Market Overview

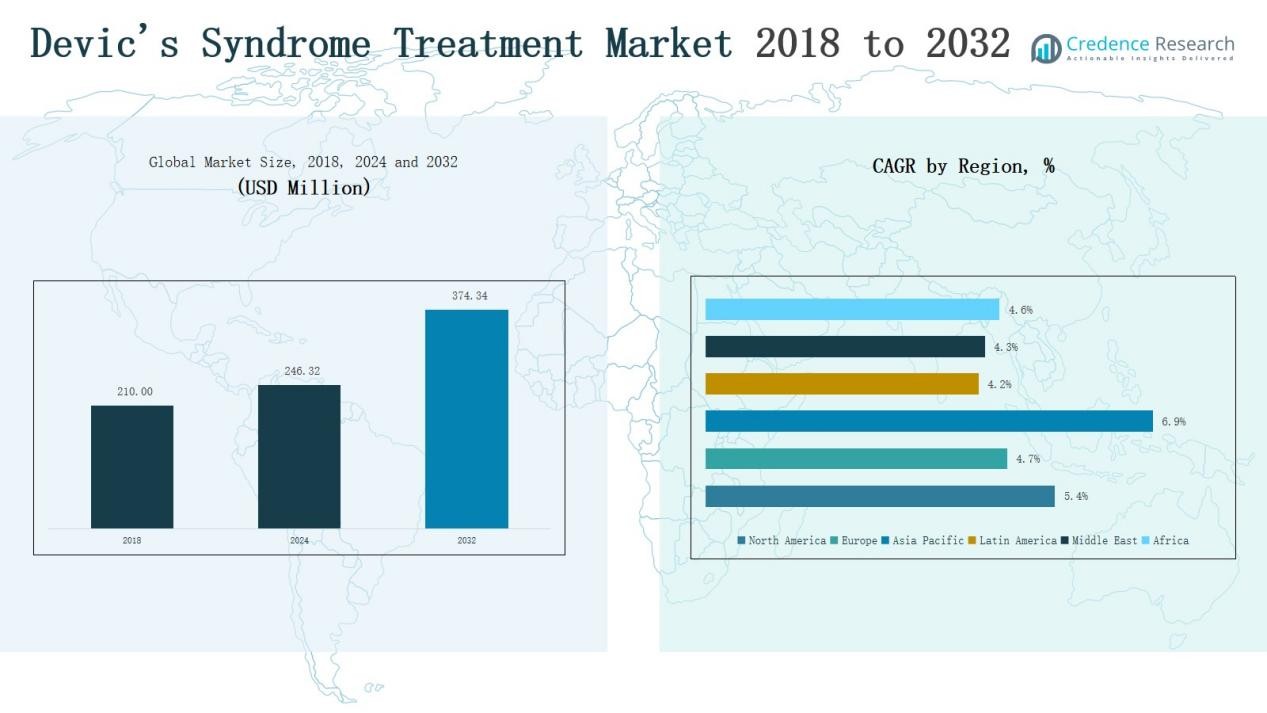

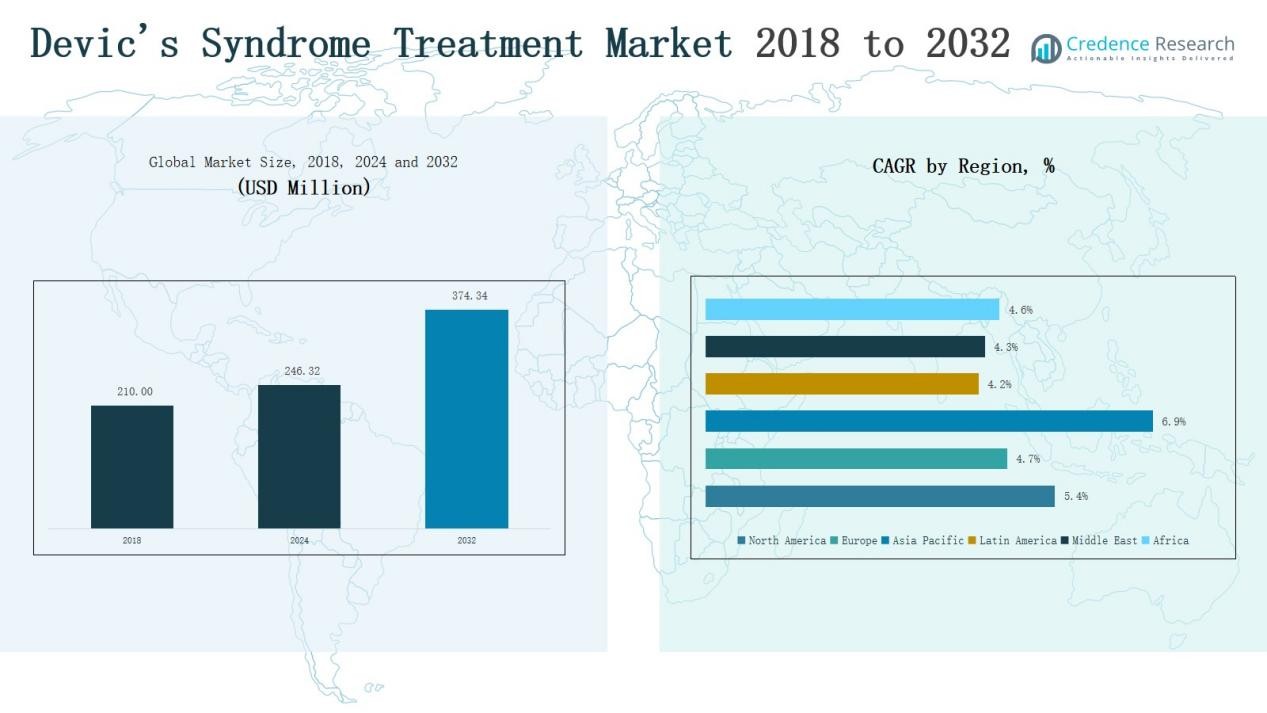

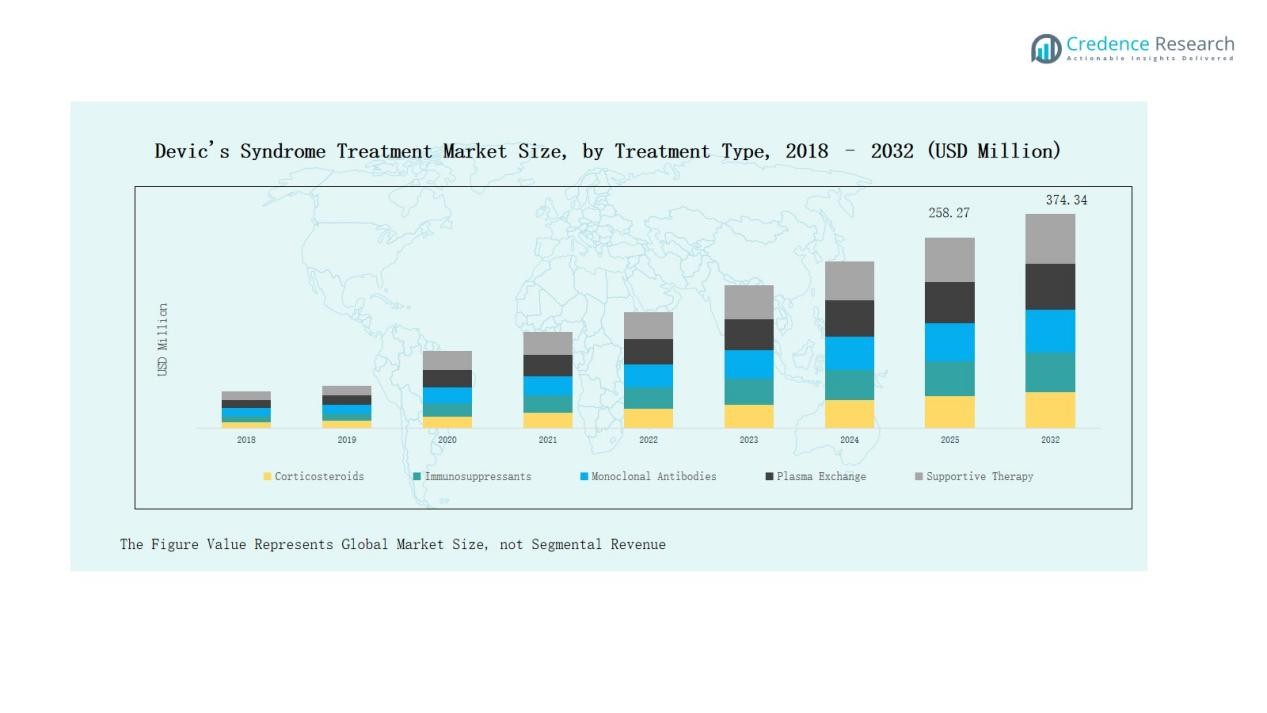

Devic’s Syndrome Treatment Market size was valued at USD 210.00 million in 2018 to USD 246.32 million in 2024 and is anticipated to reach USD 374.34 million by 2032, at a CAGR of 5.45% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Devic’s Syndrome Treatment Market Size 2024 |

USD 246.32 Million |

| Devic’s Syndrome Treatment Market, CAGR |

5.45% |

| Devic’s Syndrome Treatment Market Size 2032 |

USD 374.34 Million |

The Devic’s Syndrome Treatment Market is shaped by leading players such as Alexion Pharmaceuticals, F. Hoffmann-La Roche, Viela Bio, Chugai Pharmaceutical, and Teva Pharmaceutical Industries. These companies maintain strong portfolios across biologics, immunotherapies, and cost-effective treatment solutions, reinforcing their competitive edge through product innovation, regulatory approvals, and strategic collaborations. Alexion remains at the forefront with advanced biologic therapies, while Roche and Chugai continue to expand their monoclonal antibody pipelines. Viela Bio has strengthened its position with novel treatment launches, and Teva supports accessibility through affordable immunosuppressants. Regionally, North America leads the market with a 44.9% share in 2024, driven by advanced healthcare infrastructure, strong reimbursement policies, and early adoption of innovative biologic therapies.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Devic’s Syndrome Treatment Market grew from USD 210.00 million in 2018 to USD 246.32 million in 2024, projected to reach USD 374.34 million by 2032.

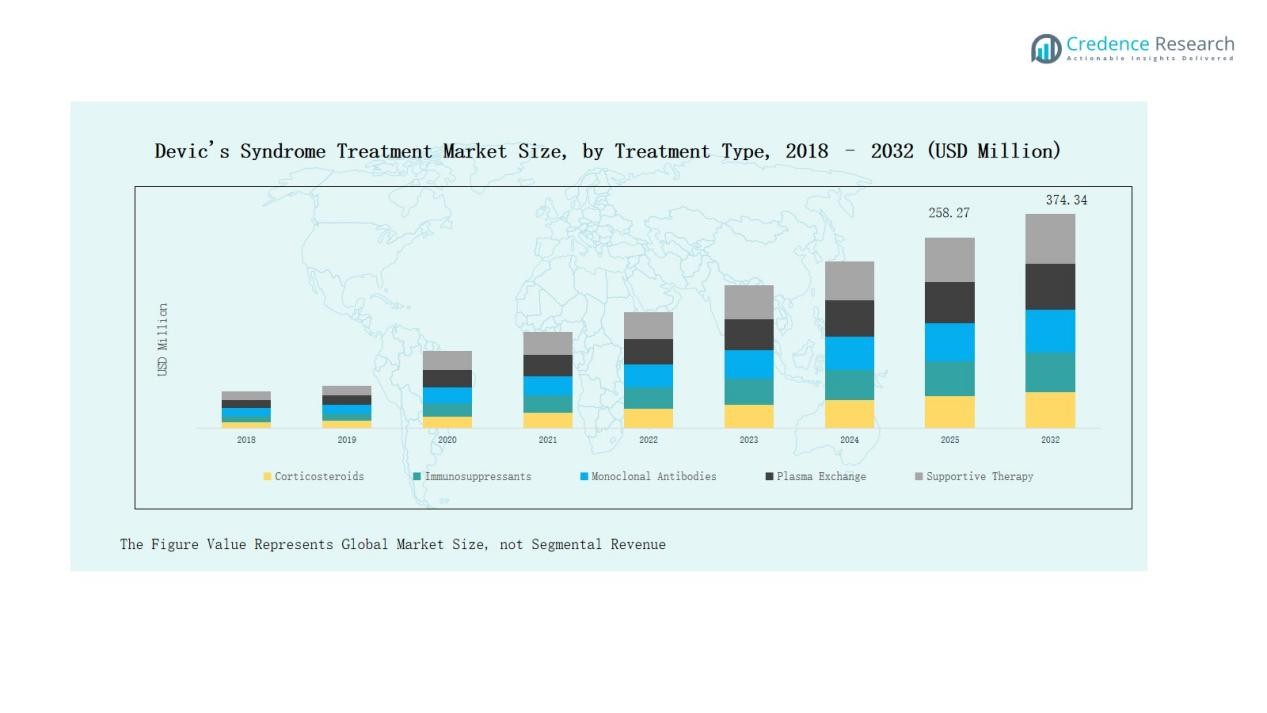

- Monoclonal antibodies lead with 42% share, followed by immunosuppressants, corticosteroids, plasma exchange, and supportive therapy, reflecting the dominance of biologics in relapse prevention.

- Hospital pharmacies hold 55% share, making them the leading distribution channel, while retail pharmacies and online pharmacies support long-term care and patient convenience.

- Hospitals dominate end-user share at 50%, with specialty clinics and home healthcare providers contributing significantly to ongoing care management and supportive therapies.

- North America leads with 44.9% market share in 2024, supported by advanced healthcare infrastructure, strong reimbursement policies, and early adoption of biologic therapies.

Market Segment Insights

By Type Segment

In the Devic’s Syndrome Treatment Market, monoclonal antibodies dominate with around 42% share, driven by strong efficacy in relapse prevention and rising approvals of advanced biologics. Immunosuppressants follow with nearly 25%, sustained by affordability and broad use in maintenance therapy. Corticosteroids account for about 18%, remaining vital in acute management of relapses. Plasma exchange holds approximately 9%, reserved for severe episodes requiring urgent intervention, while supportive therapy represents nearly 6%, focused on symptom relief and quality-of-life improvement.

- For instance, Alexion Pharmaceuticals gained FDA approval for Ultomiris (ravulizumab) for NMOSD, reinforcing its position as a long-acting complement inhibitor with proven relapse risk reduction.

By Distribution Channel Segment

Hospital pharmacies lead the distribution channel with a commanding 55% share, reflecting their role in administering complex biologics and plasma exchange drugs under specialist care. Retail pharmacies contribute close to 28%, largely from prescriptions for corticosteroids and immunosuppressants used in long-term care. Online pharmacies account for about 17%, supported by the growth of telemedicine, home delivery services, and rising patient convenience preferences.

By End-User Segment

Among end-users, hospitals dominate with nearly 50% share, owing to their critical role in acute episode management, including intravenous corticosteroid administration and plasma exchange procedures. Specialty clinics secure about 30%, reflecting their importance in ongoing care management, regular monitoring, and biologic therapy delivery. Home healthcare providers hold close to 20%, driven by the shift of supportive therapies and select biologics into patient-centric home settings.

- For instance, Cleveland Clinic expanded access to biologic therapies by integrating advanced infusion services at its specialty clinics, enabling precise administration and monitoring.

Key Growth Drivers

Rising Prevalence of Neuromyelitis Optica Spectrum Disorder (NMOSD)

The increasing global prevalence of neuromyelitis optica spectrum disorder, commonly associated with Devic’s Syndrome, is driving demand for advanced treatment options. Growing awareness and improved diagnostic capabilities have led to higher detection rates, ensuring that more patients gain access to targeted therapies. The rise in patient population has encouraged pharmaceutical companies to prioritize research and development in monoclonal antibodies and immunosuppressants, which are now widely considered frontline treatments. This prevalence surge strengthens the overall market outlook.

- For instance, Alexion’s Ultomiris (ravulizumab) entered Phase 3 clinical trials for NMOSD, extending its portfolio of complement inhibitors beyond paroxysmal nocturnal hemoglobinuria and atypical hemolytic uremic syndrome

Advancements in Biologic Therapies

The market benefits significantly from rapid advancements in biologic therapies, particularly monoclonal antibodies. These treatments demonstrate higher efficacy in preventing relapses and improving patient outcomes compared to traditional therapies. Regulatory approvals of drugs such as eculizumab and inebilizumab have transformed clinical practice, establishing biologics as standard-of-care options in many regions. Continuous innovation, coupled with expanding clinical trials for next-generation biologics, is expected to further strengthen adoption. This scientific progress not only enhances patient safety but also ensures long-term commercial growth for biopharmaceutical companies.

- For instance, AstraZeneca received U.S. FDA approval for Ultomiris (ravulizumab) for adult patients with neuromyelitis optica spectrum disorder, expanding the reach of next-generation complement inhibitors.

Supportive Government and Reimbursement Policies

Government support and favorable reimbursement policies are key growth drivers in the Devic’s Syndrome Treatment Market. Many countries are implementing reimbursement schemes to reduce patient cost burden, thereby expanding access to advanced therapies such as biologics. Financial incentives for orphan disease treatment development are also encouraging pharmaceutical firms to invest in niche markets. Additionally, healthcare authorities are collaborating with patient advocacy groups to improve awareness and accessibility. These initiatives are reinforcing treatment adoption across developed and emerging markets, fueling consistent growth momentum.

Key Trends & Opportunities

Growing Shift Toward Personalized Medicine

The trend toward personalized medicine is reshaping the Devic’s Syndrome Treatment Market. Clinicians increasingly rely on genetic and biomarker testing to identify patient subgroups most likely to respond to specific therapies. This approach reduces trial-and-error prescribing, improves treatment efficiency, and enhances safety profiles. Pharmaceutical companies are exploring companion diagnostics in tandem with biologics, enabling better patient stratification. This trend not only advances clinical outcomes but also opens new commercial opportunities in precision therapies designed for rare autoimmune disorders such as Devic’s Syndrome.

- For instance, Genentech received FDA approval for Enspryng (satralizumab-mwge), a biologic therapy targeting specific immune pathways in NMOSD, alongside companion diagnostic strategies to identify eligible patients more precisely.

Expansion of Digital Health and Telemedicine Integration

Telemedicine adoption offers significant opportunities for improving patient care in Devic’s Syndrome management. Remote consultations, e-prescriptions, and online pharmacy integration provide greater accessibility, particularly for patients in remote or underserved areas. Digital platforms also enable continuous monitoring of treatment outcomes and adherence, strengthening long-term disease control. Pharmaceutical companies and healthcare providers are increasingly leveraging digital health solutions to support home delivery of therapies and patient engagement programs. This integration is expected to enhance market reach and optimize healthcare delivery efficiency.

- For instance, Novartis partnered with the digital health platform Ada Health to integrate AI-driven symptom tracking and remote patient support tools into immunological and rare disease care pathways.

Key Challenges

High Cost of Biologic Therapies

The substantial cost of biologic therapies, particularly monoclonal antibodies, presents a major challenge. These treatments often exceed the affordability range of patients in developing markets, limiting access despite clinical benefits. Even in developed regions, reimbursement hurdles can delay or restrict availability. The high pricing structure also places pressure on healthcare systems managing chronic autoimmune disorders. Unless cost-effective alternatives or biosimilars are developed, pricing barriers will continue to hinder market penetration and prevent equitable global access to advanced therapies.

Limited Awareness and Diagnostic Delays

Delayed diagnosis remains a critical challenge in managing Devic’s Syndrome effectively. Limited awareness among both patients and primary healthcare providers often results in misdiagnosis or late-stage identification. This diagnostic lag increases the risk of severe relapses, leading to irreversible disability and higher treatment costs. Awareness gaps are especially prominent in emerging markets where specialized neurology services are scarce. Strengthening physician education programs and expanding access to diagnostic tools are vital for improving early detection and subsequent treatment outcomes.

Dependency on Specialized Infrastructure

The treatment of Devic’s Syndrome often requires specialized infrastructure such as infusion centers, plasma exchange units, and advanced hospital facilities. This dependency creates barriers in regions with limited healthcare infrastructure and trained professionals. Rural and low-resource settings face challenges in delivering timely and effective care. The lack of standardized treatment centers further limits widespread adoption of advanced biologics and plasma therapies. Overcoming this challenge will require significant healthcare investments and cross-sector collaboration to expand infrastructure capacity globally.

Regional Analysis

North America

North America dominates the Devic’s Syndrome Treatment Market with a 44.9% share in 2024. The region benefits from advanced healthcare infrastructure, strong presence of leading pharmaceutical companies, and early adoption of biologic therapies. Robust reimbursement frameworks and high awareness levels support strong uptake of monoclonal antibodies and plasma exchange. With revenues increasing from USD 95.13 million in 2018 to an expected USD 167.47 million by 2032, the region is projected to grow at a CAGR of 5.4%. Continuous R&D investments and expanding clinical trials further enhance the regional outlook.

Europe

Europe ranks second in market share, accounting for 24.4% in 2024. Growth is supported by favorable reimbursement policies, well-established healthcare systems, and high adoption of innovative biologics across major markets such as Germany, France, and the UK. The regional market is expected to rise from USD 53.34 million in 2018 to USD 86.00 million by 2032, reflecting a steady CAGR of 4.7%. Increasing collaborations between pharmaceutical companies and research institutes are expected to accelerate product development and maintain Europe’s strong market position.

Asia Pacific

Asia Pacific is the fastest-growing region, holding 19.5% share in 2024 and expanding at a CAGR of 6.9%. Rising healthcare investments, larger patient population, and rapid adoption of advanced therapies are fueling growth. Countries such as China, Japan, and India are key contributors, driven by improved diagnostic capabilities and government initiatives to expand treatment access. Market revenues are projected to increase from USD 38.75 million in 2018 to USD 82.13 million by 2032. The region’s strong growth outlook highlights significant opportunities for global and regional pharmaceutical companies.

Latin America

Latin America contributes 5.0% of the market in 2024, supported by growing awareness of rare neurological disorders and gradual improvements in healthcare infrastructure. Brazil and Argentina remain the primary revenue-generating countries. The market is forecast to expand from USD 10.71 million in 2018 to USD 17.17 million by 2032, at a CAGR of 4.2%. While limited access to high-cost biologics remains a barrier, increasing adoption of generics and supportive government programs are expected to improve patient access and strengthen market growth.

Middle East

The Middle East holds 4.2% market share in 2024, with demand driven by advanced hospital networks in GCC countries and growing adoption of biologic therapies. Revenues are expected to climb from USD 9.41 million in 2018 to USD 14.56 million by 2032, growing at a CAGR of 4.3%. High healthcare spending in countries such as Saudi Arabia and the UAE contributes to regional expansion. However, limited penetration in non-GCC countries highlights a need for broader infrastructure development and investment in rare disease treatment programs.

Africa

Africa represents the smallest market, with 1.9% share in 2024, but shows steady growth potential. Revenues are projected to increase from USD 2.67 million in 2018 to USD 6.99 million by 2032, reflecting a CAGR of 4.6%. South Africa and Egypt lead the regional market, supported by gradually improving healthcare systems and growing awareness of rare diseases. Despite challenges related to affordability and limited specialized care facilities, international collaborations and NGO-led awareness initiatives are gradually expanding treatment access across the continent.

Market Segmentations:

By Type

- Corticosteroids

- Immunosuppressants

- Monoclonal Antibodies

- Plasma Exchange

- Supportive Therapy

By Distribution Channel

- Hospital Pharmacies

- Online Pharmacies

- Retail Pharmacies

By End-User

- Home Healthcare Providers

- Hospitals (Acute Episode Management)

- Specialty Clinics (Ongoing Care Management)

By Region

- North America(U.S., Canada, Mexico)

- Europe(UK, France, Germany, Italy, Spain, Russia, Rest of Europe)

- Asia Pacific(China, Japan, South Korea, India, Australia, Southeast Asia, Rest of Asia Pacific)

- Latin America(Brazil, Argentina, Rest of Latin America)

- Middle East(GCC Countries, Israel, Turkey, Rest of Middle East)

- Africa(South Africa, Egypt, Rest of Africa)

Competitive Landscape

The Devic’s Syndrome Treatment Market is moderately consolidated, with a few key players driving innovation and market expansion. Companies such as Alexion Pharmaceuticals, F. Hoffmann-La Roche, Viela Bio, Chugai Pharmaceutical, and Teva Pharmaceutical Industries are at the forefront, leveraging strong portfolios in biologics and immunotherapies. Alexion leads with its approved biologic therapies that have set benchmarks in treatment efficacy, while Roche and Chugai continue to expand through robust R&D pipelines targeting monoclonal antibodies. Viela Bio, now part of Horizon Therapeutics, has strengthened its position through strategic acquisitions and niche product launches. Teva remains competitive by offering cost-effective immunosuppressants, ensuring wider market penetration. The competitive environment is shaped by continuous clinical trials, regulatory approvals, and collaborations with research institutes. Partnerships, licensing agreements, and regional expansions are common strategies, as companies aim to improve accessibility and address unmet needs in both developed and emerging markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Players

Recent Developments

- In March 2024, the US FDA approved ULTOMIRIS (ravulizumab-cwvz) as the first long-acting C5 complement inhibitor for adults with anti-AQP4 antibody-positive NMOSD.

- In August 2025, Alexion and AstraZeneca Rare Disease reached a Letter of Intent with Canada’s pCPA to list ULTOMIRIS on provincial formularies for NMOSD and gMG.

- In April 2025, Amgen announced that UPLIZNA (inebilizumab-cdon) gained FDA approval for IgG4-related disease, with statements highlighting its broader potential in NMOSD and other autoimmune conditions.

Report Coverage

The research report offers an in-depth analysis based on Type, Distribution Channel, End User and Region. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Monoclonal antibodies will continue to dominate as frontline therapies due to proven efficacy.

- Biosimilars are expected to gain traction, improving affordability and patient access.

- Personalized medicine will shape treatment decisions through biomarker-driven approaches.

- Digital health platforms will enhance patient monitoring and therapy adherence.

- Emerging markets will witness stronger adoption with improved healthcare infrastructure.

- Collaborations between pharmaceutical companies and research institutes will expand clinical pipelines.

- Home-based care models will grow as supportive therapies shift outside hospitals.

- Government support and reimbursement reforms will expand treatment accessibility.

- Investment in rare disease awareness will drive early diagnosis and intervention.

- Strategic acquisitions and partnerships will intensify competition and global market presence.