives preference for convenient product types.

- For instance, Caldolor is available in a 100 mg/mL concentration formulation: an 800 mg dose in 8 mL vial, and a ready-to-use bag delivering 4 mg/mL over 200 mL.

By Indication

The market is divided into pain management, fever reduction, and inflammation control. Pain management dominates due to rising surgical procedures and increasing demand for effective post-operative care. It plays a crucial role in multimodal analgesia protocols aimed at reducing opioid use. Fever reduction also represents a key application, particularly in intensive care units where rapid temperature control is necessary. Use in inflammatory conditions such as arthritis and trauma-related swelling is expanding, further supporting segment growth. Clinical studies highlighting its efficacy in multiple indications encourage wider use across healthcare settings.

- For instance, AFT Pharmaceuticals’ financial results for the 2024 financial year highlighted strong growth in its Maxigesic pain relief range in Australasia. The company’s intravenous formulation, Maxigesic IV, is typically used for post-operative pain and fever reduction rather than being solely or routinely for ICU fever management.

By Age Group

The Intravenous (IV) Ibuprofen Market is segmented into adult, pediatric, and geriatric groups. Adults represent the largest share due to high surgical volume and frequent use in emergency care. It is widely used in orthopedic, cardiovascular, and general surgeries where quick recovery is prioritized. Pediatric adoption is growing as research confirms its safety and effectiveness in children unable to take oral medications. Geriatric use is increasing with the rising prevalence of age-related procedures and chronic pain conditions. Hospitals are focusing on tailored dosing regimens to improve outcomes across all patient groups.

Segments:

Based on Product Type

- Conventional IV ibuprofen

- High-concentration IV ibuprofen

Based on Indication

- Pain management

- Fever management

Based on Age Group

Based on Distribution Channel

- Hospital pharmacies

- Retail pharmacies

- E-commerce

Based on the Geography:

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Regional Analysis

North America

North America holds 38% market share in the Intravenous (IV) Ibuprofen Market, making it the leading regional market. The United States drives growth with a high volume of surgical procedures, advanced healthcare infrastructure, and strong adoption of multimodal pain management protocols. It benefits from widespread availability of IV ibuprofen in hospitals and ambulatory surgical centers. Favorable reimbursement policies and ongoing efforts to reduce opioid usage strengthen demand. Canada also contributes significantly, supported by public healthcare initiatives and an aging population requiring orthopedic and cardiovascular surgeries. Increasing focus on patient-centric care and rapid recovery solutions ensures continued market expansion in this region.

Europe

Europe accounts for 27% market share, driven by well-established hospital networks and strong clinical adoption of IV ibuprofen. Countries such as Germany, France, and the UK lead in surgical volume and perioperative pain management protocols. It sees rising demand for opioid-sparing analgesics to comply with updated clinical guidelines. The region benefits from government-supported healthcare systems, which encourage the use of safe, evidence-based pain control methods. Availability of generic formulations supports affordability and broader access. Growing geriatric population and increasing elective surgeries further boost the demand for IV ibuprofen in European healthcare facilities.

Asia-Pacific

Asia-Pacific captures 22% market share and emerges as the fastest-growing regional market. Rapid expansion of healthcare infrastructure in China, India, and Southeast Asia drives increased availability of IV ibuprofen in both urban and semi-urban hospitals. It benefits from rising surgical procedures due to growing middle-class populations and improved access to healthcare. Medical tourism in countries like India and Thailand fuels procedural volume and analgesic consumption. Pharmaceutical companies focus on local manufacturing to reduce costs and improve supply reliability. Rising awareness of advanced pain management techniques supports wider adoption of IV ibuprofen across the region.

Latin America

Latin America represents 7% market share, supported by gradual improvements in healthcare infrastructure and rising surgical admissions. Brazil and Mexico are key contributors, with growing adoption of multimodal pain management practices. It faces challenges related to cost and availability in rural regions, but urban hospitals increasingly use IV ibuprofen for post-operative care. Government initiatives to modernize healthcare systems and improve access to essential medications support market growth. Partnerships between global pharmaceutical companies and local distributors help expand regional reach. Increasing focus on quality patient care drives hospitals to adopt faster-acting analgesics.

Middle East and Africa

Middle East and Africa hold 6% market share, driven by rising investment in hospital infrastructure and critical care facilities. Gulf Cooperation Council (GCC) countries lead with advanced surgical centers and high healthcare spending. It sees increasing use of IV ibuprofen for fever management and pain control in intensive care units. African nations gradually expand access to essential medications through international aid and government programs. Growing awareness about non-opioid pain management creates new opportunities in urban hospitals. Expansion of private healthcare networks supports steady demand for IV ibuprofen in both regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Harbin Gloria Pharmaceuticals

- Grifols

- Cumberland Pharmaceuticals

- CSL Limited

- Hyloris Pharmaceuticals

- AFT Pharmaceuticals

- Fresenius SE & Co. KGaA

- Laboratorios Valmorca

- Alveda Pharmaceuticals

- Al Nabeel International

Competitive Analysis

Competitive landscape of the Intravenous (IV) Ibuprofen Market is shaped by key players such as AFT Pharmaceuticals, Fresenius SE & Co. KGaA, Cumberland Pharmaceuticals, CSL Limited, Grifols, Harbin Gloria Pharmaceuticals, Hyloris Pharmaceuticals, Laboratorios Valmorca, Alveda Pharmaceuticals, and Al Nabeel International. These companies focus on developing high-quality IV formulations that deliver rapid pain relief and fever management in surgical and critical care settings. They invest in research and innovation to create ready-to-use and stable products that improve hospital workflow efficiency. Strategic collaborations with healthcare providers and distributors help expand product availability across multiple regions, including emerging markets with growing hospital infrastructure. Regulatory approvals and compliance with global quality standards remain central to their expansion strategies. Competitive pricing, efficient manufacturing capabilities, and robust supply chain networks allow them to meet rising demand in both public and private healthcare sectors. These players strengthen their market position by prioritizing safety, efficacy, and accessibility while supporting the global shift toward opioid-sparing pain management solutions.

Recent Developments

- In June 2025, RheumatologyAdvisor reported that IV ibuprofen in older adults resulted in a 24.0 reduction in pain at rest, 20.0 reduction in pain with movement, and 23.2 reduction in total morphine requirement between 6 and 24 hours post-surgery, when compared with placebo.

- In May 2025, Cumberland Pharmaceuticals announced a study funded by the company found no significant increases in gastrointestinal, renal, cardiovascular or bleeding adverse events when using IV ibuprofen in older adults.

- In 2025, Anesthesiology News published that IV ibuprofen is safe and effective for managing pain and fever in patients aged 60 years and older.

- In October 2023, Hyloris Pharmaceuticals received U.S. FDA approval for Maxigesic® IV (a combination of 1,000 mg paracetamol with 300 mg ibuprofen for infusion) to treat mild to moderate pain and as adjunct for moderate to severe pain in adults where IV administration is required.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Indication, Age Group, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for IV ibuprofen will rise with increasing global surgical volumes and hospital admissions.

- Hospitals will adopt it widely as part of multimodal pain management protocols to reduce opioid use.

- Development of ready-to-use and extended shelf-life formulations will improve hospital efficiency.

- Expansion of healthcare infrastructure in emerging economies will boost product availability and adoption.

- Regulatory approvals in new markets will create fresh opportunities for global manufacturers.

- Research on pediatric and geriatric applications will expand usage in sensitive patient groups.

- Partnerships between pharmaceutical companies and hospital networks will strengthen supply chains.

- Growing focus on patient recovery outcomes will drive preference for faster-acting analgesics.

- Competition will increase, encouraging manufacturers to improve pricing and production efficiency.

- Rising awareness of opioid-sparing strategies will support long-term market growth worldwide.