Market Overview

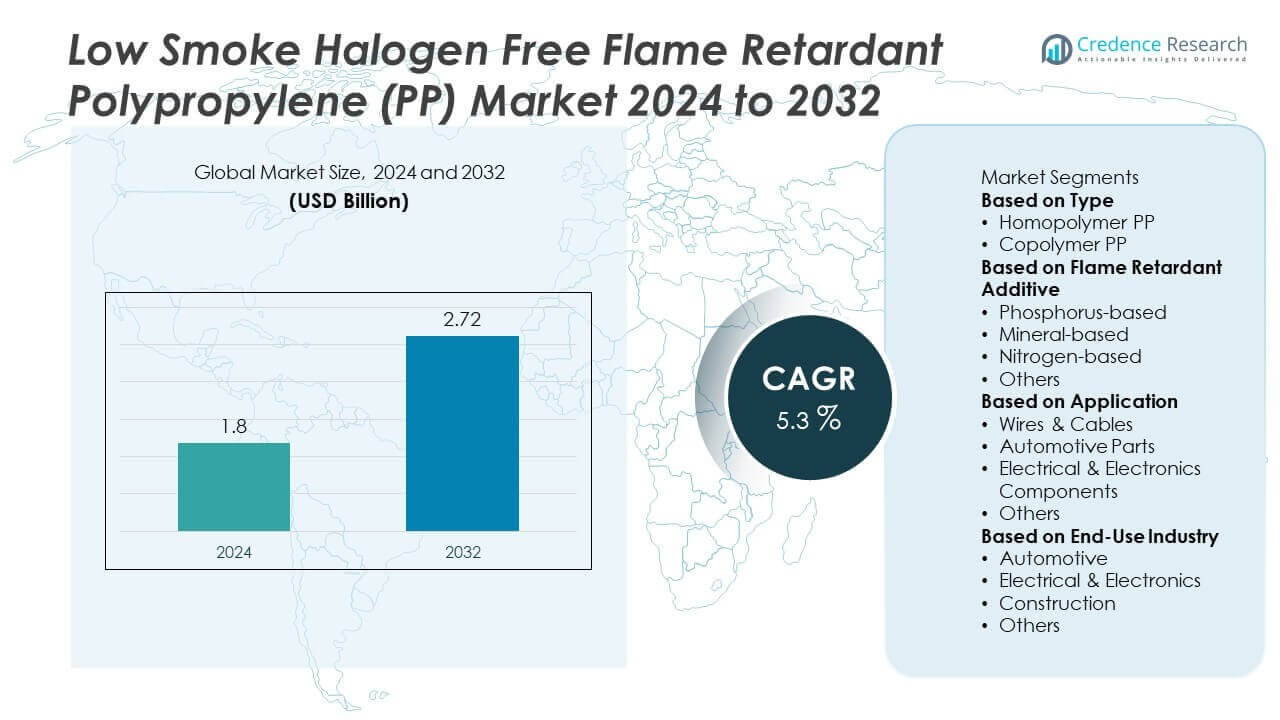

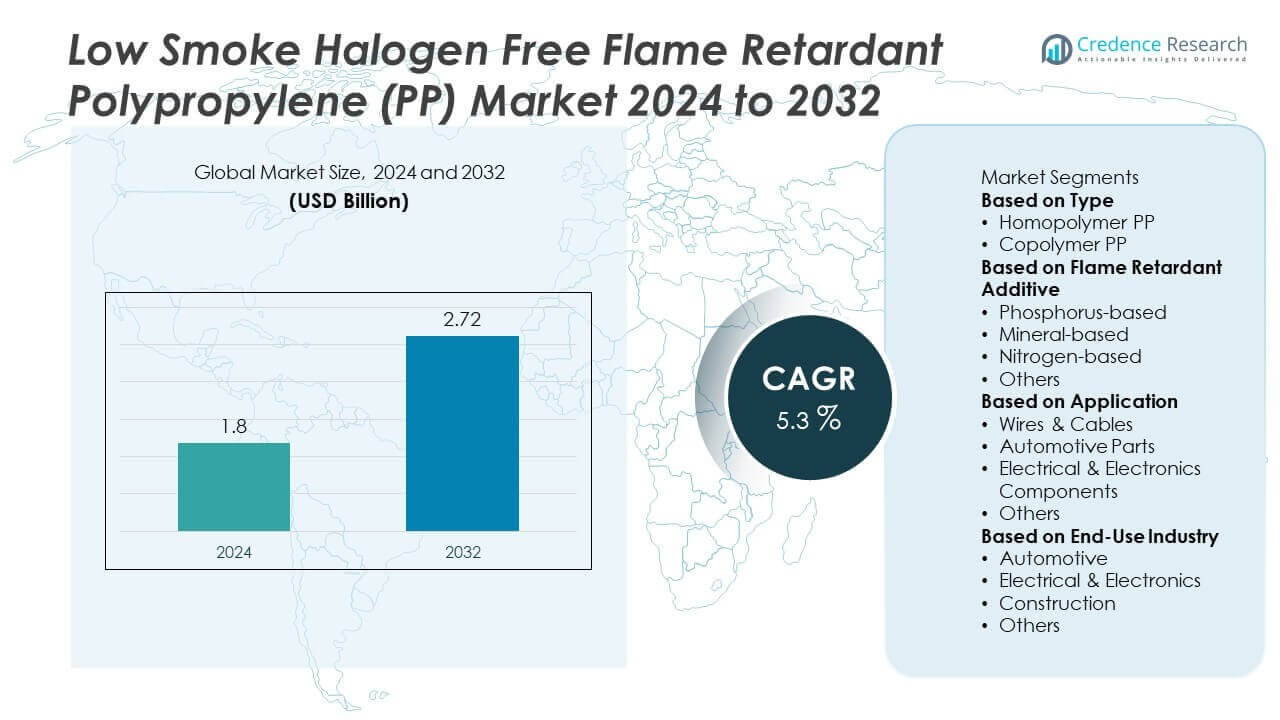

The Low Smoke Halogen Free Flame-Retardant Polypropylene (PP) Market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Low Smoke Halogen Free Flame-Retardant Polypropylene (PP) Market Size 2024 |

USD 1.8 Billion |

| Low Smoke Halogen Free Flame-Retardant Polypropylene (PP) Market, CAGR |

5.3% |

| Low Smoke Halogen Free Flame-Retardant Polypropylene (PP) Market Size 2032 |

USD 2.72 Billion |

The Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market is driven by major players including BASF SE, LG Chem Ltd., SABIC, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Clariant AG, RTP Company, Borealis AG, Avient Corporation, and TotalEnergies SE. These companies focus on developing eco-friendly formulations, enhancing flame-retardant performance, and expanding into high-demand sectors such as automotive, electrical, and construction. Asia-Pacific led the market with 38% share in 2024, supported by large-scale manufacturing and infrastructure investments. Europe followed with 27% share, driven by stringent safety regulations, while North America accounted for 23%, reinforced by automotive and building applications.

Market Insights

Market Insights

- The Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market was valued at USD 1.8 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a CAGR of 5.3% during the forecast period.

- Rising demand from wires and cables, holding 52% share in 2024, drives market growth, supported by increasing applications in construction, automotive wiring, and consumer electronics requiring flame-safe, halogen-free insulation.

- Key trends include the shift toward mineral-based flame retardants, which captured 46% share, reflecting regulatory bans on halogenated systems and growing demand for eco-friendly solutions in electrical and electronics industries.

- Leading players such as BASF, SABIC, LG Chem, and LyondellBasell focus on sustainable formulations, global expansion, and partnerships with automotive and electronics manufacturers to enhance competitiveness across regions.

- Regionally, Asia-Pacific led with 38% share in 2024, followed by Europe with 27% and North America with 23%, while Latin America and the Middle East & Africa accounted for smaller shares of 7% and 5%.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Homopolymer PP dominated the Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market in 2024, accounting for around 58% share. Its dominance is driven by superior mechanical strength, higher stiffness, and cost-effectiveness, making it the preferred choice for wire insulation and industrial applications. Homopolymers also offer easier processing in extrusion and molding, which supports their wide adoption across electrical and construction uses. Copolymer PP, holding the remaining 42% share, is gaining traction due to improved impact resistance and flexibility, especially in automotive components and consumer electronics.

- For instance, LyondellBasell produces POLYFLAM grades of glass fiber-reinforced polypropylene homopolymers that achieve a UL 94 V-0 classification at a wall thickness of 1.5 mm. These materials offer high strength, with a grade like POLYFLAM RPP 4225 CS1 maintaining a tensile stress at break of 80 MPa, making them suitable for demanding applications like cable conduits and housings.

By Flame Retardant Additive

Mineral-based additives led the market in 2024 with nearly 46% share, supported by their excellent smoke suppression, halogen-free properties, and compliance with fire safety regulations. Magnesium hydroxide and aluminum hydroxide are widely used due to non-toxic characteristics and cost efficiency in large-scale production. Phosphorus-based additives followed with about 32% share, valued for superior flame retardancy in high-performance electronics. Nitrogen-based and other specialty additives together accounted for 22% share, targeting niche applications. The dominance of mineral-based solutions is reinforced by increasing global demand for eco-compliant and safer flame-retardant polypropylene formulations.

- For instance, Clariant’s Exolit AP 422 A, a phosphorus-based additive, is an essential component in some intumescent polypropylene (PP) formulations that are suitable for electrical applications where a UL 94-V0 classification is specified.

By Application

Wires & Cables represented the leading application segment in 2024, holding nearly 52% share of the market. This dominance is driven by rising demand for halogen-free cable insulation in building infrastructure, automotive wiring, and consumer electronics, where fire safety and low smoke generation are critical. Automotive parts followed with 27% share, fueled by the shift toward lightweight, flame-retardant polymers in vehicle interiors and under-the-hood applications. Electrical and electronics components contributed about 15% share, supported by miniaturization trends and safety standards. Other niche applications held the remaining 6%, reflecting limited but steady adoption.

Key Growth Drivers

Rising Demand in Wire & Cable Applications

Wires and cables accounted for nearly 52% share of the market in 2024, making them the largest application segment. Increasing demand for fire-safe, halogen-free cable insulation in buildings, transportation, and consumer electronics drives steady growth. Stricter fire safety regulations in Europe and North America are also pushing adoption of LS-HF flame retardant polypropylene. The trend is reinforced by rapid expansion of telecommunication and renewable energy infrastructure, which requires durable and safe wiring solutions. These factors collectively make wire and cable demand a central growth driver.

- For instance, Borealis developed halogen-free FR polypropylene compounds for cable jacketing that pass IEC 60332-3-24 vertical flame spread tests and achieve limiting oxygen index (LOI) values above 30%, ensuring low smoke density and compliance with European CPR standards for building cables.

Automotive Lightweighting and Safety Standards

The automotive industry is increasingly shifting toward lightweight and flame-retardant materials, boosting demand for LS-HF polypropylene. Automotive parts accounted for about 27% market share in 2024, reflecting this trend. Stringent safety regulations require halogen-free materials that reduce toxic smoke emissions during fire incidents. LS-HF PP provides an optimal balance of mechanical strength, weight reduction, and flame resistance. Adoption is further supported by rising production of electric vehicles, where battery housings and cable insulation demand higher safety compliance. This regulatory and performance alignment drives strong growth in the automotive sector.

- For instance, SABIC introduced a halogen-free, flame-retardant PP compound (H1030) for EV battery components that offers good mechanical performance with 30% glass fiber reinforcement and demonstrates excellent electrical performance with a GWIT of over 800°C. This helps ensure safety compliance for automotive applications.

Regulatory Push for Eco-Friendly Materials

Global sustainability regulations are accelerating the use of halogen-free flame retardant polypropylene in multiple industries. Powder and mineral-based flame retardant additives are preferred for their low smoke emissions and non-toxic characteristics, aligning with fire safety and environmental compliance. Markets in Europe and North America emphasize stricter VOC and halogen-free standards, while Asia-Pacific countries are adopting similar frameworks to meet export requirements. This regulatory pressure accounted for a major boost to eco-compliant LS-HF PP, helping the material capture significant demand in 2024 and setting the foundation for long-term market expansion.

Key Trends & Opportunities

Shift Toward Mineral-Based Flame Retardants

Mineral-based additives led the market with nearly 46% share in 2024, driven by their low toxicity, cost-effectiveness, and strong smoke suppression. Increasing demand for magnesium hydroxide and aluminum hydroxide supports sustainable growth, especially in wire insulation and consumer electronics. With regulatory bans on halogenated flame retardants, mineral-based systems represent a major opportunity for producers. Ongoing innovations to improve processing efficiency and dispersion of these minerals in polypropylene will further strengthen their role in industrial and consumer applications, making them a critical trend in the market.

- For instance, manufacturers develop magnesium hydroxide-filled polypropylene compounds to achieve enhanced fire safety for applications like cable insulation and electronic housings, with formulations capable of reaching UL 94 V-0 ratings and Limiting Oxygen Index (LOI) values above 32% at 1.6 mm thickness.

Adoption in Renewable Energy and Smart Infrastructure

The transition toward renewable energy and smart infrastructure projects creates new opportunities for LS-HF PP. Wind and solar power installations require halogen-free wiring systems for safety compliance and durability under harsh conditions. Similarly, smart building infrastructure increasingly adopts flame-retardant, low-smoke cables to ensure safety and performance. This demand is particularly strong in Asia-Pacific and the Middle East, where large-scale infrastructure investments are ongoing. The growing emphasis on safe, sustainable materials positions LS-HF PP as a key material for future energy and construction ecosystems.

- For instance, Borealis supplies halogen-free polypropylene compounds for solar cable jacketing that withstand accelerated aging tests of 20,000 hours at 120 °C and meet IEC 60811-402 stress-crack resistance, ensuring long-term durability in photovoltaic and wind installations.

Key Challenges

High Production and Processing Costs

The manufacturing of LS-HF flame retardant polypropylene involves specialized flame-retardant additives, surface treatments, and compounding equipment, which raise overall costs. Energy-intensive processes, particularly for mineral-based additives, further increase production expenses. This cost burden limits adoption in price-sensitive markets, especially across Latin America and parts of Africa. While large manufacturers benefit from economies of scale, small and mid-sized producers struggle to compete effectively. These financial challenges act as a restraint, slowing down wider adoption and posing a barrier to market penetration in emerging regions.

Competition from Alternative Materials

LS-HF PP faces growing competition from alternative flame-retardant materials such as polyethylene (PE) blends, fluoropolymers, and engineering plastics with enhanced flame resistance. These materials often provide better thermal stability or easier processing, making them attractive substitutes in high-performance applications. Non-stick fluoropolymer coatings in consumer appliances and ceramic-based flame retardants in electronics are notable challengers. This rising availability of alternatives exerts pricing pressure on LS-HF PP, compelling manufacturers to differentiate through performance enhancements, sustainability compliance, and cost-optimized solutions to maintain their competitive edge in the global market.

Regional Analysis

North America

North America held 23% share of the Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market in 2024, driven by strong demand in automotive and electrical applications. The U.S. led the region with widespread adoption of halogen-free wire insulation in construction and vehicle manufacturing. Regulatory frameworks promoting fire safety and eco-friendly materials accelerated the use of mineral-based flame retardants. Canada contributed through infrastructure modernization and renewable energy projects, while Mexico added growth from automotive component production. Rising emphasis on consumer safety and energy-efficient solutions positions North America as a steady growth market over the forecast period.

Europe

Europe accounted for 27% share of the market in 2024, supported by stringent regulations on halogenated materials and high adoption of sustainable flame-retardant systems. Germany, France, and the U.K. dominated demand due to advanced automotive manufacturing and renewable energy projects requiring LS-HF PP solutions. The region’s strong focus on eco-friendly materials aligns with EU directives, boosting market penetration. Growing use in smart building infrastructure and electronic devices reinforced steady consumption. Eastern Europe added incremental growth through expanding construction activities. Europe’s emphasis on compliance, sustainability, and innovation makes it a consistent driver of demand for LS-HF polypropylene.

Asia-Pacific

Asia-Pacific led the global Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market with 38% share in 2024, supported by large-scale manufacturing and expanding urban infrastructure. China dominated the region through massive wire and cable production, while India and Southeast Asia added demand from construction and consumer electronics. Rising adoption in automotive components and renewable energy cables further strengthened growth. Cost-efficient production bases and increasing exports position Asia-Pacific as the key global hub. With rising middle-class consumption and government-backed safety regulations, the region is expected to remain the largest and fastest-growing market through the forecast period.

Latin America

Latin America represented 7% share of the Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market in 2024, led by Brazil and Mexico. Expanding middle-class households and rising demand for safe consumer appliances supported adoption. The automotive sector in Mexico also contributed through LS-HF PP applications in wiring and interiors. Construction activities in Brazil reinforced demand for halogen-free wiring systems in residential and commercial projects. However, economic volatility and high import costs challenged steady growth. Regional producers are increasingly focusing on cost-effective, mineral-based flame retardant solutions to strengthen competitiveness and capture untapped opportunities in urbanizing markets.

Middle East & Africa

The Middle East & Africa accounted for 5% share of the Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market in 2024, with growth concentrated in the Gulf nations. Infrastructure projects in Saudi Arabia and the UAE drove demand for LS-HF PP in wiring and construction materials. Rising real estate investments, particularly in urban centers, created consistent adoption of flame-retardant cables and panels. South Africa contributed through steady demand in appliances and automotive components. Limited regional production led to reliance on imports, creating opportunities for global suppliers. Awareness of fire safety and eco-friendly standards is gradually supporting adoption across the region.

Market Segmentations:

By Type

- Homopolymer PP

- Copolymer PP

By Flame Retardant Additive

- Phosphorus-based

- Mineral-based

- Nitrogen-based

- Others

By Application

- Wires & Cables

- Automotive Parts

- Electrical & Electronics Components

- Others

By End-Use Industry

- Automotive

- Electrical & Electronics

- Construction

- Others

By Geography

- North America

- Europe

- UK

- France

- Germany

- Italy

- Spain

- Russia

- Belgium

- Netherlands

- Austria

- Sweden

- Poland

- Denmark

- Switzerland

- Rest of Europe

- Asia Pacific

- China

- Japan

- South Korea

- India

- Australia

- Thailand

- Indonesia

- Vietnam

- Malaysia

- Philippines

- Taiwan

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Peru

- Chile

- Colombia

- Rest of Latin America

- Middle East

- UAE

- KSA

- Israel

- Turkey

- Iran

- Rest of Middle East

- Africa

- Egypt

- Nigeria

- Algeria

- Morocco

- Rest of Africa

Competitive Landscape

The competitive landscape of the Low Smoke Halogen Free Flame Retardant Polypropylene (PP) market is shaped by leading players such as BASF SE, LG Chem Ltd., SABIC, LyondellBasell Industries Holdings B.V., Mitsubishi Chemical Group Corporation, Clariant AG, RTP Company, Borealis AG, Avient Corporation, and TotalEnergies SE. These companies compete through innovation in additive formulations, expanding product portfolios, and strengthening global distribution networks. A key focus remains on mineral-based and eco-friendly flame-retardant solutions that align with stringent fire safety and environmental regulations across Europe, North America, and Asia-Pacific. Strategic collaborations with automotive and electrical manufacturers drive deeper market penetration, while investments in R&D enable advancements in polymer performance, including higher thermal stability and mechanical strength. Regional manufacturers target cost-efficient formulations to compete in price-sensitive markets, especially in Latin America and the Middle East. Overall, differentiation through sustainability, compliance, and high-performance solutions defines the competitive strategies across this market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- BASF SE

- LG Chem Ltd.

- SABIC

- LyondellBasell Industries Holdings B.V.

- Mitsubishi Chemical Group Corporation

- Clariant AG

- RTP Company

- Borealis AG

- Avient Corporation

- TotalEnergies SE

Recent Developments

- In April 2025, Mitsubishi Chemical Group expanded flame-retardant compound capacity in China and France for cable sheathing, covering polyolefins used in LSZH PP systems.

- In February 2025, Avient introduced ECCOH™ XL 8054 FR, a halogen-free, low-smoke compound for wire and cable.

- In November 2024, Clariant launched Exolit AP 422 A, a melamine-free, non-halogenated APP suited to polyolefin systems, including PP-based WPC at >50% wood content.

- In 2024, LyondellBasell issued its POLYFLAM PP brochure showing halogen-free FR PP grades achieving UL 94 V-0 and CTI 600 V at thin walls.

Report Coverage

The research report offers an in-depth analysis based on Type, Flame Retardant Additive, Application, End-Use Industry and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for LS-HF flame retardant polypropylene will continue to grow in wire and cable applications.

- Automotive adoption will rise as manufacturers prioritize lightweight, flame-retardant materials for safety compliance.

- Electrical and electronics components will see steady growth with stricter fire safety standards.

- Mineral-based flame retardants will expand their dominance due to eco-friendly and cost-effective properties.

- Phosphorus and nitrogen-based additives will gain traction in high-performance and specialized applications.

- Regulatory frameworks in Europe and North America will drive wider use of halogen-free solutions.

- Asia-Pacific will maintain its leadership supported by industrial growth and large-scale manufacturing.

- Europe will grow steadily, driven by sustainability goals and advanced automotive applications.

- Companies will increase R&D investments to enhance thermal stability and processing efficiency.

- Competition from alternative flame-retardant materials will push differentiation through sustainability and performance.

Market Insights

Market Insights