Market Overview:

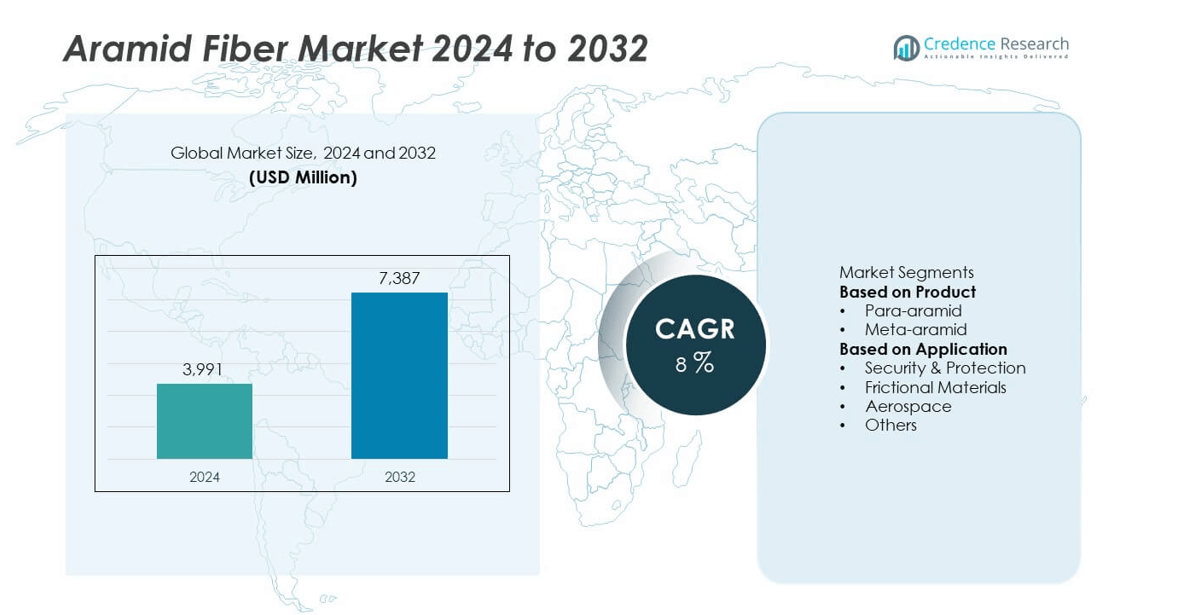

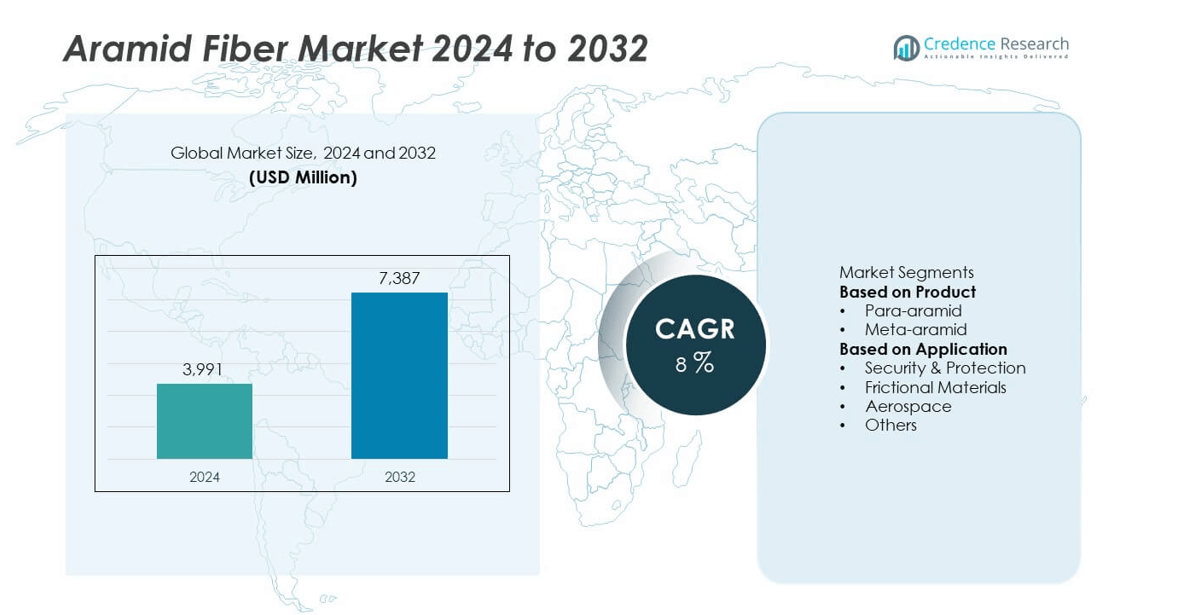

The global aramid fiber market was valued at USD 3,991 million in 2024 and is projected to reach USD 7,387 million by 2032, expanding at a CAGR of 8% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Aramid Fiber Market Size 2024 |

USD 3,991 million |

| Aramid Fiber Market, CAGR |

8% |

| Aramid Fiber Market Size 2032 |

USD 7,387 million |

The aramid fiber market is led by major players including DuPont de Nemours, Inc., Teijin Aramid B.V., Kolon Industries, Inc., Hyosung Corporation, Yantai Tayho Advanced Materials Co., Ltd., Toray Industries, Inc., Huvis Corporation, Kermel S.A., China National Bluestar (Group) Co., Ltd., and SRO Aramid (Jiangsu) Co., Ltd. These companies focus on high-performance para-aramid and meta-aramid fibers for defense, automotive, and aerospace applications. North America dominated the global market with a 32.6% share in 2024, driven by strong defense and aerospace industries. Asia Pacific followed closely with 30.4%, fueled by industrial growth and rising demand for heat-resistant materials, while Europe accounted for 28.3%, supported by strict safety standards and expanding use of aramid composites in electric vehicles and industrial applications.

Market Insights

- The aramid fiber market was valued at USD 3,991 million in 2024 and is projected to reach USD 7,387 million by 2032, growing at a CAGR of 8%.

- Rising demand for lightweight, high-strength materials in defense, aerospace, and automotive industries is driving global market growth.

- Advancements in sustainable production, recycling technologies, and hybrid fiber composites are shaping key market trends.

- Leading companies such as DuPont, Teijin Aramid, and Kolon Industries are expanding manufacturing capacities and forming partnerships to strengthen competitiveness.

- North America held a 32.6% share in 2024, followed by Asia Pacific with 30.4% and Europe with 28.3%, while the para-aramid product segment accounted for a dominant 67.4% share in the global aramid fiber market.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Segmentation Analysis:

By Product

Para-aramid dominated the aramid fiber market with a 67.4% share in 2024, driven by its high tensile strength, thermal stability, and abrasion resistance. Its extensive use in ballistic protection, aerospace components, and high-performance industrial applications solidifies its dominance. Para-aramid fibers like Kevlar and Twaron provide lightweight yet strong materials suitable for defense and automotive systems. DuPont’s Kevlar XP enables weight reduction of up to 15% in body armor while maintaining superior ballistic protection, making it a preferred choice for military and law enforcement safety gear worldwide.

- For instance, DuPont’s Kevlar XP enables a significant reduction in back face deformation and an approximately 10% to 15% reduction in the overall weight of soft armor vests, which improves mobility for defense and law enforcement users worldwide.

By Application

The security and protection segment accounted for the largest share of 42.8% in 2024, fueled by rising defense budgets and increased adoption of advanced personal protective equipment. Aramid fibers are key materials in bulletproof vests, helmets, and armored vehicles due to their impact resistance and thermal durability. Strict workplace safety regulations further boost demand in industrial and civil protection. Teijin Aramid’s Twaron-based fabrics are widely utilized by defense agencies for enhanced ballistic and thermal performance, reinforcing the segment’s continued leadership in the global market.

- For instance, Teijin Aramid’s Twaron fabric provides tensile strength exceeding 3,400 MPa and thermal resistance up to 500 °C, making it a standard material for ballistic vests supplied to NATO and European defense agencies.

Key Growth Drivers

Rising Demand for Lightweight and High-Strength Materials

The increasing need for lightweight and durable materials in defense, aerospace, and automotive sectors drives the aramid fiber market. Aramid fibers deliver exceptional strength-to-weight ratios and withstand extreme conditions better than steel or nylon. Their use enhances vehicle and aircraft efficiency while maintaining high safety standards. Airbus employs para-aramid composites in aircraft fuselages to improve fuel efficiency and structural integrity. These properties continue to expand applications across aerospace and defense manufacturing.

- For instance, Airbus integrates carbon fiber reinforced plastic (CFRP) composite panels that contribute to the A350’s overall structural weight reduction of over 20 tonnes compared to previous generation metallic aircraft, while providing a high strength-to-weight ratio which improves fuel efficiency and structural durability in commercial operations.

Expansion in Defense and Protective Applications

Rising global defense spending and stringent safety regulations are boosting demand for aramid-based protective solutions. Aramid fibers are essential for ballistic vests, helmets, and flame-resistant uniforms due to their high thermal and cut resistance. DuPont and Teijin have expanded manufacturing capacity to meet defense and law enforcement requirements. The increase in modernization programs and global security concerns reinforces aramid’s critical role in personal and vehicle protection, supporting sustained growth across military applications.

- For instance, DuPont’s Spruance facility in Richmond, Virginia, is a major manufacturing site for the Kevlar polymer, which is then used to produce fibers for various applications including body armor used by the U.S. military and NATO forces.

Growing Application in Automotive and Aerospace Sectors

Automotive and aerospace manufacturers increasingly use aramid fibers to cut weight while maintaining durability in friction and structural components. Aramids improve the lifespan and heat tolerance of brake pads, gaskets, and composite panels. Honeywell integrates aramid composites into vehicle braking systems to reduce wear and improve heat dissipation. The aerospace sector’s shift toward lightweight materials for fuel savings and emission reduction further strengthens aramid fiber adoption in next-generation aircraft and transport systems.

Key Trends & Opportunities

Advancement in Recycling and Circular Fiber Technologies

Sustainable production and recycling of aramid fibers are emerging as key trends. Chemical recycling technologies and closed-loop initiatives help recover fibers without degrading their strength. Teijin Aramid’s Twaron recycling program reuses post-consumer aramid waste from protective gear, reducing environmental impact. These initiatives promote circular economy practices, lower carbon emissions, and enhance raw material efficiency. Growing regulatory focus on waste reduction is accelerating investment in eco-friendly production technologies.

- For instance, Teijin’s closed-loop system processes over 500 metric tons of aramid waste annually, enabling fiber recovery with mechanical properties exceeding 90% of virgin Twaron strength, significantly lowering CO₂ emissions across its European production network.

Integration in Smart Textiles and Next-Gen Composites

Aramid fibers are increasingly integrated into smart fabrics and hybrid composites for defense, aerospace, and industrial uses. Their flexibility, conductivity, and durability make them suitable for wearable electronics and flame-resistant uniforms with embedded sensors. Ongoing R&D collaborations between material scientists and defense firms are driving the creation of multi-functional aramid-based materials. These innovations open new opportunities for advanced protection systems and intelligent textile solutions.

- For instance, Kolon Industries produces Heracron-based aramid fabric that is widely used in high-performance applications such as military protective gear and aerospace components due to its high strength, heat resistance, and low elongation properties.

Key Challenges

High Production Costs and Complex Manufacturing Process

The cost of aramid fiber production remains high due to complex polymerization and spinning techniques. Para-aramid synthesis requires elevated temperatures and specialized equipment, increasing energy and capital costs. These factors make aramids pricier than alternatives such as UHMWPE and carbon fibers. Manufacturers are now optimizing production lines and expanding capacity to achieve economies of scale and reduce overall costs, aiming to improve affordability in industrial and defense applications.

Environmental and Recycling Limitations

Aramid fibers pose recycling challenges because of their high chemical resistance and non-biodegradable nature. Waste accumulation from used protective gear and composites remains a concern. Mechanical recycling often reduces fiber quality, while chemical recovery is costly and energy-intensive. The absence of standardized recycling frameworks limits large-scale reuse. Industry players are investing in new green technologies and process innovations to enhance recyclability and reduce environmental impact from aramid fiber waste.

Regional Analysis

North America

North America held a 32.6% share of the aramid fiber market in 2024, driven by high demand from defense, aerospace, and automotive sectors. The United States leads regional growth with strong military procurement and advanced composite manufacturing. Increasing adoption of lightweight materials for aircraft, body armor, and frictional components supports market expansion. For instance, DuPont’s Kevlar and Honeywell’s Spectra Shield are widely used in ballistic protection and industrial safety gear. Continuous investments in research for high-performance aramid composites and rising defense modernization programs strengthen North America’s leadership position.

Europe

Europe accounted for a 28.3% share in 2024, supported by stringent safety regulations and the growing use of aramid fibers in automotive and industrial applications. Germany, France, and the United Kingdom dominate regional demand, driven by strong aerospace and defense industries. The region’s emphasis on energy efficiency and sustainability fosters increased use of lightweight materials in electric vehicles. For instance, Teijin Aramid operates advanced production facilities in the Netherlands to supply Twaron for protective and automotive applications. The region’s regulatory support for high-strength, recyclable composites continues to fuel steady market growth.

Asia Pacific

Asia Pacific captured a 30.4% share of the aramid fiber market in 2024 and is projected to record the fastest growth through 2032. China, Japan, and South Korea are key contributors, supported by rapid industrialization, strong automotive manufacturing, and expanding defense capabilities. Rising investment in infrastructure and electronics also drives demand for heat-resistant aramid fibers. For instance, Kolon Industries in South Korea produces Heracron para-aramid to meet growing regional needs. Government-backed initiatives promoting local material innovation and increased foreign investments in advanced textile production are reinforcing Asia Pacific’s position as a global growth hub.

Latin America

Latin America held a 5.2% share in 2024, driven by expanding automotive manufacturing and increasing adoption of industrial safety standards. Brazil and Mexico lead regional demand, focusing on vehicle components and protective gear. The presence of international partnerships with European and U.S. aramid producers enhances regional supply capabilities. For instance, collaborations between local manufacturers and DuPont have improved access to high-strength fibers for industrial use. Growing awareness of worker safety and the expansion of export-oriented automotive production continue to strengthen market prospects across the region.

Middle East & Africa

The Middle East & Africa accounted for a 3.5% share in 2024, supported by rising investments in defense modernization and industrial safety initiatives. Countries such as the UAE, Saudi Arabia, and South Africa are adopting aramid-based protective solutions for military and oil & gas applications. The region’s increasing focus on infrastructure resilience and personal protective equipment drives steady market growth. For instance, regional defense agencies are sourcing aramid materials for ballistic vests and heat-resistant uniforms. Strategic collaborations with global fiber producers and expanding local manufacturing are expected to enhance market presence over the forecast period.

Market Segmentations:

By Product

By Application

- Security & Protection

- Frictional Materials

- Aerospace

- Others

By Geography

- North America

- Europe

- Germany

- France

- U.K.

- Italy

- Spain

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- South-east Asia

- Rest of Asia Pacific

- Latin America

- Brazil

- Argentina

- Rest of Latin America

- Middle East & Africa

- GCC Countries

- South Africa

- Rest of the Middle East and Africa

Competitive Landscape

The competitive landscape of the aramid fiber market is characterized by strong technological innovation and expanding production capabilities among leading players such as DuPont de Nemours, Inc., Teijin Aramid B.V., Kolon Industries, Inc., Hyosung Corporation, Yantai Tayho Advanced Materials Co., Ltd., Toray Industries, Inc., Huvis Corporation, Kermel S.A., China National Bluestar (Group) Co., Ltd., and SRO Aramid (Jiangsu) Co., Ltd. These companies focus on developing high-performance para-aramid and meta-aramid fibers to cater to defense, aerospace, and automotive industries. Continuous R&D investments are directed toward enhancing thermal resistance, strength, and recyclability. Strategic collaborations with defense agencies and OEMs are expanding their global footprint. For instance, DuPont and Teijin have established advanced material supply agreements to meet growing demand for protective and composite applications. Increasing competition is driving innovation in lightweight, sustainable aramid solutions, strengthening market differentiation and supporting long-term growth in high-performance material sectors.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

- DuPont de Nemours, Inc.

- Teijin Aramid B.V.

- Kolon Industries, Inc.

- Hyosung Corporation

- Yantai Tayho Advanced Materials Co., Ltd.

- Toray Industries, Inc.

- Huvis Corporation

- Kermel S.A.

- China National Bluestar (Group) Co., Ltd.

- SRO Aramid (Jiangsu) Co., Ltd.

Recent Developments

- In June 2025, Teijin Aramid said Twaron reinforced Bridgestone’s solar car tire. The tire supported the World Solar Challenge entry. The announcement highlighted energy-efficient reinforcement.

- In June 2025, Toray’s Arawin division exhibited aramid at CWIEME Berlin. The showcase ran June 3–5 in Germany. It underlined electrical insulation applications.

- In March 2025, Hyosung Advanced Materials showcased aramid innovations. The firm presented ALKEX at Tire Technology Expo and JEC World. The focus was mobility safety and composites.

- In October 2024, Toray Advanced Materials Korea broke ground for Aramid Fiber Unit 2. The Gumi site added a second aramid line. IT film units were expanded alongside aramid

Report Coverage

The research report offers an in-depth analysis based on Product, Application and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- Growing demand for lightweight and durable materials will continue to drive aramid fiber adoption.

- Expansion in defense and aerospace applications will strengthen market growth globally.

- Increasing use of aramid composites in electric vehicles will boost automotive performance and safety.

- Technological advancements in fiber spinning and processing will enhance strength and heat resistance.

- Rising focus on sustainability will encourage development of recyclable and eco-friendly aramid materials.

- Strategic partnerships among manufacturers and OEMs will expand global supply chains.

- Growth in industrial protective clothing demand will increase meta-aramid fiber consumption.

- Asia Pacific will emerge as the fastest-growing market due to rapid industrialization and infrastructure development.

- Integration of aramid fibers in 5G components and electronics will create new opportunities.

- Continuous R&D investment will drive innovation in hybrid and high-modulus aramid fiber products.