Market Overview

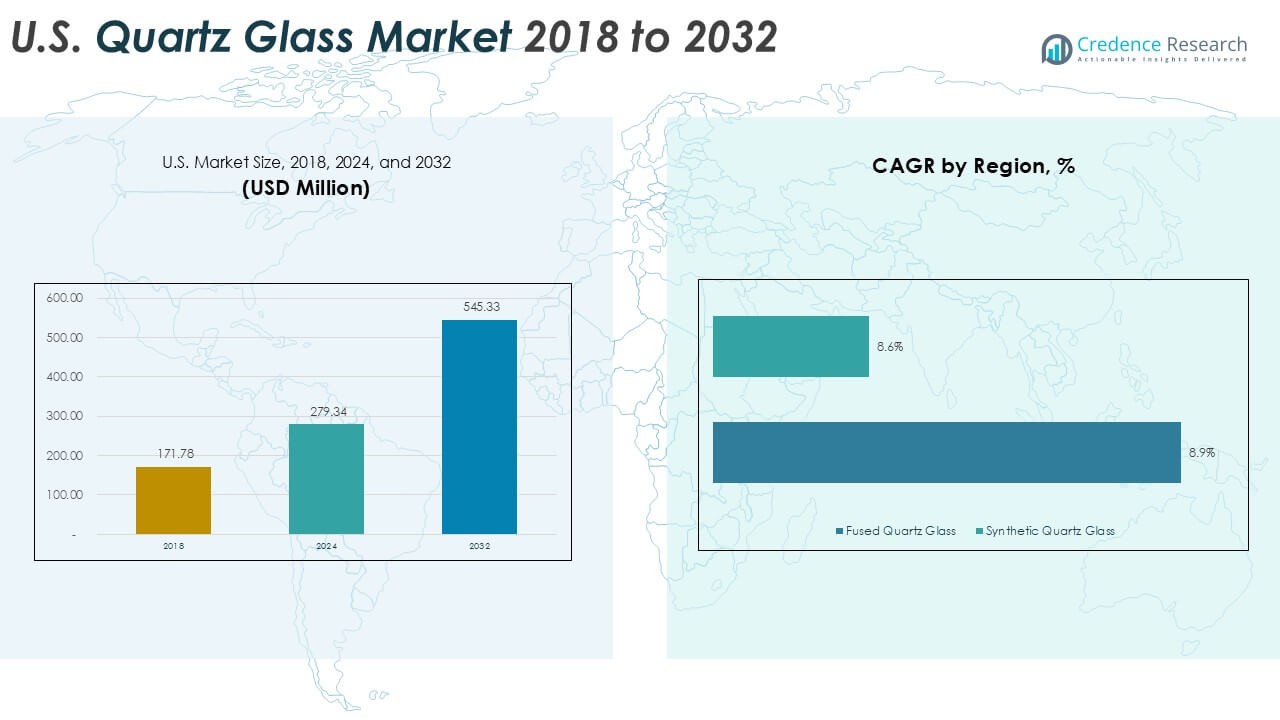

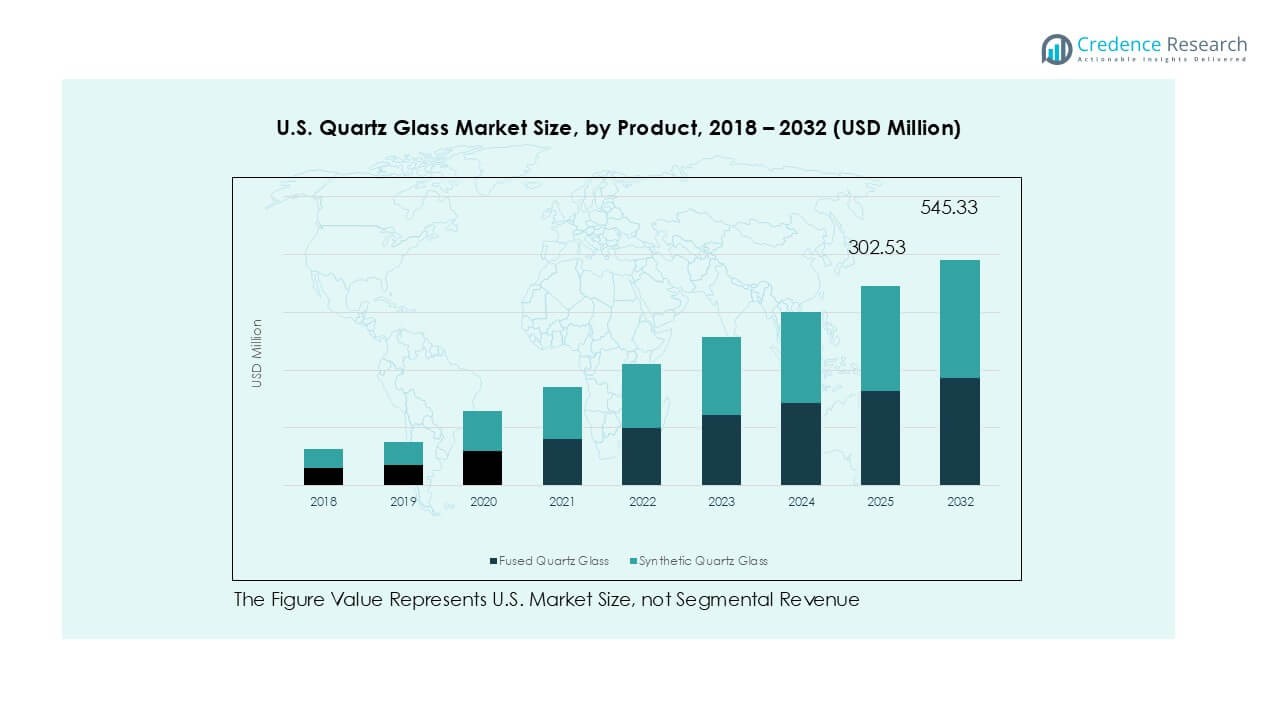

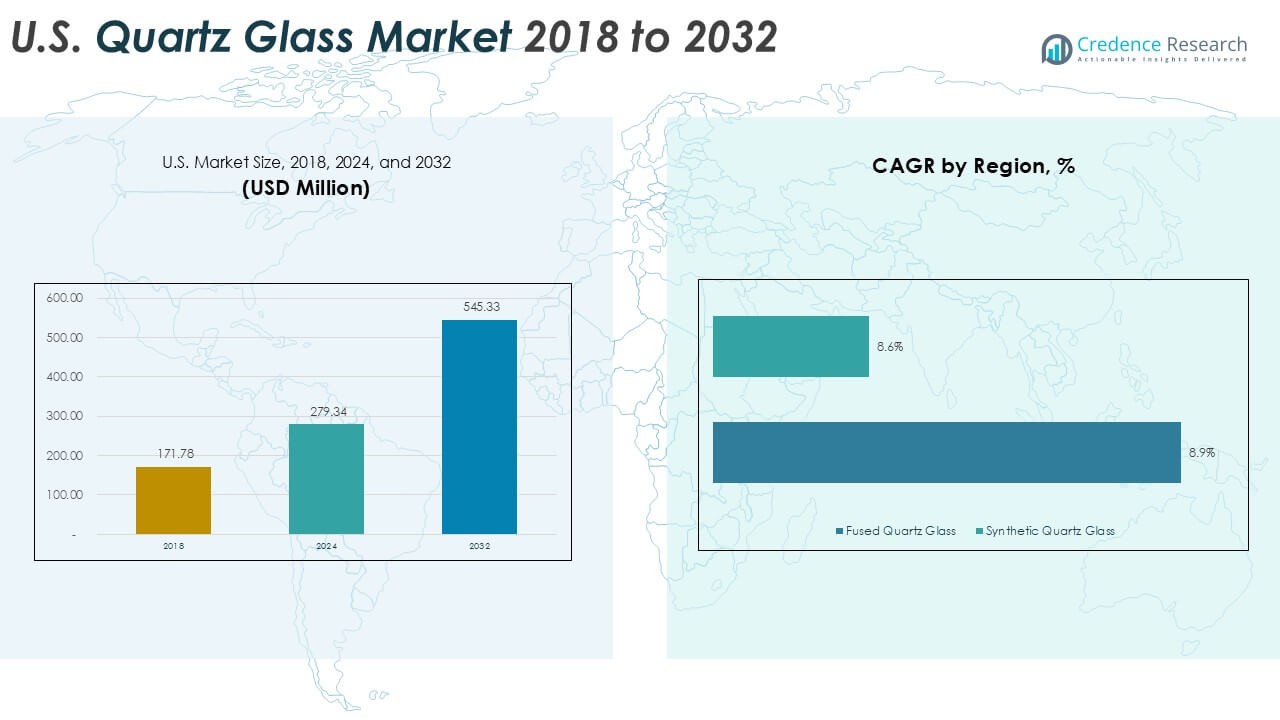

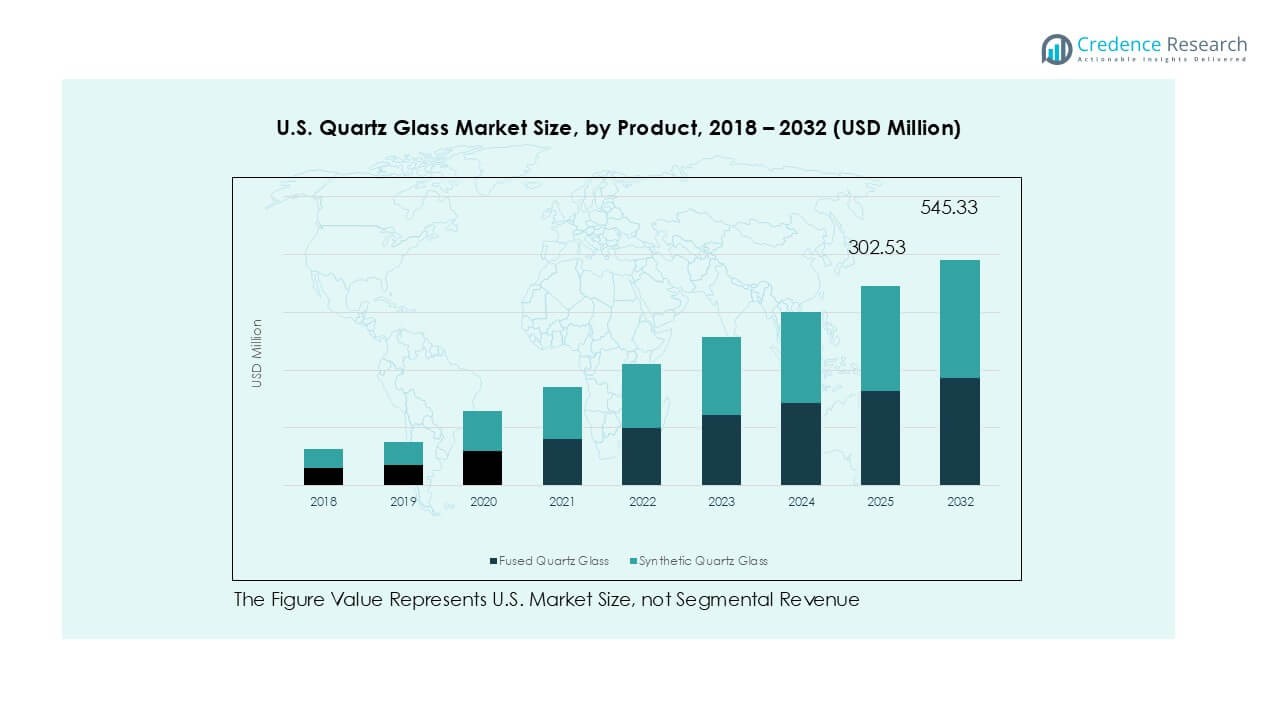

The U.S. Quartz Glass market size was valued at USD 171.78 million in 2018, reaching USD 279.34 million in 2024, and is anticipated to attain USD 545.33 million by 2032, at a CAGR of 8.7% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| U.S. Quartz Glass Market Size 2024 |

USD 279.34 Million |

| U.S. Quartz Glass Market, CAGR |

8.7% |

| U.S. Quartz Glass Market Size 2032 |

USD 545.33 Million |

The U.S. quartz glass market is led by key players such as Tosoh Quartz, Inc., Saint-Gobain S.A., Heraeus Holding, Shin-Etsu Quartz Products Co., Ltd., and Precision Electronic Glass, which dominate through high-purity product offerings for semiconductor, optics, and solar applications. Mid-tier companies including Swift Glass, Insaco Inc., and S & S Optical Company, Inc. strengthen the competitive landscape with custom fabrication and specialized components. Regionally, the South holds the largest share at 27%, driven by expanding semiconductor fabs and solar manufacturing in states like Texas and North Carolina. The Northeast follows with 28% share, supported by strong R&D hubs and photonics demand, while the West and Midwest accounted for 23% and 22%, respectively, reflecting growth in solar, optics, and medical device sectors. This regional spread highlights diverse industrial bases that support market expansion across the U.S.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The U.S. quartz glass market was valued at USD 279.34 million in 2024 and is projected to reach USD 545.33 million by 2032, growing at a CAGR of 8.7%.

- Rising demand from semiconductor fabrication remains the key driver, with quartz tubes and plates widely used in wafer processing, photolithography, and deposition systems across advanced chip manufacturing.

- A major trend is the shift toward synthetic quartz glass with higher purity and lower hydroxyl content, supporting applications in EUV lithography, optics, and precision medical devices.

- The competitive landscape is led by Tosoh Quartz, Inc., Saint-Gobain S.A., Heraeus Holding, and Shin-Etsu Quartz Products, while mid-sized firms like Swift Glass and Insaco focus on customized solutions.

- Regionally, the South leads with 27% share due to semiconductor fabs, followed by the Northeast at 28%, the West at 23%, and the Midwest at 22%, while by form, quartz tubes dominate with over 40% share.

Market Segmentation Analysis:

By Product

Fused quartz glass dominated the U.S. market in 2024, accounting for over 60% share. Its leadership stems from superior thermal stability, low thermal expansion, and high optical transmission, making it indispensable in semiconductor fabrication and laboratory applications. Rising demand for wafer processing, photomasks, and high-purity containers further strengthens adoption. Synthetic quartz glass is expanding due to higher purity and lower hydroxyl content, which improve UV transparency and reliability. Growth is fueled by applications in excimer lasers and precision optics, but fused quartz remains the primary driver due to cost efficiency and wider usage base.

- For instance, Momentive Technologies supplies fused quartz crucibles capable of operating continuously at temperatures required for silicon wafer production, widely used in the Czochralski crystal growth process.

By Application

Semiconductors & electronics led the market in 2024, contributing over 45% share. The dominance is driven by quartz’s role in wafer etching, deposition, and photolithography, where resistance to high temperatures and contamination control are critical. The solar energy sector is rapidly gaining momentum as quartz glass supports photovoltaic cells and thin-film technologies, particularly in high-intensity UV transmission components. Optics & photonics applications also advance due to rising laser and imaging demands. Still, the semiconductor industry continues to drive volume and revenue, supported by sustained chip manufacturing capacity expansions in the U.S.

- For instance, Intel’s Arizona fabs integrate fused quartz tubes and rods in diffusion furnaces for 300 mm wafer production, ensuring uniform processing at high thermal loads.

By Form

Quartz tubes emerged as the largest segment, holding above 40% share in 2024. Their dominance is supported by wide use in semiconductor processing equipment, UV disinfection systems, and laboratory devices. Tubes offer superior thermal shock resistance and high purity, making them suitable for high-intensity lamps, diffusion furnaces, and analytical instruments. Quartz rods and plates/sheets are gaining traction in optics, photonics, and specialty equipment requiring dimensional precision. However, tubes remain the key growth driver, with demand strengthened by expansion of semiconductor fabs and rising adoption of UV-C disinfection systems across healthcare and consumer applications.

Key Growth Drivers

Rising Semiconductor Fabrication Demand

The U.S. quartz glass market is strongly driven by rapid growth in semiconductor manufacturing. Quartz glass plays a critical role in wafer processing, diffusion furnaces, photolithography, and deposition systems due to its high purity and ability to withstand extreme thermal and chemical conditions. With the U.S. CHIPS and Science Act promoting domestic semiconductor capacity, several leading foundries and integrated device manufacturers are expanding production facilities. This expansion significantly boosts demand for quartz tubes, plates, and rods used in cleanroom environments. The rising complexity of chip designs, including the move toward advanced nodes below 5 nanometers, also requires more precise and reliable quartz-based components. As the U.S. government pushes for reduced reliance on overseas semiconductor supply chains, quartz glass will continue to benefit from its essential role in maintaining quality and efficiency in chip fabrication.

- For instance, Intel’s $20 billion expansion of its Ocotillo campus in Chandler, Arizona, includes new fabs requiring extensive quartz tubes and plates for 300 mm wafer processing.

Growing Adoption in Solar Energy

The rapid adoption of solar energy technologies is a key driver for quartz glass consumption. Quartz glass is widely used in photovoltaic manufacturing, particularly in thin-film solar cells and silicon-based photovoltaic modules, due to its excellent UV transmittance, durability, and resistance to thermal stress. U.S. federal incentives and state-level renewable energy mandates are accelerating the deployment of solar installations, which directly translates into rising demand for quartz-based components. Concentrated solar power (CSP) projects also rely on high-purity quartz glass for mirrors, tubes, and protective layers to ensure maximum efficiency and longevity. The push for carbon neutrality and the transition toward clean energy sources by 2050 create a stable growth path for quartz suppliers serving the solar industry. With rising production of solar wafers and cells across North America, quartz glass is set to remain integral in meeting energy diversification goals.

- For instance, First Solar’s Ohio facility, which reached 6 GW of module production capacity in 2023, uses quartz glass sheets and covers for thin-film solar cells.

Expanding Use in Optics, Photonics, and Medical Applications

The U.S. market also benefits from growing adoption of quartz glass in optics, photonics, and medical applications. In optics and photonics, quartz glass is essential for laser systems, imaging lenses, and precision instruments, offering superior transparency across a wide spectral range. Increasing investments in defense, aerospace, and scientific research continue to create opportunities for quartz suppliers. In the medical field, quartz glass supports laboratory equipment, diagnostic instruments, and UV disinfection systems, driven by post-pandemic emphasis on hygiene and infection control. Portable UV-C sterilization units and laboratory devices use quartz tubes and rods for efficiency and durability. The combination of high chemical stability, biocompatibility, and light transmission makes quartz indispensable in advanced healthcare and research applications. As demand for precision medical devices and next-generation photonics systems grows, the quartz glass industry is positioned to expand across both established and emerging niches.

Key Trends & Opportunities

Shift Toward High-Purity and Synthetic Quartz Glass

A major trend in the U.S. quartz glass market is the increasing preference for high-purity synthetic quartz products. Semiconductor and optics applications require extremely low hydroxyl content and superior UV transparency, characteristics that synthetic quartz delivers more reliably than natural fused quartz. Manufacturers are investing in advanced production techniques to meet the rising specifications demanded by chipmakers and photonics companies. The opportunity lies in developing quartz materials that can withstand extreme ultraviolet (EUV) lithography, which is critical for advanced semiconductor nodes. As U.S. foundries scale up EUV adoption, synthetic quartz suppliers are well-positioned to capture long-term contracts. This transition also creates opportunities for collaboration between quartz producers and semiconductor tool makers to co-develop specialized products tailored for next-generation fabrication.

- For instance, Corning produces synthetic fused silica with OH content <1 ppm, ensuring deep-UV transmission below 190 nm for excimer lasers and lithography optics.

Integration with Renewable Energy and Environmental Solutions

The U.S. quartz glass industry is increasingly aligned with sustainability goals, opening opportunities in renewable energy and environmental applications. Beyond solar cells, quartz glass plays a role in UV water purification, air disinfection, and waste treatment systems. The market for UV-C quartz tubes is expanding as industries and municipalities adopt disinfection solutions to improve public health and reduce chemical usage. Growth in electric vehicle (EV) battery production also boosts quartz consumption, as high-purity materials are required in certain processing equipment. With government incentives supporting renewable infrastructure, quartz suppliers can tap into growing demand across solar, energy storage, and green water technologies. This positions the industry to benefit from both energy transition policies and rising environmental awareness among consumers and businesses.

Key Challenges

High Production Costs and Supply Chain Constraints

One of the major challenges for the U.S. quartz glass market is the high cost of production. Manufacturing high-purity quartz products involves energy-intensive processes, strict contamination control, and advanced processing technologies, which drive up operating expenses. Dependence on high-quality raw materials, such as natural quartz sand, further adds to supply chain vulnerabilities, especially since much of the global supply originates from limited geographies. Price fluctuations and import reliance expose U.S. manufacturers to risks. While synthetic quartz addresses some issues, it requires advanced infrastructure and capital-intensive production lines. These cost and supply pressures make it challenging for smaller players to compete and limit overall scalability in meeting rising demand from semiconductors and solar industries.

Technological Barriers in Advanced Applications

The increasing complexity of applications, particularly in semiconductors and EUV lithography, poses technological challenges. Producing quartz glass with extreme purity, minimal defects, and consistent performance is technically demanding. Any flaws can compromise semiconductor yields or optical system precision, leading to costly failures. U.S. quartz producers face pressure to meet international standards while competing with established global players who have mature expertise in high-spec quartz. Research and development requirements are significant, as customers demand specialized solutions tailored to cutting-edge technologies. Balancing cost efficiency with innovation remains a hurdle, making technological advancement both an opportunity and a constraint for domestic suppliers.

Regional Analysis

Northeast

The Northeast region accounted for over 28% share of the U.S. quartz glass market in 2024. Strong demand stems from the concentration of semiconductor R&D hubs, photonics companies, and advanced medical research facilities. States like New York and Massachusetts host several electronics and biotechnology firms that rely on quartz glass for wafer processing, optics, and laboratory instruments. The region also benefits from strong academic and defense research clusters that use high-purity quartz in photonics and imaging systems. This combination of advanced manufacturing and research intensity sustains the Northeast’s leading role in quartz consumption.

Midwest

The Midwest held around 22% market share in 2024, supported by its role in automotive manufacturing, industrial production, and renewable energy initiatives. States such as Michigan and Ohio are expanding solar module assembly and precision equipment industries, boosting demand for quartz tubes and plates. The region also benefits from its growing medical device sector, which uses quartz in laboratory diagnostics and sterilization systems. With investments in EV battery manufacturing and advanced materials, the Midwest is expected to strengthen its adoption of synthetic quartz products to support high-performance industrial and energy applications.

South

The South captured nearly 27% share of the U.S. quartz glass market in 2024, making it a key growth region. This dominance is fueled by the presence of expanding semiconductor fabs and solar panel production facilities, particularly in Texas and North Carolina. The South also benefits from strong aerospace and defense activities, where quartz is critical in optics and photonics applications. Rising demand for UV disinfection technologies in healthcare and municipal systems further supports quartz tube adoption. The combination of low-cost manufacturing environments and government incentives positions the South as a strategic hub for quartz demand growth.

West

The Western region represented about 23% share of the U.S. quartz glass market in 2024. California remains the core driver, with its large semiconductor base, photonics startups, and renewable energy investments. The region leads in solar energy adoption, which directly drives demand for quartz glass in photovoltaic production and concentrated solar power projects. Medical research centers and biotechnology hubs in California also rely on quartz-based laboratory equipment. Strong innovation ecosystems and sustainability-focused policies make the West a leading adopter of high-purity synthetic quartz glass, particularly for advanced semiconductor manufacturing and clean energy applications.

Market Segmentations:

By Product

- Fused Quartz Glass

- Synthetic Quartz Glass

By Application

- Semiconductors & Electronics

- Solar Energy

- Optics & Photonics

- Medical & Laboratory

- Others

By Form

- Quartz Tubes

- Quartz Rods

- Quartz Plates/Sheets

- Others

By Geography

- Northeast

- Midwest

- South

- West

Competitive Landscape

The U.S. quartz glass market is moderately consolidated, with competition driven by technological capabilities, product purity, and customer-specific solutions. Leading players such as Tosoh Quartz, Inc., Saint-Gobain S.A., and Heraeus Holding dominate with extensive product portfolios covering fused and synthetic quartz for semiconductor, optics, and solar applications. Mid-sized firms like Precision Electronic Glass, Insaco Inc., and Swift Glass strengthen their positions through custom fabrication and precision-engineered components tailored for medical, laboratory, and industrial uses. Regional players such as S & S Optical and American Precision Glass Corp. provide niche solutions, ensuring strong localized competition. Companies are increasingly investing in synthetic quartz production, R&D for high-purity applications, and strategic partnerships with semiconductor and photonics firms to maintain competitiveness. Financial growth is closely tied to expansion in semiconductor fabs and renewable energy projects, while recent developments highlight rising adoption of UV-C quartz glass in healthcare and water treatment markets.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- Tosoh Quartz, Inc.

- Saint-Gobain S.A.

- Heraeus Holding

- Quartz Solutions

- Precision Electronic Glass

- Insaco Inc.

- American Precision Glass Corp.

- S & S Optical Company, Inc.

- Shin-Etsu Quartz Products Co., Ltd.

- Swift Glass

- Sandfire Scientific

- Other Key Players

Recent Developments

- In July 2025, QSIL inaugurated (opened) an expansion building at its ceramics site in Auma-Weidatal for the metallization process. While this is not directly quartz glass, it is part of its high-performance materials / production footprint.

- In March 2025, Heraeus (Heraeus Covantics) launches a new quartz manufacturing plant in Shenyang, China.The facility cost is ~600 million yuan (≈ USD 83.6 million). It focuses on high-purity and ultra-high-purity synthetic quartz products.

- In January 2025, Heraeus Covantics is formed (reorganization). Heraeus combined its high-performance materials units, Heraeus Conamic and Heraeus Comvance, into a new operating company under the name.

- In December 2024 / January 2025, QSIL GmbH Quarzschmelze Ilmenau is acquired by SCHOTT AG. Effective early 2025, SCHOTT acquired the quartz glass production facility in Ilmenau, Germany, including about 275 employees. The acquisition is seen as strategic for SCHOTT to bolster its semiconductor materials portfolio and ensure supply chain resilience.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Form and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with rising semiconductor fabrication in the U.S.

- Demand for high-purity synthetic quartz will increase with EUV lithography adoption.

- Growth in solar energy installations will support quartz use in photovoltaic modules.

- Medical and laboratory applications will expand with focus on UV disinfection systems.

- Optics and photonics will gain traction with defense and aerospace investments.

- Localized production will grow to reduce dependency on imported raw materials.

- Innovation in advanced quartz processing will enhance product precision and purity.

- Partnerships between quartz suppliers and semiconductor firms will strengthen.

- Regional demand will rise in the South and West due to fab expansions.

- Sustainability and renewable energy projects will create long-term opportunities for quartz adoption.