Market overview

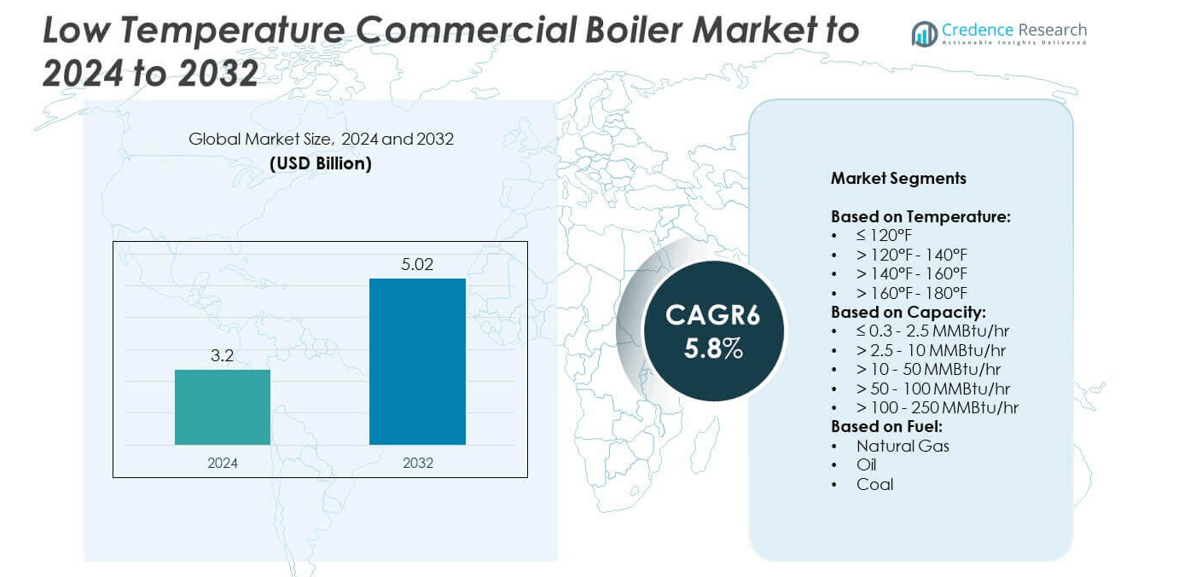

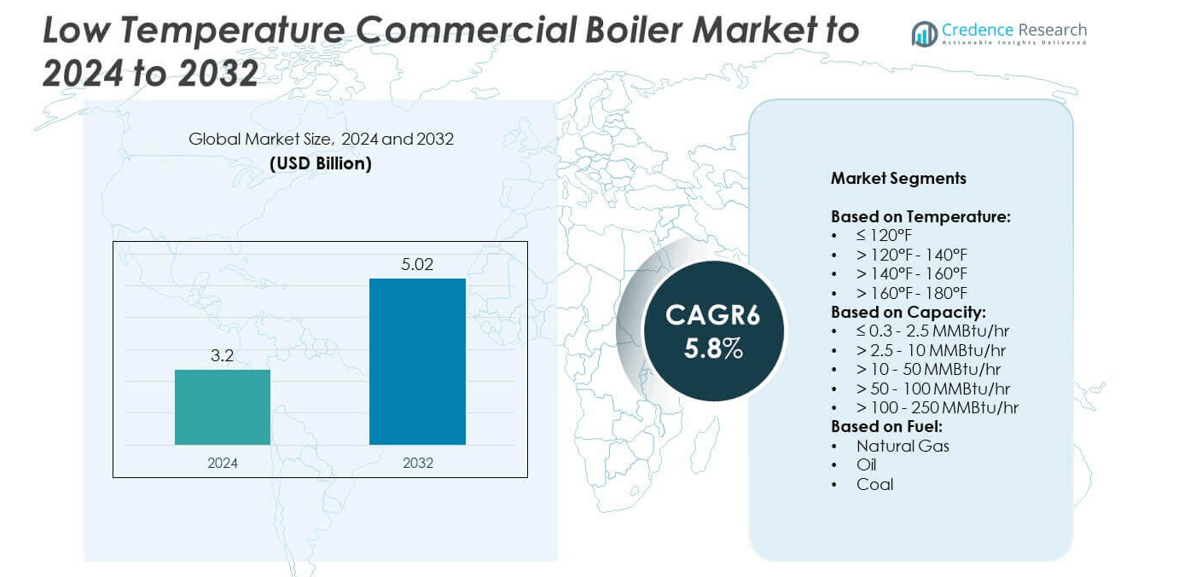

The Low Temperature Commercial Boiler Market size was valued at USD 3.2 Billion in 2024 and is anticipated to reach USD 5.02 Billion by 2032, at a CAGR of 5.8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Temperature Commercial Boiler Market Size 2025 |

USD 3.2 Billion |

| Low Temperature Commercial Boiler Market ,CAGR |

5.8% |

| Low Temperature Commercial Boiler Market Size 2032 |

USD 5.02 Billion |

The Low Temperature Commercial Boiler Market is highly competitive, with key players including Weil-McLain, Bosch, WOLF, VIESSMANN, Cleaver-Brooks, Ariston Holding N.V., FERROLI S.p.A, Hurst Boiler & Welding Co, Inc., Daikin Europe, and Babcock Wanson. These companies focus on product innovation, digital integration, and compliance with emission regulations to strengthen their market positions. Europe emerged as the leading region in 2024, commanding 38% of the market share, supported by stringent environmental policies, widespread adoption of natural gas infrastructure, and strong demand for energy-efficient solutions. North America and Asia Pacific also showed significant growth potential, driven by commercial infrastructure expansion and rising focus on sustainable heating technologies.

Market Insights

- The Low Temperature Commercial Boiler Market was valued at USD 3.2 Billion in 2024 and is expected to reach USD 5.02 Billion by 2032, growing at a CAGR of 5.8% during.

- Growing demand for energy-efficient heating solutions in commercial spaces such as hospitals, schools, and hotels is driving market expansion, supported by government incentives and strict emission regulations.

- A major trend is the adoption of smart, IoT-enabled boiler systems offering predictive maintenance and remote monitoring, along with rising integration of hybrid solutions combining natural gas and renewable sources.

- The market is competitive, with companies focusing on product innovation, eco-friendly designs, and expansion into emerging regions, while high upfront installation costs remain a restraint limiting adoption among small enterprises.

- Europe held the largest regional share at 38% in 2024, while North America accounted for 27% and Asia Pacific 24%, with the >2.5–10 MMBtu/hr capacity segment leading at 38%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Temperature

The temperature segment is divided into ≤120°F, >120°F–140°F, >140°F–160°F, and >160°F–180°F. The >140°F–160°F sub-segment dominated in 2024, capturing nearly 42% of the market share. This range balances efficiency with performance, making it ideal for commercial heating in offices, hotels, and healthcare facilities. Demand is fueled by regulatory pressure for energy-efficient heating solutions and the ability of these systems to provide consistent heat output without compromising energy savings. Their adaptability to modern building designs also supports the sub-segment’s continued leadership in the market.

- For instance, Viessmann manufactures industrial and commercial boilers, with certain models offering efficiencies over 95.5%. Their commercial and industrial heating solutions offer up to 44 MW of heat, which can be achieved by linking multiple individual hot water boilers, such as the Vitomax HW (up to 20 MW) and Vitomax LW (up to 22 MW), into cascade systems.

By Capacity

Capacity-wise, the market includes ≤0.3–2.5 MMBtu/hr, >2.5–10 MMBtu/hr, >10–50 MMBtu/hr, >50–100 MMBtu/hr, and >100–250 MMBtu/hr. The >2.5–10 MMBtu/hr range held the largest share in 2024, accounting for 38%. This capacity range is most suitable for mid-sized commercial buildings, schools, and hospitals. Growing renovation projects and replacement of outdated heating systems drive strong adoption. Its balance of compact size, fuel efficiency, and adequate heating capacity makes it a preferred choice. Rising demand for mid-range boilers across urban commercial infrastructure sustains this sub-segment’s dominance.

- For instance, Cleaver-Brooks’ CBEX series uses EX tube technology that enhances heat transfer by up to 85 % over traditional tubes.

By Fuel

The fuel segment is classified into natural gas, oil, and coal. Natural gas emerged as the leading sub-segment in 2024, securing more than 55% of the market share. Its dominance is driven by widespread gas infrastructure, relatively lower emissions, and compliance with stringent environmental regulations in North America and Europe. Governments offering incentives for clean fuel adoption have further accelerated demand. Natural gas boilers also deliver lower operational costs compared to oil and coal alternatives, making them highly attractive for long-term commercial heating applications in both developed and emerging markets.

Key Growth Drivers

Rising Demand for Energy-Efficient Heating Solutions

Energy efficiency remains the strongest growth driver in the low temperature commercial boiler market. Governments and regulatory bodies are mandating strict emission reduction targets, encouraging businesses to adopt boilers that operate at higher efficiency levels with lower fuel consumption. Commercial facilities such as offices, schools, and healthcare centers increasingly prefer boilers that reduce operating costs while supporting sustainability goals. This shift toward eco-friendly and cost-effective heating systems ensures steady demand, making energy efficiency the most critical factor shaping the market’s expansion over the forecast period.

- For instance, Bosch’s Buderus SSB Gen2 commercial line offers 798–8192 MBH per module and dual 441 stainless-steel heat exchangers for high-duty campuses.

Expansion of Commercial Infrastructure

Rapid growth in commercial construction is significantly boosting boiler installations. Hotels, educational institutes, and hospitals require consistent heating solutions, and low temperature boilers offer both reliability and efficiency. Urbanization and rising investments in commercial infrastructure across Asia Pacific and North America further drive adoption. Replacement of outdated systems with modern, low-emission boilers adds momentum. The need for compact, efficient, and flexible solutions in modern building designs continues to push demand, making infrastructure growth a central driver of the market’s long-term development.

- For instance, the UK’s Clean Heat Market Mechanism requires boiler manufacturers selling over 19,999 gas boilers annually to ensure that a portion of their total sales are heat pumps, starting with a 6% target in the first year (2025/26).

Supportive Government Regulations and Incentives

Government policies promoting clean energy and emission control serve as another vital driver. Many countries in Europe and North America provide subsidies, rebates, or tax credits for installing low-emission, natural gas-based systems. These incentives accelerate replacement of coal and oil boilers, further driving the adoption of modern systems. Additionally, building codes increasingly require high-efficiency heating equipment in commercial facilities. Such supportive measures ensure compliance while making energy-efficient boilers financially viable, significantly boosting overall market penetration and aligning with global sustainability targets.

Key Trends & Opportunities

Shift Toward Natural Gas and Renewable Integration

A strong trend in the market is the shift toward natural gas-fired boilers, supported by expanding pipeline networks and emission reduction initiatives. Natural gas has gained preference due to lower operational costs and cleaner combustion compared to oil and coal. In parallel, opportunities exist in integrating renewable energy sources, such as hybrid systems that combine boilers with solar or heat pump technologies. These advancements align with net-zero goals and provide commercial buildings with flexible, eco-friendly heating solutions, creating long-term opportunities for manufacturers and system providers.

- For instance, the Vaillant Group develops energy-efficient heating technologies, including heat pumps that can cover up to 75% of energy demand from environmental heat.

Adoption of Smart and Connected Boiler Systems

The growing adoption of IoT-enabled and digitally connected boilers is a major trend. Commercial facilities are integrating smart systems that provide predictive maintenance, remote monitoring, and energy consumption tracking. These solutions not only reduce downtime but also optimize performance, lowering operational costs for businesses. Manufacturers are capitalizing on this trend by offering advanced controls and digital platforms. This digitalization trend creates new opportunities for service models and aftermarket offerings, strengthening customer engagement and ensuring continuous improvements in system efficiency and lifecycle management.

- For instance, Lochinvar’s CON·X·US platform supports advanced boiler control and monitoring via smart devices. This platform allows management of boilers in cascade systems, with the mobile app enabling control for systems of up to 8 units. The maximum cascade size, which can be up to 16 units for some Lochinvar commercial boilers, depends on the specific boiler model and control interface.

Key Challenges

High Initial Installation and Upgrade Costs

Despite long-term cost savings, the high upfront investment required for low temperature commercial boilers remains a major challenge. Installation involves not only the boiler system itself but also associated infrastructure upgrades, which can strain budgets of small and mid-sized enterprises. In developing regions, limited financial incentives further restrict adoption. This cost barrier delays replacement of outdated systems and slows market penetration, particularly in cost-sensitive sectors, posing a significant hurdle to growth despite the long-term benefits of efficiency and sustainability.

Dependence on Natural Gas Infrastructure

Another key challenge is the market’s heavy reliance on natural gas infrastructure. While natural gas is cleaner than oil and coal, its availability varies across regions, limiting adoption in areas without established pipelines. In developing markets, the absence of robust distribution networks restricts commercial installations. Moreover, volatility in natural gas prices can impact operational cost advantages. This dependency on infrastructure and pricing uncertainties poses risks for market stability and requires diversification strategies, including hybrid systems and renewable integration, to mitigate regional adoption gaps.

Regional Analysis

North America

North America accounted for 27% of the market share in 2024, supported by rising demand for energy-efficient heating systems across commercial buildings. The U.S. leads the region due to strong adoption of natural gas-fired boilers, driven by regulatory support and a well-established gas distribution network. Replacement of aging oil-fired systems with modern low-emission boilers further drives growth. Canada is also witnessing increased adoption as commercial construction activity expands, particularly in healthcare and educational facilities. Government incentives and energy efficiency standards remain critical factors supporting the region’s steady market expansion.

Europe

Europe dominated the market with a 38% share in 2024, maintaining its leadership through stringent emission regulations and aggressive decarbonization goals. Countries such as Germany, the UK, and France are front-runners, driven by advanced infrastructure and strong government incentives. The shift toward natural gas and hybrid systems is pronounced, supported by widespread adoption of high-efficiency heating technologies. Retrofitting old buildings and replacing outdated systems remain major contributors to regional demand. Europe’s strong focus on energy transition, carbon reduction, and adherence to strict environmental standards ensures its continued dominance in the forecast period.

Asia Pacific

Asia Pacific held 24% of the market share in 2024, driven by rapid urbanization, rising commercial construction, and infrastructure investments. China and India lead the region, where expanding healthcare, hospitality, and educational sectors fuel demand for reliable and efficient heating solutions. The shift from coal-based systems to natural gas is accelerating, though regional disparities in gas infrastructure limit penetration in some areas. Japan and South Korea are adopting advanced, energy-efficient boilers supported by government programs. The region’s fast-growing commercial base and increasing environmental regulations make it one of the strongest growth engines for the market.

Latin America

Latin America captured 6% of the market share in 2024, with growth driven primarily by Brazil and Mexico. Rising investments in commercial infrastructure, particularly in hospitality and healthcare sectors, support demand. However, limited natural gas infrastructure in several countries restricts wider adoption, keeping oil-fired systems relevant in specific markets. Government initiatives promoting cleaner technologies are beginning to influence buyer decisions, though economic constraints limit large-scale replacement projects. Despite challenges, growing urbanization and efforts to modernize heating infrastructure create opportunities for gradual adoption of low temperature commercial boilers across the region.

Middle East & Africa

The Middle East & Africa accounted for 5% of the market share in 2024, with growth concentrated in countries like Saudi Arabia, the UAE, and South Africa. Expanding commercial construction in hospitality, healthcare, and education drives demand for efficient heating solutions in colder zones and high-altitude areas. However, limited penetration of natural gas infrastructure in parts of Africa slows adoption. Energy efficiency programs and rising focus on sustainability in Gulf nations provide new opportunities. Although starting from a smaller base, steady infrastructure investments are expected to support moderate growth in the coming years.

Market Segmentations:

By Temperature:

- ≤ 120°F

- > 120°F – 140°F

- > 140°F – 160°F

- > 160°F – 180°F

By Capacity:

- ≤ 0.3 – 2.5 MMBtu/hr

- > 2.5 – 10 MMBtu/hr

- > 10 – 50 MMBtu/hr

- > 50 – 100 MMBtu/hr

- > 100 – 250 MMBtu/hr

By Fuel:

By Geography:

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the Low Temperature Commercial Boiler Market is shaped by established global manufacturers such as Weil-McLain, Bosch, WOLF, VIESSMANN, Cleaver-Brooks, Ariston Holding N.V., FERROLI S.p.A, Hurst Boiler & Welding Co, Inc., Daikin Europe, and Babcock Wanson. These companies compete on the basis of product efficiency, fuel flexibility, and compliance with stringent emission regulations. Innovation in digital monitoring, IoT integration, and hybrid boiler solutions is a central strategy to enhance operational performance and meet sustainability goals. Many players are expanding their presence through partnerships, acquisitions, and regional manufacturing facilities to serve growing demand in Asia Pacific and Europe. A strong focus on energy efficiency certifications, government incentives, and after-sales service further differentiates market participants. The emphasis on cost-effective yet environmentally friendly solutions ensures continuous investment in R&D, driving advancements in design, efficiency, and reliability while strengthening competitive positioning across developed and emerging regions.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Weil-McLain

- Bosch

- WOLF

- VIESSMANN

- Cleaver-Brooks

- Ariston Holding N.V.

- FERROLI S.p.A

- Hurst Boiler & Welding Co, Inc.

- Daikin Europe

- Babcock Wanson

Recent Developments

- In 2025, Daikin Europe launched the Daikin Altherma 4 H heat pump, specifically for residential heating, showcasing advanced refrigerant technology and high energy efficiency.

- In 2024, Viessmann introduced a hybrid gas and electric commercial hot water boiler to improve energy efficiency.

- In 2024, Bosch launched a new range of condensing hot water boilers specifically for large commercial buildings.

Report Coverage

The research report offers an in-depth analysis based on Temperature, Capacity, Fuel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily due to rising demand for energy-efficient heating systems.

- Gas-fired boilers will continue to dominate, supported by emission regulations and infrastructure growth.

- Hybrid systems integrating renewable energy will gain wider adoption across commercial sectors.

- Digitalization and IoT-enabled smart boilers will enhance monitoring and predictive maintenance.

- Healthcare and educational facilities will remain leading end-users due to reliability needs.

- Replacement of outdated oil and coal boilers will accelerate in developed regions.

- Europe will maintain leadership, but Asia Pacific will witness the fastest growth.

- Government incentives and carbon reduction policies will strongly influence adoption rates.

- Initial cost barriers will persist, but long-term efficiency savings will drive investment.

- Growing focus on sustainability will push innovation toward low-emission and eco-friendly boiler designs.