Market Overview

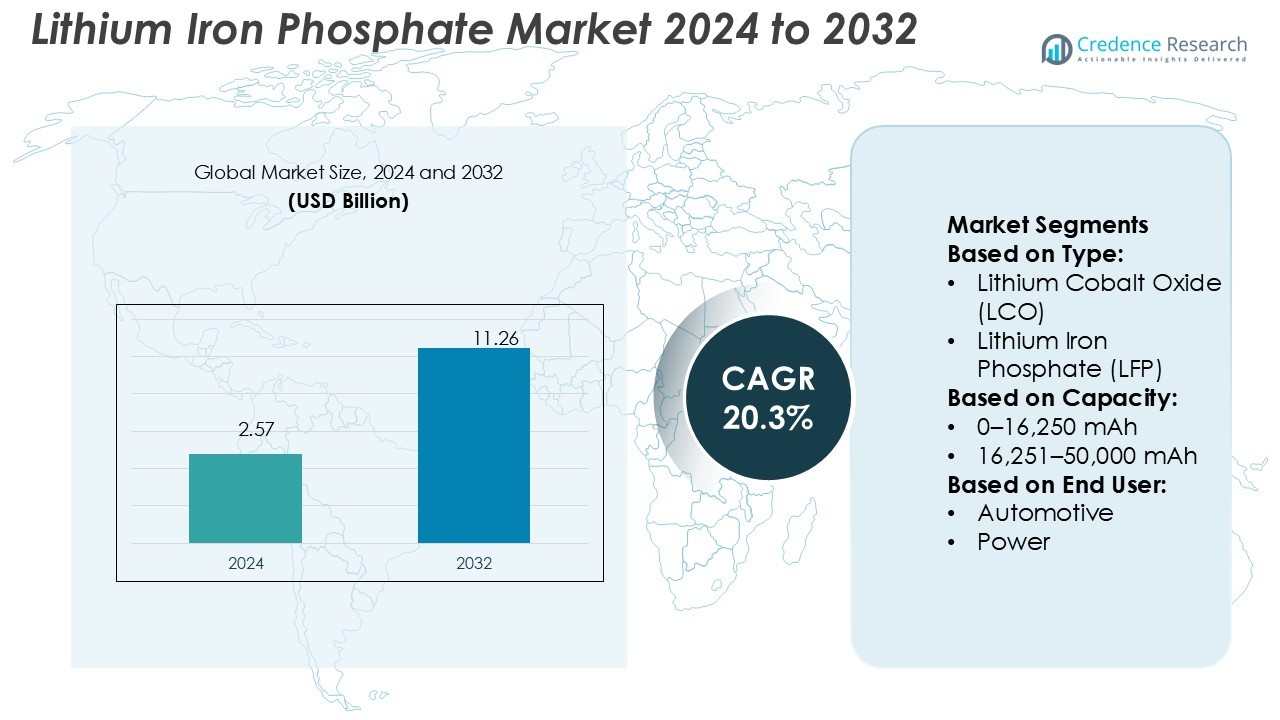

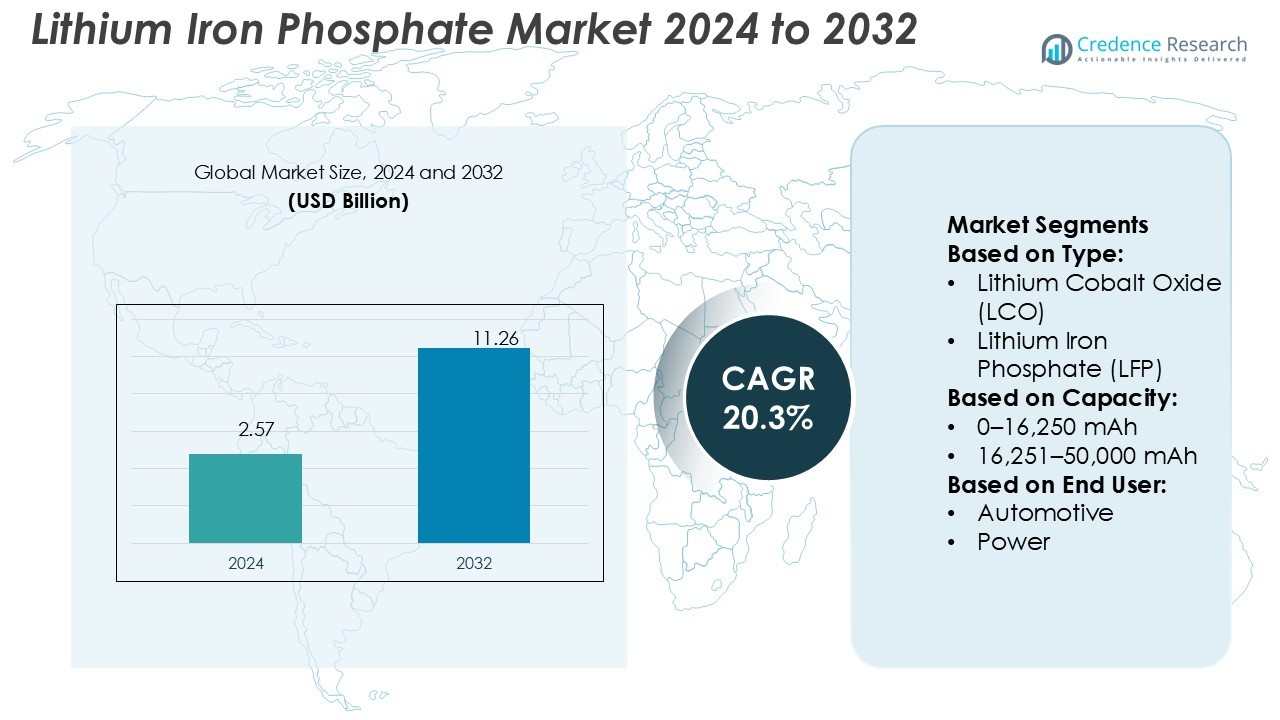

Lithium Iron Phosphate Market size was valued USD 2.57 billion in 2024 and is anticipated to reach USD 11.26 billion by 2032, at a CAGR of 20.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Lithium Iron Phosphate Market Size 2024 |

USD 2.57 Billion |

| Lithium Iron Phosphate Market, CAGR |

20.3% |

| Lithium Iron Phosphate Market Size 2032 |

USD 11.26 Billion |

The lithium iron phosphate (LFP) market is shaped by prominent players such as Lithiumwerks, Ding Tai Battery Company, Exide Technologies, Prologium Technology, Energon, Contemporary Amperex Technology, Duracell, Clarios, Koninklijke Philips, and A123 Systems. These companies compete through advancements in safety, cost efficiency, and large-scale production to serve the automotive, energy storage, and industrial sectors. Contemporary Amperex Technology maintains a strong leadership position with extensive manufacturing capacity and global partnerships, while firms like A123 Systems and Lithiumwerks focus on high-performance applications. Regionally, Asia-Pacific leads the global market with a 41% share, driven by China’s dominance in EV production, renewable integration, and cost-effective supply chains. This regional leadership positions Asia-Pacific as the primary growth hub for LFP batteries.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Lithium Iron Phosphate Market size was valued at USD 2.57 billion in 2024 and is projected to reach USD 11.26 billion by 2032, growing at a CAGR of 20.3%.

- Rising electric vehicle adoption and renewable energy storage projects are the major drivers fueling market growth, as demand for safe and cost-effective battery solutions continues to increase globally.

- The market shows a clear trend toward cobalt-free chemistries, with companies focusing on improving safety, cycle life, and affordability while expanding large-scale production to capture growing demand.

- Competitive intensity remains high with players such as Contemporary Amperex Technology, A123 Systems, Lithiumwerks, Exide Technologies, and Clarios investing in manufacturing capacity, high-performance designs, and strategic partnerships.

- Asia-Pacific leads the market with a 41% share, supported by China’s dominance in EV and renewable storage, while the automotive sector holds the largest end-user share, highlighting its critical role in overall market expansion.

Market Segmentation Analysis:

By Type

The Lithium Iron Phosphate (LFP) segment dominates the lithium battery market with a 46% share. LFP batteries are widely used in electric vehicles, energy storage systems, and industrial applications due to their safety, long cycle life, and lower cost compared to Lithium Cobalt Oxide (LCO) and Nickel Manganese Cobalt (Li-NMC). Growing demand for sustainable mobility and grid-scale renewable energy storage drives adoption. While LCO and Li-NMC serve consumer electronics and high-energy density needs, LFP remains the preferred option for large-scale and cost-sensitive applications.

- For instance, Ding Tai Battery Company manufactures a 52 V, 23.4 Ah battery pack with a LiNiCoMn chemistry that delivers a continuous discharge current of 40 A and supports over 700 charge-discharge cycles.

By Capacity

The 50,001–100,000 mAh segment leads with a 38% share, fueled by its role in electric vehicles and renewable energy storage systems. This range provides a balance of energy density and operational life, making it suitable for powering EV battery packs and mid-scale energy storage units. Demand is increasing as automotive manufacturers prioritize range efficiency and renewable projects integrate larger storage solutions. Lower-capacity batteries dominate portable electronics, while high-capacity options above 100,000 mAh serve grid-level storage and marine uses, but the mid-capacity segment offers the most versatile growth potential.

- For instance, Exide Technologies offers the EV2500 lithium-ion product, which features a nominal voltage of 12.8 V and a capacity of 200 Ah. It supports more than 4,000 cycles at 80% depth of discharge.

By End User

The automotive sector holds the largest share at 54%, driven by accelerating electric vehicle adoption worldwide. Automakers are shifting to LFP chemistries due to their lower cost, thermal stability, and ability to meet range expectations in mass-market EVs. Expansion of EV fleets in China, Europe, and the U.S. strengthens this dominance. Power and industrial sectors also contribute, with LFP used in renewable storage, backup power, and industrial automation. Aerospace and marine applications remain niche but are gaining traction as energy-dense, safer solutions are required for specialized transport and defense systems.

Key Growth Drivers

Rising Electric Vehicle Adoption

The surge in electric vehicle (EV) production is a primary growth driver for the lithium iron phosphate (LFP) market. Automakers increasingly adopt LFP batteries due to their lower cost, safety benefits, and long lifecycle compared to alternatives like nickel-based chemistries. Strong demand in China, Europe, and North America continues to boost production. Government policies supporting EV adoption, such as subsidies and carbon reduction goals, further accelerate market expansion. LFP’s stability under high temperatures makes it ideal for mass-market EVs.

- For instance, ProLogium’s third-generation lithium ceramic battery (LCB) achieved a volumetric energy density of 811.6 Wh/L and gravimetric energy density of 359.2 Wh/kg, as certified by TÜV Rheinland.

Expansion of Renewable Energy Storage

The growth of solar and wind energy projects has created strong demand for cost-effective and durable energy storage solutions. LFP batteries dominate large-scale storage applications due to their ability to provide long cycle life, deep discharge capability, and safety advantages over other lithium chemistries. Utilities and commercial operators adopt LFP-based systems to ensure reliable grid stability and integrate variable renewable energy sources. Falling battery costs combined with global clean energy initiatives amplify the role of LFP in energy storage infrastructure.

- For instance, Energon’s “Energon Series” outdoor LFP energy storage cabinet offers a nominal capacity of 215 kWh in a single unit and is built from battery modules, each consisting of 51.2 V / 280 Ah cells.

Technological Advancements in Battery Manufacturing

Continuous advancements in manufacturing processes and material optimization drive growth in the LFP market. Innovations such as improved cathode formulations, enhanced energy density, and cost-effective production methods strengthen competitiveness against higher-density batteries. Companies are investing in large-scale manufacturing plants to meet rising EV and storage demand. Additionally, recycling technologies and second-life applications create sustainable use cases. These developments lower production costs, enhance efficiency, and expand adoption across diverse end-user sectors, reinforcing LFP’s long-term market position.

Key Trends & Opportunities

Shift Toward Cobalt-Free Chemistries

Growing concerns about cobalt supply shortages and ethical mining practices encourage manufacturers to move toward cobalt-free alternatives like LFP. This trend benefits LFP as a sustainable, stable, and affordable option for EVs and storage systems. Automakers like Tesla and BYD have already integrated LFP into mass-market vehicles, signaling wider acceptance. This transition opens opportunities for further cost reduction and supply chain resilience while reducing dependence on limited raw material sources.

- For instance, while Duracell’s public datasheets focus on consumer chemistries (e.g. CR2032 coin cells with ~225 mAh capacity) and rechargeable AA nickel-metal hydride (NiMH) units at 2,500 mAh capable of hundreds of charge cycles.

Localization of Battery Production

Global governments and manufacturers are focusing on regional battery production hubs to reduce import dependence and strengthen supply security. LFP battery producers benefit from this shift, with large investments in gigafactories across Asia, Europe, and the U.S. Localized production not only minimizes logistics costs but also enables manufacturers to align with regional policies promoting EV adoption and renewable energy. This trend positions LFP suppliers to capture market share through capacity expansion and strategic regional partnerships.

- For instance, Philips’s PAP Battery Kit (used in sleep therapy devices) is a lithium-ion pack rated at 90 W, offers over 14 hours of backup operation, and supports ≥ 70 % of rated capacity after 1,000 cycles.

Integration in Emerging Applications

Beyond EVs and energy storage, LFP batteries are gaining traction in marine, aerospace, and industrial automation. Their safety, long lifecycle, and operational reliability make them suitable for specialized applications requiring stable energy supply. For instance, electric ferries and defense systems increasingly explore LFP integration. Industrial sectors also adopt LFP-based solutions for backup power and heavy equipment. These emerging opportunities diversify demand, creating new growth avenues outside the automotive-dominated landscape.

Key Challenges

Lower Energy Density Compared to Alternatives

One of the main challenges for LFP batteries is their lower energy density compared to nickel-based chemistries. This limitation reduces driving range in EVs, which can be a critical factor for consumers. While suitable for short to mid-range vehicles, LFP batteries face difficulty competing in premium EV segments demanding higher energy output. Manufacturers are investing in R&D to improve energy density, but closing the gap with lithium nickel manganese cobalt oxide (NMC) remains a significant technical challenge.

Raw Material Supply and Price Volatility

Although LFP avoids cobalt and nickel, the market still faces raw material constraints, especially with lithium and phosphate. Rising demand across EVs, storage, and electronics increases pressure on supply chains, leading to potential cost fluctuations. Price volatility in lithium carbonate directly impacts battery production costs, making affordability a concern for large-scale projects. Securing stable raw material sources and investing in recycling technologies are essential for mitigating risks and ensuring long-term market growth.

Regional Analysis

North America

North America holds a 22% share of the lithium iron phosphate (LFP) market, driven by strong electric vehicle (EV) adoption and renewable energy integration. The U.S. leads regional growth with large-scale investments in EV manufacturing, government incentives, and utility-scale storage projects. Canada contributes with clean energy policies and expanding industrial uses. Partnerships between automakers and battery producers enhance supply security. Increasing establishment of gigafactories supports localized production, reducing import reliance. The region’s focus on sustainability, coupled with federal funding for green initiatives, positions North America as a major hub for long-term LFP battery deployment.

Europe

Europe accounts for 20% of the LFP market, supported by stringent carbon emission regulations and EV-focused policies. Germany, France, and the UK are key contributors with strong automotive manufacturing bases and renewable integration. Regional governments promote clean mobility and battery independence, encouraging investments in localized gigafactories. Demand for cobalt-free chemistries further boosts LFP adoption across passenger EVs and energy storage projects. Industrial automation and backup power applications also add to regional consumption. With the EU Green Deal and rising electrification, Europe continues to expand its share while reinforcing supply chain resilience through domestic production capabilities.

Asia-Pacific

Asia-Pacific dominates the global LFP market with a 41% share, led by China’s extensive EV production and renewable storage deployment. China drives global adoption through large-scale capacity, supportive policies, and strong domestic manufacturers like BYD and CATL. India and Japan also contribute with growing EV adoption and renewable storage investments. The region benefits from cost-efficient production and robust supply chains, enabling large-scale exports to global markets. Expanding demand in Southeast Asia further strengthens growth. Asia-Pacific’s leadership in technology innovation, government-backed subsidies, and manufacturing scale ensures its continued dominance in the global LFP market.

Latin America

Latin America represents 9% of the LFP market, with Brazil and Mexico emerging as key contributors. The region’s growth is fueled by increasing renewable energy projects, especially solar, which require cost-effective and durable storage solutions. Automotive electrification remains limited but is gaining traction with supportive policies in Brazil. Investments in industrial applications such as backup power and grid stabilization also support demand. Despite slower adoption compared to Asia and Europe, improving policy frameworks and strategic investments in green energy make Latin America an attractive emerging market for LFP batteries over the forecast period.

Middle East & Africa

The Middle East & Africa (MEA) accounts for 8% of the global LFP market, supported by rising renewable energy initiatives and infrastructure modernization. Countries such as the UAE and Saudi Arabia invest in large-scale solar projects, driving demand for LFP storage solutions. Africa’s adoption remains concentrated in industrial backup and off-grid power, addressing energy access challenges. Automotive electrification is still at an early stage but expected to expand with policy support. MEA’s growing renewable energy focus and infrastructure projects provide opportunities, though supply chain constraints and limited local production capacity restrict faster market expansion.

Market Segmentations:

By Type:

- Lithium Cobalt Oxide (LCO)

- Lithium Iron Phosphate (LFP)

By Capacity:

- 0–16,250 mAh

- 16,251–50,000 mAh

By End User:

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The lithium iron phosphate (LFP) market is highly competitive, with key players including Lithiumwerks, Ding Tai Battery Company, Exide Technologies, Prologium Technology, Energon, Contemporary Amperex Technology, Duracell, Clarios, Koninklijke Philips, and A123 Systems. The lithium iron phosphate (LFP) market is characterized by intense competition, driven by growing demand across automotive, energy storage, and industrial sectors. Companies are focusing on advancing battery performance through innovations in safety, cycle life, and energy efficiency while reducing production costs to remain competitive. Strategic investments in gigafactories, recycling technologies, and regional supply chains are reshaping the market landscape. The push for cobalt-free chemistries, driven by sustainability concerns and raw material security, further strengthens LFP’s position. Additionally, collaborations with automotive manufacturers and renewable energy providers highlight the importance of partnerships in capturing long-term growth opportunities.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In April 2025, CATL has announced the successful launch of its new generation of sodium-ion batteries, designed to offer a high-energy density and cost-effective solution for electric vehicles (EVs) and energy storage systems. These sodium-ion batteries are seen as a promising alternative to traditional lithium-ion batteries, with the potential to reduce reliance on lithium while utilizing more abundant sodium.

- In December 2024, Stellantis and CATL’s joint venture effort to build a LFP battery plant in Zaragoza, Spain. The plant is carbon neutral and worth. Production is set to begin from the last quarter of 2026 with an overarching aim of supporting the Spanish and EU authorities and attaining a capacity of 50 GWh.

- In September 2024, Hyundai and Kia have announced a collaboration to develop new Lithium Iron Phosphate (LFP) cathode technology aimed at improving the performance and efficiency of their electric vehicle (EV) batteries. This innovation is expected to enhance the energy density, safety, and cost-effectiveness of LFP batteries, supporting the companies’ goal of delivering more affordable and sustainable electric vehicles.

- In March 2023 Gotion, Inc. and Edison Power Co., Ltd. made a cooperative cooperation to expand the scale of large storage batteries and recycling industries in Japan for the development of renewable energy and the introduction of Gotion batteries in Japan. Gotion will also collaborate with Edison Power to work on the creation of a wholesale circular storage battery recycling system of LFP batteries in Japan.

Report Coverage

The research report offers an in-depth analysis based on Type, Capacity, End-User and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand with rising electric vehicle adoption worldwide.

- Renewable energy projects will drive strong demand for large-scale storage solutions.

- Advancements in manufacturing will improve battery performance and lower costs.

- Cobalt-free chemistries will strengthen LFP’s role in sustainable applications.

- Regional gigafactory investments will boost localized production and supply security.

- Recycling and second-life use will enhance sustainability and resource efficiency.

- Industrial automation and backup power needs will broaden adoption beyond mobility.

- Emerging marine and aerospace applications will create new growth opportunities.

- Government policies on clean energy and emissions will accelerate adoption.

- Competition will intensify as companies scale capacity and innovate technologies.