Market overview

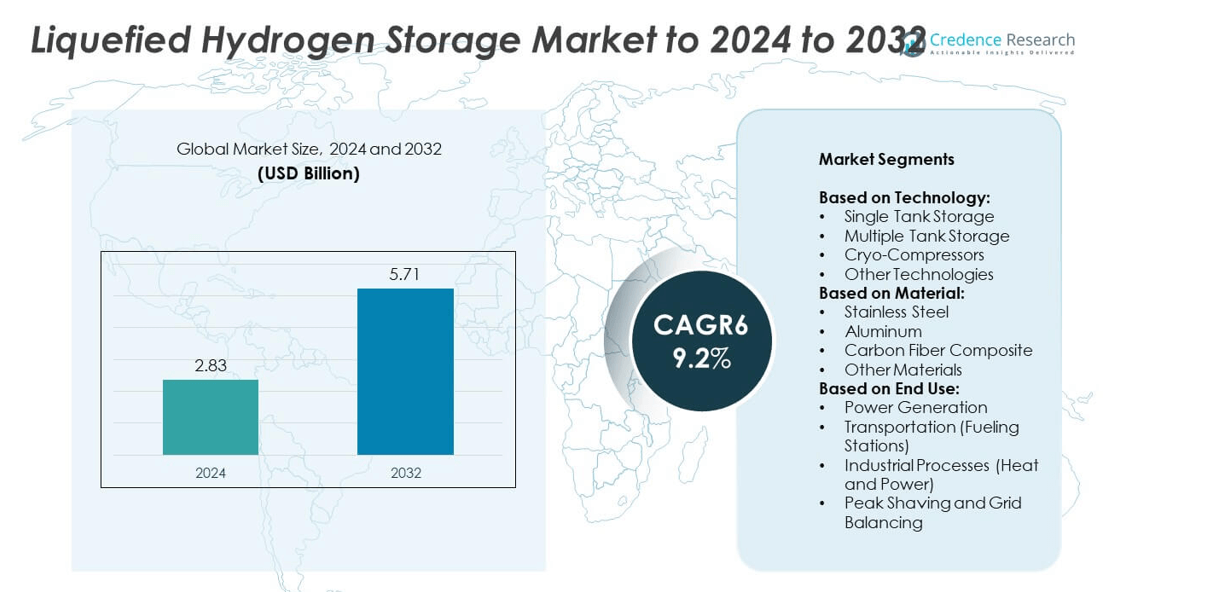

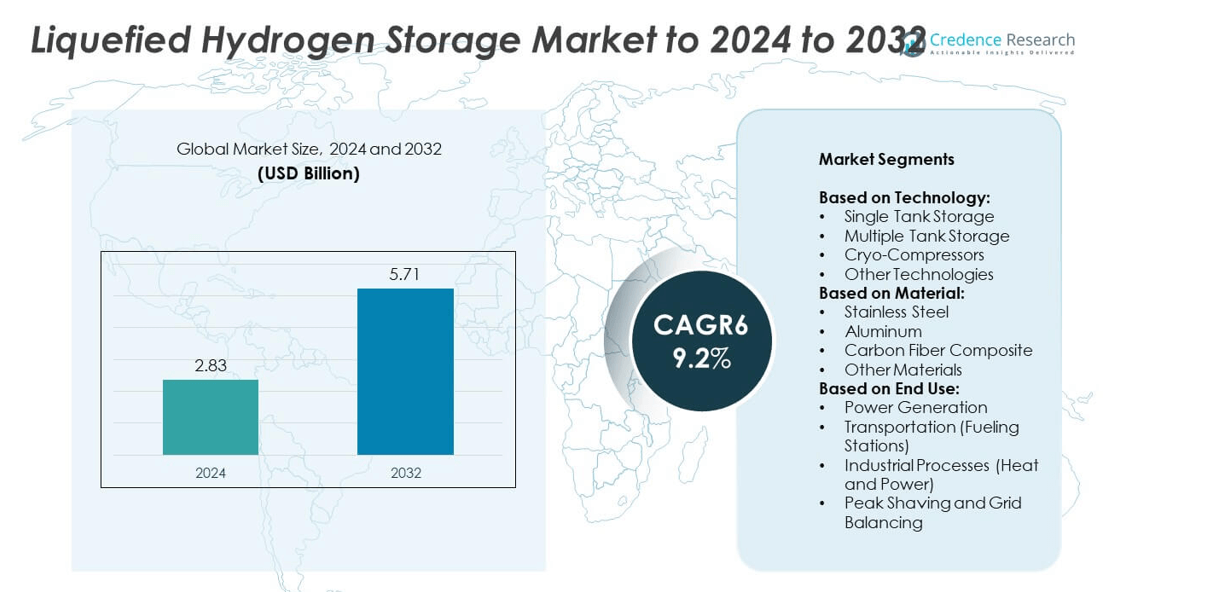

The Liquefied Hydrogen Storage Market size was valued at USD 2.83 Billion in 2024 and is anticipated to reach USD 5.71 Billion by 2032, at a CAGR of 9.2% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Liquefied Hydrogen Storage Market Size 2025 |

USD 2.83 Billion |

| Liquefied Hydrogen Storage Market, CAGR |

9.2% |

| Liquefied Hydrogen Storage Market Size 2032 |

USD 5.71 Billion |

The liquefied hydrogen storage market is shaped by major players including Air Liquide, Linde, Chart Industries, Air Products, Iwatani Corporation, Kawasaki, Showa Denko, and Worthington Industries. These companies are focusing on advanced cryogenic storage systems, lightweight composite tanks, and large-scale infrastructure to support hydrogen adoption in transportation, power generation, and industrial processes. North America emerged as the leading region in 2024 with a 38% share, driven by strong government funding and hydrogen hub development. Europe followed with 28% share, supported by ambitious decarbonization policies, while Asia Pacific accounted for 24%, fueled by large-scale projects in Japan, South Korea, and China.

Market Insights

- The liquefied hydrogen storage market was valued at USD 2.83 Billion in 2024 and is projected to reach USD 5.71 Billion by 2032, growing at a CAGR of 9.2% during.

- Rising adoption of hydrogen in transportation, particularly fueling stations holding over 50% share in 2024, is driving demand for efficient storage systems supported by government incentives and infrastructure investments.

- A key trend is the shift toward lightweight carbon fiber composites and advanced cryogenic technologies to improve efficiency, safety, and cost-effectiveness across mobility and industrial applications.

- The competitive landscape features strong players focusing on innovation, collaborations, and large-scale hydrogen hub development, with emphasis on expanding industrial use and renewable integration.

- North America led the market with 38% share in 2024, followed by Europe at 28% and Asia Pacific at 24%, while Latin America accounted for 6% and the Middle East and Africa together represented 4%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Technology

Single tank storage dominated the liquefied hydrogen storage market in 2024, holding more than 40% share due to its simpler design, operational reliability, and lower maintenance costs compared to other technologies. It remains the preferred option for stationary applications where efficiency and space optimization are critical. Multiple tank storage is expanding in large-scale projects, while cryo-compressors are gaining adoption for mobility solutions that require higher pressure handling. Growing investment in advanced containment and insulation systems is expected to support the adoption of other technologies across emerging hydrogen hubs.

- For instance, Verne and Lawrence Livermore National Laboratory (LLNL) demonstrated a single cryo-compressed hydrogen system storing over 29 kilograms of hydrogen. This benchmark represents a tripling of previous records for a single CcH2 system and is the first of its kind large enough for heavy-duty transportation, such as Class 8 semi-trucks.

By Material

Stainless steel accounted for the largest share of over 45% in 2024, driven by its durability, corrosion resistance, and compatibility with cryogenic temperatures. The material remains the industry benchmark for storage tanks used in power and transport sectors. Aluminum is being used for lighter structures, while carbon fiber composite materials are advancing in mobility solutions due to their weight advantage. Other materials, including hybrid composites, are under development to enhance efficiency. The push for lightweight yet robust designs is expected to accelerate the shift toward advanced composites in coming years.

- For instance, the NASA and CB&I tank for large-scale liquid hydrogen storage, as detailed in a 2021 technical document, uses SA-240 Grade 304 stainless steel for the inner vessel.

By End Use

Transportation, particularly fueling stations, held the dominant share of more than 50% in 2024, supported by rapid expansion of hydrogen refueling networks and adoption of fuel cell vehicles. Power generation is gaining momentum as liquefied hydrogen is increasingly integrated into renewable energy storage projects. Industrial processes such as heat and power applications continue to use hydrogen for efficiency and emission reduction. Peak shaving and grid balancing represent niche but growing applications, as grid operators look to hydrogen storage to stabilize renewable-heavy power systems and ensure long-term energy security.

Key Growth Drivers

Rising Adoption in Transportation Sector

The transportation sector is a key growth driver, as hydrogen-powered mobility expands globally. Fuel cell vehicles and hydrogen-powered trucks require efficient liquefied storage solutions for long-distance travel. Governments are investing in refueling infrastructure, particularly in Europe, Japan, and North America. Single and multiple tank storage technologies are being deployed in fueling stations to meet rising demand. With transportation accounting for more than half of end-use in 2024, the sector’s rapid expansion directly drives the adoption of advanced liquefied hydrogen storage systems.

- For instance, Kawasaki Heavy Industries launched its Suiso Frontier LH₂ carrier in December 2019, which is the world’s first liquefied hydrogen carrier. The vessel is capable of transporting 1,250 m³ of liquid hydrogen at –253 °C and made its first international voyage in early 2022 to demonstrate long-distance hydrogen shipping.

Integration with Renewable Energy Storage

Renewable energy integration is another key growth driver, as liquefied hydrogen enables large-scale storage of intermittent solar and wind power. Power producers are increasingly using hydrogen to ensure grid reliability and meet decarbonization targets. Peak shaving and grid balancing projects are boosting demand for cryogenic hydrogen storage systems. As countries transition to net-zero energy systems, large-scale hydrogen infrastructure investments are accelerating. This trend positions liquefied hydrogen storage as a central enabler of renewable integration and energy security strategies across advanced and emerging markets.

- For instance, Air Liquide operates a liquid hydrogen production and storage plant in Nevada, supplying 30 tons per day, with storage tanks designed to stabilize renewable hydrogen demand for mobility and energy markets.

Expansion of Industrial Applications

Industrial use is a key growth driver, as sectors such as steel, chemicals, and refineries integrate liquefied hydrogen for heat and power. Hydrogen helps lower carbon footprints while providing high energy efficiency. Increasing emphasis on green hydrogen production aligns with stricter emission regulations, further boosting storage demand. Stainless steel tanks dominate industrial applications due to durability and safety standards. Expanding pilot projects in ammonia and methanol production are also strengthening adoption. Rising demand from energy-intensive industries ensures sustained growth for liquefied hydrogen storage across global markets.

Key Trends & Opportunities

Advancement in Lightweight Materials

A major trend and opportunity is the shift toward carbon fiber composites and hybrid materials for hydrogen tanks. These materials reduce system weight, improve portability, and increase efficiency, especially for transport applications. Automakers and aerospace companies are collaborating with storage manufacturers to scale adoption of advanced composites. Ongoing R&D efforts aim to enhance thermal insulation and pressure resistance. The move from stainless steel dominance toward lightweight alternatives presents a significant opportunity for suppliers to tap into the growing mobility and aviation hydrogen sectors.

- For instance, Hexagon Purus supplies Type IV composite hydrogen cylinders certified up to 700 bar for lightweight mobility applications.

Government Funding and Infrastructure Development

Government-led initiatives represent another key trend and opportunity shaping the liquefied hydrogen storage market. Programs in the U.S., EU, and Asia-Pacific are supporting hydrogen storage and distribution infrastructure through grants, subsidies, and regulatory frameworks. For instance, hydrogen valleys and regional hubs are being developed with strong public-private investments. Such policies not only accelerate refueling station installations but also create consistent demand for cryogenic tanks and compressors. This funding momentum provides significant opportunities for global suppliers to expand production and scale projects.

- For instance, Plug Power received a conditional commitment for a U.S. DOE loan guarantee of up to $1.66 billion in May 2024, to support the development and construction of up to 6 clean hydrogen plants across the U.S., with associated liquefaction and storage systems.

Key Challenges

High Capital and Operational Costs

One key challenge in the market is the high capital and operational costs of liquefied hydrogen storage systems. Maintaining cryogenic temperatures at -253°C requires advanced insulation and specialized equipment, increasing both setup and running expenses. The cost factor limits adoption across small-scale industries and emerging economies. While government incentives help offset some expenses, large upfront investment remains a barrier to widespread deployment. Addressing cost reduction through technological innovation and economies of scale will be critical for broader adoption of hydrogen storage solutions.

Infrastructure Gaps and Safety Concerns

Another key challenge involves infrastructure gaps and safety concerns associated with liquefied hydrogen storage. The lack of widespread refueling stations and limited cryogenic logistics restrict hydrogen’s accessibility for mobility applications. Additionally, strict safety standards are needed to mitigate risks of leakage and explosion due to hydrogen’s volatile nature. Building a reliable, standardized infrastructure requires significant investment and cross-industry collaboration. Unless these gaps are addressed, the expansion of hydrogen storage into new regions and applications will face delays, limiting market scalability.

Regional Analysis

North America

North America held the largest share of 38% in the liquefied hydrogen storage market in 2024, driven by strong government support, expansion of hydrogen fueling networks, and investments in renewable integration. The U.S. leads with large-scale projects under the Department of Energy’s hydrogen initiatives, while Canada is advancing hydrogen hubs to decarbonize transport and power sectors. Rising adoption of fuel cell vehicles and industrial decarbonization projects also contribute to regional demand. Key players are focusing on stainless steel and composite storage solutions to meet safety and performance requirements, further strengthening the region’s leadership position in the global market.

Europe

Europe accounted for 28% of the liquefied hydrogen storage market share in 2024, supported by ambitious decarbonization goals under the EU Green Deal and Hydrogen Strategy. Countries such as Germany, France, and the Netherlands are investing heavily in hydrogen hubs and refueling infrastructure. The region emphasizes industrial applications, particularly in steelmaking and chemical processing, driving demand for advanced cryogenic storage technologies. Strong collaboration between governments and private companies accelerates innovation in lightweight composites. Europe’s focus on grid balancing and renewable energy storage further boosts adoption, ensuring steady market growth across industrial, transportation, and energy applications.

Asia Pacific

Asia Pacific captured 24% of the liquefied hydrogen storage market in 2024, fueled by rapid developments in Japan, South Korea, and China. Japan’s hydrogen roadmap emphasizes liquefied hydrogen imports and fueling infrastructure, while South Korea is scaling hydrogen mobility projects. China leads in industrial adoption, supported by large-scale pilot projects in power and chemical sectors. Growing demand for clean transport solutions, combined with investments in hydrogen-powered heavy-duty vehicles, supports regional growth. The focus on lightweight storage materials, particularly aluminum and composites, is increasing adoption for mobile applications, strengthening Asia Pacific’s role as a fast-growing market.

Latin America

Latin America accounted for 6% of the liquefied hydrogen storage market in 2024, with Chile and Brazil emerging as key contributors. Chile is leading hydrogen adoption through renewable-powered green hydrogen projects, which require advanced liquefied storage infrastructure for exports. Brazil is exploring hydrogen integration into its transport and industrial sectors, supported by abundant renewable resources. Regional governments are promoting international partnerships to attract investment in hydrogen hubs. While the market is at a developing stage, strong renewable potential positions Latin America as a promising growth region for liquefied hydrogen storage over the coming years.

Middle East and Africa

The Middle East and Africa together represented 4% of the liquefied hydrogen storage market in 2024, driven mainly by large-scale hydrogen export projects in Saudi Arabia and the United Arab Emirates. These countries are investing in liquefaction and storage facilities to supply Europe and Asia with green hydrogen. In Africa, South Africa is taking early steps by linking hydrogen projects with its mining and energy industries. However, infrastructure gaps and funding limitations remain challenges. With increasing global demand for hydrogen exports, the region holds long-term potential for scaling liquefied hydrogen storage infrastructure.

Market Segmentations:

By Technology:

- Single Tank Storage

- Multiple Tank Storage

- Cryo-Compressors

- Other Technologies

By Material:

- Stainless Steel

- Aluminum

- Carbon Fiber Composite

- Other Materials

By End Use:

- Power Generation

- Transportation (Fueling Stations)

- Industrial Processes (Heat and Power)

- Peak Shaving and Grid Balancing

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The liquefied hydrogen storage market features leading players such as Showa Denko K.K., Taylor-Wharton, Linde plc, Chiyoda Corporation, Baker Hughes Company, Cryospain S.A., Praxair Technology Inc., Worthington Industries Inc., Air Liquide S.A., Nel Hydrogen Fueling, Hydrogenics Corporation, DKSH Holdings Ltd., Kawasaki, Chart Industries Inc., Air Products Chemicals Inc., and Iwatani Corporation. The competitive landscape is defined by strong investments in advanced cryogenic storage technologies, lightweight composite materials, and energy-efficient insulation systems. Companies are focusing on large-scale deployment in transportation and power generation, with collaborations between energy firms and technology providers strengthening market positions. Strategic expansions in hydrogen hubs across North America, Europe, and Asia Pacific are fueling growth opportunities, while government-backed projects accelerate infrastructure development. Intense competition is pushing continuous innovation, particularly in safety compliance, modular designs, and cost optimization. This competitive environment ensures steady technological advancement, enabling the market to address both mobility and industrial-scale hydrogen storage requirements globally.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Showa Denko K.K.

- Taylor-Wharton

- Linde plc

- Chiyoda Corporation

- Baker Hughes Company

- Cryospain, S.A.

- Praxair Technology, Inc.

- Worthington Industries, Inc.

- Air Liquide S.A.

- Nel Hydrogen Fueling

- Hydrogenics Corporation

- DKSH Holdings Ltd.

- Kawasaki

- Chart Industries, Inc.

- Air Products Chemicals, Inc.

- Iwatani Corporation

Recent Developments

- In 2025, Taylor-Wharton partnered with GenH2 to introduce a “zero-loss” liquid hydrogen storage solution.

- In 2024, Kawasaki and CB&I (a subsidiary of McDermott) formed a strategic agreement to build a commercial LH2 supply chain.

- In 2024, Air Liquide started trial operations of its Trailblazer 20 MW electrolyzer with Siemens Energy in Germany, aiming to produce renewable hydrogen for its pipeline network.

Report Coverage

The research report offers an in-depth analysis based on Technology, Material, End-Use and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The liquefied hydrogen storage market will grow steadily with rising global hydrogen adoption.

- Transportation applications will remain the leading demand driver due to expanding fuel cell vehicles.

- Power generation and renewable energy integration will create strong opportunities for storage systems.

- Industrial sectors such as steel and chemicals will accelerate adoption to reduce carbon emissions.

- Lightweight composite materials will gain momentum, replacing heavy stainless steel structures.

- Governments will increase funding for infrastructure, boosting storage and refueling projects worldwide.

- Asia Pacific will emerge as the fastest-growing region supported by large-scale hydrogen initiatives.

- Safety standards and regulations will shape technology development and global deployment.

- Strategic collaborations between energy companies and manufacturers will expand production capacity.

- Technological innovation in cryogenic efficiency will enhance cost competitiveness and long-term market growth.