Market Overview

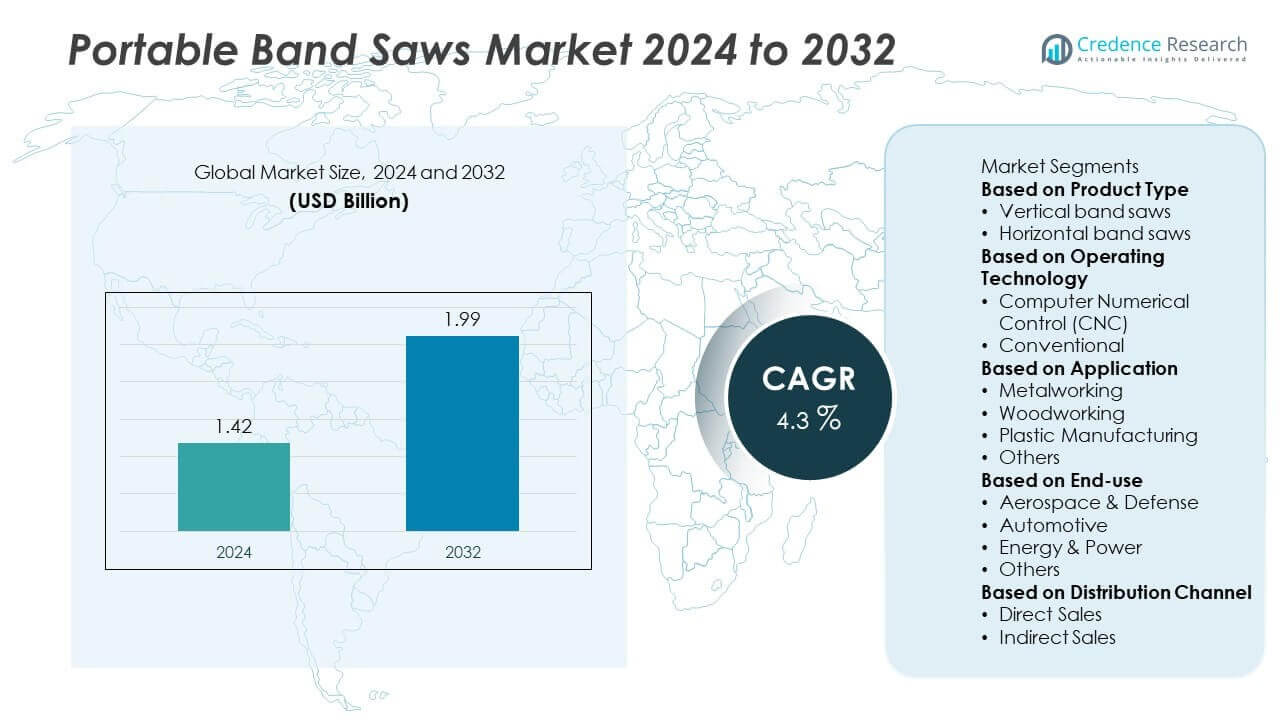

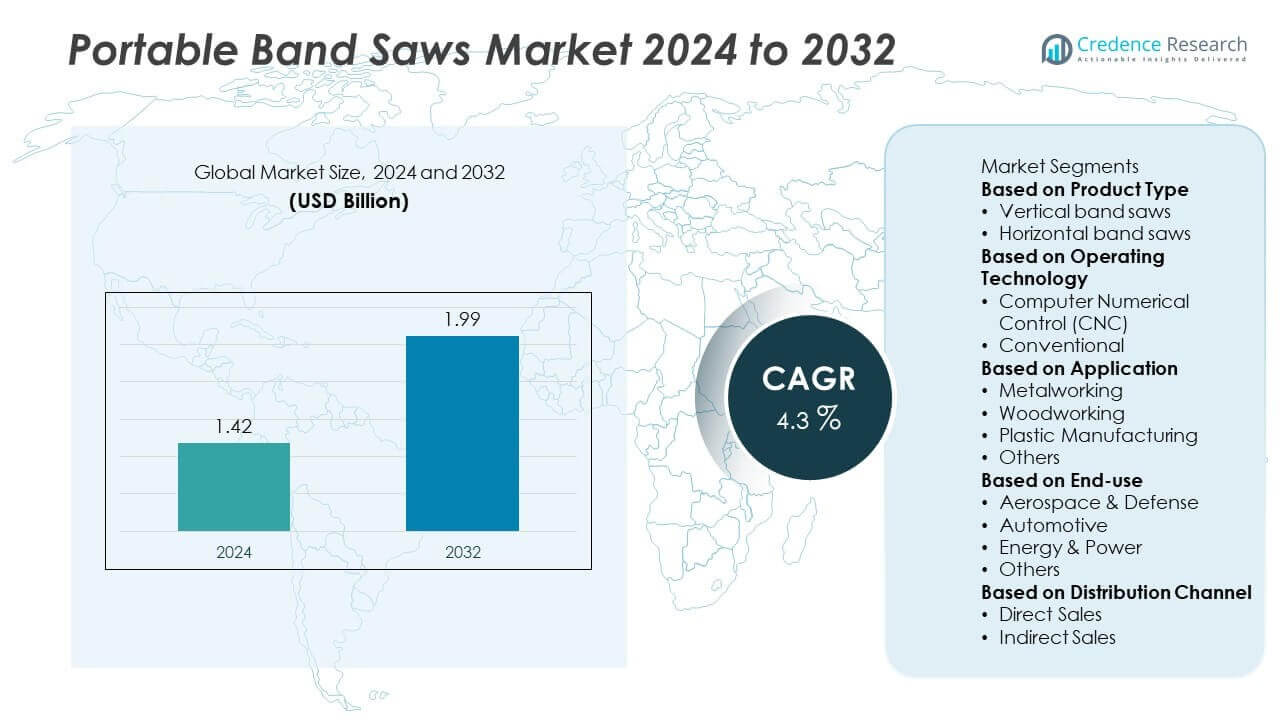

Portable Band Saws Market size was valued at USD 1.42 billion in 2024 and is anticipated to reach USD 1.99 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Portable Band Saws Market Size 2024 |

USD 1.42 Billion |

| Portable Band Saws Market, CAGR |

4.3% |

| Portable Band Saws Market Size 2032 |

USD 1.99 Billion |

The portable band saws market is shaped by leading players such as Makita, Everett Portable Bandsaw, Bauer, JPW Industries, Bosch, Ryobi, Milwaukee, Kaka Industrial, Dewalt, and Emerson Electric. These companies drive competition through innovation in cordless models, ergonomic designs, and advanced blade technologies to meet rising demand in construction, metalworking, and woodworking. Regionally, Asia-Pacific leads the market with 35% share in 2024, driven by rapid industrialization and infrastructure growth across China, India, and Southeast Asia. North America follows with 32% share, supported by strong adoption in automotive, aerospace, and construction sectors, while Europe holds 27% share, underpinned by precision engineering and established industrial bases.

Market Insights

Market Insights

- The portable band saws market was valued at USD 1.42 billion in 2024 and is projected to reach USD 1.99 billion by 2032, growing at a CAGR of 4.3% during the forecast period.

- Rising demand from metalworking applications, which accounted for over 40% share in 2024, is a key growth driver, supported by widespread use in automotive, construction, and fabrication industries.

- A major trend is the shift toward cordless and battery-powered models, with manufacturers focusing on lightweight, ergonomic designs and durable blade technologies to enhance efficiency and safety.

- The market is competitive with players such as Makita, Milwaukee, Bosch, Dewalt, and Emerson Electric leading innovations, while smaller firms like Kaka Industrial and Everett Portable Bandsaw focus on cost-effective offerings.

- Asia-Pacific leads with 35% share, followed by North America at 32% and Europe at 27%, while vertical band saws dominated by product type with 55% share in 2024.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product Type

Vertical band saws dominated the portable band saws market in 2024, capturing over 55% share. Their dominance stems from precision cutting capabilities and widespread use in industrial workshops. Vertical models are favored for complex shapes, detailed designs, and versatile cutting of wood, plastics, and metals. Demand is reinforced by adoption in small to medium-scale manufacturing, where flexibility and accuracy are critical. Horizontal band saws hold a smaller share, catering mainly to large stock cutting in metalworking industries, but their use is limited compared to the broader versatility of vertical models.

- For instance, JPW Industries’ JET VBS-1813VS-DC vertical bandsaw models support throat capacities of up to 18 inches and cutting speeds ranging from 90 to 1,600 SFPM, enabling precision cutting of both ferrous and non-ferrous materials in manufacturing workshops.

By Operating Technology

The conventional segment led the market with more than 60% share in 2024, supported by cost-effectiveness and ease of use across workshops. Small businesses and contractors prefer conventional models due to affordability and lower training requirements. Their lightweight design and straightforward maintenance further drive adoption in woodworking and general construction tasks. In contrast, Computer Numerical Control (CNC) portable band saws are steadily gaining ground, especially in precision-driven industries. However, higher costs and limited penetration among smaller operators restrict their market share, making conventional technology the preferred choice.

- For instance, Kaka Industrial offers conventional band saws with maximum cutting capacities of 178 mm round and 127 × 305 mm rectangular stock, operating at adjustable speeds between 80 and 240 SFPM, making them suitable for versatile workshop use without CNC integration.

By Application

Metalworking emerged as the leading application segment in 2024, accounting for over 40% share of the portable band saws market. This dominance is attributed to rising demand in automotive, construction, and fabrication industries where precise and durable metal cutting is essential. Portable band saws enable efficient handling of pipes, sheets, and structural components, driving adoption. Woodworking applications follow closely, supported by furniture and interior construction industries. Plastic manufacturing and other niche applications contribute smaller shares, mainly serving specialized sectors requiring adaptable cutting solutions, but remain secondary compared to the scale of metalworking demand.

Key Growth Drivers

Rising Demand in Metalworking Industries

The growing adoption of portable band saws in metalworking is a major market driver. Industries such as automotive, construction, and fabrication rely on these tools for accurate cutting of pipes, bars, and structural metals. Their portability and precision enable efficient operations in fieldwork and repair applications. With global infrastructure and automotive manufacturing expanding, demand for durable cutting equipment continues to increase. The ability of portable band saws to handle diverse metals positions them as essential tools for industrial growth, fueling steady market expansion.

- For instance, Milwaukee’s M18 FUEL Deep Cut Band Saw delivers cutting speeds up to 550 SFPM and achieves up to 78 cuts on 1-5/8″ Unistrut per charge with an XC5.0 battery, making it a reliable tool for metal fabrication and construction contractors.

Expansion of Small-Scale Manufacturing and Workshops

Small and medium enterprises (SMEs) are fueling portable band saw adoption due to cost-effectiveness and ease of use. Workshops and job shops prefer these tools for versatile applications, including woodworking and light fabrication. Their compact design, relatively low investment, and minimal maintenance make them attractive for operators with budget constraints. Growth in construction, furniture making, and repair services further supports this demand. As SMEs continue to expand across developing economies, the preference for affordable and flexible cutting tools will reinforce market penetration of portable band saws.

- For instance, the Ryobi 18V ONE+ Compact Band Saw (model P590) features a 2-1/2″ cutting capacity and weighs 7.35 lb (bare tool), making it suitable for SMEs and workshops to cut copper pipes, conduit, and wood efficiently with minimal setup requirements.

Technological Advancements in Cutting Equipment

Innovation in portable band saws, such as lightweight designs and improved blade technology, is driving adoption. Manufacturers are introducing ergonomically designed models with higher efficiency and reduced vibration, enhancing operator comfort and accuracy. Advances in blade materials also improve cutting speed and durability, reducing downtime and replacement costs. While conventional models dominate, growing integration of automation and CNC features is broadening application in high-precision industries. These technological improvements not only increase productivity but also extend the lifespan of equipment, creating strong demand across industrial and construction sectors.

Key Trends & Opportunities

Shift Toward Cordless and Battery-Powered Models

The portable band saw market is witnessing a shift toward cordless models powered by lithium-ion batteries. These versions provide mobility, eliminate dependence on wired connections, and improve workplace safety. Growing investments in high-capacity rechargeable batteries allow longer operation times, making them suitable for construction sites and field applications. Manufacturers focusing on battery efficiency and fast-charging capabilities are well-positioned to capture this opportunity. The trend toward cordless solutions aligns with broader adoption of portable power tools, reflecting demand for flexibility and convenience among end-users.

- For instance, DeWalt’s 20V MAX XR Deep Cut Band Saw (DCS374) delivers a 5-inch cutting capacity and achieves up to 149 cuts in 1-5/8″ strut with a 5.0Ah battery, highlighting advancements in cordless endurance and performance.

Opportunities in Emerging Economies

Developing markets in Asia-Pacific, Latin America, and Africa present strong growth opportunities for portable band saws. Rapid urbanization, expanding infrastructure projects, and increasing small-scale manufacturing support demand for cutting tools. Rising investments in automotive and construction industries in countries such as India, Brazil, and Indonesia boost adoption. Affordable and versatile saws appeal to local contractors and workshops, creating a steady revenue stream. Global manufacturers focusing on cost-optimized models tailored to these markets can strengthen their presence, leveraging rising demand in price-sensitive but rapidly industrializing economies.

- For instance, Makita offers its XBP05ZB 18V LXT Compact Brushless Band Saw, featuring a 2″ x 2″ cutting capacity and a weight of 7.3 lbs with the battery, which is designed for portability.

Key Challenges

High Competition from Alternative Cutting Tools

Portable band saws face strong competition from tools such as angle grinders, circular saws, and plasma cutters. These alternatives often provide faster cutting or higher precision in specific applications, reducing reliance on band saws. In woodworking, for instance, circular saws dominate due to efficiency in straight cuts. The availability of low-cost alternatives in developing markets further limits adoption. For portable band saw manufacturers, differentiation through improved features and durability is necessary to maintain relevance and counter competition from versatile substitute tools.

Maintenance and Blade Replacement Costs

Frequent blade wear and the need for regular maintenance present challenges for portable band saw users. Continuous cutting of metals and hard materials accelerates blade degradation, increasing replacement expenses. Smaller workshops and contractors often face budget constraints, making recurring costs a barrier to adoption. Downtime associated with blade changes also impacts productivity, particularly in large-scale operations. Manufacturers addressing these challenges through durable blade designs and low-maintenance equipment stand to reduce customer concerns, but the issue remains a limiting factor for broader market penetration.

Regional Analysis

North America

North America held over 32% share of the portable band saws market in 2024, driven by strong demand across construction, automotive, and aerospace sectors. The region benefits from advanced manufacturing infrastructure and high adoption of power tools in industrial workshops. U.S. contractors and fabricators prefer portable band saws for field applications, while woodworking and repair services support consistent sales. Growing replacement demand for cordless, battery-powered models further enhances growth. Continuous investments in infrastructure modernization and expansion of small-scale workshops reinforce the region’s market leadership, with manufacturers focusing on ergonomic designs and durable blade technologies to meet diverse needs.

Europe

Europe accounted for more than 27% share of the portable band saws market in 2024, supported by strong industrial bases in Germany, Italy, and the UK. The region’s focus on precision engineering and advanced manufacturing boosts adoption in metalworking and automotive sectors. Demand is further reinforced by woodworking industries, particularly in furniture and interior design. European manufacturers emphasize innovation, integrating energy-efficient and low-noise models to meet strict workplace safety regulations. The trend toward CNC-controlled equipment is gaining momentum, especially among large workshops, enhancing cutting precision. Regional adoption is also supported by ongoing infrastructure development and increased workshop automation.

Asia-Pacific

Asia-Pacific dominated with over 35% share of the portable band saws market in 2024, making it the largest regional contributor. Rapid industrialization in China, India, and Southeast Asia drives demand in construction, automotive, and metal fabrication sectors. Expanding small-scale workshops and growing furniture manufacturing further strengthen adoption. The region’s cost-sensitive markets favor conventional models, but cordless and technologically advanced saws are gaining traction with rising disposable incomes. Strong investments in infrastructure projects and rising exports of fabricated metal products contribute to sustained demand. Asia-Pacific’s large workforce and continuous industrial growth ensure its position as the fastest-growing regional market.

Latin America

Latin America captured over 4% share of the portable band saws market in 2024, supported by infrastructure expansion and growing construction activities in Brazil and Mexico. Adoption is primarily concentrated in metalworking and woodworking sectors, with rising demand from local contractors and small-scale workshops. However, the region faces challenges such as limited access to high-end CNC models due to cost constraints. Manufacturers introducing affordable, durable, and cordless solutions are gaining traction. Growth prospects remain steady, fueled by increasing urbanization and the need for efficient cutting tools in building, furniture manufacturing, and automotive aftermarket services across key Latin American economies.

Middle East & Africa

The Middle East & Africa region accounted for around 2% share of the portable band saws market in 2024. Growth is driven by ongoing infrastructure development, particularly in Gulf countries, and rising investments in construction and metal fabrication. Demand remains limited compared to other regions due to smaller manufacturing bases and lower penetration of advanced cutting equipment. However, portable band saws are increasingly adopted in woodworking and repair workshops. Affordable models dominate sales, while cordless designs are slowly entering the market. With industrial diversification initiatives and growing construction projects, the region presents long-term opportunities for market expansion.

Market Segmentations:

By Product Type

- Vertical band saws

- Horizontal band saws

By Operating Technology

- Computer Numerical Control (CNC)

- Conventional

By Application

- Metalworking

- Woodworking

- Plastic Manufacturing

- Others

By End-use

- Aerospace & Defense

- Automotive

- Energy & Power

- Others

By Distribution Channel

- Direct Sales

- Indirect Sales

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the portable band saws market features key players such as Makita, Everett Portable Bandsaw, Bauer, JPW Industries, Bosch, Ryobi, Milwaukee, Kaka Industrial, Dewalt, and Emerson Electric. These companies compete through product innovation, distribution reach, and technological integration. Manufacturers are focusing on cordless and lightweight designs to cater to growing demand in construction and field applications. Bosch, Makita, and Dewalt emphasize ergonomic models with improved safety features, while Milwaukee and Ryobi target professional contractors with durable, high-performance tools. Smaller players like Kaka Industrial and Everett Portable Bandsaw strengthen their positions through cost-effective offerings tailored for SMEs and workshops. Emerson Electric leverages its global presence and engineering expertise to expand its customer base. Partnerships with distributors and expansion into emerging markets remain crucial strategies. The competition is intensifying as companies align with trends in battery-powered solutions and advanced blade technologies to gain an edge in market share.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In September 2024, Milwaukee has unveiled its newest M18 FUEL™ Deep Cut Band Saw (2929-20) for faster cutting and maximum power, and which is part of the new M18 FUEL™ Deep Cut Band Saw Kit (2929-22). The new cordless Milwaukee M18 FUEL™ Deep Cut Band Saw helps work get done faster by cutting 4-in black iron pipe 20% faster than the previous generation of band saws for performance that outruns many competitors.

- In 2024, DeWalt announced a dual-switch cordless band saw system requiring two-hand activation, enhancing jobsite safety.

- In 2024, DeWalt highlighted its DCS377B’s variable-speed trigger and dial, enabling optimized blade speed for different materials.

- In 2024, Ryobi Tools launched new 18v Cordless 2-1/2″ Portable Band Saw that will be sold for approximately $99 bare tools. This is a brushed model with a 32-7/8″ blade. Two are included in the box. The new Ryobi P590 18V 2-1/2″ Cordless Portable Band Saw will use any of the Ryobi 18-volt batteries and has a 2-1/2″ width of cut with about 3″ depth of cut. The automatic blade tension now allows for an easy blade change. There are two adjustment screws to adjust the blade tracking along with an adjustable material stop.

Report Coverage

The research report offers an in-depth analysis based on Product Type, Operating Technology, Application, End-use, Distribution Channel and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily, supported by rising demand in metalworking and fabrication.

- Cordless and battery-powered band saws will gain wider adoption across industries.

- Vertical band saws will continue holding the dominant share due to versatility.

- Conventional models will remain popular, but CNC adoption will grow in precision industries.

- Asia-Pacific will maintain leadership with industrial growth and infrastructure projects.

- North America will see stable growth from automotive, aerospace, and construction sectors.

- Europe will strengthen its share through innovation in ergonomic and safety-focused designs.

- Manufacturers will focus on durable blades and low-maintenance models to reduce downtime.

- SMEs and workshops will drive consistent demand for cost-effective and flexible solutions.

- Competition will intensify as global players expand portfolios targeting emerging markets.

Market Insights

Market Insights