Market Overview

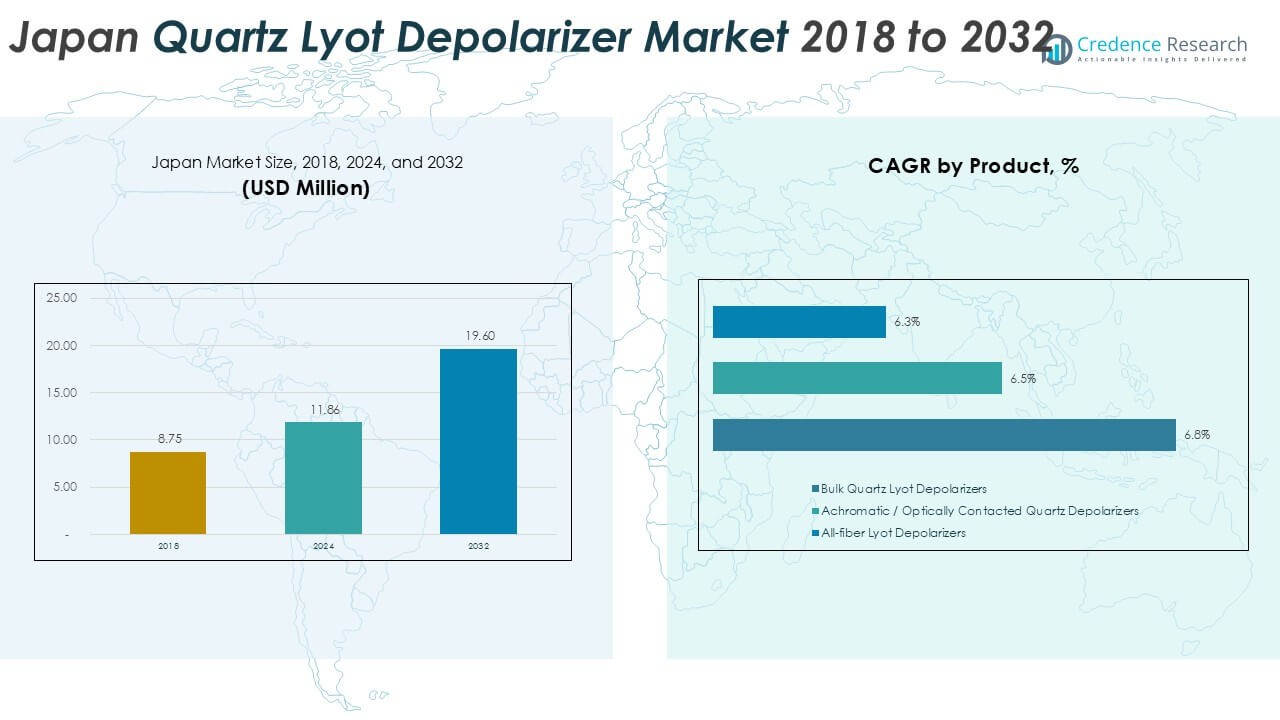

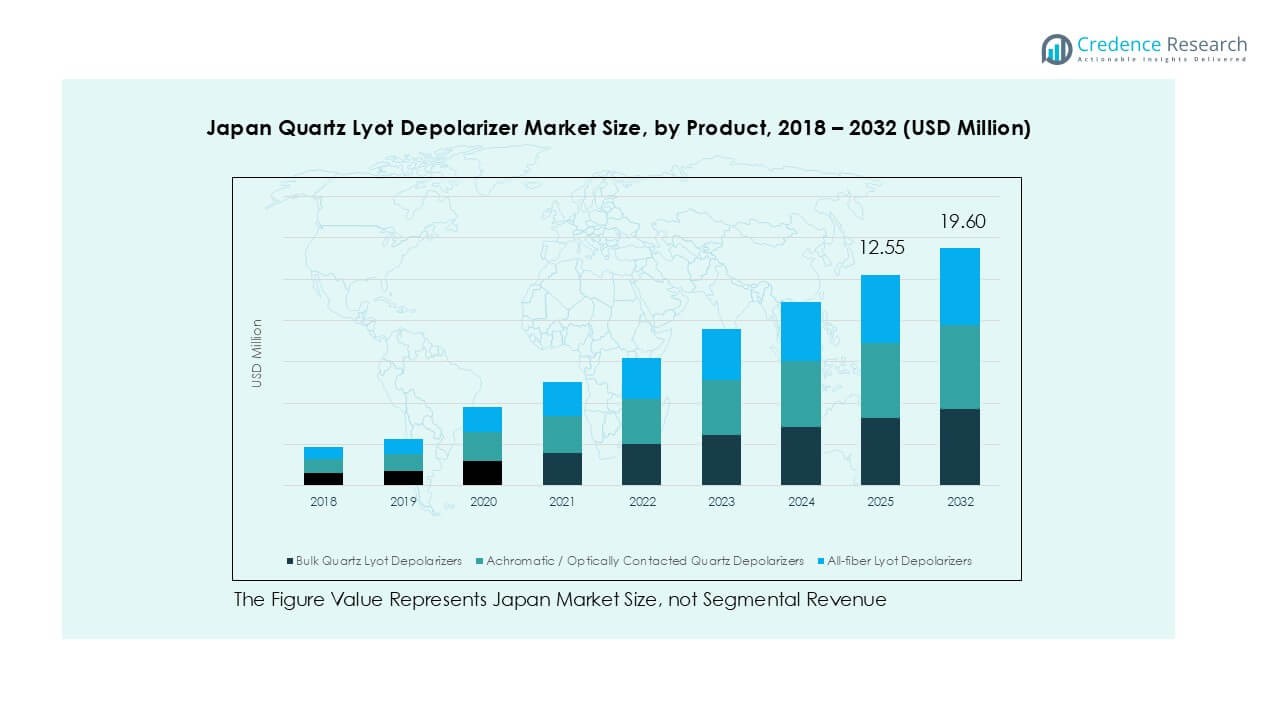

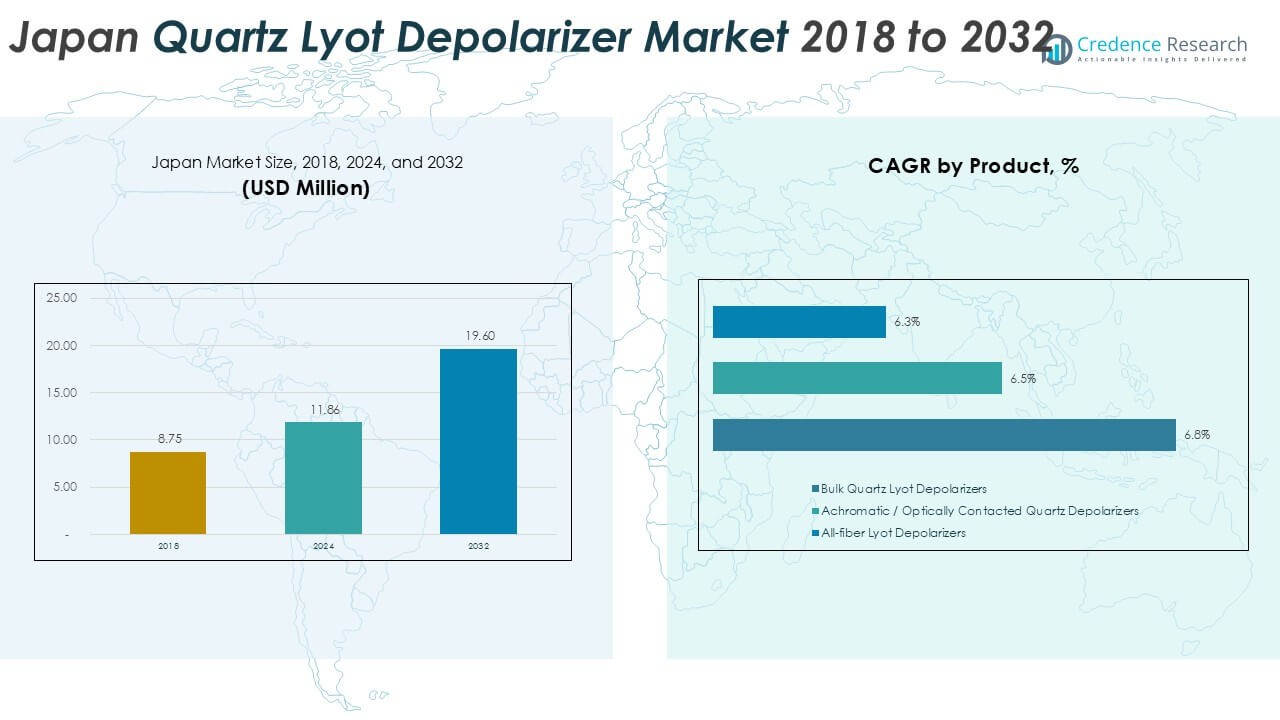

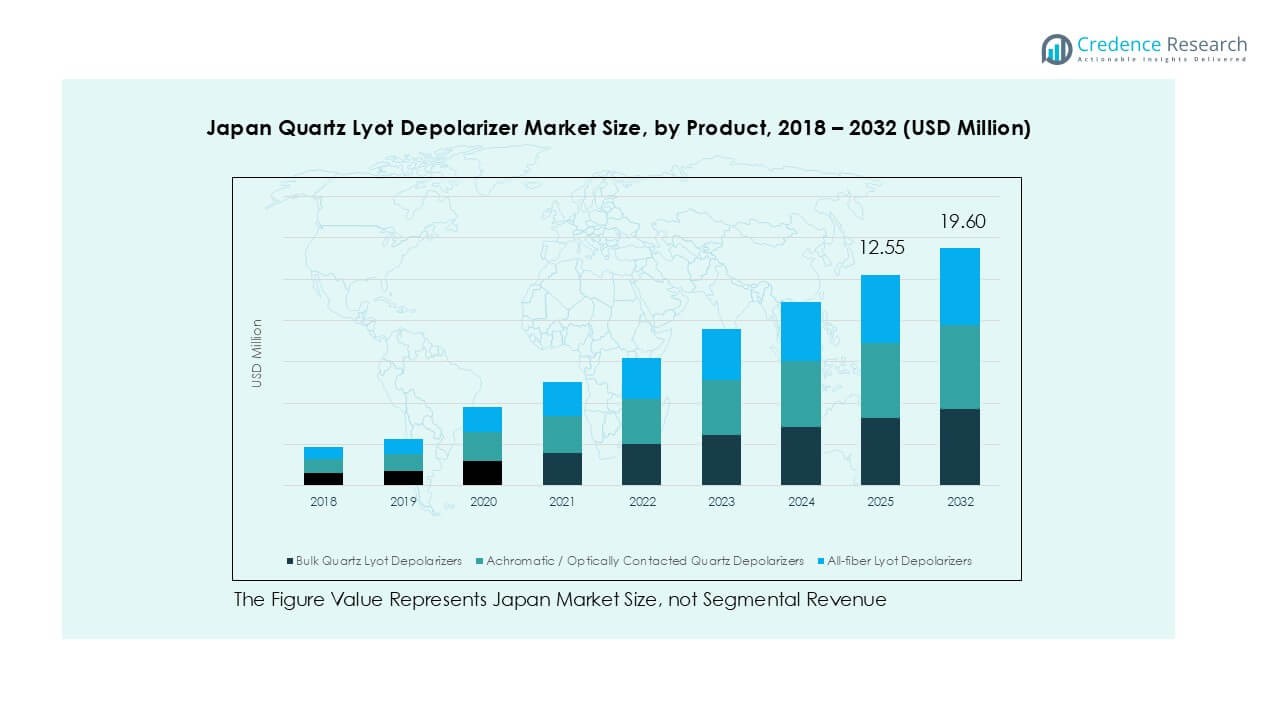

Japan Quartz Lyot Depolarizer Market size was valued at USD 8.75 million in 2018, reached USD 11.86 million in 2024, and is anticipated to reach USD 19.60 million by 2032, at a CAGR of 6.3% during the forecast period.

| REPORT ATTRIBUTE |

DETAILS |

| Historical Period |

2020-2023 |

| Base Year |

2024 |

| Forecast Period |

2025-2032 |

| Japan Quartz Lyot Depolarizer Market Size 2024 |

USD 11.86 Million |

| Japan Quartz Lyot Depolarizer Market, CAGR |

6.3% |

| Japan Quartz Lyot Depolarizer Market Size 2032 |

USD 19.60 Million |

The Japan Quartz Lyot depolarizer market is led by established players such as Thorlabs, Jenoptik AG, Excelitas Technologies Corp., Leysop Ltd, and Tower Optical Corporation, who maintain strong positions through wide product portfolios and advanced optical technologies. Regional specialists like OptoSigma Corporation and Edmund Optics India Private Limited strengthen the domestic presence by meeting customized research and industrial demands. Kanto emerged as the leading region in 2024, accounting for 35% of the market share, driven by its concentration of telecom infrastructure, R&D institutions, and advanced manufacturing. Kansai and Chubu followed with 20% and 15% shares respectively, supported by strong industrial and semiconductor bases. This combination of global and regional players ensures healthy competition, innovation, and product integration across telecom, research, and industrial laser applications in Japan.

Access crucial information at unmatched prices!

Request your sample report today & start making informed decisions powered by Credence Research Inc.!

Download Sample

Market Insights

- The Japan Quartz Lyot depolarizer market was valued at USD 11.86 million in 2024 and is projected to reach USD 19.60 million by 2032, expanding at a CAGR of 6.3%.

- Growing demand from telecom and fiber-optic systems, which held about 35% share in 2024, drives market growth, supported by 5G expansion and data transmission needs.

- A key trend is the shift toward all-fiber depolarizers, favored for compact integration in next-generation optical systems, along with rising adoption of achromatic depolarizers in imaging and spectroscopy.

- Competition is led by Thorlabs, Jenoptik, Excelitas Technologies, and OptoSigma, with firms focusing on R&D, telecom partnerships, and advanced instrumentation to strengthen market presence.

- Kanto region dominated with 35% share, followed by Kansai (20%) and Chubu (15%), while bulk quartz depolarizers accounted for the leading product segment at over 40% share in 2024.

Market Segmentation Analysis:

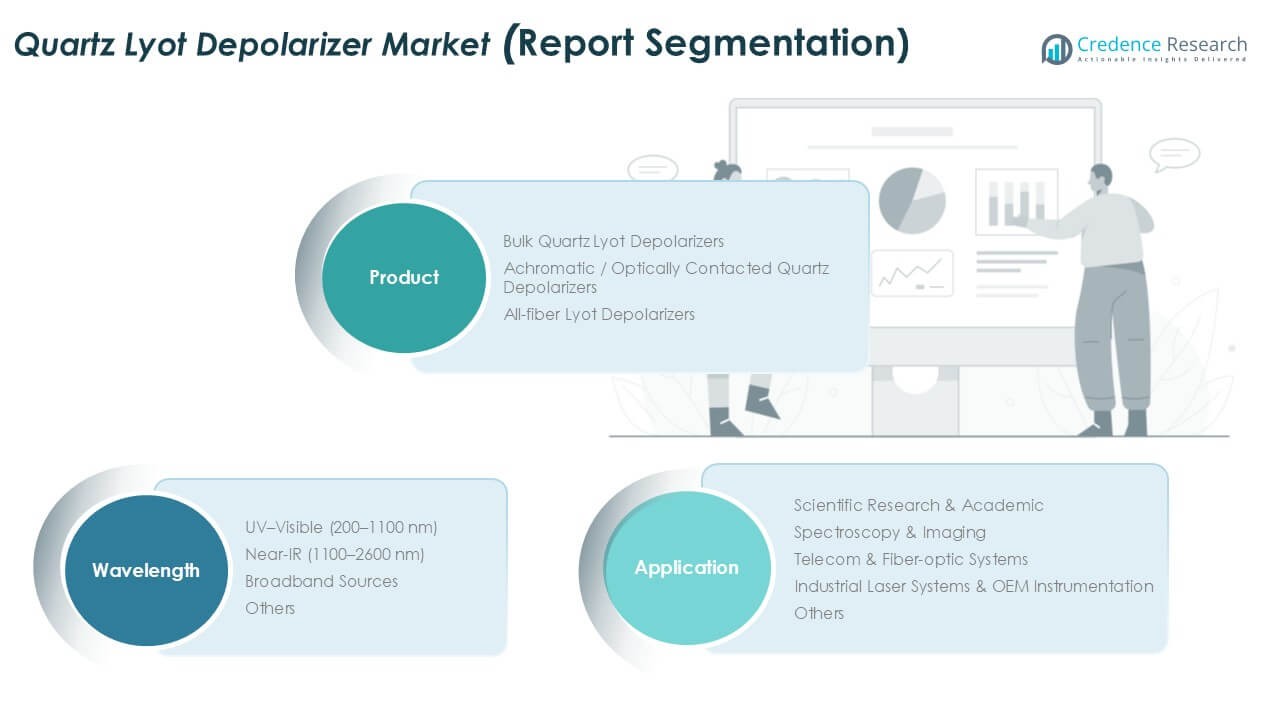

By Product

In the Japan Quartz Lyot depolarizer market, bulk quartz Lyot depolarizers held the dominant share of over 40% in 2024. Their widespread adoption comes from high reliability, stable optical performance, and cost-effectiveness, making them the preferred choice for both academic and industrial applications. Achromatic or optically contacted quartz depolarizers are gaining traction, driven by demand in precision optical instrumentation and high-end laser systems. All-fiber Lyot depolarizers remain a niche but fast-growing category, supported by the increasing integration of fiber-optic technologies in telecom networks and next-generation communication systems.

- For instance, in 2023, Nikon focused on strengthening its earnings and expanding its business in multiple segments. In its Imaging Products Business, revenue grew substantially due to a weaker yen and a shift toward mid-to-high-end mirrorless cameras and lenses. The company released several new consumer products, including the Z f full-frame mirrorless camera and multiple NIKKOR Z lenses.

By Application

The telecom and fiber-optic systems segment accounted for the largest share, representing about 35% of the Japan market in 2024. Strong deployment of 5G and high-speed data transmission networks fuels this growth, as Lyot depolarizers help minimize polarization-related distortions. Scientific research and academic applications also contribute significantly, supported by government-funded optical research projects. Spectroscopy and imaging segments are expanding steadily, driven by adoption in life sciences and material analysis. Industrial laser systems and OEM instrumentation present a growing niche as manufacturers integrate depolarizers for precision and high-power optical setups.

- For instance, NTT (Nippon Telegraph and Telephone) achieved significant innovations in its optical networks in 2023 to support high-speed and energy-efficient communications. In one notable advancement, the company successfully expanded optical transmission capacity and simultaneously reduced power consumption by 67% using a new multi-core fiber amplification system.

By Wavelength

The UV–Visible (200–1100 nm) segment dominated the market with nearly 45% share in 2024. Its leadership is supported by broad applicability in spectroscopy, laser systems, and academic experiments requiring accurate polarization control across visible and near-UV ranges. Near-IR depolarizers are seeing strong growth, fueled by rising applications in telecom, fiber-optics, and defense technologies. Broadband sources are also gaining adoption in advanced imaging and industrial R&D, though they remain secondary to UV–Visible solutions. Other specialized wavelength depolarizers continue to address custom needs in niche optical instruments and scientific innovations.

Key Growth Drivers

Rising Demand from Telecom and Fiber-Optic Networks

Japan’s rapid expansion of telecom infrastructure and fiber-optic networks is a major growth driver for the quartz Lyot depolarizer market. The shift toward 5G and ultra-high-speed internet services has increased reliance on polarization control solutions, where Lyot depolarizers play a vital role in reducing polarization-related errors in signal transmission. Telecom operators and equipment manufacturers are incorporating depolarizers to enhance system efficiency and minimize signal distortion across long-distance optical fiber networks. This trend is further supported by government initiatives to strengthen digital connectivity, creating sustained demand in telecom and communication-based applications.

- For instance, Fujikura produced over 12.5 million kilometers of optical fiber in 2023, with significant deployment in Japan’s 5G infrastructure projects, integrating polarization control technologies to improve high-speed data transmission.

Growing Use in Scientific Research and Academic Applications

Japan is heavily investing in advanced optical research across universities, national laboratories, and R&D centers. Quartz Lyot depolarizers are essential in spectroscopy, imaging, and photonics experiments, offering accurate polarization control critical for precision results. Their use in academic projects involving quantum optics, biomedical imaging, and laser research has significantly boosted demand. Funding support from agencies such as JST (Japan Science and Technology Agency) encourages adoption of high-performance optical instruments, including Lyot depolarizers. The country’s strong academic-industrial collaboration ensures that laboratory innovations are quickly applied in commercial instruments, reinforcing long-term market growth in research-driven applications.

- For instance, RIKEN’s Center for Advanced Photonics (RAP) continued to advance its world-leading research in quantum optics and attosecond laser technologies in 2023. For instance, a research highlight from December 2023 detailed the progress of the Optical Quantum Computing Research Team, which focused on developing measurement-based quantum computing, a potentially more scalable approach for creating quantum computers.

Industrial and OEM Integration in Laser Systems

The industrial laser systems and OEM instrumentation sector is another key driver, with Japan leading in laser technology for manufacturing, semiconductors, and precision engineering. Quartz Lyot depolarizers are increasingly integrated into high-power lasers and optical systems to improve beam quality and reliability. OEM manufacturers also prefer depolarizers for their durability and adaptability across UV, visible, and near-IR ranges, supporting applications in lithography, medical lasers, and material processing. As industries demand more accurate and efficient optical systems, depolarizers are becoming integral to next-generation equipment. This industrial adoption creates consistent opportunities, especially in Japan’s high-tech and precision-focused economy.

Key Trends & Opportunities

Advancement in Fiber-Based Depolarizers

A growing trend in the Japan market is the adoption of all-fiber Lyot depolarizers, which integrate seamlessly with modern fiber-optic communication systems. These solutions eliminate the need for bulk optical components, reducing space requirements and enhancing compatibility with compact devices. The rising shift toward miniaturization in photonics and telecommunication instruments creates opportunities for fiber-based depolarizers to replace traditional setups. Companies developing fiber-integrated solutions stand to benefit from partnerships with telecom operators and data center providers. This trend also aligns with Japan’s smart city initiatives and IoT expansion, which depend on robust, high-speed fiber-optic networks.

- For instance, in 2023, NTT was highly active in advancing its optical fiber and network technologies for next-generation services, but did not deploy over 330,000 kilometers of new optical fiber.

Emergence of Achromatic Depolarizers in High-Precision Applications

Achromatic and optically contacted quartz depolarizers are gaining traction in Japan’s medical imaging, spectroscopy, and aerospace sectors. These depolarizers provide stable performance across wide wavelength ranges, making them ideal for precision instrumentation. With rising demand for accuracy in advanced imaging and diagnostics, manufacturers are exploring achromatic depolarizers for both laboratory and commercial use. The opportunity lies in expanding their integration within OEM instruments and advanced laser setups, particularly in biomedical engineering and space research. Japanese companies specializing in optics are well-positioned to leverage this niche by focusing on innovation and cross-sector applications.

Key Challenges

High Manufacturing Complexity and Costs

Producing quartz Lyot depolarizers requires advanced optical fabrication techniques and precise alignment, which significantly increase costs. Japan’s market faces challenges in balancing affordability with high-quality standards, especially when competing with lower-cost alternatives from global suppliers. The complexity in manufacturing achromatic depolarizers further limits scalability, restricting widespread adoption in cost-sensitive applications. Smaller companies often struggle with production efficiency, while larger players focus only on premium markets. These high costs limit penetration in emerging areas, slowing overall market growth despite strong demand potential.

Limited Awareness and Niche Applications

Another key challenge is the limited awareness of quartz Lyot depolarizers outside specialized research and telecom sectors. While they play a critical role in polarization control, many industrial and commercial users remain unaware of their benefits compared to simpler alternatives. Additionally, their applications are often confined to niche markets like spectroscopy, precision imaging, and telecom, which narrows growth opportunities. Expanding awareness and promoting broader industrial use cases are crucial to overcoming this barrier. Without diversification of applications, the market risks stagnation despite Japan’s strength in photonics and laser technologies.

Regional Analysis

Kanto

Kanto led the Japan Quartz Lyot depolarizer market in 2024 with nearly 35% share, supported by its dominance in telecom infrastructure, R&D institutions, and advanced manufacturing industries. The Tokyo and Yokohama hubs drive adoption in fiber-optic systems, academic research, and spectroscopy applications. Strong government-backed projects in photonics and digital infrastructure further boost demand. The concentration of universities and research labs accelerates use in scientific experiments, while industrial OEMs integrate depolarizers into high-end instrumentation. With increasing investment in 5G deployment and photonics R&D, Kanto is expected to retain leadership across both telecom and scientific applications during the forecast period.

Kansai

Kansai accounted for about 20% market share in 2024, driven by its strong industrial base in Osaka and Kyoto. The region is home to leading electronics manufacturers, laser technology developers, and optical component firms. Demand is strong from industrial laser systems and OEM instrumentation, where depolarizers ensure precision and performance in advanced manufacturing. Research universities in Kyoto and Nara also create steady demand through optical studies and spectroscopy applications. Kansai’s innovation-driven ecosystem, combined with its manufacturing strength, positions the region as a vital contributor to growth, particularly in industrial laser integration and scientific advancements.

Chubu

Chubu represented approximately 15% of the market share in 2024, with demand concentrated in Nagoya’s industrial and manufacturing sector. The region is a hub for precision engineering, automotive, and semiconductor equipment, driving adoption of depolarizers in OEM instruments and laser systems. Local research institutes also contribute to demand through advanced optical studies and spectroscopy-based innovations. The presence of key semiconductor and electronics manufacturers enhances opportunities, particularly for UV–Visible depolarizers used in lithography and inspection. Chubu’s industrial strength ensures steady growth, making it an important regional market despite being smaller than Kanto and Kansai.

Kyushu

Kyushu held nearly 12% share of the Japan Quartz Lyot depolarizer market in 2024, supported by its growing electronics and semiconductor industries. Fukuoka and Kumamoto, home to major chip production and laser-based manufacturing, are driving adoption. Scientific institutions and government-supported projects further strengthen the region’s role in photonics research. The integration of depolarizers in telecom infrastructure is also growing, as the region expands digital connectivity. With rising investments in semiconductor equipment and optical communication systems, Kyushu is emerging as a competitive region, particularly in near-IR depolarizer adoption linked to advanced telecom and industrial laser applications.

Hokkaido and Tohoku

Hokkaido and Tohoku together accounted for about 10% of market share in 2024, led by strong academic research activity. Universities in Sendai and Sapporo drive adoption through optical studies, spectroscopy, and imaging experiments. The region also benefits from government-funded R&D programs focused on advanced materials and photonics. While industrial use is comparatively limited, telecom expansion projects are steadily increasing demand for fiber-based depolarizers. Growth opportunities remain in aligning local academic innovations with commercial applications. The region’s future potential lies in bridging research capabilities with industry, particularly in scientific and broadband-related optical systems.

Chugoku and Shikoku

Chugoku and Shikoku held nearly 8% share in 2024, representing the smallest but steadily growing market segment. Demand is supported by industrial applications, particularly in Hiroshima and Okayama, where precision engineering and optical instruments are manufactured. Academic institutions contribute through niche research projects involving spectroscopy and imaging. While telecom adoption is slower compared to Kanto or Kansai, government-driven regional connectivity initiatives are expected to boost future demand. The region’s relatively smaller share reflects limited industrial scale but shows steady growth opportunities in industrial lasers and optical system integration across local OEM markets.

Market Segmentations:

By Product

- Bulk Quartz Lyot Depolarizers

- Achromatic / Optically Contacted Quartz Depolarizers

- All-fiber Lyot Depolarizers

By Application

- Scientific Research & Academic

- Spectroscopy & Imaging

- Telecom & Fiber-optic Systems

- Industrial Laser Systems & OEM Instrumentation

- Others

By Wavelength

- UV–Visible (200–1100 nm)

- Near-IR (1100–2600 nm)

- Broadband Sources

- Others

By Geography

- Kanto

- Kansai

- Chubu

- Kyushu

- Hokkaido and Tohoku

- Chugoku and Shikoku

Competitive Landscape

The competitive landscape of the Japan Quartz Lyot depolarizer market is shaped by both global optical technology leaders and domestic precision optics companies. Key participants such as Thorlabs, Jenoptik AG, and Excelitas Technologies Corp. maintain strong positions with broad product portfolios, advanced depolarizer designs, and established distribution networks across research institutions and telecom sectors. Local firms, including OptoSigma Corporation and Edmund Optics India Private Limited, strengthen regional presence by catering to customized research and industrial needs. Companies like Leysop Ltd, Foctek Photonics, and Hunan Dayoptics expand competition by offering bulk and achromatic depolarizers tailored for spectroscopy, imaging, and fiber-optic applications. Strategic developments focus on integrating depolarizers into high-power laser systems, OEM instruments, and fiber-optic networks to meet Japan’s growing demand. With continuous innovation and government-backed photonics initiatives, competition is intensifying, pushing companies to emphasize R&D investments, strategic collaborations, and product diversification to secure long-term growth in this niche but high-value market.

Shape Your Report to Specific Countries or Regions & Enjoy 30% Off!

Key Player Analysis

Recent Developments

- In 2023, Thorlabs launched a new generation of integrated depolarizers focused on improving efficiency and reducing device size.

- In 2023, OptoSigma released a smaller, more compact version of its popular depolarizer model.

Report Coverage

The research report offers an in-depth analysis based on Product, Application, Wavelength and Geography. It details leading market players, providing an overview of their business, product offerings, investments, revenue streams, and key applications. Additionally, the report includes insights into the competitive environment, SWOT analysis, current market trends, as well as the primary drivers and constraints. Furthermore, it discusses various factors that have driven market expansion in recent years. The report also explores market dynamics, regulatory scenarios, and technological advancements that are shaping the industry. It assesses the impact of external factors and global economic changes on market growth. Lastly, it provides strategic recommendations for new entrants and established companies to navigate the complexities of the market.

Future Outlook

- The market will expand steadily with increasing demand from telecom and fiber-optic networks.

- Bulk quartz depolarizers will continue to hold the largest share due to cost-effectiveness and reliability.

- All-fiber depolarizers will see faster growth as integration in compact systems increases.

- Achromatic depolarizers will gain adoption in high-precision imaging and spectroscopy applications.

- Research and academic institutions will remain a consistent demand source for advanced optical studies.

- Industrial laser and OEM instrumentation sectors will strengthen their use of depolarizers for precision systems.

- Kanto will retain leadership, while Kansai and Chubu will show strong industrial-driven growth.

- Semiconductor and electronics expansion in Kyushu will create new opportunities for near-IR depolarizers.

- Rising government support for photonics R&D will drive innovation and product diversification.

- Competition will intensify as global and domestic players focus on advanced optical solutions.