Market Overview

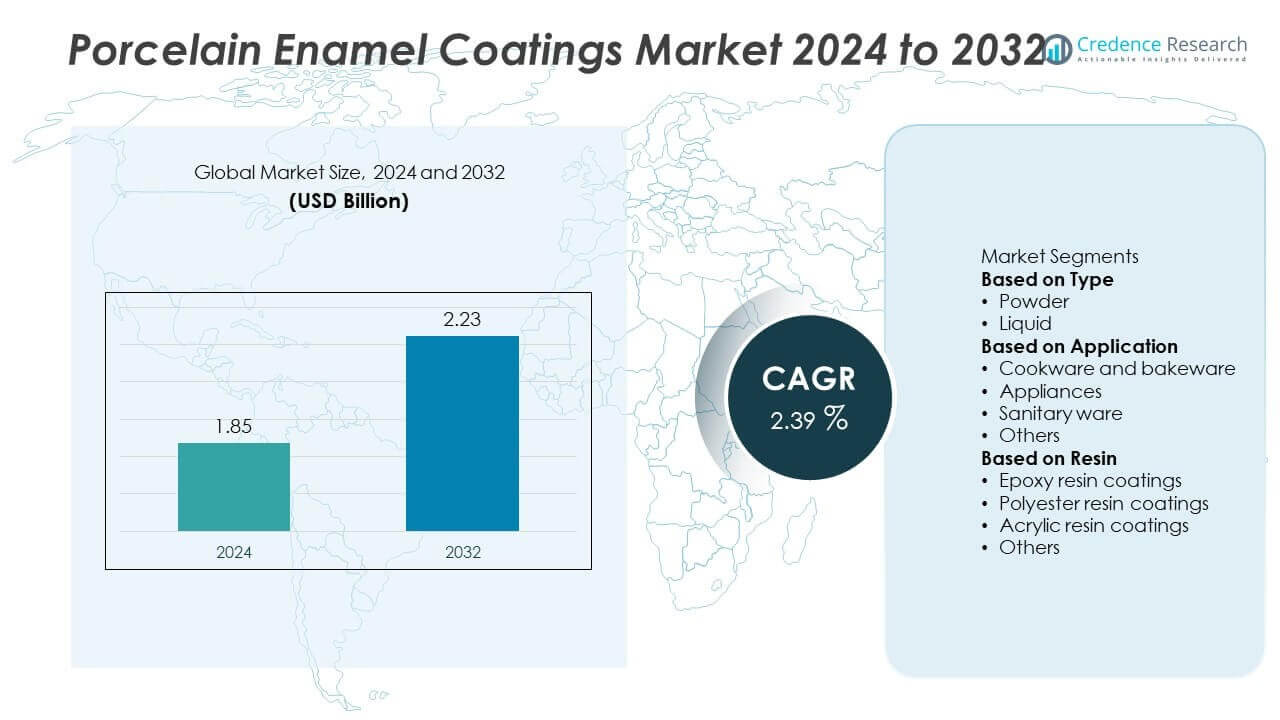

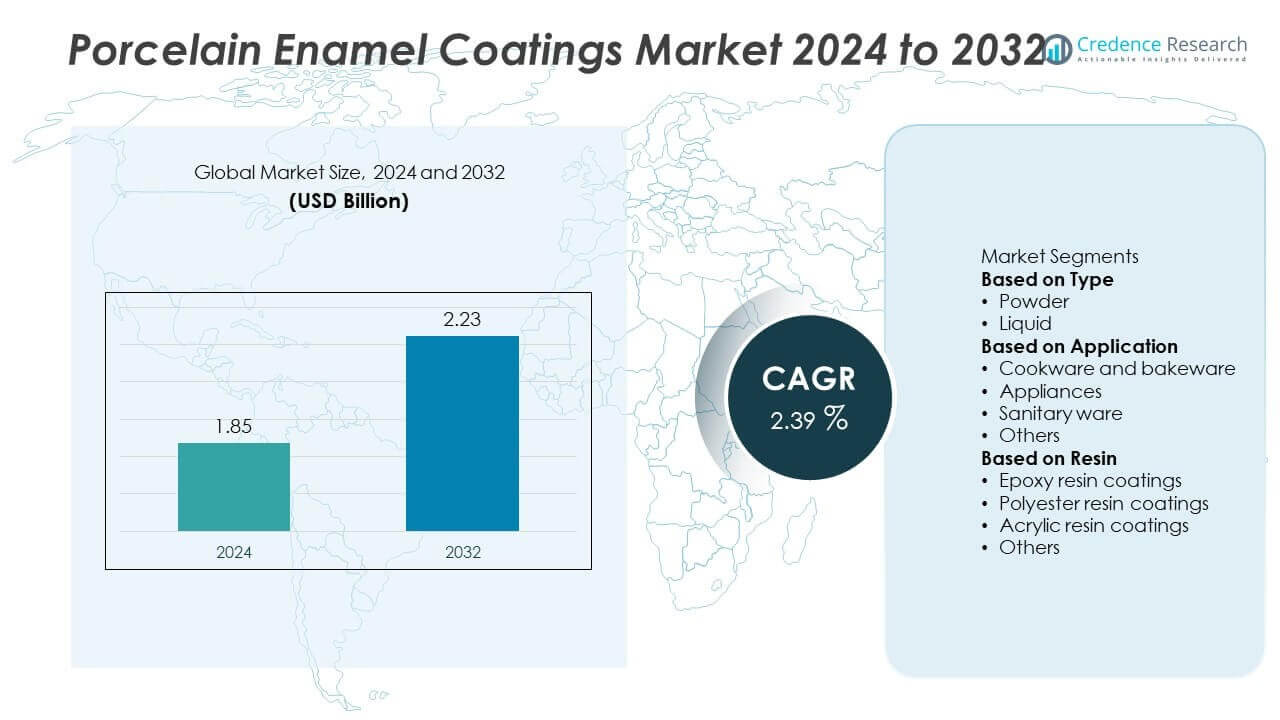

The porcelain enamel coatings market was valued at USD 1.85 billion in 2024 and is projected to reach USD 2.23 billion by 2032, growing at a CAGR of 2.39% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Porcelain Enamel Coatings Market Size 2024 |

USD 1.85 Billion |

| Porcelain Enamel Coatings Market, CAGR |

2.39% |

| Porcelain Enamel Coatings Market Size 2032 |

USD 2.23 Billion |

The porcelain enamel coatings market is led by companies including Minerva Paints & Coatings, BASF, Altana, Glidden Paints, Decoral System, Mayco Industries, Asian Paints Limited, Colormaker, FERRO-ENAMEL, and Ferro. These players compete through innovation in powder and resin-based coatings, focusing on durability, heat resistance, and eco-compliance. Asia-Pacific emerged as the leading region with 35% share in 2024, driven by large-scale appliance manufacturing and rising cookware demand. Europe followed with 28% share, supported by strict environmental regulations and advanced coating technologies. North America held 25% share, driven by strong consumer demand in appliances and kitchenware, while Latin America and the Middle East & Africa accounted for smaller shares of 7% and 5% respectively.

Market Insights

Market Insights

- The porcelain enamel coatings market was valued at USD 1.85 billion in 2024 and is projected to reach USD 2.23 billion by 2032, growing at a CAGR of 2.39%.

- Key drivers include rising demand in cookware and appliances, which together represented 45% share in 2024, supported by durability, heat resistance, and non-reactive properties.

- Market trends highlight the shift toward eco-friendly powder coatings, which held 60% share, as companies adopt low-VOC and sustainable solutions to align with global environmental standards.

- The competitive landscape includes major players such as Minerva Paints & Coatings, BASF, Altana, Glidden Paints, Decoral System, Mayco Industries, Asian Paints Limited, Colormaker, FERRO-ENAMEL, and Ferro, focusing on R&D, partnerships, and expansion into emerging markets.

- Regionally, Asia-Pacific led with 35% share in 2024, followed by Europe at 28% and North America at 25%, while Latin America and the Middle East & Africa accounted for 7% and 5% respectively.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Type

Powder coatings dominated the porcelain enamel coatings market in 2024, capturing nearly 60% share. Their dominance is driven by higher durability, smooth finish, and cost-effectiveness compared to liquid coatings. Powder variants are also preferred due to lower VOC emissions and compliance with environmental regulations, which boost their adoption in industrial applications. Liquid coatings, while still important for complex geometries, hold a smaller share due to higher processing costs and environmental concerns. Rising demand from cookware and household appliances continues to strengthen the leadership of powder-based porcelain enamel coatings.

- For instance, Ferro Corporation, now Vibrantz Technologies, produces porcelain enamel powder coatings for cookware. A typical firing range for these products is 810 °C to 850 °C for steel, though this can vary by formulation.

By Application

Cookware and bakeware led the application segment of porcelain enamel coatings in 2024 with about 45% share. This leadership stems from the widespread use of enamel coatings in pots, pans, and ovens, valued for heat resistance, non-reactive surfaces, and ease of cleaning. Growing consumer preference for durable and safe cookware further drives demand. Appliances, including washing machines and refrigerators, also account for significant usage, supported by rising household ownership. Sanitary ware and other niche applications, such as architectural uses, add incremental growth but remain secondary in overall share.

- For instance, enamel frits are designed for cookware coatings, with some formulations providing resistance to thermal cycling up to 500 °C for oven interiors and stovetop applications. Some manufacturers specializing in porcelain enamel, like Capricorn Coatings and Colours, produce frits for these high-temperature applications.

By Resin

Epoxy resin coatings held the largest share of the resin-based porcelain enamel coatings segment in 2024, accounting for nearly 40%. Their strength lies in superior adhesion, corrosion resistance, and compatibility with metal substrates used in cookware and appliances. Polyester resin coatings follow closely due to their excellent outdoor durability and weather resistance, making them popular in appliances and sanitary ware. Acrylic and other resins remain niche categories, used mainly in specialized products. The strong adoption of epoxy coatings is supported by regulatory requirements for extended product life and enhanced consumer demand for reliable finishes.

Key Growth Drivers

Rising Demand in Cookware and Appliances

The growing use of porcelain enamel coatings in cookware and household appliances remains a primary driver. In 2024, cookware and bakeware accounted for about 45% share due to their heat resistance, durability, and non-reactive properties. Manufacturers are increasingly adopting enamel coatings to enhance product lifespan and consumer safety. Demand is further supported by lifestyle changes, urbanization, and rising kitchenware replacement rates. This trend positions cookware and appliances as consistent demand centers, fueling steady growth for enamel coatings in domestic and international markets.

- For instance, Asian Paints supplies enamel coatings for appliances such as washing machines, which can withstand the temperatures of a typical washing cycle. Standard wash temperatures generally range from cold (around 20–30°C) to hot (around 60°C for sanitation), which the enamel is designed to endure repeatedly.

Environmental and Regulatory Compliance

Powder-based porcelain enamel coatings, which captured nearly 60% share in 2024, benefit from stricter global environmental standards. Powder coatings emit lower VOCs compared to liquid alternatives, aligning with sustainability regulations. Governments across North America and Europe are enforcing eco-friendly coating practices, accelerating adoption. Manufacturers are also investing in cleaner technologies to meet compliance while enhancing product performance. This alignment with environmental goals strengthens long-term demand, making eco-compliant coatings a central growth factor in the global market.

- For instance, BASF’s powder coating formulations for appliances are designed to comply with EU REACH standards and significantly reduce volatile organic compound (VOC) emissions compared to solvent-based coatings.

Expanding Applications in Sanitary Ware and Construction

Porcelain enamel coatings are increasingly used in sanitary ware, building panels, and construction applications. Sanitary ware adoption is growing due to enamel’s non-porous surface, corrosion resistance, and ease of cleaning. In the construction sector, architects value enamel-coated panels for aesthetics, durability, and weather resistance. This broader application scope opens new revenue streams beyond cookware and appliances. Rising infrastructure investments in Asia-Pacific and the Middle East are creating significant opportunities, enhancing the role of enamel coatings across diverse industrial and residential uses.

Key Trends & Opportunities

Technological Advancements in Coating Processes

Manufacturers are focusing on advanced coating technologies to enhance adhesion, finish quality, and durability. Digital spraying and automated powder systems improve precision, reduce waste, and support large-scale production. These innovations lower operational costs while meeting strict performance requirements in consumer and industrial applications. Companies are also developing hybrid resin formulations that offer improved thermal and chemical resistance. The shift toward technology-driven efficiency creates an opportunity for producers to scale operations while aligning with evolving product quality expectations.

- For instance, Ferro Techniek develops and manufactures specialized thick-film heating elements for high-volume consumer appliances like water heaters and coffee machines. These are created using a screen-printing process on porcelain-enameled metal substrates and offer a fast, reliable, and energy-efficient heat source.

Sustainability-Driven Market Expansion

The transition to sustainable and energy-efficient coatings is a major trend shaping the market. Powder coatings, with their eco-friendly nature, align with global carbon-reduction goals and regulations such as REACH in Europe. Manufacturers are also exploring bio-based and recyclable resin systems to meet consumer and regulatory pressure for sustainable solutions. This sustainability focus not only ensures compliance but also enhances brand positioning. Growing consumer awareness of health and environmental impact is likely to drive continued preference for eco-certified enamel coatings.

- For instance, BASF offers coatings made with biomass-balanced resins, which contribute to a reduction in fossil resource consumption and CO2 emissions. These offerings include low-VOC formulations for products like water-based dispersions used in architectural coatings.

Key Challenges

High Initial Processing and Equipment Costs

The porcelain enamel coating process requires specialized kilns, spraying systems, and surface preparation equipment. These capital-intensive requirements raise entry barriers for small and medium-scale manufacturers. Additionally, high energy costs associated with curing processes increase overall production expenses, impacting profitability. While large players can offset costs through economies of scale, smaller firms face challenges in competing effectively. This financial pressure limits wider adoption in price-sensitive markets, creating a challenge for consistent global expansion of porcelain enamel coatings.

Competition from Alternative Coatings

The market faces rising competition from alternative coatings such as fluoropolymers and sol-gel ceramics. These substitutes offer similar corrosion resistance and durability while sometimes providing easier application processes. In cookware, non-stick coatings like PTFE are strong competitors due to their lightweight and convenience features. In appliances and construction, powder-polymer coatings are gaining traction. The presence of multiple alternatives places pricing pressure on porcelain enamel coatings, forcing manufacturers to differentiate through quality, durability, and eco-compliance to maintain market share.

Regional Analysis

North America

North America accounted for 25% share of the porcelain enamel coatings market in 2024, driven by strong demand from cookware, appliances, and sanitary ware. The U.S. leads the region due to high household appliance penetration and consumer preference for durable, eco-friendly coatings. Regulatory standards promoting low-VOC coatings have further supported the adoption of powder-based porcelain enamels. Canada contributes steadily, supported by construction and residential refurbishment activities. Growth is reinforced by increasing replacement cycles in kitchenware and the rising popularity of enamel-coated panels in commercial construction projects across urban centers.

Europe

Europe held 28% share of the porcelain enamel coatings market in 2024, supported by strict environmental regulations and advanced coating technologies. Germany, Italy, and France dominate the region due to their established cookware and appliance industries. The EU’s REACH regulations encourage the use of powder coatings, boosting market penetration. Strong sanitary ware demand also drives growth, particularly in Western Europe. Eastern European countries are gradually expanding their adoption with rising infrastructure development. Sustainability goals and consumer preference for long-lasting, eco-friendly products continue to reinforce the market’s steady growth across Europe.

Asia-Pacific

Asia-Pacific emerged as the largest regional market with 35% share in 2024, fueled by rapid industrialization, urbanization, and population growth. China leads consumption, supported by large-scale appliance manufacturing and cookware exports. India and Southeast Asian nations are witnessing growing demand from urban households and construction projects. The rising middle-class population drives purchases of modern kitchenware and sanitary ware. Cost-effective production capabilities and expanding manufacturing bases also position Asia-Pacific as a global hub for porcelain enamel coatings. Infrastructure investments and export opportunities further strengthen the region’s dominant role in the market.

Latin America

Latin America accounted for 7% share of the porcelain enamel coatings market in 2024, led by Brazil and Mexico. Growth is driven by increasing demand for cookware and appliances, supported by expanding middle-class households and changing lifestyles. Construction activity also supports the adoption of enamel-coated panels and sanitary ware in urban areas. However, economic volatility and fluctuating import costs create challenges for consistent growth. Local manufacturers are focusing on cost-efficient powder coatings to strengthen competitiveness. Rising awareness of sustainable coatings is also expected to gradually enhance adoption across key markets.

Middle East & Africa

The Middle East & Africa held 5% share of the porcelain enamel coatings market in 2024, supported by rising construction and infrastructure projects. Demand for sanitary ware is growing in Gulf nations due to rapid urban development and high investments in real estate. South Africa shows potential in cookware and appliances, driven by consumer preference for durable and affordable products. Limited regional manufacturing capacity leads to reliance on imports, creating opportunities for global suppliers. Increasing awareness of eco-friendly coatings and the adoption of powder enamel solutions are expected to gradually support market expansion.

Market Segmentations:

By Type

By Application

- Cookware and bakeware

- Appliances

- Sanitary ware

- Others

By Resin

- Epoxy resin coatings

- Polyester resin coatings

- Acrylic resin coatings

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the porcelain enamel coatings market features key players such as Minerva Paints & Coatings, BASF, Altana, Glidden Paints, Decoral System, Mayco Industries, Asian Paints Limited, Colormaker, FERRO-ENAMEL, and Ferro. These companies focus on strengthening their product portfolios through innovation in powder and resin-based coatings, with an emphasis on eco-friendly and durable solutions. Large multinational firms leverage global distribution networks and R&D capabilities to cater to cookware, appliances, and sanitary ware industries, while regional manufacturers target niche applications and cost-effective solutions. Strategic investments in advanced coating technologies and compliance with environmental regulations remain critical growth strategies. Partnerships with appliance and cookware manufacturers, along with expansion into emerging markets in Asia-Pacific and Latin America, further support competitiveness. Price pressure from alternative coatings and raw material cost fluctuations, however, pose challenges, driving firms to differentiate through quality, performance, and sustainability initiatives.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Minerva Paints & Coatings

- BASF

- Altana

- Glidden Paints

- Decoral System

- Mayco Industries

- Asian Paints Limited

- Colormaker

- FERRO-ENAMEL

- Ferro

Recent Developments

- In August 2025, Asian Paints and PPG renewed their India joint ventures for 15 years, covering industrial and powder coatings.

- In June 2025, BASF Coatings won the “Trophée de l’Industrie s’engage 2025” for a collaboration with Renault and Dürr on an Overspray-Free Application (OFLA) process achieving “100% paint transfer efficiency with zero overspray.”

- In May 2025, BASF Coatings expanded its biomass-balanced product portfolio, launching new coatings under the Glasurit® Eco Balance and R-M eSense brands in North America.

- In 2024, Ferro (now Vibrantz Technologies) sold its Onda, Spain manufacturing operations to Xphere Global Specialities, trimming ceramics/enamel manufacturing footprint.

Report Coverage

The research report offers an in-depth analysis based on Type, Application, Resin and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Demand for porcelain enamel coatings will continue to grow in cookware and bakeware.

- Powder coatings will strengthen their dominance due to eco-friendly and durable properties.

- Appliances will remain a major application segment, supporting consistent market expansion.

- Sanitary ware adoption will rise as urban infrastructure projects accelerate globally.

- Epoxy resin coatings will sustain leadership, driven by corrosion resistance and adhesion benefits.

- Sustainability regulations will push manufacturers toward low-VOC and recyclable formulations.

- Asia-Pacific will maintain leadership, supported by industrial growth and manufacturing capacity.

- Europe will expand steadily, driven by strict environmental compliance and advanced technologies.

- Companies will invest more in R&D to enhance efficiency and coating performance.

- Competition from alternative coatings will drive differentiation through quality and sustainability.

Market Insights

Market Insights